Fill Out Your Va 21 8940 Form

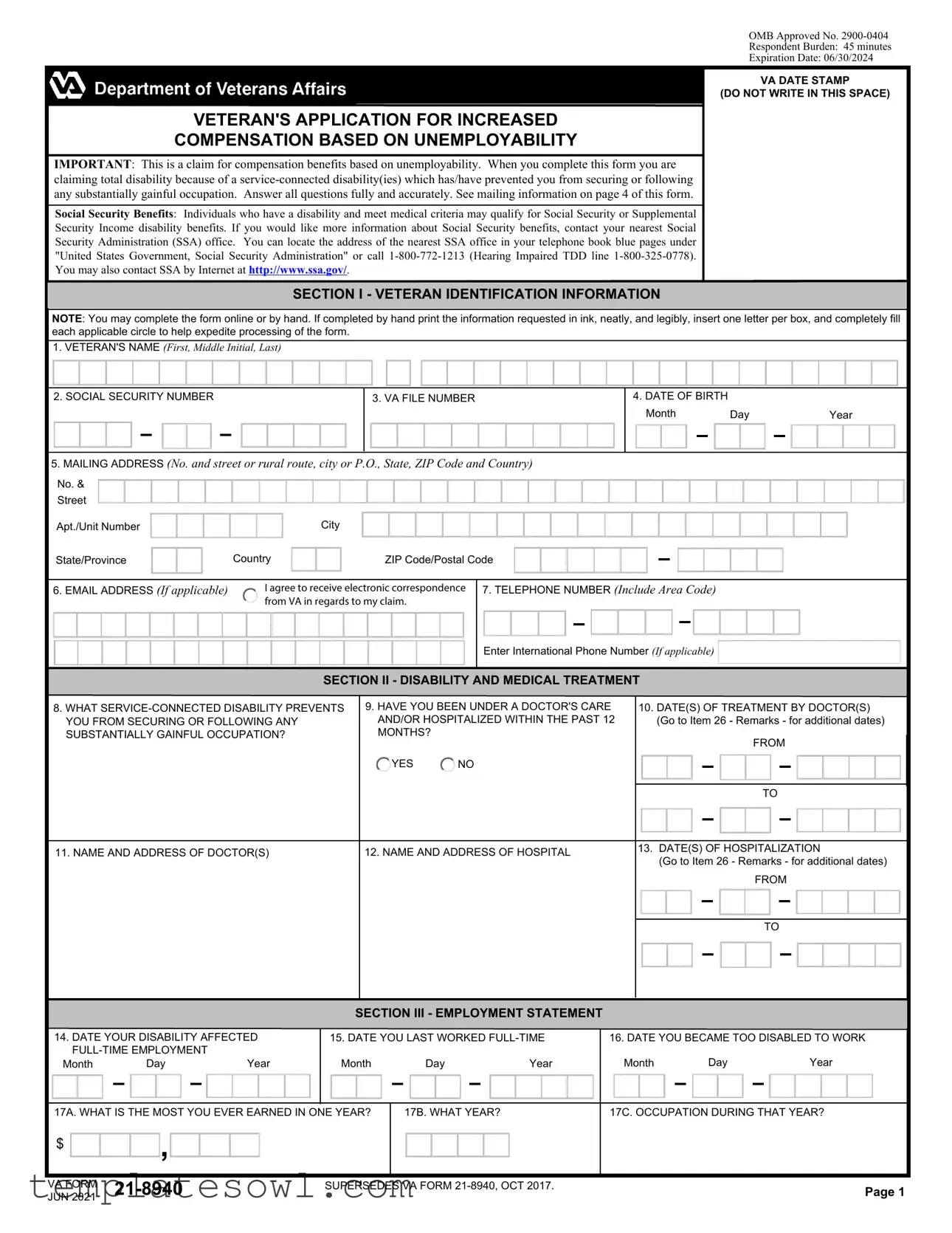

The VA Form 21-8940, officially titled "Veteran's Application for Increased Compensation Based on Unemployability," is a critical document for veterans seeking disability compensation from the Department of Veterans Affairs (VA). This form facilitates the claim for benefits due to an inability to secure or maintain any gainful employment as a direct result of service-connected disabilities. Completing this form requires a thorough understanding of one’s medical history, details about employment, and the specifics of the disabling conditions. Veterans must provide comprehensive identification information, including their name, Social Security Number, and VA File Number. Sections dedicated to disability, medical treatment, and employment status guide applicants through the necessary disclosures regarding their work history and prior medical care. It’s important for applicants to take their time to answer all questions accurately; the estimated completion time for the form is about 45 minutes. The VA emphasizes the importance of honest disclosures as they play a significant role in determining eligibility for benefits based on unemployability. Lastly, the form also supports communication regarding potential Social Security benefits, guiding veterans on how to seek additional financial assistance if needed. A clear understanding of the VA Form 21-8940 can help veterans navigate the complexities of their compensation claims effectively.

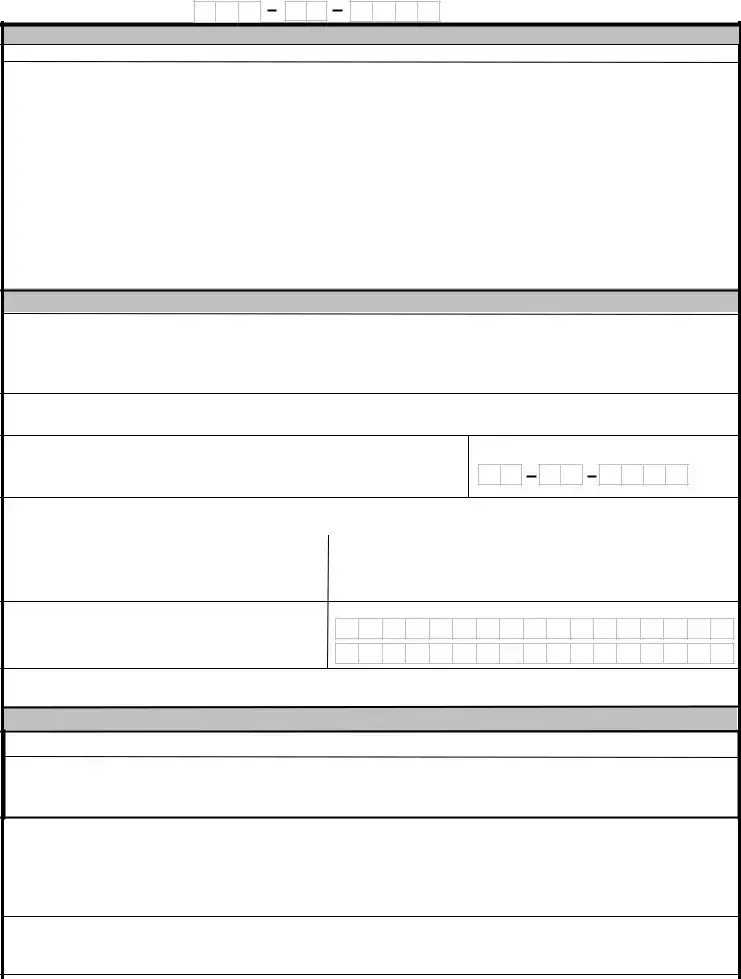

Va 21 8940 Example

OMB Approved No.

VETERAN'S APPLICATION FOR INCREASED

COMPENSATION BASED ON UNEMPLOYABILITY

IMPORTANT: This is a claim for compensation benefits based on unemployability. When you complete this form you are claiming total disability because of a

Social Security Benefits: Individuals who have a disability and meet medical criteria may qualify for Social Security or Supplemental Security Income disability benefits. If you would like more information about Social Security benefits, contact your nearest Social Security Administration (SSA) office. You can locate the address of the nearest SSA office in your telephone book blue pages under "United States Government, Social Security Administration" or call

SECTION I - VETERAN IDENTIFICATION INFORMATION

VA DATE STAMP

(DO NOT WRITE IN THIS SPACE)

NOTE: You may complete the form online or by hand. If completed by hand print the information requested in ink, neatly, and legibly, insert one letter per box, and completely fill each applicable circle to help expedite processing of the form.

1.VETERAN'S NAME (First, Middle Initial, Last)

2. SOCIAL SECURITY NUMBER

3. VA FILE NUMBER

4. DATE OF BIRTH

Month |

|

|

Day |

|

|

|

Year |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.MAILING ADDRESS (No. and street or rural route, city or P.O., State, ZIP Code and Country)

No. &

Street

Apt./Unit Number

State/Province

Country

City

ZIP Code/Postal Code

6. EMAIL ADDRESS (If applicable) |

I agree to receive electronic correspondence |

from VA in regards to my claim.

7.TELEPHONE NUMBER (Include Area Code)

Enter International Phone Number (If applicable)

SECTION II - DISABILITY AND MEDICAL TREATMENT

8. WHAT |

9. HAVE YOU BEEN UNDER A DOCTOR'S CARE |

10. DATE(S) OF TREATMENT BY DOCTOR(S) |

||||||||||||||||||

YOU FROM SECURING OR FOLLOWING ANY |

AND/OR HOSPITALIZED WITHIN THE PAST 12 |

|

(Go to Item 26 - Remarks - for additional dates) |

|||||||||||||||||

SUBSTANTIALLY GAINFUL OCCUPATION? |

MONTHS? |

|

|

|

|

|

|

|

|

FROM |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TO |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. NAME AND ADDRESS OF DOCTOR(S) |

12. NAME AND ADDRESS OF HOSPITAL |

13. DATE(S) OF HOSPITALIZATION |

||||||||||||||||||

|

(Go to Item 26 - Remarks - for additional dates) |

|||||||||||||||||||

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

FROM |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TO |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION III - EMPLOYMENT STATEMENT

14.DATE YOUR DISABILITY AFFECTED

Month |

|

|

Day |

|

|

|

Year |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15. DATE YOU LAST WORKED |

16. DATE YOU BECAME TOO DISABLED TO WORK |

|||||||||||||||||||||||||||

Month |

|

|

Day |

|

|

|

Year |

|

Month |

|

|

Day |

|

|

|

Year |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17A. WHAT IS THE MOST YOU EVER EARNED IN ONE YEAR? |

17B. WHAT YEAR? |

17C. OCCUPATION DURING THAT YEAR? |

|||||||||||||

$ |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

JUN 2021 |

|

|

|

|

|

|

|

|

|

Page 1 |

|||||

VA FORM |

|

|

|

|

|

|

SUPERSEDES VA FORM |

|

|||||||

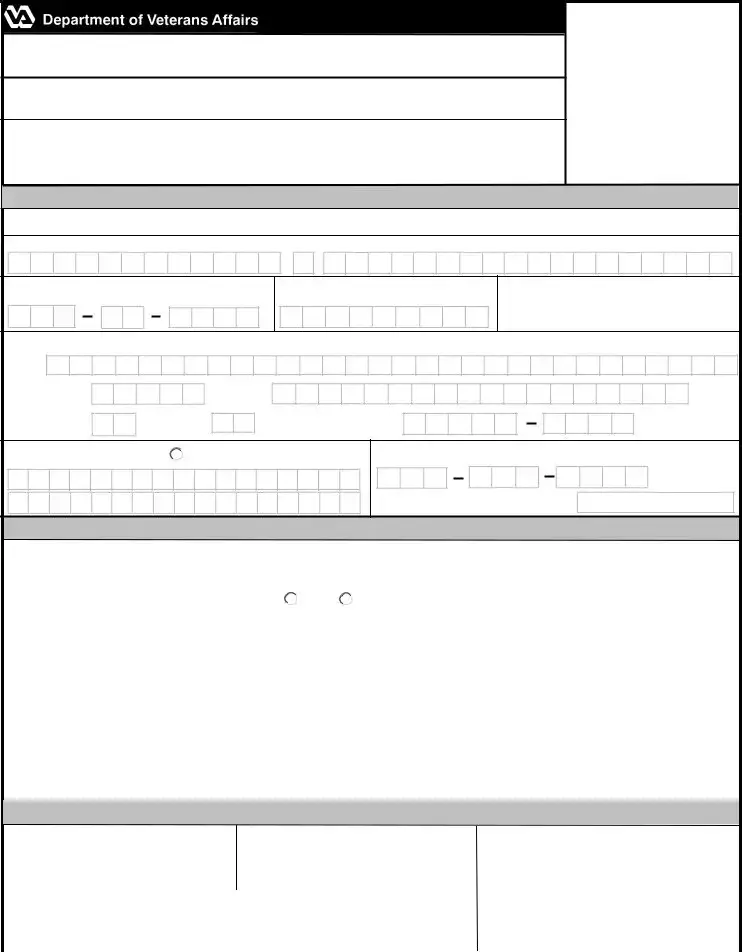

VETERAN'S SOCIAL SECURITY NUMBER

SECTION III - EMPLOYMENT STATEMENT (Continued)

18. LIST ALL YOUR EMPLOYMENT INCLUDING

(Include any military duty including inactive duty for training) (Note: For additional employment information use Section V, Remarks)

NAME AND ADDRESS OF EMPLOYER (OR UNIT) |

TYPE OF WORK |

HOURS |

|||

PER WEEK |

|||||

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D. DATES OF EMPLOYMENT |

|

TIME LOST |

HIGHEST GROSS EARNINGS |

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

FROM |

|

|

|

|

|

|

|

|

|

|

|

|

|

TO |

FROM ILLNESS |

|

|

PER MONTH |

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME AND ADDRESS OF EMPLOYER (OR UNIT) |

|

|

TYPE OF WORK |

|

|

|

HOURS |

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PER WEEK |

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATES OF EMPLOYMENT |

|

TIME LOST |

|

|

HIGHEST GROSS EARNINGS |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

FROM |

|

|

|

|

|

|

|

|

|

|

|

|

|

TO |

|

FROM ILLNESS |

|

|

|

|

PER MONTH |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

NAME AND ADDRESS OF EMPLOYER (OR UNIT) |

|

|

TYPE OF WORK |

|

|

|

|

HOURS |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PER WEEK |

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATES OF EMPLOYMENT |

|

|

|

|

|

|

|

TIME LOST |

HIGHEST GROSS EARNINGS |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

FROM |

|

|

|

|

|

|

|

|

|

|

|

|

|

TO |

|

|

|

|

|

|

|

FROM ILLNESS |

|

|

PER MONTH |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

NAME AND ADDRESS OF EMPLOYER (OR UNIT) |

|

|

|

|

|

|

|

|

TYPE OF WORK |

|

|

|

|

HOURS |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PER WEEK |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATES OF EMPLOYMENT |

|

|

|

|

|

|

|

|

|

|

|

|

TIME LOST |

||||||||

|

FROM |

|

|

|

|

|

|

|

TO |

|

|

|

|

|

|

|

FROM ILLNESS |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

HIGHEST GROSS EARNINGS

PER MONTH

,

NAME AND ADDRESS OF EMPLOYER (OR UNIT) |

TYPE OF WORK |

HOURS

PER WEEK

|

|

|

|

|

|

|

|

|

|

|

|

|

DATES OF EMPLOYMENT |

|

|

|

|

|

|

|

TIME LOST |

|

HIGHEST GROSS EARNINGS |

|||||||||||||||||||||

|

|

|

|

|

|

|

FROM |

|

|

|

|

|

|

|

|

|

|

|

|

|

TO |

|

|

|

|

|

|

FROM ILLNESS |

|

|

PER MONTH |

|||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VA FORM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 2 |

|||||||||||

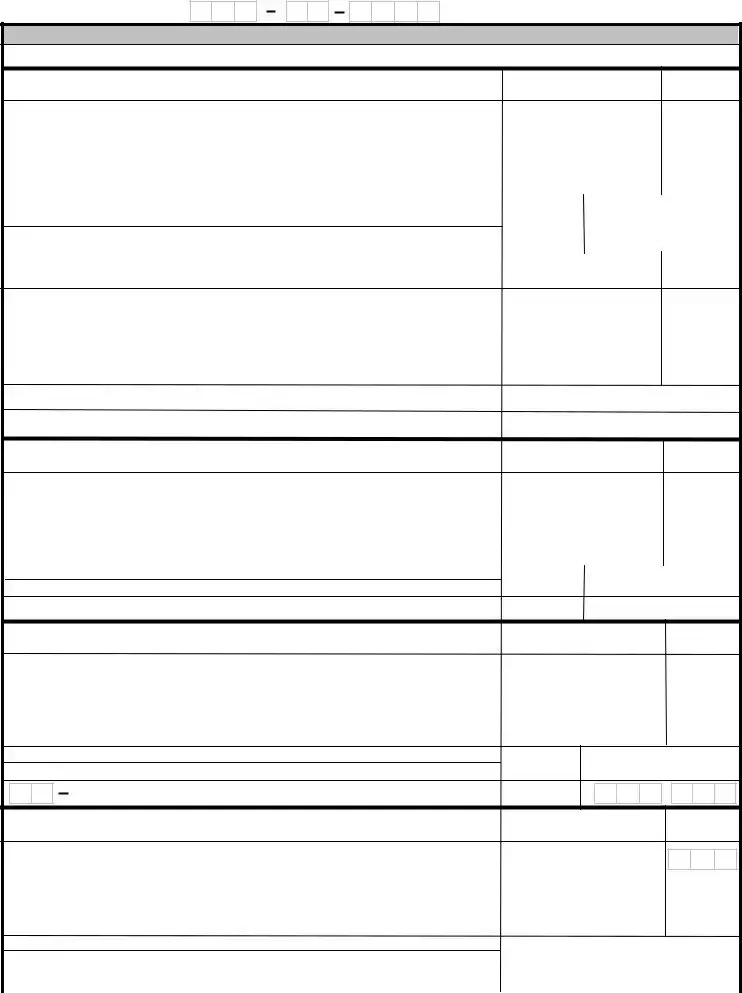

VETERAN'S SOCIAL SECURITY NUMBER

SECTION III - EMPLOYMENT STATEMENT (Continued)

19.IF YOU ARE CURRENTLY SERVING IN THE RESERVE OR NATIONAL GUARD, DOES YOUR SERVICE CONNECTED DISABILITY PREVENT YOU FROM PERFORMING YOUR MILITARY DUTIES?

|

YES |

|

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20A. INDICATE YOUR TOTAL EARNED INCOME FOR THE PAST 12 MONTHS |

|

20B. IF PRESENTLY EMPLOYED, INDICATE YOUR CURRENT MONTHLY EARNED |

|

|||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

, |

|

|

|

|

|

|

|

INCOME |

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

21A. DID YOU LEAVE YOUR LAST JOB/SELF- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

21B. DO YOU RECEIVE/EXPECT TO RECEIVE |

21C. DO YOU RECEIVE/EXPECT TO RECEIVE |

|

||||||||||||||||||||||||||||||||||

|

EMPLOYMENT BECAUSE OF YOUR DISABILITY? |

DISABILITY RETIREMENT BENEFITS? |

|

|

WORKERS COMPENSATION BENEFITS? |

|

||||||||||||||||||||||||||||||

|

YES |

|

NO |

|

(If "Yes," explain in Item 26, |

YES |

|

NO |

|

|

|

|

|

|

|

|

|

YES |

|

|

|

NO |

|

|||||||||||||

|

|

|

"Remarks") |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

22. HAVE YOU TRIED TO OBTAIN EMPLOYMENT SINCE YOU BECAME TOO DISABLED TO WORK? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

YES |

|

NO (If "Yes," complete Items 22A, 22B, and 22C) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

22A. |

|

|

|

|

22B. |

|

|

|

|

|

|

|

|

|

|

|

|

22C. |

|

|||||||||||

|

|

|

NAME AND ADDRESS OF EMPLOYER |

|

|

|

TYPE OF WORK |

|

|

|

|

DATE APPLIED (MM/DD/YYYY) |

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME AND ADDRESS OF EMPLOYER |

TYPE OF WORK |

|

DATE APPLIED (MM/DD/YYYY) |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME AND ADDRESS OF EMPLOYER |

TYPE OF WORK |

|

DATE APPLIED (MM/DD/YYYY) |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION IV - SCHOOLING AND OTHER TRAINING

23.EDUCATION (Check highest year completed)

GRADE SCHOOL |

1 |

2 3 |

4 |

5 6 |

7 |

8 HIGH SCHOOL |

9 |

10 |

11 12 COLLEGE |

Fresh |

Soph |

Jr |

Sr |

24A. DID YOU HAVE ANY OTHER EDUCATION AND TRAINING BEFORE YOU WERE TOO DISABLED TO WORK? |

|

|

|

|

|||||||||

YES |

|

NO |

|

(If "Yes," complete Items 24B and 24C) |

|||||||||||

|

|

24B. TYPE OF EDUCATION OR TRAINING |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24C. DATES OF TRAINING

|

BEGINNING (MM/DD/YYYY) |

|

|

COMPLETION (MM/DD/YYYY) |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25A. HAVE YOU HAD ANY EDUCATION AND TRAINING SINCE YOU BECAME TOO DISABLED TO WORK?

YES |

|

NO |

|

(If "Yes," complete Items 25B and 25C) |

||||||||||

|

|

25B. TYPE OF EDUCATION OR TRAINING |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25C. DATES OF TRAINING

|

BEGINNING (MM/DD/YYYY) |

|

|

COMPLETION (MM/DD/YYYY) |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VA FORM

Page 3

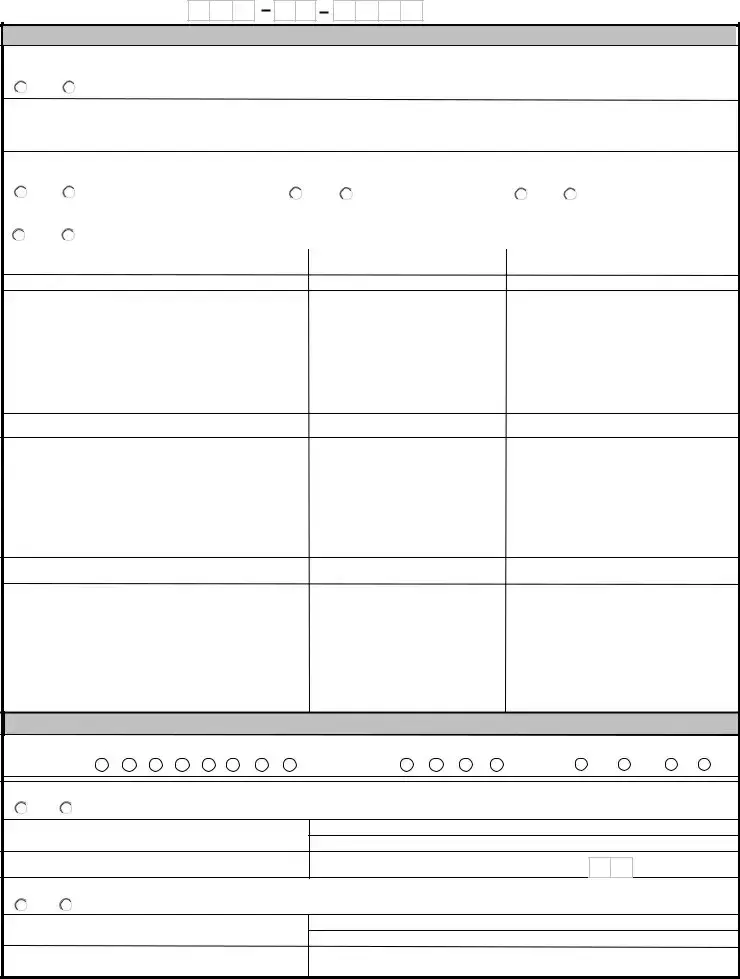

VETERAN'S SOCIAL SECURITY NUMBER

SECTION V - REMARKS

NOTE: This section can be used for any additional information, if needed. 26. REMARKS

SECTION VI - AUTHORIZATION, CERTIFICATION, AND SIGNATURE

AUTHORIZATION FOR RELEASE OF INFORMATION: I authorize the person or entity, including but not limited to any organization, service provider, employer, or Government agency, to give the Department of Veterans Affairs any information about me except protected health information, and I waive any privilege which makes the information confidential.

CERTIFICATION OF STATEMENTS: I CERTIFY THAT as a result of my

I UNDERSTAND THAT IF I AM GRANTED

27. SIGNATURE OF CLAIMANT (Required)

28. DATE SIGNED (MM/DD/YYYY)

WITNESSES NEEDED IF "X" MARK IS MADE (Signature made by mark must be witnessed by two persons to whom the person making the statement is personally known and the signature and address of such witnesses must be shown in Items 29A & 29B and 30A & 30B.

29A. SIGNATURE OF WITNESS (Sign in ink) |

29B. ADDRESS OF WITNESS |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30A. SIGNATURE OF WITNESS (Sign in ink) |

30B. ADDRESS OF WITNESS |

PENALTY: The law provides severe penalties which include fine or imprisonment or both for the willful submission of any statement or evidence of a material fact, knowing it to be false or for the fraudulent acceptance of any payment to which you are not entitled.

SECTION VII - WHERE TO SEND CORRESPONDENCE

MAIL TO:

Department of Veterans Affairs

Evidence Intake Center

PO Box 4444

Janesville, WI

PRIVACY ACT NOTICE: VA will not disclose information collected on this form to any source other than what has been authorized under the Privacy Act of 1974 or Title 38, Code of Regulations 1.576 for routine uses (i.e., civil or criminal law enforcement, congressional communications, epidemiological or research studies, the collection of money owed to the United States, litigation in which the United States is a party or has an interest, the administration of VA programs and delivery of VA benefits, verification of identity and status, and personnel administration) as identified in the VA system of records, 58VA21/22/28, Compensation, Pension, Education, and Veteran Readiness and Employment Records - VA, published in the Federal Register. Your response is required to obtain or retain benefits. Giving us your SSN account information is mandatory. Applicants are required to provide their SSN under Title 38, U.S.C. 5101 (c)(1). VA will not deny an individual benefits for refusing to provide his or her SSN unless the disclosure of the SSN is required by a Federal Statute of law in effect prior to January 1, 1975, and still in effect. The requested information is considered relevant and necessary to determine maximum benefits provided under the law. The responses you submit are considered confidential (38 U.S.C. 5701). Information submitted is subject to verification through computer matching programs with other agencies.

RESPONDENT BURDEN: We need this information to determine your eligibility for compensation. Title 38, United States Code, allows us to ask for this information. We estimate that you will need an average of 45 minutes to review the instructions, find the information, and complete this form. VA cannot conduct or sponsor a collection of information unless a valid OMB control number is displayed. You are not required to respond to a collection of information if this number is not displayed. Valid OMB control numbers can be located on the OMB Internet Page at www.reginfo.gov/public/do/PRAMain. If desired, you can call

VA FORM |

Page 4 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Title | Veteran's Application for Increased Compensation Based on Unemployability |

| OMB Approval Number | 2900-0404 |

| Respondent Burden | Average time to complete: 45 minutes |

| Expiration Date | 06/30/2024 |

| Purpose | This form is a claim for compensation benefits based on unemployability due to service-connected disabilities. |

| Governing Law | Title 38, United States Code |

Guidelines on Utilizing Va 21 8940

Completing the VA Form 21-8940 is a process that requires attention to detail and accuracy. This form is essential for veterans seeking compensation based on unemployability due to service-connected disabilities. To ensure the application is processed smoothly, it is important to provide all requested information clearly and thoroughly. Following these steps will help guide you through the completion of the form.

- Begin by confirming that your information is accurate to expedite processing.

- Fill in your personal information in Section I. Ensure you provide your full name, Social Security Number, VA File Number, date of birth, and contact details including mailing address, email (if applicable), and phone number.

- In Section II, describe the service-connected disability that impacts your ability to work. Specifically, you will need to indicate if you have been under a doctor’s care and provide the names and addresses of any relevant doctors or hospitals.

- Proceed to Section III to discuss employment. Clearly state the date your disability affected your full-time employment and the date you last worked. Record details about your employment history for the last five years, including all employers and types of work done.

- If applicable, answer questions about your current status in the Reserve or National Guard and related to any earned income over the past twelve months and your current monthly income.

- In Section IV, check the highest level of education you completed and note any additional education and training relevant to your employment history.

- Use Section V for any further remarks or additional information if necessary.

- Sign and date the form in Section VI. Remember that if you sign with an "X," two witnesses must also sign, providing their addresses.

- Finally, send the completed form to the address provided. Make sure to mail it to the Department of Veterans Affairs, Evidence Intake Center, with the appropriate mailing address specified in the instructions.

What You Should Know About This Form

What is the purpose of the VA Form 21-8940?

The VA Form 21-8940 is used by veterans to apply for increased compensation based on unemployability due to service-connected disabilities. By filling out this form, veterans claim total disability because their service-related health issues prevent them from securing or following any substantially gainful occupation. Proper completion of this form is essential for evaluating eligibility for such compensation benefits.

What information do I need to provide on the form?

The form requires several pieces of information, including your personal details (name, contact information, and date of birth), your service-connected disabilities, treatment history, and employment background. You'll need to list your previous employers and describe your earnings, as well as provide details about any education or training you have received. Additionally, if applicable, you'll need to disclose whether you’ve received other forms of disability or workers' compensation benefits.

How long does it take to complete VA Form 21-8940?

Completing the VA Form 21-8940 typically takes around 45 minutes. This includes reviewing the instructions, collecting necessary information, and filling out the form accurately. Taking your time to provide detailed responses can help ensure that your application is processed smoothly.

Where should I send the completed form?

Once you have filled out the VA Form 21-8940, mail it to the Department of Veterans Affairs Evidence Intake Center at PO Box 4444, Janesville, WI 53547-4444. Make sure to use the correct address so that your application arrives at the appropriate department without unnecessary delays.

What if I need assistance while filling out the form?

If you need help with the form or have questions while filling it out, consider reaching out to a local veterans’ organization or a representative from the VA. They can provide guidance and support to ensure that your application is completed correctly and fully, improving your chances of receiving the benefits you may qualify for.

Common mistakes

When completing the VA Form 21-8940, many individuals inadvertently make several mistakes that can hinder their applications for increased compensation based on unemployability. One common mistake is failing to provide complete and accurate personal information. This includes essential details such as the veteran’s full name, social security number, and VA file number. Incomplete information can cause delays in processing the application, and in some cases, it may even lead to a denial of benefits.

Another frequent error is neglecting to thoroughly answer all questions. Each question on the form serves a specific purpose and provides critical information to the Department of Veterans Affairs (VA). Omitting answers, even for seemingly minor queries, could result in requests for additional information that extend the review process. Ensuring that all items are completed carefully is crucial.

Veterans often do not articulate their specific service-connected disabilities clearly. Question 8 specifically asks about the disabilities preventing gainful employment. A vague description may lead to misunderstandings about the severity or impact of the disabilities, which can negatively affect the outcome of the claim.

Additionally, some applicants fail to provide accurate information regarding their employment history. Sections that inquire about previous work, including the names of employers and dates of employment, must be addressed thoroughly. Incomplete records can suggest a lack of transparency, raising questions about eligibility.

Individuals may also overlook the importance of medical documentation. In Section II, applicants are required to disclose if they have been under a doctor's care or hospitalized within the past year. Inadequate details regarding treatments, doctors’ names, or addresses can lead to difficulties in verifying the medical necessity of the claim.

Another mistake is providing inconsistent information. If the details provided in this form conflict with information in other records, such as previous VA claims or Social Security benefits, it may prompt additional scrutiny. Consistently accurate information strengthens the credibility of the application.

Some applicants may fail to acknowledge the requirement of reporting earnings accurately. Incomplete income details or misrepresented employment circumstances can create issues. Clearly stating any earned income for the past 12 months ensures compliance with VA regulations.

Failure to sign and date the application is another simple yet significant error. An unsigned form is considered incomplete, and the application will not be processed until it is properly authenticated. Moreover, veterans should be cautious with witness signatures if their own signature is made by mark.

Applicants frequently forget to provide any additional information in Section V. This section allows for further clarification and can be an opportunity to elaborate on any complexities of the case. Neglecting this space may limit the context for the approval team.

Finally, not reviewing the entire application before submission is a common oversight. Mistakes ranging from typos to misstatements can have significant consequences. Taking the time to carefully review the form ensures that all information is correct and complete.

Documents used along the form

The VA Form 21-8940 is a crucial document for veterans seeking increased compensation based on unemployability due to service-connected disabilities. Alongside this form, there are several other documents that may be required to support the application process. Each of these documents plays an important role in assessing eligibility for benefits, providing the necessary information about the veteran's circumstances and disabilities. Below is a list of commonly associated forms and documents that veterans may need to utilize when submitting their application.

- VA Form 21-4138: This statement in support of claim allows veterans to provide additional information about their service and disabilities. It is often used to explain circumstances that may not be covered in the primary application.

- VA Form 21-4192: This request for employment information helps gather details from the veteran's previous employers regarding their work history and reasons for leaving employment due to service-connected disabilities.

- VA Form 21-526EZ: This form is a fully developed claim for disability compensation and is often submitted alongside the 21-8940 to establish a primary basis for the disability claim.

- Medical Records: Relevant medical documentation that verifies the veteran's service-connected disabilities is crucial. These reports from healthcare providers support the claims related to unemployability.

- Social Security Administration Documentation: If the veteran receives Social Security Disability Insurance or Supplemental Security Income, forms or statements from the SSA can assist in establishing the total impact of the disabilities on employability.

Therefore, it is informative for veterans to have these documents prepared and submitted where necessary. This practice can ensure a thorough evaluation of their claims for increased compensation. Being organized not only facilitates the process but also enhances the opportunity for a favorable outcome.

Similar forms

-

VA Form 21-526EZ: This form is used to apply for disability compensation. It shares the purpose of establishing eligibility for compensation benefits, though it focuses on initial claims rather than increased compensation due to unemployability.

-

VA Form 21-4192: Known as the Employment Information in Connection with Claim for Disability Benefits form, this document collects employment data like the 21-8940 but specifically focuses on current and past job details to assess how the claimed disability affects employment.

-

VA Form 21-0779: This application form is for veterans seeking special monthly compensation. Similar to the 21-8940, it is used to establish the impact of disabilities on a veteran's daily life and their ability to earn a living.

-

Social Security Administration Form SSA-3368: This form is completed to apply for Social Security Disability benefits. Like the VA 21-8940, it assesses the claimant's disabling condition and its effect on work capabilities, serving the same population seeking disability support.

-

VA Form 21-530: The Application for Burial Benefits form may seem unrelated but is similar in that it serves as a claims form to access benefits from the VA. Both forms require detailed personal and service-related information to process claims effectively.

Dos and Don'ts

Filling out the VA Form 21-8940 can be a crucial step in securing the benefits you deserve. Here’s a list of key practices to follow, along with pitfalls to avoid:

- Do fill out the form completely and accurately. Every detail matters.

- Do use black or blue ink if you're completing the form by hand to ensure clarity.

- Do include all relevant dates, particularly those linked to your employment and medical treatment.

- Do check for any updates or changes in the form guidelines on the VA website before submitting.

- Do keep a copy of your completed form for your records.

- Don't leave any questions unanswered; if it's not applicable, indicate that clearly.

- Don't use pencil, as legibility issues may arise. Stick to ink.

- Don't exaggerate or misrepresent your circumstances; truthful statements are vital.

- Don't forget to sign and date the form. An incomplete submission can delay processing.

- Don't hesitate to ask for help if you're unsure about how to answer specific questions; it's okay to seek assistance.

Being thorough and honest with your application can pave the way for a smoother review process. Each step you take brings you closer to the support you may need.

Misconceptions

The VA Form 21-8940 is crucial for veterans claiming increased compensation based on unemployability due to service-connected disabilities. However, several misconceptions can lead to confusion. Here are four common misunderstandings about this form:

- Misconception 1: "You must be completely disabled to file this form."

- Misconception 2: "The form can only be completed by hand."

- Misconception 3: "Once submitted, you cannot make any changes."

- Misconception 4: "Filing this form guarantees approval of benefits."

Many believe that total disability is necessary to apply for benefits using this form. In reality, you can qualify if your service-connected disabilities prevent you from securing or maintaining any substantial gainful employment, even if you are not entirely unable to work.

Some individuals think they can only fill out this form on paper. This is incorrect; you have the option to complete the form online, which can simplify the process and help ensure legibility.

This form is not set in stone after submission. You can provide additional information or make corrections later. Just ensure that any updates are communicated appropriately to the VA, especially if they impact your claim.

While the form is essential for initiating your claim, it does not guarantee that benefits will be awarded. The VA will review the submitted information along with medical and employment records to determine eligibility.

Key takeaways

- Form Purpose: VA Form 21-8940 is used to claim compensation benefits based on unemployability due to a service-connected disability.

- Follow Instructions: Fill out all sections fully and accurately to avoid delays in processing.

- Identification Information: Provide your name, social security number, and VA file number in Section I.

- Disability Details: Clearly state what service-connected disability prevents you from working in Section II.

- Employment History: List all employers and types of work for the past five years in Section III.

- Provide Treatment Dates: Indicate any doctor's treatment and hospitalization dates accurately.

- Income Information: Report your total earned income for the past 12 months.

- Education and Training: Record your highest completed education and any training received before or after becoming disabled.

- Remarks Section: Use Section V to provide additional relevant information that may support your claim.

- Signature Requirement: Ensure to sign and date the form. If you mark the form, it requires two witnesses.

Browse Other Templates

Us Bank Human Resources - Employee Assistance helps employees manage personal or professional challenges.

Erc Form 941 - Small entities benefit from understanding the implications of this form.