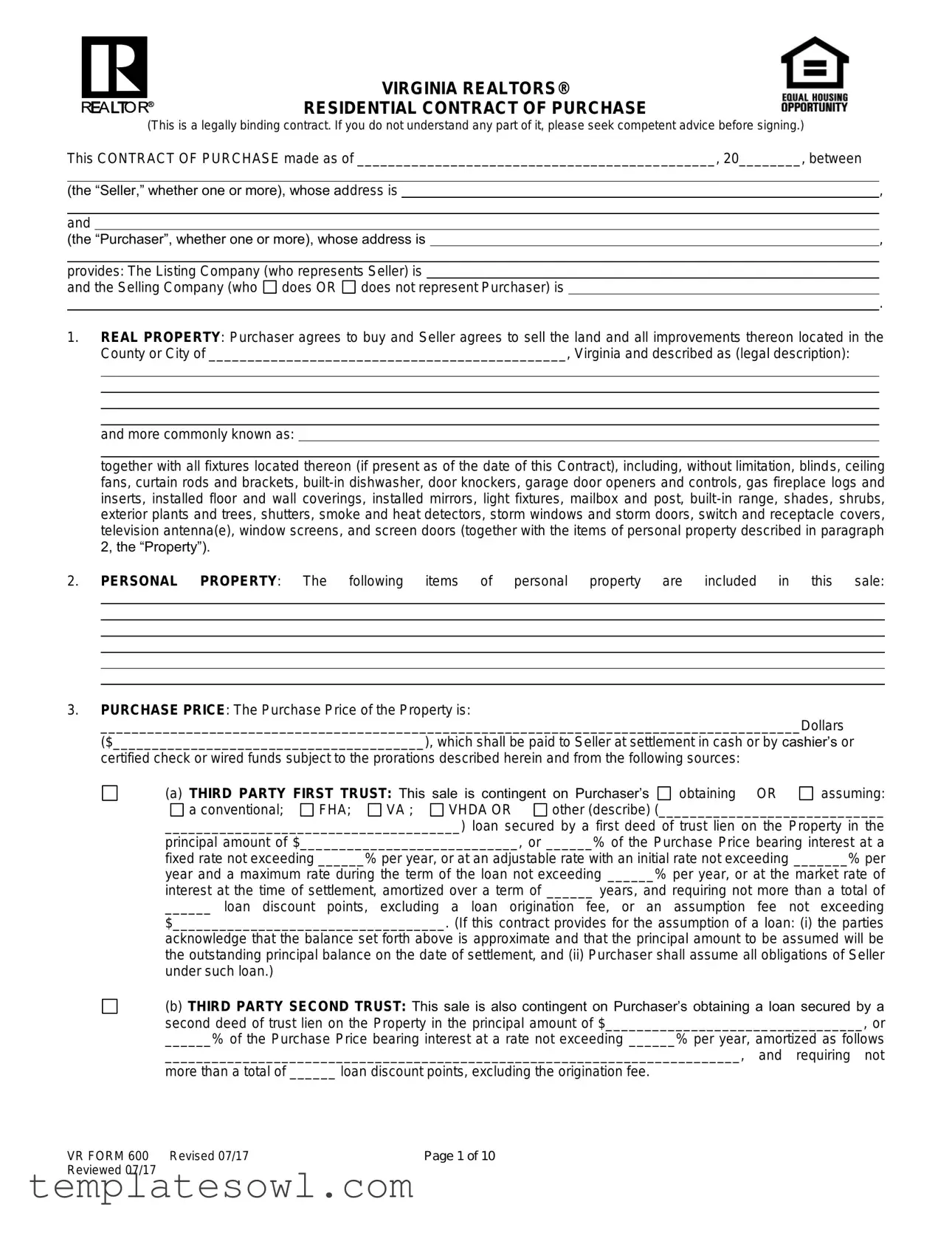

Fill Out Your Var 600 Form

Understanding the Var 600 form is essential for any real estate transaction involving residential property in Virginia. This form, known as the Virginia Realtors® Residential Contract of Purchase, outlines the agreement between the seller and the purchaser regarding the sale of specific real property, which includes both the land and any improvements on it. At its core, the contract details critical information such as the identities of the buyer and seller, the purchase price, and the terms of payment. It addresses not only the property itself but also any personal property that may be included in the sale, along with details about financial arrangements like third-party loans and seller financing options. The form ensures that both parties outline their responsibilities, including the deposit requirements and the conditions regarding financing contingencies. Additionally, it includes clauses about settlement procedures, title insurance, and the condition of the property at the time of sale, thereby providing a comprehensive framework that governs the transaction. Navigating this contract can be complex, underscoring the importance of seeking expert advice if any part is unclear.

Var 600 Example

VIRGINIA REALTORS®

RESIDENTIAL CONTRACT OF PURCHASE

(This is a legally binding contract. If you do not understand any part of it, please seek competent advice before signing.)

This CONTRACT OF PURCHASE made as of ______________________________________________, 20________, between |

|

|

|||||

|

|

|

|

|

|

|

|

(the “Seller,” whether one or more), whose address is |

|

, |

|||||

|

|

|

|

|

|

|

|

and |

|

|

|

||||

(the “Purchaser”, whether one or more), whose address is |

|

, |

|||||

|

|

|

|

|

|||

provides: The Listing Company (who represents Seller) is |

|

|

|

||||

and the Selling Company (who does OR does not represent Purchaser) is |

|

|

|||||

|

|

|

|

|

|

. |

|

1.REAL PROPERTY: Purchaser agrees to buy and Seller agrees to sell the land and all improvements thereon located in the County or City of ______________________________________________, Virginia and described as (legal description):

and more commonly known as:

together with all fixtures located thereon (if present as of the date of this Contract), including, without limitation, blinds, ceiling fans, curtain rods and brackets,

2, the “Property”).

2. PERSONAL PROPERTY: The following items of personal property are included in this sale:

3.PURCHASE PRICE: The Purchase Price of the Property is:

__________________________________________________________________________________________Dollars ($________________________________________), which shall be paid to Seller at settlement in cash or by cashier’s or certified check or wired funds subject to the prorations described herein and from the following sources:

(a) THIRD PARTY FIRST TRUST: This sale is contingent on Purchaser’s |

obtaining OR |

assuming: |

||||

a conventional; |

FHA; |

VA ; |

VHDA OR |

other (describe) (_____________________________ |

||

______________________________________) loan secured by a first deed of trust lien on the Property in the

principal amount of $____________________________, or ______% of the Purchase Price bearing interest at a

fixed rate not exceeding ______% per year, or at an adjustable rate with an initial rate not exceeding _______% per

year and a maximum rate during the term of the loan not exceeding ______% per year, or at the market rate of

interest at the time of settlement, amortized over a term of ______ years, and requiring not more than a total of

______ loan discount points, excluding a loan origination fee, or an assumption fee not exceeding

$___________________________________. (If this contract provides for the assumption of a loan: (i) the parties

acknowledge that the balance set forth above is approximate and that the principal amount to be assumed will be the outstanding principal balance on the date of settlement, and (ii) Purchaser shall assume all obligations of Seller under such loan.)

(b) THIRD PARTY SECOND TRUST: This sale is also contingent on Purchaser’s obtaining a loan secured by a second deed of trust lien on the Property in the principal amount of $_________________________________, or

______% of the Purchase Price bearing interest at a rate not exceeding ______% per year, amortized as follows

__________________________________________________________________________, and requiring not

more than a total of ______ loan discount points, excluding the origination fee.

VR FORM 600 Revised 07/17 |

Page 1 of 10 |

Reviewed 07/17 |

|

(c) SELLER FINANCING: Seller agrees that $__________________________________ or ____% of the Purchase

Price shall be evidenced by a note made by Purchaser payable to Seller bearing interest at a rate of ______% per

year amortized as follows

.

The note shall be secured by a deferred purchase money |

first, |

second, |

OR |

(specify priority) |

_____________ deed of trust lien on the Property. The deed of trust and note shall provide, among other things,

that: (i) the note shall be due and payable in full if the Property, or any interest therein, is transferred, sold, or

conveyed; (ii) Purchaser shall have the right to prepay the note at any time in whole or in part |

with a premium |

|

penalty of _______% of the amount prepaid, or |

without premium or penalty; (iii) a lot release schedule shall be |

|

provided, if applicable; (iv) a late payment charge not exceeding five percent of the payment may be assessed by Seller for any payment more that seven (7) calendar days late; (v) the note and deed of trust shall otherwise be in form satisfactory to Seller; (vi) other terms:

.

Such financing shall be contingent upon review and approval of Seller of a current credit report on each Purchaser and a current personal financial state of each Purchaser, which documents must be provided to Seller within

______ business days following execution of this Contract by both parties. The deed of trust shall be recorded at

Purchaser’s expense at settlement. Purchaser may not assign this Contract in whole or in part, without the prior written consent of Seller, which Seller shall be under no obligation whatsoever to give.

(d) BALANCE OF PURCHASE PRICE: Purchaser will provide the balance of the Purchase Price from Purchaser’s funds in cash or by cashier’s or certified check or wired funds at settlement.

(e)OTHER FINANCING TERMS:

4.DEPOSIT: Purchaser shall make a deposit of $___________ to be held by _______________________________ (the

“Escrow Agent”) in the form of:  check

check  cash

cash  other _______________________ (the “Deposit”). Purchaser [select

other _______________________ (the “Deposit”). Purchaser [select

one]:  has paid the Deposit to the Escrow Agent OR

has paid the Deposit to the Escrow Agent OR  will pay the Deposit to the Escrow Agent within ______ days (the

will pay the Deposit to the Escrow Agent within ______ days (the

“Extended Deposit Date”) after the date this Contract is fully executed by the parties. If Purchaser fails to pay the Deposit as set forth herein, then Purchaser shall be in breach of this Contract. At Seller’s option and in lieu of all other remedies set forth in this Contract, Seller may terminate this Contract by written notice to Purchaser and neither party shall have any further obligation hereunder.

If the Escrow Agent is a Virginia Real Estate Board (“VREB”) licensee, the parties direct the Escrow Agent to place the Deposit in an escrow account by the end of the fifth business banking day following the latter of: (i) the date this Contract is fully executed by the parties, or (ii) the Extended Deposit Date. If the Escrow Agent is not a VREB licensee, the parties direct the Escrow Agent to place the Deposit in an escrow account in conformance with applicable Federal or Virginia law and regulations. The Deposit may be held in an interest bearing account and the parties waive any claim to interest resulting from such Deposit. The Deposit shall not be released by the Escrow Agent until (i) credited toward the purchase price at settlement; (ii) Seller and Purchaser agree in writing as to its disposition; (iii) a court of competent jurisdiction orders a disbursement of the funds; or (iv) disbursed in such manner as authorized by the terms of this Contract or by Virginia law or regulations. Seller and Purchaser agree that Escrow Agent shall have no liability to any party for disbursing the Deposit in accordance with this paragraph, except in the event of Escrow Agent’s negligence or willful misconduct.

If the Property is foreclosed upon while this Contract is pending, the terms of Section

5.FINANCING:

(a)This Contract and Purchaser’s obligation hereunder are contingent upon Purchaser obtaining and delivering to Seller a written commitment or commitments, as the case may be (the “Commitment”) for the

Company to furnish Seller and Listing Company information about the status of Purchaser’s loan approval process, including specific items required by Purchaser’s lender or actions Purchaser must perform to obtain loan approval. Purchaser agrees, upon written request by Seller, to provide written consent satisfactory to Purchaser’s lender to permit Purchaser’s lender to provide such information to Seller and Listing Company.

VR FORM 600 Revised 07/17 |

Page 2 of 10 |

Reviewed 07/17 |

|

(b)If Purchaser does not obtain the Commitment and so notifies Seller or Listing Company in writing before 5:00 p.m. local time on ______________________________, 20_____ (if no date is filled in, the date shall be the same date set forth in paragraph 9), then this Contract shall terminate upon giving such notice and the Deposit shall be refunded to Purchaser. If Purchaser does not obtain the Commitment and notice thereof is not received by the deadline, or such later deadline as the parties may agree upon in writing, then Purchaser’s financing contingency set out in subparagraph 5(a) above shall nonetheless continue unless Seller gives Purchaser written notice of intent to terminate this Contract. If Seller gives Purchaser such notice, this Contract shall terminate as of 5:00 p.m. local time on the third day following Seller’s delivery of such notice to Purchaser unless before that time Purchaser has delivered to Seller a Commitment in compliance with the provisions of subparagraph 5(a) above, or a removal of Purchaser’s financing contingency and evidence of the availability of funds necessary to settle without such financing. As used in this paragraph 5, the term Commitment shall mean a written acknowledgment from the Purchaser’s lender or lenders that (i) selling, settling on or leasing another property is not required for underwriting approval, unless Purchaser’s obligations under this Contract are contingent on such sale, settlement or lease;

(ii)Purchaser has made application for the financing and paid all fees associated therewith; and (iii) as of the date of the

Commitment, Purchaser’s credit, income and assets, and debt have been verified by lender’s underwriter as adequate or as meeting underwriting requirements without further action by Purchaser as of that date. If Purchaser provides Seller evidence that it has obtained the Commitment and the lender issuing such Commitment notifies Purchaser, after the date set forth in this paragraph 5(b), that it will not provide the financing, Purchaser shall notify Seller in writing of such fact within three (3) days of

Purchaser’s receipt of such notice from the lender.

(c)If the balance of the Purchase Price in excess of the Deposit is to be paid in cash without third party or Seller financing,

Purchaser shall give the Seller written verification from Purchaser’s bank or other sources within fifteen (15) days after the date this Contract is fully ratified that Purchaser has or can have the balance of the Purchase Price in cash not later than the settlement date. If Purchaser fails to give such verification within such time, Seller may terminate this Contract by giving Purchaser written notice thereof within ten (10) days after the date by which verification was to be given.

(d)Purchaser represents to Seller that neither Purchaser’s obligations under this Contract nor Purchaser’s financing is dependent or contingent on the sale or settlement or lease of other real property, unless specified in a written contingency. Purchaser acknowledges that Seller is relying on this representation.

(e)The occurrence of any of the following shall constitute a default by Purchaser under this Contract, which Purchaser may cure only by providing evidence reasonably satisfactory to Seller, within three (3) days of written notice by Seller of such default, of Purchaser’s ability to settle timely:

(i)Purchaser fails to make timely application for any financing provided for hereunder, or to diligently pursue obtaining such financing;

(ii)Purchaser fails to lock in the interest rate(s) provided for hereunder and the rate(s) increase so that Purchaser no longer qualifies for the financing;

(iii)Purchaser fails to comply with the lender’s reasonable requirements in a timely manner;

(iv)Purchaser fails to notify the lender, Seller, or Listing Company promptly of any material adverse change in Purchaser’s financial situation that affects Purchaser’s ability to obtain the financing;

(v)Purchaser does not have the down payment, closing costs or fees, or other funds required to settle as provided in this Contract;

(vi)Purchaser does or fails to do any act following ratification of this Contract that prevents Purchaser from obtaining the financing; or

(vii)Purchaser makes any deliberate misrepresentation, material omission, or other inaccurate submission or statement that results in Purchaser’s inability to secure the financing.

(f) Purchaser |

does OR |

does not intend to occupy the Property as a primary residence. |

(g)Nothing in this Contract shall prohibit Purchaser from pursuing alternative financing from the financing specified in paragraph 3 unless it delays settlement or increases expense to Seller without Seller’s written agreement. Purchaser’s failure to obtain the alternative financing shall be at Purchaser’s risk, and shall not relieve Purchaser of the consequences set forth in this paragraph 5 should Purchaser fail to pursue, as required in this paragraph 5, the financing set forth in paragraph 3.

6.VA/FHA LOAN:

(a)It is expressly agreed that notwithstanding any other provision of this Contract, the Purchaser shall not be obligated to complete the purchase of the Property or to incur any penalty by forfeiture of earnest money Deposits or otherwise unless the Purchaser has been given in accordance with HUD/FHA or VA requirements a written statement by the Federal Housing Commissioner, Department of Veterans Affairs, or a Direct Endorsement lender setting forth the appraised value of the Property (excluding closing costs) as not less than the Purchase Price. The Purchaser shall have the privilege and option of proceeding with consummation of this Contract without regard to the amount of the appraised valuation by giving Seller written notice thereof within three (3) days after receipt of notification of the appraised value. THE APPRAISED VALUATION IS ARRIVED AT TO DETERMINE THE MAXIMUM MORTGAGE THE DEPARTMENT OF HOUSING AND URBAN DEVELOPMENT/DEPARTMENT OF VETERANS AFFAIRS WILL INSURE. HUD/DEPARTMENT OF VETERAN AFFAIRS

VR FORM 600 Revised 07/17 |

Page 3 of 10 |

Reviewed 07/17 |

|

DOES NOT WARRANT THE VALUE OR THE CONDITION OF THE PROPERTY. THE PURCHASER SHOULD SATISFY HIMSELF/HERSELF THAT THE PRICE AND CONDITION OF THE PROPERTY ARE ACCEPTABLE.

(b)If Purchaser is obtaining VA financing and elects to complete the purchase at a purchase price in excess of the appraised value as established by the Department of Veterans Affairs (the “Department”), Purchaser will disclose the source of such funds to the Department and pay the excess amount from such source. Such funds will not be borrowed funds unless approved by the Department.

(c)If Purchaser is obtaining FHA financing, the parties acknowledge that the loan amount may be approximate because financed acquisition costs cannot be determined until settlement.

7.LOAN FEES: Except as otherwise agreed upon in this Contract, Purchaser shall pay all points, loan origination fees, charges, and other costs imposed by a lender or otherwise incurred in connection with obtaining the loan or loans. The amount of any contributions Seller agrees to make under this Contract toward Purchaser’s loan fees shall include miscellaneous and tax service fees charged by a lender for financing described in this Contract and which by regulation or law Purchaser is not permitted to pay.

8.TITLE INSURANCE. Purchaser may, at Purchaser’s expense, purchase owner’s title insurance. Depending on the particular circumstances of the transaction, such insurance could include affirmative coverage against possible mechanics’ and materialmen’s liens for labor and materials performed prior to Settlement and which, though not recorded at the time of recordation of Purchaser’s deed, could be subsequently recorded and would adversely affect Purchaser’s title to the Property.

The coverage afforded by such title insurance would be governed by the terms and conditions thereof, and the premium for obtaining such title insurance coverage will be determined by its coverage. Purchaser may purchase title insurance at either

“standard” or “enhanced” coverage and rates. For purposes of owner’s policy premium rate disclosure by Purchaser’s lender(s), if any, Purchaser and Seller require that enhanced rates be quoted by Purchaser’s lender(s). Purchaser understands that nothing herein obligates Purchaser to obtain any owner’s title insurance coverage at any time, including at Settlement, and that the availability of enhanced coverage is subject to underwriting criteria of the title insurer.

9.SETTLEMENT; POSSESSION: Settlement shall be made at

on or about _______________________, 20 _____. Possession of the Property shall be given at settlement, unless otherwise agreed in writing by the parties. At settlement, Seller will deliver the deed described in paragraph 15, an affidavit acceptable to

Purchaser and Purchaser’s title insurance company as to parties in possession and mechanic’s liens, applicable

10.EXPENSES; PRORATIONS; ROLLBACK TAXES:

(a) Each party shall bear its own expenses in connection with this Contract, except as specifically provided otherwise herein. Seller agrees to pay the expense of preparing the deed and the recordation tax applicable to grantors; all expenses incurred by Purchaser in connection with the purchase, including without limitation title examination, insurance premiums, survey costs, recording costs and the fees of Purchaser’s attorney, shall be borne by Purchaser. All taxes, assessments, interest, rent escrow deposits, and other ownership fees, if any, shall be prorated as of the date of settlement. In addition to the Purchase Price, Purchaser agrees to pay Seller for all fuel, oil and/or propane remaining in the tank(s) (if applicable) at the prevailing market price as of the date of settlement.

(b) Rollback taxes shall be paid as follows: |

|

. |

11.BROKERAGE FEE; SETTLEMENT STATEMENTS: Seller and Purchaser authorize and direct the settlement agent to disburse to Listing Company and/or Selling Company from the settlement proceeds their respective portions of the brokerage fee payable as a result of this sale and closing under the Contract. Each of Listing Company and/or Selling Company shall deliver to the settlement agent, prior to settlement, a signed written statement setting forth the fee to which such company is entitled and stating how such fee and any additional sales incentives are to be disbursed. Seller and Purchaser authorize and direct the settlement agent to provide to each of Seller, Purchaser, Listing Company and Selling Company a copy of the closing disclosure for the transaction.

12.BROKER INDEMNIFICATION: Seller and Purchaser agree to hold harmless Listing Company, Selling Company, the officers, directors and employees, or any real estate broker or salesperson employed by or affiliated with the Listing Company or Selling Company for any delay, or expense caused by such delay, in settlement due to regulatory or legal requirements.

13.RISK OF LOSS: All risk of loss or damage to the Property by fire, windstorm, casualty, or other cause is assumed by Seller until settlement. In the event of substantial loss or damage to the Property before settlement, Purchaser shall have the option of either (i) terminating this Contract and recovering the Deposit, or (ii) affirming this Contract, in which event Seller shall assign to Purchaser all of Seller’s rights under any policy or policies of insurance applicable to the Property.

14.WOOD INFESTATION INSPECTION AND REPORT: Prior to settlement, Seller shall provide Purchaser a report, dated not more than 30 days prior to date of settlement, from a wood infestation control company certified and licensed by the

VR FORM 600 Revised 07/17 |

Page 4 of 10 |

Reviewed 07/17 |

|

Commonwealth of Virginia and properly insured, concerning the presence of or damage from termites or other wood- destroying insects in the primary dwelling, in any other dwelling(s) on the Property as to which a certificate of occupancy has been issued and is in effect, and in the following additional structures

(the “Applicable Structures”). If the inspection reveals active infestation in any of the Applicable Structures, Seller shall have such infestation treated by a company licensed by the Commonwealth of Virginia and properly insured. If the inspection reveals damage to any Applicable Structure, Seller shall have the damage repaired by a contractor licensed in the Commonwealth of Virginia; provided, however, that if the estimated aggregate cost of such treatment or repairs or both exceeds $1,000, and Purchaser and Seller cannot agree on how the amount exceeding $1,000, will be paid, Purchaser shall have the right either (i) to accept repairs or treatment not exceeding $1,000, in which event Seller shall have such repairs or treatment performed at Seller’s expense, (ii) to receive a credit at settlement in the amount of $1,000, or (iii) to terminate this Contract and receive a refund of the Deposit.

15.TITLE: At settlement Seller shall convey the Property to Purchaser by general warranty deed containing English covenants of title (except that conveyance from a personal representative of an estate or from a trustee or institutional lender shall be by special warranty deed), free of all encumbrances, tenancies, and liens (for taxes and otherwise), but subject to such restrictive covenants and utility easements of record which do not materially and adversely affect the use of the Property for residential purposes or render the title unmarketable. If the Property does not abut a public road, title to the Property must include a recorded easement providing adequate access thereto. In the event this sale is subject to a financing contingency under paragraph 3(a) or 3(b), the access to a public road must be acceptable to each lender. If the examination reveals a title defect of a character that can be remedied by legal action or otherwise within a reasonable time, then Seller, at Seller’s expense and subject to the Remediation Limit set forth in paragraph 18, shall promptly take such action as is necessary to cure such defect. If the defect is not cured within 60 days after Seller receives notice of the defect, then Purchaser shall have the right to (i) terminate this Contract, in which event the Deposit shall be returned to Purchaser, and Purchaser and Seller shall have no further obligations hereunder, or (ii) waive the defect and proceed to settlement with no adjustment to the Purchase Price. If Seller has agreed to cure such defect, the parties agree that the settlement date prescribed in paragraph 9 shall be extended as necessary to enable Seller to cure such title defect, but not for more than 60 days unless agreed by the parties.

16.EQUIPMENT CONDITION AND INSPECTION:

(a)Purchaser agrees to accept the Property at settlement, and Seller agrees to deliver the Property to Purchaser at settlement, in its present physical condition, ordinary wear and tear excepted, but with such repairs and improvements as the parties otherwise agree.

(b)If Purchaser’s obligations under this Contract are contingent on a professional home inspection of the Property, then Purchaser shall be entitled to receive the Property at settlement in such condition as determined by such inspection and any negotiation and agreements relating to it. Purchaser and Purchaser’s agents, inspectors, and engineers shall have the right to conduct a preoccupancy or presettlement inspection to verify that the condition of the Property conforms to this Contract and that no material damage or changes necessitating repairs have occurred to the Property after the date of this Contract or after any prior inspection of the Property provided for herein. Purchaser shall not be entitled to require Seller to correct defects discovered at a preoccupancy or presettlement inspection but existing as of the time of a prior inspection of the Property if those defects were not reported to Seller in connection with such prior inspection and Seller has not agreed to remedy such defects.

(c)If Purchaser’s obligations under this Contract are not contingent on a professional home inspection of the Property, then

Seller warrants that all appliances, heating and cooling equipment, plumbing and electric systems will be in working condition at the time of settlement or of Purchaser’s occupancy, whichever occurs first. Purchaser and Purchaser’s agents, inspectors, and engineers shall have the right to conduct a preoccupancy or presettlement inspection to verify that the condition of the Property conforms to this Contract and that no material damage or changes necessitating repairs have occurred to the Property after the date of this Contract. Seller’s obligations in this regard are limited by the Remediation Limit set forth in paragraph 18 of this Contract.

(d)Seller will provide Purchaser, Purchaser’s professional inspectors and engineers, Selling Company, and representatives of Purchaser’s lenders reasonable access to the Property to conduct inspections as appropriate and in compliance with this

Contract. Seller will have all utilities in service at the time of all inspections to be conducted pursuant to this Contract, including those provided for in any separate provision or addendum dealing with inspections of the Property.

(e)Seller agrees to deliver the Property in

VR FORM 600 Revised 07/17 |

Page 5 of 10 |

Reviewed 07/17 |

|

17.WELL AND SEPTIC:

(a)If the Property is served by an

(b)If the Property is served by a sewage disposal system, Seller agrees to provide Purchaser with a certificate dated not more than 30 days prior to settlement from the appropriate governmental authority, or from an acceptable private company, indicating that there is no evidence of malfunction of or needed maintenance to the sewage disposal system.

(c)If contamination of the water or septic system malfunction or needed maintenance is found, then Seller, at Seller’s expense and subject to the Remediation Limit set forth in paragraph 18, shall effect the appropriate remedies or repairs. If Seller fails to do so as soon as practicable, Purchaser shall have the right to (i) terminate this Contract, in which event the Deposit shall be returned to Purchaser, and Purchaser and Seller shall have no further obligations hereunder, or (ii) waive the defect and proceed to settlement with no adjustments to the Purchase Price.

18.SELLER’S AND PURCHASER’S OPTION: In the event that the total cost of fulfilling Seller’s obligations set forth in paragraphs 15, 16 (c), and 17 above exceed $____________________________ in the aggregate (the “Remediation Limit”), Seller shall have the option (i) to fulfill Seller’s obligations fully at Seller’s expense, or (ii) to pay or credit the Remediation Limit to Purchaser and refuse to pay any excess over that amount. If Seller elects option (ii), Purchaser shall have the right to either accept the Property in its present condition (in which case the Seller shall pay or credit the Remediation Limit to Purchaser at settlement), or to terminate this Contract and receive a refund of the Deposit. If no amount is entered in the space in this paragraph, the parties agree that the amount shall be $1,000. The Remediation Limit is independent of any obligations agreed to by Seller in connection with an inspection of the Property pursuant to a separate addendum to this Contract, or provision other than contained in paragraphs 15, 16 (c) and 17, dealing with the right of Purchaser to conduct an inspection of the Property.

19.HOME PURCHASER’S INSPECTION: Purchaser may have a professional home inspection performed at Purchaser’s

expense by one or more qualified/licensed inspectors. Purchaser (Please check and initial): WAIVES (purchaser’s

WAIVES (purchaser’s

initial):_______ OR  DESIRES (purchaser’s initial): _______ a professional home inspection. If Purchaser desires an inspection contingency, see attached home inspection addendum or separate provision of this Contract.

DESIRES (purchaser’s initial): _______ a professional home inspection. If Purchaser desires an inspection contingency, see attached home inspection addendum or separate provision of this Contract.

20.NOTICE TO PURCHASER REGARDING SETTLEMENT AGENT AND SETTLEMENT SERVICES: Choice of Settlement

Agent: Chapter 27.3 (§

To facilitate the settlement agent’s preparation of various closing documents, including any

21.MECHANICS LIEN NOTICE:

(a)Virginia law

MAY BE FILED AFTER SETTLEMENT. LEGAL COUNSEL SHOULD BE CONSULTED.

VR FORM 600 Revised 07/17 |

Page 6 of 10 |

Reviewed 07/17 |

|

(b)Seller shall deliver to Purchaser at settlement an affidavit, on a form acceptable to Purchaser’s lender, if applicable, signed by Seller that no labor or materials have been furnished to the Property within the statutory period for the filing of mechanics’ or materialmens’ liens against the Property. If labor or materials have been furnished during the statutory period, Seller s hall deliver to Purchaser an affidavit signed by Seller and the person(s) furnishing the labor or materials that the costs thereof have been paid.

22.CONDOMINIUM DISCLOSURE: The Seller represents that the Property [select one]:  is OR

is OR  is not a condominium resale, which is subject to the Virginia Condominium Act

is not a condominium resale, which is subject to the Virginia Condominium Act

If the Property is a condominium resale, the Condominium Act requires the Seller to obtain from the unit owners’ association a resale certificate and provide it to the Purchaser or Purchaser’s authorized agent. The information contained in the resale certificate shall be current as of the specified date on the resale certificate. The Purchaser may cancel this Contract (a) within three days after the date of this Contract, if on or before the date that the Purchaser signs this Contract, the Purchaser receives the resale certificate or is notified that the resale certificate will not be available; (b) within three days after receiving the resale certificate if the resale certificate or notice that the resale certificate will not be available is hand delivered, delivered by electronic means, or delivered by a commercial overnight delivery service or the United States Postal Service and a receipt obtained; or (c) within six days after the postmark date if the resale certificate or notice that the resale certificate will not be available is sent to the Purchaser by United States mail. The Purchaser may also cancel this Contract at any time prior to settlement if the Purchaser has not been notified that the resale certificate will not be available and the resale certificate is not delivered to the Purchaser. Notice of cancellation shall be provided to the Seller (owner) or his agent by one of the following methods: (i) hand delivery; (ii) United States mail, postage prepaid, provided the sender retains sufficient proof of mailing, which may be either a United States postal certificate of mailing or a certificate of service prepared by the sender confirming such mailing; (iii) electronic means provided the sender retains sufficient proof of the electronic delivery, which may be an electronic receipt of delivery, a confirmation that the notice was sent by facsimile, or a certificate of service prepared by the sender confirming the electronic delivery; or (iv) overnight delivery using a commercial service or the United States Postal Service. In the event of a dispute, the sender shall have the burden to demonstrate delivery of the notice of cancellation. Such cancellation shall be without penalty, and the Seller shall cause any deposit to be returned promptly to the Purchaser, but not later than thirty days from the date of cancellation. Seller shall provide written instructions to the Association for the delivery of

the resale certificate to Purchaser or Purchaser’s authorized agent who isfor

the purposes of this paragraph. The right to receive the resale certificate and to cancel this Contract terminates at settlement. If the Purchaser has received the resale certificate, the Purchaser has a right, at Purchaser’s sole expense, to request from the unit owners’ association a resale certificate update or financial update. A request for an updated resale certificate does not extend the cancellation periods set forth above.

23. PROPERTY OWNERS’ ASSOCIATION DISCLOSURE: The Seller represents that the Property [select one]:

is OR

is OR

is not located within a development which is subject to the Virginia Property Owners’ Association Act (§§

is not located within a development which is subject to the Virginia Property Owners’ Association Act (§§

the Code of Virginia) (the “Act”). If the Property is within such a development, the Act requires the Seller to obtain from the property owners’ association an association disclosure packet and provide it to the Purchaser, or Purchaser’s authorized agent. The information contained in the association disclosure packet shall be current as of the specified date on the disclosure packet. The Purchaser may cancel this Contract (a) within three days after the date of this Contract, if on or before the date that the Purchaser signs this Contract, the Purchaser receives the association disclosure packet or is notified that the association disclosure packet is not available; (b) within three days after receiving the association disclosure packet, if the association disclosure packet or notice that the association disclosure packet will not be available is hand delivered, delivered by electronic means, or delivered by a commercial overnight delivery service or the United States Postal Service and a receipt obtained; or (c) within six days after the postmark date if the association disclosure packet or notice that the association disclosure packet will not be available is sent to the Purchaser by United States mail. The Purchaser may also cancel this Contract at any time prior to settlement if the Purchaser has not been notified that the association disclosure packet will not be available and the association disclosure packet is not delivered to the Purchaser. Notice of cancellation shall be provided to the Seller (owner) or his agent by one of the following methods: (i) hand delivery; (ii) United States mail, postage prepaid, provided the sender retains sufficient proof of mailing, which may be either a United States postal certificate of mailing or a certificate of service prepared by the sender confirming such mailing; (iii) electronic means provided the sender retains sufficient proof of the electronic delivery, which may be an electronic receipt of delivery, a confirmation that the notice was sent by facsimile, or a certificate of service prepared by the sender confirming the electronic delivery; or (iv) overnight delivery using a commercial service or the United States Postal Service. In the event of a dispute, the sender shall have the burden to demonstrate delivery of the notice of cancellation. Such cancellation shall be without penalty, and the Seller shall cause any deposit to be returned promptly to the Purchaser, but not later than thirty days from the date of cancellation. Seller shall provide written instructions to the Association for delivery of the disclosure packet to Purchaser or Purchaser’s authorized

agent who isfor the purposes of this paragraph. The right to

receive the association disclosure packet and to cancel this Contract terminates at settlement. If the Purchaser has received the association disclosure packet, the Purchaser has a right, at Purchaser’s sole expense, to request an update of such disclosure packet from the property owners’ association. A request for an updated disclosure packet does not extend the cancellation periods set forth above.

24.

VR FORM 600 Revised 07/17 |

Page 7 of 10 |

Reviewed 07/17 |

|

(a)Attached to this Contract is a fully executed “Disclosure of Information and Acknowledgment

(b)The Lead Paint Act grants Purchaser the right, for a period of ten (10) days after the date this Contract is fully ratified, to conduct a risk assessment or inspection for the presence of

(i) Purchaser reserves the right to conduct a risk assessment or inspection for

(i) Purchaser reserves the right to conduct a risk assessment or inspection for

(ii) Purchaser waives the right to conduct a risk assessment or inspection for

(ii) Purchaser waives the right to conduct a risk assessment or inspection for

25.NOTICE TO PURCHASER(S): Purchaser should exercise whatever due diligence Purchaser deems necessary with respect to information on sexual offenders registered under Chapter 23

26.NOTICE OF DISCLOSURE PURSUANT TO VIRGINIA RESIDENTIAL PROPERTY DISCLOSURE ACT:

Disclosure  is OR

is OR  is not attached. (Attachment does not become part of this Contract.)

is not attached. (Attachment does not become part of this Contract.)

27.DEFAULT: If Seller or Purchaser defaults under this Contract, the defaulting party, in addition to all other remedies available at law or in equity, shall be liable for the brokerage fee referenced in paragraph 11 hereof as if this Contract had been performed and for any damages and all expenses incurred by

28.MISCELLANEOUS: This Contract may be signed in one or more counterparts, each of which shall be deemed to be an original and all of which together shall constitute one and the same document. Documents delivered by facsimile machine shall be considered as originals. Unless otherwise specified herein, “days” mean calendar days. For the purpose of computing time periods, the first day shall be the day following the Date of Ratification or delivery of the notice that triggers the time period. Deadlines run until 11:59 p.m. on the date of the deadline. This Contract represents the entire agreement between Seller and Purchaser and may not be modified or changed except by written instrument executed by the parties. This Contract shall be construed, interpreted and applied according to the laws of the state in which the Property is located and shall be binding upon and shall inure to the benefit of the heirs, personal representatives, successors, and assigns of the parties. To the extent any handwritten or typewritten terms herein conflict with or are inconsistent with the printed term hereof, the handwritten and typewritten terms shall control. Whenever the context shall so require, the masculine shall include the feminine and singular shall include the plural. Unless otherwise provided herein, the provisions of this Contract affecting title shall be deemed merged into the deed delivered at settlement and shall not survive settlement.

29.

30.BROKERS: LICENSEE STATUS:

(a) Listing Company and Selling Company may from time to time engage in general insurance, title insurance, mortgage loan, real estate settlement, home warranty, and other real

VR FORM 600 Revised 07/17 |

Page 8 of 10 |

Reviewed 07/17 |

|

(b) Disclosure of Real Estate Board/Commission licensee status, if any is required in this transaction:

.

31.OTHER TERMS: (Use this space for additional terms not covered elsewhere in this Contract.)

32.ACCEPTANCE: This Contract, when signed by Purchaser, shall constitute an offer to enter into a bilateral contract, and the offer shall remain in effect unless earlier withdrawn, until _______________________________ (local time in Virginia), on

_______________________________, 20 _________(date). If not accepted by such time, this offer shall be null and void.

33.ELECTRONIC SIGNATURES. ______ /______ If this paragraph is initialed by both parties, then

in accordance with the Uniform Electronic Transactions Act (UETA) and the Electronic Signatures in Global and National Commerce Act, or

WITNESS the following duly authorized signatures: |

|

|

|

|

|||

PURCHASER: |

|

|

SELLER: |

|

|

||

/ |

|

|

|

/ |

|||

DATE |

|

|

PURCHASER |

|

DATE |

|

SELLER |

/ |

|

|

|

/ |

|||

DATE |

|

|

PURCHASER |

|

DATE |

|

SELLER |

/ |

|

|

|

/ |

|||

DATE |

|

|

PURCHASER |

|

DATE |

|

SELLER |

/ |

|

|

|

/ |

|||

DATE |

|

|

PURCHASER |

|

DATE |

|

SELLER |

Receipt of deposit per paragraph 4 above is hereby acknowledged.

____________/________________________________________

VR FORM 600 Revised 07/17 |

Page 9 of 10 |

Reviewed 07/17 |

|

For information purposes only:

Selling Company’s Name and Address |

Listing Company’s Name and Address: |

___________________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Office Phone: _______________ Fax: |

|

|

Office Phone: ____________ Fax: |

|

|

|

|

|

||||||||||||||

MLS Broker Code: __________ Office ID No. |

|

|

MLS Broker Code: __________ Office ID No. |

|||||||||||||||||||

Firm license No.: |

|

|

|

|

Firm license No.: |

|

|

|

|

|

|

|||||||||||

Agent Name: |

|

|

|

|

Agent Name: |

|

|

|

|

|

|

|

|

|||||||||

Agent MLS ID No.: |

|

|

Agent MLS ID No.: |

|

|

|

|

|

|

|

||||||||||||

Agent license No.: |

|

|

Agent license No.: |

|

|

|

|

|

|

|

||||||||||||

Agent |

|

|

Agent |

|

|

|

|

|

|

|||||||||||||

This Contract has been ratified by Purchaser and Seller as of |

|

, 20 |

(“Date of Ratification”). |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acknowledgement that Contract is ratified as of the date above.

Selling Firm |

|

Listing Firm |

|

(signature) |

(signature) |

||

COPYRIGHT©2017 by VIRGINIA REALTORS®. All rights reserved. This form may be used only by members in good standing with VIRGINIA REALTORS®. The reproduction of this form, in whole or in part, or the use of the name "VIRGINIA REALTORS®," in connection with any other form, is prohibited without prior written consent from VIRGINIA REALTORS®

VR FORM 600 Revised 07/17 |

Page 10 of 10 |

Reviewed 07/17 |

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The Var 600 form is the Virginia REALTORS® Residential Contract of Purchase, a legally binding agreement when buying or selling a residential property in Virginia. |

| Legal Compliance | This form complies with Virginia law, specifically the Virginia Residential Property Disclosure Act and applicable statutes governing real estate transactions. |

| Property Definition | It outlines that the Purchaser agrees to buy, and the Seller agrees to sell, the property defined by its legal description and commonly known address. |

| Deposit Requirements | A monetary deposit is required upfront and is held by an Escrow Agent until settlement occurs or conditions are met. |

| Financing Contingencies | The contract may include conditions dependent on the Purchaser obtaining necessary financing, which can come from various sources, including public programs. |

| Inspection Clause | The form provides for inspections, including mandatory wood infestation inspections, ensuring the property is free from significant damage or defects. |

| Risk of Loss | Until settlement, the Seller assumes all risks of loss or damage to the property from various causes, including fire or windstorm. |

| Title Insurance | The Purchaser has the option to seek title insurance to protect against any liens or claims that may affect property ownership. |

| Closing Process | Settlement is to be completed around a specific date provided within the document when the transfer of property ownership occurs. |

Guidelines on Utilizing Var 600

Filling out the Var 600 form is an important step in the home purchasing process. This document lays out the agreement between the buyer and seller. Completing it accurately is crucial to avoiding misunderstandings later on. The following steps will guide you through filling out the Var 600 form carefully.

- Date: Write the current date at the top of the form where indicated.

- Seller's Information: Provide the name(s) and address(es) of the seller(s) in the appropriate fields.

- Purchaser's Information: Enter the name(s) and address(es) of the purchaser(s). Ensure this information is accurate.

- Listing and Selling Company: Fill in the name of the listing company and selling company that represents each party, if applicable.

- Property Location: Specify the exact location of the property including the county or city, and its legal description.

- Purchase Price: Clearly write the agreed purchase price in both words and numbers.

- Financing Details: Complete the financing section, detailing the type of loan required and any contingencies. Pay special attention to interest rates and loan amounts.

- Deposit: State the amount of the deposit and the method of payment. Choose whether the deposit was made or will be made, along with expected timing.

- Inspection and Condition: Fill out any specifics related to inspections and the condition of the property as agreed upon.

- Signatures: Ensure all parties sign the document at the end. Provide printed names and dates next to signatures.

After you've filled out the form, review it for any mistakes. Make sure all information is accurate and legible. Discuss with all parties involved if any clarifications are needed. Once everyone agrees and signs, the transaction can move forward smoothly.

What You Should Know About This Form

What is the Var 600 form?

The Var 600 form is a legally binding Residential Contract of Purchase used in Virginia real estate transactions. This document outlines the agreement between the Seller and Purchaser related to the sale of residential property, including terms and conditions, purchase price, warranties, and obligations of both parties. It is crucial for individuals involved in such transactions to review the form carefully and seek legal advice if they do not understand any part of it.

What details are required from the Seller and Purchaser?

The Var 600 form requires the full names and addresses of both the Seller(s) and Purchaser(s). Additionally, it provides space to identify the companies representing them, specifically the Listing Company and the Selling Company. This information establishes clear identities and helps in communication during the transaction.

What information is included regarding the property?

The form specifies the property being sold, including its legal description, location in Virginia, and common name. It also lists fixtures that are part of the sale, such as appliances, window treatments, and installed goods that remain with the property. This clarity helps prevent disputes about what is included in the transaction.

How is the purchase price determined?

The purchase price is detailed in the Var 600 form, along with payment terms. The Purchaser agrees to pay the identified amount in cash, via a cashier’s check, certified check, or wired funds at settlement. The form includes contingencies for third-party financing, outlining specifics such as loan types, interest rates, and terms, which are crucial for both parties’ understanding of the financial implications of the sale.

What is the significance of the deposit requirement?

A deposit serves as a sign of good faith from the Purchaser. The Var 600 form outlines the amount and form of the deposit, as well as conditions under which it may be forfeited or refunded. It clarifies that if the Purchaser fails to make the deposit as scheduled, the Seller has the right to terminate the contract, which underscores the importance of adhering to this requirement.

What contingencies are included in the contract?

The Var 600 form contains various contingencies, specifically regarding financing and property inspections. Purchasers are required to obtain a written loan commitment, and if they cannot secure financing by a specified date, the contract may be terminated, leading to a refund of the deposit. Furthermore, property condition and inspections are also addressed, ensuring that the Purchaser has the opportunity to verify the condition of the property before finalizing the sale.

What happens at settlement according to the Var 600 form?

Settlement is the final step in the transaction where ownership is transferred from the Seller to the Purchaser. The form specifies the date and location of settlement, as well as conditions regarding possession of the property. At settlement, the Seller provides a deed and other necessary documents, while the Purchaser must provide the agreed purchase price. Proper handling of this process is vital to ensure a smooth transfer of ownership.

How does the Var 600 form address property inspections?

The form emphasizes the importance of property condition and allows the Purchaser to conduct inspections before settlement. If significant issues are revealed, the Purchaser can negotiate repairs or potentially terminate the contract. This section protects the interests of the Purchaser and ensures they are fully informed about the property's condition before completing the purchase.

What are the implications of failing to comply with the Var 600 form?

Failure to comply with any stipulations in the Var 600 form may result in a breach of contract. This breach could lead to various consequences, including loss of the deposit, legal disputes, or termination of the contract. Both the Seller and Purchaser must understand their rights and obligations to avoid potential pitfalls that could arise from non-compliance.

Common mistakes

When filling out the Var 600 form, individuals often encounter several hurdles that can lead to misunderstandings and delays. A significant mistake is not providing accurate addresses for both the Seller and the Purchaser. This information is crucial for establishing the legal identities of the parties involved. Inaccurate or incomplete addresses can create confusion during the closing process and potentially invalidate the contract.

Another common error occurs in the financing section. Often, potential Purchasers neglect to specify the exact terms of any financing being utilized, such as interest rates or loan percentages. These details, while they may seem minor, are fundamental for verifying the financial commitments of the parties involved. Missing this information can lead to complications when securing financing or at settlement.

Inadequate legal descriptions of the property are also frequently overlooked. Individuals sometimes fail to provide a precise legal description, merely summarizing the property instead. This lack of specificity can result in disputes over what exactly is being sold, leading to future legal issues. Ensuring that the legal description is thorough is essential for the integrity of the contract.

Purchasers may mistakenly believe that their financing contingencies are not binding, leading to significant issues. It is critical to understand that if a Purchaser fails to obtain financing as delineated in the contract, they could be held in breach. Failure to diligently pursue financing can lead to unnecessary legal complications and financial loss.

Moreover, individuals often misstate the amount of deposit being made. This is a critical part of the agreement and if the deposit is incorrect or inaccurately reported, the Seller retains the right to terminate the contract. Double-checking the amount and ensuring it matches any supporting documentation can help avoid this mistake.

In some situations, buyers may forget to acknowledge the survey and title insurance requirements. Not addressing these elements can result in unanticipated costs and delays later on. A clear understanding and explicit mention of who handles these elements and the associated costs is crucial.

Failing to follow through with the deadlines outlined in the contract can lead to confusion and potential breaches. The importance of timely actions, particularly concerning financing applications and deposit payments cannot be overstated. Missing deadlines may lead to contract termination or loss of deposits, so vigilant attention to dates is essential.

Purchasers sometimes overlook the need for mutual understanding about the condition of the property. The form emphasizes the necessity of agreeing on how the property will be delivered at settlement. Miscommunication regarding the state of the property or repairs needed may lead to disputes post-settlement.

Another common pitfall occurs when individuals do not utilize legal counsel. Many people underestimate the complexity of these forms or the implications of the contract terms. It is always advisable for individuals to seek competent legal advice to review the document and ensure their interests are adequately protected.

Lastly, people may neglect to keep copies of the submitted form and accompanying documents. This can become problematic should disputes arise later on. Retaining a copy ensures that no one is at a disadvantage if discrepancies in the paperwork are identified. Overall, attention to detail and comprehensive understanding of each section of the Var 600 form is vital in ensuring a seamless transaction.

Documents used along the form

The Var 600 form, a key document in the home buying process in Virginia, often goes hand-in-hand with several other important forms. While each document serves a distinct purpose, together they contribute to a smooth and successful transaction. Understanding these forms helps both sellers and purchasers navigate real estate transactions confidently.

- Disclosure of Information on Lead-Based Paint and Lead-Based Paint Hazards: This document informs buyers of any known presence of lead in homes built before 1978, ensuring they understand the potential risks and can make informed decisions.

- Virginia Residential Property Disclosure Act Disclosure: Sellers must provide this form to disclose known defects in the property, enhancing transparency about the property's condition.

- Home Inspection Contingency Addendum: This addendum allows the buyer to conduct a home inspection within a specified timeframe, giving them the option to negotiate repairs, ask for credits, or back out of the deal if issues arise.

- Financing Addendum: If a buyer is using a specific financing method (like VA or FHA loans), this document outlines financing terms and conditions, ensuring both parties are on the same page about payment expectations.

- Settlement Statement (HUD-1 or Closing Disclosure): This summary provides a detailed breakdown of all costs and credits associated with the transaction, allowing both the buyer and seller to see where funds will go at closing.

- Deed of Trust: This legal document secures the loan by creating a lien on the property in favor of the lender, outlining the terms under which the property can be seized if the loan is not repaid.

- Affidavit of Title: This form is provided by the seller at closing, affirming that they have clear title to the property and outlining any liens or encumbrances, ensuring the buyer is fully informed before the transfer of ownership.

With these forms in your toolkit, you can approach your real estate transaction with more confidence. Each document plays a part in safeguarding your interests and facilitating a transparent, fair process. Understanding these essential elements paves the way for a successful home-buying experience in Virginia.

Similar forms

The VAR 600 form, commonly known as the Virginia Realtors® Residential Contract of Purchase, shares similarities with several other documents in real estate transactions. Below is a list of six documents that are similar to the VAR 600 form, along with a brief description of each:

- Purchase and Sale Agreement: This document outlines the terms under which a buyer agrees to purchase property from a seller. Like the VAR 600, it specifies details such as the purchase price, closing date, and contingencies related to financing and inspections.

- Offer to Purchase Real Estate: An offer to purchase is a proposal made by a buyer to purchase a property. Similar to the VAR 600, it requires acceptance from the seller to become binding and includes key details like price and conditions of sale.

- Lease Purchase Agreement: This document combines leasing and purchasing in one contract. Like the VAR 600, it identifies purchase terms, payment amounts, and conditions for purchase after the rental period is completed.

- Buy-Sell Agreement: This is a contract between co-owners regarding the sale of property. It addresses rights and responsibilities similar to those covered in the VAR 600, including pricing and the process for future sale.

- Real Estate Listing Agreement: This contract allows a real estate agent to sell a property on behalf of the seller. Like the VAR 600, it details seller's obligations and agent's commission, and it outlines the property description and terms of sale.

- Escrow Agreement: An escrow agreement outlines the terms for an escrow agent to hold funds during a real estate transaction. This is comparable to the VAR 600 in ensuring secure handling of deposits and funds until the conditions of the purchase are met.

Dos and Don'ts

When filling out the Var 600 form, keep the following points in mind:

- Do double-check all entries for accuracy to avoid delays and potential misunderstandings.

- Do provide complete information for both the Seller and Purchaser sections, including addresses.

- Do ensure that the Purchase Price is clearly stated and matches any verbal agreements.

- Do sign and date the form appropriately to make it legally binding.

- Don't leave any required fields blank; doing so may result in complications later.

- Don't use vague terms; clarity helps ensure all parties understand their obligations and rights.

- Don't forget to include any contingencies that have been discussed, as these can greatly affect the contract.

- Don't rush through the process. Take the time to read through all the terms and conditions thoroughly.

Misconceptions

- Misconception: The Var 600 form is only for buyers. In reality, the Var 600 form serves both parties involved in a real estate transaction, namely the seller and the purchaser. It outlines the obligations, rights, and agreements for both buyers and sellers, ensuring a clear understanding of the transaction for everyone involved.

- Misconception: Signing the Var 600 means the buyer is guaranteed to get the property. This is not the case. The form includes several contingencies that must be met before the transaction can be finalized, such as financing approval and inspections. If these conditions are not satisfied, the contract could be terminated without any penalties to the buyer.

- Misconception: The deposit is non-refundable once made. Many believe that a deposit is final and cannot be reclaimed. However, the Var 600 outlines specific conditions under which a buyer can receive their deposit back, particularly if the contract is terminated due to unmet contingencies.

- Misconception: The seller is responsible for all repairs/upkeep of the property until settlement. While the seller must keep the property in good condition, the Var 600 specifies that the seller’s obligation is limited to reasonable maintenance and allowing the buyer access for inspections. If significant changes or damage occur, buyers might have certain rights to terminate the contract or negotiate repairs.

Key takeaways

When using the Var 600 form for the purchase of residential property in Virginia, several key considerations arise. Here are some essential takeaways:

- Understand the Parties Involved: Clearly identify the Seller and Purchaser, including their addresses. This section sets the foundation for the contractual obligations.

- Define the Property: Provide a comprehensive legal description of the property in question. Detail its location and commonly known address, as well as any included personal property.

- Purchase Price Clarity: Document the Purchase Price in both numeric and written formats. This ensures clarity and avoids disputes regarding amounts owed at settlement.

- Contingencies Matter: Familiarize yourself with financing contingencies that can impact the contract. These include third-party loans, seller financing, and the process of obtaining financing commitments.

- Deposit Requirements: Specify the deposit amount and the Escrow Agent holding it. The timing and method of this deposit can affect the contract's validity.

- Inspection and Condition Obligations: Understand the duties around inspections, including the seller's obligation to provide a wood infestation report and maintain property conditions prior to settlement.

- Title Insurance Importance: Consider purchasing title insurance. It protects against potential future claims against the property, adding a layer of security for your investment.

- Closing Procedures: Be aware of what happens at settlement, including the transfer of ownership, the completion of necessary paperwork, and the disbursement of funds.

By keeping these factors in mind, parties involved in the residential purchase can navigate the process more effectively, ensuring a smoother transaction from offer to settlement.

Browse Other Templates

Asset Distribution Record,Equipment Transfer Acknowledgment,Property Accountability Statement,Material Receipt Confirmation,Inventory Control Form,Government Property Hand Receipt,Item Management Documentation,Supply Chain Receipt Form,Inventory Trac - The form includes detailed information such as stock numbers and item descriptions.

Va Form 28-8606 - Clear documentation is vital for the success of the rehabilitation program.

De 2525xx - Your request will not be processed until all requirements are met.