Fill Out Your Var 700 Form

Real estate transactions, particularly commercial purchases, necessitate comprehensive agreements that detail the intricacies of the sale and protect the interests of all parties involved. The Var 700 form, more formally known as the Virginia REALTORS® Commercial Purchase Agreement, serves as a legally binding document that outlines critical elements of the transaction. This form begins with the identification of the seller and purchaser, ensuring that the brokerage relationships are disclosed at the outset. It stipulates the property details, including tax parcel information and physical location, while also addressing the presence of any tenants. Central to this agreement is the purchase price, which includes provisions for deposits and payment arrangements that must be honored at settlement. The form accurately details the responsibilities of both the seller and purchaser regarding settlement procedures, the condition of the property, and the handling of any contingencies, such as inspections and financing. Legal due diligence is also emphasized, with sections dedicated to title and survey objections that can impact the transaction's validity. Moreover, it lays out the potential ramifications in case of default by either party, establishing a clear framework for resolving disputes. In summary, the Var 700 form encapsulates the key components essential for a successful commercial real estate transaction, highlighting the necessity for clarity and legal compliance throughout the process.

Var 700 Example

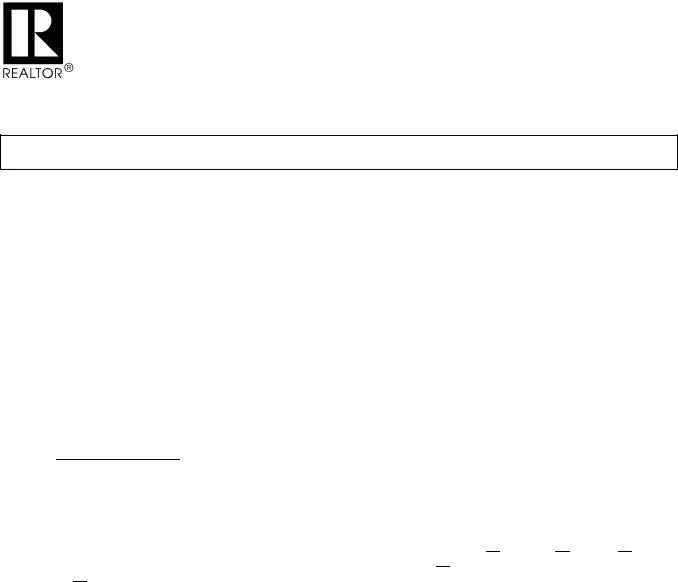

VIRGINIA REALTORS®

Commercial Purchase Agreement

Each commercial transaction is different. This form may not address your specific purpose. This is a legally binding document. If not understood, seek competent advice before signing.

This Commercial Purchase Agreement (the “Agreement”) is dated ___________, 20 13 , between

__________________________________________________________(“Seller”)and

__________________________________________ (“Purchaser”). The parties acknowledge that

______________________________________ (“Listing Broker”) represents Seller and that

___________________________________________ (“Selling Broker”) represents [select one]: Seller

Purchaser. The parties further acknowledge that disclosure of the brokerage relationships was made to them by the real estate licensees involved in this transaction when specific assistance was first rendered and confirmed in writing.

1.Sale of Property. Purchaser agrees to buy and Seller agrees to sell the land, all improvements thereon, and all rights and appurtenances thereto belonging, located in the City/County of _____________________, Virginia, with a tax parcel no. of __________________ and a street address of

______________________________________________________. Seller discloses that [select one]: there are no tenants or other parties in possession of the Property OR there are tenants or persons who are in possession of the Property as set forth on SCHEDULE A attached hereto.

2.Purchase Price.The purchase price for the Property is

______________________________________________ Dollars ($____________________) (the “Purchase Price”) and shall be paid to Seller at Settlement, subject to the prorations and adjustments described herein, as follows:

A.Deposit: Purchaser shall make a deposit of $___________ to be held by

_______________________________ (the “Escrow Agent”) in the form of:  check

check  cash

cash  other

other

_______________________ (the “Deposit”). Purchaser [select one]:  has paid the Deposit to the Escrow Agent OR

has paid the Deposit to the Escrow Agent OR  will pay the Deposit to the Escrow Agent within ______ days (the “Extended Deposit Date”) after the date this Contract is fully executed by the parties. If Purchaser fails to pay the Deposit as set forth herein, then Purchaser shall be in breach of this Contract. At Seller’s option and in lieu of all other remedies set forth in this Contract, Seller may terminate this Contract by written notice to Purchaser and neither party shall have any further obligation hereunder.

will pay the Deposit to the Escrow Agent within ______ days (the “Extended Deposit Date”) after the date this Contract is fully executed by the parties. If Purchaser fails to pay the Deposit as set forth herein, then Purchaser shall be in breach of this Contract. At Seller’s option and in lieu of all other remedies set forth in this Contract, Seller may terminate this Contract by written notice to Purchaser and neither party shall have any further obligation hereunder.

If the Escrow Agent is a Virginia Real Estate Board (“VREB”) licensee, the parties direct the Escrow Agent to place the Deposit in an escrow account by the end of the fifth business banking day following the latter of: (i) the date this Contract is fully executed by the parties, or (ii) the Extended Deposit Date. If the Escrow Agent is not a VREB licensee, the parties direct the Escrow Agent to place the Deposit in an escrow account in conformance with applicable Federal or Virginia law and regulations. The Deposit may be held in an interest bearing account and the parties waive any claim to interest resulting from such Deposit. The Deposit shall not be released by the Escrow Agent until (i) credited toward the purchase price at settlement; (ii) Seller and Purchaser agree in writing as to its disposition, (iii) a court of competent jurisdiction orders a disbursement of the funds, or (iv) disbursed in such manner as authorized by the terms of this Contract or by Virginia law or regulations. Seller and Purchaser agree that Escrow Agent shall have no liability to any party for disbursing the Deposit in accordance with this paragraph, except in the event of Escrow Agent’s negligence or willful misconduct.

B.Balance. The balance of the Purchase Price shall be paid by Purchaser at Settlement in certified funds or bank wire (inclusive of any loan obtained by Purchaser to purchase the Property).

VR Form 700 Revised 07/19 |

Page 1 of 9 |

Reviewed 07/19 |

|

3.Settlement.

A.Settlement of Property. Settlement of the purchase and sale of the Property shall be made at

_____________________________________ on ___________________ (“Settlement”). Possession of the Property shall be delivered to Purchaser at Settlement.

B.Deliveries by Seller at Settlement. At Settlement, Seller shall deliver to Purchaser the following:

(i)A general warranty deed with full English covenants of title (the “Deed”) conveying to the Purchaser good and marketable fee simple title to the Property, free and clear of all liens, encumbrances, conditions and restrictions, except any lien for real estate taxes not yet due and payable, and any Title Objections for which Purchaser has no objection and/or has waived such objection pursuant to Paragraph 5;

(ii)An affidavit for the benefit of Purchaser and its title insurer, satisfactory to Purchaser’s title company (the “Affidavit”) stating that (i) no right to a mechanic’s or materialman’s lien has accrued with respect to the Property as a result of any act or omission by the Seller and (ii) there are no outstanding leases or agreements with regard to, or other parties in or entitled to possession of, the Property except as disclosed in SCHEDULE A attached hereto;

(iii)A Certificate of

(iv)If the Property is leased, a tenant estoppel certificate and an assignment of lease (including the transfer of the security deposit at Settlement) for each and every tenant of the Property, in forms acceptable to Purchaser; and

(v)Such other Seller certifications as Purchaser’s lender or title company may reasonably

require.

C.Costs and Prorations. Seller shall pay the costs of preparing the Deed, the Grantor’s tax thereon and any other expenses incurred by Seller. Purchaser shall pay for the title search, title insurance premiums, survey expenses, lender fees, Grantee’s tax and all other settlement expenses incurred by Purchaser. Real estate taxes, rent, CAM and assessments, as applicable, shall be prorated between Seller and Purchaser as of the date of the Settlement. Each party shall pay its own legal, accounting and other expenses incurred in connection with this Agreement or Settlement.

D.Condition of Property. Purchaser agrees to accept the Property at Settlement in its physical condition at the time this Agreement is fully executed by all parties, except as otherwise provided herein. Seller agrees to maintain the Property in good condition and repair until Settlement. At Settlement, Seller agrees to transfer to Purchaser all existing warranties, if any, on the Property’s roof, structural components, HVAC, mechanical, electrical, security and plumbing systems.

4.Feasibility Period.

A.For a period of ___________________________ (_____) days following execution of this Agreement by all parties (the “Feasibility Period”), Purchaser, its agents and contractors, shall have the right to:

(i) enter the Property for the purpose of inspecting the Property and performing tests as are desirable to Purchaser in its sole and absolute discretion; (ii) seek zoning information from the local governing authority concerning Purchaser’s intended use of the Property; and/or (iii) apply for lender financing to acquire the Property.

B.Within five (5) days after Seller’s receipt of a fully executed copy of this Agreement, if not previously delivered, Seller shall deliver to Purchaser copies of the following materials related to the Property if in Seller’s possession: (i) any Phase I or other environmental studies; (ii) a current survey; (iii) the most current owner’s title insurance policy; and (iv) all leases and rent rolls for each tenant identified in SCHEDULE A (including without limitation, the base monthly rental and all taxes, insurance, and other

VR Form 700 Revised 07/19 |

Page 2 of 9 |

Reviewed 07/19 |

|

C.If Purchaser is not satisfied in its sole and absolute discretion with all aspects of the Property (including zoning) or the Materials, or has not obtained financing upon terms and conditions satisfactory to Purchaser, then Purchaser shall have the right, upon written notice to Seller prior to the expiration of the Feasibility Period, to terminate this Agreement, in which event the Deposit shall be refunded in full to Purchaser and the parties shall have no further obligation or liability to one another, except for any liability pursuant to the indemnity provisions of Paragraphs 4D., 10 and 11. Purchaser acknowledges that the Feasibility Period will not be extended for any reason, regardless of whether Purchaser has completed its inspections or zoning inquiry, or has obtained financing.

D.If Purchaser fails to acquire the Property, Purchaser agrees: (i) to repair any damage arising as a result of its exercise of the right of access granted in this Paragraph 4; (ii) to indemnify and hold Seller harmless from any and all liability of any kind or nature whatsoever as a result of the exercise of such right of access, other than as a result of Seller’s negligence or misconduct or the negligence or misconduct of Seller’s agents, employees or contractors; and (iii) upon demand to return the Materials to Seller.

5.Title and Survey Objections. Purchaser may, at its sole expense, obtain a title insurance commitment and a survey for the Property. Prior to the expiration of the Feasibility Period, Purchaser shall notify the Seller in writing as to any title or survey objections regarding the Property that the Purchaser is unwilling to accept (collectively the “Title Objections”). Seller shall advise Purchaser in writing within ten (10) days after receipt of such notice, which if any of the Title Objections will not be cured by Seller at or prior to Settlement. If Seller fails to respond to Purchaser within such ten (10) day period or if Seller’s response indicates that it does not intend to cure one or more of the Title Objections, then Purchaser may, at its option either (i) terminate this Agreement by giving written notice to Seller; (ii) cure such Title Objections at its own expense and proceed to Settlement with no reduction in the Purchase Price; or (iii) waive such Title Objections and proceed to Settlement, with no reduction in the Purchase Price. If Purchaser elects to terminate this Agreement, the Deposit shall be refunded in full to Purchaser and the parties shall have no further obligation or liability to one another, except for any liability pursuant to the indemnity provisions of Paragraphs 4D., 10 and 11.

6.Conditions Precedent to Obligation of Purchaser. This Agreement and all of Purchaser’s obligations hereunder are further subject to Purchaser determining in its sole and absolute discretion that all of the conditions set forth in this Paragraph 6 have been satisfied or waived in writing by Purchaser. In the event that any of the following conditions are not satisfied or waived by Purchaser, Purchaser may give written notice to Seller terminating this Agreement on or before Settlement, in which event the Deposit shall be refunded in full to Purchaser and the parties shall have no further obligation or liability to one another, except for any liability pursuant to the indemnity provisions of Paragraphs 4D., 10 and 11.

A.Seller’s Representations and Warranties. All the representations and warranties of Seller made herein shall have been true when made and shall be true and correct as of Settlement, with no material changes therein.

B.Seller’s Deliveries. As of Settlement, Seller shall have taken all action and delivered all documents and materials required by this Agreement.

C.No Litigation. As of Settlement, there shall be no litigation, proceeding or investigation pending, or to the knowledge of Purchaser or Seller threatened, which might prevent or adversely affect the intended use of the Property or which questions the validity of any action taken or to be taken by Seller or Purchaser hereunder, or which threatens the continued operation of the Property for commercial purposes.

7.Representations and Warranties of the Seller. Seller, jointly and severally (if more than one Seller), represents and warrants unto Purchaser as of the date hereof and on the Settlement date that:

A.Authority and Marketable Title. Seller is the owner of the Property, possesses the requisite authority to enter into and perform this Agreement, and has the absolute right to sell, assign, and transfer the Property to Purchaser at Settlement.

B.No Pending Litigation or Bankruptcy. There are no actions, suits or proceedings at law or in equity pending, threatened against, or affecting the Property before or by any federal, state, municipal, or other governmental department, commission, board, bureau, agency, or instrumentality. No bankruptcy or similar action, whether

VR Form 700 Revised 07/19 |

Page 3 of 9 |

Reviewed 07/19 |

|

voluntary or involuntary, is pending or is threatened against Seller, and Seller has no intention of filing or commencing any such action within ninety (90) days following Settlement.

C.No Outstanding Purchase Option. No option, right of first refusal or other contractual opportunity to purchase the Property has been granted to, or executed with, a

D.No Notice of Repairs. Seller has received no written notice from any governmental agency that repairs, alterations or corrections that must be made to the Property.

E.Utilities. The Property is connected to [select one]: □ a municipal water and sewer system and has utility meters installed within the Property OR □ a well and septic system located on the Property. Seller makes no representation on whether the capacities of such utilities are sufficient for Purchaser’s intended use of the Property.

F.Hazardous Materials. To the best of Seller’s actual knowledge, no toxic or hazardous materials (as said terms are defined in any applicable federal or state laws) have been used, discharged or stored on or about the Property in violation of said laws, and to the best of Seller’s knowledge, no such toxic or hazardous materials are now or will be at Settlement located on or below the surface of the Property. There are no petroleum storage tanks located on or beneath the surface of the Property.

G.Parties in Possession. As of the Settlement date, there will be no adverse or other parties in possession of the Property or any part thereof, nor has any party been granted any license, lease or other right or interest relating to the use or possession of the Property or any part thereof, except for the Leases attached hereto and made a part hereof as SCHEDULE A.

H.Other Contracts. Seller is not a party to any contracts relating to the Property that is not terminable at will, except as disclosed on SCHEDULE B, which is attached hereto and made a part hereof. Between the date of this Agreement and the Settlement date, Seller will not, without the prior written consent of Purchaser, which consent shall not be unreasonably withheld, enter into any contract relating to the Property that is not terminable at will.

I.No Undisclosed Restrictions. Seller has not, nor to the best of Seller’s knowledge or belief has any predecessor in title, executed or caused to be executed any document with or for the benefit of any governmental authority restricting the development, use or occupancy of the Property that has not specifically been disclosed to Purchaser or wouldn’t be revealed by a title report.

8.Risk of Loss. The risk of loss or damage to the Property by fire or other casualty prior to Settlement shall be on the Seller. If such loss or damage materially and adversely affects the use of the Property as of Settlement, Purchaser shall be entitled to terminate this Agreement by written notice to Seller, in which event the Deposit shall be refunded in full to Purchaser and the parties shall have no further obligation or liability to one another, except for any liability pursuant to the indemnity provisions of Paragraphs 4D., 10 and 11.

9.Condemnation. If, prior to Settlement, any taking pursuant to the power of eminent domain is proposed or occurs, as to all or any portion of the Property intended to be acquired at Settlement by the Purchaser, or sale occurs in lieu thereof, the Purchaser shall be entitled to terminate this Agreement by written notice to Seller, in which event the Deposit shall be refunded in full to Purchaser and the parties shall have no further obligation or liability to one another, except for any liability pursuant to the indemnity provisions of Paragraphs 4D., 10 and 11.

10.Access/Cooperation. During the term of this Agreement, Purchaser and his duly authorized agents shall be entitled to reasonable access to the Property for the purpose of surveying, appraising and making other findings related to the Property. Purchaser agrees to indemnify and hold the Seller harmless from any and all liability of any kind or nature whatsoever as a result of the exercise of such right of access, other than as a result of the Seller’s gross negligence or willful misconduct.

11.Agents and Brokers. Each party represents and warrants that it did not consult or deal with any broker or agent with regard to this Agreement or the transaction contemplated hereby, except for the Listing Broker and the Selling Broker, and each party hereto agrees to indemnify and hold harmless the other party from all liability,

VR Form 700 Revised 07/19 |

Page 4 of 9 |

Reviewed 07/19 |

|

expense, loss, cost or damage, including reasonable attorneys’ fees, that may arise by reason of any claim, demand or suit of any agent or broker arising out of facts constituting a breach of the foregoing representation and warranty. Listing Broker shall be paid a brokerage fee by Seller of _________% of the Purchase Price.

Selling Broker shall be paid by Seller a fee of _________% of the Purchase Price. The fees to the Listing Broker

and Selling Broker shall be paid in cash at Settlement.

12.Notices. Any notice, request or demand required or permitted to be given pursuant to this Agreement shall be in writing and shall be deemed sufficiently given if, delivered by hand or messenger at the address of the intended recipient, sent prepaid by Federal Express (or a comparable guaranteed overnight delivery service), or deposited in the United States first class mail (registered or certified, postage prepaid, with return receipt requested), addressed to the intended recipient, at the intended recipient’s address set forth below, or at such other address as the intended recipient may have specified by written notice to the sender given in accordance with the requirements of this Paragraph. Any such notice, request or demand so given shall be deemed given on the day it is received by the recipient.

For the Seller: _________________________________________________

_________________________________________________

_________________________________________________

For Purchaser: _________________________________________________

_________________________________________________

_________________________________________________

13.Default.

A.Default by Purchaser. If Purchaser defaults under this Agreement, the damages suffered by Seller would be difficult to ascertain. Therefore, Seller and Purchaser agree that, in the event of a default by

Purchaser, Seller’s sole and exclusive remedy, in lieu of all other remedies, shall be to terminate this Agreement and retain the Deposit as full and complete liquidated damages. If the Deposit is retained as liquidated damages, Seller agrees to pay

B.Default by Seller. If Seller defaults under this Agreement, Purchaser shall have the option to (i) seek specific performance of this Agreement, or (ii) terminate this Agreement, in which event the Deposit shall be promptly refunded to Purchaser. Seller shall be liable for Purchaser’s expenses in the filing of any specific performance action, including reasonable attorney’s fees and court costs.

C.Right to Cure Default. Prior to any termination of this Agreement as provided in Subparagraphs 13A. and 13B., the

D.Brokerage Fees. Notwithstanding the remedies set forth in Subparagraphs 13A., 13B, and 13C, if either Seller or Purchaser defaults under this Agreement, the defaulting party shall be liable for the full amount of the brokerage fees set forth in Paragraph 11 and any brokerage fees set forth in Seller’s listing agreement with the Listing Broker for the Property (which document is hereby incorporated herein by this reference) as if this Agreement and Seller’s listing agreement had been performed, and for any damages and all expenses incurred by the Listing Broker and the Selling Broker in connection with this transaction and the enforcement of this Agreement and Seller’s listing agreement, including, without limitation, attorney’s fees and court costs. Payment of a real estate broker’s fee as the result of a transaction relating to the Property which occurs subsequent to a

VR Form 700 Revised 07/19 |

Page 5 of 9 |

Reviewed 07/19 |

|

default under this Agreement shall not relieve the defaulting party of liability for any brokerage fees due under this Agreement or Seller’s listing agreement.

14.Miscellaneous.

A.Final Agreement. This Agreement contains the entire agreement between the parties hereto relating to the Property and supersedes all prior and contemporaneous negotiations, understandings and agreements, written or oral, between the parties hereto.

B.Virginia Law Applicable. This Agreement shall be construed, performed and enforced in accordance with the laws of the Commonwealth of Virginia and shall not be amended or modified and no waiver of any provision hereof shall be effective unless set forth in a written instrument executed with the same formality as this Agreement.

C.Assignment. This Agreement shall not be assigned by one party without the written consent of the other party, except the assignment of this Agreement to an entity owned by Purchaser or the principals of Purchaser shall not require the consent of Seller, but Purchaser shall provide written notice to Seller of such assignment. This Agreement shall inure to the benefit of the parties hereto and their respective and permitted successors and assigns.

D.Counterparts. This Agreement may be signed in one or more counterparts, each of which is deemed to be an original and all of which shall together constitute the same instrument. The parties agree that a fax of any signed original document shall have the same effect as an original.

E.

F.WIRE FRAUD ALERT. Criminals are hacking email accounts of real estate agents, title companies, settlement attorneys, and others, resulting in fraudulent wire instructions being used to divert funds to the account of the criminal. Purchaser and Seller are advised to not wire any funds without personally speaking with the intended recipient of the wire to confirm the routing number and the account number. Neither Purchaser or Seller should send personal information such as Social Security numbers, bank account numbers, and credit card numbers except through secured email or personal delivery to the intended recipient.

15.Additional Provisions:

16.Acceptance. To be effective this Agreement must be executed by Purchaser and Seller and an original copy of this Agreement returned to Purchaser no later than 5:00 p.m. on _______________________________, or this Purchase Agreement shall be deemed withdrawn.

VR Form 700 Revised 07/19 |

Page 6 of 9 |

Reviewed 07/19 |

|

Each of the parties has executed this Agreement in its name pursuant to due authority as of the dates set forth below.

Purchaser

Printed Name:

Title (if applicable):

Date:

Purchaser

Printed Name:

Title (if applicable):

Date:

Selling Company’s Name and Address

____________________________________

____________________________________

____________________________________

____________________________________

Seller

Printed Name:

Title (if applicable):

Date:

Seller

Printed Name:

Title (if applicable):

Date:

Listing Company’s Name and Address

Agent’s Name |

|

|

Agent’s Name |

||||||

Agent’s tel. no. |

|

|

Agent’s tel. no. |

|

|||||

Fax no. |

|

|

Fax no. |

|

|

||||

Agent’s |

|

|

|

Agent’s |

|

||||

COPYRIGHT©2019 by Virginia REALTORS®. All rights reserved. This form may be used only by members in good standing with Virginia REALTORS®. The reproduction of this form, in whole or in part, or the use of the name "Virginia REALTORS®", in connection with any other form, is prohibited without prior written consent from Virginia REALTORS®. The original form was licensed to Virginia REALTORS® (“VR”) by Central Virginia Regional MLS, LLC (“CVR MLS”) for use by members of VR and may not be otherwise used or duplicated without the written consent of CVR MLS. Seek legal advice if you do not understand any provision of this form.

VR Form 700 Revised 07/19 |

Page 7 of 9 |

Reviewed 07/19 |

|

SCHEDULE A

LEASES, AGREEMENTS AND CONTRACTS

FOR TENANTS AND OTHER PARTIES

IN POSSESSION OF THE PROPERTY

List below each such tenant or other party in possession of the Property, and provide Purchaser with a copy of each lease, license or other agreement. If verbal agreement, summarize terms below.

Also provide Purchaser with any contract affecting the Property that is not terminable at will.

VAR Form 700 Revised 07/19 |

Schedule A |

Reviewed 07/19 |

|

SCHEDULE B

CONTRACTS RELATING TO THE PROPERTY

(Not terminable at will)

VAR Form 700 Revised 07/19 |

Schedule B |

Reviewed 07/19 |

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Commercial Use | The Var 700 form serves as a Commercial Purchase Agreement specifically designed for transactions involving commercial property in Virginia. |

| Parties Involved | This form recognizes the roles of the Seller, Purchaser, Listing Broker, and Selling Broker, ensuring clarity in brokerage relationships. |

| Deposit Requirements | Purchasers must make an initial Deposit that the Escrow Agent holds until the settlement or other agreed-upon resolution. |

| Condition of Property | At Settlement, the Purchaser accepts the property in its current condition, unless other agreements have been made, emphasizing the importance of inspections prior to this point. |

| Governing Law | This agreement is governed by the laws of Virginia, specifically ensuring all statutory requirements related to real estate transactions are met. |

Guidelines on Utilizing Var 700

Filling out the Var 700 form is a crucial step in any commercial real estate transaction. This form outlines the agreement between the seller and purchaser and establishes the framework for the sale. To ensure that all necessary information is included accurately, it's essential to approach this process with diligence and attention to detail.

- Date: Write the date of the agreement at the top of the form where indicated.

- Seller Information: Fill in the full legal name(s) of the seller(s) in the provided space.

- Purchaser Information: Enter the full legal name(s) of the purchaser(s) in the corresponding section.

- Broker Representation: In the specified fields, indicate the name of the listing broker and the selling broker representing the transaction.

- Property Description: Provide complete details about the property being sold, including the city/county, tax parcel number, and the street address.

- Occupancy Status: Select whether there are tenants in possession of the property or if no tenants exist.

- Purchase Price: Clearly state the purchase price in both words and numbers.

- Deposit Amount: Specify the deposit amount and the name of the escrow agent who will hold the deposit.

- Extended Deposit Date: If applicable, indicate a date for the deposit to be made.

- Settlement Location: Fill in the address where the settlement will occur and the date of settlement.

- Deliveries at Settlement: List the documents that the seller will provide at settlement, such as the deed and any necessary affidavits.

- Feasibility Period: Specify the length of the feasibility period and detail any inspections or tests that may be conducted during this time.

- Notices: Complete the notice section by entering the addresses for both the seller and purchaser as required.

- Signatures: Ensure all parties sign and date the form where indicated to validate the agreement.

After completing the form, it should be reviewed carefully for accuracy. Any mistakes or omissions may delay the process or lead to misunderstandings later on. Once confirmed, the form can be submitted according to the instructions provided in your transaction. Always keep a copy for your records, as it will serve as an important document throughout the transaction process.

What You Should Know About This Form

What is the VAR 700 form?

The VAR 700 form is the Virginia REALTORS® Commercial Purchase Agreement. It is a legally binding document used to outline the terms and conditions for the sale of commercial property in Virginia. This agreement details the responsibilities of both the seller and the purchaser regarding the transaction and property involved.

Who are the parties involved in the VAR 700 form?

The parties involved in the VAR 700 form include the Seller, the Purchaser, and any Brokers representing either party. It is important for all parties to have a clear understanding of their roles, as this will facilitate a smoother transaction process.

What should I do if I don’t understand the VAR 700 form?

If you find any part of the VAR 700 form unclear, it is crucial to seek competent advice before signing. Understanding all terms and conditions in the agreement will help prevent future issues and ensure all parties are protected.

What is included in the sale of property?

The agreement states that the Purchaser agrees to buy all land, improvements, and rights related to the property. This includes any enhancements made to the land and any appurtenances that come with it. These specifics help clarify what is being transferred to the purchaser upon sale.

What is an Escrow Agent?

An Escrow Agent holds the deposit made by the Purchaser until the sale is finalized. The specifics of how the deposit will be handled, including the timeline for placing it in an escrow account, are outlined in the agreement. This ensures that the funds are safeguarded until all obligations in the contract are fulfilled.

What happens during the Settlement?

The Settlement is the official closing of the sale, where ownership of the property is transferred from the Seller to the Purchaser. During this meeting, relevant documents, such as the general warranty deed and various certificates, are delivered to finalize the purchase. It is essential for both parties to be adequately prepared for this step.

Can the Purchaser back out of the sale?

Yes, within a specified Feasibility Period, the Purchaser has the right to terminate the agreement if they are not satisfied with property inspections, financing, or zoning inquiries. If termination occurs during this period, the deposit will be refunded in full, allowing both parties to move on without further obligations.

What should I know about Title and Survey Objections?

Purchasers are encouraged to obtain a title insurance commitment and survey for the property. If issues arise regarding ownership or property limits, the Purchaser has the option to address or waive these objections within a particular timeframe before Settlement.

What if there is damage to the property before Settlement?

The Seller bears the risk of loss or damage to the property prior to Settlement. If the damage is significant enough to affect the property’s usability as of Settlement, the Purchaser may choose to terminate the Agreement. Such a step would also result in a full refund of the deposit to the Purchaser.

Common mistakes

Completing the VAR 700 form can be a daunting task, and several common mistakes may lead to complications down the line. Individuals often fail to enter the date correctly at the beginning of the agreement. Missing or incorrect dates can create confusion regarding the timeline of the contract. Ensuring that the date is accurate is crucial, as it affects the validity of the agreement and any deadlines established within.

Another frequent oversight involves the description of the property. Some individuals leave out essential information such as the tax parcel number or the complete street address. Without this information, it may become difficult to identify the property in question. Each detail plays a vital role in ensuring clarity and preventing disputes in the future.

Many people also make errors in selecting the appropriate party representation in the form. They may either leave the selection blank or fail to indicate whether the Listing Broker is representing the Seller or Purchaser. Such omissions can lead to misunderstandings about the roles of each party, ultimately complicating negotiations or settlement.

Additionally, purchasers sometimes neglect to specify the deposit amount and related payment details. This section is crucial in establishing the financial obligations of the purchaser. If the deposit is not clearly defined or if there are conflicting details in this regard, it could lead to disputes about financial commitments.

A common mistake occurs when entering information about any existing tenants or parties in possession of the property. It is essential to select the correct option regarding tenants or to include them explicitly in the attached Schedule A. Failing to disclose tenant information may expose the seller to liability or hinder the purchaser's planned use of the property.

Finally, individuals often underestimate the importance of initialing or signing where required. Each section requiring acknowledgment must be appropriately addressed. Neglecting to do so can result in a legally unenforceable agreement or disputes about the validity of signatures. Attention to detail is imperative when completing the VAR 700 form to ensure a smooth transaction process.

Documents used along the form

When navigating the complexities of a commercial real estate transaction in Virginia, several important forms and documents accompany the Var 700 form, also known as the Commercial Purchase Agreement. Each of these documents plays a significant role in ensuring that the transaction proceeds smoothly and legally. Here’s a brief overview of some of the key documents you might encounter.

- Title Insurance Policy: This policy protects the purchaser from potential losses due to defects in the title that could arise after the sale, ensuring that the buyer has clear ownership of the property.

- Deed: The deed is the legal document that transfers ownership of the property from the seller to the purchaser, confirming that the seller has the right to sell the property.

- Settlement Statement: This document outlines the final financial transactions involved in the sale, including the purchase price and any prorated expenses, helping to clarify how funds will be distributed at closing.

- Escrow Agreement: This agreement outlines the terms under which the purchase deposit is held by a third party (the escrow agent) until all conditions of the sale are satisfied.

- Tenant Estoppel Certificate: If the property has tenants, this certificate verifies the terms of the existing leases and confirms that there are no outstanding claims or disputes with the tenants.

- Loan Commitment Letter: If the purchaser is financing the purchase, this document from the lender outlines the terms of the loan and confirms the lender's commitment to provide funding.

- Environmental Inspection Report: This report assesses the property for any environmental hazards, which can be crucial to understand potential liabilities associated with the property before completing the sale.

- Disclosure Statements: These are required documents in which the seller reveals specific information about the property, including any known defects or issues that may affect its value or use.

In summary, each form and document used alongside the Var 700 serves a crucial purpose in the real estate transaction process. Understanding the specific role of each can help both buyers and sellers navigate their commercial real estate dealings with greater confidence and clarity.

Similar forms

- Residential Purchase Agreement: Similar to the Var 700, a Residential Purchase Agreement outlines the terms of buying and selling a residential property. It specifies purchase price, deposits, and contingencies, ensuring both parties understand their commitments.

- Lease Agreement: This document outlines the terms under which a tenant can occupy a rental property. Like the Var 700, it includes details about payments, duration, conditions of use, and expectations from both landlords and tenants.

- Commercial Lease Agreement: Much like the Var 700, this document governs the leasing of commercial properties. It establishes terms for rent, maintenance responsibilities, and rights concerning the property, emphasizing the specific needs of a business tenant.

- Title Insurance Policy: This document is essential for real estate transactions. Similar to parts of the Var 700, it protects against potential disputes regarding ownership, ensuring that buyers are shielded from any title defects that may arise post-purchase.

- Escrow Agreement: An Escrow Agreement supervises the handling of funds during a real estate transaction. Similar to the Var 700's provisions on deposits, it ensures that funds are securely managed until all contractual conditions are met, safeguarding both buyer and seller.

Dos and Don'ts

Filling out the Var 700 form requires careful attention to detail. Below are guidelines outlining key dos and don'ts to ensure the process runs smoothly.

- Do: Read the entire form thoroughly before filling it out. Understanding every section is crucial.

- Do: Ensure all personal and property information is accurate. Mistakes can lead to significant delays and complications.

- Do: Consult a legal advisor if any section is unclear. Their expertise can prevent future disputes.

- Do: Keep a copy of the completed form for your records. This can be vital for reference later on.

- Do: Include all required signatures. Incomplete forms may be considered invalid.

- Don't: Rush through the form. Take your time to ensure accuracy and completeness.

- Don't: Skip any sections, even if they seem unimportant. Each detail plays a role in the agreement.

- Don't: Ignore deadlines. Adhering to timelines is crucial for a smooth transaction.

- Don't: Sign without fully understanding the implications. This form is legally binding.

- Don't: Forget to have your advisor review the form before submission. Their insights can be invaluable.

Misconceptions

- Misconception: The Var 700 form is a universal agreement applicable to all commercial transactions. Each commercial deal is unique, and this form may not cover every specific situation. It’s crucial to understand its limitations.

- Misconception: Signing the Var 700 form means I am fully protected. While it is a legally binding document, it does not guarantee protection against all potential issues. Understanding its terms is vital.

- Misconception: The form includes all pertinent details without the need for additional documentation. Some important information may require supplementary documents or disclosures that are not inherently part of the Var 700.

- Misconception: The deposit is refundable under any circumstances. The deposit is only refundable under specific conditions, such as if the agreement is terminated during the feasibility period.

- Misconception: I can make changes to the agreement without consulting the other party. Both parties must agree in writing to any modifications. Communication is key to ensuring all changes are recognized.

- Misconception: The form eliminates the need for professional advice. It's always wise to consult a real estate attorney or related professional before signing, to fully understand your rights and obligations.

- Misconception: The form protects me from buyer’s remorse. Once signed, the terms are binding. If you are not satisfied, the ability to exit the contract may depend on specific conditions being met.

Key takeaways

The Var 700 form, known as the Virginia REALTORS® Commercial Purchase Agreement, serves as a crucial document in commercial real estate transactions. Understanding its key components is essential for both sellers and purchasers. Below are important takeaways regarding the use of this form:

- Legally Binding Agreement: This form is a legally binding contract. It is vital to fully understand the implications of the agreement before signing, as it represents a commitment to the transaction.

- Deposit Requirements: The agreement outlines the necessity for an initial deposit to be made, specifying the conditions under which the deposit may be retained or refunded. Failure to pay the deposit could result in a breach of contract.

- Feasibility Period: There is a defined period during which the purchaser can inspect the property and conduct due diligence. If unsatisfied with the findings, the purchaser can terminate the agreement within this timeframe and receive a refund of the deposit.

- Disclosure Obligations: The agreement contains provisions requiring both parties to disclose relevant information. This includes identifying any tenants or other parties in possession of the property, which can affect the transaction significantly.

Browse Other Templates

Point Park Transcripts - Write the full address where transcripts should be sent.

Mortgage Payoff Request - Ensuring the accuracy of the information you provide can help expedite your payoff request.