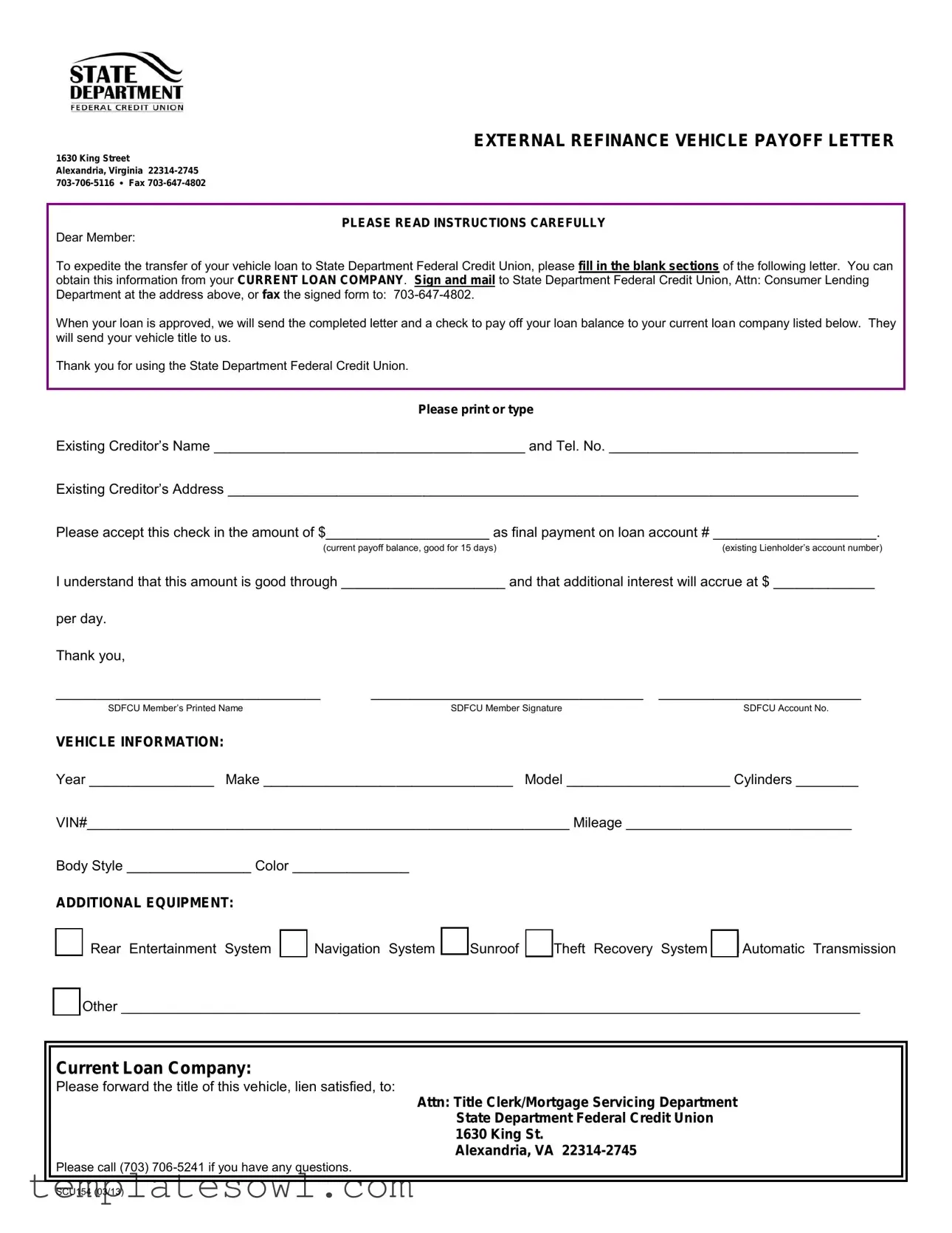

Fill Out Your Vehicle Payoff Sample Letter Form

When managing the complexities of refinancing a vehicle loan, the Vehicle Payoff Sample Letter form simplifies the process for members of the State Department Federal Credit Union (SDFCU). This form serves as a critical tool to ensure a seamless transition of your vehicle loan from your current lender to SDFCU. It requires important details such as the existing creditor’s name, contact information, and address, alongside specifics related to the vehicle, including its year, make, model, and VIN. Members will need to specify the payoff amount that should be sent to the current lender and acknowledge the timeline for which that amount is valid. The completed letter must be signed and submitted either via mail or fax, initiating the process that leads to the title transfer of the vehicle once the loan is paid off. The instructions are straightforward and designed to expedite the handling of the loan for a smooth refinancing experience. Additional details about any vehicle equipment, such as navigation systems or sunroofs, can also be included, enhancing clarity in the loan payoff communication.

Vehicle Payoff Sample Letter Example

EXTERNAL REFINANCE VEHICLE PAYOFF LETTER

1630 King Street

Alexandria, Virginia

PLEASE READ INSTRUCTIONS CAREFULLY

Dear Member:

To expedite the transfer of your vehicle loan to State Department Federal Credit Union, please fill in the blank sections of the following letter. You can obtain this information from your CURRENT LOAN COMPANY. Sign and mail to State Department Federal Credit Union, Attn: Consumer Lending Department at the address above, or fax the signed form to:

When your loan is approved, we will send the completed letter and a check to pay off your loan balance to your current loan company listed below. They will send your vehicle title to us.

Thank you for using the State Department Federal Credit Union.

Please print or type

Existing Creditor’s Name ________________________________________ and Tel. No. ________________________________

Existing Creditor’s Address _________________________________________________________________________________

Please accept this check in the amount of $_____________________ as final payment on loan account # _____________________.

(current payoff balance, good for 15 days)(existing Lienholder’s account number)

I understand that this amount is good through _____________________ and that additional interest will accrue at $ _____________

per day.

Thank you, |

|

|

__________________________________ |

___________________________________ |

__________________________ |

SDFCU Member’s Printed Name |

SDFCU Member Signature |

SDFCU Account No. |

VEHICLE INFORMATION: |

|

|

Year ________________ Make ________________________________ Model _____________________ Cylinders ________

VIN#______________________________________________________________ Mileage _____________________________

Body Style ________________ Color _______________

ADDITIONAL EQUIPMENT:

□Rear Entertainment System □ Navigation System □Sunroof □Theft Recovery System □Automatic Transmission

□Other _______________________________________________________________________________________________

Current Loan Company:

Please forward the title of this vehicle, lien satisfied, to:

Attn: Title Clerk/Mortgage Servicing Department

State Department Federal Credit Union

1630 King St.

Alexandria, VA

Please call (703)

SCU154 (03/13)

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Vehicle Payoff Sample Letter is used to facilitate the transfer of a vehicle loan to the State Department Federal Credit Union. |

| Required Information | Members must provide their existing creditor's name, contact number, and address, as well as the specific loan account details. |

| Submission Method | The completed letter can be mailed or faxed to the Consumer Lending Department at the State Department Federal Credit Union. |

| Loan Approval | Once the loan is approved, a check will be sent to the current loan company to pay off the existing loan balance. |

| Governing Law | This document is governed by Virginia state law, as the credit union is located in Alexandria, Virginia. |

Guidelines on Utilizing Vehicle Payoff Sample Letter

Filling out the Vehicle Payoff Sample Letter form is a straightforward process. Once completed, you'll send it to the State Department Federal Credit Union for your vehicle loan transfer. Keeping your current loan information handy will make this filling-out process much easier.

- Start by entering the name and telephone number of your current loan company in the designated section.

- Next, fill in the full address of your current loan company.

- In the appropriate space, specify the amount of the final payment you are submitting.

- Provide the account number associated with your existing loan.

- Indicate the date up to which the mentioned amount is valid.

- Note the daily accruing interest for any additional days after the stated date.

- Sign and print your name at the bottom of the form. Make sure to include your SDFCU account number too.

- Fill in the vehicle information section, including the year, make, model, number of cylinders, VIN, mileage, body style, and color.

- If applicable, check any additional equipment options that enhance your vehicle's value.

- Designate the current loan company to forward the vehicle title to the State Department Federal Credit Union, ensuring to address it to the Title Clerk/Mortgage Servicing Department.

- Finally, keep a copy for your records and send the signed form via mail or fax to the provided contact information.

What You Should Know About This Form

What is the purpose of the Vehicle Payoff Sample Letter form?

The Vehicle Payoff Sample Letter form is used to notify your current loan company of your intent to pay off your vehicle loan. By completing this form, you authorize State Department Federal Credit Union (SDFCU) to process the payoff amount and facilitate the transfer of the vehicle title to them.

How do I fill out the Vehicle Payoff Sample Letter form?

To complete the form, provide the required information about your current loan company, including their name, telephone number, and address. Additionally, write the amount you are paying, the loan account number, and the date that the payoff amount is valid. Your personal and vehicle information, along with your SDFCU account details, also need to be included.

Who should I send the completed letter to?

Once you have filled out the letter, send it to State Department Federal Credit Union's Consumer Lending Department at 1630 King St., Alexandria, VA 22314-2745. You can also fax it to 703-647-4802.

What happens after I send in the Vehicle Payoff Sample Letter?

After processing your loan application, SDFCU will issue a check to pay off your current loan balance. This check will be sent to your existing loan company, which will then send the vehicle title to SDFCU once the loan is satisfied.

How long is the payoff amount valid?

The payoff amount listed on the form is valid for 15 days. Be mindful that interest will continue to accrue daily, so it is important to initiate the payoff process as soon as possible.

What should I do if my current loan company does not have the Vehicle Payoff Sample Letter?

Your current loan company may not have the specific form, but they are likely familiar with the process. Simply provide them with the information indicated in the form, and they can assist you with the necessary steps to complete the loan payoff.

What if I have questions while filling out the form?

If you encounter any difficulties while filling out the form, you may contact SDFCU at (703) 706-5241 for assistance. They can help clarify any sections and guide you through the process.

Which vehicles are eligible for this form?

The Vehicle Payoff Sample Letter can be used for any vehicle under loan. Fill out the specific details of your vehicle—including make, model, and VIN—to ensure the correct vehicle is described in the payoff process.

Can I use this form for refinancing purposes?

Yes, the form is intended for individuals who are refinancing their vehicle loan with SDFCU. It streamlines the transition by providing your current lender with the necessary information for loan payoff.

Is my personal information used securely?

Yes, your personal information will be handled with the utmost care and used solely for the vehicle payoff process. SDFCU prioritizes your privacy and security.

Common mistakes

When filling out the Vehicle Payoff Sample Letter form, individuals often make critical errors that can delay the loan payoff process. One common mistake is failing to provide the Current Creditor's Name and telephone number. Incomplete information can lead to complications, preventing the State Department Federal Credit Union from contacting the existing loan company. It is crucial to ensure accuracy in these details.

Another frequent issue arises when the Existing Creditor's Address is not filled out completely. Simply providing a partial address may cause confusion. Loan companies need precise information to accurately identify the loan account and process the request efficiently.

People sometimes overlook the importance of confirming the loan amount they are submitting. This amount must reflect the correct payoff balance as listed by the current loan company. Submitting an incorrect payout figure can result in insufficient funds being sent, thereby prolonging the payoff process.

A key area where mistakes frequently occur is in missing the expiration date for the payoff amount. The form specifies that the listed amount is valid for a limited period. Omitting this date can lead to misunderstandings about the urgency of the transaction.

While signing the form seems straightforward, individuals may forget to include their printed name along with their signature. This step makes it clear who is authorizing the transaction and can prevent processing delays at the credit union.

Another common error involves providing incorrect information about the vehicle details. Incorrect specifications such as the VIN or vehicle model can create significant hurdles later on. It’s essential to double-check these details to facilitate smooth communication and processing with the existing lender.

Some individuals may neglect to indicate any additional equipment included with the vehicle on the form. While this may seem minor, failure to mention features can affect the vehicle’s valuation and the lender’s decisions on the payoff process.

Lastly, people often forget to include their SDFCU Account Number. This number is necessary for the credit union's records to ensure the payoff is correctly linked to the right account. Omitting it can cause delays and unwanted complications when processing the loan transfer.

Documents used along the form

When using the Vehicle Payoff Sample Letter form, it's important to have a few additional documents ready. These documents can help streamline the payoff process and facilitate communication with your current loan company. Below is a list of forms that are often needed alongside the payoff letter.

- Loan Account Statement: This document provides a detailed breakdown of your current loan balance. It shows the principal owed, interest accrued, and any applicable fees, giving you a clear understanding of what needs to be paid off.

- Title Transfer Form: A title transfer form is necessary when moving the ownership of the vehicle from one lender to another. This helps ensure that the new lender receives the vehicle title once the loan payoff is finalized.

- Identification Verification: Providing a copy of your driver’s license or state ID helps verify your identity. Loan companies often request this to match the account to the authorized individual and prevent fraud.

- Power of Attorney: If someone else is handling the payoff on your behalf, a power of attorney document may be required. This form grants permission for another person to act on your behalf in financial matters, simplifying the process.

- Loan Approval Letter from New Lender: A loan approval letter from your new lender confirms that you've been approved for financing. This document serves as proof that the new lender is ready to take over the existing loan.

Having these documents prepared can make the vehicle payoff process smoother and help prevent any delays. Being organized will help ensure that you receive the title promptly, allowing for a seamless transition between lenders.

Similar forms

- Loan Payoff Statement: This document outlines the remaining balance due on a loan, similar to the payoff letter. It specifies the amount necessary to settle the debt and may include details about the loan account.

- Release of Lien Document: This is used to formally release the claim a lender has against the vehicle once the loan is paid off, ensuring that the borrower obtains clear title.

- Title Transfer Form: After a loan is paid off, this document facilitates the transfer of ownership of the vehicle's title from the lender to the borrower.

- Vehicle Loan Agreement: This document contains the initial terms and conditions of the vehicle loan, providing context for the payment process outlined in the payoff letter.

- Credit Union Membership Application: Similar in nature to the vehicle payoff request, this document requires the member's information to process services offered by the credit union.

- Loan Modification Request: If a borrower wishes to change the terms of their loan, this request resembles the payoff process by requiring specific documentation and lender approval.

- Vehicle Financing Application: When obtaining financing, this application is similar in that it collects necessary details about the vehicle and the borrower for processing loan requests.

- Credit Report Authorization Form: This form allows lenders to check a borrower’s credit history, similar to how the payoff letter verifies current loan details with the existing lender.

- Final Payment Receipt: After completing a payoff, a receipt is issued, much like the payoff letter, confirming the payment has been settled.

- Affidavit of Vehicle Ownership: This document may be used to declare ownership of the vehicle, similar to the information sought in the payoff letter for validation purposes.

Dos and Don'ts

When filling out the Vehicle Payoff Sample Letter form, keep these important do's and don'ts in mind:

- Do double-check the information you input for accuracy.

- Do clearly print or type your details to ensure legibility.

- Do include the current loan company's name and phone number.

- Do specify the correct payoff amount and account number.

- Don't forget to sign the letter before sending it.

- Don't leave any blank sections that are essential to the process.

- Don't send the letter without checking the date of the stated payoff amount.

- Don't hesitate to reach out to the loan company if you have questions about the information required.

Misconceptions

There are several misconceptions surrounding the Vehicle Payoff Sample Letter form. Understanding these can help ensure a smoother refinancing process.

- It’s only for certain types of loans. Many believe that this form is limited to specific types of vehicle loans. In reality, it can be used for various types of existing loans, as long as you're refinancing through the State Department Federal Credit Union.

- You must be present for the payoff. Some assume they need to be physically present at the current loan company to process the payoff. This is not the case. Simply completing the form and sending it to the credit union is sufficient for the process to begin.

- It can only be faxed. Another common misunderstanding is that you can only submit the form by fax. While faxing is one option, mailing the signed letter is equally acceptable and often preferred by some members.

- The form guarantees loan approval. Lastly, it’s mistaken that filling out this form automatically guarantees loan approval. While the form initiates the refinancing process, approval is still subject to the credit union's underwriting criteria.

Key takeaways

Here are key takeaways about filling out and using the Vehicle Payoff Sample Letter form:

- The form is meant for transferring your vehicle loan to State Department Federal Credit Union (SDFCU).

- Contact your current loan company to obtain necessary details before filling out the letter.

- All blank sections should be clearly filled in, including the existing creditor's name and contact information.

- A signed and completed letter must be mailed or faxed to SDFCU for processing.

- The payoff amount provided is valid for 15 days; any additional interest will accrue daily.

- Include vehicle details such as year, make, model, and VIN, to ensure accurate processing.

- Your current loan company will receive the payoff check and will send the vehicle title to SDFCU once satisfied.

- If you have questions while filling out the form, you can reach SDFCU at (703) 706-5241 for assistance.

Browse Other Templates

Medication List Example - Easily label medications to remember when to take them.

Pa W2 - Section II must be completed with forms like 1099-R, 1099-MISC, and others included in the submission.