Fill Out Your Va 10 10Ec Form

The VA Form 10-10EC is a crucial document for veterans seeking extended care services from the Department of Veterans Affairs. This form serves to assess the anticipated copayment obligations based on various financial details such as income, assets, and specific expenses associated with the veteran’s care. One of the key aspects of the form is that veterans are not required to make a copayment for the first 21 days of extended care services within any 12-month period, which is particularly beneficial during times of immediate need. When completing this form, veterans will need to provide accurate and current information regarding their and their spouse’s income, deductible expenses, and both fixed and liquid assets. Particular attention must be given to the accurate reporting of health insurance coverage, as this information directly impacts potential copayments. The completion process generally takes around 90 minutes, and it is recommended to seek assistance from the Social Work staff at local VA medical facilities if there are questions or uncertainties. Moreover, specific sections of the form focus on essential household details, marital status, and financial obligations, emphasizing the importance of a comprehensive understanding of one’s financial situation while navigating the extended care services offered by the VA.

Va 10 10Ec Example

OMB Number:

Estimated Burden: 90 min.

Expiration Date: 06/30/2021

INSTRUCTIONS FOR COMPLETING APPLICATION FOR

EXTENDED CARE SERVICES (VAF

STEP 1. Before You Start. . . .

What is VA Form

To determine the estimated amount of your monthly copayment obligations for extended care services provided to you by VA, either directly by VA or paid for by VA. There is no copayment for the first 21 days of extended care services that VA provides to you in any 12 month period. You must report any changes that might affect the copayment amount to your local VA medical facility within 10 calendar days of the change.

Where can I get help filling out the form?

Contact the Social Work staff at your local VA medical facility for assistance on understanding the information and financial data needed to complete VA Form

What will I need to know in order to complete the form?

Current income of both veteran and spouse (can report monthly or annual income).

Current deductible expenses (can report monthly or annual expenses). For example property taxes may be reported as an annual amount.

Value of fixed and liquid assets of both veteran and spouse. See Section IV of these instructions for further information regarding the reporting of assets.

All health insurance information covering you even if it is through your spouse (a copy of your insurance card). Medicare information (Part A & Part B) (a copy of your Medicare card).

Spousal/Dependent information (including spouse's social security number, dependents date of birth).

STEP 2. Completing the application . . . .

Section I - General Information. Include your name and full social security number.

Section II - Insurance Information. Include information for Medicare and all health insurance companies that cover you. It is important that we obtain all health insurance coverage for you (including coverage through a spouse). Please make a copy of your Medicare card and all health insurance cards and include them with this completed application.

Section III - Spouse/Dependent Information. In order to determine if a veteran must pay an extended care copayment amount, it is necessary to identify spousal and/or dependent information and whether they are residing in the community (not institutionalized). A spouse or dependent is considered institutionalized if they are residing in a nursing home or hospital setting. A dependent other than spouse would be son, daughter, stepson, or stepdaughter. Provide address and phone number of spouse or dependent if different from the veteran. Report current marital status. Do not include spousal information if you and spouse are legally separated or divorced. If you are certifying that a person is your spouse for the purpose of VA benefits, your marriage must be recognized by the place where you and/or your spouse resided at the time of marriage, or where you and/or your spouse reside when you file your claim (or at a later date when you become eligible for benefits) (38 U.S.C. 103(c)). Additional guidance on when VA recognizes marriages is available at http://www.va.gov/opa/marriage/.

Section IV - Fixed Assets. Used only in the determination of the extended care copayment amount when a veteran reaches 181 days or more of institutional (inpatient) extended care services.

Report real property minus any outstanding lien or mortgage.

Exclude burial plots, veteran's primary residence and veteran's vehicle (if the veteran is receiving institutional (inpatient) extended care services this is the primary residence and vehicle of the spouse or dependents).

Section V - Liquid Assets. Used only in the determination of the extended care copayment amount when a veteran reaches 181 days or more of institutional (inpatient) extended care services.

Report cash, stocks, dividends received from IRA, 401K's and other tax deferred annuities, bonds, mutual funds, retirements accounts (e.g. IRA, 401Ks, annuities), art, rare coins, stamp collections, and other collectibles.

Exclude household and personal items such as furniture, clothing and jewelry if the veteran has a spouse or dependents residing in the community.

If the veteran has a spouse residing in the community (not institutionalized), the spousal resource protection amount may be applied to reduce the value of liquid assets.

VA FORM |

|

|

JAN 2017 |

EXISTING STOCK OF VA FORM |

Section VI - Current Gross Income of Veteran and Spouse. Do not include income from dependents.

Report wages, bonuses, tips, severance pay and accrued benefits

Report income from a business (minus business expenses)

Report cash gifts, inheritance amounts, intrest income, and the standard dividend income from non tax deferred annunities.

Report retirement income and pension income.

Report unemployment payments, worker's compensation payments, black lung payments, tort settlement payments, social security payments, and court mandated payments.

Report payments from VA or any other Federal programs, and any other income.

Exclude income of the Veteran's dependents.

Section VII. Expenses. Not used in the determination of the extended care copayment amount when a veteran reaches 181 days or more of institutional (inpatient) extended care services and does not a have a spouse or dependents residing in the community (not institutionalized).

Report basic subsistence (living) expenses.

Include any educational expense incurred by the veteran, spouse or dependent.

Include any funeral or burial expenses for your spouse or dependent as well as any prepaid funeral or burial arrangements for yourself, spouse, or dependent.

Include rent or mortgage payment for primary residence only.

Include amount paid for utilities (electricity, gas, water or phone). You can calculate the amount by using the average monthly expenses during the past year for your utilities.

Include car payment for one vehicle only.

Include amount spent for food for veteran, spouse or dependent.

Include

Include court ordered payments such as alimony or child support.

Include insurance premiums such as automobile and homeowners. Exclude life insurance premiums.

Include taxes paid on property and average monthly expense for taxes paid on income over the past 12 months.

STEP 3. Submitting your application

What do I do when I have finished my application?

1.Read Section VIII, Consent for Assignment of Benefits, Section IX, Consent to Agreement to Make Copayments, and Section X, Privacy Act and Paperwork Reduction Act Information.

2.In Section VIII and Section IX, you or an individual to whom you have delegated your Power of Attorney must sign and date.

3.Attach any documentation such as copies of Medicare and other health insurance cards, and your Power of Attorney documents to your application.

4.Return the original form and supporting documentation to the Social Work staff at your local VA medical facility.

STEP 4. Finding out what my Extended Care Copayment Amount will be.

Once the VA Form

VA FORM

JAN 2017

OMB Number:

Estimated Burden: 90 min.

Expiration Date: 06/30/2021

APPLICATION FOR EXTENDED CARE SERVICES

Federal law provides criminal penalties, including a fine and/or imprisonment, for any materially false, fictitious, or fraudulent statement or representation. (See 18 U.S.C. 287 and 1001)

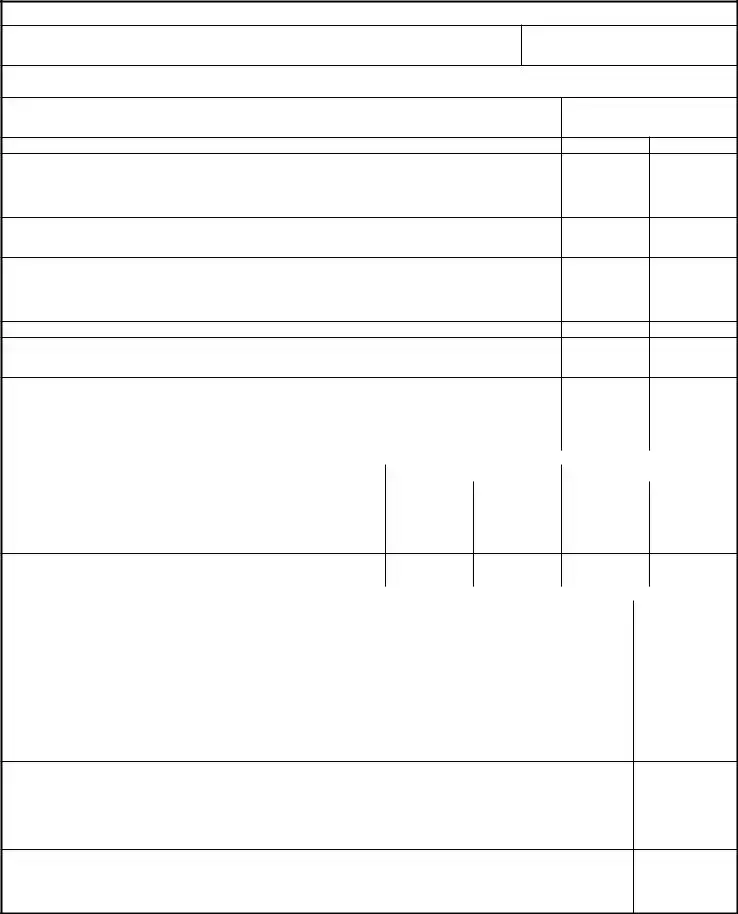

SECTION I - GENERAL INFORMATION

1.VETERAN'S NAME (Last, First, MI)

2. SOCIAL SECURITY NUMBER

SECTION II - INSURANCE INFORMATION

ANSWER YES OR NO WHERE APPLICABLE (OTHERWISE PROVIDE THE REQUESTED INFORMATION)

3. ARE YOU ELIGIBLE FOR MEDICAID? |

3A. ARE YOU ENROLLED IN MEDICARE PART A (Hospital Insurance) |

3B. EFFECTIVE DATE (If "Yes") |

|||||||||

|

|

YES |

|

NO |

|

|

YES |

|

NO |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

4. NAME OF INSURANCE COMPANY |

4A. ADDRESS OF INSURANCE COMPANY |

4B. PHONE NUMBER OF INSURANCE COMPANY |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

4C. NAME OF POLICY HOLDER

4D. RELATIONSHIP OF POLICY HOLDER

4E. POLICY NUMBER

4F. GROUP NAME AND/OR NUMBER

SECTION III - SPOUSE/DEPENDENT INFORMATION

5. CURRENT MARITAL STATUS (Check one)

|

LEGALLY SEPARATED |

|

MARRIED |

|

|

|

|

WIDOWED |

|

|

|

|

|

NEVER MARRIED

DIVORCED

5A. SPOUSE'S NAME (Last, First, MI)

5B. SPOUSE RESIDING IN THE COMMUNITY? (Provide address and phone number if different from veteran)

YES

5C. SPOUSE'S SOCIAL SECURITY NUMBER

6. DEPENDENT'S NAME (Last, First, MI)

6A. DEPENDENT'S DATE OF BIRTH

6B. DEPENDENT'S SOCIAL SECURITY NUMBER

6C. DEPENDENT RESIDING IN THE COMMUNITY? (Provide address and phone number if different from veteran)

YES

7. DEPENDENT'S NAME (Last, First, MI)

7A. DEPENDENT'S DATE OF BIRTH

7B. DEPENDENT'S SOCIAL SECURITY NUMBER

7C. DEPENDENT RESIDING IN THE COMMUNITY? (Provide address and phone number if different from veteran)

YES

We need to collect information regarding income, assets and expenses for you and your spouse. If you do not wish to provide this information you must sign agreeing to make copayments and will be charged the maximum copayment amount for all services. See the top of page 2, read, sign and date.

VA FORM |

|

|

|

JAN 2017 |

EXISTING STOCK OF VA FORM |

PAGE 1 |

APPLICATION FOR EXTENDED CARE SERVICES, CONTINUED

VETERAN'S NAME

SOCIAL SECURITY NUMBER

I do not wish to provide my detailed financial information. I understand that I will be assessed the maximum copayment amount for extended care services and agree to pay the applicable VA copayment as required by law.

SIGNATURE (Sign in ink) |

DATE |

SECTION IV - FIXED ASSETS (VETERAN AND SPOUSE) |

VETERAN |

SPOUSE |

1.Primary Residence (Market value minus mortgages or liens. Exclude if veteran receiving only non- institutional extended care services or spouse or dependent residing in the community). If the veteran and spouse maintain separate residences, and the veteran is receiving institutional (inpatient) extended care

services, include value of the veteran's primary residence.) |

$ |

$ |

2.Other Residences/Land/Farm or Ranch (Market value minus mortgages or liens. This would include a second

home, vacation home, rental property.) |

$ |

$ |

|

3.Vehicle(s) (Value minus any outstanding lien. Exclude primary vehicle if veteran receiving only non- institutional extended care services or spouse or dependent residing in community. If the veteran and spouse maintain separate residences and vehicles, and the veteran is receiving institutional (inpatient) extended care

services, include value of the veteran's primary vehicle.) |

$ |

$ |

SECTION V - LIQUID ASSETS (VETERAN AND SPOUSE)

1.Cash, Amount in Bank Accounts (e.g., checking and savings accounts, certificates of deposit, individual

retirement accounts, stocks and bonds). |

$ |

$ |

|

2.Value of Other Liquid Assets (e.g., art, rare coins, stamp collections, collectibles) Minus the amount you owe on these items. Exclude household effects, clothing, jewelry, and personal items if veteran receiving only

|

$ |

$ |

||||

SUM OF ALL LINES FIXED AND LIQUID ASSETS |

|

TOTAL ASSETS |

$ |

$ |

||

SECTION VI - CURRENT GROSS INCOME OF VETERAN AND SPOUSE |

|

|||||

|

|

|

|

|||

CATEGORY |

|

VETERAN |

SPOUSE |

|||

|

|

|

|

|

||

HOW MUCH |

HOW OFTEN |

HOW MUCH |

HOW OFTEN |

|||

|

||||||

|

|

|

|

|

|

|

1. Gross annual income from employment (e.g., wages, bonuses, tips, |

|

|

|

|

|

|

severances pay, accrued benefits) |

$ |

|

|

$ |

|

|

2. Net income from your farm/ranch, property or business. |

$ |

|

|

$ |

|

|

|

|

|

|

|||

3.List other income amounts (e.g., social security, Retirement and pension,

interest, dividends) Refer to instructions. |

$ |

$ |

|

|

|

SECTION VII - DEDUCTIBLE EXPENSES |

|

|

|

|

|

|

|

|

|

ITEMS |

|

|

AMOUNT |

|

|

|

|

|

1. |

Educational expenses of veteran, spouse or dependent (e.g., tuition, books, fees, material, etc.) |

|

$ |

|

|

|

|

|

|

2. |

Funeral and Burial (spouse or child, amount you paid for funeral and burial expenses, including prepaid arrangements) |

$ |

||

|

|

|

|

|

3. |

Rent/Mortgage (monthly amount or annual amount) |

|

|

$ |

|

|

|

|

|

4. |

Utilities (calculate by average monthly amounts over the past 12 months) |

|

|

$ |

|

|

|

|

|

5. |

Car Payment for one vehicle only (exclude gas, automobile insurance, parking fees, repairs) |

|

$ |

|

|

|

|

|

|

6. |

Food (for veteran, spouse and dependent) |

|

|

$ |

|

|

|

|

|

7.

health insurance, hospital and nursing home expenses) |

$ |

|

|

|

|

8. |

$ |

|

|

|

|

9. |

Insurance (e.g., automobile insurance, homeowners insurance) Exclude Life Insurance |

$ |

|

|

|

10.Taxes (e.g., personal property for home, automobile) Include average monthly expense for taxes paid on income over the

past 12 months. |

|

$ |

|

|

|

|

TOTALS |

$ |

|

|

VA FORM |

|

|

JAN 2017 |

PAGE 2 |

APPLICATION FOR EXTENDED CARE SERVICES, CONTINUED

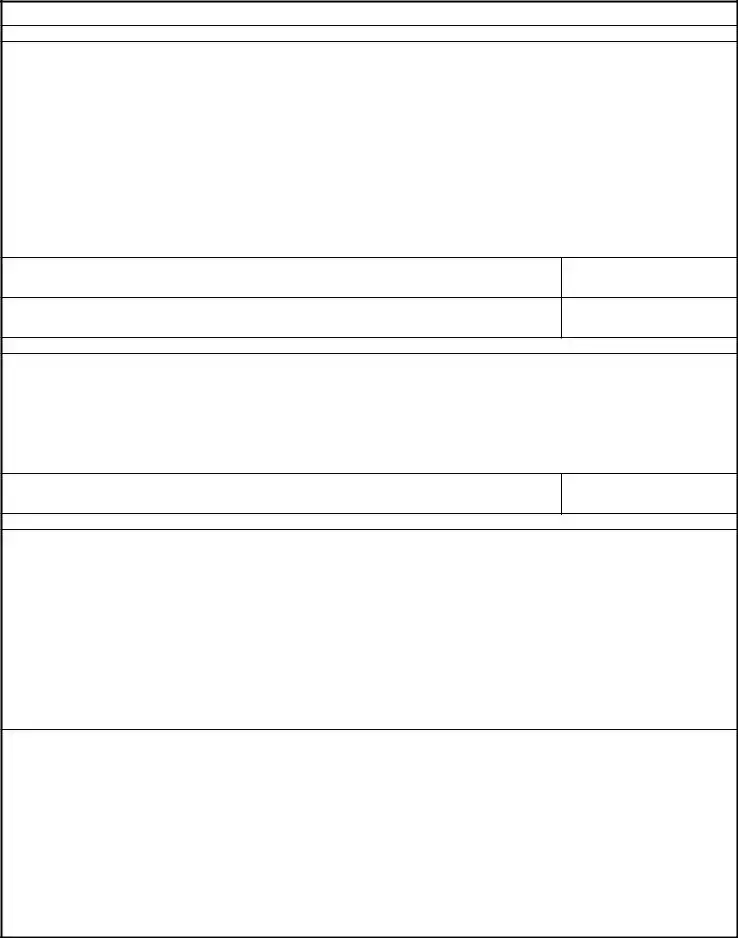

SECTION VIII - CONSENT FOR ASSIGNMENT OF BENEFITS

I understand that pursuant to 38 U.S.C. Section 1729 and 42 U.S.C. 2651, the Department of Veterans Affairs (VA) is authorized to recover or collect from my health plan (HP) or any other legally responsible third party for the reasonable charges of nonservice- connected VA medical care or services furnished or provided to me. I hereby authorize payment directly to VA from any HP under which I am covered (including coverage provided under my spouse's HP) that is responsible for payment of the charges for my medical care, including benefits otherwise payable to me or my spouse. Furthermore, I hereby assign to the VA any claim I may have against any person or entity who is or may be legally responsible for the payment of the cost of medical services provided to me by the VA. I understand that this assignment shall not limit or prejudice my right to recover for my own benefit any amount in excess of the cost of medical services provided to me by the VA or any other amount to which I may be entitled. I hereby appoint the Attorney General of the United States and the Secretary of Veterans' Affairs and their designees as my

SIGNATURE (Sign in ink)

DATE

VETERANS NAME

SOCIAL SECURITY NUMBER

SECTION IX - CONSENT TO AGREEMENT TO MAKE COPAYMENTS

Completion of this form with signature of the Veteran or veteran's representative is certification that the veteran/representative has received a copy of the Privacy Act Statement and agrees to make appropriate copayments.

l declare under penalty of perjury that the foregoing is true and accurate to the best of my knowledge and I agree to make the applicable copayment for extended care services as required by law. I understand that any materially false, fictitious, or fraudulent statement or representation, made knowingly, is punishable by a fine and/or imprisonment pursuant to title 18, United States Code, Sections 287 and 1001.

SIGNATURE (Sign in ink)

DATE

SECTION X - PRIVACY ACT AND PAPERWORK REDUCTION ACT INFORMATION

The VA is asking you to provide the information on this form under Title 38, United States Code, sections 1710, 1712, 1722 and 1729 for VA to determine your eligibility for extended care benefits and to establish financial eligibility, if applicable, when placed in extended care services. Obligation to respond is voluntary. The information you supply may be verified through a

ADDITIONAL COMMENTS:

VA FORM |

|

|

JAN 2017 |

PAGE 3 |

Form Characteristics

| Fact Name | Description |

|---|---|

| OMB Number | The OMB Number for the VA Form 10-10EC is 2900-0629. |

| Estimated Burden | It is estimated that filling out the form will take approximately 90 minutes. |

| Expiration Date | The form is set to expire on June 30, 2021. |

| Purpose | This form helps determine the monthly copayment obligations for extended care services provided by the VA. |

| No Copayment Period | There is no copayment required for the first 21 days of extended care services within a 12-month period. |

| Documentation Requirement | Applicants must report any income, expenses, and asset changes to the local VA medical facility within 10 days. |

| Governing Law | The application follows federal regulations under Title 38, United States Code, sections 1710, 1712, 1722, and 1729. |

| Help Availability | Assistance can be obtained from the Social Work staff at local VA medical facilities for completing the form. |

Guidelines on Utilizing Va 10 10Ec

Completing the VA Form 10-10EC is a crucial step in determining your copayment obligations for extended care services provided by the Veterans Affairs (VA). It’s important to gather all necessary information before you begin, as this will ensure a smoother application process and help avoid potential delays in receiving care.

- Gather Required Information: Collect your current income and deductible expenses, as well as the values of both fixed and liquid assets for you and your spouse. You will also need health insurance and Medicare information, along with details about any dependents.

- Complete Section I: Fill in your full name and Social Security number in the General Information section.

- Fill Out Section II: Provide information regarding your insurance coverage, including Medicare and any other health insurance. Make copies of your Medicare and insurance cards to attach to your application.

- Complete Section III: Provide details about your spouse and any dependents, including names, Social Security numbers, and current residency status. Make sure to report your marital status accurately.

- Report Fixed Assets in Section IV: List your and your spouse's real property values, excluding burial plots and primary residences (if applicable) as instructed.

- Fill in Liquid Assets in Section V: Provide figures for cash, stocks, and other liquid assets while excluding personal items like furniture and clothing.

- Detail Current Gross Income in Section VI: Report your and your spouse's income sources, excluding dependents’ income.

- Report Expenses in Section VII: Input your basic living expenses and any educational or medical costs incurred. Ensure these values align with your financial documents.

- Review Consent Sections: Carefully read through Sections VIII (Consent for Assignment of Benefits) and IX (Consent to Agreement to Make Copayments). Sign and date these sections.

- Attach Supporting Documentation: Include copies of necessary documents, such as health insurance cards and, if relevant, Power of Attorney papers.

- Submit Your Application: Return your completed form and all attachments to the Social Work staff at your local VA medical facility.

Once submitted, your application will be processed, and you will receive guidance on your estimated monthly copayment obligations for the extended care services requested. Take action promptly to ensure you can access the care you need without unnecessary delays.

What You Should Know About This Form

What is VA Form 10-10EC used for?

VA Form 10-10EC is primarily used to determine your estimated monthly copayment obligations for extended care services provided by the VA. These services can be delivered directly by the VA or arranged by the VA through other means. Notably, there are no copayments for the first 21 days of extended care services in any 12-month period. If there are changes that could affect your copayment amount, it is essential to report these changes to your local VA medical facility within 10 calendar days.

Where can I get help filling out the form?

If you need assistance with the form, reach out to the Social Work staff at your local VA medical facility. They can provide guidance on the information and financial details needed to successfully complete VA Form 10-10EC. Getting help ensures that you include all necessary information and avoid any mistakes.

What information do I need to complete the form?

To fill out the form accurately, you will need specific details, including the current income of both you and your spouse (monthly or annual amount), current deductible expenses (monthly or annual), the value of both fixed and liquid assets, and information regarding any health insurance coverage. This includes a copy of your Medicare card and any health insurance cards for either you or your spouse. Additionally, you should gather details about your spouse or dependents, such as their social security number and date of birth. Making sure you have this information ready will help streamline your application process.

What do I do when I have finished my application?

Upon completing your application, there are several important steps. First, review Sections VIII, IX, and X, which involve consents for benefits and privacy rights. It's crucial that either you or someone you have appointed as your Power of Attorney signs these sections. Next, attach all necessary documentation, like copies of Medicare and health insurance cards. Finally, submit the original form along with your supporting documents to the Social Work staff at your local VA medical facility for processing. This will initiate the assessment of your extended care copayment obligations.

How will I find out the amount of my Extended Care Copayment?

After submitting VA Form 10-10EC, the Social Work staff at your local VA medical facility will schedule a counseling session. During this session, they will provide you with information on your estimated monthly copayment obligations for the requested extended care services. This support will help you understand your financial responsibilities regarding your care.

Common mistakes

Completing the VA Form 10-10EC correctly is vital for veterans seeking extended care services. However, many people make common mistakes that can complicate the process. Understanding these pitfalls can help ensure a smoother application experience.

One significant mistake is failing to report accurate income information. It is essential to provide the current gross income of both the veteran and the spouse. Omitting bonus amounts, interest income, or other forms of income can lead to inaccuracies in the copayment determination. This oversight may result in a higher copayment than necessary or complications in processing the application.

Another frequent error involves the failure to include essential health insurance information. Not all veterans realize that they must report all health insurance coverage, including Medicare and any private health insurance policies. Without this information, the VA cannot accurately assess what services and costs may apply to the individual.

Some applicants also overlook the importance of detailing their spousal and dependent information accurately. For example, if the applicant's marital status changes, this must be reported promptly. If a spouse has been institutionalized, this information is vital for determining the extended care copayment. Failure to disclose accurate relationship statuses or resident information can jeopardize eligibility for benefits.

In addition, many individuals forget to provide copies of necessary documentation, such as Medicare cards or health insurance cards. These documents are crucial for verifying coverage, and without them, the processing of the application could stall.

Estimating liquid and fixed assets inaccurately can lead to problems. It is essential to provide a correct evaluation of assets, including properties and bank accounts. Veterans should ensure they exclude items like burial plots and vehicles correctly, as misunderstanding these exclusions can impact the copayment calculation.

In some cases, applicants do not take the time to read and understand all sections of the form. Skipping over the consent sections, or failing to sign and date appropriately, can result in the rejection of the application. Each section plays a role in the overall application process, and overlooking even minor details can lead to complications.

Lastly, failing to report any changes in circumstances promptly can cause issues. After submitting the application, if any financial situation changes, such as increased income or a new dependent, this must be reported to the local VA medical facility within ten calendar days. Ignoring this requirement can lead to the incorrect copayment amount being assigned.

In summary, avoiding these common mistakes will aid veterans in successfully completing the VA Form 10-10EC. By carefully reviewing all information, ensuring accuracy, and remaining attentive to changes, veterans can navigate this process more effectively and focus on securing the care they need.

Documents used along the form

Along with the VA Form 10-10EC, veterans may need to prepare several other forms and documents for their extended care services application. These documents help to provide a complete picture of a veteran's situation and ensure that the application process goes smoothly. Here are some key forms and documents commonly used alongside the VA 10-10EC:

- VA Form 10-10EZ: This form is used for enrollment in the VA health care system. It collects personal and financial information, helping the VA assess eligibility for benefits.

- VA Form 21-526EZ: This streamlined application form is for veterans seeking service-connected disability compensation. It details the veteran's service history and medical issues.

- VA Form 21-527EZ: This form is used when applying for pension benefits. It requires information about income, assets, and family size to determine eligibility.

- VA Form 21-4142: This is the Authorization and Consent to Release Information form. It allows the VA to obtain medical records from private providers.

- Medicare Card: A copy of the Medicare card is crucial for verifying coverage. It helps in understanding any costs the veteran may still face, even with VA care.

- Health Insurance Cards: Submitting copies of all health insurance cards is essential. This clarifies additional coverage the veteran may have, which can affect copayment amounts.

- Power of Attorney Documents: If another person is filing on behalf of the veteran, these documents permit them to act in the veteran’s interests, especially regarding decision-making.

- Proof of Income: Documents like recent pay stubs or bank statements verify the income of both the veteran and their spouse. This information is crucial for determining copayment amounts.

- Financial Expense Documentation: Receipts or statements for medical, housing, and other expenses help provide an accurate estimation of financial standing.

- Proof of Veteran Status: Documents such as a discharge papers or DD Form 214 confirm the veteran’s eligibility for benefits and services.

Having these documents ready can significantly expedite the process and prevent delays. It’s important to check each form for accuracy and completeness before submission. Seek assistance from local VA staff if needed to ensure everything is correctly filled out.

Similar forms

- VA Form 10-10EZ: This document, like the 10-10EC, is utilized to gather financial information from veterans. The 10-10EZ is specifically for veterans applying for medical benefits, while the 10-10EC focuses on determining copayment responsibilities for extended care services.

- VA Form 21-526EZ: Much like the 10-10EC, this form is used to evaluate claims from veterans. However, the 21-526EZ is aimed at disability compensation claims, collecting information about income, assets, and dependents, which can influence the claim's outcome.

- Medicare Application Forms: Similar to the 10-10EC, Medicare applications seek detailed information about a person's income and health insurance coverage. Both forms aim to assess eligibility for benefits but within different healthcare systems.

- Social Security Administration (SSA) Forms: SSA forms, specifically those used for benefits eligibility, gather information about income, resources, and household size. Like the 10-10EC form, these forms help evaluate eligibility for assistance based on financial criteria.

- Medicaid Application: The Medicaid application process mirrors the 10-10EC in that both collect substantial financial information from the applicant. Both forms help determine eligibility for long-term care coverage based on income and assets.

- VA Form 10-10SH: This form is used to apply for housing assistance and shares similarities with the 10-10EC in its request for information related to income and financial circumstances, crucial for determining eligibility for benefits or services.

Dos and Don'ts

When filling out the VA Form 10-10EC, consider the following dos and don’ts to ensure accurate and complete submission.

- Do gather all necessary financial documents before starting, including income statements, asset information, and health insurance details.

- Do provide accurate information about your current income, expenses, and any changes that could affect your copayment obligations.

- Do report both liquid and fixed assets accurately, excluding exempt items like your primary residence and vehicle, if applicable.

- Do list all sources of insurance coverage, including Medicare and private insurance, and attach copies of relevant cards.

- Do reach out for help if needed. Contact your local VA medical facility’s Social Work staff for guidance.

- Don’t omit dependent information if required. Accurate reporting helps determine copayment status.

- Don’t include income from dependents in your gross income figures. Only report your own and your spouse's income.

- Don’t forget to sign and date Sections VIII and IX. Failure to do so may delay your application.

- Don’t neglect to submit all required documentation, including additional financial evidence if requested.

Following these guidelines will help ensure a smoother application process for extended care services.

Misconceptions

In understanding VA Form 10-10EC, misconceptions often arise that may lead to confusion regarding its purpose and the requirements for completion. Below are some common misconceptions along with clarifications.

- Misconception 1: The form is only for veterans in nursing homes.

- Misconception 2: It is mandatory to provide detailed financial information.

- Misconception 3: All income and assets must be reported.

- Misconception 4: There is no benefit if a veteran has an above-average income.

- Misconception 5: Changes in personal circumstances do not need to be reported.

- Misconception 6: The form is only required once.

- Misconception 7: Assistance in filling out the form is not available.

In fact, the VA 10-10EC form applies to all veterans seeking extended care services, regardless of whether they reside in a nursing home or in the community.

The form indeed collects information on income and assets, but if a veteran prefers not to disclose this information, they can opt to pay the maximum copayment amount instead.

Certain items, such as a veteran's primary residence and vehicle, are excluded when determining copayment amounts.

While income does affect copayment rates, veterans are still entitled to apply for benefits, and many options exist for assistance based on specific situations.

Change in income or marital status, for instance, must be reported to the local VA medical facility within 10 calendar days as it can alter copayment obligations.

This form may need to be completed multiple times, particularly if there are changes in financial or personal circumstances that affect eligibility or copayment levels.

Help is readily available at local VA medical facilities, where social work staff can provide guidance on completing the form accurately.

Understanding these misconceptions can make the process of applying for extended care services less daunting and ensure that veterans receive the benefits for which they are eligible.

Key takeaways

Understanding how to fill out and use the VA Form 10-10EC is essential for veterans seeking extended care services. Here are some key takeaways:

- Purpose of the Form: The VA Form 10-10EC is used to estimate monthly copayment obligations for extended care services provided directly by the VA or paid for by the VA. Remember, there is no copayment for the first 21 days of services in any 12-month period.

- Report Changes: If there are any changes in your financial situation that affect your copayment amount, it’s crucial to inform your local VA medical facility within 10 calendar days. This can include changes to income, assets, or family status.

- Gather Necessary Documents: Before you begin filling out the form, ensure you have important information handy. This includes current income details of both the veteran and spouse, health insurance information, and any applicable Medicare details.

- Submit Supporting Documentation: Make sure to attach any necessary documentation, such as copies of health insurance cards and any Power of Attorney documents, along with your completed form. This helps the VA process your application smoothly.

- Estimated Copayment Amount: After submitting the form, the Social Work staff at your local VA facility will guide you through understanding your estimated copayment obligations for extended care services.

Being prepared and informed can make filling out the VA Form 10-10EC much more manageable.

Browse Other Templates

Annual Nonprofit Filing,Kansas Not-for-Profit Report,NP Corporation Update Form,Kansas Nonprofit Annual Submission,Annual Organizational Report for NP,Nonprofit Corporation Filing Form,Kansas Nonprofit Mandatory Report,NP Corporate Annual Filing,Annu - To ensure accuracy, review all provided information before submission.

S1 Form - Participants receive a Vaccine Information Statement (VIS) prior to signing.