Fill Out Your Va 26 8923 Form

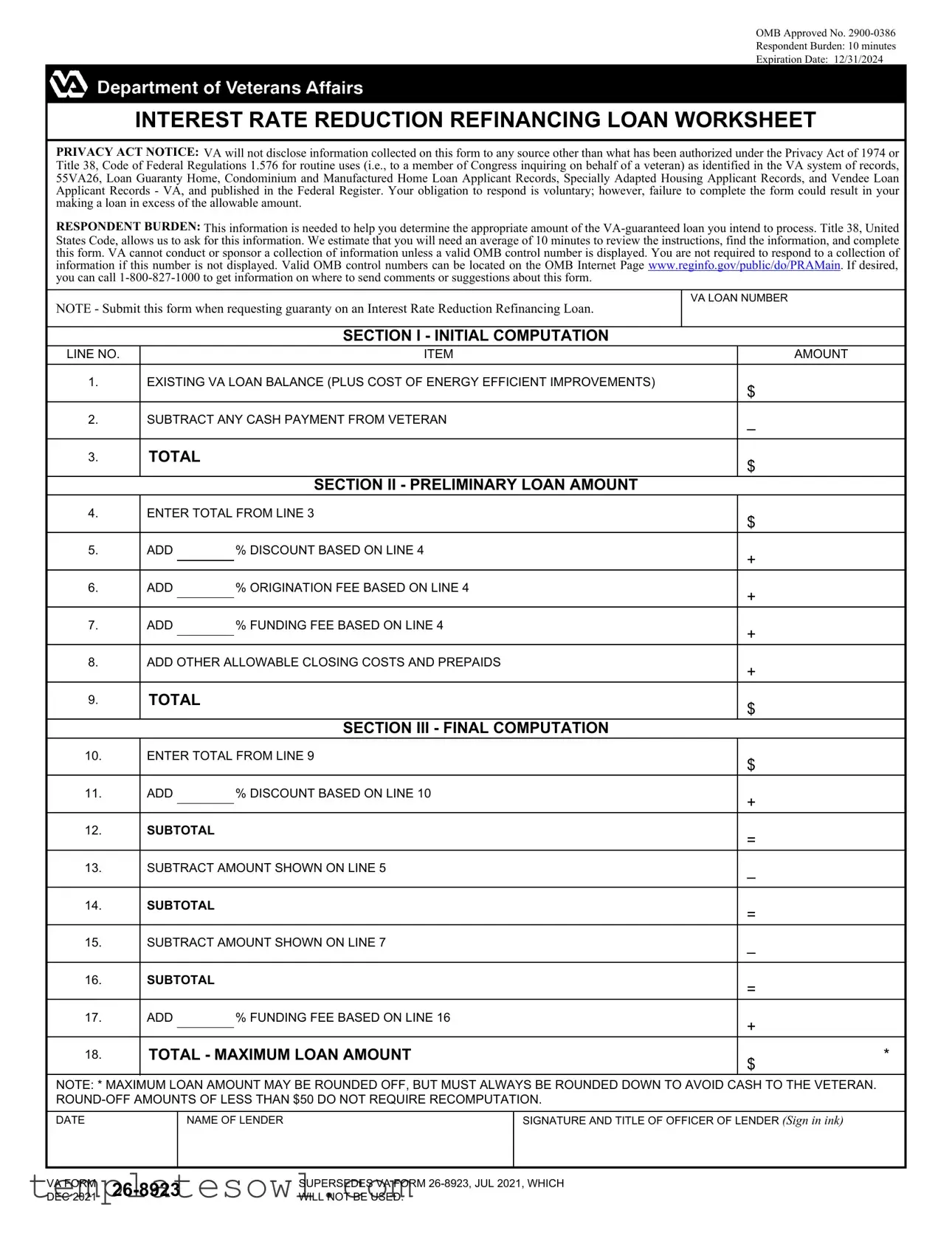

The VA Form 26-8923 serves an essential role in the process of obtaining an Interest Rate Reduction Refinancing Loan (IRRRL). This form, officially titled the Interest Rate Reduction Refinancing Loan Worksheet, is used to help borrowers determine the appropriate amount of their VA-guaranteed loan. Completing this form is important, as it ensures that the loan does not exceed the allowable amount. You'll find that the form includes various sections for initial computations, preliminary loan amounts, and final calculations, guiding you through each critical step. The entire process typically takes about 10 minutes and is voluntary, but skipping it could lead to potential issues with your loan amount. Furthermore, you can rest assured that your information is safeguarded under the Privacy Act of 1974. As this form is essential for veterans seeking refinancing, understanding its structure and requirements is crucial for successfully navigating the VA loan process. The form must be signed by an authorized lender, ensuring its authenticity and adherence to regulation. Be sure to check the expiration date of 12/31/2024 to stay compliant.

Va 26 8923 Example

OMB Approved No.

Respondent Burden: 10 minutes

Expiration Date: 12/31/2024

INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET

PRIVACY ACT NOTICE: VA will not disclose information collected on this form to any source other than what has been authorized under the Privacy Act of 1974 or Title 38, Code of Federal Regulations 1.576 for routine uses (i.e., to a member of Congress inquiring on behalf of a veteran) as identified in the VA system of records, 55VA26, Loan Guaranty Home, Condominium and Manufactured Home Loan Applicant Records, Specially Adapted Housing Applicant Records, and Vendee Loan Applicant Records - VA, and published in the Federal Register. Your obligation to respond is voluntary; however, failure to complete the form could result in your making a loan in excess of the allowable amount.

RESPONDENT BURDEN: This information is needed to help you determine the appropriate amount of the

NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan.

SECTION I - INITIAL COMPUTATION

VA LOAN NUMBER

LINE NO. |

|

|

ITEM |

AMOUNT |

|

1. |

EXISTING VA LOAN BALANCE (PLUS COST OF ENERGY EFFICIENT IMPROVEMENTS) |

$ |

|

||

|

|

|

|

|

|

2. |

SUBTRACT ANY CASH PAYMENT FROM VETERAN |

– |

|

||

|

|

|

|

|

|

3. |

TOTAL |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

SECTION II - PRELIMINARY LOAN AMOUNT |

|

|

4. |

ENTER TOTAL FROM LINE 3 |

$ |

|

||

|

|

|

|

|

|

5. |

ADD |

% DISCOUNT BASED ON LINE 4 |

+ |

|

|

|

|

|

|

|

|

6. |

ADD |

% ORIGINATION FEE BASED ON LINE 4 |

+ |

|

|

|

|

|

|

|

|

7. |

ADD |

% FUNDING FEE BASED ON LINE 4 |

+ |

|

|

|

|

|

|

|

|

8. |

ADD OTHER ALLOWABLE CLOSING COSTS AND PREPAIDS |

+ |

|

||

|

|

|

|

|

|

9. |

TOTAL |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

SECTION III - FINAL COMPUTATION |

|

|

10. |

ENTER TOTAL FROM LINE 9 |

$ |

|

||

|

|

|

|

|

|

11. |

ADD |

% DISCOUNT BASED ON LINE 10 |

+ |

|

|

|

|

|

|

|

|

12. |

SUBTOTAL |

|

= |

|

|

|

|

|

|

|

|

13. |

SUBTRACT AMOUNT SHOWN ON LINE 5 |

– |

|

||

|

|

|

|

|

|

14. |

SUBTOTAL |

|

= |

|

|

|

|

|

|

|

|

15. |

SUBTRACT AMOUNT SHOWN ON LINE 7 |

– |

|

||

|

|

|

|

|

|

16. |

SUBTOTAL |

|

= |

|

|

|

|

|

|

|

|

17. |

ADD |

% FUNDING FEE BASED ON LINE 16 |

+ |

|

|

|

|

|

|

|

|

18. |

TOTAL - MAXIMUM LOAN AMOUNT |

$ |

* |

||

|

|

|

|

|

|

NOTE: * MAXIMUM LOAN AMOUNT MAY BE ROUNDED OFF, BUT MUST ALWAYS BE ROUNDED DOWN TO AVOID CASH TO THE VETERAN. |

|

||||

|

|

||||

DATE

NAME OF LENDER

SIGNATURE AND TITLE OF OFFICER OF LENDER (Sign in ink)

VA FORM |

SUPERSEDES VA FORM |

|

DEC 2021 |

WILL NOT BE USED. |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The VA Form 26-8923 is used to request guaranty on an Interest Rate Reduction Refinancing Loan. |

| OMB Approval | This form is approved by the Office of Management and Budget (OMB) under number 2900-0386. |

| Respondent Burden | Completing this form is estimated to take about 10 minutes of your time. |

| Expiration Date | The current expiration date for this form is December 31, 2024. |

| Confidentiality | Information on this form is protected by the Privacy Act of 1974. The VA will not disclose this information without authorization. |

| Legal Requirement | Title 38 of the United States Code mandates that this information be collected from veterans. |

| Submission Guidelines | This form must be submitted when seeking a guaranty for an Interest Rate Reduction Refinancing Loan. |

| Notes on Loan Amount | Maximum loan amounts calculated must always be rounded down to prevent cash payouts to the veteran. |

Guidelines on Utilizing Va 26 8923

Once you have gathered all the necessary documents and information, you are ready to complete the VA Form 26-8923. Following these steps will ensure that you fill out the form accurately, facilitating the loan process.

- Obtain the Form: Download or request a copy of the VA Form 26-8923 from the VA website or your lender.

- Section I - Initial Computation:

- Locate the existing VA loan balance. Include any costs for energy-efficient improvements.

- Subtract any cash payment made by the veteran, if applicable.

- Enter the total amount on Line 3.

- Section II - Preliminary Loan Amount:

- Transfer the total from Line 3 to Line 4.

- Calculate the % discount based on Line 4 and add it to the total.

- Add the % origination fee based on Line 4 to the current total.

- Add the % funding fee based on Line 4 to the total amount.

- Include any other allowable closing costs and prepays and calculate the new total.

- Enter this new total on Line 9.

- Section III - Final Computation:

- Transfer the total from Line 9 to Line 10.

- Add the % discount based on Line 10, then calculate and enter this subtotal.

- Subtract the amount shown on Line 5 from the current subtotal.

- Continue to subtract the amount on Line 7 from the new subtotal.

- Add the % funding fee based on the latest subtotal.

- Record the final total as the maximum loan amount on the last line.

- Finalize the Form:

- Include the date.

- Provide the name of the lender.

- Have an officer of the lender sign the form in ink.

What You Should Know About This Form

What is the VA Form 26-8923 used for?

The VA Form 26-8923 is a worksheet required for processing an Interest Rate Reduction Refinancing Loan (IRRRL). You need this form to determine the correct amount of the VA-guaranteed loan you’re applying for. This helps ensure you do not exceed the allowable loan limits.

How long does it take to complete the VA Form 26-8923?

Completing the VA Form 26-8923 typically takes about 10 minutes on average. This time includes reviewing the instructions, gathering required information, and filling out the form accurately.

What information do I need to provide on this form?

You will need to provide information related to your existing VA loan balance, any cash payment you plan to make, and costs associated with energy-efficient improvements. Additionally, you'll need to provide calculations regarding discounts, origination fees, and funding fees, which contribute to the total loan amount.

Is it mandatory to complete the VA Form 26-8923?

While completing the form is voluntary, failing to do so may lead to obtaining a loan amount that exceeds what is permissible. It is highly recommended to complete the form to secure the correct loan guarantee.

What happens if I don’t include a valid OMB control number?

If your form does not display a valid OMB control number, you are not required to respond. The OMB control number ensures that the information collection is sanctioned; always check the official OMB website for its validity.

Where do I send my completed VA Form 26-8923?

After filling out the VA Form 26-8923, submit it to the appropriate VA office as per the instructions provided with the form or consult the VA’s official website for specific submission details.

What are the consequences of rounding the maximum loan amount?

While rounding off the maximum loan amount is permissible, it must always be rounded down. This is to prevent cash disbursement to you, the veteran. Any amounts less than $50 that require rounding do not necessitate a recomputation.

Can I get assistance with this form?

Yes, if you have questions or need help completing the VA Form 26-8923, you can reach out to the VA directly at 1-800-827-1000. They provide resources and information that can assist you in the completion process.

Common mistakes

When filling out the VA Form 26-8923, some common mistakes can lead to complications or delays in processing the application. One frequent error is failing to provide accurate financial figures. Each section requires precise amounts, particularly in the "Existing VA Loan Balance" and subsequent calculations. Misreporting these figures can affect the loan amount and may cause the application to be denied or delayed.

Another mistake involves overlooking cash payments made by the veteran. It's crucial to subtract any cash payments from the existing loan balance. Neglecting this step will result in an inflated total, which can affect the overall loan computation. Therefore, double-checking this entry is essential for an accurate application.

Additionally, many people forget to include allowable closing costs and prepaid expenses. The form specifically asks for these expenses in Section II. Failing to add these figures can skew the total loan amount. It's important to gather all relevant documentation and ensure these figures are properly included in the calculations.

Using the wrong percentages for discounts, origination fees, or funding fees is another frequent oversight. Each of these fees is based on the total amount calculated. If the percentages are applied incorrectly, the resulting errors can significantly alter the loan amount. Confirmation of the correct rates is advisable before submission.

Moving to Section III, another mistake arises in the final computation process. Applicants sometimes miscalculate the subtotal or forget to carry forward totals from previous lines. This oversight can lead to an incorrect maximum loan amount, which in turn affects the funding process.

Signatures are often a point of contention as well. Applicants sometimes neglect to sign the form or forget to provide their printed name. The signature and title of the lender's officer are equally important and must be completed in ink. A missing signature may result in a rejection of the application.

Another error to avoid is failing to round down the maximum loan amount correctly. The instructions specify that this amount must always be rounded down to avoid providing cash to the veteran. Applicants can easily overlook this detail, which can lead to compliance issues.

Lastly, individuals may not be aware of the expiration date of the form. Using an outdated form can lead to unnecessary delays. Always check to confirm that you have the most recent version of VA Form 26-8923 before proceeding with the application.

Documents used along the form

The VA Form 26-8923 is used in the context of Interest Rate Reduction Refinancing Loans. It is often accompanied by several other forms and documents essential for processing the loan application. Below is a list of these related documents.

- VA Form 26-1880: This form is used to apply for a Certificate of Eligibility. This certificate confirms the applicant's eligibility for a VA loan, which is important for determining the applicable loan limits and guaranty amount.

- VA Form 26-6393: Also known as the VA Loan Processing Checklist, this document helps ensure that all required information and documentation are collected and submitted. It serves as a useful guide for both the lender and the applicant throughout the loan process.

- VA Form 26-8923A: This is a required addendum to the VA Form 26-8923. It provides additional details on the loan adjustments being requested, as well as the borrower’s financial information necessary for assessing the loan's viability.

- Loan Estimate (LE): Issued by the lender, this form outlines the estimated costs associated with the loan. It includes interest rates, monthly payments, and various fees, helping borrowers understand the financial implications of their refinancing options.

- Closing Disclosure (CD): This document is provided before closing on the loan. It details all final terms and costs associated with the loan, ensuring that the borrower has a clear understanding of what they will owe and under what terms.

These forms and documents work together to smooth out the refinancing process, ensuring that both lenders and borrowers have the information needed for a successful transaction.

Similar forms

- VA Form 26-8923 (Interest Rate Reduction Refinancing Loan Worksheet): This form is specifically used to calculate and document the necessary information for a VA-guaranteed Interest Rate Reduction Refinancing Loan, allowing veterans to obtain lower interest rates on existing loans.

- VA Form 26-1880 (Request for a Certificate of Eligibility): This document helps veterans apply for a Certificate of Eligibility, verifying their entitlement to VA loans. Both forms are integral parts of the VA loan process and ensure veterans can benefit from loan guarantees.

- VA Form 26-8937 (Verification of VA Benefits): This form is used to verify a veteran's reported income and benefits when applying for a VA loan. Similar to the 26-8923, it helps ensure that the loan amount aligns with the veteran's financial situation.

- VA Form 26-8938 (Loan Guaranty Certificate): This form is issued after the loan application process to certify that a veteran's mortgage loan has been guaranteed by the VA. It confirms the completion of essential calculations and documentation, akin to those found in the 26-8923.

- VA Form 26-8206 (Loan Analysis Worksheet): This document serves to analyze a veteran's loan application in detail. It collects similar financial data to the 26-8923, helping lenders assess the viability of loan approval for veterans.

- VA Form 26-8790 (Check List for VA Loan): This checklist outlines the necessary documentation and steps for a loan application. Like the 26-8923, it ensures that all pertinent information is gathered to facilitate the loan approval process.

Dos and Don'ts

When filling out the VA Form 26-8923, consider the following guidelines:

- Complete the form in its entirety to avoid delays in processing.

- Double-check all figures for accuracy, particularly in the financial sections.

- Include any cash payment made by the veteran to ensure the calculations are correct.

- Submit the form by the stated expiration date to maintain eligibility.

- Keep a copy of the completed form for your records.

Avoid these common mistakes:

- Do not omit required sections, as this may lead to an incomplete application.

- Avoid rounding off amounts incorrectly; always round down.

- Do not submit the form without the appropriate signature.

- Steer clear of using an outdated version of the form, as it may not be accepted.

Misconceptions

When it comes to the VA Form 26-8923, there are several misconceptions that can lead to confusion. Here are eight of them, along with clarifications to help you better understand this form.

- This form is only for new loans. Many believe the VA Form 26-8923 is only applicable when applying for new loans. In reality, this form is specifically designed for Interest Rate Reduction Refinancing Loans (IRRRL), which help veterans refinance existing loans.

- Completing the form is mandatory for all veterans. While the form is required for the IRRRL process, filling it out is voluntary. However, not completing it may prevent veterans from securing the best loan terms.

- The form is complicated and time-consuming. Many people think that filling out the VA Form 26-8923 is a complex task. In fact, it typically takes an average of only 10 minutes to complete.

- Submitting the form guarantees loan approval. It's important to understand that submitting VA Form 26-8923 does not automatically mean loan approval. The form aids in determining eligibility, but other factors will also influence the final decision.

- The information on the form is not secure. Some assume that the personal information shared on the form isn't protected. However, the Veterans Affairs department follows strict privacy regulations to ensure your information is secure and only disclosed under specific conditions.

- All refinancing loans require this form. This form is specific to IRRRLs. Other types of refinancing may not need VA Form 26-8923, so it’s essential to understand what type of loan you are applying for.

- It’s impossible to get help with the form. Some might feel overwhelmed and think they must complete the form alone. In reality, assistance is available. Veterans can reach out to lenders or call the VA at 1-800-827-1000 for guidance.

- The OMB control number is not important. It’s a common misconception that the OMB control number on the form is irrelevant. In fact, if this number is not displayed, you are not obligated to provide any information, so it’s crucial to look for it.

Understanding these misconceptions can help veterans navigate the VA Form 26-8923 process more effectively and secure the benefits they deserve.

Key takeaways

When filling out and using the VA Form 26-8923, there are several important points to keep in mind:

- Time Commitment: Completing the form typically takes about 10 minutes. Plan accordingly to gather the necessary information.

- Loan Purpose: Use this form when you are requesting a guaranty on an Interest Rate Reduction Refinancing Loan.

- Existing Loan Balance: You'll need to calculate your existing VA loan balance and include costs for any energy-efficient improvements.

- Discounts and Fees: The form requires you to add percentages for discounts, origination fees, and funding fees based on your preliminary loan amount.

- Total Calculation: After summing all related costs, the final computation section helps you determine the maximum loan amount.

- Rounding Rules: When rounding off the maximum loan amount, always round down. This ensures no cash is returned to the veteran.

- Privacy Assurance: The information you provide is protected under the Privacy Act. VA will only disclose it as authorized.

Follow these guidelines closely to ensure a smooth loan process.

Browse Other Templates

What Is Business Debt Schedule - The schedule is beneficial for managing cash flow by keeping debt repayment in focus.

Four Point Inspection Florida - Missing items from the form can lead to unnecessary delays or complications in proving coverage eligibility.