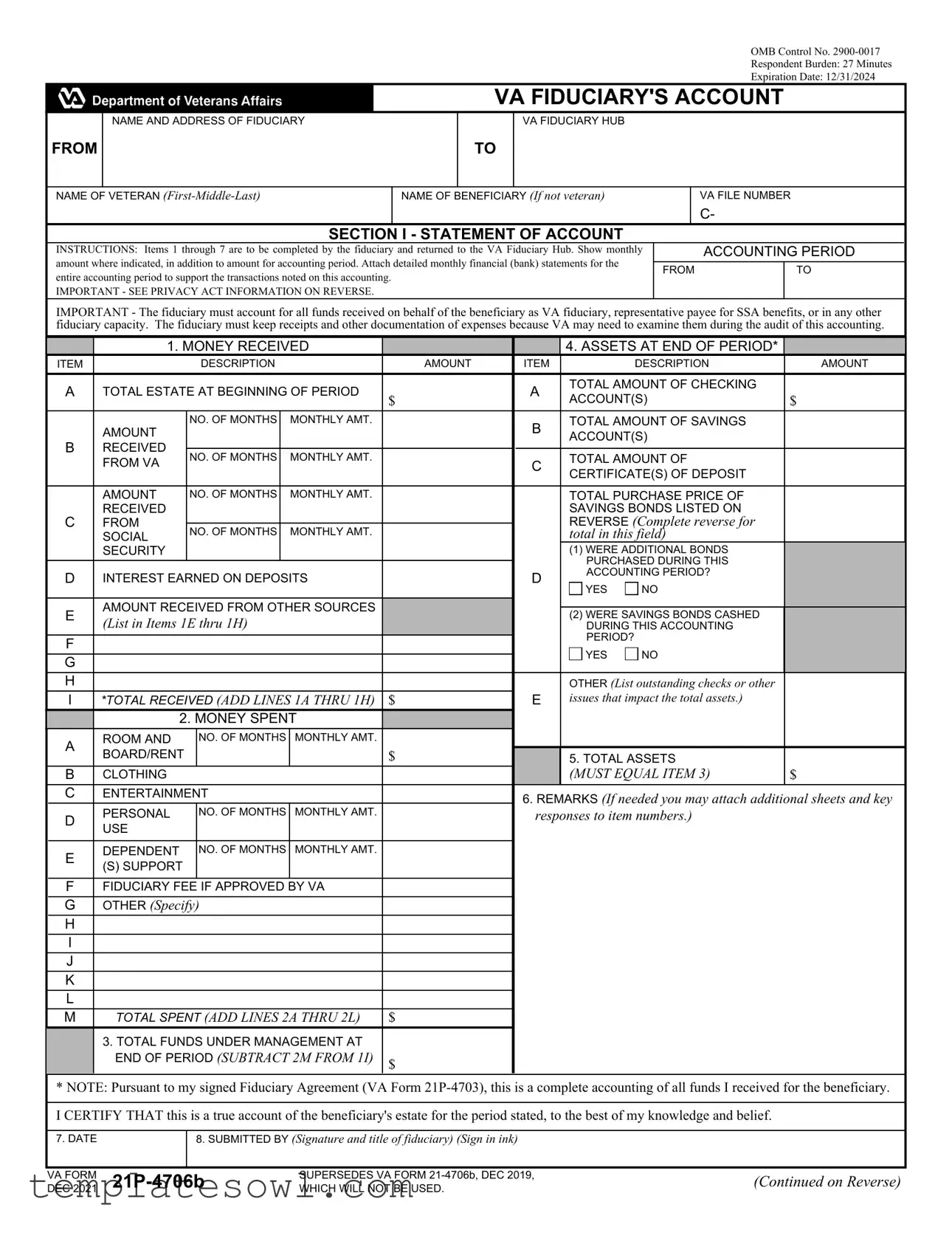

Fill Out Your Va 21P 4706B Form

The VA Form 21P-4706B is an essential tool for fiduciaries managing the financial affairs of veterans or their beneficiaries. This form focuses on providing a clear statement of account, detailing all funds received and spent on behalf of the beneficiary. When filling out this form, fiduciaries need to include accurate information regarding the veteran's name, beneficiary details, and VA file number, all of which serve to establish a complete financial picture. The document requires fiduciaries to report monthly income and expenses, ensuring a transparent accounting of financial transactions over the specified accounting period. Additionally, accompanying financial statements must be attached to support the reported figures, a step crucial for compliance and accountability. Privacy and adherence to legal standards are underscored, as fiduciaries must be ready for possible audits from the VA. The form also includes a background information section, where fiduciaries provide personal criminal and credit histories, affirming their fitness for this vital role. Understanding and accurately completing the VA Form 21P-4706B is key to safeguarding the interests of those who served our country and require assistance with their finances.

Va 21P 4706B Example

|

|

|

|

|

|

|

|

OMB Control No. |

||

|

|

|

|

|

|

|

|

Respondent Burden: 27 Minutes |

||

|

|

|

|

|

|

|

|

Expiration Date: 12/31/2024 |

||

|

|

|

|

VA FIDUCIARY'S ACCOUNT |

||||||

|

NAME AND ADDRESS OF FIDUCIARY |

|

|

|

VA FIDUCIARY HUB |

|

|

|

|

|

FROM |

|

|

TO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME OF VETERAN |

NAME OF BENEFICIARY (If not veteran) |

|

|

VA FILE NUMBER |

||||||

|

|

|

|

|

|

|

|

C- |

||

|

SECTION I - STATEMENT OF ACCOUNT |

|

|

|

|

|

||||

INSTRUCTIONS: Items 1 through 7 are to be completed by the fiduciary and returned to the VA Fiduciary Hub. Show monthly |

|

|

ACCOUNTING PERIOD |

|

||||||

amount where indicated, in addition to amount for accounting period. Attach detailed monthly financial (bank) statements for the |

|

|

|

|

|

|||||

FROM |

|

TO |

||||||||

entire accounting period to support the transactions noted on this accounting. |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|||

IMPORTANT - SEE PRIVACY ACT INFORMATION ON REVERSE. |

|

|

|

|

|

|

|

|

||

IMPORTANT - The fiduciary must account for all funds received on behalf of the beneficiary as VA fiduciary, representative payee for SSA benefits, or in any other fiduciary capacity. The fiduciary must keep receipts and other documentation of expenses because VA may need to examine them during the audit of this accounting.

|

1. MONEY RECEIVED |

|

|

|

4. ASSETS AT END OF PERIOD* |

|

||||||

ITEM |

|

|

DESCRIPTION |

|

|

AMOUNT |

ITEM |

|

DESCRIPTION |

AMOUNT |

||

A |

TOTAL ESTATE AT BEGINNING OF PERIOD |

|

A |

TOTAL AMOUNT OF CHECKING |

|

|||||||

$ |

ACCOUNT(S) |

$ |

||||||||||

|

|

|

|

|

|

|

|

|||||

|

AMOUNT |

NO. OF MONTHS |

|

MONTHLY AMT. |

|

B |

TOTAL AMOUNT OF SAVINGS |

|

||||

B |

|

|

|

|

|

|

ACCOUNT(S) |

|

||||

|

|

|

|

|

|

|

|

|||||

RECEIVED |

NO. OF MONTHS |

|

MONTHLY AMT. |

|

|

TOTAL AMOUNT OF |

|

|||||

|

FROM VA |

|

|

C |

|

|||||||

|

|

|

|

|

|

|

CERTIFICATE(S) OF DEPOSIT |

|

||||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||

|

AMOUNT |

NO. OF MONTHS |

|

MONTHLY AMT. |

|

|

TOTAL PURCHASE PRICE OF |

|

||||

C |

RECEIVED |

|

|

|

|

|

|

|

SAVINGS BONDS LISTED ON |

|

||

FROM |

|

|

|

|

|

|

|

REVERSE (Complete reverse for |

|

|||

|

SOCIAL |

NO. OF MONTHS |

|

MONTHLY AMT. |

|

|

total in this field) |

|

||||

|

SECURITY |

|

|

|

|

|

|

|

(1) WERE ADDITIONAL BONDS |

|

||

|

|

|

|

|

|

|

|

|

PURCHASED DURING THIS |

|

||

|

|

|

|

|

|

|

|

|

|

|||

D |

INTEREST EARNED ON DEPOSITS |

|

D |

ACCOUNTING PERIOD? |

|

|||||||

|

YES |

NO |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|||

E |

AMOUNT RECEIVED FROM OTHER SOURCES |

|

|

|

|

|

||||||

|

|

(2) WERE SAVINGS BONDS CASHED |

|

|||||||||

(List in Items 1E thru 1H) |

|

|

|

|

|

|||||||

|

|

|

|

|

DURING THIS ACCOUNTING |

|

||||||

F |

|

|

|

|

|

|

|

|

PERIOD? |

|

|

|

|

|

|

|

|

|

|

|

YES |

NO |

|

||

G |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||

H |

|

|

|

|

|

|

|

|

OTHER (List outstanding checks or other |

|

||

I |

*TOTAL RECEIVED (ADD LINES 1A THRU 1H) |

$ |

E |

issues that impact the total assets.) |

|

|||||||

|

2. MONEY SPENT |

|

|

|

|

|

|

|||||

A |

ROOM AND |

|

NO. OF MONTHS |

MONTHLY AMT. |

|

|

|

|

|

|

||

BOARD/RENT |

|

|

|

|

|

$ |

|

5. TOTAL ASSETS |

|

|||

|

|

|

|

|

|

|

|

|||||

B |

CLOTHING |

|

|

|

|

|

|

|

(MUST EQUAL ITEM 3) |

$ |

||

C |

ENTERTAINMENT |

|

|

|

6. REMARKS (If needed you may attach additional sheets and key |

|||||||

D |

PERSONAL |

|

NO. OF MONTHS |

MONTHLY AMT. |

|

responses to item numbers.) |

|

|||||

USE |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||

E |

DEPENDENT |

|

NO. OF MONTHS |

MONTHLY AMT. |

|

|

|

|

|

|||

(S) SUPPORT |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||

FFIDUCIARY FEE IF APPROVED BY VA

G OTHER (Specify)

H

I

J

K

L

M |

TOTAL SPENT (ADD LINES 2A THRU 2L) |

$ |

|

3. TOTAL FUNDS UNDER MANAGEMENT AT |

|

|

END OF PERIOD (SUBTRACT 2M FROM 1I) |

$ |

* NOTE: Pursuant to my signed Fiduciary Agreement (VA Form

I CERTIFY THAT this is a true account of the beneficiary's estate for the period stated, to the best of my knowledge and belief.

7. DATE |

|

8. SUBMITTED BY (Signature and title of fiduciary) (Sign in ink) |

|

|

|

|

|

|

|

VA FORM |

SUPERSEDES VA FORM |

(Continued on Reverse) |

||

DEC 2021 |

WHICH WILL NOT BE USED. |

|||

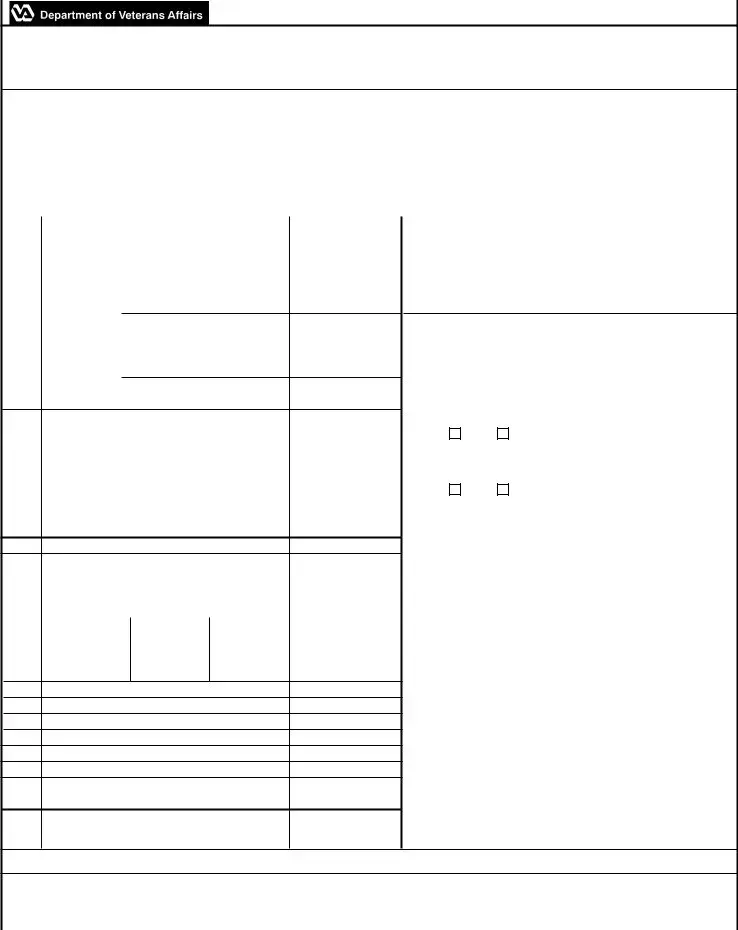

9. BACKGROUND INFORMATION

Answer the questions below if you are an individual appointed to serve as fiduciary for the beneficiary named on the reverse side of this form. The questions pertain to your personal criminal and credit history. Failure to provide a response may impact your ability to serve as a VA fiduciary.

You are not required to respond to these questions if you are serving as VA fiduciary in one of the following capacities for the beneficiary named on the reverse:

•administrator of a facility

•company or corporation

•

I certify that during this accounting period, I have not been convicted of any offense under Federal or State law, which resulted in imprisonment for more than one year. I understand the Department of Veterans Affairs may obtain my criminal background history to verify my response. Initial the box below to certify and acknowledge this information.

I certify that during this accounting period, I did not default on a debt, was not the subject of collection action by a creditor and did not file bankruptcy. To the best of my knowledge, no adverse credit information was reported to a credit bureau because I was unable to meet my personal financial obligations. I understand the Department of Veterans Affairs may obtain my credit history report to verify my response. Initial the box below to certify and acknowledge this information.

10. EXPLANATION OF BACKGROUND INFORMATION (If necessary)

LINE |

SERIAL NUMBER |

DATE OF |

PURCHASE |

LINE |

SERIAL NUMBER |

DATE OF |

PURCHASE |

|

NO. |

PURCHASE |

PRICE |

NO. |

PURCHASE |

PRICE |

|||

|

|

|||||||

|

|

|

|

|

|

|

|

|

1. |

|

|

|

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

9. |

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

|

|

|

10. |

|

|

|

SECTION II - CERTIFICATION OF U.S. SAVINGS BONDS

I CERTIFY THAT the savings bonds listed above are the property of the estate of the beneficiary and are in my custody and control.

SIGNATURE OF FIDUCIARY (Sign in ink)

DATE

PRIVACY ACT INFORMATION: The VA will not disclose information on the form to any source other than what has been authorized under the Privacy Act of 1974 or Title 5, Code of Federal Regulations 1.526 for routine uses (i.e. request from Congressman on behalf of a beneficiary) as identified in the VA system of records, 37VA27, VA Supervised Fiduciary/Beneficiary and General Investigative Records, published in the Federal Register. You are required to respond (38 U.S.C. 5701) to obtain or retain benefits. The information will be used to ensure the proper administration of the beneficiary's income and estate. Failure to furnish the requested information may result in the suspension of payments and/or the appointment of a successor fiduciary.

RESPONDENT BURDEN: We need this information to ensure proper administration of the beneficiary's estate. Title 38, United States Code allows us to ask for this information. We estimate that you will need an average of 27 minutes to review the instructions, find the information, and complete this form. VA cannot conduct or sponsor a collection of information unless a valid OMB control number is displayed. You are not required to respond to a collection of information if this number is not displayed. Valid OMB control numbers can be located on the OMB Internet Page at https://reginfo.gov/public/do/PRAMain.

VA FORM

Form Characteristics

| Fact Name | Description |

|---|---|

| OMB Control Number | The form is identified by OMB Control No. 2900-0017, which is important for tracking purposes. |

| Time to Complete | On average, it takes about 27 minutes for respondents to complete the form and gather necessary documentation. |

| Expiration Date | This form will remain valid until its expiration date of December 31, 2024. |

| Privacy Act Information | The form contains a Privacy Act notice, ensuring that personal information is protected and used only for authorized purposes. |

| Funding Responsibility | The fiduciary must account for all funds received on behalf of the beneficiary, ensuring transparency and accountability. |

Guidelines on Utilizing Va 21P 4706B

Filling out the VA Form 21P-4706B involves collecting and reporting financial information about the beneficiary's estate. This form requires accuracy and completeness to ensure that the accounting period is properly documented. The form must be submitted to the VA Fiduciary Hub along with any required supporting materials.

- Obtain the form VA 21P-4706B from a reliable source or the VA website.

- Fill in the name and address of the fiduciary at the top of the form.

- Provide the name of the veteran and the beneficiary (if different from the veteran).

- Enter the VA file number associated with the beneficiary.

- Complete Section I, which covers the statement of account:

- For Money Received, list income sources in Items 1A through 1H and fill in the amounts.

- For Money Spent, detail expenses in Items 2A through 2L, and total these amounts.

- Calculate the total funds under management at the end of the period in Item 3, by subtracting the total spent from total received.

- Review the assets at the end of the period in Item 5, ensuring it matches your calculations.

- If necessary, provide remarks in Item 6 or attach additional sheets.

- Sign and date the certification in Section I as the fiduciary, verifying the accuracy of the information.

- Complete Section II regarding savings bonds by certifying their custody under your control.

- Double-check that all information is accurate, then submit the form to the VA Fiduciary Hub along with any required financial statements.

What You Should Know About This Form

What is the VA Form 21P-4706B?

The VA Form 21P-4706B is a document used by fiduciaries to report the financial activities related to the management of a beneficiary's estate. The form records the funds received and spent on behalf of the beneficiary over a specific accounting period. Fiduciaries must complete this form thoroughly to ensure accurate reporting and compliance with VA regulations.

Who needs to complete the VA Form 21P-4706B?

This form is required for fiduciaries who manage funds for veterans or beneficiaries receiving assistance from the VA. A fiduciary could be a family member, a court-appointed individual, or a representative from a corporation or organization. It is essential that the fiduciary completes the form accurately to reflect their stewardship of the beneficiary's finances.

How often should the VA Form 21P-4706B be submitted?

Fiduciaries must submit the VA Form 21P-4706B covering an accounting period as specified by the VA. Typically, this is done annually or as requested by the VA. It's crucial to adhere to submission timelines to avoid delays or issues with the management of the beneficiary's benefits.

What information must be included in the form?

The form requires detailed information about funds received and expenditures. Specifically, fiduciaries must report all money received, how it was spent, and the total assets at the end of the accounting period. This includes categories such as rent, clothing, entertainment, and other expenses. Additionally, fiduciaries need to include any financial statements for verification.

Are there any privacy concerns when filling out the VA Form 21P-4706B?

Yes, there are privacy considerations. The information collected in the form is protected under the Privacy Act of 1974. The VA will not disclose any information without proper authorization. It is important for fiduciaries to keep this information confidential and secure, as it pertains to the financial status of beneficiaries.

What happens if a fiduciary fails to submit the form?

If a fiduciary fails to submit the VA Form 21P-4706B, they risk facing administrative actions from the VA. This could result in the suspension of payments to the beneficiary or the appointment of a successor fiduciary to manage the estate. Timely submission is crucial to avoid complications.

What documentation should be attached to the form?

Fiduciaries are required to attach detailed monthly financial statements, such as bank statements, to support the transactions reported on the form. This documentation provides transparency and helps the VA verify the accuracy of the accounting reported by the fiduciary.

Can fiduciaries include personal expenses on the form?

No, fiduciaries should not include personal expenses on the VA Form 21P-4706B. It is strictly for reporting financial activities on behalf of the beneficiary. Personal expenses must be kept separate to ensure proper management of the beneficiary's funds and compliance with VA guidelines.

What is the estimated time to complete the form?

The VA estimates that completing the form will take approximately 27 minutes. This includes reviewing instructions, gathering necessary information, and filling out the form itself. Fiduciaries should allocate sufficient time to complete it accurately to ensure all required details are included.

What should a fiduciary do if they need assistance with the form?

If a fiduciary needs help completing the VA Form 21P-4706B, they can reach out to the VA Fiduciary Hub for guidance. There are also resources available online and through veteran assistance organizations that can offer support in understanding the reporting requirements and process.

Common mistakes

Filling out the VA Form 21P-4706B can be a complex task, and mistakes can lead to delays or complications. One common mistake occurs when the fiduciary fails to include all required financial documentation. It's essential to attach detailed monthly financial statements for the entire accounting period. This information supports the transactions and ensures transparency. Without these documents, the form may be returned or rejected.

Another frequent error involves inaccuracies in reporting money received. Fiduciaries sometimes forget to include all sources of income or miscalculate the amounts, which can result in discrepancies. Each entry in Sections 1 through 3 must be precise. Ensure all funds received on behalf of the beneficiary are accounted for, and double-check the total at the end of the accounting period.

Some fiduciaries also neglect to verify the beneficiaries' names and VA file numbers. These details are crucial for ensuring the form is processed correctly. Even minor errors in names or numbers can lead to significant delays in benefits. Take the time to review this information carefully before submitting the form.

Another area where mistakes are often made is in the calculation of total assets and expenses. The totals must match across different sections of the form. If errors occur in counting expenses in Section 2, it can lead to incorrect totals in Section 3. It is critical to ensure that all calculations are accurate to prevent issues with VA audits.

A lack of clear remarks or explanations can also be problematic when needed. The remarks section is the fiduciary's opportunity to provide additional context or address any unusual transactions. If significant expenses or sources of income are not adequately explained, it could raise red flags during the review process.

Moreover, another common oversight is neglecting to sign and date the form correctly. This step is necessary to affirm that the fiduciary certifies the accuracy of the information provided. An unsigned form may be considered incomplete and could result in a return to the fiduciary, adding to delays.

Lastly, some individuals underestimate the importance of providing thorough background information. The form requests details about criminal and credit history, which, if not completed, can impact one's ability to serve as a fiduciary. Omitting these details or providing incomplete answers may raise concerns about the fiduciary's reliability.

By being aware of these common mistakes, fiduciaries can help ensure their forms are filled out accurately and completely. Attention to detail is vital in this process. Consider reviewing the form multiple times and having a trusted individual look over it to catch any potential errors before submission.

Documents used along the form

The VA Form 21P-4706B is an essential document for fiduciaries managing the finances of veterans or their beneficiaries. This form tracks the income and expenditures related to the beneficiary's estate. Accompanying this form, several other documents may be required to ensure complete compliance with the reporting standards set forth by the Department of Veterans Affairs. Below is a list of common forms used in conjunction with the VA Form 21P-4706B.

- VA Form 21P-4703: This form is the Fiduciary Agreement, which establishes the fiduciary's authority to manage the beneficiary’s finances. It is a vital document that outlines the responsibilities and duties of the fiduciary.

- VA Form 21-4142: This is a General Release form. It allows the VA to obtain necessary medical records from third parties. This form may be required if the beneficiary's financial management is tied to health-related issues.

- VA Form 21P-0847: This form is used to designate a representative payee. It authorizes the fiduciary to receive and manage benefits on behalf of the beneficiary, ensuring funds are distributed as intended.

- VA Form 21-526EZ: This is the application for disability compensation and related compensation benefits. If the beneficiary is a veteran applying for benefits, this form must be filled out and submitted alongside the fiduciary's accountings.

- VA Form 21-0819: The Improved Pension Eligibility Verification Report collects financial information to determine continued eligibility for benefits. This helps assure that the beneficiary still qualifies for the support being managed by the fiduciary.

- VA Form 21-0779: This is a request for a determination regarding fiduciary qualifications. The fiduciary must complete this form to confirm their eligibility and suitability to manage the beneficiary's estate.

Each of these forms plays a critical role in the fiduciary process, ensuring that the funds are managed correctly and in compliance with VA guidelines. It is essential for fiduciaries to have a clear understanding of these documents and to submit them as required.

Similar forms

The VA Form 21P-4706B is primarily used for reporting financial information related to the management of a beneficiary’s estate by a fiduciary. Several other forms serve similar functions and share key features. Here’s a list of those similar documents:

- VA Form 21P-4703: Fiduciary Agreement - This document outlines the agreement between the VA and the fiduciary, establishing their responsibilities, much like how the 21P-4706B requires a fiduciary to account for funds managed on behalf of a beneficiary.

- VA Form 21-8738: Application for VA Benefits - This form collects essential information from applicants for VA benefits, similar to how the 21P-4706B captures pertinent personal and financial data for auditing purposes.

- VA Form 21-0845: Authorization to Disclose Personal Information to a Third Party - This document allows beneficiaries or fiduciaries to share information, paralleling the requirement in the 21P-4706B for accountability and transparency regarding the management of funds.

- VA Form 21-674: Request for Approval of School Attendance - Although intended for education benefits, the tracking of funds and reporting is reminiscent of the financial oversight obligations in the 21P-4706B.

- Social Security Administration Form SSA-11: Request to be Selected as Payee - This form serves a similar purpose for Social Security benefits. Both documents involve fiduciaries managing funds on behalf of another and require detailed accounting.

- IRS Form 1040: U.S. Individual Income Tax Return - This tax form necessitates detailed financial reporting but focuses on individual income taxation. Like the VA Form 21P-4706B, it requires accurate tracking and reporting of financial matters.

Each of these forms plays a crucial role in ensuring proper financial management and reporting responsibilities, allowing for appropriate oversight and accountability.

Dos and Don'ts

When filling out the VA Form 21P 4706B, there are several important guidelines to follow for an effective submission. Below is a list outlining what you should and shouldn't do.

- Do ensure that all sections of the form are completed accurately. Double-check all amounts and details to avoid any discrepancies.

- Do attach detailed monthly financial statements for the entire accounting period to support the transactions listed on the form.

- Do keep receipts and other documentation of expenses as required by the VA. These may be needed for audits.

- Do sign the form in ink, certifying that the information provided is truthful and complete.

- Do review the Privacy Act information provided on the form to understand how your personal data will be used.

- Don't leave any fields blank unless specified. Incomplete forms could lead to processing delays.

- Don't forget to account for all funds received on behalf of the beneficiary. This includes not only VA payments but any other fiduciary sources.

- Don't ignore the section requiring background information about your criminal and credit history if applicable. Omission may affect your fiduciary status.

- Don't submit the form without checking the expiration date to ensure it is still valid.

- Don't provide false or misleading information. Doing so may result in legal repercussions or loss of fiduciary responsibilities.

Misconceptions

Understanding the VA Form 21P-4706B is crucial for fiduciaries managing a beneficiary's estate. However, several misconceptions exist around this important document. Here are ten of the most common misunderstandings:

- Only veterans can be beneficiaries: This form can be used for beneficiaries who are not veterans. Family members or dependents may also be the recipient of benefits.

- Receiving money is not a fiduciary duty: This form requires fiduciaries to account for all funds received on behalf of the beneficiary. Failing to document this can lead to serious consequences.

- Savings bonds do not need to be reported: All savings bonds held by the beneficiary must be reported on the form. This includes purchases made within the accounting period.

- The form is optional for fiduciaries: Completing this form is mandatory for fiduciaries. Failure to provide a complete accounting may result in the suspension of benefits.

- The form only tracks money spent: This form tracks both money received and money spent, ensuring an accurate representation of the beneficiary’s estate.

- Documents are not required with the form: Fiduciaries must attach detailed financial statements to support the transactions noted on the form.

- There's no need for verification of background information: The form requires fiduciaries to provide details about their criminal and credit history, which may be verified by the VA.

- The deadline for submission is flexible: This form must be submitted by the fiduciary within a specified timeframe. Delays can impact the beneficiary.

- Writing errors are inconsequential: Any inaccuracies or insufficient information on the form can lead to significant delays in processing or even the appointment of a successor fiduciary.

- The form is the same as previous versions: VA Form 21P-4706B supersedes older versions and includes updated requirements that must be followed to ensure compliance.

It’s important to clarify these misconceptions to fulfill fiduciary responsibilities effectively. Adhering to the requirements of the VA Form 21P-4706B ensures proper management of the beneficiary's estate and helps protect their interests.

Key takeaways

The VA Form 21P-4706B is essential for fiduciaries managing veterans' benefits. Here are key takeaways that will help you navigate this form effectively:

- Purpose of the Form: This form is used to provide a detailed accounting of funds managed on behalf of a veteran or beneficiary.

- Completion Requirement: Fiduciaries must fill out items 1 through 7 and return the form to the VA Fiduciary Hub.

- Attach Supporting Documents: Include detailed monthly financial statements to verify transactions recorded in the accounting.

- Account for All Funds: Fiduciaries are obligated to account for all funds received, including any SSA benefits.

- Keep Receipts and Documentation: It is crucial to retain receipts as the VA may request them for audit purposes.

- Savings Bond Information: If applicable, specify any savings bonds purchased or cashed during the accounting period in the indicated sections.

- Signature Requirement: The form must be signed in ink by the fiduciary to certify its accuracy.

- Background Check: Disclose personal criminal and credit history as required, failing to do so may impact fiduciary status.

- Privacy Act Compliance: Be aware that the information shared on this form is protected and will not be disclosed without authorization.

Browse Other Templates

Geico Premium Increase - Finally, remember to date the form to confirm the timeline of events.

Nyc Doing Business Data Form - The completion of the form is necessary for all affordable housing loans or grants.

Asset Distribution Record,Equipment Transfer Acknowledgment,Property Accountability Statement,Material Receipt Confirmation,Inventory Control Form,Government Property Hand Receipt,Item Management Documentation,Supply Chain Receipt Form,Inventory Trac - Failure to maintain proper hand receipts can result in administrative actions.