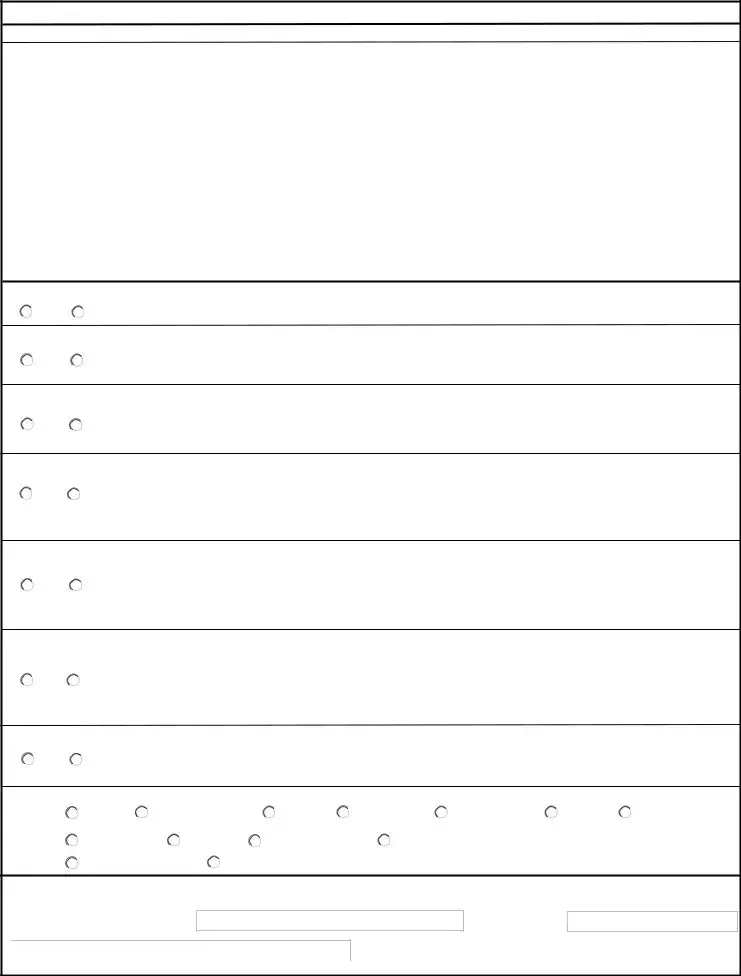

Fill Out Your Va 21 8416 Form

The VA Form 21-8416 is an essential document for veterans seeking to report their medical expenses, all aimed at potentially increasing their benefit rate. This form invites you to detail the out-of-pocket expenses incurred for both medical and dental care that you have paid for yourself or a qualifying household member, such as a spouse or parent. By providing thorough and accurate information, you can help the VA determine what expenses may be deducted from your income, thereby potentially enhancing your overall benefit rate. Various types of expenses can be included, ranging from hospital and nursing home fees to transportation costs for medical appointments, vision care expenses, and insurance premiums. However, it’s important to only report unreimbursed costs, as any amounts you have already received or expect to receive reimbursement for should be excluded. The form requires careful attention to documentation since you may need to verify your expenses within three years of your claim's decision. Whether you are filing for routine medical costs or more complex expenses related to in-home care, proper completion of this form ensures that your financial needs are fully assessed and considered in your benefits review.

Va 21 8416 Example

INSTRUCTIONS FOR MEDICAL EXPENSE REPORT

VA may be able to pay you a higher benefit rate if you identify expenses VA can deduct from your income. Your benefit rate is based on your income. Your

Report any medical or dental expenses that you paid for yourself or for a relative who is a member of your household (spouse, grandchild, parent, etc.) for which you were not reimbursed and do not expect to be reimbursed. Below are examples of expenses you should include, if applicable:

• |

Hospital expenses |

• |

Nursing home costs |

• |

Doctor's office fees |

• |

Hearing aid costs |

• |

Dental fees |

• |

Home health service expenses |

• |

• |

Expenses related to transportation to a hospital, |

|

• |

Vision care costs |

|

doctor, or other medical facility |

• Medical insurance premiums |

• Monthly Medicare deduction |

||

IMPORTANT NOTES

•Do not include any expenses for which you were or will be reimbursed. If you receive reimbursement after you have filed this claim, promptly notify the VA office handling your claim.

•If you are a veteran, VA can deduct allowable expenses paid by either you or your spouse.

•If you are not sure whether VA can deduct a payment for a particular expense, furnish a complete description of the purpose of the payment. We will let you know if we cannot deduct an expense.

•If you are claiming expenses for an

•VA may require you to verify the amounts you paid, so keep all receipts or other documentation of payments for

at least 3 years after we make a decision on your medical expense claim. If you are unable to provide documentation of your claimed medical expenses when VA asks you to do so, your benefits may be retroactively reduced or discontinued.

•If you need more space to report expenses, attach a separate sheet of paper with columns corresponding to those on this form. Be sure to write your VA file number on any attachments.

FEES FOR CLAIMS: Section 5904, Title 38, United States Code (codified in § 14.636, Title 38, Code of Federal Regulations) contains provisions regarding fees that may be charged, allowed, or paid for services provided by a

PRIVACY ACT NOTICE: VA will not disclose information collected on this form to any source other than what has been authorized under the Privacy Act of 1974 or Title 38, code of Federal Regulations 1.576 for routine uses (i.e., civil or criminal law enforcement, congressional communications, epidemiological or research studies, the collection of money owed to the United States, litigation in which the United States is a party or has an interest, the administration of VA programs and delivery of VA benefits, verification of identity and status, and personnel administration) as identified in the VA system of records, 58VA21/22/28, Compensation, Pension, Education, and Vocational Rehabilitation and Employment Records - VA, published in the Federal Register. Your obligation to respond is required to obtain or retain benefits. The requested information is considered relevant and necessary to determine maximum benefits provided under law. VA uses your SSN to identify your claim file. Providing your SSN will help ensure that your records are properly associated with your claim file. Giving us your SSN account information is voluntary. Refusal to provide your SSN by itself will not result in the denial of benefits. VA will not deny an individual benefits for refusing to provide his or her SSN unless the disclosure of the SSN is required by a Federal Statute of law in effect prior to January 1, 1975, and still in effect. The responses you submit are considered confidential (38 U.S.C. 5701). Information submitted is subject to verification through computer matching programs with other agencies.

RESPONDENT BURDEN: We need this information to determine whether medical expenses you paid may be used to reduce the amount of income we count in determining eligibility to benefits (38 U.S.C. 1503). Title 38, United States Code, allows us to ask for this information. We estimate that you will need an average of 30 minutes to review the instructions, find the information, and complete this form. VA cannot conduct or sponsor a collection of information unless a valid OMB control number is displayed. You are not required to respond to a collection of information if this number is not displayed. Valid OMB control numbers can be located on the OMB Internet Page at www.reginfo.gov/public/do/PRAMain. If desired, you can call

DEC 2021 |

|

|

VA FORM |

|

Page 1 |

OMB Control No.

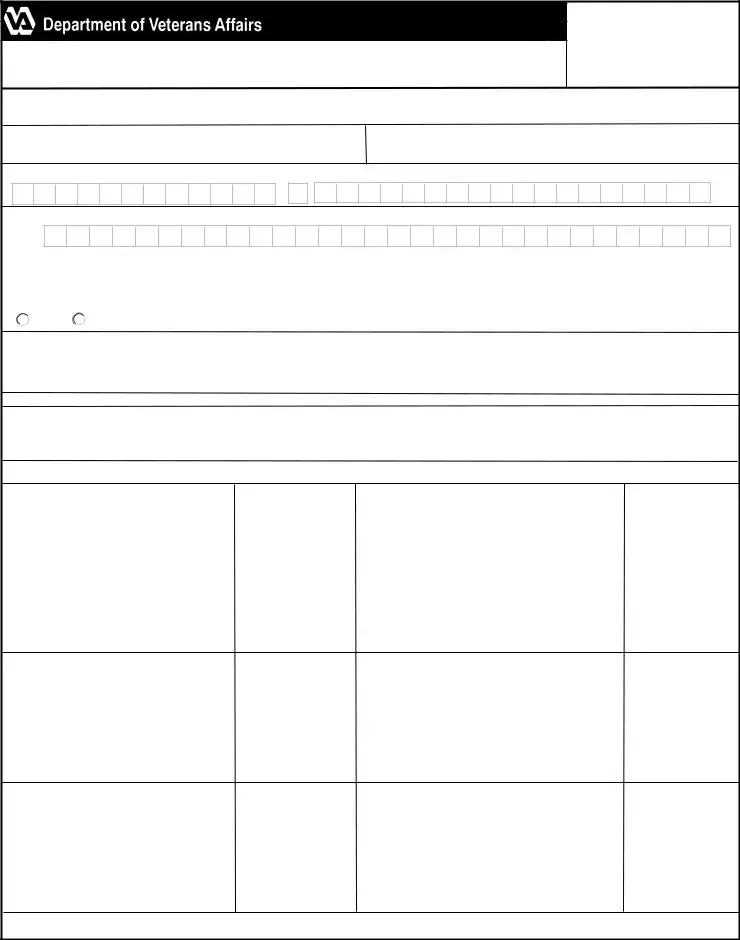

MEDICAL EXPENSE REPORT

1. NAME OF VETERAN (First, Middle Initial, Last)

VA DATE STAMP

(DO NOT WRITE IN THIS SPACE)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. VA FILE NUMBER (If applicable) |

|

|

|

|

|

|

|||||||||||||||||

2. SOCIAL SECURITY NUMBER |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4.NAME OF CLAIMANT (First, Middle Initial, Last)

5.CURRENT MAILING ADDRESS OF CLAIMANT (Number and street or rural route, P. O. Box, City, State, ZIP Code and Country) No. &

Street

|

Apt./Unit Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

State/Province |

|

|

|

|

|

|

|

Country |

|

|

|

|

|

ZIP Code/Postal Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

6. CHANGE OF ADDRESS (Check box if address is different from last address furnished to VA) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

7. TELEPHONE NUMBER OF CLAIMANT (Include Area Code) |

|

|

|

|

|

8. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Enter International |

Phone Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

(If applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

9. MILEAGE FOR PRIVATELY |

|

OWNED VEHICLE TRAVEL FOR MEDICAL PURPOSES |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Report miles traveled to a hospital, doctor, or other medical facility in a privately owned vehicle (POV) such as a car, truck, or motorcycle. Itemize travel occurring between the dates ________________ and ________________ . If no dates appear on this line, refer to the accompanying letter for the dates you should report medical expenses. If you do not

have a letter, please report unreimbursed medical expenses on a calendar year basis (ex. 01/01/XXXX thru 12/31/XXXX). We will calculate the allowable deduction for your mileage based on the current POV mileage reimbursement rate for automobiles specified by the United States General Services Administration (GSA).

|

NOTE: You may also claim deductions for other payments related to travel for medical purposes, such as taxi fares, buses, or other forms of public transportation. |

||||||||||||

|

Report these types of medical travel expenses in Item 22. |

|

|

|

|

|

|

|

|

|

|||

|

A. MEDICAL FACILITY TO WHICH |

B. TOTAL ROUNDTRIP |

C. AMOUNT REIMBURSED |

|

|

D. DATE |

|

|

E. WHO NEEDED TO |

||||

|

|

MILES TRAVELED |

FROM ANOTHER SOURCE |

|

|

TRAVELED |

TRAVEL? |

||||||

|

TRAVELED |

|

|

|

|||||||||

|

|

|

|

(Such as a VA Medical Center) |

|

(Month/Day/Year) |

(Self, spouse, child) |

||||||

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

Month |

Day |

Year |

|

|

||

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

Day |

Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

Day |

Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

Day |

Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

Day |

Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

Day |

Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IMPORTANT: Be sure to sign and date this form in Items 12A & 12B on page 4. Unsigned reports will be returned.

VA FORM |

Page 2 |

|

SUPERSEDES VA FORM |

||

|

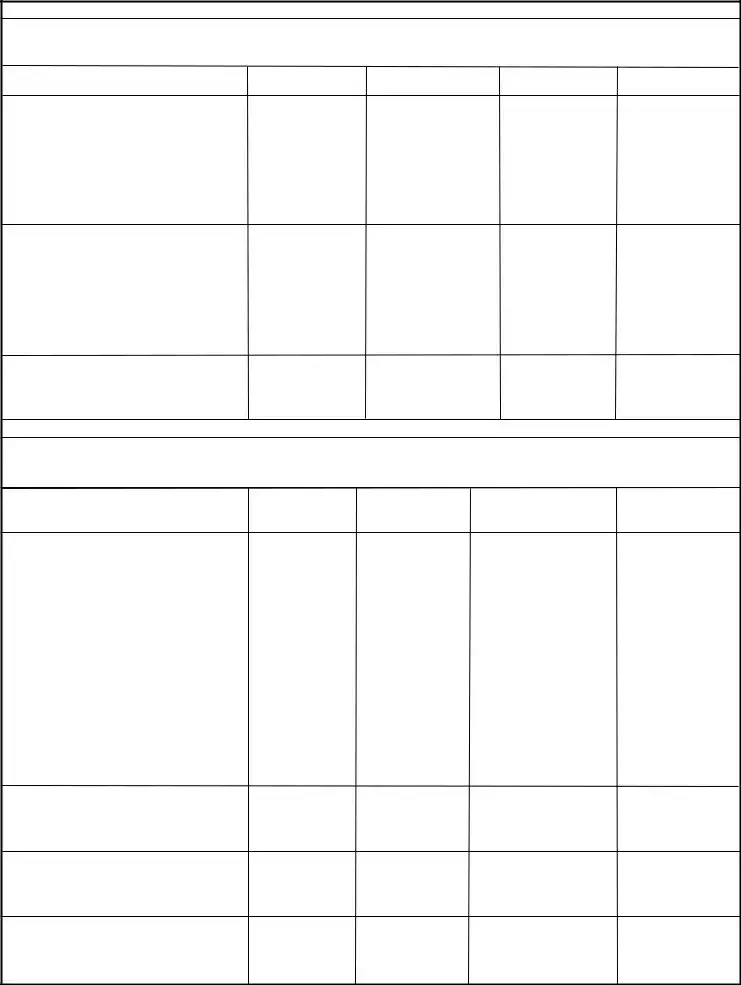

10.

IMPORTANT - You must complete the attached

Report amounts paid between the dates __________________ and _________________. If no dates appear on this line refer to the accompanying letter for the dates you

should report medical expenses. If you do not have a letter, please report unreimbursed medical expenses on a calendar year basis (ex. 01/01/XXXX thru 12/31/XXXX).

|

A. NAME OF PROVIDER |

|

B. HOURLY RATE/ |

C. AMOUNT PAID |

|

D. DATE PAID |

|

E. FOR WHOM PAID |

||||

|

|

|

NUMBER OF HOURS |

|

(Month/Day/Year) |

|

(Self, spouse, child, etc.) |

|||||

|

|

|

|

|

|

|||||||

|

|

|

|

|

Month |

Day |

Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

Day |

Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

Day |

Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

Day |

Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

Day |

Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. ITEMIZATION OF MEDICAL EXPENSES

IMPORTANT - If you are claiming expenses for care in an assisted living, adult day care, or a similar facility, you must complete the appropriate worksheet (page 6). Report medical expenses that you paid between the dates __________________ and _________________. If no dates appear on this line refer to the accompanying

letter for the dates you should report medical expenses. If you do not have a letter, please report unreimbursed medical expenses on a calendar year basis

(ex. 01/01/XXXX thru 12/31/XXXX). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

A. MEDICAL EXPENSE (Physician or |

B. AMOUNT PAID |

|

|

C. DATE PAID |

D. NAME OF PROVIDER |

|

E. FOR WHOM PAID |

||||||||

|

Hospital Charges, Eyeglasses, Oxygen |

|

|

(Name of doctor, dentist, |

|

|||||||||||

|

|

|

|

(Month/Day/Year) |

(Self, spouse, child, etc.) |

|||||||||||

|

Rental, Medical Insurance, etc.) |

|

|

|

hospital, lab, etc.) |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

MEDICARE (PART B) |

|

|

Month |

Day |

Year |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MEDICARE (PART D) |

|

|

Month |

Day |

Year |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PRIVATE MEDICAL INSURANCE |

|

|

Month |

Day |

Year |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

Month |

Day |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

Year |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

Day |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

Year |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

Day |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

Year |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

Day |

Year |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VA FORM

Page 3

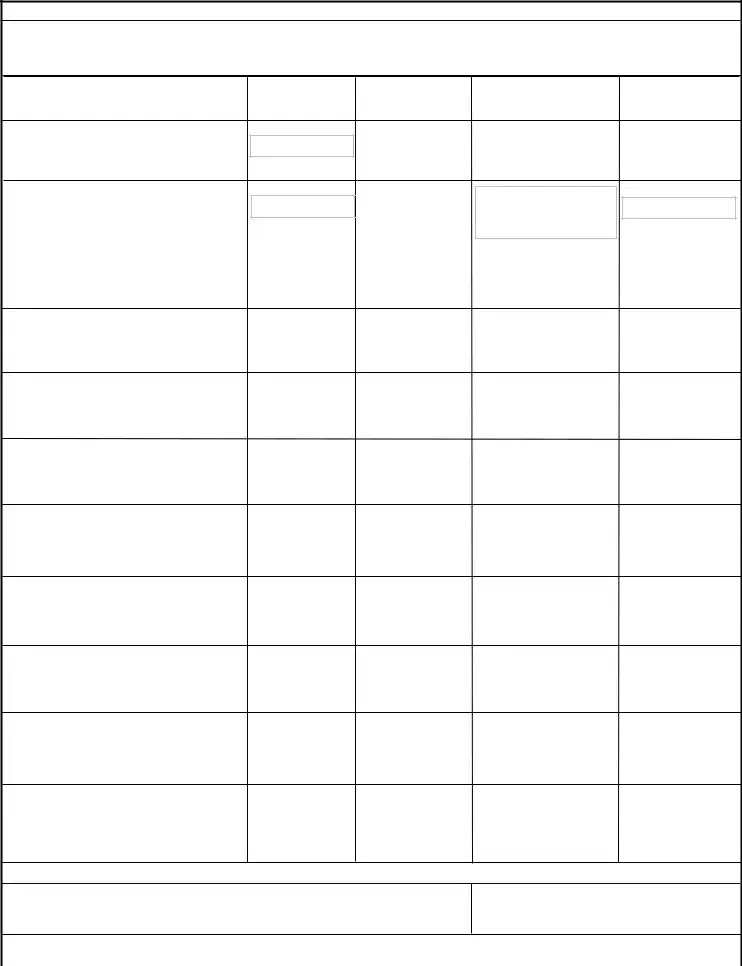

11. ITEMIZATION OF MEDICAL EXPENSES (Continued)

IMPORTANT - If you are claiming expenses for care in an assisted living, adult day care, or a similar facility, you must complete the appropriate worksheet (page 6). Report medical expenses that you paid between the dates __________________ and _________________. If no dates appear on this line refer to the accompanying

letter for the dates you should report medical expenses. If you do not have a letter, please report unreimbursed medical expenses on a calendar year basis (ex. 01/01/XXXX thru 12/31/XXXX).

A. MEDICAL EXPENSE (Physician or Hospital Charges, Eyeglasses, Oxygen Rental, Medical Insurance, etc.)

MEDICARE (PART B)

B. AMOUNT PAID

C. DATE PAID |

|

D. NAME OF PROVIDER |

|

E. FOR WHOM PAID |

|

|

(Name of doctor, dentist, |

|

|||

(Month/Day/Year) |

|

(Self, spouse, child, etc.) |

|||

|

hospital, lab, etc.) |

||||

|

|

|

|

|

|

Month Day |

Year |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Month Day |

Year |

|

MEDICARE (PART D) |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

Day |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PRIVATE MEDICAL INSURANCE |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

Month |

Day |

Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

Day |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

Day |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

Year |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

Day |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

Day |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

Year |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

Day |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

Day |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

Day |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

Year |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CERTIFICATION: I have not and will not receive reimbursement for these expenses. I certify that the above information is true.

12A. SIGNATURE OF CLAIMANT (Do NOT print)

12B. DATE SIGNED

Month |

|

Day |

|

|

Year |

||||

|

|

|

|

|

|

|

|

|

|

PENALTY: The law provides severe penalties which include fine or imprisonment, or both, for the willful submission of any statement or evidence of a material fact, knowing it is false, or fraudulent acceptance of any payment to which you are not entitled.

VA FORM |

Page 4 |

WORKSHEET FOR

NOTE: Only complete this worksheet if you are claiming expenses for

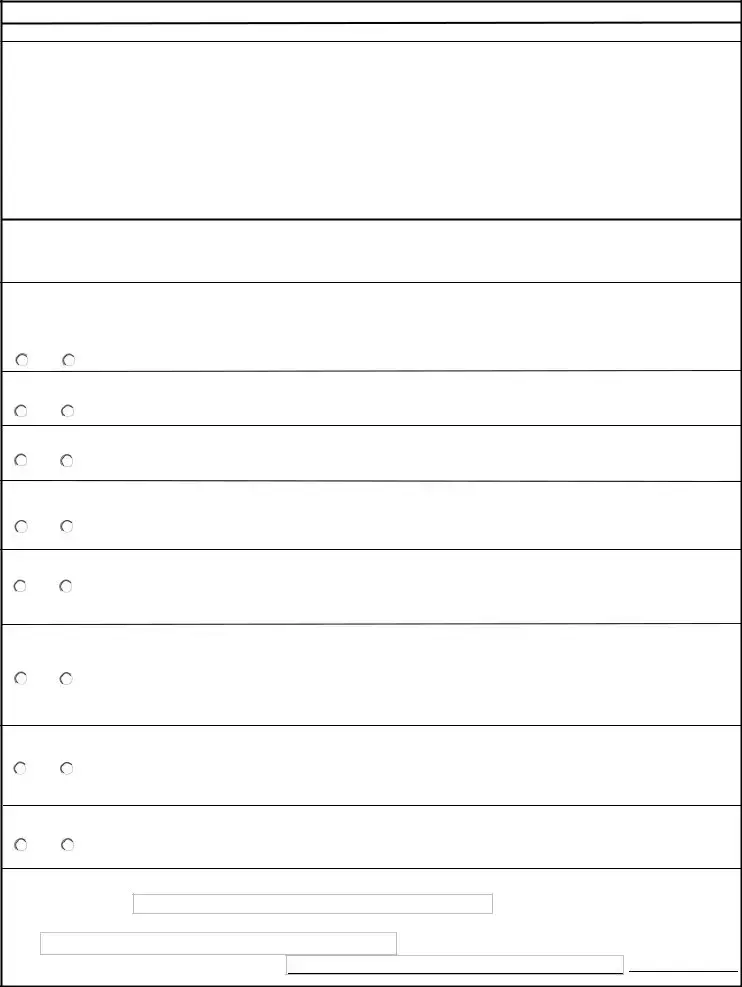

IMPORTANT: VA recognizes the following five activities as Activities of Daily Living (ADLs) for medical expense purposes:

(1)Eating

(2)Bathing/Showering

(3)Dressing

(4)Transferring (for example, from bed to chair)

(5)Using the toilet

Custodial Care is regular -

•assistance with two or more ADLs, or

•supervision because a person with a mental disorder is unsafe if left alone due to the mental disorder

IMPORTANT: The following activities are examples of Instrumental Activities of Daily Living (IADLs) for VA purposes. VA generally does not recognize assistance

with these activities as medical expenses: (1) Shopping; (2) Food Preparation; (3) Housekeeping; (4) Laundering; (5) Handling medications; (6) Using the telephone;

(7) Transportation (except for medical purposes such as transportation to a doctor's appointment).

INSTRUCTIONS: Use this worksheet if you are claiming payments to a disabled person's

Follow the steps below to determine whether or not:

•the attendant must be a health care provider for VA purposes and

•VA may deduct payment for assistance with IADLs as well as assistance with ADLs and custodial care

STEP 1. Are you (the claimant) the disabled person?

YES |

NO |

(If "NO," skip to Step 6) |

STEP 2. Has VA determined that you are eligible for special monthly pension? (Special monthly pension means pension at the aid and attendance or housebound rate or Parents' DIC at the aid and attendance level)

YES |

NO |

(If "YES," the attendant does not need to be a health care provider. Skip to Step 3) |

|

|

(If "NO," skip to Step 4) |

STEP 3. Is the primary responsibility of the

|

|

(If "YES," payments to this |

|

YES |

NO |

may claim these expenses in Item 10. Skip to Step 8) |

|

(If "NO," payments to this |

|||

|

|

||

|

|

services and custodial care qualify as medical expenses. You may claim these expenses in Item 10. Skip to Step 8) |

STEP 4. Are you claiming special monthly pension?

(If "YES," please complete and attach with this application VA Form

YES NORegular Aid and Attendance. Please make sure every item on this form is complete and signed by a Physician, Physician Assistant (PA), Certified Nurse Practitioner (CNP), or Clinical Nurse Specialist (CNS))

(If "NO," the attendant must be a health care provider and payments for assistance with IADLs do not qualify as medical expenses. Payments for health care services or assistance with ADLs qualify as medical expenses. You may claim these expenses in Item 10. Skip to Step 8)

STEP 5. Is the primary responsibility of the

|

|

(If "YES," payments to this |

YES |

NO |

Please report separately in Item 10 amounts you pay an |

by a health care provider, (2) assistance with IADLs; and (3) custodial care. Skip to Step 8) |

(If "NO," payments to this

STEP 6. Does the disabled person require the health care services or custodial care that the

(If "YES," you must submit a statement from a physician or physician assistant that: (1) the disabled person requires the health care

YES NOservices or custodial care that the attendant provides him or her because of mental or physical disability, and (2) describes the mental or physical disability. The

(If "NO," the attendant must be a health care provider and payments for assistance with IADLs do not qualify as medical expenses. Payments to the

STEP 7. Is the primary responsibility of the

YES |

|

|

(If "YES," payments to the |

|||||||

NO |

|

IADLs. You may claim these expenses in Item 10) |

|

|

|

|

||||

|

|

|

(If "NO," payments to the |

|||||||

|

|

|

attendant for health care or custodial care qualify as medical expenses. You may report these expenses in Item 10) |

|||||||

STEP 8. Check all activities below that the attendant assists the disabled person with: |

|

|

|

|||||||

ADLs: |

EATING |

BATHING/SHOWERING |

DRESSING |

TRANSFERRING |

USING THE TOILET |

SHOPPING |

FOOD PREPARATION |

|||

|

|

|

|

|

|

|

|

|

|

|

IADLs: |

HOUSEKEEPING |

LAUNDRY |

MANAGING FINANCES |

HANDLING MEDICATIONS |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

USING THE TELEPHONE |

TRANSPORTATION FOR |

|

|

||||||

STEP 9.

I CERTIFY that the information stated within this WORKSHEET FOR

reflects the current environment pertaining to ____________________________________________________ and his or her care from________________________________

|

(Name of Person Requiring Care) |

|

(Name of Attendant) |

||

|

|

|

|

|

|

|

(Name, Signature and Title of Certifying Official) |

|

|

|

|

|

|

(Date Certified) |

|||

VA FORM |

Page 5 |

WORKSHEET FOR AN ASSISTED LIVING, ADULT DAY CARE, OR A SIMILAR FACILITY

NOTE: Only complete this worksheet if you are claiming expenses for an assisted living facility, adult day care or similar facility.

IMPORTANT: VA recognizes the following five activities as Activities of Daily Living (ADLs) for medical expense purposes:

(1)Eating

(2)Bathing/Showering

(3)Dressing

(4)Transferring (for example, from bed to chair)

(5)Using the toilet

Custodial Care is regular -

• assistance with two or more ADLs, or

• supervision because a person with a mental disorder is unsafe if left alone due to the mental disorder.

INSTRUCTIONS: Use this worksheet if you are claiming a disabled person's care in an assisted living facility, adult day care, or similar facility as unreimbursed medical expenses. Follow the steps below to determine whether VA may deduct all or some of your

STEP 1. Are the expenses you wish to claim due to the disabled person's treatment in a hospital, inpatient treatment center, nursing home, or VA approved medical foster home?

YES

YES  NO

NO

STEP 2. Do all of the following apply to the facility?

•The facility is licensed (if the State or country requires it)

•The facility's staff (or the facility's contracted staff) provides the disabled person with health care or custodial care or both.

•If the facility is residential, it is staffed 24 hours per day with caregivers

YES |

NO |

(If "NO," payments to the facility do not qualify as medical expenses. You are finished completing this worksheet) |

STEP 3. Are you (the claimant) the disabled person? Are you a veteran, surviving spouse, or Parents' DIC claimant?

YES |

NO |

(If "NO," to either of these questions, skip to Step 8) |

STEP 4. Has VA determined that you are eligible for special monthly pension? (Special monthly pension means pension at the aid and attendance or housebound rate or Parents' DIC at the aid and attendance level)

YES |

NO |

(If "NO," skip to Step 6) |

|

|

STEP 5. If you answered "YES" in Step 2, you stated that the facility provides you with health care and/or custodial care.

|

Is this the primary reason you live in the facility (or attend day care in the facility)? |

||

YES |

NO |

(If "YES," all payments to this facility qualify as medical expenses. You may claim these expenses in Item 11. Skip to Step 10) |

|

(If "NO," payments to this facility for meals and lodging do not qualify as medical expenses. Only claim amounts you pay the facility for |

|||

|

|

||

health care services or custodial care)

STEP 6. Are you claiming special monthly pension?

(If "YES," please complete and attach with this application VA Form

YES NOfor Regular Aid and Attendance. Please make sure every item is complete and the form is signed by a Physician, Physician Assistant (PA), Certified Nurse Practitioner (CNP), or Clinical Nurse Specialist (CNS))

(If "NO," payments to this facility for meals and lodging do not qualify as medical expenses. Only claim amounts you pay the facility for health care services or assistance with ADLs provided by a health care provider in Item 11. Skip to Step 10)

STEP 7. If you answered "YES" in Step 2, you stated that the facility provides you with health care and/or custodial care. Is this the primary reason you live in the facility (or attend day care in the facility)?

|

|

(If "YES," all payments to this facility may qualify as medical expenses if VA rates you as eligible for special monthly pension or Parents' |

YES |

NO |

DIC. Please report separately in Item 11 applicable amounts you pay the facility for: (1) lodging and meals, (2) health care services or |

assistance with ADLs provided by a health care provider, and (3) custodial care. Skip to Step 10) |

(If "NO," payments to this facility for meals and lodging do not qualify as medical expenses. Please report separately in Item 11 applicable amounts you pay the facility for: (1) health care services or assistance with ADLs provided by a health care provider, and (2) custodial care. Skip to Step 10)

STEP 8. Does the disabled person require the health care services or custodial care that the facility provides to him or her because of the disabled person's mental or physical disability?

(If "YES," you must submit a statement from a physician or physician assistant that: (1) the disabled person requires the health care

YES NOservices or custodial care that the facility provides to him or her because of mental or physical disability, and (2) describes the mental or physical disability)

(If "NO," claim only amounts you pay the facility for health care services or assistance with ADLs provided by a health care provider in Item 11. Skip to Step 10)

STEP 9. If you answered "YES" in Step 2, you stated that the facility provides the disabled person with health care and/or custodial care. Is this the primary reason the disabled person lives in the facility or attends day care in the facility?

YES |

NO |

(If "YES," claim all payments to this facility (to include meals and lodging) as medical expenses in Item 11) |

|

(If "NO," payments to this facility for meals and lodging do not qualify as medical expenses. Only claim amounts you pay the facility for |

|||

|

|

||

|

|

health care services or custodial care in Item 11) |

STEP 10. Facility Certification: Please submit a current statement showing the fees claimant pays to your facility and breakdown of the care received.

I CERTIFY that the information stated within this WORKSHEET FOR AN ASSISTED LIVING, ADULT DAY CARE, OR SIMILAR FACILITY is accurate and reflects the current environment pertaining to _______________________________________________________________________________________ and his or her care at this

(Name of person staying at your facility)

facility____________________________________________________________________

(Name and address of facility)

(Name, Signature and Title of Person Certifying for the Facility)

(Date Certified)

VA FORM |

Page 6 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The VA Form 21P-8416 is designed to report unreimbursed medical expenses, which may help veterans qualify for higher benefit rates by reducing their reported income. |

| Eligible Expenses | Examples of deductible expenses include hospital fees, nursing home costs, dental care, and medical insurance premiums. It is essential that the expenses are not reimbursed. |

| Document Retention | Claimants should keep all receipts and documentation for at least three years after the VA makes a decision regarding their medical expense claims. Failure to provide documentation can result in reduced benefits. |

| Governing Law | This form is governed by Title 38 of the United States Code and corresponding regulations, particularly regarding fee provisions and submission requirements. |

Guidelines on Utilizing Va 21 8416

Filling out the VA Form 21-8416 is an important step for veterans seeking to report medical expenses that may help increase their benefit rates. After completing the form, it should be submitted to the appropriate VA office. This ensures that your out-of-pocket medical and dental expenses are accurately considered in determining your benefit eligibility.

- Start by entering the name of the veteran in the first field of the form.

- Add the veteran’s Social Security number in the next box.

- If applicable, include the VA file number.

- Fill in the name of the claimant (this may be the same as the veteran).

- Provide the current mailing address of the claimant; make sure to include all required details like street, city, state, and ZIP code.

- Indicate in the box provided if there has been a change of address since the last information was provided to the VA.

- Enter the telephone number of the claimant, including the area code.

- If available, provide the e-mail address of the claimant.

- Document the mileage for privately owned vehicle travel for medical purposes, including all necessary details for each trip taken.

- If claiming expenses for home attendant care, complete the related sections accurately, detailing the provider’s name, amount paid, hours worked, and for whom the service was rendered.

- List all the itemized medical expenses, including each provider's name and the respective amounts paid. Be sure to include specific details regarding the service received.

- Sign and date the form at the bottom of page 4, confirming that you have not received and do not expect reimbursement for the reported expenses.

- If needed, attach a separate sheet for additional expenses and label it with your VA file number.

What You Should Know About This Form

What is the purpose of the VA Form 21-8416?

The VA Form 21-8416 is used to report medical and dental expenses incurred by veterans or their family members. By detailing these out-of-pocket costs, veterans may qualify for higher benefits from the VA. Essentially, this form identifies allowable expenses that can be deducted from a veteran's income, potentially increasing their benefit rate. It's essential to report only unreimbursed expenses that won't be compensated in the future.

Who can I report expenses for on this form?

You can report medical and dental expenses for yourself or for relatives living in your household. This includes your spouse, parent, grandchild, or any dependent. The form is flexible enough to allow for a variety of expenses, ensuring that all qualifying medical costs are recognized when calculating your financial eligibility for VA benefits.

What types of expenses should be included?

When filling out the form, it's important to include a range of out-of-pocket expenses. Common expenses reported include hospital bills, nursing home costs, doctor visits, dental fees, and prescription medications. Additionally, transportation costs to medical appointments and medical insurance premiums can also be reported. Remember, these should be unreimbursed expenses, meaning you should not report anything that you've been or will be reimbursed for later.

What should I do if I receive reimbursement for an expense after I submit the form?

If you receive any reimbursement for an expense you previously claimed, it's crucial to inform the VA immediately. Failing to do so can result in complications regarding your benefits. You want to ensure that your claim remains accurate and that you're not penalized for errors that you didn’t intend. Keeping clear communication with the VA will help you avoid potential issues.

How should I handle the documentation of my medical expenses?

It's vital to maintain meticulous records of all your medical expenses. The VA may require verification of these amounts, so saving receipts and documentation for at least three years after your claim decision is recommended. If you cannot provide documentation when requested, there's a risk that your benefits could be reduced or halted. Keeping organized records simplifies the verification process and protects your benefits.

What if I need more space on the form to report my medical expenses?

If you find the space on the VA Form 21-8416 insufficient to list all your medical expenses, don't worry. You can attach an additional sheet of paper to the form. Make sure to organize this sheet with columns matching those on the form for clarity. And don’t forget to include your VA file number on any attachments to ensure it gets processed correctly!

Common mistakes

Filling out the VA Form 21-8416 can feel daunting, and many individuals unfortunately make common errors that can hinder the processing of their claims. One major mistake is failing to include all relevant medical expenses. It is essential to provide a comprehensive list of out-of-pocket costs, including hospital fees, prescription drug expenses, and dental care. Many people overlook smaller expenses that can add up, leading to potential reductions in benefits if not reported.

Another frequent error occurs when people mistakenly include reimbursed expenses. It's crucial to remember that if you have received or expect to receive payment for a particular service, that expense should not be reported. This often leads to discrepancies and can complicate the review process, which may cause delays or reductions in benefits. Always double-check to ensure that you are listing only unreimbursed expenses.

A third mistake is not providing adequate documentation for claimed expenses. The VA may request verification of your medical costs, and if you fail to adequately support your claims with receipts or paperwork, your request could be denied. It is advisable to gather and organize these documents as you fill out the form, keeping them for at least three years after your claim is approved. Maintaining meticulous records will work in your favor.

Many also forget to sign and date the form. This might seem trivial, but unsigned forms automatically lead to rejection. Ensure that you complete this final step before submitting. Take a moment to review everything and confirm that all sections are filled out correctly, and that your signature is on the line.

Lastly, not following the specific instructions regarding in-home care expenses can lead to mistakes. If you are claiming payments for in-home care, you must complete additional worksheets to determine which payments are allowable. Neglecting this step could result in missed deductions, affecting the overall benefit amount. Carefully read all accompanying instructions to ensure your form is fully compliant and complete.

Documents used along the form

The VA Form 21-8416 is used to report medical expenses that may be deducted from income to potentially increase benefits. Along with this form, there are several other documents and forms that individuals may need to submit or be aware of during the claims process. Each document serves a specific purpose and helps streamline the evaluation of claims for medical expense deductions.

- VA Form 21-2680: This form is used to assess eligibility for special monthly pensions based on the need for aid and attendance. It must be completed by a physician and provides vital medical information regarding a claimant’s health status.

- Worksheet for In-Home Attendant Expenses: This worksheet helps detail the costs associated with hiring an in-home attendant. It is important for those claiming these expenses as it outlines the necessary criteria for deductions related to daily living assistance.

- VA Form 21-0779: This is the application for increased pension based on the need for regular aid and attendance. It includes information regarding the claimant’s health care needs and helps the VA evaluate eligibility for enhanced benefits.

- VA Form 10-10EZ: This health benefits application form allows veterans to apply for Department of Veterans Affairs health care benefits and services, including information about insurance and existing medical coverage.

- Utility Bills or Proof of Expenses: Proof of out-of-pocket medical expenses may also be required. Copies of relevant receipts, bills, or statements that support the claimed expenses should be included for verification purposes.

- Letters of Support or Statement from Physicians: Additional statements from doctors or health care providers may be required for some claims, especially those involving complex medical conditions or unusual expenses.

Combining these forms and documents with the VA Form 21-8416 can provide a comprehensive view of eligibility and entitlements concerning medical expense claims. Proper submission of these documents helps in ensuring a smoother claims process and in receiving the appropriate benefits.

Similar forms

The VA Form 21-8416 is used to report medical expenses for veterans seeking higher benefit rates. Several documents are similar to this form in terms of their purpose or requirements for reporting medical-related expenses. Below are five such documents, each explained briefly:

- Form 21-2680: This document is used for applying for special monthly pension benefits based on the need for aid and attendance. Like the VA Form 21-8416, it requires detailed information about medical expenses to determine eligibility for additional financial support.

- Form 21-4142: This is the Authorization and Consent to Release Information to the VA. It allows the VA to obtain medical records to verify the expenses reported. Similar to the VA Form 21-8416, it is focused on ensuring that all necessary data is available for decision-making regarding benefits.

- Form 21-0781: This form is utilized to apply for benefits based on reported secondary conditions stemming from a primary service-connected disability. Like the VA Form 21-8416, it seeks specific financial and medical information to process claims effectively.

- Form 21P-0969: This document is a Request for Employment Information in Connection with Claim for Disability Benefits. It is similar in that it requests comprehensive details regarding expenses and supports the determination of benefit rates, including medical expenses that affect income.

- Form 10-10EZ: This is the Application for Health Benefits, which includes inquiries about income and financial need similar to those found in the VA Form 21-8416. It assists in establishing eligibility for health services through the VA and requires accurate reporting of medical-related costs.

Dos and Don'ts

When completing the VA Form 21-8416, it is crucial to ensure accuracy and thoroughness. Here is a list of important dos and don'ts:

- Do report only unreimbursed medical and dental expenses.

- Do include expenses for yourself or household relatives.

- Do keep receipts and documentation for at least 3 years.

- Do provide a complete description of any ambiguous expenses.

- Don’t claim any expenses that you have been or will be reimbursed for.

- Don’t forget to sign and date the form before submission.

- Don’t neglect to attach additional sheets if you need more space to report expenses.

Misconceptions

- Misconception 1: Only veterans can claim medical expenses on this form.

- Misconception 2: All medical expenses are deductible.

- Misconception 3: Receipts are not necessary for claims.

- Misconception 4: You cannot claim expenses for a spouse.

- Misconception 5: The VA will automatically calculate deductions without information from you.

- Misconception 6: Attaching additional pages is not allowed.

- Misconception 7: Mileage deductions are not claimable.

- Misconception 8: Completing the worksheet for in-home care is optional.

This form can be used by claimants related to veterans, such as spouses or dependents. They can report unreimbursed medical expenses too.

Not all medical expenses qualify. Only those you have paid and for which you have not been reimbursed are eligible.

It's important to keep all receipts and documentation for at least three years. VA may ask for proof of payment.

You can claim medical expenses paid for a spouse or other household members, provided you haven’t been reimbursed.

You must provide detailed information about your expenses, including the purpose of each payment, so the VA can accurately calculate deductions.

If you need more space to list expenses, you can attach a separate sheet. Just ensure it mirrors the format of the form.

You can claim mileage for travel to medical appointments using your privately owned vehicle, plus other transportation costs.

If you are claiming in-home attendant expenses, you must complete the appropriate worksheet to determine eligibility for deductions.

Key takeaways

Understanding the VA Form 21-8416 for reporting medical expenses is essential for veterans and their dependents. This form helps in potentially increasing benefit rates by allowing for the deduction of specific medical expenses from income. Here are key takeaways when filling out the form:

- Identify all applicable medical and dental expenses not reimbursed. Include costs such as hospital bills, doctor's fees, and medical insurance premiums.

- Expenses for relatives in the household can also be reported, as long as they were not reimbursed.

- Leave out expenses that you anticipate being reimbursed for. If reimbursement occurs post-filing, notify the VA immediately.

- Keep all receipts and documentation for at least three years after your claim decision, as they may be requested for verification.

- Use additional sheets if more space is needed to list expenses, and be sure to add your VA file number to those attachments.

- If in-home care or assisted living costs are being claimed, complete the specific worksheets provided in the form.

- Sign and date the form in the designated areas to avoid it being returned due to a lack of signatures.

- Understand your privacy rights; any information submitted will be kept confidential in accordance with the Privacy Act of 1974.

Browse Other Templates

Trec License - The costs associated with repairs can be clearly delineated using this amendment.

Medi-cal Coverage - If self-employed, report your net income after expenses.

California Repo - Promotes transparency in the handling of repossession situations.