Fill Out Your Va 10 10Ezr Form

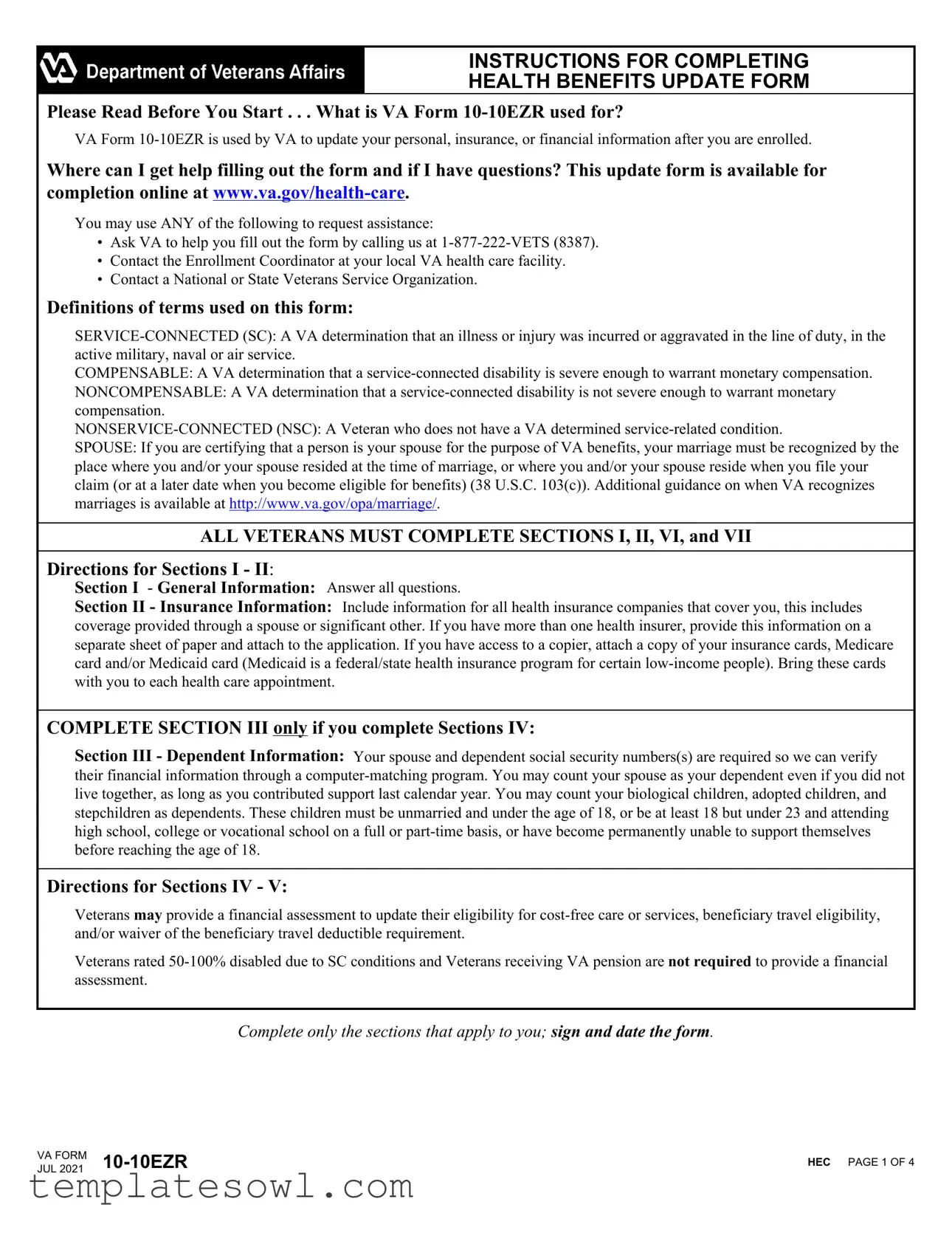

The VA Form 10-10EZR serves a crucial role in the Department of Veterans Affairs' efforts to maintain accurate and up-to-date records for the health benefits of veterans. After enrollment, veterans must use this form to provide necessary updates regarding their personal, insurance, or financial information. Completing the form correctly is essential to ensure that the VA can effectively process health care benefits and maintain eligibility for services. The form is segmented into various sections: General Information, Insurance Information, Dependent Information, Previous Calendar Year Gross Annual Income, Previous Calendar Year Deductible Expenses, and Consent to Copays. Each section caters to specific aspects, such as reporting income, detailing dependent information, and ensuring consent for copayments and communications. For those needing help, resources are readily available, including online assistance and support from local enrollment coordinators. Accurate information is vital not only for personal eligibility but also for the integrity of VA records, as the completion process includes important declarations about income and care costs.

Va 10 10Ezr Example

INSTRUCTIONS FOR COMPLETING

HEALTH BENEFITS UPDATE FORM

Please Read Before You Start . . . What is VA Form

VA Form

Where can I get help filling out the form and if I have questions? This update form is available for completion online at

You may use ANY of the following to request assistance:

•Ask VA to help you fill out the form by calling us at

•Contact the Enrollment Coordinator at your local VA health care facility.

•Contact a National or State Veterans Service Organization.

Definitions of terms used on this form:

COMPENSABLE: A VA determination that a

NONCOMPENSABLE: A VA determination that a

SPOUSE: If you are certifying that a person is your spouse for the purpose of VA benefits, your marriage must be recognized by the place where you and/or your spouse resided at the time of marriage, or where you and/or your spouse reside when you file your claim (or at a later date when you become eligible for benefits) (38 U.S.C. 103(c)). Additional guidance on when VA recognizes marriages is available at http://www.va.gov/opa/marriage/.

ALL VETERANS MUST COMPLETE SECTIONS I, II, VI, and VII

Directions for Sections I - II:

Section I - General Information: Answer all questions.

Section II - Insurance Information: Include information for all health insurance companies that cover you, this includes coverage provided through a spouse or significant other. If you have more than one health insurer, provide this information on a separate sheet of paper and attach to the application. If you have access to a copier, attach a copy of your insurance cards, Medicare card and/or Medicaid card (Medicaid is a federal/state health insurance program for certain

COMPLETE SECTION III only if you complete Sections IV:

Section III - Dependent Information: Your spouse and dependent social security numbers(s) are required so we can verify their financial information through a

Directions for Sections IV - V:

Veterans may provide a financial assessment to update their eligibility for

Veterans rated

Complete only the sections that apply to you; sign and date the form.

VA FORM |

HEC PAGE 1 OF 4 |

|

JUL 2021 |

Continued ...

Section IV - Previous Calendar Year Gross Annual Income of Veteran, Spouse and Dependent Children.

Report:

•Gross annual income from employment, except for income from your farm, ranch, property or business. Include your wages, bonuses, tips, severance pay and other accrued benefits and your child's income information if it could have been used to pay your household expenses.

•Net income from your farm, ranch, property, or business.

•Other income amounts, including retirement and pension income, Social Security Retirement and Social Security Disability income, compensation benefits such as VA disability, unemployment, Workers Compensation and Black Lung, cash gifts, interest and dividends, including tax exempt earnings and distributions from Individual Retirement Accounts (IRAs) or annuities.

Do Not Report:

Donations from public or private relief, welfare or charitable organizations; Supplemental Security Income (SSI) and

Section V - Previous Calendar Year Deductible Expenses.

Report

Section VI - Consent to Copays and to Receive Communications.

By submitting this application, you are agreeing to pay the applicable VA copayments for care or services (including urgent care) as required by law. You also agree to receive communications from VA to your supplied email, home phone number, or mobile number. However, providing your email, home phone number, or mobile number is voluntary.

Section VII - Submitting Your Update.

1.Read Paperwork Reduction and Privacy Act Information, Section VI Consent to Copays and Assignment of Benefits.

2.Sign and Date the form. You or an individual to whom you have delegated your Power of Attorney must sign and date the form. If you sign with an "X", 2 people you know must witness you as you sign. They must sign the form and print their names. If the form is not signed and dated appropriately, VA will return it for you to complete.

3.Attach any continuation sheets, a copy of supporting materials or your Power of Attorney documents to your application.

Where do I mail my update?

Mail the completed VA Form

PAPERWORK REDUCTION ACT AND PRIVACY ACT INFORMATION

The Paperwork Reduction Act of 1995 requires us to notify you that this information collection is in accordance with the clearance requirements of Section 3507 of the Paperwork Reduction Act of 1995. We may not conduct or sponsor, and you are not required to respond to, a collection of information unless it displays a valid OMB number. We anticipate that the time expended by all individuals who must complete this form will average 15 minutes. This includes the time it will take to read instructions, gather the necessary facts and fill out the form.

Privacy Act Information: VA is asking you to provide the information on this form under 38 U.S.C. Sections 1710, 1712, and 1722 in order for VA to determine your eligibility for medical benefits. Information you supply may be verified from initial submission forward through a computer matching program. VA may disclose the information that you put on the form as permitted by law. VA may make a "routine use" disclosure of the information as outlined in the Privacy Act systems of records notices and in accordance with the Notice of Privacy Practices. Providing the requested information is voluntary, but if any or all of the requested information is not provided, it may delay or result in denial of your request for health care benefits. Failure to furnish the information will not have any effect on any other benefits to which you may be entitled. If you provide VA your Social Security Number, VA will use it to administer your VA benefits. VA may also use this information to identify veterans and persons claiming or receiving VA benefits and their records, and for other purposes authorized or required by law.

VA FORM |

HEC PAGE 2 OF 4 |

OMB Approved No.

HEALTH BENEFITS UPDATE FORM

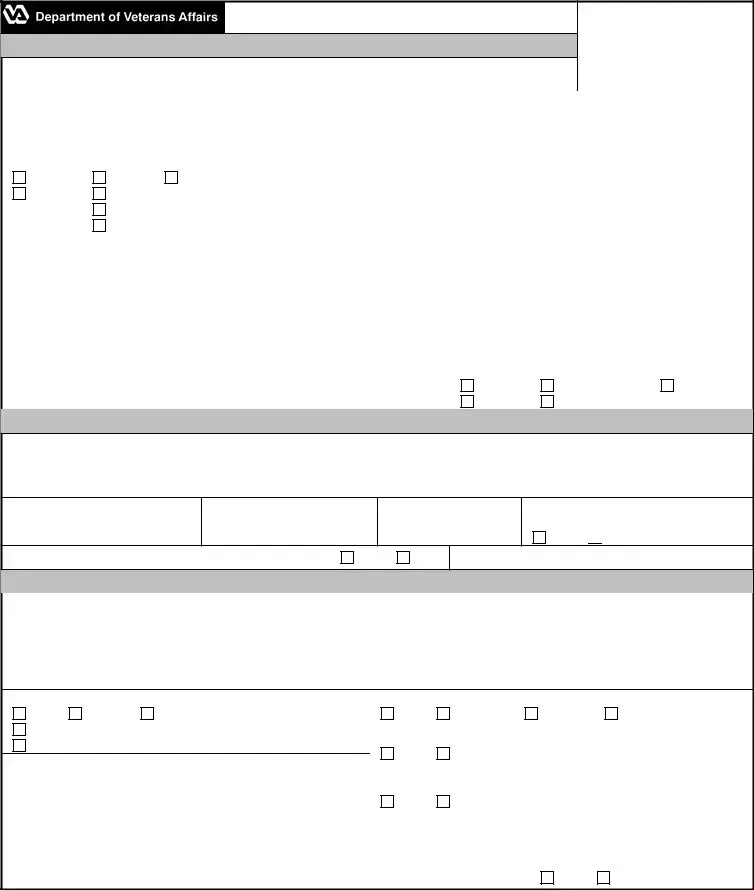

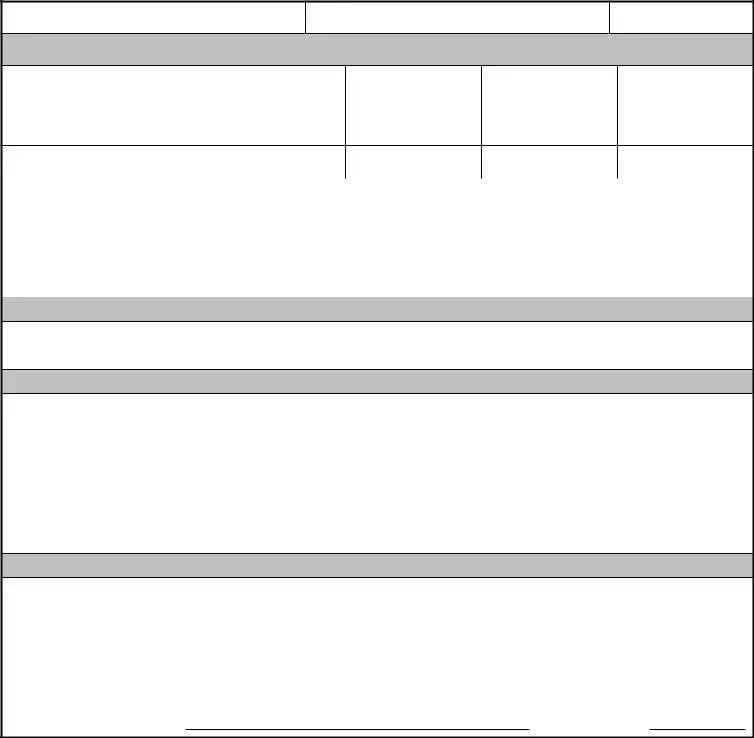

SECTION I - GENERAL INFORMATION

Federal law provides criminal penalties, including a fine and/or imprisonment, for any materially false, fictitious, or fraudulent statement or representation. (See 18 U.S.C. 287 and 1001).

VA DATE STAMP

(For VHA Use Only)

1A. VETERAN'S NAME (Last, First, Middle Name) |

|

|

|

|

|

|

|

|

2. SOCIAL SECURITY NUMBER |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1B. VETERAN'S PREFERRED NAME (Last, First, Middle Name) |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

3A. BIRTH SEX |

3B. |

4. DATE OF BIRTH |

|

|

|

5. HOME TELEPHONE NUMBER (optional) |

|

|

||||||||||||

|

|

MALE |

|

|

MALE |

|

FEMALE |

(mm/dd/yyyy) |

|

|

|

|

|

|

|

|

(Include area code) |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

FEMALE |

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

6. MOBILE TELEPHONE NUMBER (optional) |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

CHOOSE NOT TO ANSWER |

|

|

|

|

|

|

|

|

|

(Include area code) |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7A. MAILING ADDRESS (Street) |

|

|

|

|

|

|

|

7B. CITY |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7C. STATE |

|

7D. ZIP CODE |

|

|

7E. COUNTY |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8A. HOME ADDRESS (Street) |

|

|

|

|

8B. CITY |

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8C. STATE |

|

8D. ZIP CODE |

|

|

8E. COUNTY |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

9. |

|

|

|

|

|

|

10. CURRENT MARITAL STATUS |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MARRIED |

|

NEVER MARRIED |

|

SEPARATED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WIDOWED |

|

DIVORCED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION II - INSURANCE INFORMATION (Use a separate sheet for additional information)

1. ENTER YOUR HEALTH INSURANCE COMPANY NAME, ADDRESS AND TELEPHONE NUMBER (include coverage through spouse or other person)

2. NAME OF POLICY HOLDER

3. POLICY NUMBER

4. GROUP CODE

5.ARE YOU ELIGIBLE FOR MEDICAID? (Federal Health Insurance for low income adults)

YES  NO

NO

6. ARE YOU ENROLLED IN MEDICARE HOSPITAL INSURANCE PART A?

YES

NO

7. EFFECTIVE DATE (mm/dd/yyyy)

SECTION III - DEPENDENT INFORMATION (Use a separate sheet for additional dependents)

1. SPOUSE'S NAME (Last, First, Middle Name) |

7. CHILD'S NAME (Last, First, Middle Name) |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

2. SPOUSE'S SOCIAL SECURITY NUMBER |

8. CHILD'S DATE OF BIRTH (mm/dd/yyyy) |

9. CHILD'S SOCIAL SECURITY NUMBER |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

3. SPOUSE'S DATE OF BIRTH (mm/dd/yyyy) |

10. DATE CHILD BECAME YOUR DEPENDENT (mm/dd/yyyy) |

|||||||||||||||||

4. SPOUSE'S |

11. CHILD'S RELATIONSHIP TO YOU (Check one) |

|

|

|||||||||||||||

|

|

MALE |

|

FEMALE |

|

|

|

|

SON |

|

DAUGHTER |

|

STEPSON |

|

STEPDAUGHTER |

|||

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

12. WAS CHILD PERMANENTLY AND TOTALLY DISABLED BEFORE THE AGE OF 18? |

||||||||||||||||||

|

|

CHOOSE NOT TO ANSWER |

|

|||||||||||||||

|

|

|

||||||||||||||||

|

|

|

|

|

YES |

|

NO |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

||||||||||

5. DATE OF MARRIAGE (mm/dd/yyyy) |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

13. IF CHILD IS BETWEEN 18 AND 23 YEARS OF AGE, DID CHILD ATTEND |

||||||||||

|

|

|

|

|

|

|

|

|

|

SCHOOL LAST CALENDAR YEAR? |

|

|

||||||

6. SPOUSE'S ADDRESS AND TELEPHONE NUMBER |

|

|

|

|

||||||||||||||

|

|

YES |

|

NO |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|||||||||||

|

(Street, City, State, ZIP - if different from Veteran's) |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

14. EXPENSES PAID BY YOU FOR YOUR DEPENDENT CHILD FOR COLLEGE, |

||||||||||

|

|

|

|

|

|

|

|

|

|

VOCATIONAL REHABILITATION OR TRAINING (e.g., tuition, books, materials) |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15. IF YOUR SPOUSE OR DEPENDENT CHILD DID NOT LIVE WITH YOU LAST YEAR, DID YOU PROVIDE SUPPORT?

YES

NO

REMEMBER TO SIGN AND DATE THE FORM ON THE REVERSE PAGE

PREVIOUS EDITIONS OF THIS FORM ARE NOT TO BE USED

VA FORM |

HEC PAGE 3 OF 4 |

HEALTH BENEFITS UPDATE FORM

VETERAN'S NAME (Last, First, Middle)

SOCIAL SECURITY NUMBER

SECTION IV - PREVIOUS CALENDAR YEAR GROSS ANNUAL INCOME OF VETERAN, SPOUSE AND DEPENDENT CHILDREN

(Use a separate sheet for additional dependents)

|

VETERAN |

SPOUSE |

CHILD 1 |

|

|

|

|

1. GROSS ANNUAL INCOME FROM EMPLOYMENT (wages, bonuses, tips, |

|

|

|

etc.) EXCLUDING INCOME FROM YOUR FARM, RANCH, PROPERTY OR |

$ |

$ |

$ |

BUSINESS |

|||

2. NET INCOME FROM YOUR FARM, RANCH, PROPERTY OR BUSINESS |

$ |

$ |

$ |

3.LIST OTHER INCOME AMOUNTS (e.g., Social Security, compensation,

pension, interest, dividends) EXCLUDING WELFARE. |

$ |

$ |

$ |

SECTION V - PREVIOUS CALENDAR YEAR DEDUCTIBLE EXPENSES |

|

||

|

|

||

1. TOTAL |

$ |

||

Medicare, health insurance, hospital and nursing home) VA will calculate a deductible and the net medical expenses you may claim. |

|||

2. AMOUNT YOU PAID LAST CALENDAR YEAR FOR FUNERAL AND BURIAL EXPENSES (INCLUDING PREPAID BURIAL EXPENSES) |

|

||

FOR YOUR DECEASED SPOUSE OR DEPENDENT CHILD (Also enter spouse or child's information in Section III.) |

$ |

||

3. AMOUNT YOU PAID LAST CALENDAR YEAR FOR YOUR COLLEGE OR VOCATIONAL EDUCATIONAL EXPENSES (e.g., tuition, books, |

$ |

||

fees, materials) DO NOT LIST YOUR DEPENDENTS' EDUCATIONAL EXPENSES. |

|

||

SECTION VI - CONSENT TO COPAYS AND TO RECEIVE COMMUNICATIONS

By submitting this application, you are agreeing to pay the applicable VA copayments for care or services (including urgent care) as required by law. You also agree to receive communications from VA to your supplied email, home phone number, or mobile number. However, providing your email, home phone number, or mobile number is voluntary.

ASSIGNMENT OF BENEFITS

I understand that pursuant to 38 U.S.C. Section 1729 and 42 U.S.C. 2651, the Department of Veterans Affairs (VA) is authorized to recover or collect from my health plan (HP) or any other legally responsible third party for the reasonable charges of

SECTION VII - SUBMITTING YOUR UPDATE

ALL APPLICANTS MUST SIGN AND DATE THIS FORM. REFER TO INSTRUCTIONS WHICH DEFINE WHO CAN SIGN ON BEHALF OF THE VETERAN.

Federal law provides criminal penalties, including a fine and/or imprisonment, for any materially false, fictitious, or fraudulent statement or representation. (See 18 U.S.C. 287 and 1001).

I declare under penalty of perjury that the foregoing is true and accurate to the best of my knowledge. I understand that any materially false, fictitious, or fraudulent statement or representation, made knowingly, is punishable by a fine and/or imprisonment pursuant to title 18, United States Code, Sections 287 and 1001.

SIGNATURE OF APPLICANT: |

DATE (mm/dd/yyyy): |

(Sign in ink) |

VA FORM |

HEC PAGE 4 OF 4 |

Form Characteristics

| Fact Title | Fact Details |

|---|---|

| Purpose | VA Form 10-10EZR is used to update personal, insurance, or financial information for VA health benefits after enrollment. |

| Assistance | Help is available by calling 1-877-222-VETS (8387), contacting a local VA facility's Enrollment Coordinator, or reaching out to a veterans service organization. |

| Mandatory Sections | All veterans must complete Sections I, II, VI, and VII of the form. |

| Income Reporting | Veterans must report gross annual income, including wages, bonuses, and other income sources, excluding certain exemptions. |

| Dependent Information | Section III requires the Social Security numbers and details of dependents, with specific inclusion criteria for counting dependents. |

| Submission Guidelines | The completed form, along with supporting documents, should be mailed to the Health Eligibility Center in Atlanta, GA. |

| Legal Protections | The form includes warnings about penalties for providing false information under federal law, specifically 18 U.S.C. Sections 287 and 1001. |

| Privacy Act Notice | Information provided is protected under the Privacy Act and may be subject to verification through a computer-matching program. |

Guidelines on Utilizing Va 10 10Ezr

Once you have gathered all the necessary information, follow these steps to complete the VA Form 10-10EZR accurately. Ensure you have documents such as your health insurance cards and any relevant financial statements available to assist you as you fill out the form.

- Complete Section I - General Information, including your name, Social Security number, birthdate, and contact details.

- Provide your current marital status in Section I.

- Move to Section II and enter insurance information for all health insurance plans covering you, including any through your spouse.

- If applicable, attach a separate sheet for additional insurance providers and copies of your insurance cards.

- Complete Section III - Dependent Information if you have dependents; include their Social Security numbers and other relevant details.

- Fill out Sections IV and V for financial assessment, detailing previous year's gross annual income and deductible expenses.

- In Section VI, consent to copayments and the receipt of communications from the VA.

- Finally, sign and date the form in Section VII. Ensure the signature is in ink, and if you use an "X," have two witnesses sign as well.

- Attach any additional sheets, supporting documents, or Power of Attorney papers as necessary.

- Mail the completed form along with any attachments to the Health Eligibility Center at the provided address.

What You Should Know About This Form

What is VA Form 10-10EZR used for?

VA Form 10-10EZR is primarily used by the Department of Veterans Affairs to update your personal information after you have enrolled in their health care system. This may include changes to your contact details, insurance information, or financial circumstances. Keeping this information current ensures that your benefits and healthcare services are managed efficiently and accurately.

How can I get help with the VA Form 10-10EZR?

If you need assistance while filling out the VA Form 10-10EZR, several resources are available. You can complete the form online at www.va.gov/health-care. If you prefer to speak with someone, you can call the VA directly at 1-877-222-VETS (8387) for help. Additionally, your local VA health care facility has Enrollment Coordinators who can guide you through the process. You may also reach out to National or State Veterans Service Organizations for assistance.

What sections of the form must all veterans complete?

Every veteran must fill out Sections I, II, VI, and VII of the VA Form 10-10EZR. Section I gathers general information, Section II pertains to your insurance details, Section VI covers consent for copayments and communication preferences, and Section VII is where you will sign and date the form. Ensure you complete all required sections to avoid delays in processing your update.

Where should I mail my completed VA Form 10-10EZR?

Once you have filled out the VA Form 10-10EZR, you should mail it along with any necessary supporting materials to the Health Eligibility Center. The mailing address is 2957 Clairmont Road, Suite 200, Atlanta, GA 30329. Make sure to double-check that the form is signed and dated properly before sending it to avoid any delays.

What information should I include about my income on the form?

When providing details about your income on the form, be sure to include your gross annual income from all sources, including wages, bonuses, and any other employment-related earnings. You should also report net income from any businesses or properties you own. Include other income such as Social Security, pensions, and VA disability benefits. However, do not include certain types of income like donations, government need-based payments, or loans. This information helps determine your eligibility for healthcare services and any associated costs.

Common mistakes

Filling out the VA Form 10-10EZR can be a straightforward process, but mistakes can lead to delays in receiving health benefits. One common error occurs when individuals leave sections incomplete. Sections I, II, VI, and VII are mandatory, yet some veterans mistakenly skip or neglect to fully complete these sections. Every question deserves a thoughtful answer. Incomplete submissions might trigger a request for more information, prolonging the approval process.

Another frequent issue involves providing incorrect or outdated personal information. This can include anything from a misspelled name to an incorrect Social Security number. Such errors can create confusion and hinder the verification process. It is essential to input accurate details to avoid complications. Veterans should double-check all entries before submitting the form.

A third concern lies with tracking dependent information. Many veterans wrongly assume they can simply skip the dependent sections if their circumstances have not changed. However, any dependent, including spouses and children, must be listed accurately and thoroughly, since this information can affect eligibility and benefits calculations. Ensuring that all relevant social security numbers and birth dates are included is crucial.

Individuals often misinterpret the income reporting requirements, leading to further issues. Veterans should list all sources of income honestly, including wages, benefits, and other income. They may forget to include necessary items or mistakenly add ineligible sources. Remember, any misreporting might delay processing or lead to an inaccurate assessment of benefits.

People also neglect to include supporting documentation. In particular, medical expenses claimed in Section V require verified receipts. Failing to provide this proof can result in rejected claims. It is advisable to gather all relevant documentation ahead of time and ensure that all expenses align with what has been reported on the form.

Misunderstanding consent agreements can create challenges as well. Section VI requires veterans to consent to copayments and communications from the VA. Some veterans may not fully grasp the implications of this section, leading to unexpected surprises later. Fully comprehending these agreements before signing can prevent complications down the road.

Additionally, many individuals falter on the signature and date requirements. It's vital that the form is signed and dated appropriately; omission or illegible signatures may result in the VA returning the form. If someone else must sign on behalf of the veteran, proper documentation of authority must accompany the submission, which many veterans fail to remember.

Lastly, veterans often overlook the submission address. Mail your completed form to the correct location — the Health Eligibility Center in Atlanta, Georgia. An incorrect address can lead to unnecessary delays, and it's essential to ensure that the information is sent precisely as instructed.

Documents used along the form

The VA Form 10-10EZR is a crucial document for veterans seeking to update their health benefits information. When completing this form, other supporting documents may also be necessary. Here’s a brief overview of some common forms and documents that often accompany the 10-10EZR.

- VA Form 10-10EZ: This is the original health benefits application form. Veterans must complete this before submitting the 10-10EZR to ensure their enrollment in the VA health care system.

- Proof of income documents: Veterans may need to provide recent tax returns, W-2 forms, or other financial statements to verify income details reported in the 10-10EZR. This helps in determining eligibility for cost-free care.

- Copies of insurance cards: It may be helpful to attach copies of health insurance cards, including Medicare and Medicaid, to provide a clear picture of the veteran's current insurance coverage.

- VA Form 21-4138: The Statement in Support of Claim can be useful if a veteran needs to explain specific circumstances related to their health benefits eligibility. It allows space for additional explanations not covered in the 10-10EZR form.

Having these documents ready can streamline the process of updating health benefits information, ensuring that veterans receive the care and services they deserve in a timely manner.

Similar forms

- VA Form 10-10EZ: Similar to the 10-10EZR, this form is used to apply for and maintain health care benefits through the VA. However, the 10-10EZ is primarily the initial application form for new enrollees, while the 10-10EZR serves to update existing enrollment information.

- VA Form 21-526EZ: This document is used to apply for disability compensation. Like the 10-10EZR, it requires personal and financial information, but its purpose is to establish entitlement to benefits related to service-connected disabilities rather than health care.

- VA Form 21-534EZ: This form allows for applying for Dependency and Indemnity Compensation (DIC) benefits. It shares similarities with the 10-10EZR in gathering personal details but focuses specifically on the claims of survivors of veterans.

- VA Form 10-10SH: This short health benefits enrollment form identifies eligibility for the VA’s health care benefits. It is akin to the 10-10EZR but is simpler and used primarily for limited coverage options.

- VA Form 10-10172: This form is for veteran patients to request a health record. While the 10-10EZR updates personal information, the 10-10172 focuses on obtaining necessary documentation for health care purposes.

- VA Form 10-905: This document is intended for reporting changes in eligibility for health care benefits. Similar to the 10-10EZR, it requires updates to personal circumstances but focuses more on eligibility rather than general information adjustments.

Dos and Don'ts

Things to Do When Filling Out the VA Form 10-10EZR:

- Read all instructions carefully before you begin.

- Provide accurate information, ensuring names and numbers match official documents.

- Complete all required sections, specifically Sections I, II, VI, and VII.

- Include information for all health insurance policies, even those through a spouse.

- Consider using a separate sheet for additional health insurance details if needed.

- Attach copies of your insurance and Medicare cards for reference.

- Make sure to sign and date the form in ink.

- Ask for assistance if you encounter difficulties; call 1-877-222-VETS (8387) if needed.

- Mail your completed form and any additional documents to the correct address.

- Keep a copy of your completed form for your records.

Things Not to Do When Filling Out the VA Form 10-10EZR:

- Do not skip any required sections, as this may delay processing.

- Avoid using outdated versions of the form; only use the most recent version.

- Do not provide false information or guesses; always verify accuracy.

- Do not forget to include dependent information if applicable.

- Refrain from listing expenses you expect to be reimbursed for.

- Do not submit the form without your signature, as it will be returned.

- Do not assume your application will be processed without confirmation.

- Never leave optional fields blank if you choose to provide that information.

- Do not wait until the last minute to submit the form; allow for processing time.

- Do not ignore your rights regarding privacy; be aware of how your information will be used.

Misconceptions

Several misconceptions exist regarding the VA Form 10-10EZR, which can cause confusion for veterans seeking to update their health benefits information. Understanding these misconceptions is essential for completing the form accurately.

- Misconception 1: The form is only necessary for newly enrolled veterans.

- Misconception 2: Completing this form is optional.

- Misconception 3: Only veterans need to provide information.

- Misconception 4: Income does not need to be reported if it's from a government source.

- Misconception 5: Providing my Social Security number is mandatory.

- Misconception 6: There are no repercussions for submitting incorrect information.

- Misconception 7: The form can be filled out and submitted alongside other benefits claims.

Actually, the VA Form 10-10EZR is used by all veterans to update personal, insurance, or financial information at any point after enrollment, not just for those enrolling for the first time.

In reality, all veterans must complete specified sections of the form to maintain eligibility for health benefits. Failure to do so may lead to lapses in coverage.

The form requires information not only from the veteran but also from their spouse and dependent children, which is essential for the VA’s assessment process.

This is inaccurate. The form specifies that income from various sources, including Social Security and VA compensation, must be reported. However, certain types of financial assistance may be exempt.

While providing a Social Security number is often necessary for verification purposes, it is voluntary. Not providing it may delay processing but will not impact other benefits.

This belief is misleading. There are significant legal penalties for false representation, including fines and possible imprisonment, as highlighted in the form’s instructions.

In truth, the VA Form 10-10EZR must be submitted separately to specifically update health benefits information, even if other claims are being processed concurrently.

Addressing these misconceptions can clarify the responsibilities and implications for veterans. Proper comprehension of the VA Form 10-10EZR helps ensure that health care benefits remain uninterrupted and accurately reflect the veteran's current circumstances.

Key takeaways

Filling out VA Form 10-10EZR is an essential step for veterans wishing to update their personal, insurance, or financial details after enrollment. Below are key takeaways to keep in mind when completing this form:

- Purpose of the Form: VA Form 10-10EZR is designed for veterans to update their information related to health benefits efficiently.

- Sections Required: Everyone must complete Sections I, II, VI, and VII to ensure that all necessary data is provided for processing.

- Assistance Available: Veterans can seek help by calling 1-877-222-VETS (8387), visiting their local VA health care facility, or reaching out to national and state Veterans Service Organizations.

- Insurance Information: It is crucial to provide details for all health insurance coverage, including that through a spouse or partner. This ensures that VA is aware of any potential coverage that could affect benefit eligibility.

- Dependent Details: When filling out Section III, include social security numbers for dependents as VA requires this information for verification purposes.

- Financial Assessment: Section IV allows veterans to report gross income, important for determining eligibility for cost-free care or travel benefits. Only complete applicable sections if certain conditions are met.

- Consent Required: By submitting the form, veterans agree to co-pays for care and authorize communication from VA via provided contact details, although sharing this information is voluntary.

- Submission Guidelines: Ensure the form is signed and dated properly. Incomplete forms will be returned for correction, which may delay processing.

Each step in completing VA Form 10-10EZR is significant. It is essential to approach this task with care to ensure your healthcare benefits remain intact and up to date.

Browse Other Templates

How to Dissolve a Business in California - Shareholders should be educated about their rights and responsibilities in the dissolution process.

I-912 Mailing Address - The I-912 form can accommodate additional information in specified sections for clarity on financial circumstances.