Fill Out Your Va 0730D Form

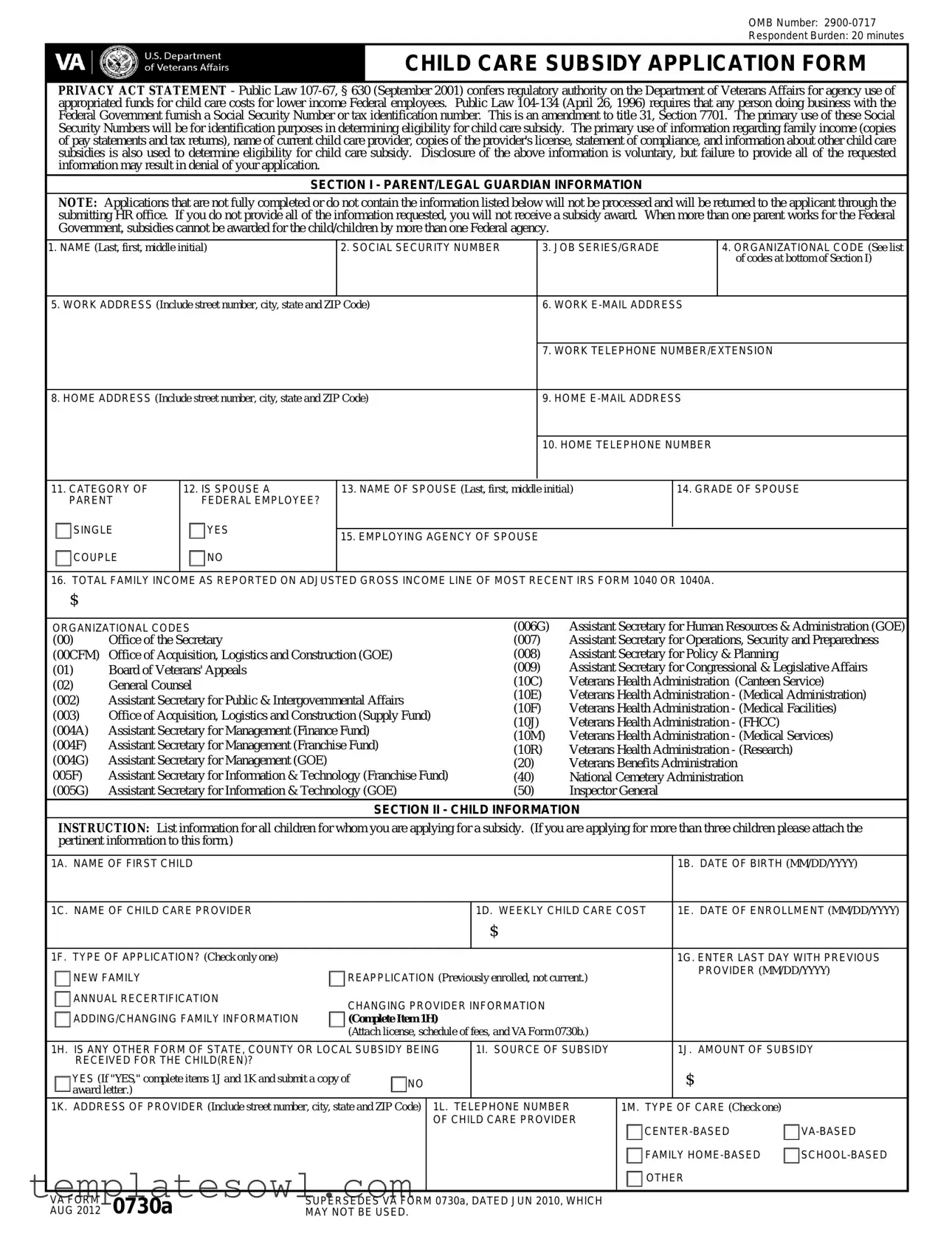

The VA 0730D form is a critical document for Federal employees seeking child care subsidies from the Department of Veterans Affairs. This application is designed specifically for lower-income individuals who require assistance managing their child care costs. It captures essential information, including the parent's or legal guardian's details, family income data, and specifics about the child care provider. Compliance is vital; incomplete applications will be returned, delaying access to potential subsidies. The form adheres to regulatory guidelines outlined in laws that mandate the collection of Social Security numbers and income verification for eligibility determination. Transparency is emphasized through the form’s Privacy Act statement, ensuring applicants are aware of how their data will be used. The form includes multiple sections tailored to gather comprehensive information on all children for whom the subsidies are being requested, allowing for a clear assessment of eligibility. Familiarity with the form’s requirements can significantly streamline the application process, ensuring that parents receive much-needed financial support without unnecessary delays.

Va 0730D Example

OMB Number:

Respondent Burden: 20 minutes

CHILD CARE SUBSIDY APPLICATION FORM

PRIVACY ACT STATEMENT - Public Law

SECTION I - PARENT/LEGAL GUARDIAN INFORMATION

NOTE: Applications that are not fully completed or do not contain the information listed below will not be processed and will be returned to the applicant through the submitting HR office. If you do not provide all of the information requested, you will not receive a subsidy award. When more than one parent works for the Federal Government, subsidies cannot be awarded for the child/children by more than one Federal agency.

1. NAME (Last, first, middle initial) |

2. SOCIAL SECURITY NUMBER |

|

3. JOB SERIES/GRADE |

|

4. ORGANIZATIONAL CODE (See list |

|||||

|

|

|

|

|

|

|

|

|

|

of codes at bottom of Section I) |

|

|

|

|

|

|

|

||||

5. WORK ADDRESS (Include street number, city, state and ZIP Code) |

|

6. WORK |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. WORK TELEPHONE NUMBER/EXTENSION |

||

|

|

|

|

|

||||||

8. HOME ADDRESS (Include street number, city, state and ZIP Code) |

|

9. HOME |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. HOME TELEPHONE NUMBER |

||

|

|

|

|

|

||||||

11. CATEGORY OF |

12. IS SPOUSE A |

13. NAME OF SPOUSE (Last, first, middle initial) |

14. GRADE OF SPOUSE |

|||||||

|

PARENT |

|

FEDERAL EMPLOYEE? |

|

|

|

|

|

||

|

|

SINGLE |

|

|

YES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

15. EMPLOYING AGENCY OF SPOUSE |

|

|

|

|||

|

|

COUPLE |

|

|

NO |

|

|

|

||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

16. TOTAL FAMILY INCOME AS REPORTED ON ADJUSTED GROSS INCOME LINE OF MOST RECENT IRS FORM 1040 OR 1040A.

$

ORGANIZATIONAL CODES

(00) Office of the Secretary

(00CFM) Office of Acquisition, Logistics and Construction (GOE)

(01)Board of Veterans' Appeals

(02)General Counsel

(002)Assistant Secretary for Public & Intergovernmental Affairs

(003)Office of Acquisition, Logistics and Construction (Supply Fund)

(004A) Assistant Secretary for Management (Finance Fund)

(004F) Assistant Secretary for Management (Franchise Fund)

(004G) Assistant Secretary for Management (GOE)

005F) Assistant Secretary for Information & Technology (Franchise Fund)

(005G) Assistant Secretary for Information & Technology (GOE)

(006G) Assistant Secretary for Human Resources & Administration (GOE)

(007)Assistant Secretary for Operations, Security and Preparedness

(008)Assistant Secretary for Policy & Planning

(009)Assistant Secretary for Congressional & Legislative Affairs

(10C) Veterans Health Administration (Canteen Service)

(10E) Veterans Health Administration - (Medical Administration)

(10F) Veterans Health Administration - (Medical Facilities)

(10J) Veterans Health Administration - (FHCC)

(10M) Veterans Health Administration - (Medical Services)

(10R) Veterans Health Administration - (Research)

(20)Veterans Benefits Administration

(40)National Cemetery Administration

(50)Inspector General

SECTION II - CHILD INFORMATION

INSTRUCTION: List information for all children for whom you are applying for a subsidy. (If you are applying for more than three children please attach the pertinent information to this form.)

1A. NAME OF FIRST CHILD |

|

|

|

|

|

|

|

|

|

|

1B. DATE OF BIRTH (MM/DD/YYYY) |

|||||

|

|

|

|

|

|

|

|

|

|

|||||||

1C. NAME OF CHILD CARE PROVIDER |

|

|

|

|

|

|

1D. WEEKLY CHILD CARE COST |

1E. DATE OF ENROLLMENT (MM/DD/YYYY) |

||||||||

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

1F. TYPE OF APPLICATION? (Check only one) |

|

|

|

|

|

|

|

|

|

|

1G. ENTER LAST DAY WITH PREVIOUS |

|||||

|

|

|

NEW FAMILY |

|

|

REAPPLICATION (Previously enrolled, not current.) |

|

|

|

PROVIDER (MM/DD/YYYY) |

||||||

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

ANNUAL RECERTIFICATION |

|

|

CHANGING PROVIDER INFORMATION |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

ADDING/CHANGING FAMILY INFORMATION |

|

|

(Complete Item 1H) |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

(Attach license, schedule of fees, and VA Form 0730b.) |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|||||||

1H. IS ANY OTHER FORM OF STATE, COUNTY OR LOCAL SUBSIDY BEING |

1I. SOURCE OF SUBSIDY |

|

|

|

1J. AMOUNT OF SUBSIDY |

|||||||||||

|

|

|

RECEIVED FOR THE CHILD(REN)? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES (If "YES," complete items 1J and 1K and submit a copy of |

|

NO |

|

|

|

|

$ |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

award letter.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1K. ADDRESS OF PROVIDER (Include street number, city, state and ZIP Code) |

1L. TELEPHONE NUMBER |

1M. TYPE OF CARE (Check one) |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

OF CHILD CARE PROVIDER |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

FAMILY |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AUG 2012 0730a |

MAY NOT BE USED. |

|

|

|

|

|

|

|

||||||||

VA FORM |

SUPERSEDES VA FORM 0730a, DATED JUN 2010, WHICH |

|

|

|

|

|

|

|||||||||

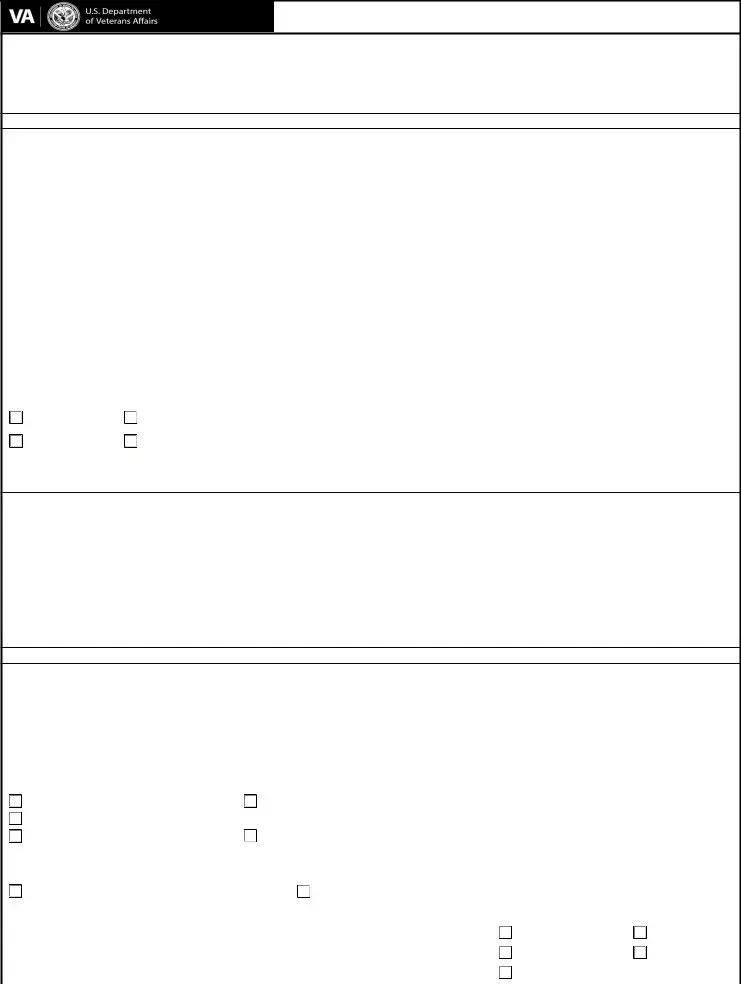

SECTION II - CHILD INFORMATION (Continued)

2A. NAME OF SECOND CHILD |

|

|

|

|

|

|

|

|

|

|

2B. DATE OF BIRTH (MM/DD/YYYY) |

||||

|

|

|

|

|

|

|

|

|

|

||||||

2C. NAME OF CHILD CARE PROVIDER |

|

|

|

|

|

|

2D. WEEKLY CHILD CARE COST |

2E. DATE OF ENROLLMENT (MM/DD/YYYY) |

|||||||

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

2F. TYPE OF APPLICATION? (Check only one) |

|

|

|

|

|

|

|

|

|

|

2G. ENTER LAST DAY WITH PREVIOUS |

||||

|

|

NEW FAMILY |

|

REAPPLICATION (Previously enrolled, not current.) |

|

|

|

PROVIDER (MM/DD/YYYY) |

|||||||

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|||||||

|

|

ANNUAL RECERTIFICATION |

|

CHANGING PROVIDER INFORMATION |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

ADDING/CHANGING FAMILY INFORMATION |

|

(Complete Item 1H) |

|

|

|

|

|

|

|

|

|||

|

|

|

|

(Attach license, schedule of fees, and VA Form 0730b.) |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|||||||||

2H. IS ANY OTHER FORM OF STATE, COUNTY OR LOCAL SUBSIDY BEING |

|

2I. SOURCE OF SUBSIDY |

|

|

|

2J. AMOUNT OF SUBSIDY |

|||||||||

|

|

RECEIVED FOR THE CHILD(REN)? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES (If "YES," complete items 2J and 2K and submit a copy of |

|

NO |

|

|

|

|

|

$ |

|

|

|||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

award letter.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2K. ADDRESS OF PROVIDER (Include street number, city, state and ZIP Code) |

2L. TELEPHONE NUMBER OF |

2M. TYPE OF CARE (Check one) |

|

|

|||||||||||

|

|

|

|

|

|

|

|

CHILD CARE PROVIDER |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

FAMILY |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

OTHER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||||

3A. NAME OF THIRD CHILD |

|

|

|

|

|

|

|

|

|

|

3B. DATE OF BIRTH (MM/DD/YYYY) |

||||

|

|

|

|

|

|

|

|

|

|

||||||

3C. NAME OF CHILD CARE PROVIDER |

|

|

|

|

|

|

3D. WEEKLY CHILD CARE COST |

3E. DATE OF ENROLLMENT (MM/DD/YYYY) |

|||||||

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

3F. TYPE OF APPLICATION? (Check only one) |

|

|

|

|

|

|

|

|

|

|

3G. ENTER LAST DAY WITH PREVIOUS |

||||

|

|

NEW FAMILY |

|

REAPPLICATION (Previously enrolled, not current.) |

|

|

|

PROVIDER (MM/DD/YYYY) |

|||||||

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|||||||

|

|

ANNUAL RECERTIFICATION |

|

CHANGING PROVIDER INFORMATION |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

ADDING/CHANGING FAMILY INFORMATION |

|

(Complete Item 1H) |

|

|

|

|

|

|

|

|

|||

|

|

|

|

(Attach license, schedule of fees, and VA Form 0730b.) |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|||||||||

3H. IS ANY OTHER FORM OF STATE, COUNTY OR LOCAL SUBSIDY BEING |

|

3I. SOURCE OF SUBSIDY |

|

|

|

3J. AMOUNT OF SUBSIDY |

|||||||||

|

|

RECEIVED FOR THE CHILD(REN)? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES (If "YES," complete items 3J and 3K and submit a copy of |

|

NO |

|

|

|

|

|

$ |

|

|

|||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

award letter.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3K. ADDRESS OF PROVIDER (Include street number, city, state and ZIP Code) |

3L. TELEPHONE NUMBER OF |

3M. TYPE OF CARE (Check one) |

|

|

|||||||||||

|

|

|

|

|

|

|

|

CHILD CARE PROVIDER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

FAMILY |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

OTHER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

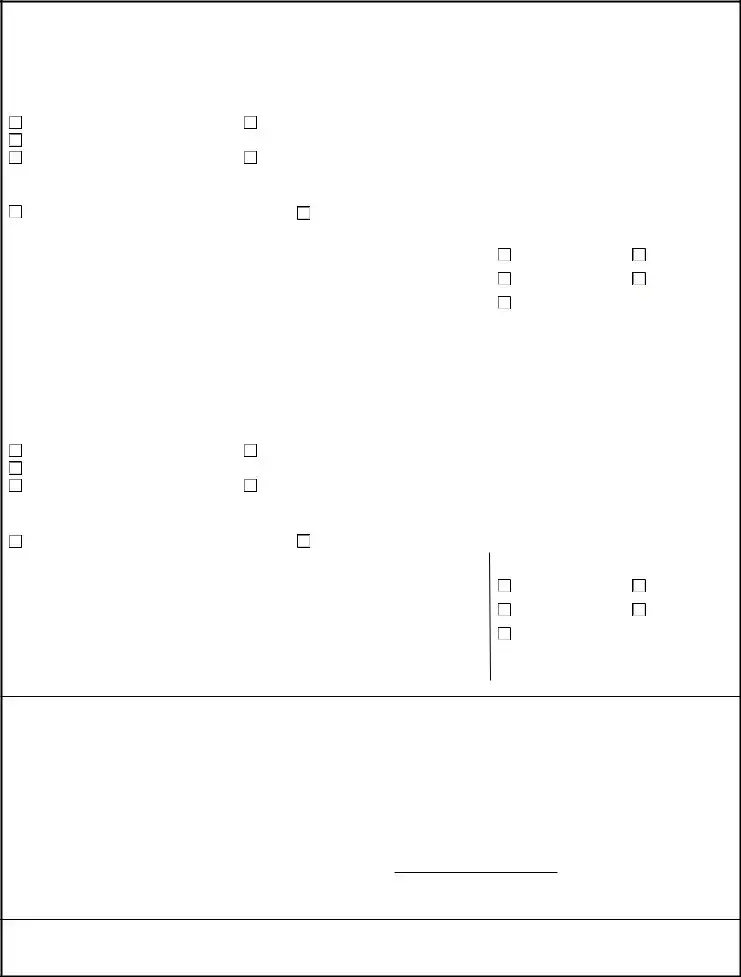

SECTION III - SIGNATURE AND CERTIFICATION OF PARENT/LEGAL GUARDIAN

I certify that the above information is true and complete to the best of my knowledge. I understand that failure to truthfully set forth this information could result in loss of child care subsidy from the Department of Veterans Affairs. I further agree to inform my local Human Resources (HR) office within 10 days if any of the above information changes. I understand that awards for child care subsidy are made on a

If I answered "YES," in Part I, block 12, I certify that my spouse has not applied for a child care subsidy from his/her Federal agency.

|

(Signature) |

|

|

(Date of signature (MM/DD/YYYY)) |

RESPONDENT BURDEN - Public reporting burden for this collection of information is estimated to average 20 minutes per response, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. Send comments regarding this burden estimate or any other aspects of this collection, including suggestions for reducing this burden, to the VA Clearance Officer (005R1B), 810 Vermont Avenue, NW, Washington, DC 20420. DO NOT send requests for benefits to this address.

VA FORM 0730a, AUG 2012, PAGE 2

Form Characteristics

| Fact Name | Description |

|---|---|

| OMB Number | The OMB number for the VA 0730D form is 2900-0717. |

| Estimated Response Time | Respondents are expected to spend about 20 minutes completing this application. |

| Governing Law for Privacy | Public Law 107-67, § 630, enacted in September 2001, provides regulatory authority for the Department of Veterans Affairs in using appropriated funds for child care costs. |

| Social Security Number Requirement | According to Public Law 104-134 (April 26, 1996), individuals engaging with the Federal Government must provide a Social Security Number or tax identification number. |

| Information Use | Information provided on family income and child care providers is primarily used to evaluate eligibility for child care subsidies. |

| Application Completion | Incomplete applications will not be processed and will be returned to the applicant through their submitting HR office. |

| First-Come, First-Served Basis | Awards for the child care subsidy are granted on a first-come, first-served basis, emphasizing the importance of timely submissions. |

Guidelines on Utilizing Va 0730D

Filling out the VA Form 0730D is an important step in applying for a child care subsidy. Ensure all necessary information is accurate and complete, as this will help prevent delays in processing your application. Below are the steps to help you complete the form successfully.

- Start by entering your name in the format: Last, First, Middle Initial.

- Provide your Social Security Number.

- Fill in your Job Series/Grade.

- Look up your Organizational Code from the list given in Section I and write it down.

- Complete your work address, including street number, city, state, and ZIP code.

- Add your work email address.

- Input your work telephone number and extension.

- Enter your home address, complete with street number, city, state, and ZIP code.

- Provide your home email address.

- List your home telephone number.

- Indicate if you are a single parent or a couple.

- If applicable, answer whether your spouse is a Federal employee.

- Fill out your spouse's name in the same format as yours: Last, First, Middle Initial.

- Input the grade of your spouse.

- Provide your spouse's employing agency.

- List your total family income as reported on the adjusted gross income line of your most recent IRS Form 1040 or 1040A.

- Next, for each child, fill in the following information: Name, date of birth (MM/DD/YYYY), child care provider's name, weekly child care cost, and date of enrollment (MM/DD/YYYY).

- Select the type of application you are submitting and enter the last day with the previous provider if changing providers.

- Indicate if you receive any other forms of state, county, or local subsidy for your child(ren) and provide the corresponding details.

- Finally, certify the information by signing and dating the form.

What You Should Know About This Form

What is the VA 0730D form and who should use it?

The VA 0730D form is also known as the Child Care Subsidy Application Form. This document is designed for lower-income Federal employees who are seeking financial assistance for child care costs. If you are a Federal employee and would like to apply for a child care subsidy, you should complete this form. It is essential to provide accurate and complete information to ensure your application is processed without delay.

What information is required to complete the VA 0730D form?

To successfully fill out the VA 0730D form, you will need to provide personal information such as your name, Social Security number, job series, and organizational code. Additionally, details about your family income, the child or children for whom you are applying for assistance, and the name and address of your child care provider must be included. Incomplete applications will be returned, so careful attention is necessary to avoid delays.

How does the application process work?

After you submit the VA 0730D form to your local Human Resources office, they will review your application for completeness. If all required information is complete, the process of determining your eligibility for the child care subsidy will commence. Due to the high demand for these subsidies, awards are distributed on a first-come, first-served basis, making timely submission of the form crucial.

What happens if I do not provide all requested information?

Should you fail to provide all necessary information requested on the VA 0730D form, your application will likely be denied, and it may be returned to you. It is important to understand that providing complete and accurate data is imperative for the successful processing of your application. If certain information is missing, it could hinder your chances of receiving the much-needed subsidy.

Can both parents apply for the subsidy if they work for different Federal agencies?

No, if both parents are Federal employees, only one of them can apply for the child care subsidy for a given child. The relevant federal regulations prohibit dual applications for the same child across multiple agencies. Only one subsidy can be awarded per child to ensure fair distribution of resources among employees.

Is there a time frame within which I must report changes in my situation?

Yes, you are required to inform your local Human Resources office within 10 days of any changes in your family situation that could affect your child care subsidy eligibility. This includes changes in employment, income, or other factors that may impact the assistance you receive. Timely reporting helps maintain your eligibility and prevents any potential disruption in your subsidy award.

Common mistakes

Filling out the VA Form 0730D, the Child Care Subsidy Application, can be a straightforward process if done correctly. However, many applicants make mistakes that can delay or prevent their eligibility for subsidies. Here are five common errors to avoid.

One significant mistake occurs in Section I, where personal information is required. Applicants often fail to provide their full name or correct Social Security Number. This information is essential for identification and eligibility verification. Omitting or incorrectly entering any detail can result in applications being returned or denied.

Another frequent error is the incorrect or incomplete listing of family income. In Section I, it is mandatory to report total family income as indicated on the most recent IRS Form 1040 or 1040A. Some applicants either overestimate or underestimate their income, while others completely skip this section. Accurate information is crucial to determine eligibility, and inaccuracies can lead to denial.

In Section II, the child information section, applicants often neglect to attach necessary documents such as the child care provider’s license or fee schedule. The incomplete submission of supporting documents is a common oversight that may lead to application delays. Ensure all required attachments are included before submitting the application.

Misunderstanding the type of application is another pitfall. Applicants might check the wrong box in Section II regarding the nature of their application, such as whether they are reapplying or changing providers. Selecting the incorrect type can create confusion and disrupt the processing of the application.

Lastly, failing to sign and date the application in Section III is a common mistake that can easily be overlooked. The certification of accuracy is crucial, and without a signature, the application will not be processed. Remember, a complete and accurate application helps ensure timely processing and eligibility for child care subsidies.

Documents used along the form

The VA 0730D form serves as the Child Care Subsidy Application. To streamline the application process, several additional forms and documents are often required. Below is a list detailing these commonly used items alongside the VA 0730D.

- VA Form 0730b - This form is used to provide additional information about the child care provider. It includes details such as the provider's license and fee structure, helping to verify compliance and eligibility.

- IRS Form 1040 - This is a standard federal income tax return form. Applicants submit their most recent IRS Form 1040 to report total family income, which is crucial for determining eligibility for the subsidy.

- Provider's License - A copy of the child care provider's license is necessary. It ensures that the provider meets local regulations and standards, confirming their ability to offer child care services.

- Subsidy Award Letter - If receiving any other form of state, county, or local subsidy, applicants must provide a copy of the award letter. This information aids in assessing overall eligibility and potential overlapping benefits.

- Pay Statements - Recent pay statements may be required to support the income information declared on the application. This helps establish financial need and confirms the data submitted is accurate.

Preparing the necessary documents in advance can speed up the processing of your application. Having everything organized and ready can ensure a smoother experience when applying for childcare subsidies through the VA. Being thorough and clear in your submissions is essential.

Similar forms

The VA Form 0730D is a Child Care Subsidy Application form used by Federal employees to apply for assistance with child care expenses. Several other documents serve similar purposes in terms of applying for benefits, collecting necessary information, and determining eligibility. Below are four documents that share similarities with the VA Form 0730D:

- Federal Employee Health Benefits (FEHB) Enrollment Form: This form is used by federal employees to enroll in health insurance plans. Like the VA Form 0730D, it requires personal details, such as social security numbers and family information, to establish eligibility for benefits.

- Dependent Care Flexible Spending Account (FSA) Application: Employees use this document to allocate pre-tax dollars for childcare expenses. Similar to the VA Form 0730D, it necessitates information about family income and child care providers to determine subsidy amounts.

- Child Nutrition Program Application: This application is utilized for various federal nutrition programs that provide assistance to families based on income. Just like the VA Form 0730D, it gathers detailed family income and dependent information to assess eligibility for subsidies.

- Supplemental Nutrition Assistance Program (SNAP) Application: Individuals apply for food benefits through this form, which, similar to the VA Form 0730D, requires detailed household information, including income and social security numbers, to evaluate eligibility for the program.

Dos and Don'ts

When filling out the VA 0730D form, it's essential to follow specific guidelines to ensure a smooth application process. Here are seven important dos and don'ts:

- Do provide accurate personal information, including your full name and Social Security number.

- Do include complete details for each child for whom you are applying for a subsidy.

- Do ensure that the type of care and the name of the child care provider are clearly indicated.

- Do submit proof of family income, such as recent pay statements or tax returns, as required.

- Don’t leave any sections of the form blank. Incomplete forms will not be processed.

- Don’t forget to check the box for the type of application you are submitting.

- Don’t provide false information. Misrepresentation can lead to denial of the subsidy.

Misconceptions

Understanding the VA 0730D form can be challenging, and there are several misconceptions surrounding it. Here are six common misunderstandings:

- The form is only for low-income families. While the VA 0730D form does prioritize lower-income applicants, any federal employee can apply for the child care subsidy regardless of income.

- You cannot apply if you are not a full-time employee. Part-time federal employees are also eligible to apply for the child care subsidy, as long as they meet the other requirements.

- Submitting the form guarantees you will receive a subsidy. Completion of the form does not guarantee approval. The application is subject to review based on eligibility criteria.

- You can submit the form to any VA office for processing. The application must be submitted to the applicant’s respective Human Resources office, not just any VA location.

- All requested information is mandatory for processing. While providing requested information is important, some details may be optional. However, leaving out vital information usually leads to delays or denials.

- If denied, you cannot reapply for the subsidy. Individuals can reapply for the child care subsidy after addressing the reasons for the denial. Review the provided feedback and make necessary adjustments before resubmitting.

Key takeaways

Filling out the VA Form 0730D, or the Child Care Subsidy Application Form, is essential for eligible federal employees seeking assistance with childcare costs. Understanding the key elements of this form can streamline the application process and improve the chances of receiving a subsidy. Here are some critical takeaways:

- Time Commitment: Expect to spend approximately 20 minutes completing the form.

- Eligibility Verification: Personal information, including Social Security Numbers, is required to determine eligibility. This information is primarily used for identification purposes.

- Income Documentation: Be prepared to submit proof of family income, such as pay statements or tax returns, to establish need for the subsidy.

- Child Care Provider Details: Information about the current child care provider, including their license and compliance status, is mandatory for consideration.

- Multiple Applications: If more than one parent is a federal employee, subsidies will only be granted through one agency for the same child/children.

- Incomplete Applications: Take care to fully complete each section. Incomplete forms will be returned without processing.

- Application Types: Select the correct application type, as this will affect how your application is processed.

- Notification of Changes: Keep your local Human Resources office informed of any changes within 10 days to avoid jeopardizing your subsidy eligibility.

- Submission Guidance: Submit the completed form through your HR office to ensure proper handling and processing.

Being thorough and attentive to detail while completing VA Form 0730D will greatly enhance potential approval outcomes. Double-checking all information reduces the risk of delays in processing and possible denial of assistance.

Browse Other Templates

London Visa Process - Review your application for completeness before sending it to the authorities.

Tdi Application - Each responsible entity must submit its legal name and FEIN.

The Three Stages of Driver Licensing in New York State Are - Utilizing the DL-59 form equals taking an essential step toward fully recognized driving privileges in Pennsylvania.