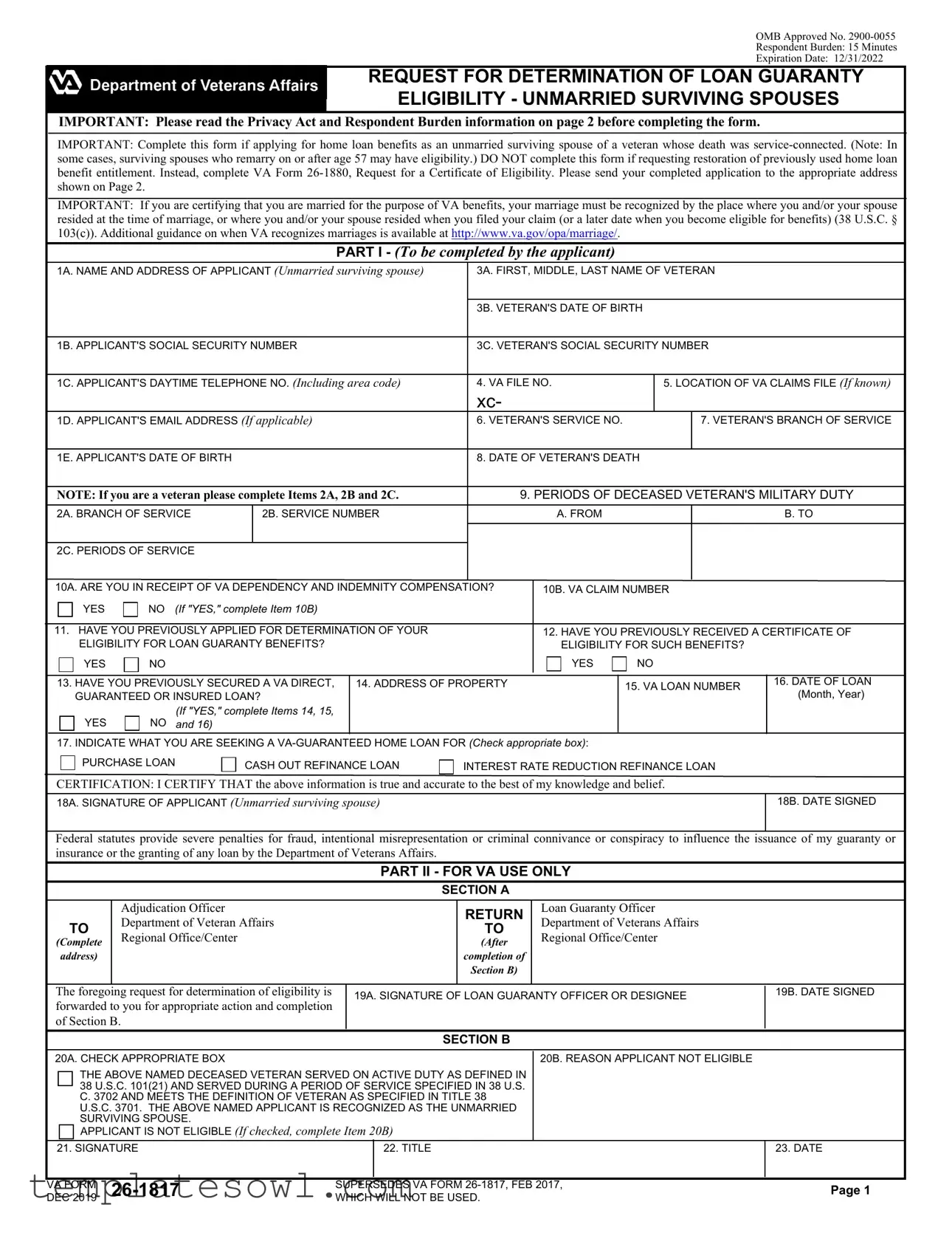

Fill Out Your Va 26 1817 Form

The VA Form 26-1817 is a critical document for unmarried surviving spouses seeking home loan benefits linked to veterans’ service. This form enables the applicant to assert their eligibility for a loan guaranty, underscoring the program's commitment to support these individuals during challenging times. Designed with a straightforward structure, the form requires essential personal information, including the applicant's name, contact details, and the veteran's service and death information. The process is meant to be efficient, with an estimated completion time of approximately 15 minutes, allowing applicants to provide key data crucial for determining loan eligibility. It’s important to note that the form specifically caters to those whose eligibility arises from the service-connected death of a veteran. For applicants who have previously availed of benefits, a different form, VA Form 26-1880, is applicable. Accurate completion of this document is imperative, as it serves not only as a request for determining eligibility but also as a certification of the truthfulness of the provided information, carrying significant implications under federal law. The application must be sent to the correct regional office, based on the applicant's location, ensuring it reaches the appropriate adjudication officer for timely processing. Understanding the various components and requirements of VA Form 26-1817 is essential for any surviving spouse aiming to access vital loan benefits effectively.

Va 26 1817 Example

OMB Approved No.

Respondent Burden: 15 Minutes

Expiration Date: 12/31/2022

REQUEST FOR DETERMINATION OF LOAN GUARANTY

ELIGIBILITY - UNMARRIED SURVIVING SPOUSES

IMPORTANT: Please read the Privacy Act and Respondent Burden information on page 2 before completing the form.

IMPORTANT: Complete this form if applying for home loan benefits as an unmarried surviving spouse of a veteran whose death was

IMPORTANT: If you are certifying that you are married for the purpose of VA benefits, your marriage must be recognized by the place where you and/or your spouse resided at the time of marriage, or where you and/or your spouse resided when you filed your claim (or a later date when you become eligible for benefits) (38 U.S.C. § 103(c)). Additional guidance on when VA recognizes marriages is available at http://www.va.gov/opa/marriage/.

PART I - (To be completed by the applicant)

|

1A. NAME AND ADDRESS OF APPLICANT (Unmarried surviving spouse) |

3A. FIRST, MIDDLE, LAST NAME OF VETERAN |

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3B. VETERAN'S DATE OF BIRTH |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

1B. APPLICANT'S SOCIAL SECURITY NUMBER |

3C. VETERAN'S SOCIAL SECURITY NUMBER |

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

1C. APPLICANT'S DAYTIME TELEPHONE NO. (Including area code) |

4. VA FILE NO. |

|

5. LOCATION OF VA CLAIMS FILE (If known) |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

xc- |

|

|

|

|

|

|

|

|

|

|

|

1D. APPLICANT'S EMAIL ADDRESS (If applicable) |

6. VETERAN'S SERVICE NO. |

|

|

7. VETERAN'S BRANCH OF SERVICE |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

1E. APPLICANT'S DATE OF BIRTH |

|

|

8. DATE OF VETERAN'S DEATH |

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

NOTE: If you are a veteran please complete Items 2A, 2B and 2C. |

|

9. PERIODS OF DECEASED VETERAN'S MILITARY DUTY |

|||||||||||||||||||||

|

2A. BRANCH OF SERVICE |

|

2B. SERVICE NUMBER |

|

|

|

A. FROM |

|

|

|

B. TO |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2C. PERIODS OF SERVICE |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

10A. ARE YOU IN RECEIPT OF VA DEPENDENCY AND INDEMNITY COMPENSATION? |

|

10B. VA CLAIM NUMBER |

|

|

|||||||||||||||||||

|

|

|

|

|

YES |

|

|

|

NO (If "YES," complete Item 10B) |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|||||||||||||||||||

|

11. HAVE YOU PREVIOUSLY APPLIED FOR DETERMINATION OF YOUR |

|

|

12. HAVE YOU PREVIOUSLY RECEIVED A CERTIFICATE OF |

||||||||||||||||||||

|

|

|

|

|

ELIGIBILITY FOR LOAN GUARANTY BENEFITS? |

|

|

|

|

ELIGIBILITY FOR SUCH BENEFITS? |

|

|

||||||||||||

|

|

|

|

|

YES |

|

|

|

NO |

|

|

|

|

|

|

YES |

|

NO |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

13. HAVE YOU PREVIOUSLY SECURED A VA DIRECT, |

14. ADDRESS OF PROPERTY |

|

|

|

|

|

15. VA LOAN NUMBER |

16. DATE OF LOAN |

|

||||||||||||||

|

|

|

|

|

GUARANTEED OR INSURED LOAN? |

|

|

|

|

|

|

|

|

|

|

|

(Month, Year) |

|||||||

|

|

|

|

|

|

|

|

|

|

(If "YES," complete Items 14, 15, |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

YES |

|

|

NO and 16) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. INDICATE WHAT YOU ARE SEEKING A

PURCHASE LOAN

CASH OUT REFINANCE LOAN

INTEREST RATE REDUCTION REFINANCE LOAN

CERTIFICATION: I CERTIFY THAT the above information is true and accurate to the best of my knowledge and belief.

18A. SIGNATURE OF APPLICANT (Unmarried surviving spouse) |

18B. DATE SIGNED |

Federal statutes provide severe penalties for fraud, intentional misrepresentation or criminal connivance or conspiracy to influence the issuance of my guaranty or insurance or the granting of any loan by the Department of Veterans Affairs.

|

|

|

|

|

|

|

PART II - FOR VA USE ONLY |

|

|||

|

|

|

|

|

|

|

SECTION A |

|

|

||

|

|

|

|

Adjudication Officer |

|

|

|

RETURN |

|

Loan Guaranty Officer |

|

|

|

|

|

Department of Veteran Affairs |

|

|

|

|

Department of Veterans Affairs |

|

|

|

TO |

|

|

|

TO |

|

|

||||

|

Regional Office/Center |

|

|

|

|

Regional Office/Center |

|

||||

(Complete |

|

|

|

(After |

|

|

|||||

|

address) |

|

|

|

|

completion of |

|

|

|

||

|

|

|

|

|

|

|

|

Section B) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

The foregoing request for determination of eligibility is |

|

19A. SIGNATURE OF LOAN GUARANTY OFFICER OR DESIGNEE |

19B. DATE SIGNED |

||||||||

forwarded to you for appropriate action and completion |

|

|

|

|

|

|

|

||||

of Section B. |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

SECTION B |

|

|

||

20A. CHECK APPROPRIATE BOX |

|

|

|

|

|

20B. REASON APPLICANT NOT ELIGIBLE |

|

||||

|

|

|

THE ABOVE NAMED DECEASED VETERAN SERVED ON ACTIVE DUTY AS DEFINED IN |

|

|

||||||

|

|

|

|

||||||||

|

|

|

38 U.S.C. 101(21) AND SERVED DURING A PERIOD OF SERVICE SPECIFIED IN 38 U.S. |

|

|

||||||

|

|

|

|

||||||||

|

|

|

C. 3702 AND MEETS THE DEFINITION OF VETERAN AS SPECIFIED IN TITLE 38 |

|

|

||||||

|

|

|

U.S.C. 3701. THE ABOVE NAMED APPLICANT IS RECOGNIZED AS THE UNMARRIED |

|

|

||||||

|

|

|

SURVIVING SPOUSE. |

|

|

|

|

|

|

|

|

|

|

|

APPLICANT IS NOT ELIGIBLE (If checked, complete Item 20B) |

|

|

||||||

21. SIGNATURE |

|

|

22. TITLE |

|

23. DATE |

||||||

DEC 2019 |

|

|

|

|

|

|

Page 1 |

||||

WHICH WILL NOT BE USED. |

|

||||||||||

VA FORM |

|

SUPERSEDES VA FORM |

|

||||||||

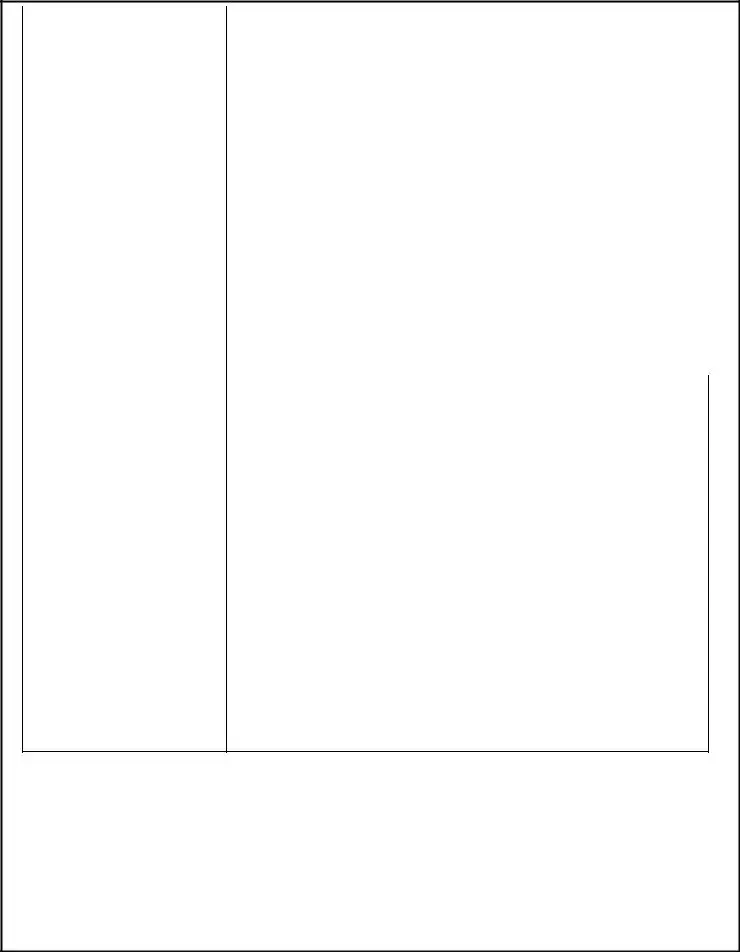

If you live in: |

Please send your completed application to: |

|

|

Georgia, North Carolina, South |

Department of Veterans Affairs |

Carolina, Tennessee |

Atlanta Regional Loan Center |

|

P.O. Box 100023 |

|

Decatur, GA |

Connecticut, Delaware, Indiana, |

Department of Veterans Affairs |

Maine, Massachusetts, Michigan, |

Cleveland Regional Loan Center |

New Hampshire, New Jersey, |

1240 East Ninth Street |

New York, Ohio, Pennsylvania, |

Cleveland, OH 44199 |

Rhode Island, Vermont |

|

|

|

Alaska, Colorado, Idaho, |

Department of Veterans Affairs |

Montana, Oregon, Utah, |

Denver Regional Loan Center |

Washington, Wyoming |

P.O. Box 25126 |

|

Denver, CO 80225 |

Hawaii, Guam, American Samoa |

Department of Veterans Affairs |

Commonwealth of the Northern |

VA Regional Office |

Marianas |

Loan Guaranty Division (26) |

|

459 Patterson Road |

|

Honolulu, HI 96819 |

Arkansas, Louisiana, Oklahoma, |

Department of Veterans Affairs |

Texas |

Houston Regional Loan Center |

|

6900 Almeda Road |

|

Houston, TX |

|

|

Arizona, California, New |

Department of Veterans Affairs |

Mexico, Nevada |

Phoenix Regional Loan Center |

|

3333 N. Central Avenue |

|

Phoenix, AZ |

District of Columbia, Kentucky, |

Department of Veterans Affairs |

Maryland,Virginia, |

Roanoke Regional Loan Center |

West Virginia |

210 Franklin Road, S.W. |

|

Roanoke, VA 24011 |

Illinois, Iowa, Kansas, |

Department of Veterans Affairs |

Minnesota, Missouri, Nebraska, |

St. Paul Regional Loan Center |

North Dakota, South Dakota, |

1 Federal Drive, Ft. Snelling |

Wisconsin |

St. Paul, MN |

|

|

Alabama, Florida, Mississippi, |

Department of Veterans Affairs |

Puerto Rico, U.S. Virgin Islands |

St. Petersburg Regional Loan Center |

|

9500 Bay Pines Boulevard |

|

St. Petersburg, FL 33744 |

PRIVACY ACT INFORMATION: VA will not disclose information collected on this form to any source other than what has been authorized under the Privacy Act of 1974 or Title 38, Code of Federal Regulations 1.576 for routine uses (e.g., to a member of Congress inquiring on behalf of a veteran) as identified in the VA system of records, 55VA26, Loan Guaranty Home, Condominium and manufactured Home Loan Applicant Records, Specially Adapted Housing Applicant Records, and Vendee Loan Applicant Records - VA, published in the Federal Register. Your obligation to respond is required in order to determine the surviving spouse's qualifications for a loan. Giving us your SSN account information is voluntary. VA will not deny an individual benefits for refusing to provide his or her SSN unless the disclosure of the SSN is required by a Federal Statute of law in effect prior to January 1, 1975, and still in effect.

RESPONDENT BURDEN: We need this information to determine a surviving spouse's qualifications for a

VA FORM |

Page 2 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | Form VA 26-1817 is used to determine the loan guaranty eligibility for unmarried surviving spouses of veterans who died from service-connected causes. |

| OMB Approval | The form is approved by the Office of Management and Budget with the number 2900-0055. |

| Completion Time | Applicants generally spend about 15 minutes completing this form. |

| Expiration Date | The current version of the form expired on December 31, 2022. |

| Eligibility Conditions | Unmarried surviving spouses may qualify for benefits unless they remarry before age 57, in which case they might still be eligible. |

| Legal Reference | The form is governed by 38 U.S.C. § 3702, which outlines eligibility for VA-guaranteed loans. |

| Submission Guidance | Completed applications must be sent to the appropriate VA Regional Loan Center designated for the applicant's state of residence. |

Guidelines on Utilizing Va 26 1817

Filling out the VA Form 26-1817 is a straightforward process. This form is essential for unmarried surviving spouses of veterans applying for loan guaranty eligibility. Gather all necessary information before starting to ensure an efficient completion. Once the form is filled out, send it to the appropriate address based on your location as indicated on the form.

- Provide Applicant Information: Fill in your full name, address, Social Security number, daytime phone number, email address (if applicable), and date of birth.

- Fill in Veteran Information: Enter the veteran's full name, date of birth, and Social Security number.

- Complete Service Details: If applicable, provide the veteran's service number, branch of service, and periods of military duty.

- Answer VA Dependency Compensation Question: Indicate whether you receive VA Dependency and Indemnity Compensation by checking 'Yes' or 'No'.

- Previous Applications: Answer questions about any prior applications for eligibility determination and whether you have received a certificate of eligibility.

- Loan Information: If applicable, provide details about any VA direct, guaranteed, or insured loans, including property address and loan number.

- Specify Loan Purposes: Check the appropriate box for what you are seeking a VA-guaranteed home loan for (purchase, cash-out refinance, or interest rate reduction refinance).

- Certification: Sign and date the form, certifying that all provided information is accurate.

After completing the form, review all information for accuracy. Ensure that all required sections are filled out. Once you're satisfied, send the form to the designated VA regional loan center based on your state to initiate the eligibility process.

What You Should Know About This Form

What is the purpose of VA Form 26-1817?

VA Form 26-1817 is used to determine the eligibility of unmarried surviving spouses of veterans for loan guaranty benefits. If your spouse's death was service-connected, you must complete this form to apply for home loan benefits. It's important to read any accompanying instructions carefully to ensure your application is filled out correctly.

Who should complete the VA Form 26-1817?

This form should be filled out by unmarried surviving spouses of veterans. If you are applying for home loan benefits and have not remarried (or you remarried after the age of 57), you need to complete this form. Conversely, if you are requesting the restoration of a benefit that has already been used, you should use VA Form 26-1880 instead.

What information is required on the form?

You will need to provide various types of information, including your name, contact details, and social security number. Additionally, you must include information about the veteran, such as their full name, date of birth, social security number, and branch of service, along with details regarding their military service. The form also asks whether you currently receive any VA benefits or have previously applied for loan guaranty eligibility.

Where do I send my completed VA Form 26-1817?

Your completed application should be sent to the appropriate regional loan center based on your location. Each state is assigned a specific center, so it's essential to check the instructions provided on page 2 of the form for the correct mailing address. This ensures your application is processed in a timely manner.

What happens after I submit the form?

After you submit the form, it will be reviewed by the VA. An adjudication officer will assess your eligibility based on the information you provided, and you will receive a response regarding your application. Keep an eye on your mail or email for any updates or requests for additional information from the VA.

Common mistakes

Filling out the VA Form 26-1817 can be a complicated process. Several common mistakes often occur, which may delay the application or lead to denial of benefits.

Many individuals neglect to read the instructions carefully before beginning the application. Understanding the specific requirements outlined in the instructions can help avoid unnecessary errors. For instance, some applicants are unaware that the form is exclusively for unmarried surviving spouses of veterans whose deaths were service-connected. Failure to recognize this can result in submitting the wrong form altogether.

Another mistake is incorrect entry of personal information. Applicants must ensure that their names, social security numbers, and other critical details are accurately filled out. A simple typo can lead to complications, especially in verifying identity against federal records. Furthermore, not providing a daytime telephone number can hinder the processing of the application, as VA representatives may not be able to contact the applicant for clarifications.

In addition, some applicants skip the section where they must indicate whether they have applied for benefits before. The responses to questions about previous applications or eligibility certificates can significantly impact the review process. Consistency and transparency in this section are vital.

Understanding the context of eligibility is essential. Misunderstandings often arise regarding previous marriages. If a surviving spouse has remarried, even if the marriage was after the age of 57, they may still need to confirm their eligibility status, but some fail to do so. Ensuring the marriage is recognized by relevant authorities also is crucial.

A further common oversight is to bypass the certification section, where applicants must certify that the information provided is true to the best of their knowledge. Failure to sign this section can lead to automatic rejection of the application.

Inaccuracies concerning the veteran's information are also frequent. For instance, applicants must provide the veteran's date of birth and Social Security number correctly. Missing or incorrect details can complicate the verification process, leading to delays.

Poor organization is another issue. Collecting all necessary documents and information before starting can prevent frustration and errors during the filling process. Many applicants do not prepare adequately and, as a result, they miss critical data which can lead to incomplete applications.

Not addressing the submission requirements appropriately is also important. Failing to send the completed application to the proper VA regional office can result in unnecessary delays. Each region has specific addresses for submissions, and applicants must ensure they follow these guidelines.

Lastly, missing the deadline for submitting the application can jeopardize eligibility. It is critical to check the expiration date of the form being filled out, as submitting an outdated form can lead to automatic disqualification. Keeping track of dates and requirements is essential for ensuring timely completion.

Documents used along the form

The VA Form 26-1817 is a crucial document for unmarried surviving spouses seeking home loan benefits through the Department of Veterans Affairs. It is often used alongside other forms and documents to ensure a smooth application process. Here is a list of related documents you may encounter.

- VA Form 26-1880: This form is requested for a Certificate of Eligibility for veterans or their survivors. It helps establish eligibility for the VA home loan program.

- VA Form 21-534EZ: This simplified application form is for survivors of veterans seeking Dependents’ Indemnity Compensation (DIC) or other VA benefits.

- VA Form 21-4192: This is the Request for Employment Information in Connection with Claim for Disability Benefits. It can support claims for compensation or benefits.

- DD Form 214: Also known as the Certificate of Release or Discharge from Active Duty, this document proves a veteran's military service and is often required for VA benefits.

- VA Form 21-526EZ: This form serves as the application for disability compensation and related benefits for veterans and sometimes their dependents.

- VA Form 21-22: This is the Appointment of Veterans Service Organization as Claimant's Representative. It allows designated organizations to assist with claims.

- VA Form 21P-534: This application assists survivors in claiming benefits related to the death of a veteran when inquiries about different types of survivor benefits arise.

- VA Form 26-4514: This is the Application for Home Loan Benefits for relatives of deceased veterans. It provides further assistance in the home loan process.

Understanding these documents can make it easier for unmarried surviving spouses to navigate the application process for VA home loan benefits. Each form serves a specific purpose and is designed to help manage different aspects of a survivor's claim. Proper preparation and submission of the necessary forms can lead to a successful outcome.

Similar forms

The VA Form 26-1817 primarily focuses on determining eligibility for home loan benefits for unmarried surviving spouses of veterans. Other forms share similar purpose and structure. Here are six documents that are comparable:

- VA Form 26-1880: This form is used to request a Certificate of Eligibility for veterans, similar to how the 26-1817 assesses eligibility for surviving spouses.

- VA Form 21-530: This document assists in applying for burial benefits for veterans. Like the 26-1817, it connects to the veteran’s service and the applicant’s relationship with them.

- VA Form 21-534: Spouses or children use this form to apply for Dependency and Indemnity Compensation (DIC). It also requires information about the veteran and establishes financial claims.

- VA Form 21-8416: This form is for claiming reimbursement for qualified medical expenses for dependents of veterans. It includes the veteran’s information and is aimed at benefiting the family.

- VA Form 28-1900: This is a request for vocational rehabilitation and employment for veterans. The form evaluates eligibility based on the veteran’s service and family situation, analogous to the 26-1817.

- VA Form 21-4142: This document serves as a release for information to obtain medical records needed for veterans’ claims. It connects the veteran’s service to the benefits sought, much like the 26-1817.

Dos and Don'ts

When filling out the VA Form 26-1817, there are key dos and don'ts to remember. Following these guidelines can help ensure a smooth application process.

- Do carefully read all instructions before starting the form.

- Do provide accurate information, especially personal details like Social Security numbers and addresses.

- Do complete all required fields to avoid delays in processing.

- Do submit the form to the correct regional loan center listed for your state.

- Do keep a copy of the completed form for your records.

- Don't skip questions; detailed answers may be necessary for eligibility determination.

- Don't use correction fluid or erase any mistakes; instead, neatly cross them out and write the correct information above them.

- Don't assume your marital status is recognized without checking the specific requirements laid out by the VA.

- Don't forget to sign and date the form before submission.

Paying attention to these guidelines can help streamline your application and reduce the chances of delays or complications. Completing forms like the VA Form 26-1817 accurately is essential for accessing the benefits you deserve.

Misconceptions

- Misconception 1: The form is only for married spouses.

- Misconception 2: Filling out the form guarantees loan approval.

- Misconception 3: All surviving spouses are eligible regardless of age or marital status.

- Misconception 4: There is no need to check the application status after submission.

- Misconception 5: The personal information shared does not have privacy implications.

- Misconception 6: The time to complete the form is insignificant.

This form is specifically designed for unmarried surviving spouses of veterans whose death was service-connected. Therefore, it is incorrect to presume that only married spouses can apply.

Submitting VA Form 26-1817 does not guarantee that an applicant will receive loan benefits. The form is merely a request for determining eligibility, which the VA will review separately.

While some surviving spouses may retain benefits after remarrying at age 57 or older, eligibility can depend on various factors including age and circumstances of marriage or remarriage.

This is a misconception. Applicants should follow up on their application status after sending in the form, as processing times may vary and prompt communication is important.

Privacy is a critical concern when filling out government forms. The VA commits to protecting the personal information of applicants as dictated by the Privacy Act of 1974, but applicants should always be cautious with their sensitive information.

Although the VA estimates that it will take around 15 minutes to complete the form, individuals should recognize that gathering required information may take additional time. Careful preparation is essential for accuracy.

Key takeaways

Form VA 26 1817 is specifically for unmarried surviving spouses applying for home loan benefits due to a veteran's service-connected death.

Before starting, it is crucial to read the Privacy Act information and understand the respondent burden related to the form.

The completed form must be sent to the appropriate address based on the state of residence, which is listed on page 2 of the document.

Eligibility may be affected by prior marital status; ensure to check the rules regarding remarriage and benefits.

Accurate personal and veteran details are required, including Social Security numbers and dates of birth.

Certification at the end of the form confirms the truthfulness of the entered information and carries severe penalties for fraud or misrepresentation.

Browse Other Templates

Qr7 Form - Notify any changes in child support amounts that affect your status.

Lic Online - This form is confidential, ensuring that all information remains private and secure.

Eyemed Out of Network Claim Form - All sections of the claim form must be filled out completely to avoid delays in payment.