Fill Out Your Vehicle Appraisal Form

When dealing with vehicle taxation in Buncombe County, understanding the Vehicle Appraisal form is crucial for ensuring accurate evaluations. This form is designed to ascertain the fair market value of a vehicle as of January 1st each year, reflecting its market worth on that specific date, not on today’s valuation. The form requires essential details such as the owner's name, vehicle identification number (VIN), make, year, and current mileage. Additionally, it prompts the appraiser to note any conditions affecting the vehicle's value. Importantly, North Carolina law dictates that counties must avoid using wholesale or trade values for tax assessments, thereby ensuring taxpayers are fairly charged based on the vehicle's actual market value. The appraisal must be signed by the dealer, confirming the assessed value, and must be submitted to the tax office within a specified timeframe to be considered valid. Should discrepancies arise, there is an appeal process that must be initiated promptly. For any questions regarding the form or the appraisal process, the Buncombe County Tax Office is readily available to assist taxpayers.

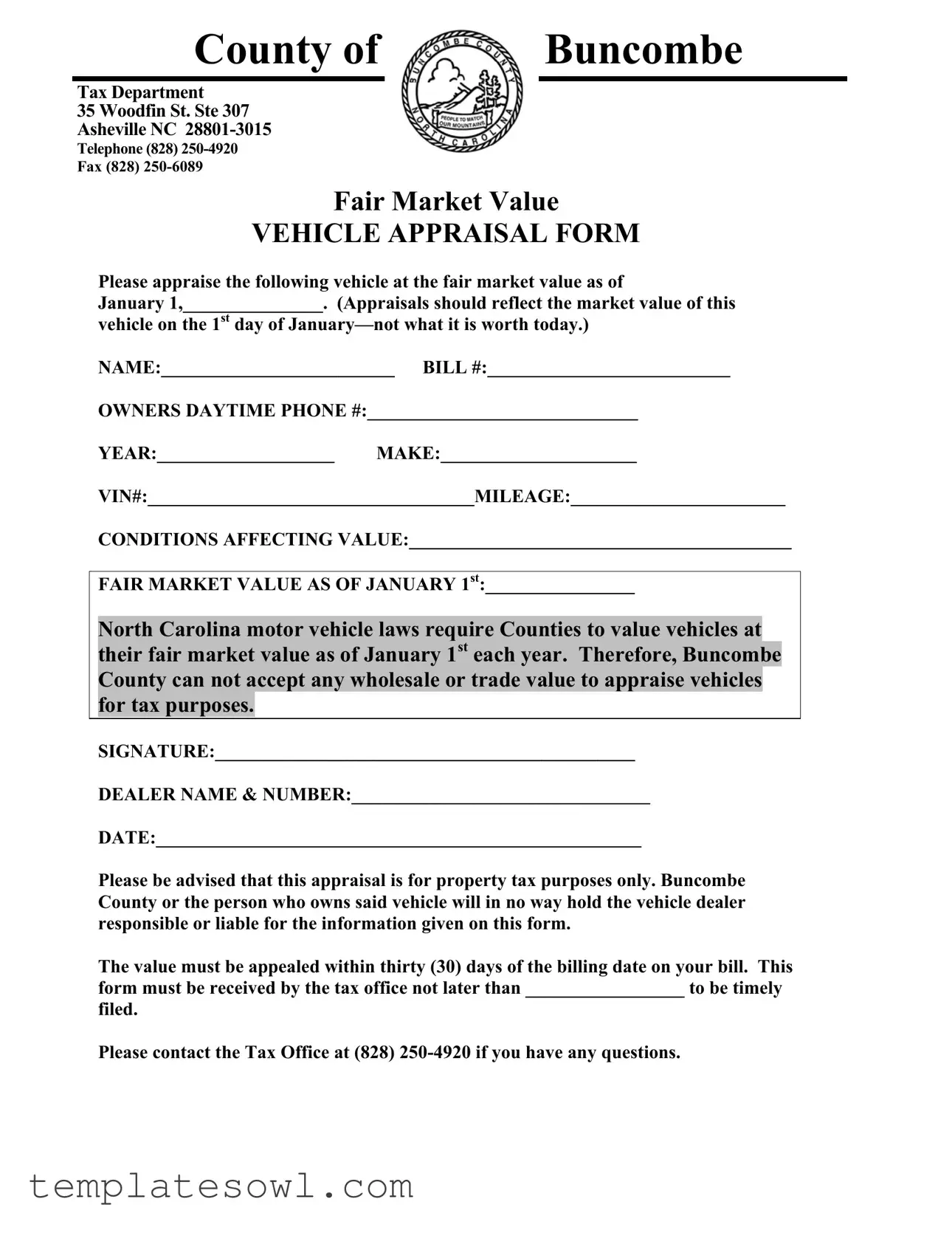

Vehicle Appraisal Example

County of Buncombe

Tax Department

35 WOODFIN ST. STE 307 ASHEVILLE NC

Telephone (828)

Fax (828)

Fair Market Value

VEHICLE APPRAISAL FORM

Please appraise the following vehicle at the fair market value as of

January 1,_______________. (Appraisals should reflect the market value of this

vehicle on the 1st day of

NAME:_________________________ BILL #:__________________________

OWNERS DAYTIME PHONE #:_____________________________

YEAR:___________________ MAKE:_____________________

VIN#:___________________________________MILEAGE:_______________________

CONDITIONS AFFECTING VALUE:_________________________________________

FAIR MARKET VALUE AS OF JANUARY 1st:________________

North Carolina motor vehicle laws require Counties to value vehicles at their fair market value as of January 1st each year. Therefore, Buncombe County can not accept any wholesale or trade value to appraise vehicles for tax purposes.

SIGNATURE:_____________________________________________

DEALER NAME & NUMBER:________________________________

DATE:____________________________________________________

Please be advised that this appraisal is for property tax purposes only. Buncombe County or the person who owns said vehicle will in no way hold the vehicle dealer responsible or liable for the information given on this form.

The value must be appealed within thirty (30) days of the billing date on your bill. This form must be received by the tax office not later than _________________ to be timely

filed.

Please contact the Tax Office at (828)

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of Form | The Vehicle Appraisal Form is designed to assess a vehicle's fair market value for property tax purposes in Buncombe County, NC. |

| Filing Deadline | This form must be submitted to the tax office no later than the specified date to ensure timely processing. |

| Governing Law | North Carolina law mandates that vehicles be valued at their fair market value as of January 1st each year. Wholesale or trade values are not acceptable. |

| Appeal Process | If you disagree with the assessed value, you must appeal it within thirty (30) days from the billing date printed on your tax bill. |

Guidelines on Utilizing Vehicle Appraisal

Filling out the Vehicle Appraisal form is a necessary step for vehicle owners looking to establish the fair market value of their vehicle for tax purposes. It’s vital that all sections are completed accurately to avoid any issues with the appraisal process. Follow these steps to ensure your form is filled out correctly.

- Start with the name section. Write your full name in the space provided.

- Next, fill in the bill number. This number should be on your tax bill and helps identify your account.

- Provide your daytime phone number. This allows the tax department to contact you if there are questions about your appraisal.

- In the year section, indicate the model year of your vehicle.

- Specify the make of the vehicle. This is the manufacturer’s name.

- Enter the VIN (Vehicle Identification Number). This unique code is found on the vehicle title or insurance documentation.

- Write down the mileage of the vehicle. Make sure this is the mileage on the vehicle as of January 1.

- In the section for conditions affecting value, describe any specific conditions that might impact your vehicle's fair market value such as recent damage, modifications, or overall condition.

- Fill in the fair market value as of January 1st. This should reflect the value of the vehicle on that specific date, not its current value.

- Sign the form in the signature area.

- Enter the dealer name and number if applicable.

- Finally, date the form in the provided section.

Ensure that you send the completed form to the Buncombe County Tax Department at the address listed at the top of the form. Remember, timing is crucial—submit the form by the deadline specified to ensure it's processed in a timely manner. If there are any uncertainties, don’t hesitate to reach out to the tax office for assistance.

What You Should Know About This Form

What is the purpose of the Vehicle Appraisal form?

The Vehicle Appraisal form is used to determine the fair market value of a vehicle for property tax purposes in Buncombe County, North Carolina. Each year, the county assesses the value of vehicles as of January 1. The appraisal should reflect what the vehicle would sell for on that specific day, not its current value.

Who needs to fill out the Vehicle Appraisal form?

This form must be completed by vehicle owners who want their vehicle assessed for tax purposes. It is essential for those who wish to appeal their vehicle’s value and ensure it accurately reflects the fair market value on January 1. If you own a vehicle and received a tax bill, this form is relevant to you.

How do I submit the Vehicle Appraisal form?

The completed form must be submitted to the Buncombe County Tax Department. You can either deliver it in person to their office at 35 Woodfin St. Ste 307, Asheville, NC, or send it via fax to (828) 250-6089. Make sure it is submitted before the deadline specified on your tax bill to ensure that it is timely filed.

What should I do if I disagree with the appraisal value?

If you disagree with the appraisal value provided, you must appeal it within 30 days from the billing date on your tax bill. Contact the Buncombe County Tax Office at (828) 250-4920 for guidance on the appeal process. Remember, you are not allowed to use wholesale or trade values when disputing the appraisal.

Common mistakes

Completing the Vehicle Appraisal form accurately is vital for ensuring that taxpayers are assessed correctly. Yet, many individuals make mistakes that can lead to issues. One common error is failing to provide a precise date in the appraisal section. The form specifically asks for the fair market value as of January 1st of the given year. Omitting this detail can cause delays or miscalculations in the appraisal process.

Another frequent mistake involves neglecting to use the correct method for determining fair market value. Taxpayers often base their appraisals on the vehicle's current worth instead of its value as of January 1st. This choice undermines the purpose of the appraisal, leading to potential disputes with tax authorities.

Many individuals overlook the importance of including all relevant vehicle details. Fields such as the VIN number, make, and year must be accurately filled in to create a comprehensive vehicle profile. Failure to provide this information could result in lost records, making it difficult for the tax department to process the appeal.

Taking care to fill out the mileage is also crucial. Inaccurate mileage impacts the vehicle's appraisal. If a person states a figure that does not reflect the vehicle's actual condition, it may lead to an inappropriate assessment. Thus, ensuring the mileage is recorded correctly can save time and prevent complications.

Misunderstanding the conditions affecting value is another misstep. Taxpayers should clearly state any pertinent conditions that might affect their vehicle's market value. For instance, if the car has been in an accident or has significant wear and tear, disclosing this information is essential. Without such details, the appraisal may not accurately reflect the vehicle's true value.

The signature section is equally important. Some individuals forget to sign the form or ask for someone else to sign it on their behalf. This can render the appraisal invalid. Each person must ensure that their own signature is present where indicated, as this confirms their acknowledgment of the details provided.

Additionally, taxpayers often fail to note the deadline for submission. The form states that it must be received by the tax office by a specific date for it to be considered timely. Missing this deadline can lead to automatic penalties or issues with the tax assessment.

Another common oversight is not contacting the tax office if clarification is needed. Individuals might hesitate to reach out, fearing they should already know the answers. However, it's prudent to seek guidance to avoid errors on the form that could complicate the appraisal process.

Finally, misunderstanding that this appraisal is solely for tax purposes can lead to mistakes. People sometimes think this appraisal serves other functions, such as insurance purposes, which it does not. This misunderstanding can lead to improperly completed forms that don't meet the state's requirements, resulting in a lack of compliance and potential fines.

Documents used along the form

When completing a Vehicle Appraisal form, there are several other documents that may also be necessary to gather or submit. These documents can help clarify ownership, support valuations, or ensure compliance with local regulations. Below is a list of common forms related to the vehicle appraisal process.

- Vehicle Title: This document proves ownership of the vehicle. It includes important details such as the owner's name, the vehicle's make and model, and its Vehicle Identification Number (VIN).

- Bill of Sale: This document serves as proof of the transaction when the vehicle was purchased. It outlines the sale conditions, purchase price, and signatures of both buyer and seller.

- Insurance Appraisal: Often required for tax purposes or to support a loan application, this appraisal from an insurance company estimates the vehicle's value based on its condition and market rates.

- Previous Year’s Tax Bill: This form shows the assessed value of the vehicle from the previous year, which may serve as a reference for the current appraisal.

- Odometer Disclosure Statement: Required in many states, this document verifies the mileage on a vehicle at the time of sale or transfer.

- Repair Receipts: Providing documentation of any significant repairs or improvements can help justify a higher appraisal value, reflecting the vehicle’s condition more accurately.

- Sales Tax Exemption Certificate: In certain cases, this document may be required to claim an exemption from sales tax based on specific criteria, such as transferring to a family member.

- Inspection Report: This report details the condition of the vehicle, often prepared by a mechanic or licensed inspector, and can affect its market value.

Gathering these documents can facilitate a smoother appraisal process and provide clarity regarding the vehicle’s worth. Ensure that all paperwork is completed accurately and submitted within the required timeframe to avoid any issues with tax assessments.

Similar forms

The Vehicle Appraisal form serves a vital purpose in assessing the fair market value of vehicles for tax purposes. Several other documents share similar functions, either in property assessment, financial evaluation, or vehicle transactions. Here’s a list of eight documents that are similar to the Vehicle Appraisal form:

- Property Tax Assessment Form: Like the Vehicle Appraisal, this form is used to determine the fair market value of real estate for property tax evaluations. Both forms require the inclusion of specific details relevant to the property or vehicle in question.

- Bill of Sale: This document captures the sale of a vehicle or property, often including similar valuation information. It serves as legal evidence of the transaction, much like how the Vehicle Appraisal records the vehicle's value for tax purposes.

- Insurance Appraisal Report: This report assesses the value of a vehicle for insurance coverage. Its primary function mirrors the Vehicle Appraisal by evaluating the vehicle's market value, although it focuses more on protection rather than tax obligations.

- Loan Application for Vehicle Financing: When financing a vehicle, lenders require a valuation to determine the loan amount. This process uses similar market value assessments to the Vehicle Appraisal as a basis for lending decisions.

- Vehicle Title Application: This document is necessary for registering a vehicle and often involves declaring its value. Similar to the Vehicle Appraisal form, this application indicates the importance of valuing vehicles accurately.

- Trade-in Value Form: When trading in a vehicle, dealers often use a valuation form to determine the trade-in value. Though aimed at different transactions, both forms aim to establish a vehicle's market value.

- Sales Tax Exemption Certificate: This document is submitted to claim exemption from sales tax under specific conditions. It includes valuation information that links to the vehicle's assessed value, mirroring the Vehicle Appraisal's intent.

- Vehicle Condition Report: This report evaluates the physical state of a vehicle and helps to establish its value. Like the Vehicle Appraisal form, it focuses on aspects that affect market value and can influence tax assessments.

Understanding the similarities between these documents can enhance awareness of their roles in vehicle valuation and related transactions. Whether for tax, insurance, or financing, accurate vehicle appraisal remains crucial.

Dos and Don'ts

When filling out the Vehicle Appraisal form, there are several important dos and don'ts to keep in mind. Here are some guidelines to help ensure your form is completed accurately and effectively.

- Do provide accurate and complete vehicle information, including the year, make, model, and VIN.

- Do appraise the vehicle based on its fair market value as of January 1, not its current worth.

- Do contact the Buncombe County Tax Office if you have any questions or need clarification regarding the form.

- Don’t use wholesale or trade-in values for your appraisal, as these are not acceptable for tax purposes.

- Don’t forget to sign the form; a signature is required for validity.

- Don’t miss the deadline for submission. Ensure the form is received by the tax office on time.

Misconceptions

Understanding the Vehicle Appraisal form can often lead to confusion. Here are six common misconceptions about it:

- Appraisals reflect current value. Many believe that the appraisal reflects the vehicle's current market value, but it actually reflects the fair market value as of January 1st of the current year.

- All values are accepted. Some people think that any value, including wholesale or trade-in values, can be used. However, North Carolina law specifies that only fair market value is accepted for tax purposes.

- The form is optional. It is a common mistake to view the appraisal form as optional. In reality, this form is necessary for determining the property tax owed on the vehicle.

- Appraisal values cannot be appealed. Some assume that once an appraisal value is given, it cannot be contested. In fact, the value can be appealed within thirty days of the billing date on the tax bill.

- Deadline for filing is flexible. There’s a misconception that filing the form late won’t affect the appraisal. Submissions must be received by the tax office by a specific deadline to be considered timely.

- The dealer is liable for the information. Some individuals think that the vehicle dealer is accountable for the values reported. This is incorrect; the form clearly states that the dealer is not responsible for the accuracy of the appraisal information provided.

Clarifying these misconceptions can help ensure a smooth appraisal process for vehicle owners.

Key takeaways

When filling out the Vehicle Appraisal form, keep these key takeaways in mind:

- The fair market value must reflect the vehicle's worth as of January 1, not its current value.

- All fields must be filled out completely, including the year, make, and VIN of the vehicle.

- Provide accurate mileage information to ensure a more precise appraisal.

- Identify any conditions affecting the vehicle’s value, such as damage or modifications.

- The appraisal is for property tax purposes, and should be filed with the Buncombe County Tax Department.

- Remember to sign the form before submitting it. A signature is required.

- The form must be submitted to the tax office by the specified deadline for it to be valid.

- If you disagree with the value assigned, you have thirty days from the billing date to appeal.

- Contact the Tax Office at (828) 250-4920 for any clarification or questions.

- Keep a copy of the completed form for your records.

Browse Other Templates

Dms 640 - This form must be completed for an initial therapy evaluation or to renew an existing prescription.

How to Evict a Tenant - The Texas Department of Insurance oversees the filing and management of this notice.