Fill Out Your Verbal Verification Form

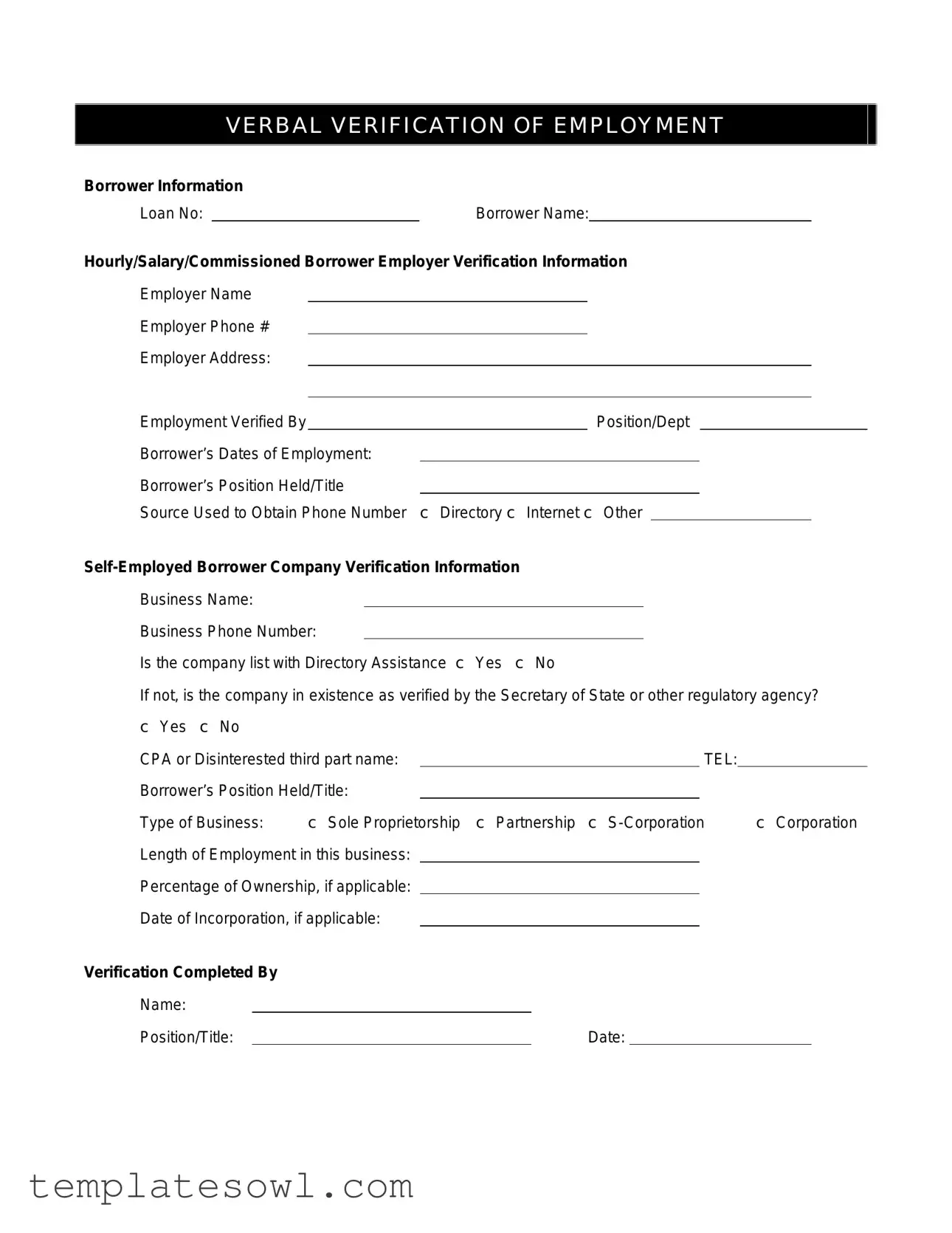

The Verbal Verification form plays a crucial role in the process of verifying employment for borrowers seeking loans. This essential document contains key information that lenders need to assess a borrower's employment history and stability. It usually begins with the borrower's details, including their loan number, name, and classification based on their income type—hourly, salary, or commissioned. Concerning the employer, the form gathers pertinent data such as the employer's name, phone number, and address while also requiring confirmation of the borrower's employment status. The form specifies the dates of employment, the title held, and how the information was obtained, whether through directories, the internet, or other means. For self-employed individuals, additional sections address their business details, including the nature of the business, ownership percentage, and verification of existence through regulatory agencies. Finally, the form must be completed by an individual responsible for the verification process, indicating their name, position, and the date of completion. This comprehensive approach ensures that all necessary aspects of employment verification are thoughtfully covered, thereby facilitating informed lending decisions.

Verbal Verification Example

VERBAL VERIFICATION OF EMPLOYMENT

Borrower Information

Loan No: |

|

Borrower Name: |

Hourly/Salary/Commissioned Borrower Employer Verification Information

Employer Name

Employer Phone #

Employer Address:

Employment Verified By |

|

|

Position/Dept |

|

|

|

Borrower’s Dates of Employment: |

|

|

|

|

|

|

Borrower’s Position Held/Title |

|

|

|

|

|

|

Source Used to Obtain Phone Number |

c Directory c Internet c Other |

|

|

|

||

Business Name:

Business Phone Number:

Is the company list with Directory Assistance c Yes c No

If not, is the company in existence as verified by the Secretary of State or other regulatory agency?

c Yes c No |

|

|

|

|

|

|

CPA or Disinterested third part name: |

|

|

TEL: |

|

||

Borrower’s Position Held/Title: |

|

|

|

|

|

|

Type of Business: |

c Sole Proprietorship |

c Partnership c |

c Corporation |

|||

Length of Employment in this business:

Percentage of Ownership, if applicable:

Date of Incorporation, if applicable:

Verification Completed By

Name:

Position/Title: |

|

Date: |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Verbal Verification form is used to confirm a borrower's employment status and income details. |

| Borrower Information | It collects essential information such as the borrower's name, loan number, and employment dates. |

| Employer Verification | Employers must provide their name, phone number, address, and verify the borrower's employment. |

| Self-Employed Section | A specific section exists for self-employed individuals to verify their business information. |

| Legal Compliance | In some states, this form is governed by specific employment verification laws that protect borrower information. |

| Verification Process | The form must be completed by a disinterested third party or a CPA to ensure credibility of the information. |

Guidelines on Utilizing Verbal Verification

Completing the Verbal Verification form accurately is essential for ensuring that all necessary information is collected. This document requires attention to detail and careful entry of relevant data. Once filled out, the form can facilitate the verification process related to the borrower's employment and business status.

- Locate the section titled Borrower Information at the top of the form.

- Fill in the Loan No assigned to this application.

- Enter the Borrower Name to identify the individual associated with this loan.

- Indicate whether the borrower is paid Hourly, Salary, or Commissioned.

- Move to the Employer Verification Information section.

- Provide the Employer Name.

- Input the Employer Phone #, being sure to double-check the number for accuracy.

- Enter the Employer Address, ensuring all elements are included.

- Fill in the Employment Verified By field with the name of the individual verifying employment.

- Document the Position/Dept of the verifier.

- Specify the Borrower’s Dates of Employment.

- Detail the Borrower’s Position Held/Title during their employment.

- Indicate the Source Used to Obtain Phone Number by marking one of the options: Directory, Internet, or Other.

- For self-employed borrowers, navigate to the Self-Employed Borrower Company Verification Information section.

- Enter the Business Name of the company.

- Provide the Business Phone Number associated with the company.

- Mark whether the company is listed with Directory Assistance by selecting Yes or No.

- If not listed, confirm the company's existence by selecting Yes or No in reference to verification by the Secretary of State or another regulatory agency.

- If applicable, fill in the details for CPA or Disinterested third-party name and their TEL.

- Provide the Borrower’s Position Held/Title (for self-employed).

- Select the Type of Business from Sole Proprietorship, Partnership, S-Corporation, or Corporation.

- Document the Length of Employment in this business.

- If applicable, list the Percentage of Ownership.

- If applicable, indicate the Date of Incorporation.

- Complete the Verification Completed By section with the verifier's Name, Position/Title, and Date.

What You Should Know About This Form

What is the purpose of the Verbal Verification form?

The Verbal Verification form is used to confirm a borrower's employment and income details. This process helps lenders assess the borrower's financial stability and ability to repay the loan. It ensures that the information provided in loan applications is accurate and up-to-date.

Who should fill out this form?

This form is typically completed by the lender or their representative. They must contact the borrower’s current or past employers to verify employment and income details. If the borrower is self-employed, additional information about their business will be needed.

What information is required on the form?

The form requires the borrower’s personal details, including their name and loan number. It also asks for information about their employer, such as the name, contact number, and address. For self-employed individuals, details about the business, including its name, type, and ownership percentage, must be provided.

How is the employment verification conducted?

Verification is conducted by contacting the borrower's employer directly. This can be done over the phone or through other methods. The lender will ask about the borrower's dates of employment, position held, and any other relevant employment details. Documentation and records may also be checked for accuracy.

What if the borrower is self-employed?

If the borrower is self-employed, they will need to provide information about their business on the form. This includes the business name, type of business entity, and any relevant licenses or permits. Verification can come from third parties like accountants to confirm the legitimacy of the business.

What happens if the employment cannot be verified?

If the employment cannot be verified, it may raise concerns for the lender about the borrower's ability to repay the loan. The lender may request additional documentation or seek alternative ways to verify the borrower's income and employment status.

How long does the verification process take?

The verification process can vary in length depending on the employer’s responsiveness. Typically, it may take a few hours to a few days. Factors like the availability of the employer or the accuracy of the contact details can influence the duration.

What should a borrower do if their employer is unresponsive?

If an employer is unresponsive, the borrower should consider providing additional contact details, such as a secondary person who can confirm employment. The borrower may also need to supply supporting documents like pay stubs, tax returns, or a letter from the employer.

Is the information on the Verbal Verification form confidential?

Yes, the information collected through the Verbal Verification form is treated with confidentiality. Lenders are obligated to comply with data protection regulations and will typically use this information solely for the purpose of evaluating the loan application.

Who completes the verification section of the form?

The verification section is usually completed by the lender or the representative conducting the verification. This includes details about who verified the employment, their position, and the date of completion. Accurate reporting is crucial for the integrity of the verification process.

Common mistakes

Completing the Verbal Verification form can seem straightforward, but several common mistakes often lead to inaccuracies and potential delays in processing. Recognizing these pitfalls can help ensure the form is filled out correctly and efficiently.

One significant mistake is insufficient borrower information. When filling out the form, users may forget to include essential details such as the loan number, borrower's full name, or employment dates. Omitting this information can cause confusion and necessitate follow-up communications, slowing down the entire verification process.

Another common error is the incomplete employer verification section. Many individuals neglect to provide a full address or correct phone numbers for their employer. This omission makes it difficult for the verifier to reach out and confirm employment status. Accurate contact information is critical for streamlined verification.

Providing inaccurate employment dates is also a frequent mistake. Some borrowers may misremember when they began or left a job. It's essential for individuals to have precise dates to avoid discrepancies during the verification process. Such inaccuracies could raise red flags and lead to further inquiry.

Additionally, people often overlook the source used to obtain the employer's phone number. Whether it’s through a directory, the internet, or another method, this section offers context that can aid in the verification. Leaving this field blank can leave reviewers unsure whether the information has been properly sourced.

Self-employed borrowers run into unique challenges as well. They may neglect to fill out the business verification information thoroughly, such as business names or CPA details. Lacking this information can hinder the verification of their employment status, causing potential delays in loan approval.

Lastly, another error involves missing or incorrect verification sign-off. Individuals filling out the form sometimes forget to include their name, title, and the date the verification was completed. This important step confirms that the information is accurate and has been reviewed. If this section is incomplete, it can lead to further complications down the line.

Documents used along the form

Alongside the Verbal Verification form, several other documents are commonly used to support employment verification and lending processes. Each plays a specific role in ensuring that the information provided by a borrower is accurate and complete. Below are descriptions of four such documents.

- Employment Verification Letter: This document is typically prepared by an employer and provides proof of a borrower's employment status. It generally includes details such as the dates of employment, job title, and salary or hourly wage. Lenders often request this letter to confirm the information given by the borrower.

- Pay Stubs: Recent pay stubs serve as evidence of income and employment. They typically show the amount of pay received, hours worked, and any deductions. Lenders may ask for a few months' worth of pay stubs to evaluate the borrower's financial stability.

- Credit Report: A credit report summarizes a borrower’s credit history. It includes information on outstanding debts, payment history, and credit inquiries. Lenders use this document to assess the borrower's creditworthiness and ability to repay the loan.

- Tax Returns: Copies of a borrower’s tax returns for the past couple of years can provide additional insight into their income and financial situation. These documents help lenders get a clearer picture of the borrower's financial background and stability.

Utilizing these documents alongside the Verbal Verification form creates a comprehensive view of a borrower’s employment and financial situations, aiding lenders in making informed decisions.

Similar forms

- Employment Verification Letter: This document is typically issued by an employer to confirm an employee's job title, dates of employment, and salary details. Both forms serve to authenticate employment information for purposes like loan applications.

- Wage Verification Form: Similar to the Verbal Verification Form, this is used to verify an individual's income, including hourly rates, salary, or commission-based earnings. It focuses on financial information rather than employment status alone.

- Self-Employment Verification Form: This document is designed for individuals who operate their own businesses. It includes details about the business structure and ownership percentage, paralleling aspects found in the Verbal Verification Form.

- Background Verification Report: This report encompasses a broader scope of a person’s employment history, including criminal and credit history. While it goes beyond employment, it is utilized to validate an individual’s overall background.

- Rental Verification Form: Used primarily in real estate rental situations, this document confirms a tenant's rental history and payment responsibility. Like the Verbal Verification Form, it serves to verify claims made by an individual for transactional purposes.

- Income Verification Form: Similar in function, this document verifies income amounts for various financial services, tying in directly to aspects of employment verification as presented in the Verbal form.

- Professional Reference Letter: Although primarily for character and competency validation, it includes employment details pertinent to an individual's work history. Like the Verbal Verification Form, it seeks to establish credibility regarding the individual's background.

Dos and Don'ts

When filling out the Verbal Verification form, it’s important to ensure accuracy and clarity. Here’s a list of things you should and shouldn’t do to facilitate a smooth process.

- Do ensure all information is accurate. Double-check names, numbers, and dates.

- Do use clear handwriting or type the information. This helps avoid misinterpretation.

- Do include all required fields. Missing information can cause delays.

- Do check the appropriate boxes. This clarifies your responses to yes/no questions.

- Don't leave any sections blank. If a section doesn’t apply, indicate that clearly.

- Don't assume information is known. Always provide complete details for the employer and business.

- Don't forget to review the form before submission. A final check can catch errors you may have missed.

Following these guidelines will help ensure that your Verbal Verification form is filled out correctly, contributing to a smoother verification process.

Misconceptions

Below are common misconceptions regarding the Verbal Verification form, along with clarifications for each.

- It is only for current employment. Many believe the form can only verify current employment. However, it can also verify past employment, as long as the necessary information is available.

- It requires a face-to-face meeting. Some think that verbal verification must occur in person. In reality, it can be conducted over the phone or through other means of communication.

- Employers are obligated to respond. There is a misconception that employers must provide verification. Employers are not legally required to respond to such requests.

- Self-employment cannot be verified. It is often believed that self-employed individuals cannot be verified. In fact, the form includes sections specifically designed for verifying self-employment status.

- All companies are listed in directory assistance. Some assume that all businesses can be found in directory assistance. However, many small or new businesses may not be listed.

- All verification must come from a CPA. A common myth is that verification must be done by a Certified Public Accountant. While a CPA can provide verification, other sources can also be used.

- The form is only for salaried employees. It is incorrectly believed that the form only applies to salary-based employees. It caters to hourly, salary, and commissioned employees alike.

- Historical employment dates are not needed. Some think that only current employment dates matter. However, complete employment history is crucial for accurate verification.

- The form guarantees employment verification. There is a misconception that filling out the form guarantees successful verification. Verification depends on the responsiveness and willingness of the employer.

- Information from the form is confidential. Many assume that all information on the form is confidential. While personal data is typically protected, details may be shared if necessary for compliance or verification processes.

Key takeaways

Understanding the Verbal Verification form is crucial for both borrowers and lenders alike. Here are some key takeaways that will help you navigate this important document.

- Accurate Information is Key: Always provide correct and current information regarding the borrower and employer. Any inaccuracies can lead to delays in the verification process.

- Be Prepared for Follow-Up: The employer may need to confirm details about employment, so ensure they are ready to provide accurate information when contacted.

- Know What to Expect: The lender uses this form to verify employment and income. It's beneficial for both parties to understand that it plays a significant role in the loan approval process.

- Self-Employment Details Matter: If the borrower is self-employed, additional information will be required. This includes business structure, ownership percentage, and verification from a CPA or third-party entity.

- Verification Sources: The form asks how the employer's phone number was obtained. Always indicate the source accurately, whether it’s from a directory, the internet, or elsewhere.

- Timely Completion: Make sure to fill out the form as quickly as possible. Delays can slow down the overall loan process.

- Signature Requirement: The form requires a name and position of the person completing the verification. This adds a layer of credibility to the information provided.

- Keep It Professional: When filling out this form, maintain a professional tone. Clear, concise responses help facilitate a smoother verification process.

Browse Other Templates

Ku Official Transcript - A designated section allows students to indicate how many transcripts they wish to request.

How Do I Find Out If a Personalized License Plate Is Available in Colorado - Proper use of this form can help expedite claims related to the accident.

Arkids - Documented deductions may help lower the overall health coverage cost for applicants.