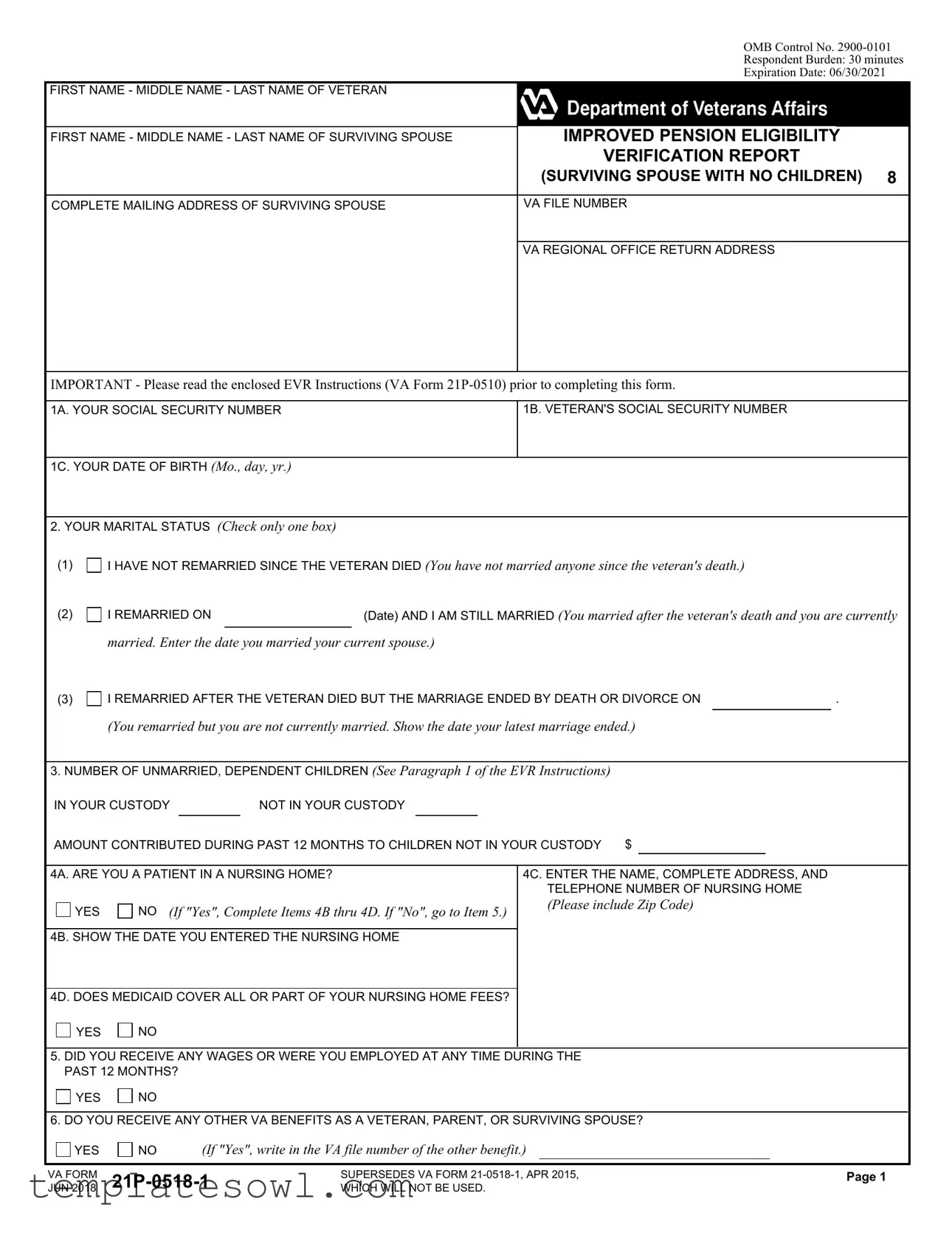

Fill Out Your Va 21 0518 1 Form

The VA 21 0518 1 form, officially known as the Improved Pension Eligibility Verification Report (Surviving Spouse with No Children), serves as a vital tool for surviving spouses seeking VA benefits. Designed to collect essential information, this form requires details such as the veteran's and surviving spouse's names, Social Security numbers, and marital status. It also prompts the surviving spouse to disclose their income, net worth, and medical expenses, ensuring a comprehensive financial snapshot. The form facilitates the evaluation of eligibility for pensions, and specific expenses related to education or vocational rehabilitation may also be reported. Careful completion is crucial, as the VA emphasizes the importance of accuracy, with harsh penalties for submitting false information. It’s essential for applicants to read the accompanying instructions, provided in VA Form 21P-0510, before proceeding. Notably, this version supersedes a previous iteration, indicating ongoing updates to streamline the application process and enhance user experience.

Va 21 0518 1 Example

|

OMB Control No. |

||

|

Respondent Burden: 30 minutes |

||

|

Expiration Date: 06/30/2021 |

||

FIRST NAME - MIDDLE NAME - LAST NAME OF VETERAN |

|

|

|

|

|

|

|

FIRST NAME - MIDDLE NAME - LAST NAME OF SURVIVING SPOUSE |

IMPROVED PENSION ELIGIBILITY |

||

|

VERIFICATION REPORT |

||

|

(SURVIVING SPOUSE WITH NO CHILDREN) 8 |

||

|

|

|

|

COMPLETE MAILING ADDRESS OF SURVIVING SPOUSE |

VA FILE NUMBER |

||

|

|

|

|

|

VA REGIONAL OFFICE RETURN ADDRESS |

||

|

|

|

|

IMPORTANT - Please read the enclosed EVR Instructions (VA Form

1A. YOUR SOCIAL SECURITY NUMBER

1B. VETERAN'S SOCIAL SECURITY NUMBER

1C. YOUR DATE OF BIRTH (Mo., day, yr.)

2.YOUR MARITAL STATUS (Check only one box)

(1)

I HAVE NOT REMARRIED SINCE THE VETERAN DIED (You have not married anyone since the veteran's death.)

I HAVE NOT REMARRIED SINCE THE VETERAN DIED (You have not married anyone since the veteran's death.)

(2) |

|

I REMARRIED ON |

|

(Date) AND I AM STILL MARRIED (You married after the veteran's death and you are currently |

|

|

|

|

|

|

|

married. Enter the date you married your current spouse.) |

||

(3) |

|

I REMARRIED AFTER THE VETERAN DIED BUT THE MARRIAGE ENDED BY DEATH OR DIVORCE ON |

. |

|

|

|

(You remarried but you are not currently married. Show the date your latest marriage ended.) |

|

|

|

|

|

|

|

3. NUMBER OF UNMARRIED, DEPENDENT CHILDREN (See Paragraph 1 of the EVR Instructions)

IN YOUR CUSTODY |

|

NOT IN YOUR CUSTODY |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

||

AMOUNT CONTRIBUTED DURING PAST 12 MONTHS TO CHILDREN NOT IN YOUR CUSTODY $ |

|||||||||||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

4A. ARE YOU A PATIENT IN A NURSING HOME? |

4C. ENTER THE NAME, COMPLETE ADDRESS, AND |

||||||||||

|

|

|

|

|

|

|

|

|

TELEPHONE NUMBER OF NURSING HOME |

||

|

|

YES |

|

NO (If "Yes", Complete Items 4B thru 4D. If "No", go to Item 5.) |

(Please include Zip Code) |

||||||

|

|

|

|||||||||

|

|

|

|

|

|

||||||

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4B. SHOW THE DATE YOU ENTERED THE NURSING HOME |

|

|

|

||||||||

4D. DOES MEDICAID COVER ALL OR PART OF YOUR NURSING HOME FEES?

YES

YES

NO

NO

5.DID YOU RECEIVE ANY WAGES OR WERE YOU EMPLOYED AT ANY TIME DURING THE PAST 12 MONTHS?

|

|

YES |

|

NO |

|

|

|

|

|

6. DO YOU RECEIVE ANY OTHER VA BENEFITS AS A VETERAN, PARENT, OR SURVIVING SPOUSE? |

||||

|

|

YES |

|

|

NO |

(If "Yes", write in the VA file number of the other benefit.) |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VA FORM |

SUPERSEDES VA FORM |

PAGE 1 |

|||||||

JUN 2018 |

WHICH WILL NOT BE USED. |

|

|||||||

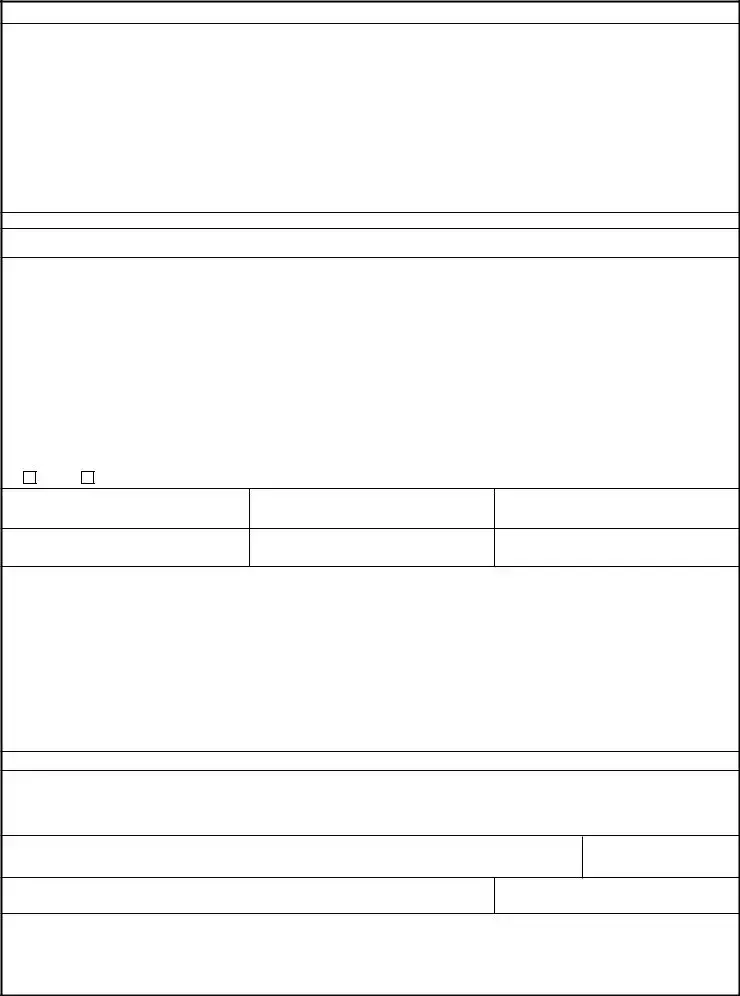

7A. MONTHLY INCOME (Read Paragraphs 2 and 3 of the EVR Instructions)

If no income or net worth was received from a particular source, write "0" or "none". VA WILL INTERPRET A BLANK SPACE AS "NONE" OR "0."

SOURCE |

SURVIVING SPOUSE |

SOCIAL SECURITY |

$ |

|

|

|

|

U.S. CIVIL SERVICE |

|

|

|

U.S. RAILROAD RETIREMENT |

|

|

|

MILITARY RETIREMENT |

|

|

|

OTHER (Show Source) |

|

|

|

OTHER (Show Source) |

|

|

|

7B. ANNUAL INCOME (Read Paragraphs 2 and 4 of the EVR Instructions)

If no income was received from a particular source, write "0" or "none". VA WILL INTERPRET A BLANK SPACE AS "NONE" OR "0."

NOTE: Report annual income for the dates indicated. If no dates are shown above the columns that follow, then report last calendar year (January through December) income in the

SOURCE |

FROM: |

FROM: |

|

|

|

|

THRU: |

THRU: |

|

|

|

GROSS WAGES FROM |

$ |

$ |

ALL EMPLOYMENT |

||

TOTAL INTEREST AND |

|

|

DIVIDENDS |

|

|

|

|

|

ALL OTHER |

|

|

(Show Source) |

|

|

|

|

|

ALL OTHER |

|

|

(Show Source) |

|

|

|

|

|

7C. DID ANY INCOME CHANGE (Increase/Decrease) DURING PAST 12 MONTHS? (Answer "NO" if there were no income changes or if the only change was a Social Security/VA

|

YES |

|

NO |

(If "YES", complete Items 7D through 7F. If "NO", go to Item 7G.) |

7D. WHAT INCOME CHANGED? (Show what income changed, for example, wages, city pension, etc.)

7E. WHEN DID THE INCOME CHANGE?

(Show the dates you received any new income or the date income changed)

7F. HOW DID INCOME CHANGE? (Explain what happened; for example, quit work, got raise, received inheritance)

|

7G. NET WORTH (Read Paragraph 5 of the EVR Instructions) |

|

|

|

|

SOURCE |

|

SURVIVING SPOUSE |

|

|

|

CASH/NON- |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

IRA'S, KEOGH PLANS, ETC. |

|

|

|

|

|

STOCKS, BONDS, MUTUAL FUNDS, ETC. |

|

|

|

|

|

REAL PROPERTY (Not your home) |

|

|

|

|

|

ALL OTHER PROPERTY |

|

|

|

|

|

8.FAMILY MEDICAL EXPENSES (Read Paragraph 6 of the EVR Instructions)

Normally, medical expenses are reported at the end of the year. If you are using this form as your annual Eligibility Verification Report and Paragraph 6 of the EVR Instructions indicates that you should report medical expenses, use VA Form

9.SURVIVING SPOUSE'S EDUCATIONAL AND VOCATIONAL REHABILITATION EXPENSES (Read Paragraph 7 of the EVR Instructions). Show amounts paid by you during the past 12 months. DO NOT REPORT CHILDREN'S EXPENSES.

$

10A. SIGNATURE OF PAYEE (Read paragraph 9 of the EVR Instructions before signing)

10B. DATE SIGNED

10C. TELEPHONE NUMBERS (Include Area Code)

DAYTIME |

EVENING |

|

|

PENALTY: The law provides severe penalties which include fine or imprisonment, or both, for the willful submission of any statement or evidence of a material fact, knowing it is false, or fraudulent acceptance of any payment to which you are not entitled.

VA FORM |

PAGE 2 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Title | Improved Pension Eligibility Verification Report (Surviving Spouse with No Children) |

| OMB Control Number | 2900-0101 |

| Expiration Date | 06/30/2021 |

| Respondent Burden | Approximately 30 minutes to complete. |

| Governing Law | U.S. Department of Veterans Affairs regulations. |

| Previous Version | This form supersedes VA Form 21-0518-1, APR 2015. |

| Instructions Reference | Enclosed instructions are provided via VA Form 21P-0510. |

Guidelines on Utilizing Va 21 0518 1

Completing the VA Form 21-0518-1 is an important step to ensure all the necessary information is properly submitted. Accurate details will help facilitate any subsequent processes related to your benefits. After filling out the form, make sure to review it thoroughly before sending it in. Each section gathers specific data that helps the VA understand your financial situation and needs.

- Begin with the veteran's name and the surviving spouse's name including first, middle, and last names.

- Provide the complete mailing address of the surviving spouse.

- Include the VA file number and the VA regional office return address.

- Fill in your Social Security number, the veteran's Social Security number, and your date of birth.

- Indicate your marital status by checking the appropriate box; choose one that reflects your current situation.

- Enter the number of unmarried, dependent children in your custody and any contributions made for children not in your custody over the last 12 months.

- Answer if you are a patient in a nursing home. If yes, provide the name, address, and phone number of the nursing home.

- Show the date you entered the nursing home and whether Medicaid covers any part of your nursing home fees.

- State whether you received any wages or were employed during the last 12 months.

- Indicate if you receive any other VA benefits and provide the VA file number if applicable.

- Report your monthly income from various sources including Social Security, military retirement, and others, entering an amount for each source.

- Report your annual income as directed, making sure to specify the time frames accurately.

- If there were any changes in income during the last 12 months, answer 'Yes' or 'No' accordingly.

- If income changed, specify what changed, when it changed, and how it changed.

- Report your net worth, detailing cash, bank accounts, stocks, bonds, and real property excluding your home.

- Address family medical expenses as instructed; use a separate form for detailed medical expenses, if required.

- Provide any educational and vocational rehabilitation expenses you've incurred over the past year.

- Sign the form, date it, and include your contact numbers for both daytime and evening.

What You Should Know About This Form

What is the VA Form 21-0518-1 used for?

The VA Form 21-0518-1 is specifically designed for surviving spouses to report their income and expenses to verify eligibility for the Improved Pension program. This report is crucial for ensuring that you continue to receive the correct level of benefits.

Who needs to complete the VA Form 21-0518-1?

This form must be completed by the surviving spouse of a veteran who does not have any dependent children. If you're a surviving spouse who has remarried, different rules may apply, and it’s essential to follow the instructions accordingly.

How long will it take to complete this form?

On average, filling out the VA Form 21-0518-1 takes approximately 30 minutes. Be sure to set aside enough time to gather all required information and accurately fill out the form to avoid delays in processing.

What should I do if I have questions while filling out the form?

If you encounter any uncertainties while completing the form, it’s crucial to refer to the enclosed EVR Instructions (VA Form 21P-0510). Additionally, contacting your local VA Regional Office can provide further clarification and assistance.

What happens if I miss the deadline to submit this form?

Missing the submission deadline may lead to delays in your benefit payments or even an interruption in your eligibility. It’s vital to submit this form on time to ensure no disruption in benefits, so make planning a priority.

Can I report my medical expenses on this form?

No, you cannot report medical expenses on the VA Form 21-0518-1. Instead, you should use VA Form 21P-8416, Medical Expense Report, for that purpose. This distinction helps ensure that your medical expenses are accounted for properly at the end of the year.

Is it necessary to provide my Social Security Number?

Yes, including your Social Security Number is essential. It helps the VA accurately track your application and ensure that your reported information is processed correctly. Incomplete information may delay your benefit processing.

What should I do if my income changes after I submit this form?

Should your income change after you submit the form, it is critical to report this change to the VA immediately. This will help maintain the accuracy of your benefits and prevent any potential overpayments or underpayments.

Common mistakes

Completing the VA Form 21-0518-1 can be challenging, and mistakes often occur. One common error is failing to read the provided instructions thoroughly. The accompanying EVR Instructions (VA Form 21P-0510) contain critical information essential for accurately completing the form. Overlooking these instructions can lead to misinterpretations and incorrect submissions.

Another frequent mistake involves providing incomplete or inaccurate personal information. This includes the names, social security numbers, and addresses of both the veteran and the surviving spouse. Errors or omissions in these fields can delay processing or result in denials of benefits. Attention to detail is crucial in this regard.

Some individuals neglect to report all sources of income, which is essential for determining eligibility for benefits. Underreporting or misrepresenting income can have severe consequences. It's important to list all income sources accurately, including wages and other benefits, and to use "0" or "none" if there is no income from a particular source.

Misunderstanding marital status checks is another common issue. Applicants should select only one option regarding their marital status. Failing to indicate accurate status—whether remarried, never remarried, or divorced—can impact eligibility. A clear understanding of the definitions for each option is necessary to ensure the correct box is checked.

Moreover, some people overlook specifying dependent children accurately. This includes providing the number of unmarried, dependent children in custody as well as those not in custody. Inadequate information about dependent children may lead to incorrect calculations and eligibility assessments.

Confusion can also arise over medical expenses reporting. Many individuals mistakenly include medical expenses when using this form as an annual Eligibility Verification Report. If this form serves as a supplement to a claim, medical expenses should not be reported. Understanding the context of use is vital for accurate reporting.

Furthermore, applicants sometimes fail to update changes in income. Changes in income during the past 12 months must be reported, and failing to do so can mislead the evaluation process. Completeness regarding income changes is crucial for maintaining benefits eligibility.

Lastly, neglecting to provide complete contact information is a notable error. Including daytime and evening telephone numbers ensures that the VA can reach the applicant for any clarifications or follow-ups. This information is often essential in the event of any processing issues or inquiries.

Documents used along the form

When submitting the VA Form 21-0518-1, it is essential to obtain and provide additional documents and forms to support the eligibility determination. These accompanying forms can help clarify information about income, expenses, and other relevant details regarding the surviving spouse's financial status. Below is a list of commonly used forms that may be needed.

- VA Form 21P-8416: This form is for reporting medical expenses incurred by the surviving spouse. It must be filled out to provide the VA with a comprehensive view of medical costs that may impact the pension eligibility.

- VA Form 21-527EZ: This is an application for pension. It is necessary if the surviving spouse is applying for pension benefits for the first time or if they need to update their current pension status.

- VA Form 21-686c: This form is used for declaring marital status. It is important for verifying the current relationship status and any changes that may affect eligibility for benefits.

- VA Form 21-530: Surviving spouses can use this application for burial benefits. It provides necessary details related to the deceased veteran's burial and any financial assistance needed.

- VA Form 29-4125: This form collects information on existing life insurance policies. It can provide insights into additional assets that may be relevant for financial evaluations.

- Social Security Administration Forms: These forms help document any income received from Social Security. Evidence of income will be critical for the pension eligibility process.

- VA Form 21P-0779: This form is used to request a waiver for certain income limits based on specific circumstances like dependent care or unusual medical expenses.

Providing accurate and complete information with these forms will assist in the timely processing of the VA benefits claim. If additional forms are required, ensure you gather them promptly to avoid delays in receiving the benefits needed.

Similar forms

The VA Form 21-0518-1 serves a specific purpose in determining the eligibility of a surviving spouse for improved pension benefits. Several other forms share a similar function in the VA system, each designed to assist in the verification or reporting of income, benefits, and other related information for various circumstances. Here are five documents that are comparable to the VA Form 21-0518-1:

- VA Form 21P-0510 - This is the Eligibility Verification Report Instructions. It guides applicants through the completion of the VA Form 21-0518-1. Without these instructions, understanding how to report income and expenses accurately could be challenging.

- VA Form 21P-8416 - This form is the Medical Expense Report. It is similar in that it collects vital information regarding expenses, specifically medical expenses, which may affect the survivor's overall financial situation and eligibility for benefits.

- VA Form 21-526EZ - This form is an Application for Disability Compensation and Related Compensation Benefits. While its primary focus is on veterans, it shares an intent to register financial and personal circumstances which impact benefits eligibility and processing.

- VA Form 22-5490 - This document serves as an Application for Survivors' and Dependents' Educational Assistance. Like the VA Form 21-0518-1, it addresses the needs of surviving spouses and dependents, ensuring they receive appropriate aid based on their unique circumstances.

- VA Form 21-0966 - This form is a Intent to File a Claim for Compensation and/or Pension. It assists individuals in expressing their intent for future benefits claims. It informs the VA about a claimant’s potential eligibility, setting the stage for subsequent applications like the VA Form 21-0518-1.

Dos and Don'ts

Things You Should Do:

- Thoroughly review the enclosed EVR Instructions (VA Form 21P-0510) before starting.

- Fill in all sections completely to avoid delays in processing.

- Use clear handwriting or type the form to ensure legibility.

- Provide accurate income information from the past 12 months.

- Report any changes in income or net worth promptly.

Things You Shouldn't Do:

- Do not leave any sections blank; a blank space may be interpreted as zero.

- Do not embellish or provide false information, as this may result in severe penalties.

- Avoid submitting the form without your signature and date.

- Do not use this form to report children’s expenses; it is for your expenses only.

- Refrain from ignoring the deadlines for submission; timely filing is crucial.

Misconceptions

-

Misconception 1: The VA Form 21-0518-1 is only for veterans.

This form is specifically designed for the surviving spouses of veterans who do not have dependent children. Its main purpose is to provide information for determining eligibility for improved pension benefits.

-

Misconception 2: You can skip sections of the form if you don’t have certain information.

It’s important to fill out all applicable sections as completely as possible. If you do not have income or assets, you should clearly indicate that by writing "0" or "none." Leaving sections blank may lead to delays or assumptions that you have not provided the required information.

-

Misconception 3: This form can be filled out without consulting the instructions.

Prior to completing the VA Form 21-0518-1, reading the enclosed EVR Instructions (VA Form 21P-0510) is essential. These instructions provide detailed guidance on how to accurately fill in the form, which helps ensure eligibility for benefits.

-

Misconception 4: My medical expenses need to be reported in this form.

Medical expenses are typically not included in this form unless specifically noted in the instructions. If any medical expenses need to be reported, you will use the VA Form 21P-8416 instead. This distinction can help streamline the process of reporting necessary information.

-

Misconception 5: All income changes must be reported regardless of their nature.

Only significant changes in income should be reported, such as changes that involve new sources of income or alterations beyond typical cost-of-living adjustments. Routine adjustments do not need to be disclosed, which helps simplify the reporting process.

Key takeaways

Here are some key takeaways about filling out and using the VA Form 21-0518-1:

- This form is specifically for surviving spouses with no children applying for improved pension eligibility.

- Make sure to read the accompanying instructions (VA Form 21P-0510) before starting to fill out the form.

- Provide accurate personal information, including both the veterans’ and surviving spouse’s names, social security numbers, and birth dates.

- Report marital status accurately; you must choose only one option regarding your marriage history since the veteran's death.

- Document any dependent children, including their custody status and any financial support you have provided.

- Be meticulous about reporting your income; include amounts from various sources and indicate any changes in your financial situation over the past 12 months.

- Provide a current mailing address, and ensure you sign and date the form before submission to avoid delays in processing.

Browse Other Templates

Nj Sellers Permit - The ST-3 form covers both goods and services that the purchaser intends to resell.

How Much Do You Have to Owe in Child Support to Go to Jail - Include phone numbers for the noncustodial parent’s daytime contact.