Fill Out Your Valic 403B Rollover Transfer Form

Navigating retirement accounts can be daunting, especially when it comes to managing your investments through the 403(b) plan offered by the Variable Annuity Life Insurance Company (VALIC). The VALIC 403B Rollover Transfer Form allows participants to transfer or roll over their retirement funds smoothly, ensuring that your financial future remains secure. This form is specifically designed for individuals looking to move their 403(b) plan assets, whether to a new employer's plan, an Individual Retirement Account (IRA), or to purchase service credit. It requires completion of critical sections, including client information, rollover or transfer requests, and important distribution types. Special considerations, such as spousal consent and vesting determinations, are also addressed, ensuring compliance with federal regulations and your unique needs. For anyone planning to make a distribution, clear understanding and accurate information are vital, as this will safeguard both tax advantages and your long-term financial health. Utilizing the VALIC 403B Rollover Transfer Form efficiently is a key step in maintaining your retirement assets and optimizing your investment decisions.

Valic 403B Rollover Transfer Example

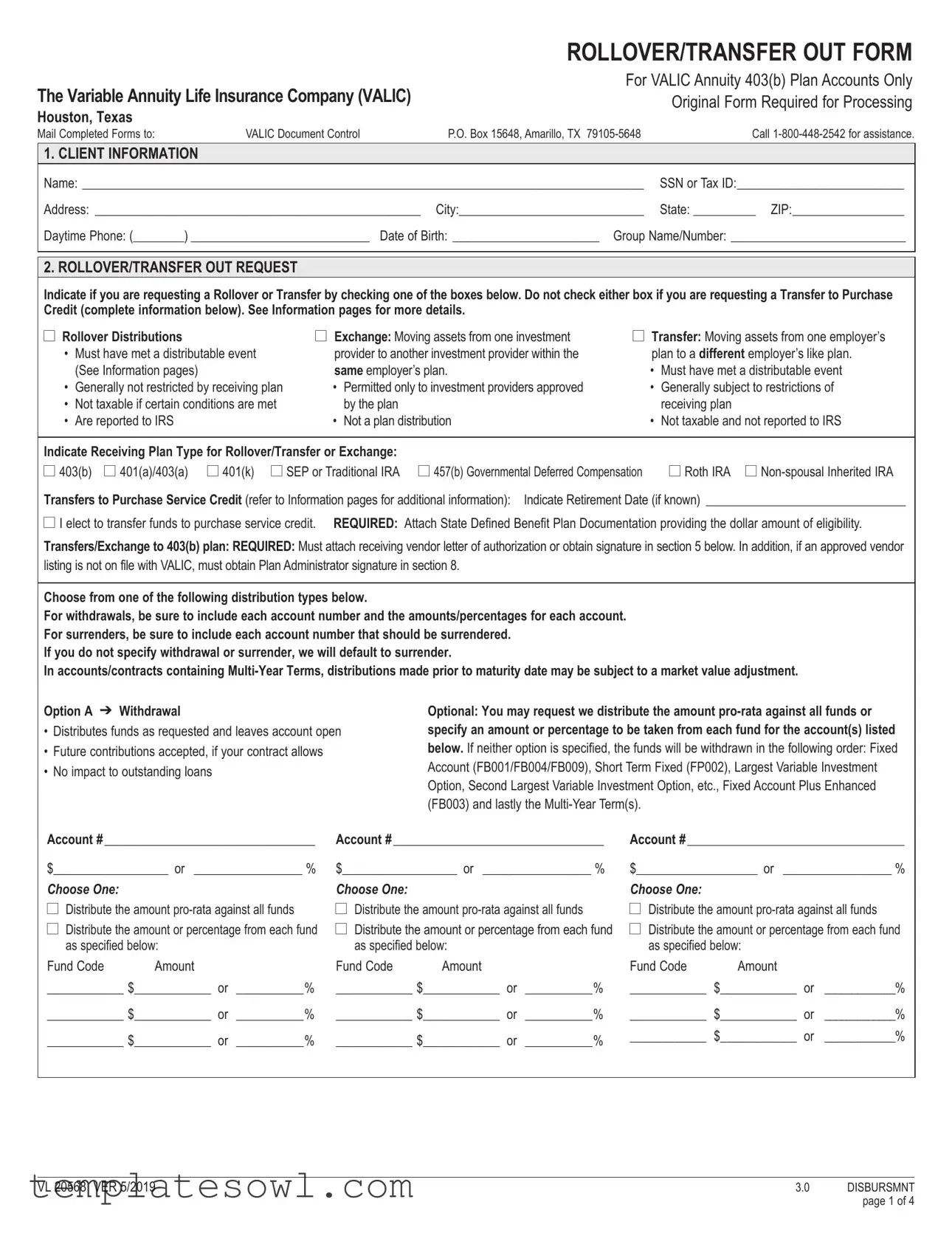

The Variable Annuity Life Insurance Company (VALIC)

Houston, Texas

Mail Completed Forms to: |

VALIC Document Control |

ROLLOVER/TRANSFER OUT FORM

For VALIC Annuity 403(b) Plan Accounts Only

Original Form Required for Processing

P.O. Box 15648, Amarillo, TX |

Call |

1. CLIENT INFORMATION

Name:_________________________________________________________________________________________ |

SSN or Tax ID:______________________________ |

Address:_ ___________________________________________________ City:_____________________________ |

State:___________ ZIP:____________________ |

Daytime Phone: (________)_____________________________ Date of Birth:_ _______________________ Group Name/Number:_____________________________ |

|

2. ROLLOVER/TRANSFER OUT REQUEST

Indicate if you are requesting a Rollover or Transfer by checking one of the boxes below. Do not check either box if you are requesting a Transfer to Purchase |

||||||||

Credit (complete information below). See Information pages for more details. |

|

|

||||||

l Rollover Distributions |

|

|

l Exchange: Moving assets from one investment |

l Transfer: Moving assets from one employer’s |

||||

• |

Must have met a distributable event |

|

provider to another investment provider within the |

plan to a different employer’s like plan. |

||||

|

(See Information pages) |

|

|

same employer’s plan. |

• |

Must have met a distributable event |

||

• |

Generally not restricted by receiving plan |

• Permitted only to investment providers approved |

• Generally subject to restrictions of |

|||||

• |

Not taxable if certain conditions are met |

by the plan |

|

|

receiving plan |

|||

• |

Are reported to IRS |

|

|

• Not a plan distribution |

• |

Not taxable and not reported to IRS |

||

|

|

|

|

|||||

Indicate Receiving Plan Type for Rollover/Transfer or Exchange: |

l 457(b) Governmental Deferred Compensation |

l Roth IRA l |

||||||

l 403(b) |

l 401(a)/403(a) |

l 401(k) |

l SEP or Traditional IRA |

|||||

Transfers to Purchase Service Credit (refer to Information pages for additional information): Indicate Retirement Date (if known)_ ________________________________

l I elect to transfer funds to purchase service credit. REQUIRED: Attach State Defined Benefit Plan Documentation providing the dollar amount of eligibility.

Transfers/Exchange to 403(b) plan: REQUIRED: Must attach receiving vendor letter of authorization or obtain signature in section 5 below. In addition, if an approved vendor listing is not on file with VALIC, must obtain Plan Administrator signature in section 8.

Choose from one of the following distribution types below.

For withdrawals, be sure to include each account number and the amounts/percentages for each account. For surrenders, be sure to include each account number that should be surrendered.

If you do not specify withdrawal or surrender, we will default to surrender.

In accounts/contracts containing

Option A → Withdrawal |

Optional: You may request we distribute the amount |

• Distributes funds as requested and leaves account open |

specify an amount or percentage to be taken from each fund for the account(s) listed |

• Future contributions accepted, if your contract allows |

below. If neither option is specified, the funds will be withdrawn in the following order: Fixed |

• No impact to outstanding loans |

Account (FB001/FB004/FB009), Short Term Fixed (FP002), Largest Variable Investment |

|

Option, Second Largest Variable Investment Option, etc., Fixed Account Plus Enhanced |

|

(FB003) and lastly the |

Account #__________________________________ |

Account #__________________________________ |

Account #___________________________________ |

|||

$__________________ or _ _________________ % |

$__________________ or _ _________________ % |

$___________________ or _ _________________ % |

|||

Choose One: |

Choose One: |

Choose One: |

|||

l |

Distribute the amount |

l |

Distribute the amount |

l |

Distribute the amount |

l |

Distribute the amount or percentage from each fund |

l |

Distribute the amount or percentage from each fund |

l |

Distribute the amount or percentage from each fund |

|

as specified below: |

|

as specified below: |

|

as specified below: |

Fund Code |

Amount |

Fund Code |

Amount |

Fund Code |

Amount |

____________ $____________ or ____________% |

____________ $____________ or ____________% |

____________ $____________ or ______________% |

|||

____________ $____________ or ____________% |

____________ $____________ or ____________% |

____________ $____________ or ______________% |

|||

____________ $____________ or ____________% |

____________ $____________ or ____________% |

____________ |

$____________ or ______________% |

||

VL 20568 VER 5/2019 |

3.0 |

DISBURSMNT |

|

|

page 1 of 4 |

2. ROLLOVER/TRANSFER OUT REQUEST (continued)

Option B → Surrender

•Automatically closes account

•Future contributions will not be accepted

•If you have an outstanding loan(s), see below

If you have an outstanding loan(s) and request a surrender of your account, a 100% withdrawal will be processed leaving your account open with no impact to outstanding loans or loan security. However, you may request your account be closed and any outstanding loan(s) terminated by checking the box below under the account number. Termination of a loan(s) may result in a taxable distribution(s). If all regulatory requirements are not met to allow a loan termination, the loan(s) will remain intact.

Account #_ _______________________________ |

Account #_ _______________________________ |

Account #_ _____________________________________ |

l DO Terminate my Loan |

l DO Terminate my Loan |

l DO Terminate my Loan |

3. ROLLOVER DISTRIBUTION REASON This section is required if you checked “Rollover Distribution” above.

l Separation from Service as of _________________ (date) due to: |

|

|

Other Distributions: |

||||

|

l Termination |

l Early Retirement |

l Normal Retirement |

l No |

l |

Beneficiary |

|

l |

Did you separate from service during or after the year you attained Age 55? |

l Yes |

l |

Qualified Domestic Relations Order (QDRO) Payment |

|||

|

|

|

|

||||

l Permanent/Total Disability as of __________ (date). Termination Date: __________ |

Attach Doctor’s Statement or Social Security Administration Documentation. |

||||||

4. SPECIAL INSTRUCTIONS

__________________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________________

5. PAYEE TRANSFER/EXCHANGE COMPANY INSTRUCTIONS

_________________________________________________________________ |

_ __________________________________________________________________ |

||

Payee Rollover/Transfer Company Name |

Receiving Account Number |

|

|

_________________________________________________________________ |

|

|

|

Attention Line/Internal Mail Code |

|

|

|

_________________________________________________________________________ |

___________________________________ |

_____________ |

_ _________________ |

Address |

City |

State |

ZIP |

Amounts will not be transferred to 403(b) vendors unless vendors’ products are approved under the employer’s plan or vendors have entered into an

I affirm that the Payee/Transfer Company noted in this section is either approved under the employer’s plan or has entered into an

__________________________________________________________________________ |

_____________________________________________________ |

Authorized Signer’s Name |

Title |

__________________________________________________________________________ |

_____________________________________________________ |

Authorized Signature |

Date |

VL 20568 VER 5/2019 |

3.0 |

DISBURSMNT |

|

|

page 2 of 4 |

6. SPOUSAL CONSENT

ERISA covered and certain other employer plans require the client to state his/her marital status and the spouse to consent to this distribution. Please check the appropriate box below:

REQUIRED FOR CLIENT: Client Marital Status |

||

l Not Married |

l Married |

l Legally Separated: Attach Court Order of Legal Separation (petition not acceptable) |

REQUIRED FOR SPOUSE: Spousal Consent

Under federal law for ERISA plans and the terms of some employer plans, as the spouse of the contract owner, you have the right to receive a survivor benefit of at least 50% of the amount in this contract if your spouse dies before you. As a result, your spouse must have written consent before making withdrawals from this contract. If you consent to the withdrawal, you will not receive a survivor benefit payment from VALIC for the amount withdrawn. If you agree to the withdrawal, please read and sign the statement below and have your signature witnessed.

•I agree to the payment of funds from the contract(s) listed in section 2.

•I understand and agree that I am giving up my right to receive a survivor benefit payment from VALIC for the amount being paid and I release VALIC from all liability for making this payment.

Spouse (Print Name):_________________________________________ Spouse’s Signature __________________________________________ Date_______________

SPOUSE’S SIGNATURE WITNESSED BY NOTARY PUBLIC

This section is only to be used for a Notary Public’s witnessing of the Spousal Consent in absence of the Plan Administrator’s Witness.

State of _________________ County of _____________ On this _____ day of _________________, year of_______________________

Before me personally appeared __________________________________ (name of spouse) known to me to be the person who

executed the SPOUSAL CONSENT and he/she acknowledged to me that he/she executed the same.

Notary Public__________________________________________________________________________

7. VESTING DETERMINATION FOR EMPLOYER CONTRIBUTION SOURCES (To be completed by the employer sponsoring the plan.)

Complete if VALIC does not provide full plan administration services to the Plan

Employer Basic |

Vested____________ % |

Employer Matching |

Vested____________ % |

Employer Other |

Vested____________ % |

Standard Service Account Only: $ ________________________

Complete if VALIC does provide full plan administration services to the Plan. Indicate hours worked if “hours of service” method is used to calculate vesting.

Indicate months worked if “elapsed time” method is used to calculate vesting. Any month in which an employee was compensated for one hour must be counted as a month worked.

Hours of Service |

Hours Worked:_____________ |

Elapsed Time |

Months Worked:____________ |

8. PLAN ADMINISTRATOR APPROVAL

To be completed where required as indicated in section 2 above or under your employer’s plan.

•I approve this distribution in accordance with current plan provisions and all applicable laws and regulations*.

•I verify that the information provided on this form for purposes of this distribution is correct to the best of my knowledge.

•I affirm that in the event of a transfer that the Payee noted in section 5 is either an approved provider under the Plan or has entered into an

Check One If Spousal Consent Required

lThe Plan Administrator’s signature serves as witness of the Client’s Spouse’s signature under the SPOUSAL CONSENT section of this form (unless spouse’s signature is notarized in section 6).

lThe Plan Administrator’s signature does NOT serve as witness of the Client’s Spouse’s signature under the SPOUSAL CONSENT section of the form.

lThe client has established to my satisfaction that spousal consent is not required.

*PLEASE NOTE: If group plan provisions include an approved vendor list, the vendor noted in section 5 MUST be part of the list on file with VALIC. If the vendor noted in section 5 is NOT one of the approved vendors on file with VALIC, processing will be delayed. Therefore, please provide a current vendor list or letter authorizing VALIC to add the approved vendor.

_________________________________________________________ |

___________________________________________________________ |

___________________ |

Plan Administrator’s Name (Print Name) |

Plan Administrator’s Signature |

Date |

VL 20568 VER 5/2019 |

3.0 |

DISBURSMNT |

|

|

page 3 of 4 |

9. CLIENT APPROVAL AND SIGNATURE GUARANTEE

•I authorize the above rollover/transfer and certify that all statements, including marital statements, are complete and accurate to the best of my knowledge and belief.

•I certify that the payee is eligible to accept this rollover/transfer on my behalf.

•I have read and understood the “Joint and Survivor Annuity and Qualified Annuity Benefit” section of the Special Tax Notice. By signing below I am agreeing to waive any benefit or right described in that section that would have been provided with respect to the amount that I am withdrawing. I also understand that I have the right to revoke any waiver if a distribution has not already been made.

•I have read and understand the information provided in the Information pages of this form, including Living Benefit Option, if applicable, and acknowledge that distributions may be subject to surrender charges as provided in the contract.

•I understand that I will be responsible for providing evidence to the IRS, if required, to verify distribution reason.

•If this rollover/transfer will result in a total surrender of my account(s), I have attached my Contract/Certificate to this form, or alternatively, I certify that my Contract/ Certificate has been lost or destroyed. If my Contract/Certificate is not attached, I agree to indemnify VALIC against any claims that may be asserted on the basis of the Contract/Certificate being found and presented for payment.

•You may contact VALIC at

________________________________________________________ |

_________________________________________________________ |

___________________ |

Client’s Name (Print Name) |

Client’s Signature |

Date |

For requests of $25,000 or more, either a Signature Guarantee (section 9) or your VFA representative’s signature (section 10) is required

Signature Guarantee:

•You may obtain a signature guarantee from an eligible guarantor including a bank,

•The Guarantor should be informed of the approximate amount of the distribution and must affix a stamp in the box to the right.

•A notarization by a notary public is not acceptable.

Signature Guarantee (if applicable)

10.FINANCIAL REPRESENTATIVE/LICENSED AGENT INFORMATION AND SIGNATURES

To be completed by your VFA representative or transferring

Branch Office Address:______________________________________________________________________________________________________________________________

City:________________________________________________________________________________ |

State:______________ ZIP:__________________________ |

|||

Licensed Agent/Registered Representative (Print Name):_____________________________________________________ |

Phone: (______)________________________ |

|||

Agent #:_________________________________ |

Location/Region:_____________________________________ |

State License #:________________________ |

||

_____________________________________________________________________________________________________________ |

_ ______________________ |

|||

Licensed Agent’s/Registered Representative’s Signature |

|

|

|

Date |

VL 20568 VER 5/2019 |

3.0 |

DISBURSMNT |

|

|

page 4 of 4 |

Information

SPECIAL TAX NOTICE

The information in this notice applies to employer plans (a tax‑qualified plan, section 403(b) plan, or governmental section 457(b) plan) (each referred to herein as “Plan”). You are receiving this notice because all or a portion of a payment you are receiving may be eligible to be rolled over to an IRA or an employer plan. This notice is intended to help you decide whether to direct such a rollover.

You have the right to at least 30 days to consider your alternatives after receiving this notice. You may waive this review period. Your signature on this form will indicate that either you have had this 30‑day review or that you have chosen to waive it and you are requesting an immediate distribution. This notice does not describe any State or local income tax rules (including withholding rules).

ELIGIBLE ROLLOVER DISTRIBUTIONS

You will be taxed on a payment from the Plan if you do not direct a rollover. If you are under age 59½ and do not direct a rollover, you will also have to pay a 10% additional income tax on early distributions (unless an exception applies). However, if you do a rollover, you will not have to pay tax until you receive payments later and the 10% additional income tax will not apply if those payments are made after you are age 59½ (or if an exception applies).

You may roll over the payment to either an IRA (an individual retirement account or individual retirement annuity) or another employer plan, (a tax qualified plan, section 403(b) plan, or governmental section 457(b) plan) that will accept the rollover.

Check with the administrator of that plan about whether the plan accepts rollovers and, if so, the types of rollovers it accepts. See below for rollover rules regarding payments from designated Roth accounts in 401(k), 403(b) or governmental 457(b) plans. The rules of the IRA or employer plan that holds the rollover will determine your investment options, fees, and rights to payment from the IRA or employer plan (for example, no spousal consent rules apply to IRAs and IRAs may not provide loans). Further, the amount rolled over will become subject to the tax rules that apply to the IRA or employer plan. There are two ways to do a rollover.

HOW DO I DO A ROLLOVER?

You can do either a direct rollover or a 60‑day rollover.

If you do a direct rollover, the Plan or IRA will make the payment directly to your IRA or an employer plan. You should contact the IRA sponsor or the administrator of the employer plan for information on how to do a direct rollover.

If you do not do a direct rollover, you may still do a rollover by making a deposit into an IRA or eligible employer plan that will accept it. You will have 60 days after you receive the payment to make the deposit. If you do not do a direct rollover, the Plan is required to withhold 20% of the payment for federal income taxes. This means that, in order to roll over the entire payment in a 60‑day rollover, you must use other funds to make up for the 20% withheld. If you do not roll over the entire amount of the payment, the portion not rolled over will be taxed and will be subject to the 10% federal early withdrawal penalty if you are under age 59½ (unless an exception applies).

If you miss the

Generally, the 60‑day rollover deadline cannot be extended. However, the IRS has the limited authority to waive the deadline under certain extraordinary circumstances, such as when external events prevented you from completing the rollover by the 60‑day rollover deadline. There are three ways to obtain a waiver of the 60‑day rollover requirement: you qualify for an automatic waiver; you self‑certify that you met the requirements of a waiver and the IRS determines during an audit or your income tax return that you qualify for a waiver, or your receive a private letter ruling granting a waiver. Payment is required to apply for a private letter ruling with the IRS. The user fee for a private letter ruling is nonrefundable. For more information, see IRS Publication 590‑A, Contributions to Individual Retirement Arrangements (IRAs).

HOW MUCH MAY I ROLLOVER?

If you wish to direct a rollover, you may direct a rollover of all or part of the amount eligible for rollover. Any payment from an employer plan or IRA is eligible for rollover, except:

•Certain payments spread over a period of at least 10 years or over your life or life expectancy (or the lives or joint life expectancy of you and your beneficiary)

•Required minimum distributions after age 72 (age 70½ if born before July 1, 1949) (or after death)

•Hardship distributions (unforeseeable emergency distribution for governmental 457(b) plans)

•Corrective distributions of contributions that exceed tax law limitations

•Loans treated as deemed distributions (for example, loans in default due to missed payments before your employment ends)

VL 20568 VER 5/2019

Effective beginning January 1, 2018, a participant has until the participant’s tax return due date for the year in which a qualified plan loan offset occurs to roll over up to 100% of the amount of the offset to an IRA or to another employer plan. A “qualified” plan loan offset is an offset due to severance from employment or an employer plan termination.

•Payments of certain automatic enrollment contributions requested to be withdrawn within 90 days of the first contribution

•Cost of life insurance paid by the Plan

•Amounts paid from certain deferred compensation plans

The Plan administrator or the payor can tell you what portion of a payment is eligible for rollover.

After‑tax Contributions. After‑tax contributions included in a payment are not taxed. If a payment is only part of your benefit, an allocable portion of your after‑tax contributions is included in the payment, so you cannot take a payment of only after‑tax contributions. However, if you have pre‑1987 after‑tax contributions maintained in a separate account, a special rule may apply to determine whether the after‑tax contributions are included in a payment. In addition, special rules apply when you do a rollover, as described below.

You may roll over to an IRA a payment that includes after‑tax contributions through either a direct rollover or a 60‑day rollover. You must keep track of the aggregate amount of the after‑tax contributions in all of your IRAs (in order to determine your taxable income for later payments from the IRAs). If you do a direct rollover of only a portion of the amount paid from the Plan and at the time the rest is paid to you, the portion directly rolled over consists first of the amount that would be taxable if not rolled over. For example, assume you are receiving a distribution of $12,000, of which $2,000 is after‑tax contributions. In this case, if you directly roll over $10,000 to an IRA that is not a Roth IRA, no amount is taxable because the $2,000 amount not directly rolled over is treated as being after‑tax contributions. If you do a direct rollover of the entire amount paid from the Plan to two or more destinations at the same time, you may be able to choose which destination receives the after‑tax contributions.

If you do a 60‑day rollover to an IRA of only a portion of the payment made to you, the after‑tax contributions are treated as rolled over last. For example, assume you are receiving a complete distribution of your benefit which totals $12,000, of which $2,000 is after‑tax contributions. In this case, if you roll over $10,000 to an IRA that is not a Roth IRA in a 60‑day rollover, no amount is taxable because the $2,000 amount not rolled over is treated as being after‑tax contributions.

You may roll over to an employer plan all of a payment that includes after‑tax contributions, but only through a direct rollover (and only if the receiving plan separately accounts for after‑tax contributions and is not a governmental section 457(b) plan). You can do a 60‑day rollover to an employer plan of part of a payment that includes after‑tax contributions, but only up to the amount of the payment that would be taxable if not rolled over.

PAYMENTS FROM DESIGNATED ROTH ACCOUNTS

After‑tax contributions included in a payment from a designated Roth account are not taxed, but earnings might be taxed. The tax treatment of earnings included in the payment depends on whether the payment is a qualified distribution. If a payment is only part of your designated Roth account, the payment will include an allocable portion of the earnings in your designated Roth account.

If the payment from the Plan is not a qualified distribution and you do not do a rollover to a Roth IRA or a designated Roth account in an employer plan, you will be taxed on the earnings in the payment. If you are under age 59½, a 10% federal early withdrawal penalty will also apply to the earnings (unless an exception applies). However, if you do a rollover, you will not have to pay taxes currently on the earnings and you will not have to pay taxes later on payments that are qualified distributions. If the payment from the Plan is a qualified distribution, you will not be taxed on any part of the payment even if you do not do a rollover. If you do a rollover, you will not be taxed on the amount you roll over and any earnings on the amount you roll over will not be taxed if paid later in a qualified distribution.

A qualified distribution from a designated Roth account in the Plan is a payment made after you are age 59½ (or after your death or disability) and after you have had a designated Roth account in the Plan for at least 5 years. In applying the 5‑year rule, you count from January 1 of the year your first contribution was made to the designated Roth account. However, if you did a direct rollover to a designated Roth account in the Plan from a designated Roth account in another employer plan, your participation will count from January 1 of the year your first contribution was made to the designated Roth account in the Plan or, if earlier, to the designated Roth account in the other employer plan.

You may roll over the payment to either a Roth IRA (a Roth individual retirement account or Roth individual retirement annuity) or a designated Roth account in

Information (continued)

an employer plan (a tax‑qualified plan or section 403(b) plan) that will accept the rollover. The rules of the Roth IRA or employer plan that holds the rollover will determine your investment options, fees, and rights to payment from the Roth IRA or employer plan (for example, no spousal consent rules apply to Roth IRAs and Roth IRAs may not provide loans). Further, the amount rolled over will become subject to the tax rules that apply to the Roth IRA or the designated Roth account in the employer Plan. In general, these tax rules are similar to those described elsewhere in this document, but differences include:

•If you do a rollover to a Roth IRA, all of your Roth IRAs will be considered for purposes of determining whether you have satisfied the 5‑year rule (counting from January 1 of the year for which your first contribution was made to any of your Roth IRAs).

•If you do a rollover to a Roth IRA, you will not be required to take a distribution from the Roth IRA during your lifetime and you must keep track of the aggregate amount of the after‑tax contributions in all of your Roth IRAs (in order to determine your taxable income for later Roth IRA payments that are not qualified distributions).

•Eligible rollover distributions from a Roth IRA can only be rolled over to another Roth IRA.

There are two ways to do a rollover. You can either do a direct rollover or a 60‑day rollover. If you do a direct rollover, the Plan will make the payment directly to your Roth IRA or designated Roth account in an employer plan. You should contact the Roth IRA sponsor or the administrator of the employer plan for information on how to do a direct rollover.

If you do not do a direct rollover, you may still do a rollover by making a deposit within 60 days into a Roth IRA, whether the payment is a qualified or nonqualified distribution. In addition, you can do a rollover by making a deposit within 60 days into a designated Roth account in an employer plan if the payment is a nonqualified distribution and the rollover does not exceed the amount of the earnings in the payment. You cannot do a 60‑day rollover to an employer plan of any part of a qualified distribution. If you receive a distribution that is a nonqualified distribution and you do not roll over an amount at least equal to the earnings allocable to the distribution, you will be taxed on the amount of those earnings not rolled over, including the 10% federal early withdrawal penalty if you are under age 59½ (unless an exception applies).

If you do a direct rollover of only a portion of the amount paid from the Plan and the portion is paid to you at the same time, the portion directly rolled over consists first of earnings.

If you do not do a direct rollover and the payment is not a qualified distribution, the Plan is required to withhold 20% of the earnings for federal income taxes (up to the amount of cash and property received other than employer stock). This means that, in order to roll over the entire payment in a 60‑day rollover to a Roth IRA, you must use other funds to make up for the 20% withheld.

ROLLOVERS OF BENEFICIARY/ALTERNATE PAYEE ACCOUNTS

Payments after death of the participant. If you receive a distribution after the participant’s death that you do not roll over, the distribution will generally be taxed in the same manner described elsewhere in this notice. However, the 10% federal early withdrawal penalty and the special rules for public safety officers do not apply, and the special rule described under the section, “Special Tax Treatment for Certain Lump‑Sum Distributions,” applies only if the participant was born on or before January 1, 1936. Note that whether a payment from a designated Roth account (see above) is a qualified distribution generally depends on when the participant first made a contribution to the designated Roth account in the Plan.

If you are a surviving spouse. If you receive a payment from the Plan as the surviving spouse of a deceased participant, you have the same rollover options that the participant would have had, as described elsewhere in this notice. In addition, if you choose to do a rollover to a traditional or Roth IRA, if applicable, you may treat the IRA as an inherited IRA or as your own. If you treat the IRA (either traditional or Roth) as an inherited IRA, payments from the IRA will not be subject to the 10% federal early withdrawal penalty. However, if the participant had started taking required minimum distributions, you will have to receive required minimum distributions from the inherited IRA. If the participant had not started taking required minimum distributions from the Plan, you will not have to start receiving required minimum distributions from the inherited IRA until the year the participant would have been age 72 (age 70½ if born before July 1, 1949).

An IRA you treat as your own is treated like any other traditional IRA of yours, so that payments made to you before you are age 59½ will be subject to the

10% federal early withdrawal penalty (unless an exception applies) and required minimum distributions from such IRA do not have to start until after you are age 72

VL 20568 VER 5/2019

(age 70½ if born before July 1, 1949). An inherited Roth IRA you treat as your own is treated like any other Roth IRA of yours, so that you will not have to receive any required minimum distributions during your lifetime and earnings paid to you in a nonqualified distribution before you are age 59½ will be subject to the 10% federal early withdrawal penalty (unless an exception applies).

If you are a surviving beneficiary other than a spouse. If you receive a payment from the Plan because of the participant’s death and you are a designated beneficiary other than a surviving spouse, the only rollover option you have is to do a direct rollover to an inherited traditional or Roth IRA, as applicable. Payments from the inherited IRA (even if a nonqualified distribution from a Roth IRA) will not be subject to the 10% federal early withdrawal penalty. You will have to receive required minimum distributions from the inherited traditional or Roth IRA. Payments under a qualified domestic relations order. If you are the spouse or former spouse of the participant who receives a payment from the Plan under a qualified domestic relations order (QDRO), you generally have the same options the participant would have (for example, you may roll over the payment to your own IRA or an eligible employer plan that will accept it). Payments under the QDRO will not be subject to the 10% federal early withdrawal penalty.

10% PENALTY

If you are under age 59½, you will have to pay the 10% federal early withdrawal penalty for any taxable payment from an employer plan (including amounts withheld for income tax) that you do not roll over, unless one of the exceptions listed below applies. This tax is in addition to the regular income tax on the payment not rolled over.

The 10% federal early withdrawal penalty does not apply to the following payments from an employer plan or IRA:

•Payments made after you separate from service if you will be at least age 55 in the year of the separation (does not apply to payments from an IRA)

•Payments that start after you separate from service if paid at least annually in equal or close to equal amounts over your life or life expectancy (or the lives or joint life expectancy of you and your beneficiary) (exception applies to IRA without regard to separation from service)

•Payments from a governmental plan made after you separate from service if you are a public safety employee and you are at least age 50 in the year of the separation

•Payments made due to disability

•Payments after your death

•Payments from a governmental 457(b) plan, unless the payment is from a separate account holding rollover contributions that were made to the Plan from a qualified plan, a section 403(b) plan, or an IRA

•Corrective distributions of contributions that exceed tax law limitations

•Payments made directly to the government to satisfy a federal tax levy

•Cost of life insurance paid by the Plan

•Payments made under a qualified domestic relations order (QDRO) (not applicable to IRA; special rule applies for IRAs under which, as part of a divorce or separation agreement, a tax‑free transfer may be made directly to an IRA of a spouse or former spouse)

•Payments up to the amount of your deductible medical expenses

•Certain payments made while you are on active duty if you were a member of a reserve component called to duty after September 11, 2001 for more than 179 days

•Payments of certain automatic enrollment contributions requested to be withdrawn within 90 days of the first contribution.

•Phased retirement payments made to federal employees

•Roth conversions/rollovers

•Qualified birth or adoption distribution up to $5,000 per child made within 1 year after such birth or adoption

•Qualified disaster distribution up to $100,000

•Coronavirus‑related distribution (CRD) up to $100,000 made on or after March 27, 2020 and before January 1, 2021

•IRA Only: (1) payments for qualified higher education expenses, (2) payments up to $10,000 used in a qualified first‑time home purchase, and (3) payments for health insurance premiums after you have received unemployment compensation for 12 consecutive weeks (or would have been eligible to receive unemployment compensation but for self‑employed status).

Note: Eligible rollovers into a governmental 457(b) plan that were previously subject to the 10% federal early withdrawal penalty will continue to be subject to

Information (continued)

that penalty at the time of withdrawal unless you are over age 59½ or some other exception applies.

IN‑PLAN ROLLOVER TO A DESIGNATED ROTH ACCOUNT

You cannot roll over a taxable distribution to a designated Roth account in another employer’s plan. However, you can convert the taxable distribution into a designated Roth account in the distributing Plan.

•If you roll over the taxable account to a designated Roth account in the same Plan, the amount rolled over (reduced by any after‑tax amounts directly rolled over) will be taxed. However, the 10% federal early withdrawal penalty will not apply (unless you take the amount rolled over out of the designated Roth account within the 5‑year period that begins on January 1 of the year of the rollover).

•If you roll over taxable account to a designated Roth account in the same Plan, later payments from the designated Roth account that are qualified distributions will not be taxed (including earnings after the rollover). A qualified distribution from a designated Roth account is a payment made both after you attain age 59½ (or after your death or disability) and after you have had a designated Roth account in the Plan for a period of at least 5 years. The 5‑year period described in the preceding sentence begins on January 1 of the year your first contribution was made to the designated Roth account. However, if you made a direct rollover to a designated Roth account in the Plan from a designated Roth account in a plan of another employer, the 5‑year period begins on January 1 of the year your first contribution was made to the designated Roth account in the Plan or, if earlier, to the designated Roth account in the plan of the other employer. Payments from the designated Roth account that are not qualified distributions will be taxed to the extent allocable to earnings after the rollover, including the 10% additional income tax on early distributions (unless an exception applies).

•If the Plan permits an in‑plan Roth direct rollover option for amounts that are not otherwise distributable under the terms of the Plan, the Plan is not required to permit any other rollover or distribution options of such amounts. For more information, please contact your Plan administrator.

ROLLOVERS TO A ROTH IRA

If you roll over the payment to a Roth IRA, a special rule applies under which the amount of the payment rolled over (reduced by any after‑tax amounts) will be taxed. However, the 10% additional income tax on early distributions will not apply (unless you take the amount rolled over out of the Roth IRA within 5 years, counting from January 1 of the year of the rollover).

If you roll over the payment to a Roth IRA, later payments from the Roth IRA that are qualified distributions will not be taxed (including earnings after the rollover). A qualified distribution from a Roth IRA is a payment made after you are age 59½ (or after your death or disability, or as a qualified first‑time homebuyer distribution of up to $10,000) and after you have had a Roth IRA for at least 5 years. In applying this 5‑year rule, you count from January 1 of the year for which your first contribution was made to a Roth IRA. Payments from the Roth IRA that are not qualified distributions will be taxed to the extent of earnings after the rollover, including the 10% federal early withdrawal penalty (unless an exception applies). You do not have to take required minimum distributions from a Roth IRA during your lifetime. For more information, see IRS Publication 590‑A, Contributions to Individual Retirement Arrangements (IRAs), and IRS Publication 590‑B, Distributions from Individual Retirement Arrangements (IRAs).

LOANS

If you request a total surrender/withdrawal of your Plan account and you have an outstanding loan, the account balance will be reduced by the outstanding loan balance and if applicable outstanding loan security will be returned to the account. The loan offset amount is treated as a distribution to you at the time of the offset and will be taxed (including the 10% additional income tax on early distributions, unless an exception applies) (in the case of a nonqualified distribution from a designated Roth account, only to the extent of the earnings in the loan offset) unless you do a 60‑day rollover in the amount of the loan offset to an IRA or employer plan (or in the amount of the nonqualified distribution earnings to a Roth IRA or designated Roth account in any employer plan). You may also choose to pay off the outstanding loan balance prior to the surrender by submitting payment in full.

EXTENDED ROLLOVER DEADLINE FOR CERTAIN OFFSET LOANS

Beginning after December 31, 2017, a participant who incurs a “qualified” plan loan offset will have until the participant’s tax return due date (including extensions) for the year in which the offset occurred to make a rollover of up to 100% of the amount of the qualified plan loan offset. A “qualified” plan loan offset is a plan loan offset that occurs as the direct result of termination of employment or the employer’s termination of the plan.

VL 20568 VER 5/2019

EXTENDED ROLLOVER DEADLINE FOR CERTAIN QUALIFIED BIRTH OR ADOPTION DISTRIBUTIONS

Beginning after December 31, 2019, a participant who incurs a qualified birth or adoption distribution may rollover of up to 100% of the amount of the qualified birth or adoption distribution to the plan or an IRA without regard to the normal 60‑day rollover time limit .

EXTENDED ROLLOVER DEADLINE FOR CERTAIN CORONAVIRUS‑RELATED DISTRIBUTIONS

For coronavirus‑related distributions made on or after March 27, 2020, and before January 1, 2021, up to 100% of such distributions may be rolled over to the plan or an IRA without regard to the normal 60‑day rollover time limit for up to three years from the date of the distribution.

SPECIAL TAX TREATMENT FOR CERTAIN LUMP‑SUM DISTRIBUTIONS

If you were born on or before January 1, 1936 and receive a lump‑sum distribution (including a nonqualified distribution from a designated Roth account) that you do not roll over, special rules for calculating the amount of the tax on the payment (or the earnings in the payment for a nonqualified distribution) might apply to you (not applicable to governmental 457(b) plan distributions). For more information, see IRS Publication 575, Pension and Annuity Income.

ELIGIBLE RETIRED PUBLIC SAFETY OFFICER

If the Plan is a governmental plan, you retired as a public safety officer, and your retirement was by reason of disability or was after normal retirement age, you can exclude from your taxable income Plan payments (including nonqualified distributions from designated Roth accounts) paid directly as premiums to an accident or health plan (or a qualified

long‑term care insurance contract) that your employer maintains for you, your spouse, or your dependents, up to a maximum of $3,000 annually. For this purpose, a public safety officer is a law enforcement officer, firefighter, chaplain, or member of a rescue squad or ambulance crew.

NONRESIDENT ALIEN

If you are a nonresident alien and you do not do a direct rollover to a U.S. IRA or U.S. employer plan, instead of withholding 20%, the Plan is generally required to withhold 30% of the payment for federal income taxes. If the amount withheld exceeds the amount of tax you owe (as may happen if you do a 60‑day rollover), you may request an income tax refund by filing Form 1040NR and attaching your Form 1042‑S. See Form W‑8BEN for claiming that you are entitled to a reduced rate of withholding under an income tax treaty. For more information, see also IRS Publication 519, U.S. Tax Guide for Aliens, and IRS Publication 515, Withholding of Tax on Nonresident Aliens and Foreign Entities.

OTHER SPECIAL RULES

•If a payment is one in a series of payments for less than 10 years, your choice whether to make a direct rollover will apply to all later payments in the series (unless you make a different choice for later payments).

•If your payments for the year are less than $200 (not including payments from a designated Roth account in the Plan), the Plan is not required to allow you to do a direct rollover and is not required to withhold for federal income taxes. However, you may do a 60‑day rollover.

•Unless you elect otherwise, a mandatory cashout of more than $1,000 will be directly rolled over to an IRA chosen by the Plan administrator. A mandatory cashout is a payment from a plan to a participant made before age 62 (or normal retirement age, if later) and without consent, where the participant’s benefit does not exceed $5,000 (not including any amounts held under the plan as a result of a prior rollover made to the plan).

•You may have special rollover rights if you recently served in the U.S. Armed Forces. For more information, see IRS Publication 3, Armed Forces’ Tax Guide.

•You may have special rollover rights if you were affected by a federally declared disaster. For more information on special rollover

rights related to disaster relief, see the IRS website @ www.irs.gov

FOR MORE INFORMATION

You may wish to consult with the Plan administrator or a professional tax adviser, before taking a payment from the Plan or IRA. Also, you can find more detailed information on the federal tax treatment of payments from employer plans and IRAs in: IRS Publication 575, Pension and Annuity Income; IRS Publication 590‑A, Contributions to Individual Retirement Arrangements (IRAs); IRS Publication 590‑B, Distributions from Individual Retirement Arrangements (IRAs); and IRS Publication 571, Tax‑Sheltered Annuity Plans (403(b) Plans). These publications are available from a local IRS office, on the web at www.irs.gov or by calling 1‑800‑TAX‑FORM.

Information (continued)

ADDITIONAL INFORMATION

DISTRIBUTABLE EVENT

Generally a distributable event includes attainment of age 59½ (Before January 1, 2020 attainment of age 70½ for governmental 457(b) plans), severance from employment, disability or death. However, the employer’s plan may place additional restrictions that must also be met prior to a distribution. If you have met a distributable event, you may request a rollover of funds to any eligible plan type or a transfer to a like plan type. If you wish to move funds from your VALIC 403(b) account to another 403(b) account via a rollover distribution, and have made contributions prior to 01‑01‑87, those amounts may lose a grandfathered status that can impact future required distributions. However, movement of funds from your VALIC 403(b) account to another 403(b) account via a transfer distribution may retain the status. For more information, please call 1‑800‑448‑2542.

TRANSFERS

Transfers to a like plan will not be taxed or reported to the IRS. Generally, transfers are allowed regardless of employment status. However, your employer’s Plan may restrict you to authorized carriers. Transferred amounts generally become subject to the requirements of the plan receiving the transfer as though originally contributed to that plan.

For distributions occurring after January 1, 2015, under federal tax rules individuals cannot make more than one nontaxable 60‑day IRA rollover within any one‑year period, even if the rollovers involve different IRAs. The one‑rollover per year limitation does not apply to a rollover to or from a qualified plan nor does it apply to IRA trustee‑to‑trustee transfers. IRA owners requesting a distribution for a rollover should be advised that they have the option to request a trustee‑to‑trustee transfer from one IRA to another IRA.

LIVING BENEFIT OPTIONS

If you have chosen a living benefit option with your annuity contract, withdrawals from the contract will reduce the account value and may reduce or cancel benefits of the living‑benefit option. Withdrawals exceeding the Maximum Annual Withdrawal Amount may reduce future Maximum Annual Withdrawal Amounts and reduce or eliminate any eligible income credit. Minimum distribution amounts calculated for each year will include the value of the living benefit. One year’s required minimum distribution based solely on the value of each individual account will not be treated as an excess withdrawal, but may reduce the Maximum Withdrawal Period and reduce or eliminate any eligible income credit. See your contract endorsement.

PRIVATE TAX‑EXEMPT EMPLOYER DEFERRED COMPENSATION PLANS

Section 457(b) deferred compensation plans sponsored by private tax‑exempt employers require participants to make an irrevocable election regarding the distribution of benefits. Commencement of payments cannot be later than April 1st of the year following the year you attain age 72 (age 70½ if born before July 1, 1949) unless you are still working for the plan’s sponsor. Please contact your plan administrator for more information. Distributions from a Section 457(b) plan sponsored by a private tax‑exempt employer are not eligible for a rollover to another plan or IRA.

INTERNAL REVENUE SERVICE (IRS) AND DEPARTMENT OF LABOR (DOL) GUIDANCE ON MARRIAGE

For federal tax law and ERISA purposes, under current IRS and DOL guidance (1) a same‑sex marriage that was valid in the state or country it was entered into will be recognized by the IRS or DOL, regardless of the married couple’s place of domicile; and (2) although a state may recognize domestic partnerships or civil unions, the terms “spouse,” “husband and wife,” “husband,” and “wife” do not include individuals who have entered into a registered domestic partnership, civil union, or other similar formal relationship recognized under state law that is not denominated as a marriage under the laws of that state.

QUALIFIED JOINT AND SURVIVOR ANNUITY AND QUALIFIED ANNUITY BENEFIT: FOR ERISA PLANS ONLY

This notice should be provided to you at least 30 days, but no more than 180 days, before your proposed distribution date.

If you are married, your retirement plan distributions will be paid to you in the form of a Qualified Joint and Survivor Annuity (“QJSA”) unless you elect a different form of distribution. Under your QJSA, if your spouse survives you, the plan will pay him or her at least 50% of the amount the plan had been paying to you, on the same frequency as the payments to you. If you are not married, your benefit will be paid monthly over your life and will end upon your death unless you elect a different form of distribution. This benefit is referred to as a Qualified Annuity Benefit (“QAB”). The plan may satisfy the QJSA or QAB by using your vested account balance to purchase an annuity contract from an insurance company. The actual monthly payments made under the annuity contract will depend on the value of your account balance, annuity purchase rates used by the insurance company, your age, and if VL 20568 VER 5/2019

you are married, your spouse’s age at the time the distribution begins.

The following table reflects the relative values of monthly payments from a Joint and Survivor Annuity and a Life Annuity, assuming a vested account balance of $5,000 and an interest rate of 6%. This table is based on the Annuity 2000 Mortality tables. The table is hypothetical and does not reflect the value of your individual benefit or the actual payments you or your beneficiaries would receive. Please note that as the ages change, the payment amount will change. If none of the examples closely approximates your situation, you may obtain a more accurate value specific to your situation from your plan administrator or from your financial professional.

Age at Benefit Starting Date |

|

|

|

|

|

|

||

Annuitant |

70 |

65 |

60 |

55 |

50 |

45 |

40 |

35 |

Spouse |

65 |

70 |

55 |

60 |

45 |

50 |

35 |

40 |

Monthly Payment |

|

|

|

|

|

|

|

|

Annuitant Life |

39.62 |

35.35 |

32.38 |

30.27 |

28.75 |

27.61 |

26.76 |

26.13 |

Only |

||||||||

Joint and |

35.47 |

33.65 |

30.21 |

29.26 |

27.53 |

26.99 |

26.07 |

25.76 |

50% Survivor |

||||||||

Joint and |

33.71 |

32.86 |

29.23 |

28.78 |

26.95 |

26.70 |

25.73 |

25.58 |

75% Survivor |

||||||||

This QJSA or QAB requirement may not apply to smaller account balances (generally below $5,000) and will not apply if you have elected another form of benefit. A partial withdrawal would be considered another form of benefit for this purpose. Other alternate forms of benefits that may be available under your employer’s plan and under your plan investments may include:

Annuity

An annuity can provide you with payments for your life or for your life and that of your beneficiary; payments for a specified period; payments for your lifetime with a minimum guaranteed period; or a continuation of payments to your surviving spouse that is different from the plan’s percentage of the payments made to you. Generally, the more that the form of payment guarantees, such as a minimum period of payments, or payments to your surviving spouse or to another beneficiary, the more that specified benefit amount will cost. There are IRS rules that may limit the period during which payments may be made.

If you elect a

Installments

If you elect to receive your benefits in installments, you may specify the dollar amount and frequency of your payments. The period of time over which you receive these installments cannot be greater than your life expectancy or the joint life and last survivor expectancy of you and your designated beneficiary. There are other IRS rules that may further limit the period over which you receive payments.

In order to elect one of these alternative forms of benefits you must waive your right to the QJSA or QAB, and if you are married, your spouse must also consent in writing. In addition, this written consent must be witnessed by a Notary Public or by your Plan Administrator. You are entitled to 30 days (but no more than 180 days) within which to make this decision. Although you have at least 30 days to make this decision, under some circumstances, you may waive this minimum

The investment options available to you, the right to change investment options, and the fees imposed under the investment options will not be affected by your decision to defer distributions.

Please send completed forms to: |

|

|

VALIC Document Control |

Overnight delivery: |

|

P.O. Box 15648 |

VALIC Document Control |

|

Amarillo, TX |

||

1050 N. Western St. |

||

|

Amarillo, TX |

|

Call |

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Processing Requirement | The VALIC 403B Rollover Transfer form must be submitted in original form for processing. |

| Mailing Address | Completed forms must be mailed to VALIC Document Control, P.O. Box 15648, Amarillo, TX 79105-5648. |

| Contact Information | For assistance, individuals can call VALIC at 1-800-448-2542. |

| Document Authorization | Transferring funds requires a letter of authorization from the receiving vendor or a signature from the plan administrator. |

Guidelines on Utilizing Valic 403B Rollover Transfer

Filling out the Valic 403B Rollover Transfer form is an important step for anyone looking to transfer their retirement funds. It's essential to complete the form accurately to ensure a smooth process. Below are the straightforward steps to help you complete the form properly.

- Provide Client Information: Fill in your name, Social Security number or Tax ID, address, city, state, ZIP code, daytime phone number, date of birth, and group name/number.

- Select Rollover/Transfer Request: Check the appropriate box indicating whether you are requesting a rollover, transfer, or exchange. If transferring to purchase service credit, ensure you attach needed documentation.

- Indicate Receiving Plan Type: Specify the type of receiving plan for your rollover or transfer, such as 457(b), Roth IRA, 403(b), etc.

- Choose Distribution Type: For withdrawals, list the account numbers along with the withdrawal amounts or percentages. If surrendering, specify which accounts you want to close.

- Complete Rollover Distribution Reason: If you checked "Rollover Distribution," indicate the reason for the distribution such as separation from service or disability.

- Fill out Special Instructions: Provide any additional special instructions you might have regarding your account.

- Complete Payee Transfer/Exchange Company Information: Enter the receiving company's name, account number, address, and include a letter of authorization if required.

- Provide Spousal Consent: Mark your marital status and if married, have your spouse sign the spousal consent section. If needed, a notary public may witness this section.

- Vesting Determination: If applicable, have your employer complete the vesting determination section.

- Plan Administrator Approval: Obtain the plan administrator's approval and signature if required.

- Client Approval and Signature Guarantee: Sign the form, confirming the information is accurate. A signature guarantee is needed for requests over $25,000.

- Complete Agent Information: If applicable, have your financial representative complete their information and sign the form.

Once you’ve filled out the form, it's ready to be mailed to VALIC Document Control at the provided address. Make sure to double-check all the information for accuracy before sending it. If any assistance is needed, you can contact the support line for help.

What You Should Know About This Form

1. What is the Valic 403B Rollover Transfer form used for?

The Valic 403B Rollover Transfer form is designed for individuals who wish to transfer or roll over funds from their VALIC Annuity 403(b) Plan Accounts to another retirement account. This could include a rollover to an IRA or another employer's retirement plan, allowing for greater flexibility in managing retirement savings.

2. What information do I need to provide on the form?

To complete the form, you must provide personal details like your name, Social Security Number (or Tax ID), address, date of birth, and contact information. Additionally, you must indicate whether you are requesting a rollover or a transfer and provide related details such as the receiving plan type and specific account numbers for the funds being transferred.

3. How do I submit the completed form?

Once you have filled out the form, mail it to VALIC Document Control at P.O. Box 15648, Amarillo, TX 79105-5648. Ensure that you send the original form, as copies may not be processed.

4. Do I need spousal consent to make a rollover?

If you are married, you typically need spousal consent for a rollover from your 403(b) plan, especially if it is an ERISA plan. Your spouse must sign the spousal consent section of the form, acknowledging their understanding of the withdrawal and any implications it may have on survivor benefits.

5. What options do I have for receiving my rollover funds?

You can choose from several options when requesting a rollover. You can request a direct rollover, where funds are transferred directly to the new account. Alternatively, you can opt for a 60-day rollover, where you receive the funds and then deposit them into another account within 60 days. Make sure to be aware of the tax implications for the latter option, as 20% may be withheld for taxes.

6. What are the tax implications of rolling over my 403(b)?

A direct rollover generally avoids immediate tax consequences. You won’t owe taxes until you withdraw funds from the new account. However, if you go with a 60-day rollover and fail to transfer the entire taxable amount, you may be taxed on the portion not rolled over and could incur a penalty if you are younger than 59½ years. Always consult a tax advisor for personalized guidance.

7. What if I missed the 60-day rollover deadline?

If you miss the 60-day rollover deadline, the IRS can grant a waiver under certain circumstances, such as when external events prevent timely completion. Depending on your situation, you may self-certify that you meet waiver requirements or seek a private letter ruling from the IRS, which may involve additional fees.

8. Are there restrictions on which plans I can transfer funds to?

Yes. You can only transfer your funds to plans approved under your employer's 403(b) plan or those with which your employer has entered into an information-sharing agreement. It's crucial to check this before initiating the rollover to avoid processing delays.

9. What happens if I have outstanding loans associated with my account?

If you have loans tied to your account and wish to do a full withdrawal (surrender), you can opt to leave your account open to avoid impacting your outstanding loans. Alternatively, you can choose to terminate the loan, but it may result in a taxable distribution. Be sure to consider how your decision may affect your loans before proceeding with the rollover.

Common mistakes

Filling out the Valic 403(b) Rollover Transfer form can seem straightforward, but many people make mistakes that can complicate the process or even lead to delays. Understanding these common pitfalls is crucial for ensuring a smooth transfer of funds.

One frequent error occurs in the Client Information section. Individuals sometimes forget to include essential details, such as the correct Social Security Number or Tax ID. Omitting this information could result in a hold on the application while Valic tries to verify the correct details.

Another typical mistake is failing to clearly indicate the type of transfer or rollover being requested. The form provides checkboxes for this purpose, but individuals often leave these boxes unchecked, leading to confusion in processing. It is imperative to mark the appropriate option clearly to ensure that the request is processed correctly.

People frequently overlook the requirements for attached documentation. For instance, if transferring to a 403(b) plan, it is necessary to include a letter of authorization from the receiving vendor. Skipping this step creates processing delays and can ultimately impede the entire transfer process.

Incorrectly filling out the amounts or percentages for the distribution is yet another notable mistake. Inaccurate entries here may lead to unintended consequences, such as receiving a reduced amount than anticipated. It is important to double-check calculations and ensure that all figures are correct before submission.

In the Rollover Distribution Reason section, applicants sometimes check the incorrect boxes or fail to provide adequate explanations. This oversight could impact the tax implications of the distribution. Understanding which categories apply to one’s situation is vital for ensuring compliance with tax regulations regarding rollovers.

Individuals might also neglect the spousal consent requirements. If married, clients must indicate their marital status and provide their spouse's signature if required. Failure to secure this consent can result in the application being deemed incomplete, delaying the transfer.

Another common issue involves signature guarantees. For deposits of $25,000 or more, the form necessitates either a signature guarantee or the VFA representative's signature. Many people neglect this requirement, which can halt the transfer process until adequate verification is provided.

Moreover, participants sometimes misinterpret sections requiring the Plan Administrator's approval. If the administrator's signature is absent, delays in processing can arise. This oversight often stems from a lack of understanding of which sections require administrative involvement, emphasizing the need for clarity throughout the application.

Lastly, individuals may not thoroughly read the Special Tax Notice provided with the form. Ignoring the information on tax consequences can lead to unexpected tax liabilities. Awareness of rollover rules and consequences is imperative for anyone completing the Valic 403(b) Rollover Transfer form, ensuring not only compliance but also protection from unforeseen financial repercussions.

Documents used along the form

When completing the Valic 403B Rollover Transfer form, there are other important documents that may also need to be prepared or submitted depending on your specific situation. Here’s a brief overview of some of these forms to help you navigate the process smoothly.

- Receiving Vendor Letter of Authorization: This document is required if you are transferring funds to another 403(b) vendor. It confirms that the receiving vendor is authorized to accept the rollover and outlines the specific details necessary to process the transaction.

- Plan Administrator Approval Form: This is needed to verify that the transfer or rollover complies with your employer’s plan provisions. The Plan Administrator must indicate their approval, ensuring the transaction adheres to all applicable laws and regulations.

- Spousal Consent Form: If your plan is governed by ERISA, obtaining your spouse’s consent is essential if you're married. This form confirms that your spouse understands the implications of the withdrawal and willingly agrees to it, thereby waiving certain rights.

- State Defined Benefit Plan Documentation: If you are transferring to purchase service credit, this documentation will provide proof of the eligibility and the dollar amount necessary for the transaction. It ensures that your request aligns with the state requirements.

- Signature Guarantee Form: For requests of $25,000 or more, a signature guarantee is necessary. This form needs to be completed by an eligible guarantor (such as a bank or broker-dealer) to verify your identity and authorize the transfer.

Gathering these documents in advance can help streamline the rollover or transfer process. If you have any questions about which forms you need or how to fill them out, it’s always a good idea to reach out to a financial advisor or the appropriate plan administrator for guidance.

Similar forms

Direct Rollover Request Form: This document allows individuals to transfer retirement funds directly from one account to another without incurring tax penalties. Similar to the Valic 403B Rollover Transfer form, it requires personal information, the type of rollover being requested, and details about the receiving account.

IRA Transfer Form: Often used for transferring assets from one IRA to another, this form shares similarities with the Valic form in requiring account holder information and specifying the nature of the transfer. It focuses on moving funds between individual retirement accounts.

401(k) Rollover Form: This form enables employees to roll over 401(k) retirement plans into another qualified retirement account. It mirrors the Valic 403B form by detailing the needed personal information and giving options on where to transfer funds.

Qualified Domestic Relations Order (QDRO): A QDRO is a legal document often used in divorce proceedings to divide retirement plan assets. Like the Valic form, it requires specific information about the parties involved and clear instructions for fund distribution, although it has legal and marital implications.

Transfer Authorization Form for Pension Plans: This document facilitates the movement of funds between pension plans. Similar to the Valic rollover form, it requires extensive personal data and outlines the requested transfer type and amount, ensuring compliance with the plan's rules.

Dos and Don'ts

When filling out the Valic 403B Rollover Transfer form, there are several key points to keep in mind. Below is a list of dos and don’ts to ensure the process goes smoothly.

- Do provide accurate and complete personal information, including your name, address, SSN, and day time phone number.

- Do indicate clearly whether you are requesting a rollover or transfer by checking the appropriate box.

- Do ensure you attach any required documentation, such as vendor letters of authorization or evidence of eligibility for transfers to purchase service credit.

- Do verify that the receiving plan is eligible to accept your rollover before submitting the form.

- Do keep a copy of the completed form and any attachments for your records.

- Don’t leave blank spaces in essential fields; this can lead to processing delays.

- Don’t check more than one box under the Rollover/Transfer request section; it may confuse the processing team.

- Don’t forget to have your spouse sign and date the consent form if you are married, as this is mandatory for certain plans.

- Don’t wait until the last minute to submit the form; allow ample time for processing and any potential follow-up.

- Don’t submit the form without ensuring all required signatures, including those from authorized personnel, have been gathered.

Misconceptions

- Misconception: A rollover and transfer are the same. A rollover moves money from one retirement account to another, while a transfer typically involves moving funds without taking possession. They have different rules and implications.

- Misconception: Taxes are automatically withheld during a rollover. If done correctly, a rollover is not taxed. Taxes only apply if you receive the funds directly and do not complete the rollover within 60 days.

- Misconception: All retirement accounts accept rollovers. Not every retirement account accepts rollover contributions. It is essential to check with the receiving account to confirm they can accept the funds.

- Misconception: You can wait indefinitely to complete a rollover. There is a strict 60-day deadline for completing a rollover after receiving a distribution. Failing to meet this deadline may result in taxes and penalties.

- Misconception: You can only rollover the entire amount of a distribution. You may roll over any part of your eligible distribution. It is possible to keep part of the distribution and roll over the rest.

- Misconception: Spousal consent is required for all rollovers. Spousal consent is only necessary for ERISA-covered plans. If the plan is not subject to ERISA, you may not need spousal consent to complete a rollover.

- Misconception: After-tax contributions cannot be rolled over. After-tax contributions can be rolled over, but the tax implications must be carefully managed to avoid unnecessary taxes.

- Misconception: You need to close your account to perform a rollover. It is not mandatory to close your account when executing a rollover. You can often leave the account open while rolling over specific funds.

- Misconception: All distributions trigger penalties. Penalties only apply to early withdrawals made before age 59½ unless an exception applies, like a qualified rollover.

- Misconception: Notarizing the form guarantees acceptance. While notarization can help validate the spousal consent, the acceptance of the rollover depends on compliance with plan rules and regulations.

Key takeaways

- The Valic 403B Rollover Transfer form must be completed in its original form for processing.

- All personal information, including your name, address, and Social Security Number, must be filled out accurately.

- Clearly indicate whether you are requesting a Rollover or Transfer by checking the appropriate box.

- Specific documentation may be required for transfers, such as receiving vendor letters of authorization.

- If applicable, spousal consent is essential and must be notarized unless witnessed by the Plan Administrator.

- Ensure that you are aware of any potential tax implications associated with your distribution.

- If all regulatory requirements are not met, outstanding loans may remain intact after a surrender request.

- For amounts of $25,000 or more, a Signature Guarantee or the signature of your licensed agent is required.

- Review the Special Tax Notice provided in the form to understand your rights and obligations regarding rollovers.

Browse Other Templates

Proof of Pregnancy Form - Patient’s age during the first HIV diagnosis is recorded to help track medical history.

Gonzaga Admission Requirements - Be sure to complete all sections of the form for processing.