Fill Out Your Valic Form

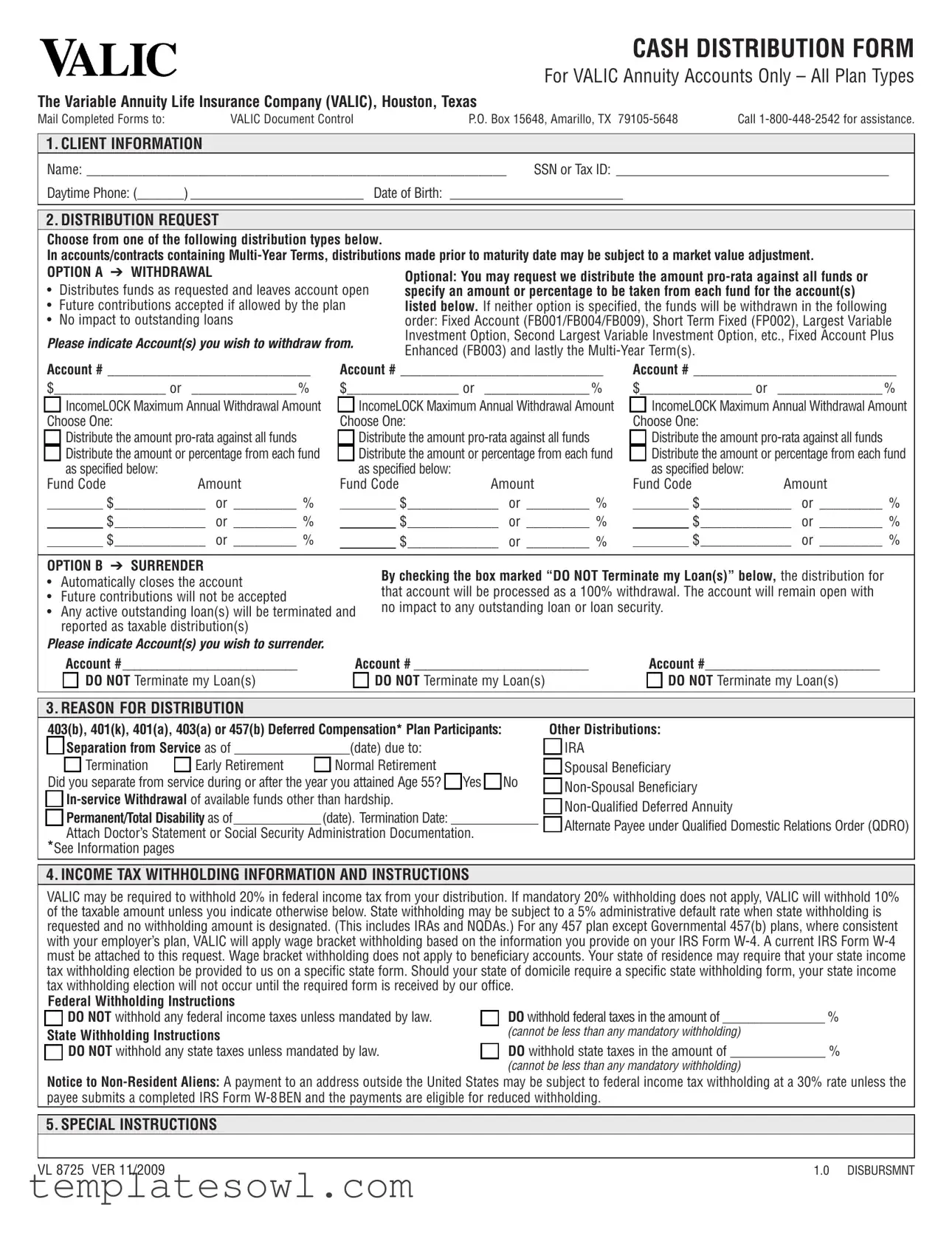

The Valic Cash Distribution Form serves as a crucial document for those looking to access their annuity account holdings through withdrawals or surrenders, ensuring that all necessary information is collected and processed efficiently. It is tailored specifically for various plan types, encompassing accounts like 403(b), 401(k), and others under the purview of the Variable Annuity Life Insurance Company, based in Houston, Texas. Clients are invited to document their personal information, including name, Social Security number or Tax ID, and contact details, creating a clear record for the VALIC team. The form offers options for either a withdrawal or a complete surrender of funds, each with distinct conditions regarding tax implications and account status. When selecting withdrawal, individuals can choose a pro-rata distribution or specify amounts from each fund within their account, while surrendering funds ensures account closure, barring specific stipulations regarding outstanding loans. Critical sections address reasons for distribution, anticipated tax withholding, and spousal consent when applicable. Recognizing the complexities inherent in retirement distribution, the Valic Cash Distribution Form stands as an essential facilitator in achieving financial goals related to annuity accounts while promoting clarity and compliance with regulatory frameworks.

Valic Example

CASH DISTRIBUTION FORM

For VALIC Annuity Accounts Only – All Plan Types

The Variable Annuity Life Insurance Company (VALIC), Houston, Texas

Mail Completed Forms to: |

VALIC Document Control |

P.O. Box 15648, Amarillo, TX |

Call |

|

|

|

|

|

|

1. CLIENT INFORMATION |

|

|

|

|

Name: ____________________________________________________________ |

SSN or Tax ID: _________________________________________ |

|||

Daytime Phone: (_______) __________________________ |

Date of Birth: __________________________ |

|

||

|

|

|

|

|

2. DISTRIBUTION REQUEST

|

Choose from one of the following distribution types below. |

|

|

|

|

|

|

||||||

|

In accounts/contracts containing |

||||||||||||

|

OPTION A ➔ WITHDRAWAL |

|

|

|

|

|

|

|

|

|

|||

|

|

|

Optional: You may request we distribute the amount |

|

|||||||||

|

• |

Distributes funds as requested and leaves account open |

|

||||||||||

|

specify an amount or percentage to be taken from each fund for the account(s) |

|

|||||||||||

|

• |

Future contributions accepted if allowed by the plan |

listed below. If neither option is specified, the funds will be withdrawn in the following |

|

|||||||||

|

• |

No impact to outstanding loans |

|

|

|

order: Fixed Account (FB001/FB004/FB009), Short Term Fixed (FP002), Largest Variable |

|

||||||

|

Please indicate Account(s) you wish to withdraw from. |

Investment Option, Second Largest Variable Investment Option, etc., Fixed Account Plus |

|

||||||||||

|

Enhanced (FB003) and lastly the |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Account # _____________________________ |

Account # _____________________________ |

|

Account # _____________________________ |

|||||||||

|

$________________ or _______________ % |

$________________ or _______________ % |

|

$________________ or _______________ % |

|||||||||

|

|

IncomeLOCK Maximum Annual Withdrawal Amount |

|

IncomeLOCK Maximum Annual Withdrawal Amount |

|

|

|

IncomeLOCK Maximum Annual Withdrawal Amount |

|||||

|

Choose One: |

Choose One: |

|

Choose One: |

|||||||||

|

|

|

Distribute the amount |

|

|

|

Distribute the amount |

|

|

|

Distribute the amount |

||

|

|

|

|

|

|

||||||||

|

|

|

Distribute the amount or percentage from each fund |

|

|

|

Distribute the amount or percentage from each fund |

|

|

|

Distribute the amount or percentage from each fund |

||

|

|

|

as specified below: |

|

|

as specified below: |

|

|

|

as specified below: |

|||

Fund Code |

Amount |

Fund Code |

Amount |

Fund Code |

Amount |

||||||

|

|

$_____________ |

or _________ % |

|

|

$_____________ |

or _________ % |

|

|

$_____________ |

or _________ % |

|

|

$_____________ |

or _________ % |

|

|

$_____________ |

or _________ % |

|

|

$_____________ |

or _________ % |

|

|

$_____________ |

or _________ % |

|

|

$_____________ |

or _________ % |

|

|

$_____________ |

or _________ % |

|

|

|

|

|

|

|

|

|

|

|

|

OPTION B ➔ SURRENDER |

|

By checking the box marked “DO NOT Terminate my Loan(s)” below, the distribution for |

||||

• Automatically closes the account |

|

|||||

|

that account will be processed as a 100% withdrawal. The account will remain open with |

|||||

• Future contributions will not be accepted |

|

|||||

|

no impact to any outstanding loan or loan security. |

|||||

• Any active outstanding loan(s) will be terminated and |

||||||

|

|

|

||||

reported as taxable distribution(s) |

|

|

|

|

||

Please indicate Account(s) you wish to surrender. |

|

|

|

|

||

|

Account # _______________________________ |

Account # _______________________________ |

Account #_______________________________ |

|||

|

DO NOT Terminate my Loan(s) |

|

DO NOT Terminate my Loan(s) |

|

DO NOT Terminate my Loan(s) |

|

|

|

|

||||

3. REASON FOR DISTRIBUTION

403(b), 401(k), 401(a), 403(a) or 457(b) Deferred Compensation* Plan Participants: |

|

|

||||||||||||

|

|

Separation from Service as of _________________(date) due to: |

|

|

|

|||||||||

|

|

|

Termination |

|

Early Retirement |

|

Normal Retirement |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||||||

Did |

you separate from service during or after the year you attained Age 55? |

|

Yes |

|

No |

|

||||||||

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|||||||||

|

|

Permanent/Total Disability as of_____________ (date). Termination Date: _____________ |

|

|

|

|||||||||

|

|

|

||||||||||||

|

|

Attach Doctor’s Statement or Social Security Administration Documentation. |

|

|

|

|||||||||

|

|

|

|

|

||||||||||

*See Information pages

Other Distributions:

IRA

Spousal Beneficiary

Alternate Payee under Qualified Domestic Relations Order (QDRO)

4. INCOME TAX WITHHOLDING INFORMATION AND INSTRUCTIONS

VALIC may be required to withhold 20% in federal income tax from your distribution. If mandatory 20% withholding does not apply, VALIC will withhold 10% of the taxable amount unless you indicate otherwise below. State withholding may be subject to a 5% administrative default rate when state withholding is requested and no withholding amount is designated. (This includes IRAs and NQDAs.) For any 457 plan except Governmental 457(b) plans, where consistent with your employer’s plan, VALIC will apply wage bracket withholding based on the information you provide on your IRS Form

Federal Withholding Instructions |

DO withhold federal taxes in the amount of ________________ % |

DO NOT withhold any federal income taxes unless mandated by law. |

State Withholding Instructions

DO NOT withhold any state taxes unless mandated by law.

(cannot be less than any mandatory withholding)

DO withhold state taxes in the amount of ______________ %

(cannot be less than any mandatory withholding)

Notice to

5. SPECIAL INSTRUCTIONS

VL 8725 VER 11/2009 |

1.0 DISBURSMNT |

CASH DISTRIBUTION FORM

For VALIC Annuity Accounts Only – All Plan Types

The Variable Annuity Life Insurance Company (VALIC), Houston, Texas

Mail Completed Forms to: |

VALIC Document Control |

P.O. Box 15648, Amarillo, TX |

Call |

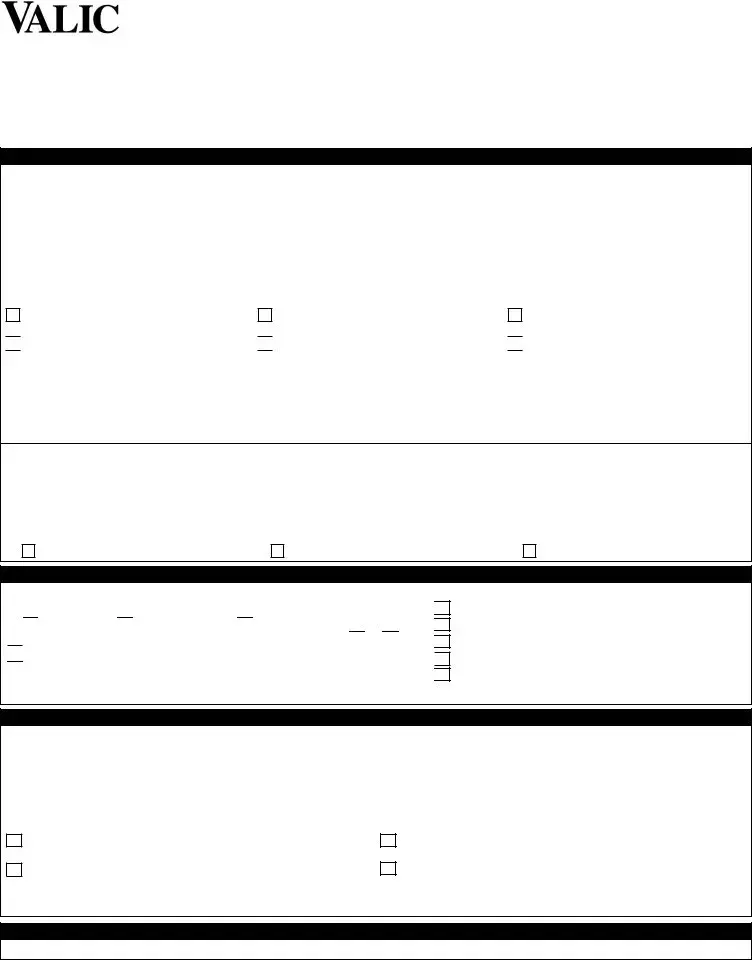

6. MAILING INSTRUCTIONS

The distribution will be mailed to your permanent address on record unless otherwise indicated below or unless your Plan requires that the check be returned to the employer:

___________________________________________________________ _____________________________ ___________ |

_______________ |

|||||||||

Street Address |

City |

|

|

State |

ZIP |

|||||

|

|

|

Check if the above is your new permanent address. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Send check by overnight delivery. I understand, by providing my credit card number below, that there will be a charge billed to my credit card for |

|||||||

|

|

|

this service and that a street address is required. If the credit card charge is not approved, the check will be sent by regular mail. |

|

|

|||||

|

|

|

|

|

|

|

Master Card |

|

|

Visa |

|

|

|

|

|

|

|

|

|

||

Card # __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ |

Expiration Date: ______________ |

|

|

American Express |

|

|

||||

|

|

|

||||||||

7. SPOUSAL CONSENT

REQUIRED FOR CLIENT: Client Marital Status |

|||||||

|

|

|

|

Not Married |

|

Married |

Legally Separated: Attach Court Order of Legal Separation (petition not acceptable) |

|

|

||||||

|

|

|

|

Missing Spouse: |

I |

hereby affirm |

that I have made reasonable attempts to locate my spouse and have not been able to do so. |

REQUIRED FOR SPOUSE: Spousal Consent

Under federal law for ERISA plans and the terms of some employer plans, as the spouse of the contract owner, you have the right to receive a survivor benefit of at least 50% of the amount in this contract if your spouse dies before you. As a result, your spouse must have written consent before making withdrawals from this contract. If you consent to the withdrawal, you will not receive a survivor benefit payment from VALIC for the amount withdrawn. If you agree to the withdrawal, please read and sign the statement below and have your signature witnessed.

•I have read and understand the Information pages and I agree to the payment of funds from the contract(s) listed in Section 2.

•I understand and agree that I am giving up my right to receive a survivor benefit payment from VALIC for the amount being paid and I release VALIC from all liability for making this payment.

Spouse’s Signature: ___________________________________ Date: _________________

SPOUSE’S SIGNATURE WITNESSED BY NOTARY PUBLIC

This section is only to be used for a Notary Public’s witnessing of the Spousal Consent in absence of the Plan Administrator’s Witness.

State of _________________ County of _____________ On this _____ day of _________________, year of _______

Before me personally appeared __________________________________ (name of spouse) known to me to be the person

who executed the SPOUSAL CONSENT and he/she acknowledged to me that he/she executed the same.

Notary Public __________________________________________________________

8. VESTING DETERMINATION FOR EMPLOYER CONTRIBUTION SOURCES

Vesting Information: To be completed by the employer sponsoring the plan if VALIC is NOT providing full plan administration services.

Employer Basic Vested ____________% Employer Supplemental/Matching Vested ____________%

All Employers: Indicate hours worked if Hours of Service is used by your plan to calculate benefits. Indicate months worked if Elapsed Time is used by your plan to calculate benefits. Any month in which an employee was compensated for one hour must be counted as a month worked.

Hours Worked ______________ or Months Worked _______________ or $ _______________

9. PLAN ADMINISTRATOR APPROVAL

To be completed where required under your employer’s plan.

•I approve this distribution in accordance with current plan provisions and all applicable laws and regulations.

•I verify that the information provided on this form for purposes of this distribution is correct to the best of my knowledge.

•If applicable, the client has established to my satisfaction that spousal consent is not required.

•I affirm that any signature of a client’s spouse in Section 7 of this form has been witnessed either by me or by a Notary Public.

Plan Administrator’s Signature: __________________________________________________________ Date: _______________________________

10. CLIENT APPROVAL

•I authorize the above distribution and certify that all statements, including marital statements, are complete and accurate to the best of my knowledge and belief.

•I have read and understand the information provided in the Information pages of this form, including IncomeLOCK Option if applicable, and acknowledge that distributions may be subject to surrender charges as provided in the contract and that this distribution may result in taxable income and penalties.

•I have read and understood the “Joint and Survivor Annuity and Qualified Annuity Benefit” section of the Information pages. By signing below I am agreeing to waive any benefit or right described in that section that would have been provided with respect to the amount that I am withdrawing. I also understand that I have the right to revoke any waiver if a distribution has not already been made.

•I understand that I will be responsible for providing evidence to the IRS, if required, to verify distribution reason.

•If this distribution will result in a total surrender of my account(s), I have attached my Contract/Certificate to this form, or alternatively, I certify that my Contract/ Certificate has been lost or destroyed. If my Contract/Certificate is not attached, I agree to indemnify VALIC against any claims that may be asserted on the basis of the Contract/Certificate being found and presented for payment.

Note: If you borrow, surrender, or withdraw any funds from your contract, the guaranteed elements,

Client’s Signature: ____________________________________________________________________ |

Date: _________________________________ |

|

|

VL 8725 VER 11/2009 |

1.0 DISBURSMNT |

CASH DISTRIBUTION FORM

For VALIC Annuity Accounts Only – All Plan Types

The Variable Annuity Life Insurance Company (VALIC), Houston, Texas

Mail Completed Forms to: |

VALIC Document Control |

P.O. Box 15648, Amarillo, TX |

Call |

|

|

|

|

INFORMATION

SPECIAL TAX NOTICE

You have the right to at least 30 days to consider your alternatives after receiving this notice. You may waive this review period. Your signature on this form will indicate that either you have had this

ELIGIBLE ROLLOVER DISTRIBUTIONS

The information in this notice applies to qualified plans,

Most withdrawals from

Roth 403(b) or 401(k) accounts may be rolled over only to another Roth account or to a Roth IRA. However, Roth IRAs may not be rolled over to a Roth 403(b) or Roth 401(k) account.

ROLLOVERS OF BENEFICIARY ACCOUNTS

Only (1) the participant, or (2) in the case of the participant’s death, the participant’s surviving spouse, or (3) in the case of a domestic relations order, the participant’s spouse or

of eligible retirement plans. The distribution must be transferred to the Beneficiary IRA in a direct

DISTRIBUTABLE EVENT

Generally a distributable event includes attainment of age 59½ (age 70½ for governmental 457(b) plans), separation from service, disability or death. However, the employer’s plan may place additional restrictions that must also be met prior to a distribution. If you have met a distributable event, you may request a rollover of funds to any eligible plan type or a transfer to a like plan type. If you wish to move funds from your VALIC 403(b) account to another 403(b) account via a rollover distribution, and have made contributions prior to

ROLLOVER/TRANSFER

Rollover Distributions: If you have met a distribute event on your eligible account(s) or plan you may roll directly to an eligible retirement plan with another carrier. The distribution will not be taxed but will be reported to the IRS. Rollover amounts due to a distributable event generally can remain free of withdrawal restrictions after moving to the receiving plan, unless the receiving plan applies restrictions to rollover amounts.

Transfers: Transfers to a like plan will not be taxed or reported to the IRS. Generally, transfers are allowed regardless of employment status. However, your employer’s plan may restrict you to authorized carriers. Transferred amounts generally become subject to the requirements of the plan receiving the transfer as though originally contributed to that plan. Exchanges of

EXAMPLES OF SOME POSSIBLE DIFFERENCES IN PLAN RESTRICTIONS

•The new plan may require spousal consent or plan administrator approval for distributions.

•The new plan may restrict distributions.

•Distributions from a governmental 457(b) deferred compensation plan are generally not subject to the 10% premature withdrawal penalty regardless of your age at the time of the distribution. If you roll your governmental 457(b) deferred compensation plan to another plan that is not a governmental 457(b) deferred compensation plan, or into an IRA, any subsequent distributions may be subject to a 10% premature withdrawal penalty.

•Eligible rollovers into a governmental 457(b) deferred compensation plan that were previously subject to a 10% premature withdrawal penalty will continue to be subject to that penalty at the time of withdrawal unless you are over age 59½ or some other exception applies.

•Amounts rolled over to a governmental 457(b) plan generally cannot be withdrawn prior to separation from service or attainment of age 70½ unless the plan allows.

ELIGIBLE ROLLOVER DISTRIBUTIONS PAID DIRECTLY TO YOU

You can request that we pay you directly. Except for IRA distributions, when we pay you directly, federal law requires us to withhold 20% for federal income taxes.

If a distribution is paid directly to you, you may subsequently roll over any

If your eligible rollover distribution is paid directly to you and not rolled over (including any amount withheld), the distribution will be taxable to you in the year you receive it. The distribution will not be taxable to the extent you roll other funds to replace the amount distributed and the amount withheld.

AMOUNTS NOT ELIGIBLE FOR ROLLOVER

Some amounts not eligible for rollover include these: amounts paid from a

If you direct us to pay the distribution to you, and it is not an eligible rollover distribution, we will apply 10% federal income tax withholding unless you indicate differently.

LOANS

If you request a total surrender of your

INCOMELOCK OPTION

If you have chosen the IncomeLOCK living benefit option, withdrawals from the contract will reduce the account value and all benefits of the IncomeLOCK

10% PENALTY

Unless an exception applies, the IRS may also assess a 10% federal tax penalty for early distributions if you are younger than age 59½.

VL 8725 VER 11/2009

CASH DISTRIBUTION FORM

For VALIC Annuity Accounts Only – All Plan Types

The Variable Annuity Life Insurance Company (VALIC), Houston, Texas

Mail Completed Forms to: |

VALIC Document Control |

P.O. Box 15648, Amarillo, TX |

Call |

|

|

|

|

SPECIAL TAX TREATMENT FOR CERTAIN

If you were born before January 1, 1936, and if your qualified plan distribution qualified as a

TAXATION OF ROTH IRAS AND ROTH ACCOUNTS

Contributions to Roth IRAs and Roth accounts are not deductible and therefore are distributed

*PRIVATE

Section 457(b) deferred compensation plans sponsored by private

QUALIFIED JOINT AND SURVIVOR ANNUITY AND QUALIFIED ANNUITY BENEFIT: FOR ERISA PLANS ONLY

This notice should be provided to you at least 30 days, but no more than 180 days, before your proposed distribution date.

If you are married, your retirement plan distributions will be paid to you in the form of a Qualified Joint and Survivor Annuity (“QJSA”) unless you elect a different form of distribution. Under your QJSA, if your spouse survives you, the plan will pay him or her at least 50% of the amount the plan had been paying to you, on the same frequency as the payments to you. If you are not married, your benefit will be paid monthly over your life and will end upon your death unless you elect a different form of distribution. This benefit is referred to as a Qualified Annuity Benefit (“QAB”).

The plan may satisfy the QJSA or QAB by using your vested account balance to purchase an annuity contract from an insurance company. The actual monthly payments made under the annuity contract will depend on the value of your account balance, annuity purchase rates used by the insurance company, your age, and if you are married, your spouse’s age at the time the distribution begins.

The following table reflects the relative values of monthly payments from a Joint and Survivor Annuity and a Life Annuity, assuming a vested account balance of $5,000 and an interest rate of 6%. This table is based on the Annuity 2000 Mortality tables. The table is hypothetical and does not reflect the value of your individual benefit or the actual payments you or your beneficiaries would receive. Please note that as the ages change, the payment amount will change. If none of the examples closely approximates your situation, you may obtain a more accurate value specific to your situation from your plan administrator or from your financial advisor.

Age at Benefit Starting Date

Annuitant |

70 |

65 |

60 |

55 |

50 |

45 |

40 |

35 |

Spouse |

65 |

70 |

55 |

60 |

45 |

50 |

35 |

40 |

Monthly Payment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annuitant Life |

|

|

|

|

|

|

|

|

Only |

39.62 |

35.35 32.38 |

30.27 |

28.75 |

27.61 |

26.76 |

26.13 |

|

Joint and |

|

|

|

|

|

|

|

|

50% Survivor |

35.47 |

33.65 30.21 |

29.26 |

27.53 |

26.99 |

26.07 |

25.76 |

|

|

|

|

|

|

|

|

|

|

Joint and |

|

|

|

|

|

|

|

|

75% Survivor |

33.71 |

32.86 |

29.23 |

28.78 |

26.95 |

26.70 |

25.73 |

25.58 |

This QJSA or QAB requirement may not apply to smaller account balances (generally below $5,000) and will not apply if you have elected another form of benefit. A partial withdrawal would be considered another form of benefit for this purpose. Other alternate forms of benefits that may be available under your employer’s plan and under your plan investments may include:

Annuity

An annuity can provide you with payments for your life or for your life and that of your beneficiary; payments for a specified period; payments for your lifetime with a minimum guaranteed period; or a continuation of payments to your surviving spouse that is different from the plan’s percentage of

the payments made to you. Generally, the more that the form of payment guarantees, such as a minimum period of payments, or payments to your surviving spouse or to another beneficiary, the more that specified benefit amount will cost. There are IRS rules that may limit the period during which payments may be made.

Lump Sum Distribution

If you elect a lump sum distribution, your benefit will be paid to you in one payment. The amount of your benefit is the vested portion of your account balance as of the valuation date used to calculate your distribution.

Installments

If you elect to receive your benefits in installments, you may specify the dollar amount and frequency of your payments. The period of time over which you receive these installments cannot be greater than your life expectancy or the joint life and last survivor expectancy of you and your designated beneficiary. There are other IRS rules that may further limit the period over which you receive payments.

In order to elect one of these alternative forms of benefits you must waive your right to the QJSA or QAB, and if you are married, your spouse must also consent in writing. In addition, this written consent must be witnessed by a Notary Public or by your Plan Administrator. You are entitled to 30 days (but no more than 180 days) within which to make this decision. Although you have at least 30 days to make this decision, under some circumstances, you may waive this minimum

The investment options available to you, the right to change investment options, and the fees imposed under the investment options will not be affected by your decision to defer distributions.

VL 8725 VER 11/2009

Form Characteristics

| Fact Name | Description |

|---|---|

| Type of Form | This is a Cash Distribution Form specifically for VALIC annuity accounts, applicable to all plan types. |

| Purpose | The form is used to request distributions from VALIC annuity accounts, allowing clients to select withdrawal or surrender options. |

| Distribution Types | Clients can choose between a withdrawal or a surrender of their account. Each option has specific implications for account closure and future contributions. |

| Tax Withholding | Federal income tax withholding may apply, typically 20% for direct payments. Additionally, state tax withholding rules vary and may apply. |

| State Compliance | State-specific withholding requirements may necessitate the use of certain state forms for proper compliance with local laws. |

| Spousal Consent | For ERISA-covered plans, spousal consent is required for distributions, ensuring spousal rights to survivor benefits are considered. |

| Mailing Instructions | Completed forms must be mailed to VALIC Document Control in Amarillo, Texas, with the option to request overnight delivery. |

Guidelines on Utilizing Valic

Filling out the Valic form is a critical step to initiate a cash distribution from your annuity account. You will provide personal information, select your desired distribution type, and account for tax withholding. Make sure you have all necessary documents and information ready before starting. Follow these instructions carefully to ensure accuracy.

- Client Information: Fill in your name, Social Security Number or Tax ID, daytime phone number, and date of birth.

- Distribution Request: Choose between a withdrawal or surrender. Specify the account numbers and the exact amount or percentage you wish to withdraw. Indicate if you want a pro-rata distribution, or specify the amounts for different funds.

- Reason for Distribution: Check the applicable reason for your distribution from the provided options. Include the separation date if applicable.

- Income Tax Withholding Information: Indicate your federal and state tax withholding preferences. You can choose to withhold percentages or opt out completely if allowed.

- Mailing Instructions: Provide your mailing address for sending the distribution check. Indicate if this is a new permanent address and if you want overnight delivery.

- Spousal Consent: If applicable, indicate your marital status and obtain your spouse's signature if the plan requires it. Have the consent witnessed by a notary if needed.

- Vesting Determination: If relevant, have your employer complete this section regarding your vesting status.

- Plan Administrator Approval: This section should be filled out by your plan administrator if required. They will sign to confirm that the distribution complies with plan rules.

- Client Approval: Sign and date to authorize the distribution. Confirm that all information is complete and accurate.

- Submission: Double-check the entire form for accuracy, then mail it to the address provided in the form.

What You Should Know About This Form

What is the VALIC Cash Distribution Form used for?

The VALIC Cash Distribution Form is specifically designed for individuals with VALIC annuity accounts who wish to initiate a distribution. This form can handle withdrawals or surrender requests from various plan types, including 403(b), 401(k), and IRA accounts.

Who should fill out the form?

This form should be completed by clients who hold annuity accounts with VALIC and want to withdraw or surrender funds. Clients must provide personal information such as name, Social Security Number (or Tax ID), and other identifying details.

What options do I have for withdrawal?

There are two main options for withdrawals: Option A allows for a withdrawal where you can specify amounts either as a pro-rata distribution across all funds or by selecting specific amounts from designated funds. Option B is for total account surrender, which will also impact any outstanding loans.

Is there a minimum withdrawal amount?

The form does not specify a minimum withdrawal amount. However, clients should check their account details, as some accounts may have restrictions or minimums based on their specific contracts.

How is tax withholding handled on distributions?

VALIC is required to withhold 20% in federal income tax for most distributions unless specified otherwise. If the mandatory withholding does not apply, a default of 10% will be withheld unless you choose a different percentage. State tax withholding may also apply.

Is spousal consent necessary for distributions?

Yes, spousal consent is required for ERISA-covered plans. Both the account owner and spouse must complete the appropriate sections of the form, and the spouse's consent must be witnessed, either by a Notary Public or a Plan Administrator.

What happens to outstanding loans when I surrender my account?

If you surrender your account, the outstanding balance of any loans will be deducted from your distribution amount. The balance will be reported as taxable income unless you roll it over into another qualified plan.

How do I ensure my distribution goes to the correct address?

Distributions are mailed to the permanent address on file unless you indicate otherwise on the form. Ensure your address is up to date and, if necessary, provide an alternate mailing address to avoid any delays.

Can I roll over my distribution to another account?

Yes, most distributions from tax-favored retirement plans are eligible for rollover to another qualified plan or to an IRA. It is essential to meet specific conditions and complete the necessary documentation to avoid tax implications.

Common mistakes

Completing the VALIC Cash Distribution Form can seem straightforward, but many people make common mistakes that can lead to delays or complications in processing their requests. Understanding these pitfalls can save time and ensure that your distribution request is processed smoothly.

One significant mistake is failing to provide complete client information. Ensure that your name, Social Security Number or Tax ID, daytime phone number, and date of birth are all filled out clearly. Missing this crucial information can cause delays in processing your request.

Another common error involves selecting the wrong distribution type. The form offers options for withdrawals and surrenders, each with specific consequences. If you choose the surrender option without realizing it, you may inadvertently close your account or end your access to future contributions. Always double-check which option best suits your needs before proceeding.

People often overlook the amounts they specify for withdrawal. Not clearly indicating the precise dollar amount or percentage for each fund can lead to misunderstandings. If not stated, the funds will be withdrawn in a default order that may not align with your preferences.

Additionally, neglecting to check the box regarding income tax withholding can have financial implications. The form allows you to specify your withholding preferences for federal and state income taxes. Failing to indicate your choice could result in automatic withholding rates that may not reflect your actual tax obligations, potentially leading to surprises during tax season.

Filling out the reason for distribution inaccurately can also cause issues. If you select "separation from service," ensure you accurately note the date. Providing incorrect dates or failing to attach required documentation, such as a doctor's statement for total disability, may delay your request.

Moreover, many forget to sign and date the form. This critical step is non-negotiable. A missing signature will render the application incomplete, causing additional processing time.

Verifying spousal consent is another essential aspect often overlooked. Your marital status must be accurate, especially for ERISA-covered plans. If you’re married, obtaining your spouse’s signature and witnessing it appropriately is vital. Not following this requirement may invalidate the distribution.

Incorrectly filling out the mailing instructions can lead to checks being sent to the wrong address. It’s wise to confirm that your permanent address is up-to-date or clearly state any temporary changes.

Finally, leaving the client approval section incomplete can jeopardize your entire submission. This section includes declarations about understanding the implications of the withdrawal. Ensure you read through this section carefully to avoid any disappointment later on.

By being mindful of these common mistakes when completing the VALIC Cash Distribution Form, you can help ensure a smoother transaction process, allowing you to access your funds without unnecessary delays.

Documents used along the form

The Valic Cash Distribution Form is a crucial document for clients looking to withdraw funds from their VALIC annuity accounts. When completing this process, other associated forms and documents are often necessary to ensure compliance and streamline the withdrawal. Each of these documents serves a specific purpose in managing retirement accounts and distributions.

- IRS Form W-4: This form is essential for clients to specify their federal income tax withholding preferences on the distribution. It allows individuals to direct withholding amounts, ensuring they meet their tax obligations and avoid unexpected liabilities.

- IRS Form W-8 BEN: Non-resident aliens use this form to claim a reduced withholding rate on U.S. source income, including distributions. It must be completed and submitted to ensure clients pay the correct amount of U.S. taxes on their distributions.

- Spousal Consent Form: For ERISA-covered plans, a spousal consent form may be necessary to confirm that a spouse agrees to the distribution request. This document protects the survivor benefits that spouses are entitled to under federal law.

- Plan Administrator Approval Form: Some plans require this form, which certifies that the plan administrator has reviewed and approved the distribution request. This ensures compliance with the plan rules and verifies the validity of the distribution process.

Understanding the purpose of each document is essential for ensuring a smooth withdrawal process. Completing these forms accurately will help facilitate a seamless distribution while staying compliant with regulations. Always check with an advisor if you have questions about specific requirements.

Similar forms

- Withdrawal Request Form: Similar to the VALIC form, this document allows investors to request the withdrawal of funds from their accounts. It also specifies how much and from which accounts the funds should be drawn, offering flexibility in withdrawal options.

- Surrender Form: This form functions like the VALIC surrender option. It allows account holders to formally request the complete withdrawal of their funds, effectively closing their accounts while detailing any implications for loans or outstanding balances.

- Distribution Request for 401(k) Plans: This document enables participants of 401(k) plans to request distributions. Like the VALIC form, it addresses reasons for the distribution, including retirement or separation from service, and includes tax withholding options.

- Direct Rollover Request Form: Just as the VALIC form addresses rollover options, this document facilitates the direct transfer of retirement funds between eligible plans. It provides beneficiaries with various options for managing their retirement savings.

- Tax Withholding Election Form: Similar to the tax withholding section of the VALIC form, this document allows account holders to indicate their federal and state tax withholding preferences during the distribution process and outlines potential penalties.

- Spousal Consent Form: This document is used to obtain consent from a spouse for the withdrawal of retirement funds, paralleling the spousal consent requirements found in the VALIC form.

- Vesting Schedule Document: Like the vesting portion in the VALIC form, this document outlines how much of an account holder's employer contributions are fully owned over time, clarifying the rights to funds based on employment duration.

Dos and Don'ts

When filling out the VALIC Cash Distribution Form, it is crucial to approach the task thoughtfully. Below is a list of ten important considerations that can guide you through this process effectively. Some points emphasize positive actions to take, while others highlight common pitfalls to avoid.

- Do ensure your personal information is accurate. Correctly entering your name, Social Security Number, and contact details prevents delays.

- Do double-check the distribution type you are selecting. Familiarize yourself with options A and B to know which suits your needs.

- Do consider tax implications carefully. Understand that federal taxes could be withheld from your distribution and decide your withholding preferences accordingly.

- Do seek assistance if needed. Utilize the hotline at 1-800-448-2542 for any questions related to the form.

- Do sign and date where required. Your signature indicates your approval of the distribution, and it is crucial for processing your request.

- Don't rush through the form. Take your time to read all sections, ensuring you understand each requirement before proceeding.

- Don't leave sections blank. Omitting information can lead to processing delays or rejection of your application.

- Don't assume your previous mailing address is correct. If you have moved, specify your new address clearly to avoid issues in receiving your distribution.

- Don't overlook spousal consent if applicable. For certain plans, your spouse’s signature may be necessary to proceed with the distribution.

- Don't forget to keep a copy of the completed form. Retaining a copy ensures you have a record of your request and details for future reference.

By adhering to these guidelines, individuals can navigate the completion of the VALIC form with greater confidence and clarity, ultimately ensuring a smoother distribution process.

Misconceptions

Misconception 1: Everyone can withdraw funds at any time without consequences.

Many believe that accessing funds from their VALIC account is as simple as submitting a request. However, certain restrictions may apply, especially for accounts with Multi-Year Terms. Withdrawals made before the maturity date could be subject to market value adjustments, which may significantly impact the amount received. It's crucial to understand the terms associated with your specific account type to avoid unexpected penalties.

Misconception 2: All funds are automatically eligible for rollover.

There’s often a belief that all distribution types can simply be rolled over into another retirement plan. Not all distributions qualify for rollover. For instance, hardship withdrawals, required minimum distributions, and amounts from non-qualified annuities do not meet this criterion. Be sure to verify which distributions are eligible to roll over with your plan administrator.

Misconception 3: Spousal consent is not needed for all withdrawals.

Some individuals assume that spousal consent is only required for specific plans. In fact, federal law mandates that spousal consent is necessary for most ERISA-covered plans. This is to protect the surviving spouse's rights to survivor benefits. If you're married, you must obtain written consent from your spouse before making significant withdrawals from the account.

Misconception 4: Withdrawals mean immediate tax liabilities without exceptions.

While it’s true that withdrawals from retirement accounts have tax implications, not all situations result in immediate tax liabilities. For example, if you are over 59½ years old, you may avoid penalties on distributions. Additionally, certain exceptions apply depending on your circumstances, such as disability or separation from service. Understanding these nuances can ultimately save you money when planning your withdrawal strategy.

Key takeaways

Key Takeaways for Filling Out and Using the VALIC Cash Distribution Form

- Ensure that all client information is accurately completed. Include your name, Social Security Number, daytime phone number, and date of birth to avoid processing delays.

- Choose your distribution option carefully. You must select between withdrawal or surrender, as each has different implications for your account and potential tax liabilities.

- Be aware of tax withholding requirements. VALIC may withhold federal and state taxes from your distribution unless you specify otherwise, which can impact the net amount you receive.

- Follow the mailing instructions. Complete forms must be mailed to the address provided, or you can opt for overnight delivery at an additional charge. Ensure that you provide a current address if it has changed.

Browse Other Templates

Modelo 145 - It has been revised as of October 2000.

Sc Restraining Order Requirements - Taking the first step by filing a restraining order can lead to a safer environment.

Refinancing an Fha Loan - Filling out this authorization is usually the first step in accessing lower interest rates or different loan terms.