Fill Out Your Va 26 8937 Form

The VA Form 26-8937 is an essential document for veterans seeking to secure benefits related to VA loans. This form, also known as the Verification of VA Benefits, plays a critical role in confirming a veteran's eligibility for VA Loan Guaranty Benefits, as well as determining any exemptions from the VA funding fee. It primarily addresses veterans receiving disability payments, those who have pending claims, or the surviving spouses of veterans receiving Dependency and Indemnity Compensation (DIC). When completing the form, veterans must provide personal information such as their name, address, date of birth, and Social Security number. The form also includes sections where veterans certify their claims regarding indebtedness related to VA benefits and previous claims filed before military discharge. Following completion, the form must be submitted to the appropriate VA Regional Loan Center, where it becomes part of the lender's loan origination package. This process ensures that veterans can access the necessary benefits while addressing their financial obligations related to VA loans.

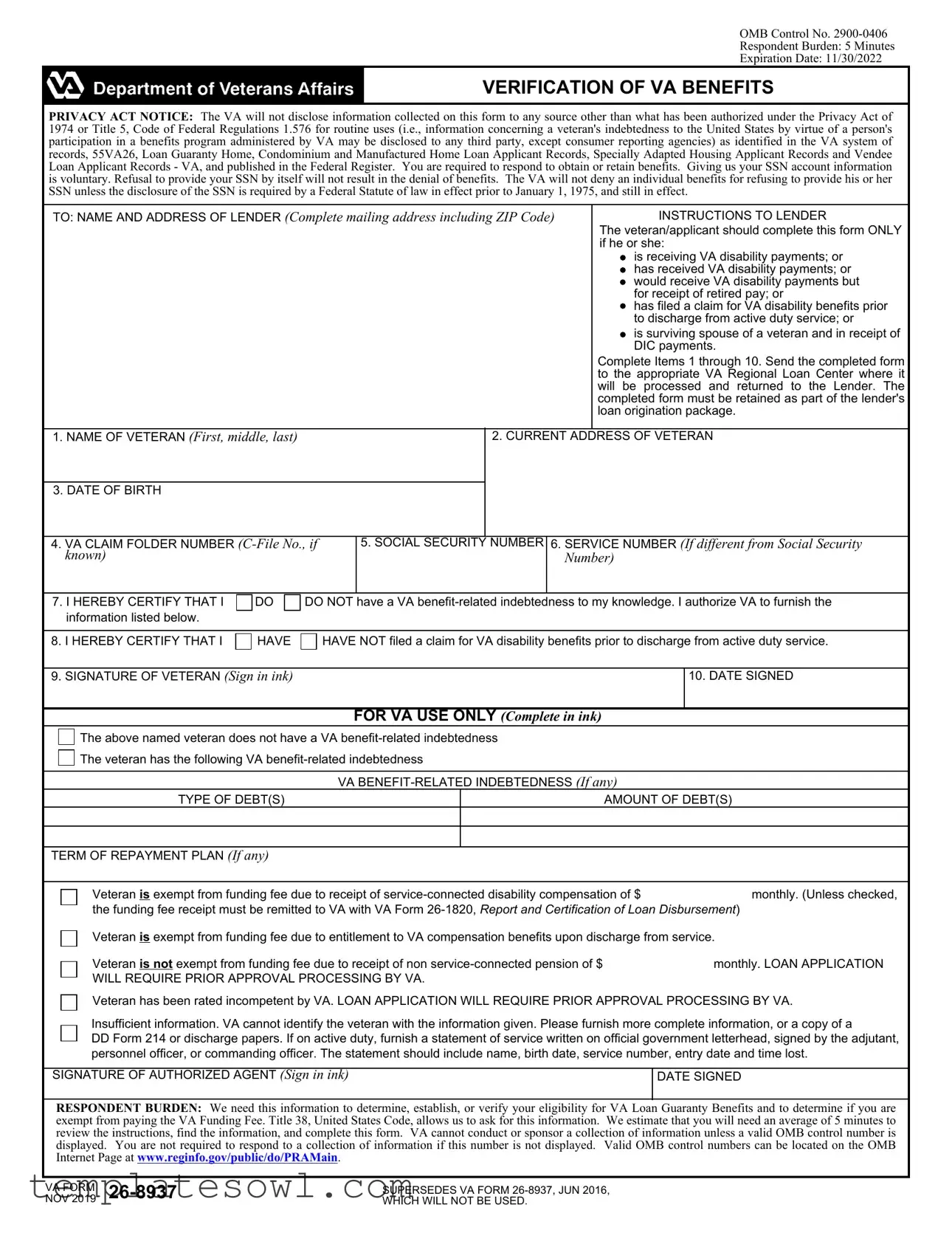

Va 26 8937 Example

OMB Control No.

Respondent Burden: 5 Minutes

Expiration Date: 11/30/2022

VERIFICATION OF VA BENEFITS

PRIVACY ACT NOTICE: The VA will not disclose information collected on this form to any source other than what has been authorized under the Privacy Act of 1974 or Title 5, Code of Federal Regulations 1.576 for routine uses (i.e., information concerning a veteran's indebtedness to the United States by virtue of a person's participation in a benefits program administered by VA may be disclosed to any third party, except consumer reporting agencies) as identified in the VA system of records, 55VA26, Loan Guaranty Home, Condominium and Manufactured Home Loan Applicant Records, Specially Adapted Housing Applicant Records and Vendee Loan Applicant Records - VA, and published in the Federal Register. You are required to respond to obtain or retain benefits. Giving us your SSN account information is voluntary. Refusal to provide your SSN by itself will not result in the denial of benefits. The VA will not deny an individual benefits for refusing to provide his or her SSN unless the disclosure of the SSN is required by a Federal Statute of law in effect prior to January 1, 1975, and still in effect.

TO: NAME AND ADDRESS OF LENDER (Complete mailing address including ZIP Code) |

INSTRUCTIONS TO LENDER |

|

|

|

The veteran/applicant should complete this form ONLY |

|

|

if he or she: |

|

|

is receiving VA disability payments; or |

|

|

has received VA disability payments; or |

|

|

would receive VA disability payments but |

|

|

for receipt of retired pay; or |

|

|

has filed a claim for VA disability benefits prior |

|

|

to discharge from active duty service; or |

|

|

is surviving spouse of a veteran and in receipt of |

|

|

DIC payments. |

|

|

Complete Items 1 through 10. Send the completed form |

|

|

to the appropriate VA Regional Loan Center where it |

|

|

will be processed and returned to the Lender. The |

|

|

completed form must be retained as part of the lender's |

|

|

loan origination package. |

|

|

|

1. NAME OF VETERAN (First, middle, last) |

2. CURRENT ADDRESS OF VETERAN |

|

3.DATE OF BIRTH

4.VA CLAIM FOLDER NUMBER

known)Number)

7. I HEREBY CERTIFY THAT I |

|

DO |

|

DO NOT have a VA |

||

information listed below. |

|

|

|

|

|

|

|

|

|

|

|

|

|

8. I HEREBY CERTIFY THAT I |

|

|

HAVE |

|

HAVE NOT filed a claim for VA disability benefits prior to discharge from active duty service. |

|

|

|

|

||||

9. SIGNATURE OF VETERAN (Sign in ink)

FOR VA USE ONLY (Complete in ink)

10. DATE SIGNED

The above named veteran does not have a VA

The above named veteran does not have a VA

The veteran has the following VA

The veteran has the following VA

VA

TYPE OF DEBT(S)

AMOUNT OF DEBT(S)

TERM OF REPAYMENT PLAN (If any)

|

Veteran is exempt from funding fee due to receipt of |

monthly. (Unless checked, |

|

||

|

the funding fee receipt must be remitted to VA with VA Form |

|

|

||

|

Veteran is exempt from funding fee due to entitlement to VA compensation benefits upon discharge from service. |

|

|

||

|

Veteran is not exempt from funding fee due to receipt of non |

monthly. LOAN APPLICATION |

|

||

|

WILL REQUIRE PRIOR APPROVAL PROCESSING BY VA. |

|

|

|

|

Veteran has been rated incompetent by VA. LOAN APPLICATION WILL REQUIRE PRIOR APPROVAL PROCESSING BY VA. Insufficient information. VA cannot identify the veteran with the information given. Please furnish more complete information, or a copy of a

DDForm 214 or discharge papers. If on active duty, furnish a statement of service written on official government letterhead, signed by the adjutant, personnel officer, or commanding officer. The statement should include name, birth date, service number, entry date and time lost.

SIGNATURE OF AUTHORIZED AGENT (Sign in ink) |

DATE SIGNED |

RESPONDENT BURDEN: We need this information to determine, establish, or verify your eligibility for VA Loan Guaranty Benefits and to determine if you are exempt from paying the VA Funding Fee. Title 38, United States Code, allows us to ask for this information. We estimate that you will need an average of 5 minutes to review the instructions, find the information, and complete this form. VA cannot conduct or sponsor a collection of information unless a valid OMB control number is displayed. You are not required to respond to a collection of information if this number is not displayed. Valid OMB control numbers can be located on the OMB Internet Page at www.reginfo.gov/public/do/PRAMain.

NOV 2019 |

WHICH WILL NOT BE USED. |

VA FORM |

SUPERSEDES VA FORM |

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Number | VA Form 26-8937 |

| OMB Control Number | 2900-0406 |

| Estimated Respondent Burden | 5 minutes |

| Expiration Date | 11/30/2022 |

| Purpose | To verify benefits eligibility for VA Loan Guaranty. |

| Privacy Act Compliance | Information is protected under the Privacy Act of 1974. |

| Instructions for Lenders | Complete if the veteran receives or has received VA disability payments. |

| Requirement for Social Security Number | Providing the SSN is voluntary; refusal does not affect benefits. |

| Eligibility Criteria | Includes veterans receiving disability payments, their surviving spouses, etc. |

| Governing Law | Title 38, United States Code, governs the collection of this information. |

Guidelines on Utilizing Va 26 8937

Once you receive the VA Form 26-8937, filling it out accurately is crucial for ensuring your VA benefits are processed correctly. Follow each step closely, and be prepared with the necessary information to avoid any delays.

- Enter the Veteran's Name: Fill in the first name, middle initial (if applicable), and last name of the veteran in the designated space.

- Provide Current Address: Write the complete mailing address of the veteran, including street address, city, state, and ZIP code.

- Specify Date of Birth: Input the date of birth of the veteran in the proper format.

- Include VA Claim Folder Number: If known, enter the VA claim folder number (C-File No.) in the provided field.

- Fill Social Security Number: Provide the veteran's social security number, ensuring that it is accurate.

- Add Service Number: If the service number is different from the social security number, include it here.

- Indicate VA Benefit-Related Indebtedness: Check the appropriate box to certify whether or not there is any VA benefit-related indebtedness known to the veteran.

- State Claim Filing Status: Check the box to confirm whether the veteran has filed a claim for VA disability benefits prior to discharge from active duty service.

- Signature of Veteran: The veteran must sign the form in ink to validate the information provided.

- Date Signed: Write the date on which the veteran signed the form.

After completing the form, send it to the appropriate VA Regional Loan Center. This form is vital for the loan origination package, so ensure that all details are filled out completely and accurately. Retain a copy for your records, and be aware that additional documentation may be required based on the veteran’s circumstances.

What You Should Know About This Form

What is the VA Form 26-8937 and why is it important?

The VA Form 26-8937, also known as the Verification of VA Benefits form, is used to certify a veteran’s eligibility for VA loan guaranty benefits. It helps veterans clarify their benefit status, including whether they have any indebtedness or have filed for disability benefits. This form is crucial for lenders who need this information to process loan applications efficiently.

Who needs to fill out the VA Form 26-8937?

This form is necessary for veterans who are receiving or have received VA disability payments. It’s also applicable to veterans who would receive such payments but for retirement pay. Additionally, surviving spouses of veterans who receive Dependency and Indemnity Compensation (DIC) payments should complete this form. It provides essential details regarding the veteran's benefit status required by lenders.

What information is required on the VA Form 26-8937?

When completing the VA Form 26-8937, the veteran must provide several pieces of information, including their full name, current address, date of birth, VA claim folder number, social security number, and service number, if different. The form also requires a certification of any known VA benefit-related indebtedness and assures whether a claim for disability benefits has been filed prior to discharge.

How is the information on VA Form 26-8937 used?

The information collected on this form is used to verify the veteran's eligibility for loan guaranty benefits and determine if they are exempt from paying the VA funding fee. Lenders will use this verified information to assess loan applications and facilitate the loan process. Additionally, the information must be part of the lender's loan origination package.

What happens if I provide incorrect information on the form?

Providing incorrect information on the VA Form 26-8937 can lead to complications in your loan application process. If the VA cannot verify your eligibility or if discrepancies arise from the information submitted, it may delay your loan approval or even result in denial. Therefore, it is vital to fill out the form accurately and completely to ensure a smooth processing experience.

What if I do not have a Social Security Number?

While providing your Social Security Number (SSN) is encouraged, it is not mandatory to obtain VA benefits. The form states that refusal to provide your SSN will not automatically result in the denial of benefits, unless specified by federal law. If you do not have an SSN, it is advisable to communicate this to the lender clearly to prevent any misunderstandings.

What is the expected time commitment to complete the VA Form 26-8937?

Completing the VA Form 26-8937 is estimated to take approximately 5 minutes. This estimate includes reviewing the form's instructions, locating the necessary information, and filling out the required sections accurately. Taking the time to prepare beforehand can help streamline the process.

Common mistakes

Completing the VA Form 26-8937 is a crucial step for veterans seeking to establish eligibility for certain benefits. However, several common mistakes can easily undermine this process. Understanding these pitfalls can help ensure the form is filled out correctly, allowing for a smoother application experience.

One of the most frequent errors is incomplete information. Many applicants neglect to fill out all required fields—such as their current address or Social Security number. Each piece of information requested is essential for processing the claim. Without complete details, the application may be delayed or even denied.

Another common mistake involves incorrect certification regarding VA benefit-related indebtedness. Applicants often mistakenly check 'do not' when they actually have an existing debt linked to their VA benefits. This can lead to significant complications, as providing false information may not only hinder their application but also cause legal issues down the line.

The date of birth is another area vulnerable to errors. Applicants sometimes enter the wrong date or fail to use the correct format. A simple mistake in this section can create confusion and may complicate the verification process, leading to unnecessary delays.

Additionally, applicants may overlook the signature requirement. The form requires the veteran’s signature; failing to sign can result in instant rejection of the application. In some instances, applicants mistakenly believe that checking the boxes suffices, but manual signs are mandatory.

Providing inaccurate service numbers is yet another way to derail an application. When veterans include a service number that does not match their records, this inconsistency can lead to identification issues. Ensuring that the correct service number is provided is vital for confirming eligibility.

Lastly, some veterans do not pay attention to submission instructions, particularly the importance of sending the completed form to the correct VA Regional Loan Center. Without following these directions, the application may be lost or returned, requiring the veteran to start the process anew.

By being aware of these common mistakes and taking the time to verify all information before submission, veterans can improve their chances of a successful application. Proper attention to detail is critical, so reviewing the form thoroughly can save time and potential stress in the future.

Documents used along the form

The VA Form 26-8937 is an important document used to verify a veteran's benefits. When preparing for a VA loan application, several related forms may also be needed to complete the process smoothly. Below is a list of forms that are often used alongside the VA 26-8937. Each serving a specific purpose, these documents help ensure that all required information is gathered.

- VA Form 26-1820: This form is used to report and certify the disbursement of a VA loan. It is necessary for lenders to complete to confirm that the loan has been properly disbursed and funded.

- VA Form 26-1880: Veterans use this form to apply for a Certificate of Eligibility (COE) for VA home loan benefits. The COE proves that the veteran has qualifying military service and the right to use VA loan benefits.

- DD Form 214: This certificate of release or discharge from active duty provides important information about a service member's military history. It is often required to verify eligibility for veterans’ benefits and programs.

- VA Form 21-526EZ: Veterans fill out this application to apply for disability compensation and related benefits. It is essential for establishing eligibility for various VA benefits.

- VA Form 21-5490: Used for the Dependency and Indemnity Compensation (DIC) program, this form helps to report the relationship to a veteran for surviving spouse or children benefits.

- VA Form 21-4138: This statement in support of claim provides additional information or clarification for specific claims. It can help veterans strengthen their applications by offering further context.

- VA Form 22-1990: This form is for veterans applying for educational benefits. It establishes eligibility for various programs and ensures that veterans can access the education benefits available to them.

- VA Form 26-8938: Similar to the 26-8937, this form is also utilized for verifying VA benefits, particularly in the context of a housing or loan application.

- VA Form 26-4555: This is the application for specially adapted housing for veterans with specific service-connected disabilities. It outlines needs for housing assistance for qualifying veterans.

- VA Form 21-2680: This form is the request for aid and attendance. It helps veterans apply for assistance if they require personal care support due to service-related disabilities.

Understanding these forms and their purposes is key for veterans seeking to make use of their benefits. Being prepared with the right documentation can streamline the loan application process, enabling veterans to access the support they deserve.

Similar forms

The VA Form 26-8937 is an important document used to verify a veteran's benefits, particularly in the context of loan applications. There are several other forms in the VA system that serve similar purposes. Here are seven documents comparable to VA Form 26-8937, along with brief explanations of how they are similar:

- VA Form 26-1820: This form is used to report and certify loan disbursement and often requires similar financial verification as VA Form 26-8937. Both are integral to the loan process.

- VA Form 21-526EZ: This is an application for veterans seeking disability compensation. Like the VA Form 26-8937, it verifies a veteran's status and eligibility for benefits.

- VA Form 21-534EZ: This document is used by surviving spouses applying for Dependency and Indemnity Compensation (DIC). It also involves benefit verification, akin to VA Form 26-8937.

- VA Form 21-550: The application for VA education benefits requires similar personal and benefit verification details, making it similar in purpose to VA Form 26-8937.

- VA Form 28-1900: This form is used for applying for Vocational Rehabilitation and Employment services. It, too, seeks to clarify a veteran’s eligibility status and related benefits.

- VA Form 21-4154: This is used for requesting VA education benefits for individuals attending school. The process involves confirming eligibility, similar to the VA Form 26-8937.

- VA Form 26-8938: This form is for verifying residual benefits for veterans who are applying for specific types of loans. It parallels the function of VA Form 26-8937 in verifying benefit status.

Each of these forms engages with the verification of veteran benefits in various capacities, reflecting the need for accurate and reliable information to support the veterans' claims and applications.

Dos and Don'ts

When filling out the VA 26-8937 form, it's essential to ensure accurate and complete information. Here are some important do's and don'ts to keep in mind:

- Do provide your full name as it appears on official documents.

- Do double-check that your Social Security Number (SSN) is accurate and complete.

- Don't leave any fields blank; every section must be filled out as required.

- Don't forget to sign and date the form where indicated.

Misconceptions

Understanding the VA Form 26-8937 is essential for veterans seeking benefits. However, several misconceptions can lead to confusion about its purpose and requirements. Here are ten common misconceptions:

- The form is only for veterans currently receiving benefits. This is incorrect. The form can also be completed by veterans who have received VA disability payments in the past or those who have filed claims prior to discharge.

- Providing my Social Security Number (SSN) is mandatory. While providing your SSN can aid in the processing of the form, it is not mandatory. Refusing to provide an SSN will not lead to a denial of benefits unless required by specific federal laws.

- This form is essentially the same as other VA forms. Each VA form has a unique purpose. The 26-8937 specifically verifies VA benefits related to loan applications, which is different from forms used for claims or appeals.

- Email submission of the form is acceptable. This form must be mailed to the appropriate VA Regional Loan Center; electronic submissions are typically not permitted.

- I only need to fill out sections that apply to my situation. All sections need to be completed to ensure comprehensive processing and to avoid delays.

- The VA only checks for current enlistment status. The VA verifies past records, including claims and other pertinent benefits, hence, accurate and complete information is crucial.

- My lender will handle all paperwork. While lenders assist throughout the process, it’s the veteran’s responsibility to complete and submit the VA Form 26-8937.

- Signing the form commits me to a loan. Signing the form is only an affirmation of your benefits status and does not obligate you to take any loan.

- The VA will automatically process my benefits as soon as I submit the form. Processing occurs only after the form is properly filled out and received by the appropriate VA office. Delays may occur in validation.

- I don’t need to keep a copy of the form once submitted. It is a good practice to retain a copy of submitted forms for your records, as this can be useful for future reference or inquiries.

Awareness of these misconceptions can greatly clarify the purpose and importance of the VA Form 26-8937 in securing housing benefits and navigating the loan application process.

Key takeaways

The VA Form 26-8937 is an essential document for veterans seeking to verify their benefits. Below are key takeaways to consider when filling out and utilizing this form.

- The form is titled "Verification of VA Benefits" and is designed to assist veterans in demonstrating their eligibility for VA Loan Guaranty Benefits.

- It is vital that the form is completed by veterans who are currently receiving VA disability payments, have received them, or have filed claims for such benefits.

- Surviving spouses receiving Dependency and Indemnity Compensation (DIC) payments should also complete this form.

- Information provided on the form is protected under the Privacy Act of 1974. Disclosure of your information will only occur in authorized situations.

- The estimated completion time for this form is about 5 minutes, making it a relatively quick task to complete.

- Providing a Social Security Number is voluntary, and refusal to provide it alone will not deny benefits, except in specific cases required by federal law.

- Complete items 1 through 10 carefully, ensuring all details are accurate to avoid processing delays.

- After completing the form, it must be sent to the appropriate VA Regional Loan Center for processing.

- Lenders are required to keep the completed form as part of the loan origination package, so ensure its timely submission.

- If there are any doubts or missing information, the VA may request further details to help identify the veteran. This could include submission of discharge papers when applicable.

By understanding these key points, veterans can effectively navigate the process of completing and using the VA Form 26-8937 to secure their benefits.

Browse Other Templates

Florida Parenting Plan Examples - Parties can suggest other arrangements not outlined in the standard form as necessary.

LLC Amendments Form,Oklahoma LLC Update Document,Articles of Organization Amendment,Public Benefit LLC Amendment,LLC Name Change Application,Oklahoma Business Structure Revision,Form for Amending LLC Articles,Oklahoma Limited Liability Company Amendm - Submit this form to the Oklahoma Secretary of State's office in Oklahoma City.