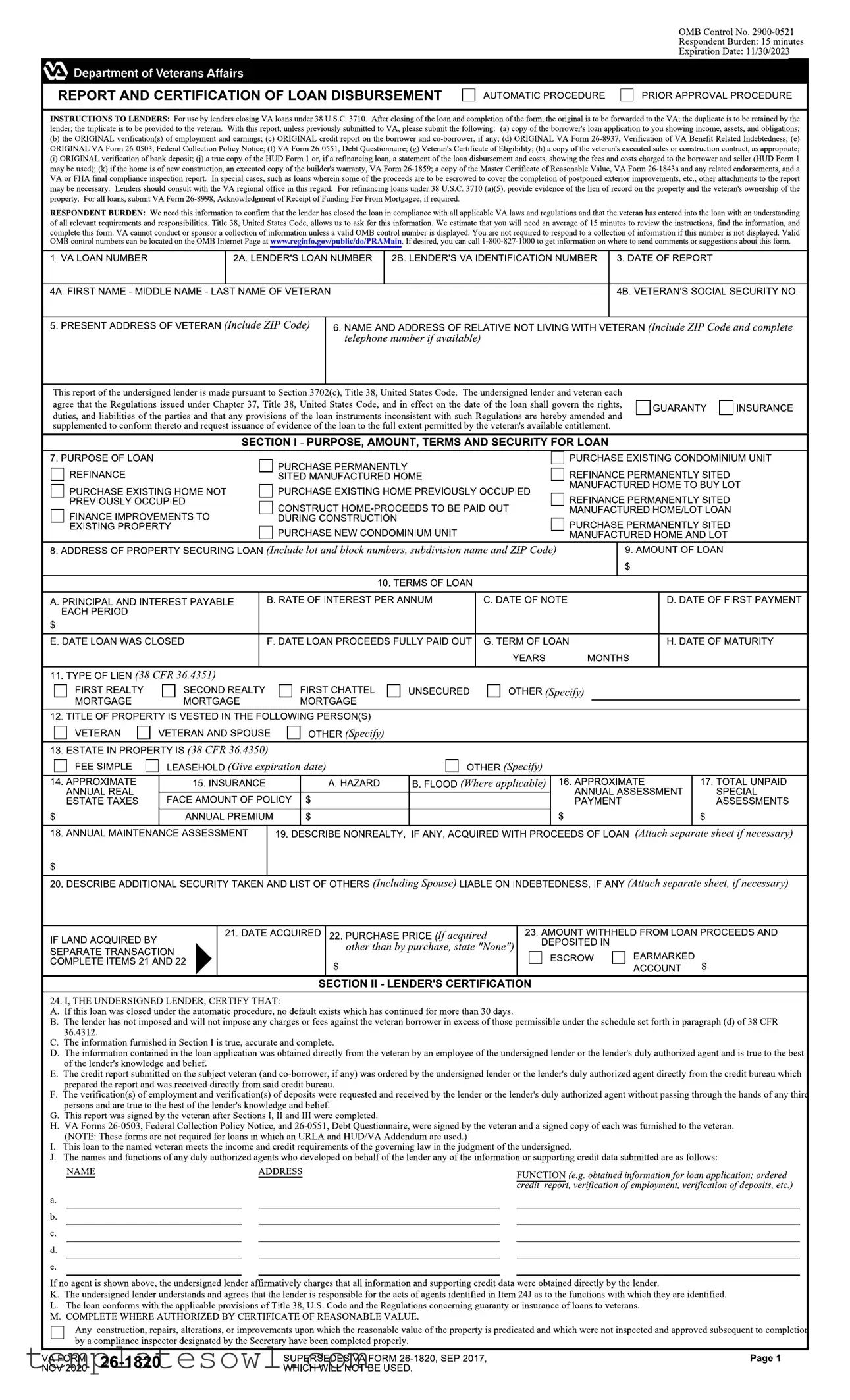

Fill Out Your Va 26 1820 Form

The VA Form 26-1820, also known as the Report and Certification of Loan Disbursement, plays a crucial role in the management of loans backed by the U.S. Department of Veterans Affairs. This form is mandated for lenders who close VA loans according to 38 U.S.C. 3710. It serves multiple purposes, ensuring that all parties comply with relevant regulations and that the veteran is informed about their responsibilities within the loan agreement. Upon closure of the loan, the lender is required to forward the original form to the VA while retaining a duplicate for their records and providing a triplicate to the veteran. The form also necessitates the submission of various supporting documentation, which could include the loan application, verification of employment and earnings, credit reports, and evidence of the veteran's eligibility. With an estimated respondent burden of just 15 minutes, lenders must carefully fill out important details such as the loan amount, terms, and property information. The form ensures that the loan is executed within the guidelines of applicable VA policies, creating a framework for accountability and clarity between lenders and veterans. In instances where clarification or additional information is necessary, the VA regional office serves as a resource for lenders, emphasizing the importance of compliance and thoroughness in the loan disbursement process.

Va 26 1820 Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The VA Form 26-1820 is used by lenders to report and certify loan disbursement for loans closed under Section 3710 of Title 38, U.S. Code, ensuring compliance with VA regulations. |

| Expiration Date | This form is set to expire on 11/30/2023, after which lenders will need to use an updated version for VA loans. |

| Respondent Burden | Completing this form requires an estimated 15 minutes of the lender’s time to review instructions, gather required information, and fill out the necessary fields. |

| Required Documentation | Lenders must submit various documents, such as the borrower’s loan application, credit report, and verification of employment, along with the completed VA Form 26-1820. |

Guidelines on Utilizing Va 26 1820

After properly filling out the VA Form 26-1820, it should be submitted as directed, with required attachments included. Make sure to keep a copy for your records, as this ensures confirmation of the loan disbursement process.

- Start by entering the VA Loan Number in the designated box.

- Input the Lender's Loan Number in section 2A.

- In section 2B, fill in the Lender's VA Identification Number.

- Provide the Date of Report in section 3.

- Enter the First Name, Middle Name, and Last Name of the Veteran in section 4A.

- Fill in the Present Address of Veteran, including ZIP Code.

- Complete section 4B with the Veteran's Social Security Number.

- In section 6, list the Name and Address of a Relative not Living with the Veteran, including phone number if available.

- Select the Purpose of Loan from the provided options in section 7.

- Input the Address of Property Securing Loan in section 8.

- Specify the Amount of Loan in section 9.

- Fill in the details for Terms of Loan and associated dates in section 10.

- Indicate the Type of Lien in section 11.

- Complete the Title of Property in section 12.

- Specify the Estate in Property in section 13.

- Estimate the Approximate Annual Real Estate Taxes in section 14.

- Provide insurance coverage details in section 15.

- List the Total Unpaid Special Assessments in section 17.

- Enter the Annual Maintenance Assessment in section 18.

- Describe any Non-Reality Acquired with Proceeds of Loan in section 19.

- Detail any Additional Security Taken in section 20.

- If applicable, complete items 21 and 22 regarding land acquired.

- Transfer the Date Acquired and Purchase Price information to sections 21 and 22.

- Specify any Amount Withheld from Loan Proceeds and Deposited in Escrow in section 23.

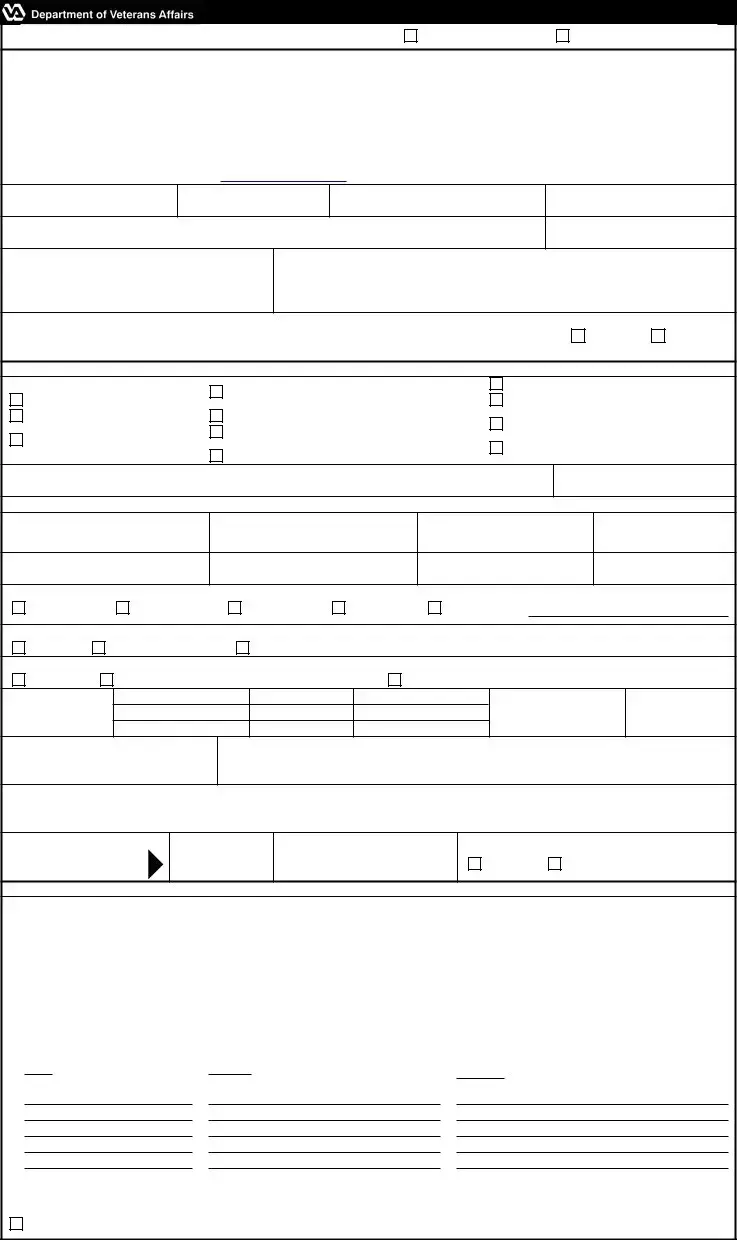

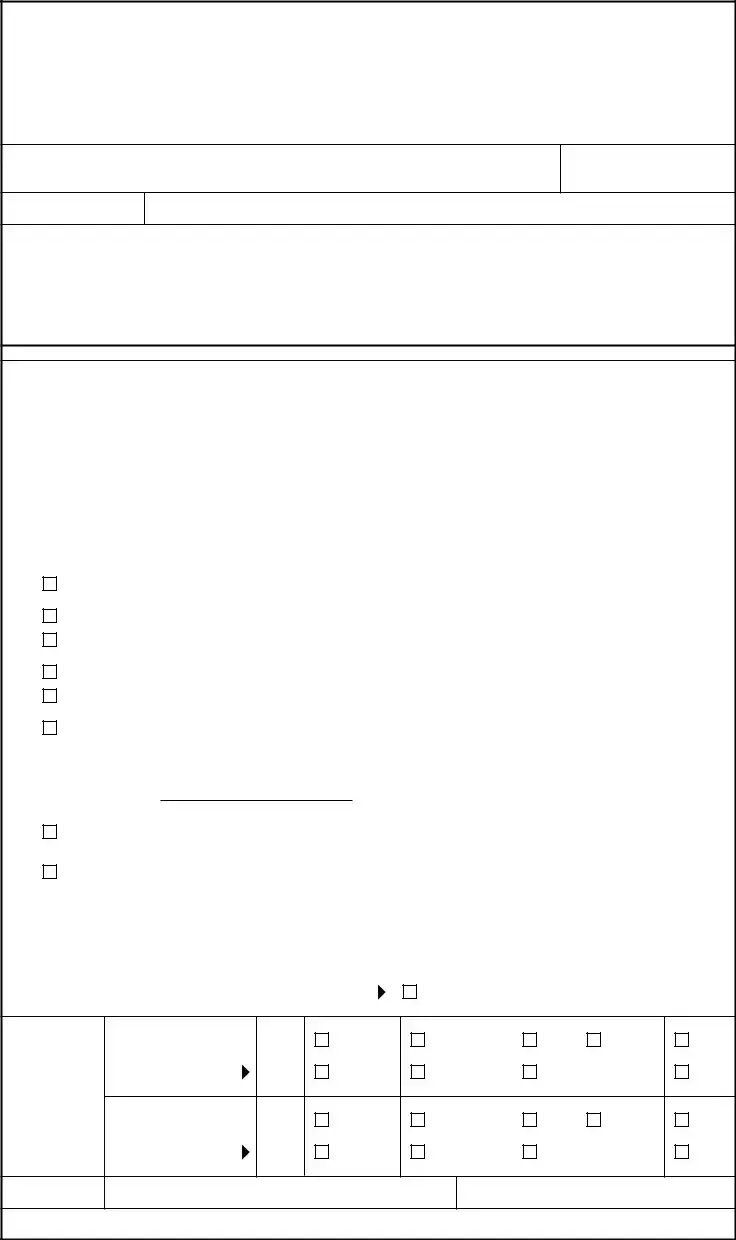

- In section 24, the lender must provide certifications regarding the loan closure and paperwork accuracy.

- Finally, fill out section 25 with the Name and Address of Lender and Telephone Number.

- Sign and date the authorization in section 26.

What You Should Know About This Form

What is the purpose of the VA Form 26-1820?

The VA Form 26-1820, also known as the Report and Certification of Loan Disbursement, is a key document used by lenders when closing VA loans under 38 U.S.C. 3710. This form serves to confirm that the transaction is compliant with all relevant regulations and to verify that the veteran has an understanding of the loan's terms and conditions. It helps ensure accountability for both the lender and the veteran by validating that the needed documentation and information have been collected and submitted appropriately.

What documents must be submitted with VA Form 26-1820?

When submitting the VA Form 26-1820, lenders need to include several important documents to provide a comprehensive overview of the loan transaction. These documents typically include a copy of the borrower's loan application, original employment and earnings verification, the original credit report, the veteran's Certificate of Eligibility, and any relevant forms regarding VA benefit-related indebtedness. Additional documents may also be required depending on the specifics of the loan, such as contracts, bank verifications, or builder warranties, especially for new constructions.

How long does it take to complete VA Form 26-1820?

Completing the VA Form 26-1820 generally requires about 15 minutes. This estimation includes reviewing the instructions, gathering the necessary information, and filling out the form itself. While this is a reasonable time frame, individuals should also prepare for any additional time that might be needed to collect accompanying documentation and ensure all elements are accurately reported.

What happens after submitting the VA Form 26-1820?

Once the VA Form 26-1820 is completed and submitted, the original document is sent to the VA, while the lender retains a duplicate for their records. The triplicate copy is given to the veteran for their reference. The information is then reviewed by the VA to ensure compliance with relevant laws and regulations. If everything is in order, this process helps facilitate the release of loan disbursement, ensuring that the veteran’s borrowing needs are appropriately met.

Common mistakes

Filling out the VA Form 26-1820 can be a straightforward process, but many people make errors that can lead to delays or complications. One common mistake is failing to provide complete and accurate contact information for the veteran. This includes not only the veteran's name but also their full address, including ZIP code, and Social Security number. Incomplete information can slow down the processing time and create unnecessary hurdles.

Another frequent error occurs when the purpose of the loan is not specified correctly. The box that indicates the purpose of the loan must accurately reflect the veteran's intentions, whether it's refinancing, purchasing a new home, or financing improvements. An incorrect designation could lead to compliance issues down the line.

People often overlook the requirement of submitting supporting documentation alongside the form. Essential documents like the verification of employment and income, as well as credit reports, must be provided. Missing these documents can lead to rejection of the loan application. It's crucial to read the checklist carefully and ensure all necessary materials are included before submission.

Lastly, signing the form is a critical step that can easily be forgotten. The lender and veteran must each sign the form once completed. Without the necessary signatures, the entire application may be deemed invalid, leading to further delays. Remember, thorough checks before submission can save a lot of time and effort in the long run.

Documents used along the form

When you are preparing to close a VA loan using the VA Form 26-1820, there are several other forms and documents that you may need to complete and submit. Each of these forms serves a distinct purpose and helps ensure that the loan process adheres to all applicable regulations. Here are some of the most important documents commonly used alongside the VA Form 26-1820:

- VA Form 26-8937, Verification of VA Benefit Related Indebtedness: This form verifies any outstanding indebtedness related to VA benefits that the veteran may have. It's essential for assessing a veteran's financial obligations.

- VA Form 26-0503, Federal Collection Policy Notice: This document informs the veteran of their obligations under federal collection regulations and must be signed by the veteran. It ensures that they are aware of the potential consequences of non-payment.

- VA Form 26-0551, Debt Questionnaire: This form collects information about the veteran's existing debts and financial obligations. Lenders need this information to evaluate the veteran's creditworthiness and ability to repay the loan.

- VA Form 26-1843a, Master Certificate of Reasonable Value: Used primarily for new construction loans, this form establishes the reasonable value of a property based on an appraisal. It is critical during the approval process for loans involving new builds.

- HUD Form 1, Settlement Statement: Often required in real estate transactions, the HUD Form 1 details all the closing costs associated with the loan. This document provides clarity on fees and ensures that both parties understand the financial aspects of the loan disbursement.

Having these documents prepared and correctly filled out will facilitate a smoother loan closing process and help ensure that all parties fulfill their obligations. It is always beneficial to double-check that all necessary paperwork is complete and accurate before submission, as this can prevent delays and additional complications.

Similar forms

The VA Form 26-1820 is a key document in the process of securing a loan through the Department of Veterans Affairs. Several other forms serve similar purposes in the realm of loan processing and reporting. Below is a list of six documents that share similarities with the VA 26-1820 form, along with explanations of how they relate:

- VA Form 26-8937: This form verifies the veteran's benefit-related indebtedness. Just as the 26-1820 seeks to confirm relevant information for the loan disbursement process, the 8937 provides crucial financial data to the lender about the veteran's existing obligations.

- VA Form 26-0503: Known as the Federal Collection Policy Notice, this form informs the veteran of the collection policies applicable to their loan. Similar to the 26-1820, it establishes essential terms and conditions that must be understood by all parties involved in the loan process.

- VA Form 26-0551: This Debt Questionnaire helps in assessing the overall financial health of the veteran. It complements the 26-1820 by gathering more information about the borrower’s liabilities, thus ensuring the lender has a full picture of the veteran's financial situation.

- HUD Form 1: This form details the settlement costs and fees associated with the loan. Much like the 26-1820, which records disbursement information, the HUD Form 1 consolidates fees and expenses, essential for transparency in financial transactions.

- VA Form 26-1859: This form serves as a builder's warranty for new constructions financed with a VA loan. It links closely to the 26-1820 since both documents ensure the lender that all aspects of the loan and property construction meet regulatory requirements.

- VA Form 26-1843a: The Master Certificate of Reasonable Value helps determine the property's appraisal value. Together with the 26-1820, this form ensures that the loan amount aligns with the property’s worth, which is crucial for protecting all parties involved.

Each of these documents plays a significant role in various steps of the loan process, providing necessary information, supporting compliance, and facilitating a smooth transaction for veterans seeking financial assistance.

Dos and Don'ts

When filling out the VA Form 26-1820, it is crucial to follow certain guidelines to ensure the process runs smoothly. Here is a list of what to do and what to avoid:

- Do: Carefully read all instructions provided with the form to ensure full understanding.

- Do: Double-check all entries for accuracy before submitting the form.

- Do: Gather all necessary documents listed in the instructions to support your submission.

- Do: Include the veteran's personal information, such as social security number and contact details, clearly.

- Do: Ensure that signatures are obtained where necessary, especially from the veteran.

- Do: Submit the completed form before the expiration date to avoid delays.

- Don't: Rush through the form; this can lead to mistakes and omissions.

- Don't: Use abbreviations or shorthand that may confuse the reviewers.

- Don't: Leave any required sections blank, as this will result in processing delays.

- Don't: Forget to keep a copy of the submitted form for your records.

- Don't: Ignore specific documentation requirements based on loan types or circumstances.

- Don't: Submit the form without confirming that all information is complete and up-to-date.

Misconceptions

Misconceptions surrounding the VA Form 26-1820 can lead to misunderstandings about its purpose and requirements. Here are six common misconceptions:

- The form is only for new loans. Many believe the VA Form 26-1820 is exclusively for new home purchases. In reality, this form is also essential for refinancing loans, providing crucial information about the loan disbursement process.

- Veterans cannot see the completed form. Some assume that once the form is filled out, the veteran never sees it. However, the veteran receives a copy for their records, ensuring transparency throughout the loan process.

- The lender submits the form without any input from the borrower. There is a misconception that the lender fills out the form solely on their own. In truth, the information provided includes details directly obtained from the veteran, reinforcing the borrower’s involvement.

- There are no consequences for missing information. Some think that incomplete forms won’t have any repercussions. However, incomplete or inaccurate information can delay the loan process or even lead to denial, making thoroughness essential.

- The form is optional. Many believe that submitting the VA Form 26-1820 is optional for lenders. This is not true; it is a mandatory requirement for VA loan processing, ensuring compliance with regulations.

- Any lender can fill out the form without special authorization. There exists an idea that any lender can submit the form without proper credentialing. In reality, the lender must have the appropriate authorization to handle VA loans, reinforcing the integrity of the process.

Key takeaways

Here are some key takeaways about filling out and using the VA Form 26-1820:

- This form is essential for lenders when closing VA loans under 38 U.S.C. 3710.

- It is required to submit the original form to the VA after completion, while the lender retains a duplicate and provides a triplicate to the veteran.

- The form serves as a certification of loan disbursement and requires documentation such as the borrower's loan application, employment verification, and credit report.

- Lenders must utilize original documents when submitting information, ensuring compliance with VA regulations.

- Timely filing of this form is important; responses should be submitted before the expiration date of 11/30/2023.

- The estimated completion time for the form is approximately 15 minutes, but accurate and thorough information is critical.

- Keep in mind, additional documentation may be necessary for special cases, such as escrowing funds for home improvements or specific refinancing scenarios.

Browse Other Templates

Op-175 - Eligible programs for per session employment are specified in the application.

Fitness Goals Questionnaire - Incorporate emergency prep into fitness planning.

Vendor Additional Insured - This form must be read carefully to understand the coverage modifications it includes.