Fill Out Your Va 21 4718A Form

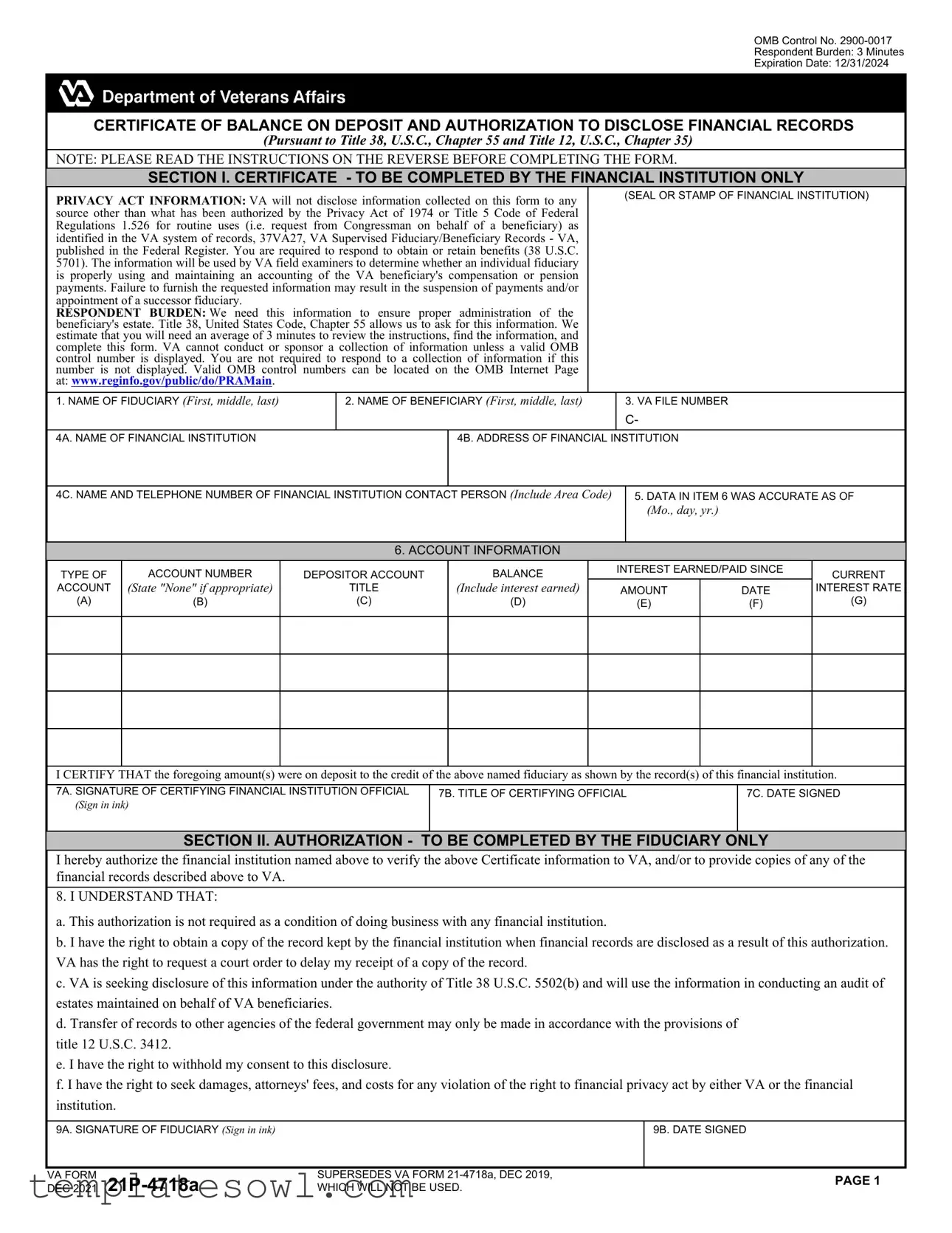

The VA Form 21P-4718A, titled "Certificate of Balance on Deposit and Authorization to Disclose Financial Records," serves a crucial role in the management of benefits for U.S. veterans and their beneficiaries. This form is utilized primarily for verifying financial records to ensure fiduciaries properly manage the funds of veterans receiving compensation or pension payments. It consists of two main sections: one certified by the financial institution and another completed by the fiduciary. Financial institutions must provide information about the account balance, account title, and interest earned, ensuring accuracy as of the date specified. The fiduciary, in turn, authorizes the disclosure of this information to the Department of Veterans Affairs (VA), facilitating transparency and accountability in financial management. The Privacy Act governs the handling of information on this form, ensuring it is shared only as permitted. The form carries an estimated respondent burden of three minutes, indicating a streamlined process designed for efficiency. The future use of the form is tied to the regulatory framework under Title 38, U.S.C., ensuring that both veterans and fiduciaries adhere to established guidelines for the administration of benefits.

Va 21 4718A Example

OMB Control No.

Respondent Burden: 3 Minutes

Expiration Date: 12/31/2024

CERTIFICATE OF BALANCE ON DEPOSIT AND AUTHORIZATION TO DISCLOSE FINANCIAL RECORDS (Pursuant to Title 38, U.S.C., Chapter 55 and Title 12, U.S.C., Chapter 35)

NOTE: PLEASE READ THE INSTRUCTIONS ON THE REVERSE BEFORE COMPLETING THE FORM.

SECTION I. CERTIFICATE - TO BE COMPLETED BY THE FINANCIAL INSTITUTION ONLY

PRIVACY ACT INFORMATION: VA will not disclose information collected on this form to any |

|

(SEAL OR STAMP OF FINANCIAL INSTITUTION) |

|||

source other than what has been authorized by the Privacy Act of 1974 or Title 5 Code of Federal |

|

|

|

||

Regulations 1.526 for routine uses (i.e. request from Congressman on behalf of a beneficiary) as |

|

|

|

||

identified in the VA system of records, 37VA27, VA Supervised Fiduciary/Beneficiary Records - VA, |

|

|

|

||

published in the Federal Register. You are required to respond to obtain or retain benefits (38 U.S.C. |

|

|

|

||

5701). The information will be used by VA field examiners to determine whether an individual fiduciary |

|

|

|

||

is properly using and maintaining an accounting of the VA beneficiary's compensation or pension |

|

|

|

||

payments. Failure to furnish the requested information may result in the suspension of payments and/or |

|

|

|

||

appointment of a successor fiduciary. |

|

|

|

|

|

RESPONDENT BURDEN: We need this information to ensure proper administration of the |

|

|

|

||

beneficiary's estate. Title 38, United States Code, Chapter 55 allows us to ask for this information. We |

|

|

|

||

estimate that you will need an average of 3 minutes to review the instructions, find the information, and |

|

|

|

||

complete this form. VA cannot conduct or sponsor a collection of information unless a valid OMB |

|

|

|

||

control number is displayed. You are not required to respond to a collection of information if this |

|

|

|

||

number is not displayed. Valid OMB control numbers can be located on the OMB Internet Page |

|

|

|

||

at: www.reginfo.gov/public/do/PRAMain. |

|

|

|

|

|

1. NAME OF FIDUCIARY (First, middle, last) |

2. NAME OF BENEFICIARY (First, middle, last) |

|

|

3. VA FILE NUMBER |

|

|

|

|

|

|

C- |

4A. NAME OF FINANCIAL INSTITUTION |

|

4B. ADDRESS OF FINANCIAL INSTITUTION |

|||

|

|

|

|

||

4C. NAME AND TELEPHONE NUMBER OF FINANCIAL INSTITUTION CONTACT PERSON (Include Area Code) |

|

5. DATA IN ITEM 6 WAS ACCURATE AS OF |

|||

|

|

|

|

|

(Mo., day, yr.) |

|

|

|

|

|

|

|

6. ACCOUNT INFORMATION |

|

|

||

TYPE OF

ACCOUNT

(A)

ACCOUNT NUMBER

(State "None" if appropriate)

(B)

DEPOSITOR ACCOUNT

TITLE

(C)

BALANCE

(Include interest earned)

(D)

INTEREST EARNED/PAID SINCE

AMOUNT |

DATE |

(E)(F)

CURRENT

INTEREST RATE

(G)

I CERTIFY THAT the foregoing amount(s) were on deposit to the credit of the above named fiduciary as shown by the record(s) of this financial institution.

7A. SIGNATURE OF CERTIFYING FINANCIAL INSTITUTION OFFICIAL |

7B. TITLE OF CERTIFYING OFFICIAL |

7C. DATE SIGNED |

(Sign in ink) |

|

|

SECTION II. AUTHORIZATION - TO BE COMPLETED BY THE FIDUCIARY ONLY

I hereby authorize the financial institution named above to verify the above Certificate information to VA, and/or to provide copies of any of the financial records described above to VA.

8. I UNDERSTAND THAT:

a. This authorization is not required as a condition of doing business with any financial institution.

b. I have the right to obtain a copy of the record kept by the financial institution when financial records are disclosed as a result of this authorization. VA has the right to request a court order to delay my receipt of a copy of the record.

c. VA is seeking disclosure of this information under the authority of Title 38 U.S.C. 5502(b) and will use the information in conducting an audit of estates maintained on behalf of VA beneficiaries.

d. Transfer of records to other agencies of the federal government may only be made in accordance with the provisions of title 12 U.S.C. 3412.

e. I have the right to withhold my consent to this disclosure.

f. I have the right to seek damages, attorneys' fees, and costs for any violation of the right to financial privacy act by either VA or the financial institution.

9A. SIGNATURE OF FIDUCIARY (Sign in ink) |

|

9B. DATE SIGNED |

|

|

|

|

|

VA FORM |

SUPERSEDES VA FORM |

PAGE 1 |

|

DEC 2021 |

WHICH WILL NOT BE USED. |

||

INSTRUCTIONS FOR COMPLETION OF VA FORM

Section I - Certificate of Balance on Deposit

The fiduciary should complete Items 1, 2 and 3 before giving the form to the financial institution. Only the financial institution should complete the rest of the items (4A through 7C) in this section. The financial institution's seal or stamp must be placed in the space provided.

The financial institution should give the completed certificate to the fiduciary who will, in turn, submit it to VA with an accounting.

Section II - Authorization to Disclose Financial Records

Only the fiduciary should complete this section.

The fiduciary may sign this section either before or after the Certificate section is completed by the financial institution.

(The fiduciary's signature in this section is not needed to allow the financial institution to complete the Certificate section.)

An independent verification of financial records may be needed when VA audits the fiduciary's account. If so, VA will ask for the information directly from the financial institution at a later time. At that time, VA will give the financial institution the fiduciary's signed authorization.

VA FORM |

PAGE 2 |

Form Characteristics

| Fact Title | Fact Details |

|---|---|

| Form Name | This form is officially titled the "Certificate of Balance on Deposit and Authorization to Disclose Financial Records". |

| OMB Control Number | The form is assigned OMB Control No. 2900-0017, which is crucial for compliance with federal regulations. |

| Respondent Burden | The estimated time to complete the form is approximately 3 minutes, ensuring it is accessible for users. |

| Expiration Date | The form is set to expire on December 31, 2024, after which it will need to be renewed or updated. |

| Governing Laws | The form operates under Title 38, U.S.C., Chapter 55 and Title 12, U.S.C., Chapter 35, ensuring alignment with federal laws. |

| Privacy Protections | The information collected is protected under the Privacy Act of 1974, ensuring the confidentiality of personal data. |

| Financial Institution Responsibilities | Only the financial institution is responsible for completing specific sections of the form, ensuring accuracy in financial reporting. |

| Fiduciary Responsibilities | The fiduciary must sign and authorize the disclosure of financial records, asserting their right to privacy and transparency. |

Guidelines on Utilizing Va 21 4718A

After you have gathered all necessary information, it's time to fill out the VA Form 21-4718A. This form is designed to obtain a certificate of balance on deposit and authorization for disclosure of financial records. Follow the steps below carefully to complete the form correctly.

- Begin with Section I. Fill in the fiduciary's name in Item 1, using the first, middle, and last name.

- In Item 2, write the name of the beneficiary, including the first, middle, and last name.

- Input the VA file number in Item 3, using the designated format.

- Provide the name of the financial institution in Item 4A.

- In Item 4B, enter the complete address of the financial institution.

- Fill in Item 4C with the name and telephone number of a contact person at the financial institution, including the area code.

- In Item 5, record the date when the information in Item 6 was accurate (month, day, year).

- For Item 6, specify the account information:

- 6A: Indicate the type of account.

- 6B: State the account number (or mark “None” if applicable).

- 6C: Provide the depositor account title.

- 6D: Outline the balance, including any interest earned.

- 6E: Mention the amount and date for interest earned/paid since.

- 6F: Fill in the current interest rate.

- In Item 7A, have the certifying official of the financial institution sign where indicated.

- Complete Item 7B with the title of the certifying official.

- Finally, in Item 7C, the official should sign and date the document in ink.

Now, move to Section II. This section is solely for the fiduciary to authorize the financial institution. The fiduciary can complete this step at any time, even before the financial institution finishes the Certificate section. Sign and date where indicated in Items 9A and 9B. Once all sections are complete, submit the signed form to the VA along with any required accounting documentation.

What You Should Know About This Form

What is the VA Form 21-4718A?

The VA Form 21-4718A, officially known as the Certificate of Balance on Deposit and Authorization to Disclose Financial Records, is a form utilized primarily for the verification of financial records related to beneficiaries of VA compensation or pension payments. This document is significant in ensuring that fiduciaries manage the funds appropriately and maintains accurate accounting for the benefit of the VA beneficiary. It includes sections that require information to be filled out by both the fiduciary and the financial institution holding the beneficiary's funds.

Who needs to complete the VA Form 21-4718A?

The completion of the VA Form 21-4718A involves two parties. Initially, the fiduciary must fill out personal information, including their name, the beneficiary's name, and the VA file number. Subsequently, the financial institution must complete the remaining sections, which include the details regarding account balances, account types, and the financial institution's contact information. This collaborative effort ensures that all relevant information is collected accurately.

How long does it take to complete the VA Form 21-4718A?

The estimated time to complete the VA Form 21-4718A is approximately 3 minutes. This timeframe is based on the understanding that the fiduciary may require a brief period to gather necessary information and review the instructions. Additionally, the financial institution may need a few moments to verify and fill in the required details about the account before signing and sealing the document.

What happens if the information on the VA Form 21-4718A is not provided?

Providing accurate information on the VA Form 21-4718A is crucial. If the fiduciary or financial institution fails to furnish the requested information, it may lead to consequences, including the suspension of payments or the appointment of a successor fiduciary. The VA uses this information to assess whether fiduciaries are properly managing and accounting for the fiduciary's funds in line with federal regulations.

Can the fiduciary withdraw their consent for disclosure?

Yes, the fiduciary has the right to withhold their consent for the financial institution to disclose their records. Under the privacy regulations referenced in the form, the fiduciary's authorization is not a requirement for conducting business with the financial institution. Should the fiduciary decide to withdraw their consent, they will have the right to seek damages or legal recourse for any violations of their financial privacy.

What should a fiduciary do after the VA Form 21-4718A is completed?

Once the form is completed, the fiduciary should submit the signed Certificate of Balance on Deposit to the VA along with any necessary accounting documentation. It is essential that the fiduciary retains a copy of the form for their records. In instances where an audit may be required, the VA may contact the financial institution directly for verification using the fiduciary's signed authorization.

Common mistakes

Filling out the VA Form 21-4718A can be a straightforward process; however, there are common mistakes that individuals should be aware of to ensure accuracy. One frequent oversight involves incomplete information in Section I. The fiduciary must provide their name and the beneficiary's name accurately. Missing either of these names can lead to delays or complications in the processing of the form. It's essential for the fiduciary to double-check that all names are spelled correctly and that no fields are left blank.

Another mistake often made is neglecting the financial institution's requirements. The financial institution must complete specific portions of the form, including placing their seal or stamp in the designated area. Sometimes, fiduciaries forget to remind the financial institution of this requirement, which can result in an incomplete submission. Without the necessary certification from the financial institution, the form may be returned, causing further delay in the benefits process.

A third common error relates to the certification of account details. The fiduciary may not ensure that the information regarding the account balance, interest earned, and account number is accurate. Inaccurate account information can lead to significant repercussions, including the possible suspension of benefits. Regular communication with the financial institution can help verify that the numbers reported are correct before submitting the form.

Lastly, individuals often overlook the signature requirement in Section II. The fiduciary must sign the authorization section; however, they might think the signature is optional if the financial institution's section is complete. This can lead to the form being rejected by the VA, as the authorization allows for the financial institution to disclose pertinent records. It's crucial for fiduciaries to ensure that they sign this section, even if the Certificate of Balance on Deposit is already filled out.

Documents used along the form

The VA Form 21P-4718A is utilized by fiduciaries for the purpose of certifying the balance in bank accounts related to VA beneficiaries. Various other forms and documents may accompany this form to facilitate the process and ensure compliance with regulations. Below is a summary of related forms often required in conjunction with the VA Form 21P-4718A.

- VA Form 21-526EZ: This form is used by veterans to apply for disability compensation and related benefits. It captures essential information about the veteran's service and medical conditions.

- VA Form 21-527EZ: It serves as an application for survivors pension benefits. This form helps determine eligibility based on the financial needs of the survivor.

- VA Form 21P-8416: This document is for reporting income. It helps the VA assess the ongoing financial suitability of the beneficiary, ensuring that benefits are not disproportionately high compared to the beneficiary's income.

- VA Form 21-674: This form is necessary for applying for educational assistance for dependents of veterans. It establishes the financial need and relationship between the veteran and the dependent.

- VA Form 22-5490: This is a request for education benefits for eligible dependents. It outlines the need for funding educational services based on military service.

- VA Form 21-4142: This is a release of information form that allows the VA to obtain private medical records necessary for assessing claims. It aids in verifying the medical conditions of veterans.

- VA Form 21-534EZ: Used for applying for Dependency and Indemnity Compensation (DIC) benefits by surviving spouses or children of veterans, this form evaluates their eligibility for financial support.

In conclusion, each of these forms serves a specific purpose within the broader context of VA benefits and fiduciary responsibilities. Completing these documents accurately is vital for proper administration and timely processing of claims for all parties involved.

Similar forms

The VA Form 21-4718A, known as the Certificate of Balance on Deposit and Authorization to Disclose Financial Records, is primarily used in connection with fiduciary responsibilities for veterans' benefits. Several documents share similarities with this form in terms of purpose, structure, and function. Here’s a list of five documents that bear similar traits:

- VA Form 21-4142: This document allows veterans or beneficiaries to authorize the release of medical information to the VA. Like the VA 21-4718A, it involves obtaining consent from an individual to disclose sensitive information, thereby ensuring transparency and compliance in handling personal records.

- VA Form 21-526EZ: Used when applying for disability compensation, this form also includes sections that require consent for the VA to access relevant financial and medical records. The emphasis on accurate record-keeping makes it similar to the purpose of the VA 21-4718A.

- Form 16-2008: This document is the Application for Benefits for a Veteran’s Child or Spouse. It functions similarly by requiring signatures and authorizations to verify eligibility for benefits and collect necessary information on the beneficiary’s financial state.

- Standard Form 180 (SF-180): This is the Request Pertaining to Military Records, which also engages participants in providing consent to release personal information. Both forms aim to streamline the process of information gathering while respecting individual privacy rights.

- VA Form 21-8330: This form requests a fiduciary to provide an initial report to the VA concerning the management of a beneficiary's funds. Just like the VA 21-4718A, it emphasizes accountability and integrity in handling financial matters related to beneficiaries’ benefits.

Each of these forms, while distinct in purpose and context, emphasizes the importance of consent and transparency in managing sensitive information within the VA system. Understanding their similarities can simplify the process for those needing to navigate these bureaucratic landscapes.

Dos and Don'ts

When filling out the VA Form 21-4718A, consider the following dos and don’ts:

- Do read the instructions on the reverse side before starting the form.

- Do ensure all names and account information are accurate before submission.

- Do gather necessary details, like the account number and balance, beforehand.

- Do provide the form to the financial institution for completion of their sections.

- Don't skip the sections that require the financial institution's seal or stamp.

- Don't forget to include your signature as the fiduciary in Section II.

- Don't submit the form without confirming that all information is filled out correctly.

- Don't overlook the expiration date of the form and submit a current version.

Misconceptions

- Misconception 1: The VA Form 21-4718A can be completed by anyone.

- Misconception 2: Completing this form is optional.

- Misconception 3: The financial institution can refuse to stamp the form.

- Misconception 4: The fiduciary’s signature is needed for the financial institution to fill out the form.

- Misconception 5: Submitting this form guarantees immediate release of funds.

- Misconception 6: Information disclosed on this form will be shared freely.

- Misconception 7: The fiduciary cannot withhold consent for the information disclosed.

This form must be completed by the fiduciary and the financial institution. Only authorized individuals should provide their signatures and information.

The information collected is essential for administering benefits, and completing the form is required to avoid delays in payments or the appointment of a new fiduciary.

The financial institution is obligated to complete its portion of the form correctly. Their seal or stamp is necessary to validate the information provided.

This is incorrect. The financial institution can sign and stamp the form independently without the fiduciary's authorization for that section.

While the form is important for processing, it does not ensure immediate access to funds. The VA needs to review and approve the disclosures first.

The VA follows strict privacy guidelines and only shares this information as allowed by law. Unauthorized sharing is not permitted.

The fiduciary has the right to withhold consent. However, doing so may affect the ability to properly manage the beneficiary's estate.

Key takeaways

Understanding the VA 21-4718A form is crucial for fiduciaries managing the financial matters of VA beneficiaries. Here are several important takeaways to consider when filling out and using this form:

- Purpose of the Form: The VA 21-4718A is designed to verify the balance on deposit for a fiduciary managing a VA beneficiary's funds. The information collected is vital for the VA’s audits and oversight of fiduciaries.

- Completing the Certificate: This form is divided into two main sections. The financial institution must complete Section I while the fiduciary fills out Section II. Ensure the financial institution includes their seal or stamp for verification.

- Time Requirements: Completing the VA 21-4718A is estimated to take approximately three minutes. This estimate includes reviewing instructions, gathering necessary information, and filling out the form.

- Privacy and Disclosure: The fiduciary must understand their rights regarding privacy and authorization. They can refuse the disclosure of financial records and have the right to seek legal recourse for any violations of their financial privacy by the VA or the financial institution.

Browse Other Templates

Bathroom Sign in and Out Sheet - This log supports overall cleanliness and sanitation efforts.

Lions Club Membership Application - Check the box to send mail to the club address if preferred.