Fill Out Your Va 26 8320 Form

The VA Form 26-8320 is a crucial component in the mortgage process for veterans, specifically pertaining to the request for a Certificate of Eligibility. This form plays a key role in determining whether veterans qualify for VA-backed home loans, which carry unique benefits such as lower interest rates and no down payment requirements. To ensure a smooth transaction, several documents must be included alongside the VA Form 26-8320 when submitted. These documents include the VA Loan Summary Sheet, a Loan Analysis, and various disclosures related to rates and compliance factors. Each submission must be organized according to a detailed transmittal list to facilitate the review process. Additionally, the form requires documentation of any benefit-related debts, verification of employment, and a completed counseling checklist for servicemembers currently on active duty. By following the established guidelines and providing all necessary documents, veterans can streamline their request for financing and unlock the opportunities available through the VA loan program.

Va 26 8320 Example

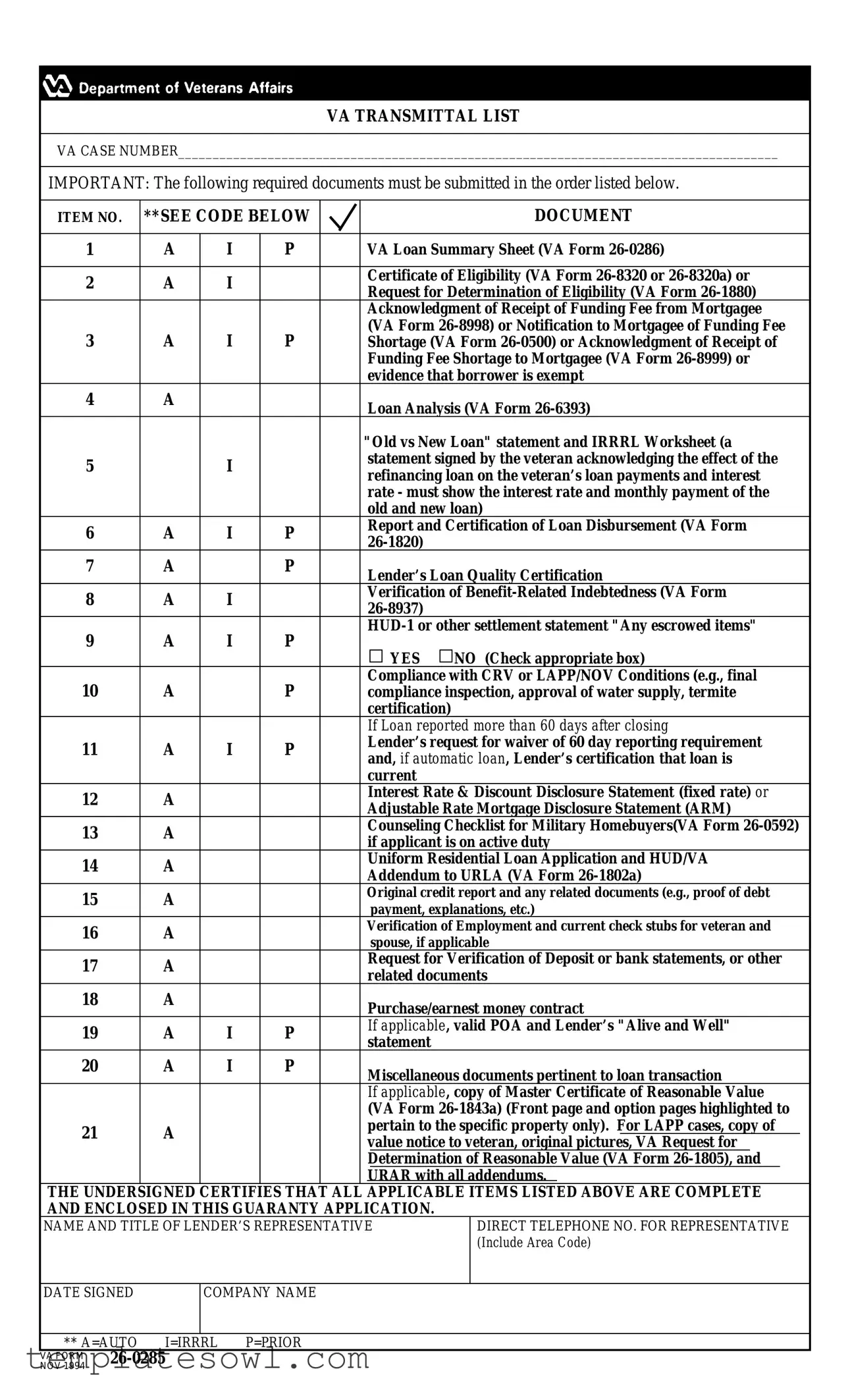

VA TRANSMITTAL LIST

VA CASE NUMBER_______________________________________________________________________________________

IMPORTANT: The following required documents must be submitted in the order listed below.

ITEM NO. |

**SEE CODE BELOW |

|

|

|

|

DOCUMENT |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

A |

I |

P |

|

|

VA Loan Summary Sheet (VA Form |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

A |

I |

|

|

|

Certificate of Eligibility (VA Form |

|||||||

|

|

|

Request for Determination of Eligibility (VA Form |

||||||||||

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

Acknowledgment of Receipt of Funding Fee from Mortgagee |

|||||||

3 |

A |

I |

P |

|

|

(VA Form |

|||||||

|

|

Shortage (VA Form |

|||||||||||

|

|

|

|

|

|

Funding Fee Shortage to Mortgagee (VA Form |

|||||||

|

|

|

|

|

|

evidence that borrower is exempt |

|||||||

4 |

A |

|

|

|

|

Loan Analysis (VA Form |

|||||||

|

|

|

|

|

|

||||||||

|

|

|

|

|

"Old vs New Loan" statement and IRRRL Worksheet (a |

||||||||

5 |

|

I |

|

|

|

statement signed by the veteran acknowledging the effect of the |

|||||||

|

|

|

|

refinancing loan on the veteran's loan payments and interest |

|||||||||

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

rate - must show the interest rate and monthly payment of the |

|||||||

|

|

|

|

|

|

old and new loan) |

|||||||

6 |

A |

I |

P |

|

|

Report and Certification of Loan Disbursement (VA Form |

|||||||

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||

7 |

A |

|

P |

|

|

Lender's Loan Quality Certification |

|||||||

|

|

|

|

|

|

||||||||

8 |

A |

I |

|

|

|

Verification of |

|||||||

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|||

9 |

A |

I |

P |

|

|

||||||||

|

|

|

YES |

NO (Check appropriate box) |

|||||||||

|

|

|

|

|

|

|

|||||||

10 |

A |

|

P |

|

|

Compliance with CRV or LAPP/NOV Conditions (e.g., final |

|||||||

|

|

|

compliance inspection, approval of water supply, termite |

||||||||||

|

|

|

|

|

|

certification) |

|

|

|

|

|

|

|

|

|

|

|

|

|

If Loan reported more than 60 days after closing |

|||||||

11 |

A |

I |

P |

|

|

Lender's request for waiver of 60 day reporting requirement |

|||||||

|

|

and, if automatic loan, Lender's certification that loan is |

|||||||||||

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

current |

|

|

|

|

|

|

|

12 |

A |

|

|

|

|

Interest Rate & Discount Disclosure Statement (fixed rate) or |

|||||||

|

|

|

|

Adjustable Rate Mortgage Disclosure Statement (ARM) |

|||||||||

|

|

|

|

|

|

||||||||

13 |

A |

|

|

|

|

Counseling Checklist for Military Homebuyers(VA Form |

|||||||

|

|

|

|

if applicant is on active duty |

|||||||||

|

|

|

|

|

|

||||||||

14 |

A |

|

|

|

|

Uniform Residential Loan Application and HUD/VA |

|||||||

|

|

|

|

Addendum to URLA (VA Form |

|||||||||

|

|

|

|

|

|

||||||||

15 |

A |

|

|

|

Original credit report and any related documents (e.g., proof of debt |

||||||||

|

|

|

|

|

payment, explanations, etc.) |

||||||||

|

|

|

|

|

|

|

|||||||

16 |

A |

|

|

|

Verification of Employment and current check stubs for veteran and |

||||||||

|

|

|

|

|

spouse, if applicable |

||||||||

|

|

|

|

|

|

|

|||||||

17 |

A |

|

|

|

|

Request for Verification of Deposit or bank statements, or other |

|||||||

|

|

|

|

related documents |

|||||||||

|

|

|

|

|

|

||||||||

18 |

A |

|

|

|

|

Purchase/earnest money contract |

|||||||

|

|

|

|

|

|

||||||||

19 |

A |

I |

P |

|

|

If applicable, valid POA and Lender's "Alive and Well" |

|||||||

|

|

statement |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

||

20 |

A |

I |

P |

|

|

Miscellaneous documents pertinent to loan transaction |

|||||||

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

If applicable, copy of Master Certificate of Reasonable Value |

|||||||

|

|

|

|

|

|

(VA Form |

|||||||

21 |

A |

|

|

|

|

pertain to the specific property only). For LAPP cases, copy of |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

value notice to veteran, original pictures, VA Request for |

|||||||||

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

Determination of Reasonable Value (VA Form |

||||||||

|

|

|

|

|

|

|

URAR with all addendums. |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

THE UNDERSIGNED CERTIFIES THAT ALL APPLICABLE ITEMS LISTED ABOVE ARE COMPLETE |

|||||||||||||

AND ENCLOSED IN THIS GUARANTY APPLICATION. |

|

|

|

|

|

|

|||||||

NAME AND TITLE OF LENDER'S REPRESENTATIVE

DIRECT TELEPHONE NO. FOR REPRESENTATIVE

(Include Area Code)

DATE SIGNED |

|

COMPANY NAME |

|

|

|

** A=AUTO |

I=IRRRL P=PRIOR |

|

VA FORM |

|

NOV 1994 |

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The VA Form 26-8320 is used for processing loan applications involving the Department of Veterans Affairs. |

| Eligibility Documentation | It can serve as a Certificate of Eligibility or Request for Determination of Eligibility. |

| Associated Forms | Along with the VA Form 26-8320, multiple other forms such as VA Form 26-0286 and VA Form 26-6393 are required for submission. |

| Funding Fee Receipt | Acknowledgment of the funding fee must be included. Relevant forms are VA Form 26-8998 and VA Form 26-0500. |

| Compliance Checks | Borrowers must meet Compliance with CRV or LAPP/NOV Conditions, like termite certification and a final compliance inspection. |

| Loan Disbursement Report | The VA Form 26-1820 serves as a report and certification of loan disbursement. |

| Form Updates | This form has undergone revisions, with the latest version released in November 1994. |

| Required Signatures | The lender's representative must certify the completeness of the documents by signing and including contact information. |

| Applicable Laws | This form is governed under Federal laws pertaining to veterans' benefits and housing assistance. |

| Lender's Quality Certification | A Lender's Loan Quality Certification is required to ensure adherence to all loan processing standards. |

Guidelines on Utilizing Va 26 8320

Filling out the VA Form 26-8320 is a crucial step in the process of obtaining a VA loan. This form, along with the required documents, helps ensure that your application meets all necessary criteria. Follow these steps carefully to complete the form accurately and efficiently.

- Start by downloading a copy of the VA Form 26-8320 from the official VA website or obtain a hard copy from your lender.

- At the top of the form, write your VA Case Number. Make sure this number is accurate, as it links your application to your veteran status.

- Review the list of required documentation provided on the form. Ensure you have all necessary documents ready to submit with your form.

- Gather the required documents in the order listed. This might include the VA Loan Summary Sheet, Certificate of Eligibility, and any other relevant paperwork.

- Check each item off the list as you compile your documents to make sure nothing is missing.

- Next, fill in the name and title of the lender's representative.

- Provide the direct telephone number for the representative, including the area code.

- Include the date you are signing the form.

- Finally, write the company name of the lender.

- Review your completed form for accuracy and completeness. Any errors or missing information can delay your loan processing.

- Once everything is checked, submit the VA Form 26-8320 along with your collected documents to the appropriate lender or VA office.

After submitting the form, the lender will process your application. Be prepared to provide any additional information they may request. It's also a good time to familiarize yourself with the next steps in securing your VA loan.

What You Should Know About This Form

What is the VA Form 26-8320?

The VA Form 26-8320, also known as the Certificate of Eligibility, is a crucial document for veterans seeking to secure a VA home loan. This form certifies that a borrower is eligible for VA loan benefits based on their military service and any prior use of VA loans. It establishes the borrower’s entitlement to VA funding and helps lenders determine loan eligibility.

Who needs to fill out the VA Form 26-8320?

Veterans, active-duty service members, and qualifying members of the National Guard and Reserves must complete the VA Form 26-8320 if they wish to obtain a VA loan. It is applicable to individuals who have not previously exhausted their VA loan entitlement or have restored their eligibility after selling a home purchased with a VA loan.

What documents are required to submit with the VA Form 26-8320?

When submitting the VA Form 26-8320, you must include several documents. Key items include the VA Loan Summary Sheet (Form 26-0286), proof of funding fee receipt, a loan analysis (VA Form 26-6393), and other related documents as specified in the VA Transmittal List. Ensure you refer to that list to avoid delays.

How do I obtain a VA Form 26-8320?

You can obtain the VA Form 26-8320 from the Department of Veterans Affairs' website or by contacting your lender. Most lenders also have electronic access to the form, allowing for easier completion and submission during the loan application process.

What should I do if my eligibility is denied?

If your eligible status is denied after submitting the VA Form 26-8320, you can request a reversal by providing additional information or documentation. You may also contact the VA for a more detailed explanation of the denial and guidance on next steps. Reassessing your application can often yield a positive outcome.

Can I submit the VA Form 26-8320 online?

Yes, many lenders allow the submission of the VA Form 26-8320 electronically as part of the loan application package. However, the specific submission method may vary by lender, so it is essential to confirm their preferred process to ensure your application is filed correctly and quickly.

How long does it take to receive a Certificate of Eligibility?

The processing time for the VA Form 26-8320 varies. Typically, if submitted online, you may receive the Certificate of Eligibility within minutes. Paper submissions could take several days to weeks, depending on mail processing times and the current workload at the VA office handling claims.

Is there a cost associated with the VA Form 26-8320?

No, there is no fee for obtaining or submitting the VA Form 26-8320. However, borrowers may need to pay a funding fee, which is typically a small percentage of the loan amount. This fee helps to sustain the VA loan benefit program and can sometimes be financed as part of the loan.

What should I do after receiving my Certificate of Eligibility?

Once you receive your Certificate of Eligibility, review it for accuracy. Keep it for your records and provide it to your lender during the loan application process. Also, ensure all other required documents are assembled to facilitate a smooth loan approval experience. Being proactive can help expedite your home loan journey.

Common mistakes

Filling out the VA Form 26-8320, which is essential for veterans seeking benefits related to home loans, can be a complex task. There are several common errors that applicants often make, and understanding these can help ensure a smoother application process.

One frequent mistake is **not providing all required documents**. The instructions are quite specific about the documentation needed, including forms like the VA Loan Summary Sheet and the Certificate of Eligibility. Leaving out even one document can delay the entire process, and in some cases, derail it completely. Organizing these documents in the order specified can save time and frustration.

Another issue arises with **incorrect or incomplete information** on the application itself. Applicants sometimes misstate their personal information, such as their Social Security number or military service details. Additionally, failing to sign the form can result in immediate rejection, even if the rest of the application is flawless. Double-checking for accuracy before submission is crucial.

Many veterans also forget to **acknowledge the funding fee**. The acknowledgment of receipt of the funding fee from mortgagees is a necessary part of the application. Without this acknowledgment, the application might be rejected or held up while further clarifications are requested.

Some applicants mistakenly believe they can use an older version of the form. Using outdated forms, such as the VA Form 26-0285, can lead to unnecessary complications. Always ensure that you are using the most current version of the form to avoid confusion or rejection.

A very crucial error is not complying with **the specific eligibility requirements** related to benefits. Some veterans may be unaware of their entitlement status or may not provide supporting documents like the Certificate of Eligibility. It’s vital to understand and meet the eligibility criteria for the VA loan program you are applying for.

Lastly, a common oversight is **not keeping copies of submitted documents**. Once the application is submitted, it’s essential to retain a copy of all documents for personal records. This can be invaluable if there are questions or discrepancies later on, ensuring that the applicant has clear records of what was submitted.

By steering clear of these mistakes, individuals can significantly improve their chances of a successful application for VA loans. Attention to detail, thorough preparation, and a clear understanding of the requirements can simplify the entire process and create a more positive experience.

Documents used along the form

The VA 26-8320 form, also known as the Certificate of Eligibility, is an essential document for veterans seeking VA loans. Several other forms and documents are required in conjunction with this form to ensure a smooth application process. Each of these documents plays a crucial role in determining eligibility and processing the loan.

- VA Loan Summary Sheet (VA Form 26-0286): This sheet summarizes the loan details, including the purpose and type of financing, helping to clarify the intent of the application.

- Certificate of Eligibility (VA Form 26-8320 or 26-8320a): Confirms a veteran's eligibility for VA loan benefits, establishing the foundation for securing a mortgage.

- Loan Analysis (VA Form 26-6393): Provides an evaluation of the loan applicant’s financial situation to determine affordability and loan suitability.

- Report and Certification of Loan Disbursement (VA Form 26-1820): Certifies that the funds have been disbursed for the loan, confirming that all necessary funding steps have been completed.

- Uniform Residential Loan Application and HUD/VA Addendum (VA Form 26-1802a): Serves as the main application form, documenting borrower details and the specifics of the loan request.

Each of these additional forms works together to facilitate the loan application process, ensuring all necessary information is collected and verified. Completing them is essential for a seamless experience in securing a VA loan.

Similar forms

The VA Form 26-8320 is an essential document in the process of securing a VA loan. It is closely related to several other forms, which serve similar purposes within the context of mortgage and eligibility verification. Below is a list of ten documents that share similarities with the VA Form 26-8320:

- VA Loan Summary Sheet (VA Form 26-0286): This form summarizes the loan information and terms, providing a concise overview necessary for loan processing.

- Certificate of Eligibility (VA Form 26-8320 or 26-8320a): This document confirms a veteran's eligibility for VA loan benefits, mirroring the purpose of the 26-8320 in establishing qualification.

- Request for Determination of Eligibility (VA Form 26-1880): Similar to the 26-8320, this form is used to assess a borrower's eligibility for VA loan programs, particularly for those who have not previously established it.

- Loan Analysis (VA Form 26-6393): The Loan Analysis provides a comprehensive review of the veteran's financial situation, helping determine the viability of the loan application, akin to what the 26-8320 achieves.

- Report and Certification of Loan Disbursement (VA Form 26-1820): This form confirms that the loan proceeds have been disbursed according to requirements, ensuring the loan's compliance status, similar to the certification aspects in the 26-8320.

- Verification of Benefit-Related Indebtedness (VA Form 26-8937): This document verifies any existing debts associated with the veteran's benefits, which can affect loan approval much like the information sought by the 26-8320.

- Compliance with CRV or LAPP/NOV Conditions: Although it includes various aspects, this compliance document ensures the property meets specific conditions, which is pertinent for loan qualification, similar to the requirements outlined in the 26-8320.

- Interest Rate & Discount Disclosure Statement: This document outlines the specifics of the loan's interest rates and fees, which is vital for borrowers to understand, echoing the financial clarity intended by the 26-8320.

- Uniform Residential Loan Application (VA Form 26-1802a): This application collects essential information regarding the borrower and property, paralleling the data requirements found in the VA Form 26-8320.

- Counseling Checklist for Military Homebuyers (VA Form 26-0592): This checklist ensures that veteran homebuyers receive necessary guidance through the homebuying process, which complements the information and verification process initiated by the 26-8320.

Understanding the function of these documents can enhance clarity in the application process for VA loans, ultimately facilitating better outcomes for veterans seeking home financing.

Dos and Don'ts

When filling out the VA 26 8320 form, it is important to adhere to specific guidelines to ensure a smooth process.

- Do make sure all required documents are gathered and organized in the correct order as listed on the form.

- Do provide accurate information; double-check your entries to minimize mistakes.

- Do sign and date the form. Your signature is essential for the submission to be valid.

- Do keep a copy of the completed form and all submitted documents for your records.

- Don't omit any documents, as missing items can delay the processing of your application.

- Don't use incorrect forms. Make sure you are using the most current version of the VA 26 8320.

- Don't forget to follow up if you do not receive confirmation of your application submission, as it is important to ensure everything is in order.

- Don't rush through the form. Taking your time will help ensure accuracy and completeness.

Misconceptions

Understanding the VA Form 26-8320 is crucial for veterans applying for a loan. Here are five common misconceptions:

- Misconception 1: The VA Form 26-8320 is the only form required for a VA loan.

- Misconception 2: Any document can be submitted in any order.

- Misconception 3: The Certificate of Eligibility is not needed if you have previously used a VA loan.

- Misconception 4: Veterans can ignore the funding fee if they have financial difficulties.

- Misconception 5: The form can be completed without assistance.

In reality, the 26-8320 is part of a larger list of documents needed for the loan process. Other forms, such as the Certificate of Eligibility, are also essential.

This is not true. Documents must be submitted in a specific order as outlined in the transmittal list. Following this order is necessary to ensure timely processing.

This is incorrect. Even if a veteran has used a VA loan before, a valid Certificate of Eligibility must still be submitted to confirm eligibility for the new loan.

Veterans should be aware that the funding fee may still apply unless they meet specific exemption criteria. Ignoring it could affect the loan application.

While it is possible to fill out the form independently, many veterans benefit from guidance. Proper assistance can help avoid mistakes that delay processing.

Clearing up these misconceptions is essential for a smooth loan application process. Make sure to review all requirements carefully.

Key takeaways

Here are key takeaways about filling out and using the VA Form 26-8320:

- Document Order is Crucial: The required documents must be submitted in the specific order listed on the transmittal form.

- Eligibility Confirmation: You can use either VA Form 26-8320 or its alternate VA Form 26-8320a to confirm eligibility for a VA loan.

- Funding Fee Acknowledgment: Include the acknowledgment of receipt of the funding fee from the mortgage lender as part of your submission.

- Loan Analysis Requirement: A loan analysis, specifically the VA Form 26-6393, is necessary to evaluate the benefits of refinancing.

- Compliance with Conditions: Ensure all compliance conditions such as final inspections and certifications are met and documented.

- Interest Rate Disclosure: Provide either a fixed-rate interest disclosure statement or an adjustable-rate mortgage disclosure statement, as applicable.

- Complete Certification: The lender’s representative must certify that all items are complete before submission, ensuring a streamlined processing of the application.

Browse Other Templates

Fl-303 Instructions - Failure to complete the form correctly may result in delays in legal proceedings.

Jic Fittings - The primary function of the 14 03 0595 form is to report any changes in property value.