Fill Out Your V10 97 Claim Form

The V10 97 Claim form is a vital document for those seeking to file a claim with Central United Life Insurance Company or Investors Consolidated Insurance Company for vision-related benefits. It consists of several parts that require information from both the insured individual and their healthcare provider. In the first section, the insured must provide personal details such as name, Social Security number, and information about dependents, if applicable. There's a clear emphasis on the importance of accurate and complete responses, as any fraudulent information could result in serious legal consequences. The form also includes an authorization section where the insured accepts responsibility for co-payments and certifies the truth of their claims. Providers complete the second part, detailing the services rendered along with any prescription information, and confirming their credentials. This step is crucial for the processing of claims and the reimbursement for the services provided. Understanding this claim form's structure and requirements is essential for ensuring a smooth claims process and securing the benefits intended for vision care.

V10 97 Claim Example

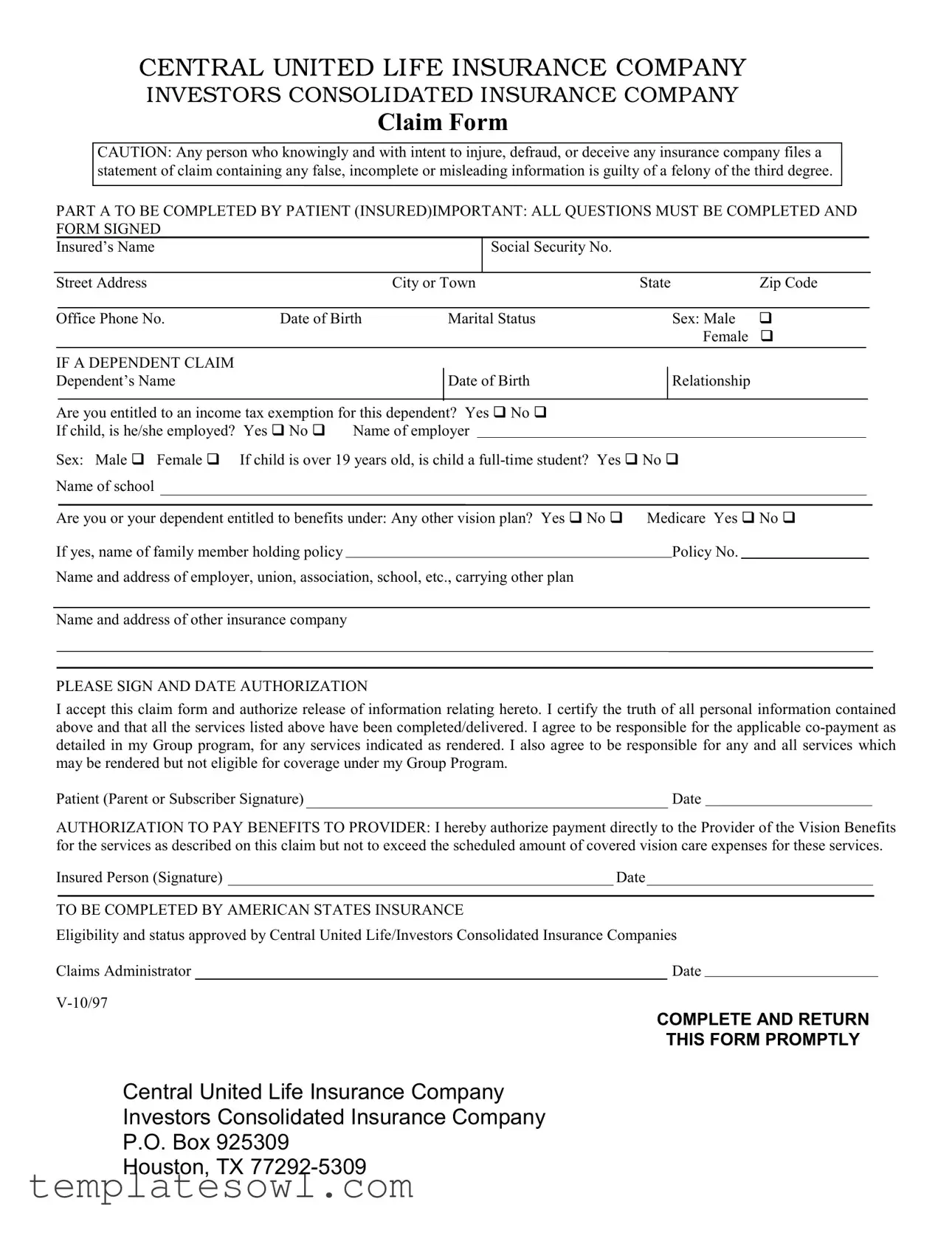

CENTRAL UNITED LIFE INSURANCE COMPANY

INVESTORS CONSOLIDATED INSURANCE COMPANY

CLAIM FORM

CAUTION: Any person who knowingly and with intent to injure, defraud, or deceive any insurance company files a statement of claim containing any false, incomplete or misleading information is guilty of a felony of the third degree.

PART A TO BE COMPLETED BY PATIENT (INSURED)IMPORTANT: ALL QUESTIONS MUST BE COMPLETED AND FORM SIGNED

|

|

|

|

|

|

|

|

|

|

|

|

Insured’s Name |

|

|

|

|

Social Security No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address |

|

City or Town |

State |

Zip Code |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

Office Phone No. |

Date of Birth |

|

Marital Status |

|

Sex: Male |

! |

|

|

|||

|

|

|

|

|

|

|

|

Female |

! |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IF A DEPENDENT CLAIM |

|

|

|

|

|

|

|

|

|

|

|

Dependent’s Name |

|

|

Date of Birth |

|

Relationship |

|

|

|

|||

|

|

|

|

|

|

|

|

||||

Are you entitled to an income tax exemption for this dependent? Yes ! No ! |

|

|

|

|

|

||||||

If child, is he/she employed? |

Yes ! No ! Name of employer |

|

|

|

|

|

|

||||

Sex: Male ! Female ! If child is over 19 years old, is child a

Name of school

Are you or your dependent entitled to benefits under: Any other vision plan? Yes ! No ! |

Medicare Yes ! No ! |

|||

If yes, name of family member holding policy |

|

|

Policy No. |

|

Name and address of employer, union, association, school, etc., carrying other plan |

|

|

|

|

|

|

|

|

|

Name and address of other insurance company |

|

|

|

|

PLEASE SIGN AND DATE AUTHORIZATION

I accept this claim form and authorize release of information relating hereto. I certify the truth of all personal information contained above and that all the services listed above have been completed/delivered. I agree to be responsible for the applicable

Patient (Parent or Subscriber Signature) |

|

Date |

AUTHORIZATION TO PAY BENEFITS TO PROVIDER: I hereby authorize payment directly to the Provider of the Vision Benefits for the services as described on this claim but not to exceed the scheduled amount of covered vision care expenses for these services.

Insured Person (Signature)Date

TO BE COMPLETED BY AMERICAN STATES INSURANCE

Eligibility and status approved by Central United Life/Investors Consolidated Insurance Companies

Claims Administrator |

|

Date |

COMPLETE AND RETURN

THIS FORM PROMPTLY

Central United Life Insurance Company

Investors Consolidated Insurance Company

P.O. Box 925309

Houston, TX

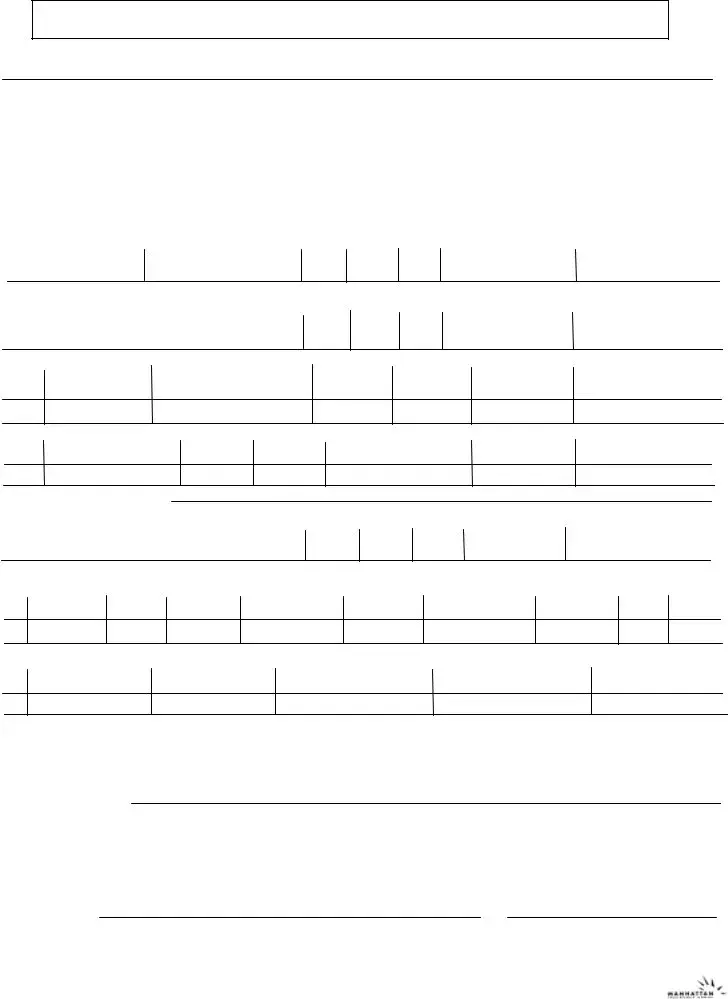

CAUTION: Any person who knowingly and with intent to injure, defraud, or deceive any insurance company files a statement of claim containing any false, incomplete or misleading information is guilty of a felony of the third degree.

PART B TO BE COMPLETED BY PROVIDER

|

Name |

Mailing Address |

|

City, State, Zip |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Soc. Sec. No. or E.I.N. |

License No. |

|

|

|

|

Phone No. |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|||||||

|

1. Is exam required as condition of employment? |

Yes ! No ! |

2. Is exam the result of occupational injury? Yes ! No ! |

|

|

||||||||||

|

3. Is exam the result of auto accident? Yes ! No ! |

|

4. Other accident? Yes ! No ! |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

If Yes to 1, 2, 3 or above, give brief description and dates |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

EXAMINATION |

Description |

Date |

|

Code |

Fee |

Plan Allowance |

Patient Responsibility |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

HAVE GLASSES BEEN PRESCRIBED? Yes ! No |

|

|

|

|

|

|

|

|

|

|

||||

|

!Description: ! Single Vision |

! Bifocal ! Trifocal |

Date |

|

Code |

Fee |

|

Plan Allowance |

Patient Responsibility |

|

|

||||

|

Bifocal/Trifocal Style: |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Prescription: |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Sphere |

Cylinder |

|

Axis |

Prism |

|

Base |

Base Curve |

|

|

|||

|

|

|

R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

L |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BIFOCAL ADD |

Height |

Width |

PUPILLARY WIDTH: |

Reading |

Distance |

|

|

|||||

|

|

|

R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

L |

|

|

|

|

|

|

|

|

|

|

|

|

|

FRAMES: Mfg. Name & Style: |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

HAVE CONTACT LENSES BEEN PRESCRIBED? Yes ! No |

|

|

|

|

|

|

|

|

|

|||||

|

!Description: ! Hard ! Soft ! Gas Permeable |

Date |

|

Code |

Fee |

|

Plan Allowance |

Patient Responsibility |

|

|

|||||

!Extended Wear ! Bifocal

Prescription:

Hard or Soft Daily Wear Contact Lenses

Base Curves Lens Rx |

Lens Size |

2nd Curve Width |

P.C. Width |

2nd. Curve Radius |

P.C. Radius |

O.Z. |

Tint |

R |

|

|

|

|

|

|

|

L |

|

|

|

|

|

|

|

Gas Permeable or Extended Wear Contact Lenses |

|

|

|

|

|

||

Lens Rx |

Lens Size |

Type or Mfg. |

Add |

|

Seg. Hgt. |

|

|

R |

|

|

|

|

|

|

|

L |

|

|

|

|

|

|

|

BIFOCAL CCL. |

|

RAM |

|

|

|

|

|

Bifocal Style |

|

Crescent |

|

|

|

|

|

|

|

Curve Top |

|

|

|

|

|

|

|

One Piece |

|

|

|

|

|

Manufacturer & Style #:

The services listed above are the only services considered for possible benefits under your vision care plan. Payment of these services is subject to current eligibility on the date services are completed/delivered.

I hereby certify that the services as indicated by the date listed have been completed/delivered and that the fees submitted are the actual fees charges and intended to be collected for these services. Payment is requested in accordance with the rules and regulations of The Health Application Network

Provider Signature |

Date |

PROVIDER signature Required |

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The V10 97 Claim form is used to submit vision care claims for benefits from Central United Life Insurance Company and Investors Consolidated Insurance Company. |

| Fraud Warning | The form includes a cautionary statement highlighting that knowingly submitting false information can be a felony, emphasizing the importance of honesty in claims. |

| Dependent Information | For dependent claims, the form collects details such as the dependent's name, relationship to the insured, and employment status, ensuring all relevant information is captured. |

| Provider Section | Part B must be completed by the healthcare provider, requiring them to certify the services rendered and associated fees, crucial for processing the claim effectively. |

Guidelines on Utilizing V10 97 Claim

After obtaining the V10 97 Claim form, it’s essential to complete it accurately to ensure timely processing of the claim. The form involves personal information, dependent details, and an authorization for provider payment. Follow these steps to fill out the form correctly.

- Begin with Part A. Fill in the Insured’s Name, Social Security Number, Street Address, City or Town, State, Zip Code, and Office Phone Number.

- Provide your Date of Birth, Marital Status, and Sex.

- If filing a dependent claim, include the Dependent’s Name, Date of Birth, and Relationship.

- Indicate your eligibility for an income tax exemption for the dependent by checking 'Yes' or 'No'.

- If claiming for a child, answer if he/she is employed and provide the employer’s name.

- State whether the child is a full-time student if over 19, and provide the name of the school.

- Answer whether you or your dependent have benefits under any other vision plan or Medicare, providing details if applicable.

- Fill in the Name and Address of the employer or other plan carrier.

- Sign and date the Authorization section confirming the accuracy of the information.

- For the Authorization to Pay Benefits to Provider, sign and date as well.

- Complete Part B by providing the Name, Mailing Address, and Sociable Security Number or E.I.N. of the provider.

- Indicate whether an exam is required for employment, resulted from an occupational injury, an auto accident, or another accident, and provide explanations if needed.

- List details of the examination, including Description, Date, Code, and Fee.

- If glasses or contact lenses were prescribed, provide the necessary details including type, description, and pricing information.

- Ensure the provider completes the final certification section, confirming the services have been delivered and that the fees are accurate.

- Review the entire form for completion before submitting it.

Once the form is filled out, submit it promptly to the address provided at the top of the document to facilitate quick processing of the claim.

What You Should Know About This Form

What is the V10 97 Claim form used for?

The V10 97 Claim form is a document used to file claims for vision benefits provided by Central United Life Insurance Company and Investors Consolidated Insurance Company. This form collects necessary information about the insured individual, their dependents, and the services received to facilitate the processing of the claim.

Who needs to fill out Part A of the form?

Part A must be completed by the patient or insured individual. This includes providing personal information such as the insured's name, social security number, address, and details about any dependents. It's important to ensure all questions are answered fully to avoid delays in claim processing.

What information is required about dependents?

If the claim concerns a dependent, you'll need to provide the dependent's name, date of birth, relationship to the insured, and whether they are entitled to any income tax exemption. Additional details, such as employment status and schooling for children over 19, may also be required to establish eligibility for benefits.

What if the insured has other insurance coverage?

The form asks whether the insured or their dependent has benefits under another vision plan or Medicare. If yes, you must provide the details of the policy holder and other insurance companies involved. This information helps coordinate benefits between multiple policies.

What is the purpose of the authorization section?

The authorization section allows the insurer to process the claim. By signing this section, the insured certifies that all provided information is accurate and authorizes the release of necessary information related to the claim. This signature is vital for the claim to be processed without issues.

How should Part B of the form be completed?

Part B must be completed by the provider of the vision services. They should provide details about the examination conducted, any prescriptions given, and the associated fees. This section verifies the services that were delivered and is essential for determining benefits eligibility.

What happens if information on the claim form is false or misleading?

Filing a claim with false, incomplete, or misleading information can have serious consequences. The form includes a cautionary statement that such actions could be considered a felony in the third degree. Honesty is crucial when submitting the claim.

Where should the completed form be sent?

Once filled out, the V10 97 Claim form should be sent to Central United Life Insurance Company or Investors Consolidated Insurance Company. The address provided on the form is P.O. Box 925309, Houston, TX 77292-5309. Prompt submission ensures quicker processing of the claim.

Common mistakes

Filling out the V10 97 Claim form is crucial for ensuring your vision care expenses are covered. However, many people make common mistakes that can delay or even deny their claims. One of the top errors is leaving questions unanswered. Each section of the form contains important questions that must be completed. Omitting information, even seemingly trivial details, can lead to complications later. Always ensure that every question is answered truthfully and completely.

Another frequent mistake is incorrect signature placement. This form requires signatures in multiple sections, particularly in the authorization areas. If a signature is missing or placed in the wrong spot, it can create confusion regarding who is responsible for the information provided. Double-check that the necessary signatures are present and correctly aligned with the corresponding sections.

Inaccurate personal information also leads to avoidable issues. Ensure that names, addresses, and Social Security numbers are entered correctly. A single typo can cause the claim to be misdirected or rejected, complicating the process of obtaining benefits. Take a moment to review all personal information before submitting the form.

Another common oversight is not noting any other insurance benefits you might have. If applicable, check the box that indicates whether you or your dependents hold policies under other vision plans or Medicare. Failing to disclose this information can lead to discrepancies and delays in processing your claim. Transparency regarding additional coverage is essential for a smooth claims process.

Lastly, individuals should pay attention to the information about the services received. Make sure to describe all procedures correctly and list the corresponding fees. Incomplete descriptions or inaccuracies in fee reporting can affect the amount reimbursed. Always ensure that the services listed are the only ones considered under the vision care plan before submission.

Documents used along the form

The V10 97 Claim form is commonly used by individuals to submit claims for vision benefits. There are several other related forms and documents that are often required to process a claim effectively. Understanding these documents can help ensure a smoother claims experience.

- Authorization Release Form: This document allows the insurance company to collect necessary medical information from healthcare providers. It ensures compliance with privacy regulations while facilitating the claims process.

- Proof of Service Form: Healthcare providers typically complete this form to confirm that the services were delivered. It outlines details such as dates of service and specific treatments provided.

- Patient Medical History Form: Often requested by insurers, this form contains important background information about the patient’s health. It helps in determining eligibility for specific coverage and services.

- Eligibility Verification Form: This is used by providers to confirm that the patient has active insurance coverage before services are provided. It can prevent payment delays and increase assurance for both parties.

- Referral Form: If specialized care is required, a referral from a primary care physician might be necessary. This form typically includes a patient's medical condition and the reason for the referral.

- Billing Statement: This document is provided by the healthcare provider and outlines the fees charged for services rendered. It is essential for the claims process to verify the billed amounts.

- ID Card: The insurance identification card provides evidence of coverage. Policyholders should submit a copy of this card along with the claim to facilitate processing.

- Appeal Letter: If a claim is denied, this letter can be submitted to contest the decision. It usually includes a detailed explanation of why the claim should be approved based on policy terms.

Using these forms alongside the V10 97 Claim form can help in gathering the necessary information to support a claim. Always ensure that all paperwork is filled out accurately and submitted promptly to expedite the claims process.

Similar forms

The V10 97 Claim form is a specific document used by insurance companies to process claims related to vision benefits. Several other documents serve a similar purpose, and understanding their similarities can provide clarity when navigating insurance claims. Here are four documents that share common characteristics with the V10 97 Claim form:

- Health Insurance Claim Form (CMS-1500): This form is used for submitting claims for medical services. Like the V10 form, it requires detailed patient information, services rendered, and provider details. Both forms emphasize accurate and complete information to avoid fraud.

- Superbill: A superbill is an itemized form provided by healthcare providers to patients for reimbursement. It includes details about medical services, similar to the V10 97 form. Both documents require patient signatures and contain service descriptions, making them essential for claims processing.

- Vision Care Provider Invoice: This document is issued by vision care providers summarizing the services delivered and associated costs. Its function closely mirrors that of the V10 97 form, as both are used to request payment for vision-related services, ensuring all services are documented clearly.

- Medicare Claim Form (CMS-1490S): This form is utilized by Medicare patients to seek reimbursement for medical expenses. Just like the V10 97, it demands thorough completion and provides a structure for listing services and provider details. Both forms are vital in facilitating the smooth processing of insurance claims.

Dos and Don'ts

When filling out the V10 97 Claim form, certain practices can help ensure a smooth process, while others can lead to complications. Here’s a guide on what to do and what to avoid:

- DO: Complete all sections of the form thoroughly. Missing information can delay your claim.

- DO: Sign and date the authorization section. This step is crucial for processing your claim.

- DO: Double-check the accuracy of your information before submitting. Errors can cause unnecessary hassles.

- DO: Provide the correct insurance details if you have other coverage. This helps coordinate benefits.

- DO: Submit the completed form promptly. Prompt submission can lead to faster processing.

- DON'T: Leave any sections blank. Each question is designed to gather essential information.

- DON'T: Provide false or misleading information. This is not only unethical but can also be considered a felony.

- DON'T: Forget to include the provider’s details if required. Missing information could affect payment.

- DON'T: Assume your claim will be processed without your follow-up. Checking in can clarify any issues.

- DON'T: Send the form without ensuring you have all supporting documents ready. Incomplete submissions may delay processing.

Misconceptions

Misconceptions about the V10 97 Claim form can lead to confusion for those filling it out. Here are eight common misunderstandings:

- All sections can be left blank if not applicable. Many people believe that they can skip sections if they think they don't apply to them. However, it is important to either answer every question or indicate that the question is not applicable.

- Only insured individuals can fill out the form. Some think that only the insured person can complete the claim form, but a parent or legal guardian can often fill it out on behalf of a dependent.

- Signatures are not necessary if the form is completed correctly. This is a misconception. Signatures are crucial as they affirm the accuracy of the information provided and authorize payment directly to the provider.

- Multiple insurance plans can be ignored. Many individuals mistakenly think they should only report one insurance plan. It's essential to disclose all other vision plans or benefits even if they seem irrelevant.

- No supporting documents are required. There is a belief that filling out the form is sufficient. In many cases, additional documentation, like receipts or medical records, is necessary to support the claim.

- The form must be submitted immediately after services are rendered. There is often confusion about timing. While prompt submission is recommended, each insurance provider has specific deadlines for submitting claims.

- If the services were not covered, the claim can be ignored. Some people think that if a service isn’t covered, they shouldn’t submit a claim at all. However, it is vital to file the claim, as some services may have partial coverage or may be reconsidered.

- All claims will be approved if correctly filled out. Many individuals believe that a correctly completed form guarantees approval. However, approval is contingent on the coverage and eligibility of the services provided.

Key takeaways

Filling out the V10 97 Claim form is essential for obtaining vision benefits smoothly. Here are some key takeaways to keep in mind:

- Complete Every Section: Make sure every question is answered fully. An incomplete form can lead to delays in processing your claim.

- Patient Authorization Is Crucial: The patient or subscriber must sign and date the form to authorize the release of information about their claim.

- Provide Accurate Information: Double-check all personal and dependent information to ensure accuracy. Any errors may complicate your claim.

- Understand Co-Pay Responsibilities: Be aware of your co-payment responsibilities as outlined in your group program. You may need to pay for services that aren't covered.

- Provider Details Matter: The provider must fill out their section completely. This includes details like the examination description, fees, and whether glasses or contact lenses were prescribed.

- Eligibility Check: Claims are subject to current eligibility on the date services were received. Verify eligibility before submitting your claim.

- Submit Promptly: Return the completed claim form as soon as possible to prevent any unnecessary delays in receiving benefits.

Following these guidelines will help ensure a smoother claims experience with Central United Life Insurance Company and Investors Consolidated Insurance Company.

Browse Other Templates

Va Parent Dependent - The form includes sections to report monthly expenses for parents, including rent and utilities.

Where to Get Pay Stubs - Get immediate access to detailed paycheck information through ePayStub.

End Stage Renal Disease Enrollment Form,ESRD Medicare Application,Medicare Kidney Disease Certification,Chronic Kidney Disease Registration Document,Renal Disease Patient Entitlement Form,ESRD Patient Medical Evidence Report,Kidney Transplant Eligibi - Patients must indicate if they have undergone self-care training.