Fill Out Your Va Entitlement Worksheet Form

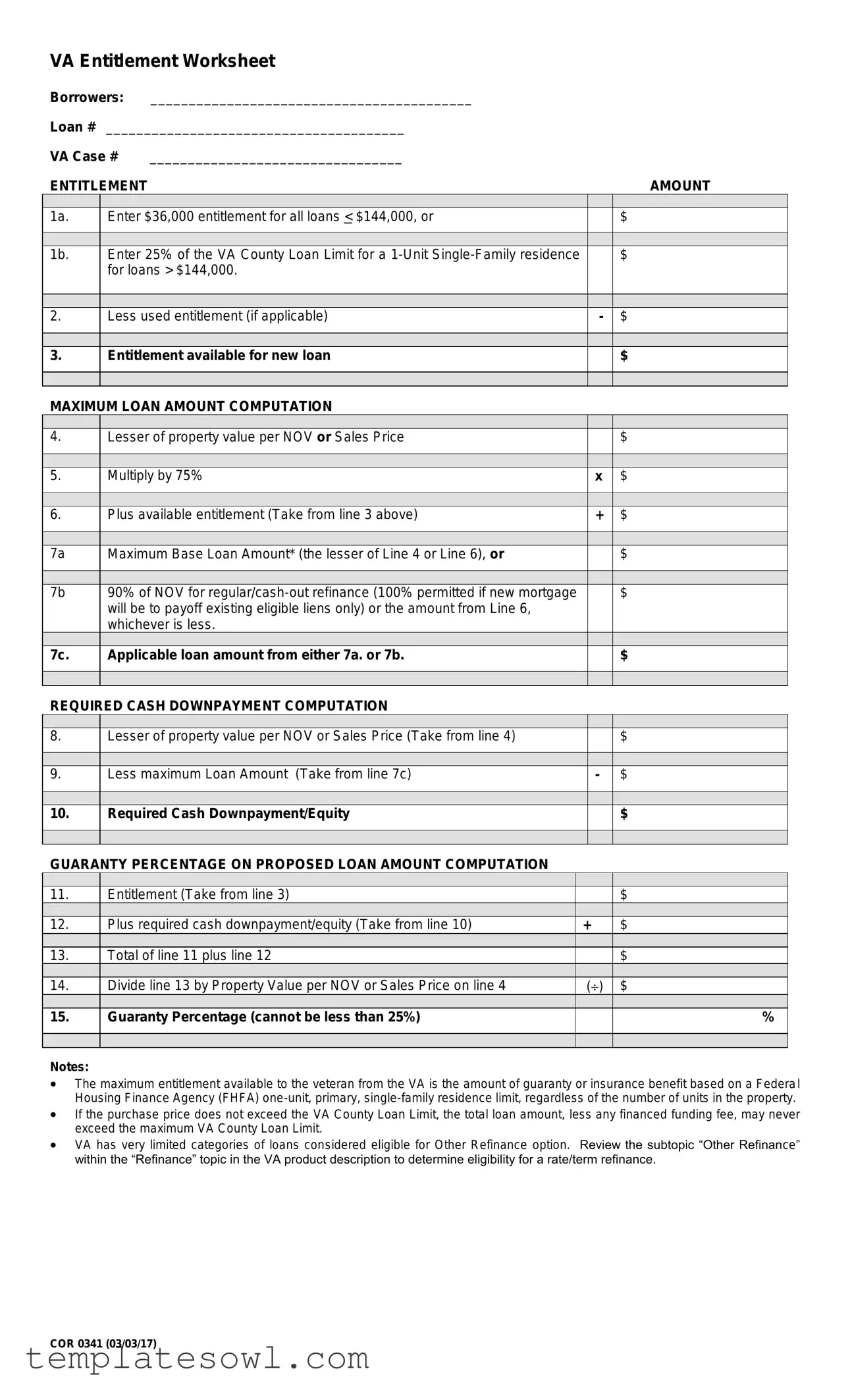

The VA Entitlement Worksheet form is a crucial document for veterans seeking to navigate home loan benefits provided by the U.S. Department of Veterans Affairs. It captures key information about the borrower's entitlement amount, which is essentially the guarantee the VA provides, allowing service members to access favorable mortgage terms. Initially, borrowers enter their entitlement figures, determining whether their loan falls below or exceeds specific thresholds. The form then breaks down maximum loan calculations, incorporating property value assessments and allowable entitlement to derive the maximum base loan amount. Following this, it details requirements for any cash down payment, which is critical for understanding how much equity a borrower must contribute toward the home. The final sections assess the guaranty percentage based on the lender's imposed limits and ensure compliance with VA regulations. Ultimately, this worksheet serves as a guide to calculate how much help the VA can provide in terms of financial backing for homes, ensuring veterans can make informed decisions in their pursuit of homeownership.

Va Entitlement Worksheet Example

VA Entitlement Worksheet

Borrowers: |

__________________________________________ |

|

|

|

|

|

|

Loan # |

_______________________________________ |

|

|

|

|

|

|

VA Case # |

_________________________________ |

|

|

|

|

|

|

ENTITLEMENT |

|

|

|

|

|

AMOUNT |

|

|

|

|

|

|

|

|

|

1a. |

Enter $36,000 entitlement for all loans < $144,000, or |

|

|

|

$ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1b. |

Enter 25% of the VA County Loan Limit for a |

|

|

|

$ |

||

|

for loans > $144,000. |

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

2. |

Less used entitlement (if applicable) |

|

- |

$ |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Entitlement available for new loan |

|

|

|

$ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MAXIMUM LOAN AMOUNT COMPUTATION |

|

|

|

|

|||

|

|

|

|

|

|

|

|

4. |

Lesser of property value per NOV or Sales Price |

|

|

|

$ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

Multiply by 75% |

|

|

x |

$ |

||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

6. |

Plus available entitlement (Take from line 3 above) |

|

+ |

$ |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7a |

Maximum Base Loan Amount* (the lesser of Line 4 or Line 6), or |

|

|

|

$ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7b |

90% of NOV for |

|

|

|

$ |

||

|

will be to payoff existing eligible liens only) or the amount from Line 6, |

|

|

|

|

||

|

whichever is less. |

|

|

|

|

||

|

|

|

|

|

|

|

|

7c. |

Applicable loan amount from either 7a. or 7b. |

|

|

|

$ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REQUIRED CASH DOWNPAYMENT COMPUTATION |

|

|

|

|

|||

|

|

|

|

|

|

|

|

8. |

Lesser of property value per NOV or Sales Price (Take from line 4) |

|

|

|

$ |

||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

9. |

Less maximum Loan Amount (Take from line 7c) |

|

- |

$ |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. |

Required Cash Downpayment/Equity |

|

|

|

$ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GUARANTY PERCENTAGE ON PROPOSED LOAN AMOUNT COMPUTATION |

|

|

|

|

|||

|

|

|

|

|

|

|

|

11. |

Entitlement (Take from line 3) |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

12. |

Plus required cash downpayment/equity (Take from line 10) |

|

+ |

|

$ |

||

|

|

|

|

|

|

|

|

13. |

Total of line 11 plus line 12 |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

14. |

Divide line 13 by Property Value per NOV or Sales Price on line 4 |

|

() |

$ |

|||

|

|

|

|

|

|

|

|

15. |

Guaranty Percentage (cannot be less than 25%) |

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes:

The maximum entitlement available to the veteran from the VA is the amount of guaranty or insurance benefit based on a Federal Housing Finance Agency (FHFA)

If the purchase price does not exceed the VA County Loan Limit, the total loan amount, less any financed funding fee, may never exceed the maximum VA County Loan Limit.

VA has very limited categories of loans considered eligible for Other Refinance option. Review the subtopic “Other Refinance” within the “Refinance” topic in the VA product description to determine eligibility for a rate/term refinance.

COR 0341 (03/03/17)

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of the VA Entitlement Worksheet | The VA Entitlement Worksheet helps veterans calculate their eligibility and entitlement amounts for VA-backed loans. |

| Entitlement Amount Calculation | For loans less than $144,000, the entitlement is $36,000. For loans over $144,000, entitlement is 25% of the VA County Loan Limit. |

| Maximum Loan Amount Determination | The maximum loan amount is calculated as the lesser of the property value or the sales price, multiplied by 75%, plus the available entitlement. |

| Cash Down Payment Requirement | The required cash down payment is computed by subtracting the maximum loan amount from the lesser of the property value or sales price. |

| Guaranty Percentage | The guaranty percentage is derived from dividing the total entitlement and cash down payment by the property value or sales price. It cannot be less than 25%. |

Guidelines on Utilizing Va Entitlement Worksheet

Filling out the VA Entitlement Worksheet is an important step toward determining eligibility for VA loans. This document guides you through various calculations needed to establish the amount of entitlement available for a new loan. Follow these steps to complete the form correctly:

- Fill in your name and loan information. Write your name in the "Borrowers" section and enter the corresponding Loan Number and VA Case Number.

- Determine your entitlement amount. For loans under $144,000, enter $36,000 on line 1a. If your loan exceeds $144,000, calculate 25% of the VA county loan limit and enter that amount on line 1b.

- Calculate used entitlement. If applicable, write the amount of any used entitlement on line 2.

- Find available entitlement. Subtract the used entitlement from the total entitlement amount and enter the result on line 3.

- Assess the property value. On line 4, write the lesser value of the property as per the Notice of Value (NOV) or sales price.

- Calculate maximum loan amount. Multiply the value from line 4 by 75% and enter the result on line 5. Then, add the value from line 3 to this amount on line 6.

- Determine the maximum base loan amount. Identify the smaller amount between line 4 and line 6 and write it on line 7a. For refinancing, use 90% of the NOV or the amount in line 6 for line 7b, writing the applicable amount on line 7c.

- Compute the required cash down payment. Write the amount from line 4 on line 8, then subtract line 7c from it and enter the difference on line 10.

- Calculate the guaranty percentage. Take the value from line 3 and write it on line 11. Add the down payment amount from line 10 to it on line 12, then sum both for line 13.

- Finish the guaranty percentage calculation. Divide the total from line 13 by the amount on line 4 and enter the result on line 14. Ensure the final percentage on line 15 is not less than 25%.

After completing these steps, your VA Entitlement Worksheet will be ready for further processing. Make sure all entries are accurate to avoid any delays in your loan application. If you have questions, consider seeking guidance from a qualified professional to assist you with the next steps.

What You Should Know About This Form

What is the VA Entitlement Worksheet form?

The VA Entitlement Worksheet form is a document used by veterans and service members to calculate their entitlement for VA loans. It helps determine the amount of VA guarantee available for a new loan based on prior entitlement used and specific loan limits.

Who needs to fill out the VA Entitlement Worksheet?

Veterans, active-duty service members, and eligible surviving spouses planning to obtain a VA loan should complete this worksheet. It is important for anyone seeking to understand their eligible loan amount and entitlement status.

What is the purpose of the entitlement amount section?

This section helps borrowers assess their eligibility for a VA loan by outlining the different entitlement amounts. It asks for the choice between a flat amount of $36,000 or 25% of the VA County Loan Limit for loans greater than $144,000.

How is the maximum loan amount calculated?

The maximum loan amount is determined by comparing the property value or sales price to the available entitlement. Specifically, it involves multiplying the property value by 75% and then adding the available entitlement from the worksheet.

What factors affect the required cash down payment?

The required cash down payment is influenced by the lesser of the property value or sales price minus the maximum loan amount. This difference indicates how much cash the borrower must pay upfront to acquire the property.

What is the significance of the guaranty percentage?

The guaranty percentage represents the level of VA backing on the proposed loan amount. It is crucial as it indicates how much the VA is willing to guarantee, which impacts the loan's terms and conditions.

Can the guaranty percentage be less than 25%?

No, the guaranty percentage cannot be less than 25%. This minimum ensures that the VA provides significant backing to help veterans secure favorable loan conditions.

What happens if I have already used my entitlement?

If you have previously utilized some of your entitlement, that amount will need to be subtracted from the total entitlement available for new loans. This calculation is critical for understanding your current borrowing capacity.

Is there a difference in entitlement limits based on county?

Yes, entitlement limits can vary by county due to different housing market values. Each county has a specific VA County Loan Limit, which is taken into account when calculating available entitlement for a new loan.

What other resources are available for understanding VA loans?

For further insights, borrowers can consult the VA’s official website, specifically looking at topics related to refinancing options, and eligibility criteria. Local VA offices and approved lenders are also valuable resources for personalized assistance.

Common mistakes

When completing the VA Entitlement Worksheet, many individuals inadvertently make mistakes that can hinder the loan process. One common error occurs when borrowers do not accurately enter their entitlement amount. This amount is crucial since it provides a baseline for the maximum loan they may apply for. Many fail to understand the distinction between the fixed amount for smaller loans and the calculated percentage for larger loans, leading to incorrect figures on line 1.

Another frequent mistake involves skipping or miscalculating the used entitlement on line 2. If there have been prior loans, omitting this value can misrepresent the actual entitlement available for a new loan. This oversight can lead to confusion about what can comfortably be borrowed based on the applicant’s previous benefits.

People often overlook the significance of proper documentation on line 4, which requires accurate property value or sales price. Misunderstanding how to find this value can lead to using incorrect numbers, adversely affecting the rest of the calculations. This mistake can have cascading effects, making other calculations invalid.

Line 8, which requires the same property value from line 4, is sometimes filled incorrectly. Borrowers may not realize that these lines are connected. This can lead to a mismatch in calculations when determining the required cash downpayment. Ensuring consistency between these two lines is vital to maintaining accuracy.

When reaching the cash downpayment/equity requirements, many individuals forget to subtract the maximum loan amount from the property value correctly. This miscalculation shows up on line 10, potentially leading to unrealistic expectations about how much cash is needed at closing.

Another common oversight involves line 14, where individuals must divide the total amount from line 13 by the property value or sales price on line 4. Missing this step or misinterpreting it can cause incorrect estimations of the guaranty percentage. This error means one might assume they qualify for less than what they are entitled to receive.

Lastly, failing to review the notes at the bottom of the form can cause applicants to miss vital guidelines about loan limits and eligibility. These notes contain crucial details about maximum limits and eligibility categories that can impact their ability to secure a loan.

By addressing these mistakes, borrowers can better ensure that their VA Entitlement Worksheet is completed accurately, paving the way for a smoother loan process.

Documents used along the form

The VA Entitlement Worksheet is an important document used in the process of determining eligibility for VA loans. Several other forms are frequently used alongside this worksheet to ensure a comprehensive review of a borrower's financial status and loan application. Below is a list of some commonly associated documents.

- VA Loan Application (VA Form 26-1880): This form is used by veterans to apply for a Certificate of Eligibility (COE), which establishes their entitlement to VA loans. It requires personal information and service history.

- VA Certificate of Eligibility (COE): This document certifies the veteran's eligibility for a VA loan. It provides essential details about the veteran's entitlement and can streamline the loan approval process when presented to lenders.

- VA Funding Fee Form (VA Form 26-8930): This form helps determine the required funding fee for the loan, which varies based on the veteran's service and whether it is a first-time use of entitlement.

- Income Verification Form: This document collects the veteran's financial information, including income and debts, to assess their ability to repay the loan. Accurate income verification is crucial for loan approval.

Having these documents ready can facilitate a smoother loan process and provide critical information regarding eligibility and entitlement. Each document plays a vital role in helping veterans secure the financing they need for homeownership.

Similar forms

- VA Loan Certificate of Eligibility (COE): This document verifies a borrower's eligibility for a VA loan and details the amount of entitlement available. Like the Entitlement Worksheet, it provides essential information to determine loan eligibility.

- VA Loan Funding Fee Documentation: This document outlines the funding fee required for VA loans. Both the Funding Fee documentation and the Entitlement Worksheet assist in calculating the final loan amount, factoring in the borrower’s entitlement and potential costs.

- Loan Estimate (LE): Issued by lenders, the Loan Estimate details the terms, monthly payments, and closing costs of a mortgage. Similar to the Entitlement Worksheet, it helps borrowers understand their financial commitments in the context of a VA loan.

- Closing Disclosure (CD): A final summary of loan terms and costs provided before closing, this document parallels the Entitlement Worksheet by offering a comprehensive view of fees and payments required at loan closing.

- VA Appraisal Report: This report assesses the property's value and condition. Both the VA Appraisal Report and the Entitlement Worksheet play role in determining the maximum loan amount, based upon property valuation.

- VA Guidelines for Occupancy: These guidelines clarify borrower occupancy requirements for VA loans. This document is similar because it lays out essential borrower requirements that can affect the eligibility and terms of loans detailed in the Entitlement Worksheet.

- Debt-to-Income Ratio (DTI) Calculation: This document assesses a borrower’s ability to repay the loan by comparing debt to income. Like the Entitlement Worksheet, it is instrumental in evaluating financial readiness for taking on a VA loan.

Dos and Don'ts

Do's and Don'ts for Filling Out the VA Entitlement Worksheet

- Do: Provide accurate personal and loan information.

- Do: Ensure you enter the correct entitlement amount based on your loan eligibility.

- Do: Calculate the maximum loan amount carefully, using the property value or sales price.

- Do: Double-check your calculations for the cash downpayment to avoid mistakes.

- Do: Review the eligibility criteria for refinancing before submitting your form.

- Don't: Leave any sections blank; every field is important.

- Don't: Misinterpret the loan limits; refer to the VA guidelines if unsure.

- Don't: Provide outdated or incorrect financial information.

- Don't: Ignore the notes on entitlement limits and financing fees.

- Don't: Rush through the form; take your time to ensure all details are correct.

Misconceptions

Understanding the VA Entitlement Worksheet can be challenging, especially with so much information available. Here are seven common misconceptions about this important form:

- Entitlement Amount is Always Fixed: Many believe that the entitlement amount is a one-size-fits-all figure. In reality, it can vary based on several factors, including the loan amount and the county's loan limits.

- VA Loans Cover 100% of Home Value: Some think that a VA loan covers the full purchase price of the home. However, while VA loans offer significant benefits, they may still require a down payment, particularly for higher-priced loans.

- You Can Only Use Your Entitlement Once: A misconception is that veterans can only utilize their entitlement a single time. Fortunately, entitlement can be restored after a VA loan is paid off, allowing for future use.

- All VA Loans Are the Same: It’s easy to assume that all VA loans follow the same guidelines. However, different rules apply to purchases, refinances, and cash-out options, each with unique requirements.

- The Worksheet Is Optional: Some may view the VA Entitlement Worksheet as an optional step in the loan process. In reality, it plays a crucial role in determining loan eligibility and the amount you can borrow.

- Maximum Loan Amount Equals Entitlement: Misunderstandings often arise regarding the maximum loan amount. The loan amount is dependent not only on entitlement but also on property value and other financial factors.

- The Worksheet Shows Guaranteed Approval: Many assume that simply filling out the worksheet guarantees loan approval. Approval is contingent on a variety of criteria, including credit history and income verification.

Being aware of these misconceptions will help you navigate the VA Entitlement Worksheet with greater confidence. Always seek guidance if you're unsure about specific elements of the form.

Key takeaways

Understanding how to fill out and utilize the VA Entitlement Worksheet is crucial for veterans seeking to leverage their VA loan benefits. Here are some key takeaways:

- Determine Your Entitlement: The worksheet begins with calculating your entitlement amount. You can enter a set entitlement of $36,000 for loans under $144,000, or 25% of the county loan limit for loans over that amount.

- Track Used Entitlement: If you have previously used some of your entitlement on a different loan, make sure to accurately fill this in to determine what remains available for your new loan.

- Calculate Maximum Loan Amount: The worksheet helps compute the maximum loan amount by considering property value or sales price and factoring in your available entitlement.

- Required Cash Down Payment: After determining the maximum loan amount, you will assess any necessary cash down payment or equity required, based on the difference between property value and loan amount.

- Understand Guaranty Percentage: The final calculations provide the guaranty percentage on the proposed loan, which cannot fall below 25%. This figure is essential when evaluating loan options.

Using the VA Entitlement Worksheet is a straightforward process, but careful attention to detail is necessary to maximize your benefits.

Browse Other Templates

Healthypaws Login - Fill out the invoice number and total on the claim form.

Texas Workers Compensation - The form requires specifics about the examination, including the examining doctor's name and address.

Forscom Form 285-r - Cargo area specifications are included in the 285 R form.