Fill Out Your Verification Of Assets Request Form

The Verification Of Assets Request form serves as a critical tool for authorized Assisted Housing Authorities seeking to assess the financial situation of Bank of America customers applying for low-income government-assisted housing. Designed specifically for use by housing officials, this form requires essential customer information, including the account holder's name, social security number, and address. Additionally, it necessitates details regarding the types of accounts held, such as savings, checking, or IRAs. To initiate the verification process, the requester must provide a complete and accurate submission, including the customer's authorization, which allows Bank of America to disclose pertinent account details. This encompasses information about account balances, average balances, and interest rates, which collectively help determine the applicant's eligibility for assistance. Following submission via fax to the designated number, requests will typically receive a response within approximately two business days. The form underscores the importance of confidentiality, specifying that Bank of America will not be liable for any claims arising from the release of the requested information as long as proper procedures are followed.

Verification Of Assets Request Example

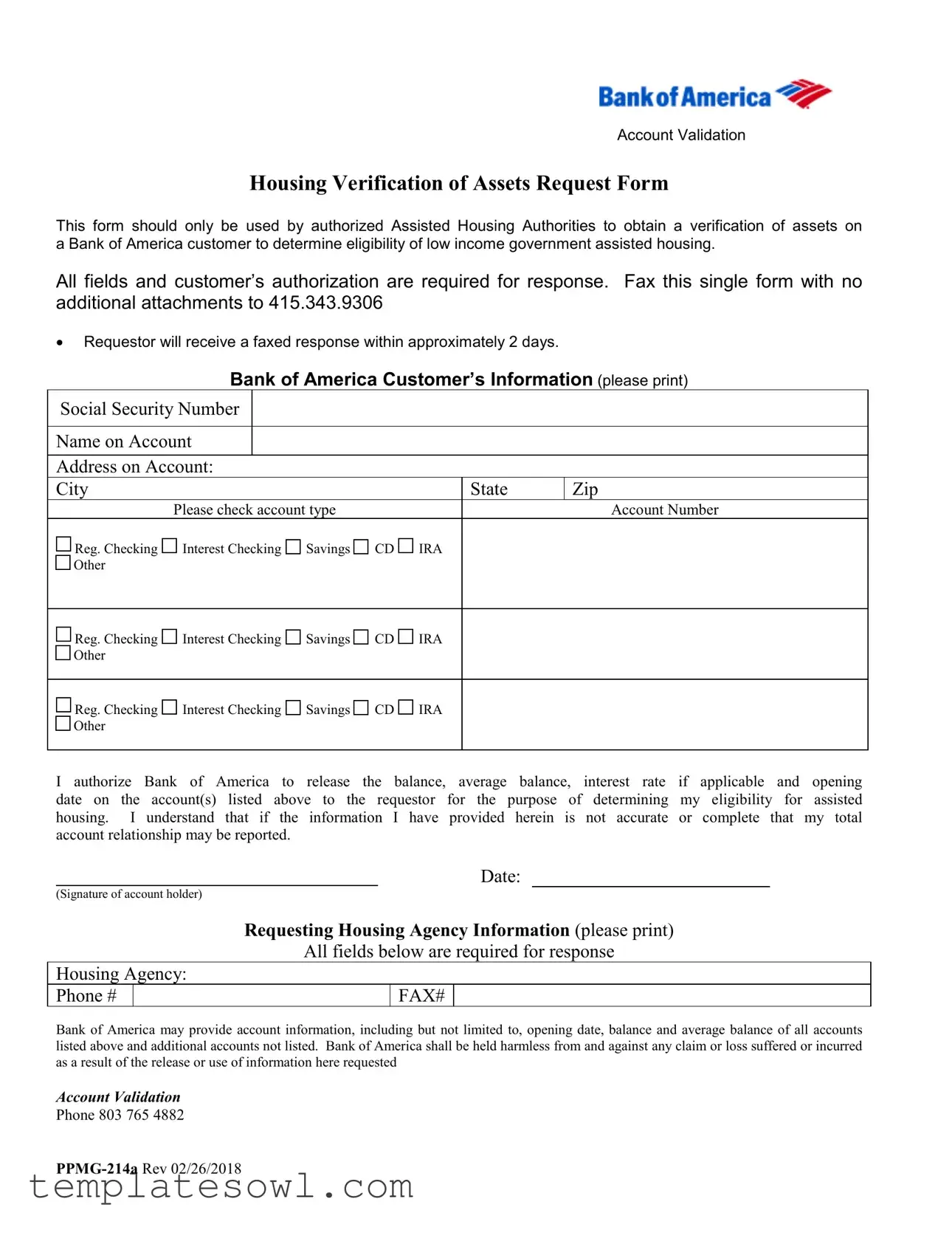

Account Validation

Housing Verification of Assets Request Form

This form should only be used by authorized Assisted Housing Authorities to obtain a verification of assets on a Bank of America customer to determine eligibility of low income government assisted housing.

All fields and customer’s authorization are required for response. Fax this single form with no additional attachments to 415.343.9306

•Requestor will receive a faxed response within approximately 2 days.

Bank of America Customer’s Information (please print)

Social Security Number

Name on Account

Address on Account:

|

City |

|

|

|

|

|

|

|

|

State |

|

|

Zip |

|

|

|

|

|

|

|

|

Please check account type |

|

|

|

|

|

|

|

|

|

Account Number |

|

|

|

||||

|

Reg. Checking |

Interest Checking |

Savings |

CD |

IRA |

|

|

|

|

|

|

|

|

|

|

|

|||

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reg. Checking |

Interest Checking |

Savings |

CD |

IRA |

|

|

|

|

|

|

|

|

|

|

|

|||

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reg. Checking |

Interest Checking |

Savings |

CD |

IRA |

|

|

|

|

|

|

|

|

|

|

|

|||

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

I authorize Bank |

of America to |

release |

the balance, |

|

average |

balance, interest rate |

if |

applicable |

and |

opening |

|

|||||||

|

date on the account(s) listed above to the requestor |

for the purpose of determining |

my |

eligibility for |

assisted |

|

|||||||||||||

|

housing. I understand that if the |

information I |

have |

provided |

herein is not accurate |

or |

complete |

that |

my total |

|

|||||||||

|

account relationship may be reported. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Date: |

|

|

|

|

|

|||

|

(Signature of account holder) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Requesting Housing Agency Information (please print) |

|

|

|

|

|

|||||||||||

|

|

|

|

All fields below are required for response |

|

|

|

|

|

||||||||||

|

Housing Agency: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Phone # |

|

|

|

|

|

|

FAX# |

|

|

|

|

|

|

|

|

|

|

|

Bank of America may provide account information, including but not limited to, opening date, balance and average balance of all accounts listed above and additional accounts not listed. Bank of America shall be held harmless from and against any claim or loss suffered or incurred as a result of the release or use of information here requested

Account Validation

Phone 803 765 4882

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose | This form is used by authorized Assisted Housing Authorities to verify the assets of Bank of America customers for low-income government housing eligibility. |

| Authorized Users | Only authorized Assisted Housing Authorities can use the Verification of Assets Request form. |

| Required Fields | All fields must be filled out. The customer's authorization is necessary for a response. |

| Submission Instructions | Fax the completed form to 415.343.9306 without any additional attachments. |

| Response Time | A faxed response will be sent to the requestor within approximately two business days. |

| Information Provided | Bank of America may disclose account balance, average balance, interest rate, and opening date of the listed accounts, as well as any additional accounts. |

| Liability Clause | Bank of America is not liable for any claims or losses resulting from the release or use of the requested information. |

| Governing Laws | This form is governed by relevant federal and state laws concerning privacy and assisted housing programs. |

Guidelines on Utilizing Verification Of Assets Request

Completing the Verification of Assets Request form is an important step for authorized Assisted Housing Authorities to gather necessary information regarding a Bank of America customer. Once the form is filled out, it can be faxed to the provided number, and a response is typically received within two days.

- Begin by printing the form for clarity and ease of completion.

- In the section titled Bank of America Customer’s Information, provide the following details:

- Social Security Number

- Name on Account

- Address on Account

- City

- State

- Zip Code

- Next, find the section labeled Account Type. Check the appropriate box for the type of accounts held:

- Regular Checking

- Interest Checking

- Savings

- CD

- IRA

- Other

- Enter the Account Number for each account type selected.

- Sign and date the section acknowledging your authorization for Bank of America to disclose relevant information to the requesting agency.

- Proceed to the Requesting Housing Agency Information section. Carefully fill in:

- Housing Agency Name

- Phone Number

- Fax Number

- Ensure all fields are filled out accurately and completely as this is required for a response.

- Finally, confirm that everything is correct, and then fax the completed form to 415.343.9306.

What You Should Know About This Form

What is the purpose of the Verification of Assets Request form?

This form is specifically designed for authorized Assisted Housing Authorities. It enables them to obtain information about a Bank of America customer’s assets. The data collected helps in assessing eligibility for low-income government-assisted housing programs.

Who is authorized to use this form?

Only officials from Assisted Housing Authorities are permitted to use this form. It ensures that the request for asset verification is legitimate and meets the necessary guidelines set forth for government-assisted housing eligibility evaluations.

What information do I need to provide on the form?

You will need to fill out several fields, including the customer’s Social Security number, name, address, and account details. Additionally, you must provide the requesting housing agency’s information, including their name, phone number, and fax number. Every field is mandatory to process the request successfully.

How should I submit the Verification of Assets Request form?

The completed form should be faxed directly to 415.343.9306. It's crucial to ensure that no additional documents are included in the fax, as only the single form will be processed.

How long does it take to receive a response?

Once submitted, you can expect a faxed response within approximately two days. This timeline allows Bank of America to process the request and respond appropriately, ensuring that all provided information is verified.

What kind of information will Bank of America provide?

Bank of America will share various details related to the accounts listed on the form. This includes the balance, average balance, interest rates (if applicable), and the opening dates of those accounts. Additional accounts not explicitly mentioned may also be included in the response.

What happens if the information provided is inaccurate or incomplete?

Providing inaccurate or incomplete information could lead to complications, including potential issues with the evaluation of the total account relationship. It is vital to double-check all entered information to avoid delays or misunderstandings in the housing eligibility review process.

Is there any liability for Bank of America when releasing this information?

Yes, the form includes a statement that Bank of America shall be held harmless for any claims or losses that may arise from the release or use of the requested information. This clause ensures that the bank is protected from any negative consequences involved with the information shared for housing eligibility purposes.

Who should I contact for more information about this form?

If you have further questions or need assistance regarding the Verification of Assets Request form, you can reach out to the Account Validation phone number listed on the form, which is 803-765-4882. They can provide guidance and support to ensure your requests are handled correctly.

Common mistakes

Filling out the Verification Of Assets Request form accurately is crucial for ensuring a smooth process in determining eligibility for low-income government-assisted housing. However, many individuals make mistakes that can lead to delays or complications. One common mistake is leaving out important details. All fields in the form are required, and omitting even one can halt the verification process. Ensure every section is completed thoroughly.

Another frequent error is providing incorrect information. Double-check the social security number, account numbers, and personal details. Mistakes in these areas can result in significant delays. Remember, the accuracy of the information provided is essential for a timely response.

Additionally, some requestors fail to sign the authorization section. Without a signature, Bank of America cannot release sensitive information. This oversight can lead to a complete rejection of the request. Always take a moment to ensure that the signature is present and dated.

Another potential pitfall involves the selection of account types. Filling in multiple types without clear indications can create confusion. Clearly indicate which account types are applicable and ensure alignment with the corresponding account numbers. This clarity will facilitate a smoother verification process.

Lastly, neglecting to provide complete contact information for the requesting housing agency is a critical oversight. Missing phone numbers or fax numbers can leave Bank of America unable to deliver the necessary information. As a result, it is vital to ensure that all contact details are accurately provided and double-checked.

Documents used along the form

The Verification of Assets Request form serves a specific purpose in determining eligibility for low-income government-assisted housing. However, several other documents and forms often accompany this request to ensure proper verification and processing. Below is a list of these related forms and documents.

- Authorization Letter: This document grants permission to a third party to access an individual's financial information. It must include the account holder’s details and signature.

- Income Verification Form: This form outlines the individual’s income sources and amounts. Typically, it requires details about employment and any government assistance received.

- Tax Returns: Recent tax returns provide a comprehensive view of an individual’s financial situation. This document helps confirm income reported on the Income Verification Form.

- Bank Statements: Copies of recent bank statements are often needed to validate current account balances and transaction history, which can support the Verification of Assets Request.

- Identification Documents: Valid photo ID, such as a driver’s license or passport, is often required. This helps ensure that the requestor is authorized to access the financial information.

- Rental History Report: This document gives a historical view of the individual’s rental payments and behavior as a tenant, which can be crucial for housing authorities assessing eligibility.

- Affidavit of Income: This is a sworn statement regarding an individual’s income for those who may not have formal documentation, providing an alternative way to verify financial status.

Submitting these forms alongside the Verification of Assets Request can streamline the process of determining eligibility for assisted housing. Ensuring that all required documents are included will facilitate quicker responses from housing authorities and financial institutions.

Similar forms

The Verification of Assets Request form shares similarities with several other important financial documents that facilitate verification and access to crucial financial information. Here are five documents that are akin to the Verification of Assets Request form, each serving a specific purpose in asset verification:

- Income Verification Form: This document is used to confirm a person's income for housing or loan eligibility. Like the Verification of Assets Request, it requires the individual's authorization and is primarily used by housing authorities or lenders to assess eligibility for programs.

- Authorization for Release of Information: Individuals often fill out this form to grant permission for financial institutions to share their financial details with third parties, such as lenders or government agencies. Both forms necessitate clear consent from the individual, ensuring that personal data is not disclosed without permission.

- Bank Statement Request Form: This form allows a client to request their bank statements, which detail their financial transactions and balance over a specific period. Similar to the Verification of Assets Request, this document is often used to establish financial stability for housing or loan applications.

- Employment Verification Form: This document is utilized to confirm an individual’s employment status and income, commonly required by landlords and lenders. Like the Verification of Assets Request, it aims to validate financial claims and determine eligibility for certain programs.

- Financial Disclosure Statement: This form is typically used in legal proceedings or loan applications to provide a comprehensive view of an individual’s financial situation. Like the Verification of Assets Request, it collects essential financial information to facilitate informed decision-making regarding credit or housing assistance.

Dos and Don'ts

When filling out the Verification Of Assets Request form, consider the following guidelines:

- Ensure all fields are completed. Missing information can delay the process.

- Double-check the customer's Social Security Number for accuracy.

- Use clear and legible handwriting or type the information to avoid confusion.

- Include the correct account type and account number to ensure accurate verification.

- Make sure the account holder's signature is present and dated.

Also, avoid the following mistakes:

- Do not include additional attachments with the form.

- Avoid ambiguous or unclear requests regarding the information needed.

- Do not fax the form to any number other than the designated fax number.

- Never leave out the requesting housing agency’s contact information.

Misconceptions

Misconceptions about the Verification of Assets Request form can lead to confusion for both housing authorities and the individuals involved. Here are nine common misconceptions, along with clarifications:

- This form can be used by anyone. The Verification of Assets Request form is designed specifically for authorized Assisted Housing Authorities only. Unauthorized parties should not attempt to use this form.

- All fields are optional. This form requires that all fields are completed. Incomplete forms will delay the processing and may result in a denial of the request.

- Attachments are allowed. The instructions specify that no additional attachments should accompany this form. Sending extra documents may lead to the rejection of the request.

- Responses take a long time to arrive. Typically, the requestor can expect a faxed response within approximately two days. This swift turnaround helps expedite the eligibility determination process.

- Only account balances are provided. The form allows for the release of additional account details. These details can include average balance, interest rate, and opening date, enhancing the requestor's understanding of the individual’s financial position.

- The account holder's consent is optional. Consent from the account holder is mandatory. The form cannot be processed without their authorization, ensuring compliance with privacy regulations.

- This form is only applicable to Bank of America accounts. While this form is primarily for Bank of America customers, the details may not be transferrable to accounts held at other financial institutions.

- Any type of housing verification can be done with this form. The form is specifically for low-income government-assisted housing. It is not a general verification tool for other housing types.

- Bank of America is liable for information provided. The bank is held harmless from any claims or losses that arise from the release or use of the requested information, emphasizing the importance of the requester's diligence.

Key takeaways

The Verification Of Assets Request form is a critical document used by authorized Assisted Housing Authorities. Here are key takeaways to keep in mind:

- This form exclusively serves authorized Assisted Housing Authorities.

- Accurate information is essential; all fields must be completed to ensure a valid response.

- The requestor should expect to receive a faxed response from Bank of America within approximately two days.

- This form must be sent without any additional attachments; send it to the specified fax number: 415.343.9306.

- Authorization from the customer is required to share account details for eligibility evaluation.

- Bank of America provides information including balance, average balance, interest rate, and account opening date.

By following these guidelines, you can facilitate a smooth verification process and ensure timely responses. Accuracy and completeness are paramount in this endeavor.

Browse Other Templates

Gic Canada Amount - Contact Scotiabank or Kotak Mahindra Bank branches in India for assistance with your fund transfer.

Lvn Application Form - Completion involves providing detailed information about the facility's services and client demographics.

Keiser University Transcripts - Review the form to ensure no mistakes are present.