Fill Out Your Va 26 1802A Form

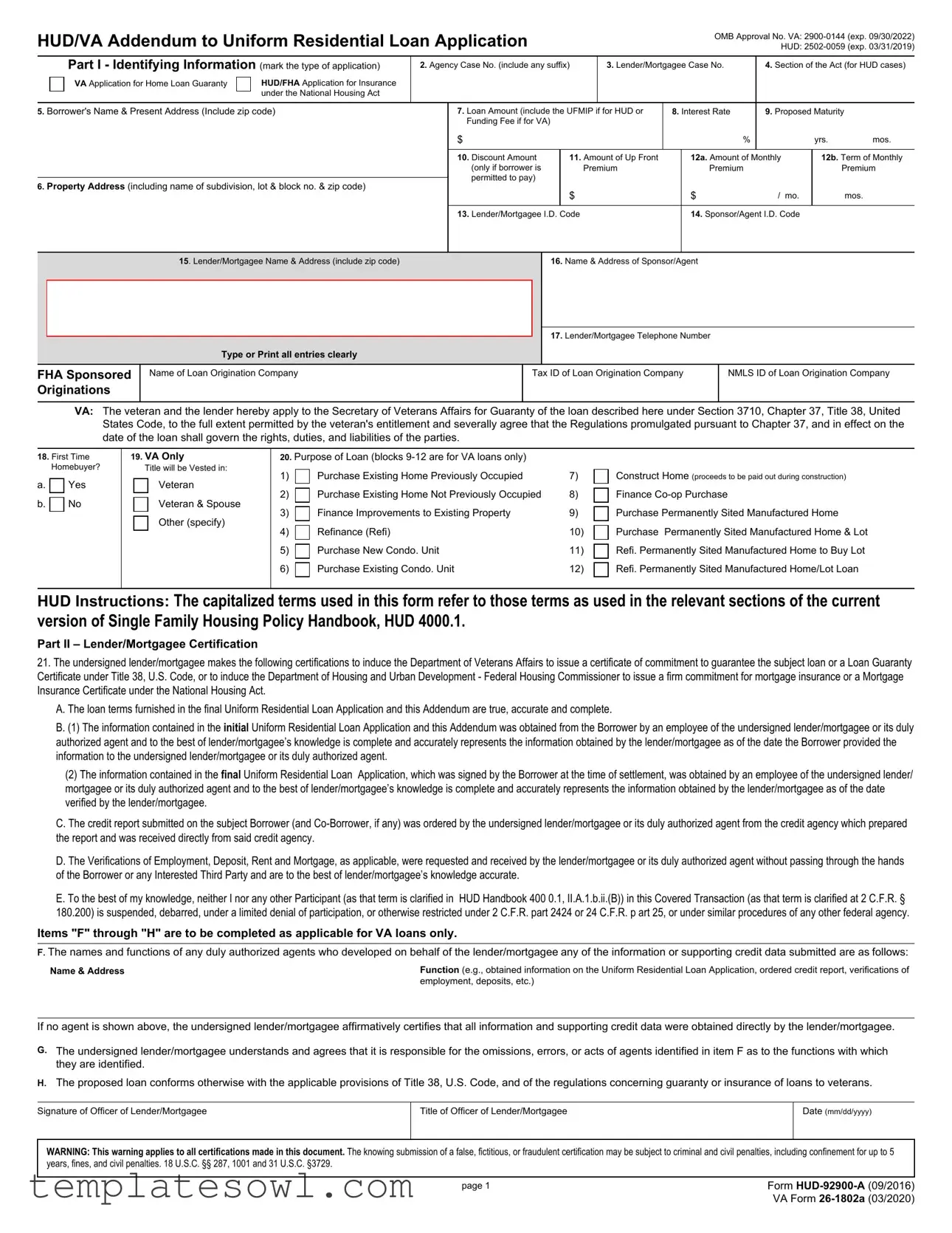

The VA Form 26-1802A, commonly known as the HUD/VA Addendum to the Uniform Residential Loan Application, serves as a pivotal tool for both veterans and lenders in securing home loan guarantees and insurance. This form is a critical part of the mortgage application process for those looking to obtain loans backed by the Department of Veterans Affairs (VA) or the Department of Housing and Urban Development (HUD). It gathers identifying information about the borrower, loan details, and property specifications, streamlining the overall application process. Sections of the form require straightforward entries, such as the loan amount, interest rate, and purpose of the loan, ensuring essential data is readily available for evaluation. Furthermore, the form emphasizes the importance of accurate information, as both the lender and borrower must certify the truthfulness of their entries. It also includes certifications made by the lender to promote accountability and adherence to federal guidelines, safeguarding both parties involved in the transaction. Obligations of the borrowers and their consent for verification of personal information play a crucial role in ensuring transparency and compliance with the regulations governing federally-backed loans. By understanding the major components of this form and its significance in the broader context of mortgage applications, veterans can better navigate the often complex landscape of home financing.

Va 26 1802A Example

HUD/VA Addendum to Uniform Residential Loan Application |

|

|

|

|

|

HUD: |

|||||

|

|

|

|

|

|

|

|

OMB Approval No. VA: |

|||

Part I - Identifying Information (mark the type of application) |

2. Agency Case No. (include any suffix) |

|

3. Lender/Mortgagee Case No. |

4. Section of the Act (for HUD cases) |

|||||||

VA Application for Home Loan Guaranty |

HUD/FHA Application for Insurance |

|

|

|

|

|

|

|

|

|

|

|

under the National Housing Act |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

5. Borrower's Name & Present Address (Include zip code) |

|

7. Loan Amount (include the UFMIP if for HUD or |

8. Interest Rate |

9. Proposed Maturity |

|||||||

|

|

|

Funding Fee if for VA) |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

% |

|

yrs. |

mos. |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

10. Discount Amount |

11. Amount of Up Front |

|

12a. Amount of Monthly |

12b. Term of Monthly |

||||

|

|

|

(only if borrower is |

|

Premium |

|

Premium |

|

|

Premium |

|

|

|

|

permitted to pay) |

|

|

|

|

|

|

|

|

6. Property Address (including name of subdivision, lot & block no. & zip code) |

|

$ |

|

|

|

$ |

/ mo. |

|

mos. |

||

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. Lender/Mortgagee I.D. Code |

|

|

|

14. Sponsor/Agent I.D. Code |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

15. Lender/Mortgagee Name & Address (include zip code)

16.Name & Address of Sponsor/Agent

Type or Print all entries clearly

17.Lender/Mortgagee Telephone Number

FHA Sponsored Originations

Name of Loan Origination Company

Tax ID of Loan Origination Company

NMLS ID of Loan Origination Company

VA: The veteran and the lender hereby apply to the Secretary of Veterans Affairs for Guaranty of the loan described here under Section 3710, Chapter 37, Title 38, United States Code, to the full extent permitted by the veteran's entitlement and severally agree that the Regulations promulgated pursuant to Chapter 37, and in effect on the date of the loan shall govern the rights, duties, and liabilities of the parties.

18. First Time |

19. VA Only |

20. Purpose of Loan (blocks |

|

|

|

||||||||||

|

|

Homebuyer? |

|

|

Title will be Vested in: |

1) |

|

Purchase Existing Home Previously Occupied |

7) |

|

Construct Home (proceeds to be paid out during construction) |

||||

a. |

|

|

|

Yes |

|

|

|

|

Veteran |

|

|

||||

b. |

|

|

|

No |

|

|

|

|

Veteran & Spouse |

2) |

|

Purchase Existing Home Not Previously Occupied |

8) |

|

Finance |

|

|

|

|

|

|

|

|

|

Other (specify) |

3) |

|

Finance Improvements to Existing Property |

9) |

|

Purchase Permanently Sited Manufactured Home |

|

|

|

|

|

|

|

|

|

|

4) |

|

Refinance (Refi) |

10) |

|

Purchase Permanently Sited Manufactured Home & Lot |

|

|

|

|

|

|

|

|

|

|

5) |

|

Purchase New Condo. Unit |

11) |

|

Refi. Permanently Sited Manufactured Home to Buy Lot |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

6) |

|

Purchase Existing Condo. Unit |

12) |

|

Refi. Permanently Sited Manufactured Home/Lot Loan |

|

|

|

|

|

|

|

|

|

|

|

|

||||

HUD Instructions: The capitalized terms used in this form refer to those terms as used in the relevant sections of the current version of Single Family Housing Policy Handbook, HUD 4000.1.

Part II – Lender/Mortgagee Certification

21.The undersigned lender/mortgagee makes the following certifications to induce the Department of Veterans Affairs to issue a certificate of commitment to guarantee the subject loan or a Loan Guaranty Certificate under Title 38, U.S. Code, or to induce the Department of Housing and Urban Development - Federal Housing Commissioner to issue a firm commitment for mortgage insurance or a Mortgage Insurance Certificate under the National Housing Act.

A.The loan terms furnished in the final Uniform Residential Loan Application and this Addendum are true, accurate and complete.

B.(1) The information contained in the initial Uniform Residential Loan Application and this Addendum was obtained from the Borrower by an employee of the undersigned lender/mortgagee or its duly authorized agent and to the best of lender/mortgagee’s knowledge is complete and accurately represents the information obtained by the lender/mortgagee as of the date the Borrower provided the information to the undersigned lender/mortgagee or its duly authorized agent.

(2)The information contained in the final Uniform Residential Loan Application, which was signed by the Borrower at the time of settlement, was obtained by an employee of the undersigned lender/ mortgagee or its duly authorized agent and to the best of lender/mortgagee’s knowledge is complete and accurately represents the information obtained by the lender/mortgagee as of the date verified by the lender/mortgagee.

C.The credit report submitted on the subject Borrower (and

D.The Verifications of Employment, Deposit, Rent and Mortgage, as applicable, were requested and received by the lender/mortgagee or its duly authorized agent without passing through the hands of the Borrower or any Interested Third Party and are to the best of lender/mortgagee’s knowledge accurate.

E.To the best of my knowledge, neither I nor any other Participant (as that term is clarified in HUD Handbook 400 0.1, II.A.1.b.ii.(B)) in this Covered Transaction (as that term is clarified at 2 C.F.R. § 180.200) is suspended, debarred, under a limited denial of participation, or otherwise restricted under 2 C.F.R. part 2424 or 24 C.F.R. p art 25, or under similar procedures of any other federal agency.

Items "F" through "H" are to be completed as applicable for VA loans only.

F. The names and functions of any duly authorized agents who developed on behalf of the lender/mortgagee any of the information or supporting credit data submitted are as follows:

Name & Address |

Function (e.g., obtained information on the Uniform Residential Loan Application, ordered credit report, verifications of |

|

employment, deposits, etc.) |

If no agent is shown above, the undersigned lender/mortgagee affirmatively certifies that all information and supporting credit data were obtained directly by the lender/mortgagee.

G.The undersigned lender/mortgagee understands and agrees that it is responsible for the omissions, errors, or acts of agents identified in item F as to the functions with which they are identified.

H.The proposed loan conforms otherwise with the applicable provisions of Title 38, U.S. Code, and of the regulations concerning guaranty or insurance of loans to veterans.

Signature of Officer of Lender/Mortgagee

Title of Officer of Lender/Mortgagee

Date (mm/dd/yyyy)

WARNING: This warning applies to all certifications made in this document. The knowing submission of a false, fictitious, or fraudulent certification may be subject to criminal and civil penalties, including confinement for up to 5 years, fines, and civil penalties. 18 U.S.C. §§ 287, 1001 and 31 U.S.C. §3729.

page 1 |

Form |

(09/2016) |

|

VA Form |

(03/2020) |

Part III - Notices to Borrowers

Public reporting burden for this collection of information is estimated to average 6 minutes per response, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. This agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless that collection displays a valid OMB control number can be located on the OMB Internet page at http://www.reginfo.gov/public/do/PRAMain. Privacy Act Information: The information requested on the Uniform Residential Loan Application and this Addendum is authorized by 38 U.S.C.

3710 (if for DVA) and 12 U.S.C. 1701 et seq. (if for HUD/FHA). The Debt Collection Act of 1982, Pub. Law

Part IV - Borrower Consent for Social Security Administration to Verify Social Security Number

I authorize the Social Security Administration to verify my Social Security number to the Mortgagee identified in this document and HUD/FHA, through a computer match conducted by HUD/FHA.

I understand that my consent allows no additional information from my Social Security records to be provided to the Mortgagee, and HUD/FHA and that verification of my Social Security number does not constitute confirmation of my identity. I also understand that my Social Security number may not be used for any other purpose than the one stated above, including resale or redisclosure to other parties. The only other redisclosure permitted by this authorization is for review purposes to ensure that HUD/FHA complies with SSA's consent requirements. I am the individual to whom the Social Security number was issued or that person's legal guardian. I declare and affirm under the penalty of perjury that the information contained herein is true and correct. I know that if I make any representation that I know is false to obtain information from Social Security records, I could be punished by a fine or imprisonment or both. This consent is valid for 180 days from the date signed, unless indicated otherwise by the individual(s) named in this loan application.

Read consent carefully. Review accuracy of social security number(s) and birth dates provided on this application.

Signature(s) of Borrower(s) |

Date Signed |

|

Signature(s) of |

Date Signed |

|||

|

|

|

|

|

|

|

|

Part V - Borrower Certification |

|

|

Is it to be sold? |

|

|

22b. Sales Price |

22c. Original Mortgage Amt |

22. Complete the following for a HUD/FHA Mortgage. |

|

|

|

|

|

|

|

22a. Do you own or have you sold other real estate within the |

Yes |

No |

Yes |

No |

NA |

|

|

past 60 months on which there was a HUD/FHA mortgage? |

|

|

|

|

|

|

|

22d. Address: |

|

|

|

|

|

$ |

$ |

|

|

|

|

|

|

|

|

22e. If the dwelling to be covered by this mortgage is to be rented, is it a part of, adjacent or contiguous to any project subdivision or group of concentrated rental properties involving eight or

more dwelling units in which you have any financial interest? |

|

Yes |

|

No If “Yes” give details. |

|

|

23.Complete for

Yes

No

IMPORTANT: If you are certifying that you are married for the purpose of VA benefits, your marriage must be recognized by the place where you and/ or your spouse resided at the time of marriage, or where you and/or your spouse resided when you filed your claim (or a later date when you become eligible for benefits) (38 U.S.C. § 103(c)). Additional guidance on when VA recognizes marriages is available at http://www.va.gov/opa/marriage/.

24.Applicable for Both VA & HUD. As a home loan borrower, you will be legally obligated to make the mortgage payments called for by your mortgage loan contract. The fact that you dispose of your property after the loan has been made will not relieve you of liability for making these payments. Payment of the loan in full is ordinarily the way liability on a mortgage note is ended. Some home buyers have the mistaken impression that if they sell their homes when they move to another locality, or dispose of it for any other reasons, they are no longer liable for the mortgage payments and that liability for these payments is solely that of the new owners. Even though the new owners may agree in writing to assume liability for your mortgage payments, this assumption agreement will not relieve you from liability to the holder of the note which you signed when you obtained the loan to buy the property. Unless you are able to sell the property to a buyer who is acceptable to VA or to HUD/FHA and who will assume the payment of your obligation to the lender, you will not be relieved from liability to repay any claim which VA or HUD/FHA may be required to pay your lender on account of default in your loan payments. The amount of any such claim payment will be a debt owed by you to the Federal Government. This debt will be the object of established collection procedures.

25.I, the Undersigned Borrower(s) Certify that:

(1)I have read and understand the foregoing concerning my liability on the loan and Part III Notices to Borrowers.

(2)Occupancy: HUD Only (CHECK APPLICABLE BOX)

I, the Borrower or

I do not intend to occupy the property as my primary residence.

Occupancy: VA Only

(a.) I now actually occupy the

(b.) My spouse is on active military duty and in his or her absence; I occupy or intend to occupy the property securing this loan as my home.

(c.) I previously occupied the property securing this loan as my home. (for interest rate reduction loans).

(d.) While my spouse was on active military duty and unable to occupy the property securing this loan, I previously occupied the property that is securing this loan as my home. (for interest rate reduction loans). Note: If box 2b or 2d is checked, the veteran's spouse must also sign below.

(e.) The veteran is on active military duty and in his or her absence, I certify that a dependent child of the veteran occupies or will occupy the property securing this loan as their home. Note: This requires that the veteran's

(f.) While the veteran was on active military duty and unable to occupy the property securing this loan, the property was occupied by the veteran's dependent child as his or her home (for interest rate reduction loans).

Note: This requires that the veteran’s

(3)Mark the applicable box (not applicable for Home Improvement or Refinancing

Loan) I have been informed that ($ |

) is: |

The reasonable value of the property as determined by VA or; The statement of appraised value as determined by HUD/FHA

Note: If the contract price or cost exceeds the VA “Reasonable Value" or HUD/FHA "Statement of Appraised Value", mark either item (a) or item (b), whichever is applicable. (a.) I have elected to complete the transaction at the contract purchase price or cost. I have

paid or will pay in cash from my own resources at or prior to loan closing a sum equal to the difference between contract purchase price or cost and the VA or HUD/FHA established value. I do not and will not have outstanding after loan closing any unpaid contractual obligation on account of such cash payment.

(b.) I was not aware of this valuation when I signed my contract but have elected to complete the transaction at the contract purchase price or cost. I have paid or will pay in cash from my own resources at or prior to loan closing a sum equal to the difference between contract purchase price or cost and the VA or HUD/FHA established value. I do not and will not have outstanding after loan closing any unpaid contractual obligation on account of such cash payment.

(4)I and anyone acting on my behalf are, and will remain, in compliance with the Fair Housing Act, 42 U.S.C. 3604, et seq., with respect to the dwelling or property covered by the loan and in the provision of services or facilities in connection therewith. I recognize that any restrictive covenant on this property related to race, color, religion, sex, disability, familial status, national origin, marital status, age, or source of income is illegal and void. I further recognize that in addition to administrative action by HUD, a civil action may be brought by the Attorney General of the United States in any appropriate U.S. court against any person responsible for a violation of the applicable law.

(5)All information in this application is given for the purpose of obtaining a loan to be insured under the National Housing Act or guaranteed by the Department of Veterans Affairs and the information in the Uniform Residential Loan Application and this Addendum is true and complete to the best of my knowledge and belief. Verification may be obtained from any source named herein.

(6)For HUD Only (for properties constructed prior to 1978) I have received information on

lead paint poisoning. |

|

Yes |

|

Not Applicable |

|

|

(7)I am aware that neither HUD/FHA nor VA warrants the condition or value of the property.

Signature(s) of Borrower(s) – Do not sign unless this application is fully completed. Read the certifications carefully and review accuracy of this application.

Signature(s) of Borrower(s) |

Date Signed |

Signature(s) of |

Date Signed |

page 2 |

Form |

(09/2016) |

|

VA Form |

(03/2020) |

Direct Endorsement Approval for a

and Urban Development

1.Borrower's Name & Present Address (Include zip code)

2.Property Address

3. Agency Case No. (include any suffix)

Approved:

Date Mortgage Approved |

|

|

|

Date Approval Expires |

|

|

||

|

|

|

|

|

|

|

|

|

Modified & |

Loan Amount (include UFMIP) |

Interest Rate |

Proposed Maturity |

|

Monthly Payment |

Amount of Up Front |

Amount of Monthly |

Term of Monthly Premium |

approved |

|

|

|

|

|

Premium |

Premium |

|

|

|

|

|

|

|

|

|

|

as follows: |

$ |

% |

Yrs. |

Mos. |

$ |

$ |

$ |

Mos. |

|

|

|

|

|

|

|

|

|

Owner Occupancy NOT required

All conditions of Approval have been satisfied

This mortgage was rated as an “accept” or “approve” by FHA's TOTAL Mortgage Scorecard. As such, the undersigned representative of the mortgagee certifies that the mortgagee reviewed the TOTAL Mortgage Scorecard findings and that this mortgage meets the Final Underwriting Decision (TOTAL) requirements for approval. The undersigned representative of the mortgagee also certifies that all information entered into TOTAL Mortgage Scorecard is complete and accurately represents information obtained by the mortgagee, that the information was obtained by the mortgagee, pursuant to FHA requirements, and that there was no defect in connection with the approval of this mortgage such that the result reached in TOTAL should not have been relied upon and the mortgage should not have been approved in accordance with FHA requirements.

Mortgagee Representative: |

|

Signature: |

Printed Name/Title: |

And if applicable:

This mortgage was rated as an “accept” or “approve” by FHA's TOTAL Mortgage Scorecard and the undersigned Direct Endorsement underwriter certifies that I have personally reviewed and underwritten the appraisal according to standard FHA requirements.

Direct Endorsement Underwriter Signature |

DE's CHUMS ID Number |

OR

This mortgage was rated as a “refer” by a FHA's TOTAL Mortgage Scorecard, or was manually underwritten by a Direct Endorsement underwriter. As such, the undersigned Direct Endorsement Underwriter certifies that I have personally reviewed and underwritten the appraisal report (if applicable), credit application, and all associated documents used in underwriting this mortgage. I further certify that:

•I have approved this loan and my Final Underwriting Decision was made having exercised the required level of Care and Due Diligence and in performing my underwriting review;

•I have performed all Specific Underwriter Responsibilities for Underwriters and my underwriting of the borrower’s Credit and Debt, Income, Qualifying Ratios and Compensating Factors, if any, and the borrower’s DTI with Compensating Factors, if any, are within the parameters established by FHA and the borrower has assets to satisfy any required down payment and closing costs of this mortgage; and

•I have verified the Mortgage Insurance Premium and Mortgage Amount are accurate and this loan is in an amount that is permitted by FHA for this loan type, property type, and geographic area.

•There was no defect in connection with my approval of this mortgage such that my Final Underwriting Decision should have changed and the mortgage should not have been approved in accordance with FHA requirements .

Direct Endorsement Underwriter Signature

The Mortgagee, its owners, officers, employees or directors

(do) builder or seller involved in this transaction.

(do) builder or seller involved in this transaction.

CHUMS ID Number

(do not) have a financial interest in or a relationship, by affiliation or ownership, with the

page 3 |

Form |

(09/2016) |

|

VA Form |

(03/2020) |

Borrower's Certification:

The undersigned certifies that:

(a.) |

I will not have outstanding any other unpaid obligations contracted in connection with the mortgage transaction or the purchase of the said |

|

property except obligations which are secured by property or collateral owned by me independently of the said mortgaged property, or |

|

obligations approved by the Commissioner; |

(b.) |

One of the undersigned intends to occupy the subject property (note: this item does not apply if |

(c.) All charges and fees collected from me as shown in the settlement statement have been paid by my own funds, gift funds, or acceptable Down Payment Assistance program funds, and no other charges have been or will be paid by me in respect to this transaction.

Borrower'(s) Signature(s) & Date

Mortgagee's Certification:

The Mortgagee by and through the undersigned certifies that to the best of its knowledge:

(a)The loan terms, loan type, property address, Borrower information including names, social security number, credit scores, marital status, employment status, and Borrower occupancy status, in its application for insurance and in this Certificate are true and correct;

(b)All loan approval conditions appearing in any outstanding commitment issued under the above case number have been fulfilled and this loan closed in a manner consistent with the mortgagee’s approval;

(c)Complete disbursement of the loan has been made to the Borrower, or to his/her creditors for his/her account and with his /her consent and any escrow has been established in accordance with applicable law;

(d)The note and security instruments are in a form acceptable to HUD and the security instrument has been recorded and is a good and valid first lien on the property described;

(e)No charge has been made to, or paid by the Borrower, except as permitted under HUD regulations;

(f)The copies of the note and security instruments which are submitted herewith are true and exact copies as executed and filed for record;

(g)It has not paid any kickbacks, fee or consideration of any type, directly or indirectly, to any party in connection with this transaction except as permitted under HUD regulations and administrative instructions; and

(h)The Mortgagee has exercised due diligence in processing this mortgage and in reviewing the file documents listed at HUD Handbook 4000.1, II.A.7.b. and the documents contain no defect that should have changed the processing or documentation and the mortgage should not have been approved in accordance with FHA requirements.

I, the undersigned authorized representative of the mortgagee certify that I have personally reviewed the mortgage documents, closing statements, application for insurance endorsement, and all accompanying documents and request the endorsement of this mortgage for FHA insurance.

Mortgagee

Name and Title of the Mortgagee's Officer

Signature of the Mortgagee's Officer |

Date |

Note: If the approval is executed by an agent in the name of the mortgagee, the agent must enter the mortgagee’s code number and type.

Code Number (5 digits) |

Type |

page 4 |

Form |

(09/2016) |

|

VA Form |

(03/2020) |

Form Characteristics

| Fact Name | Details |

|---|---|

| Title of the Form | HUD/VA Addendum to Uniform Residential Loan Application |

| OMB Approval Numbers | HUD: 2502-0059 (exp. 03/31/2019); VA: 2900-0144 (exp. 09/30/2022) |

| Governing Law | The loan is governed by the Title 38, United States Code, primarily Section 3710. |

| Purpose of Form | This form is used to apply for VA home loan guarantees and for HUD insurance on mortgages. |

| Loan Types | The form accommodates various loan types, including purchase, refinance, and construction loans for veterans. |

| Part Structure | The form is divided into multiple parts, including application information, lender certifications, and borrower certifications. |

| Significance of Section 3710 | This section details the guarantees provided to veterans for home loans, supporting their home-buying aspirations. |

| Certification Requirement | Lenders must certify the accuracy of information provided to induce the issuance of loan guarantees or insurance. |

| Privacy Act Compliance | The form mandates compliance with the Privacy Act, ensuring that personal information is responsibly handled. |

| Borrower Liability Notice | It outlines that borrowers remain liable for mortgage payments even if they sell the property. |

Guidelines on Utilizing Va 26 1802A

Filling out the VA Form 26-1802A is a critical step in applying for a home loan guarantee. It is essential to ensure that all entries are completed accurately to avoid any delays in the application process. The steps below outline how to fill out each section of the form clearly and correctly.

- Begin with **Part I - Identifying Information**: Indicate the type of application you are submitting. Fill in the Agency Case Number, Lender/Mortgagee Case Number, and Section of the Act, selecting either VA Application for Home Loan Guaranty or HUD/FHA Application for Insurance.

- Enter the Borrower's Name and Present Address, including the ZIP code.

- Input the Property Address, along with the subdivision name, lot and block numbers, and ZIP code.

- Record the Loan Amount, making sure to include the Upfront Mortgage Insurance Premium (UFMIP) if applicable, and the Interest Rate. Specify the Proposed Maturity in years and months.

- Fill in the Discount Amount and the Amount of Upfront Premium, as well as the Amount and Term of Monthly Premium, if applicable.

- Complete the Lender/Mortgagee information, including the I.D. Code, Name, Address, and Telephone Number.

- Indicate whether this is a First Time Homebuyer loan and specify the Purpose of the Loan by marking the appropriate box(es).

- For **Part II - Lender/Mortgagee Certification**, ensure the undersigned lender or mortgagee certifies the accuracy of the furnished loan terms and information. Complete the necessary statements regarding the information's accuracy and the employment verifications.

- Proceed to **Part III - Notices to Borrowers** and read the warnings and privacy notices carefully. Ensure you understand your borrowing liabilities and the conditions surrounding the loan.

- In **Part IV - Borrower Consent**, authorize verification of your Social Security number by signing and dating the section.

- Finally, move to **Part V - Borrower Certification**: Confirm the ownership status of property, sales price, and original mortgage amount as needed. Ensure that all borrower information is reviewed for accuracy before signing and dating the certification.

After completing the form, review it thoroughly. It is advisable to keep a copy for personal records. The next steps will typically involve submitting this form along with any other required documentation to the lender for processing.

What You Should Know About This Form

What is the VA 26-1802A form and when is it used?

The VA 26-1802A form, also known as the HUD/VA Addendum to the Uniform Residential Loan Application, is a document used by veterans and lenders when applying for home loan guaranty benefits. This form helps the Department of Veterans Affairs (VA) to evaluate the borrower's eligibility for a loan guaranty. It is typically used in conjunction with a standard loan application, and is specifically tailored for veterans seeking financing under the VA's home loan program. The form is critical in assessing the borrower's financial situation, loan terms, and other important details regarding the property and loan purpose.

What should I include in Part I of the VA 26-1802A form?

Part I of the VA 26-1802A form asks for identifying information crucial for processing your loan application. You should provide the type of application, agency case number, lender case number, and the specific section of the act applicable to your situation. Additionally, you'll need to enter your name, current address, property address, proposed loan amount, interest rate, and other mortgage details. Accuracy is key, as this information will help determine your eligibility for the loan guaranty.

What certifications does the lender need to provide in Part II?

In Part II of the form, the lender or mortgagee must certify that the information provided is true, accurate, and complete. This includes confirming that the borrower’s application information was obtained correctly and that a credit report was ordered from a recognized credit agency. Lenders must also assure the VA that they have adequate knowledge regarding any agents involved in processing the loan and that all applicable regulations have been followed. The certifications serve to protect both the borrower and the lender by ensuring compliance with federal guidelines.

What is the significance of borrower certifications in Part V?

In Part V, the borrower provides crucial certifications to affirm their understanding and agreement to the terms of the loan. This section requires that borrowers acknowledge their liability concerning the mortgage payments, regardless of ownership changes in the property. Furthermore, it emphasizes that borrowers must intend to occupy the property as their primary residence. The certifications bind the borrower to the terms of the loan and reinforce their understanding of the potential consequences of defaulting on payments.

Common mistakes

When filling out the VA Form 26-1802A, applicants often make common mistakes that can lead to delays or complications in the loan process. One significant error is failing to provide complete identifying information. This includes the Borrower's name, address, and the Agency Case Number. Incomplete information can hinder the processing of the application.

Another frequent oversight occurs in the Loan Amount section. Borrowers sometimes forget to include the Upfront Mortgage Insurance Premium (UFMIP) for HUD loans or the VA Funding Fee for VA loans. Omitting this information may result in an incorrect loan amount being processed, which can affect eligibility and funding.

Many applicants do not read the instructions carefully, resulting in miscommunication about the loan purpose. The various loan purposes must be marked accurately, as incorrect selections can lead to misunderstandings with lenders regarding eligibility and loan type, affecting approval.

Sometimes, individuals neglect to verify the accuracy of the Interest Rate and proposed maturity. If these details are incorrect, it can mislead lenders and cause further delays in processing the loan. Accurate figures are crucial for aligning the expectations of all parties involved.

Failure to include the correct addresses for both the property and the borrower is another common mistake. Ensuring that the Property Address is complete, including subdivision and zip code, is essential. Missing or incorrect addresses can result in issues with title searches and property assessments.

In addition, many borrowers make errors in the Certifications section. It is vital that individuals understand and complete all certifications correctly. Failing to do so can invoke compliance issues later in the process, potentially jeopardizing the loan.

Some applicants may forget to indicate if the Loan is for a refinancing option or a new purchase. Mislabeling the type of loan can lead the application into an incorrect processing path, resulting in unnecessary delays or denials.

Another mistake arises from improper signatures and dates in the certifications section. Each required party must sign and date the form appropriately. Missing signatures can cause an application to be marked incomplete, requiring resubmission.

Lastly, individuals often overlook including their Social Security Number in the required sections. Providing this information is not just standard practice; it is necessary for loan processing and verification. Omitting the Social Security Number can lead to automatic disqualification from loan approval.

Documents used along the form

When preparing to use the VA Form 26-1802A, it's essential to gather additional documentation that can support the loan application process. Each of these documents plays a significant role in determining eligibility, loan amount, and final approval. Below is a brief overview of common forms and documents needed alongside the VA Form 26-1802A.

- Uniform Residential Loan Application (URLA): This foundational document collects comprehensive information about the borrower, including employment history, assets, debts, and personal identification. It is often the starting point in the loan application process.

- Credit Report Authorization Form: This form allows lenders to obtain the borrower's credit report, which helps them assess creditworthiness. A good credit history can enhance a borrower's chances of securing favorable loan terms.

- Certificate of Eligibility (COE): Veterans need this form to verify their eligibility for VA loan benefits. This document confirms the eligibility status based on service requirements and prior usage of benefits.

- Acknowledgment of Lead-Based Paint Exposure: Required for homes built before 1978, this acknowledgment informs borrowers about potential health risks associated with lead paint. It is vital for compliance with federal regulations.

- VA Form 26-1880: This form is used to apply for a Certificate of Eligibility for VA loans. It can be submitted online or via mail to ensure that veterans can access their benefits.

- Loan Estimate: This document outlines the terms of the loan, including interest rates, monthly payments, and closing costs. Lenders must provide this within three days of receiving the loan application, giving borrowers a clear understanding of what to expect.

- Property Appraisal Report: Conducted by a licensed appraiser, this report assesses the value of the property being purchased or refinanced. Lenders rely on this to ensure that the loan amount is in line with the property's market value.

Each document serves a specific purpose and plays a crucial role in facilitating a smooth loan application process. Being prepared with these forms can streamline your experience and ultimately lead to successful loan approval. Proper documentation showcase your readiness and strengthen your application, putting you on a clearer path to achieving your homeownership dreams.

Similar forms

- VA Form 26-1880: This form is used to apply for a Certificate of Eligibility for VA home loan benefits. Similar to the VA 26-1802A, it requires the applicant to provide personal information and details about their military service. Both forms are part of the process for veterans seeking housing assistance through the VA.

- FHA Loan Application (Form 92900-A): This form is the Federal Housing Administration's version for applying for FHA-insured mortgages. Like the VA 26-1802A, it asks for borrower information, loan details, and supports documentation verification. Both forms aim to facilitate the loan application process, although they cater to different programs.

- Loan Estimate (LE): The Loan Estimate is provided by lenders for various mortgage products, detailing the terms and costs associated with the loan. Similar to the VA 26-1802A, it ensures transparency and helps borrowers make informed decisions by presenting clear, concise information about the loan.

- Closing Disclosure (CD): This document provides the final details about the mortgage loan and must be provided to borrowers three days before closing. Like the VA 26-1802A, it contains crucial financial information, ensuring borrowers understand their obligations and the costs involved before finalizing the loan.

- Form HUD-92900-B: This form applies specifically to the FHA's Direct Endorsement approval process for insured mortgages, similar to the VA 26-1802A in its certification and attestations of loan details by lenders. Both facilitate the lender's responsibilities in loan approval and servicing.

- VA Form 26-1817: This form verifies eligibility for veterans seeking a VA loan, aligning closely with the VA 26-1802A's objective of assisting veterans in obtaining housing benefits. Both require detailed information about the applicant’s military service and financial background.

- Form SF 182: The Standard Form 182 (SF 182) is used for government employee training. While its primary purpose differs, both forms serve as essential applications that require accurate information and documentation for processing loans and any benefits related to them.

- Credit Application: A general credit application collects personal and financial information required to apply for credit. Like the VA 26-1802A, it focuses on the borrower's ability to repay a loan, ensuring that lenders can assess risk accurately and fairly.

- Form 4506-T: This form requests a tax return transcript from the IRS, often used in loan applications to verify income. Similar to the VA 26-1802A, it seeks to confirm financial information, essential for the lender's decision-making process.

- Debt and Income Verification Forms: These documents are used to confirm a borrower's income and existing debts, critical for any loan underwriting. They share the goal with the VA 26-1802A of providing transparency about a borrower's financial status, ensuring all information is accurate and verified before loan approval.

Dos and Don'ts

When filling out the VA Form 26-1802A, there are important dos and don'ts to keep in mind to ensure your application is processed smoothly. Here is a helpful list of both:

- DO: Fill in all sections completely and clearly to avoid any delays in processing.

- DO: Mark the type of application accurately to ensure it meets your needs.

- DO: Double-check all provided information, including your Social Security number and loan details, for accuracy.

- DO: Sign and date the form where required, as an unsigned application may be rejected.

- DO: Keep a copy of the completed form for your records, as it may be needed for future reference.

- DON'T: Leave any part of the application blank; incomplete information may lead to processing delays or denial.

- DON'T: Provide false or misleading information, as this could result in legal penalties and affect your loan eligibility.

- DON'T: Submit the form without reviewing all entries carefully; mistakes can be costly and lead to complications.

- DON'T: Forget to include any necessary documentation required to support your application.

- DON'T: Rely solely on verbal confirmations from agents; always obtain and confirm written documentation for your records.

Misconceptions

-

Misconception 1: The VA 26-1802A form is only for veterans.

Many believe that only veterans can use this form for home loan applications. However, co-borrowers, including spouses, may also be involved in the application process.

-

Misconception 2: This form guarantees a loan approval.

Submitting the VA 26-1802A does not guarantee that the loan will be approved. It is simply part of the application process, and approval depends on various factors such as creditworthiness and the lender's assessment.

-

Misconception 3: Completing this form is the only step in applying for a VA loan.

Some people assume that filling out this form is all they need to do. In reality, it is one of several steps needed to process a VA loan application, which may include verification of income and credit history.

-

Misconception 4: The VA 26-1802A form is the same for all loans.

This form is specifically geared toward VA loans and differs from other loan applications like those for FHA loans. It's tailored to meet the unique requirements and benefits that come with VA financing.

-

Misconception 5: There are no repercussions for errors on the form.

Some people think they can overlook inaccuracies when completing this form. However, any false or misleading information can lead to severe consequences, including loan denial or legal action.

Key takeaways

When filling out and using the VA 26-1802A form, it is essential to understand the following key points:

- The form serves as an addendum to the Uniform Residential Loan Application, specifically for veterans seeking home loan guaranties.

- Comprehensive identification details, including case numbers and borrower information, are required to complete the application efficiently.

- Clearly state the purpose of the loan, as well as whether this is a first-time homebuyer situation.

- Both the borrower and the lender must certify that all provided information is accurate to ensure compliance and avoid penalties.

- Disclosure of a valid Social Security Number (SSN) is mandatory for the application process and helps in verifying identity.

- Understanding your obligations is critical; selling your property does not eliminate your responsibility for mortgage payments.

- Notification of the potential risks associated with mortgage loans, including delinquencies and defaults, is provided in the instructions.

- The lender must ensure that all certifications align with federal regulations to avoid penalties related to misleading information.

- Keep a copy of your completed form for personal records and future reference regarding your loan application.

Browse Other Templates

Renew Handicap Parking Permit Florida Online - Seek assistance from a local tax collector if there are questions about the form.

Dmv Plate Surrender - There is no cost involved in surrendering your plates, making this process hassle-free.

Capf160 - The CAPF 160 also supports the smooth operation of activities.