Fill Out Your Verification Of Employment Loss Form

The Verification Of Employment Loss form plays a crucial role in determining an individual's eligibility for public assistance after experiencing a job loss or income reduction. This form requires comprehensive details about the employee, including their name, Social Security number, job title, and the type of work they performed. It also gathers data about their pay structure—such as their rate of pay, frequency of payment, and employment history. Employers need to provide insights into the circumstances surrounding the termination, explicitly stating whether the loss of income is permanent or temporary and when the employee might be expected to return to work. Additionally, the form includes sections to document any benefits the employee may receive, such as vacation pay or insurance coverage. Accurate completion of this form is essential for prompt processing of assistance requests, as it validates the employee's situation and enables agencies to make informed decisions regarding eligibility and support. Timely submission of the completed form enhances the chances of receiving swift assistance, helping individuals navigate their financial challenges during difficult times.

Verification Of Employment Loss Example

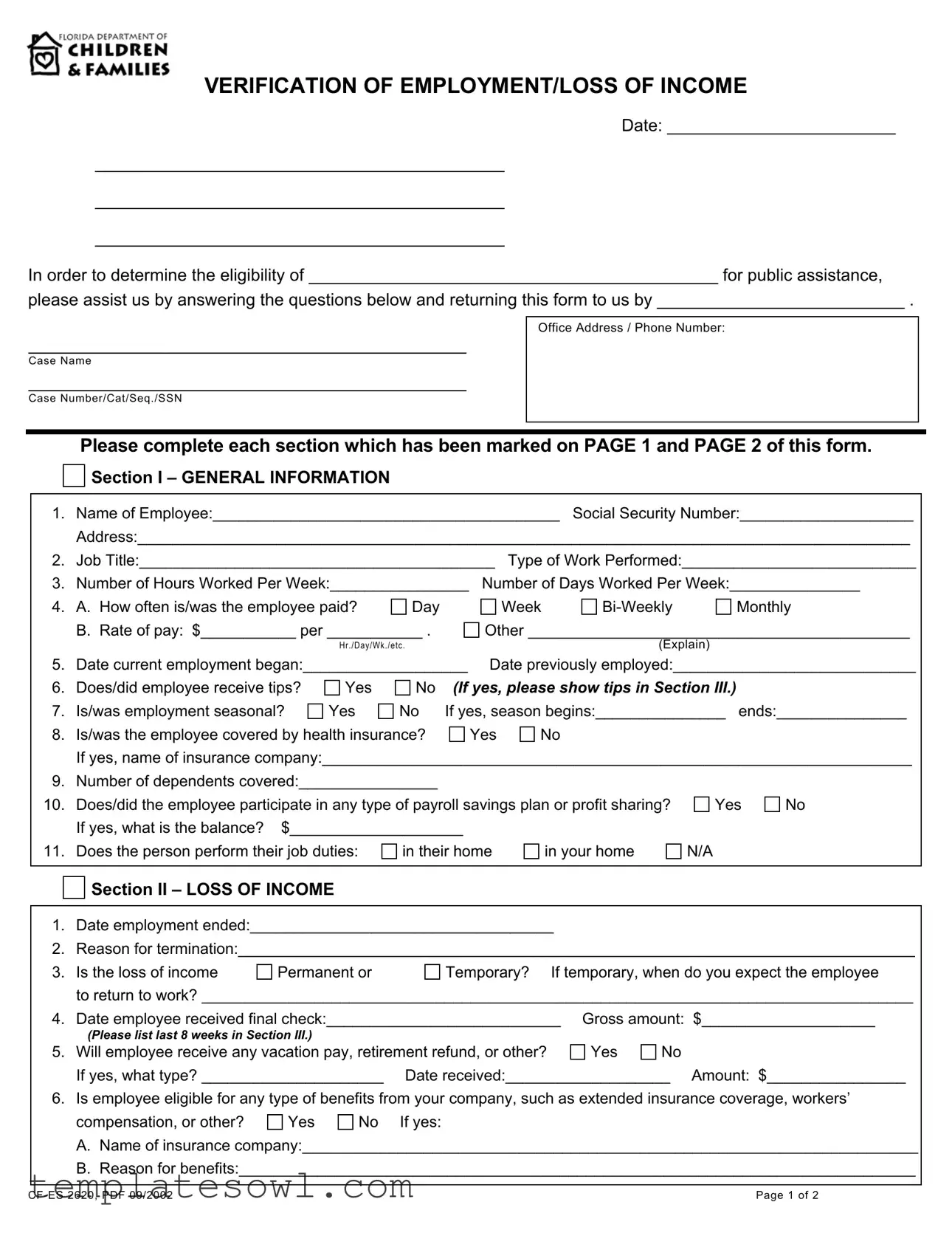

VERIFICATION OF EMPLOYMENT/LOSS OF INCOME

Date: ________________________

___________________________________________

___________________________________________

___________________________________________

In order to determine the eligibility of ___________________________________________ for public assistance,

please assist us by answering the questions below and returning this form to us by __________________________ .

______________________________________________

Case Name

______________________________________________

Case Number/Cat/Seq./SSN

Office Address / Phone Number:

Please complete each section which has been marked on PAGE 1 and PAGE 2 of this form.

Section I – GENERAL INFORMATION

1.Name of Employee:________________________________________ Social Security Number:____________________

Address:_________________________________________________________________________________________

2.Job Title:_________________________________________ Type of Work Performed:___________________________

3. |

Number of Hours Worked Per Week:________________ |

Number of Days Worked Per Week:_______________ |

||||||

4. |

A. How often is/was the employee paid? |

Day |

|

Week |

Monthly |

|||

|

B. Rate of pay: $___________ per ___________ . |

Other ____________________________________________ |

||||||

|

|

H r . / D a y / W k . / e t c . |

|

|

(Explain) |

|

||

5. |

Date current employment began:___________________ |

Date previously employed:____________________________ |

||||||

6. |

Does/did employee receive tips? |

Yes |

No (If yes, please show tips in Section III.) |

|

||||

7. |

Is/was employment seasonal? |

Yes |

No If yes, season begins:_______________ ends:_______________ |

|||||

8. |

Is/was the employee covered by health insurance? |

Yes |

No |

|

|

|||

|

If yes, name of insurance company:____________________________________________________________________ |

|||||||

9. |

Number of dependents covered:________________ |

|

|

|

|

|

||

10. |

Does/did the employee participate in any type of payroll savings plan or profit sharing? |

Yes |

No |

|||||

|

If yes, what is the balance? $____________________ |

|

|

|

|

|

||

11. |

Does the person perform their job duties: |

in their home |

|

in your home |

N/A |

|

||

Section II – LOSS OF INCOME

1.Date employment ended:___________________________________

2.Reason for termination:______________________________________________________________________________

3. |

Is the loss of income |

Permanent or |

Temporary? If temporary, when do you expect the employee |

|||

|

to return to work? __________________________________________________________________________________ |

|||||

4. |

Date employee received final check:___________________________ |

Gross amount: $____________________ |

||||

|

(Please list last 8 weeks in Section III.) |

|

|

|

|

|

5. |

Will employee receive any vacation pay, retirement refund, or other? |

Yes |

No |

|||

|

If yes, what type? _____________________ |

Date received:___________________ Amount: $________________ |

||||

6. |

Is employee eligible for any type of benefits from your company, such as extended insurance coverage, workers’ |

|||||

|

compensation, or other? |

Yes |

No |

If yes: |

|

|

A.Name of insurance company:_______________________________________________________________________

B.Reason for benefits:______________________________________________________________________________

Page 1 of 2 |

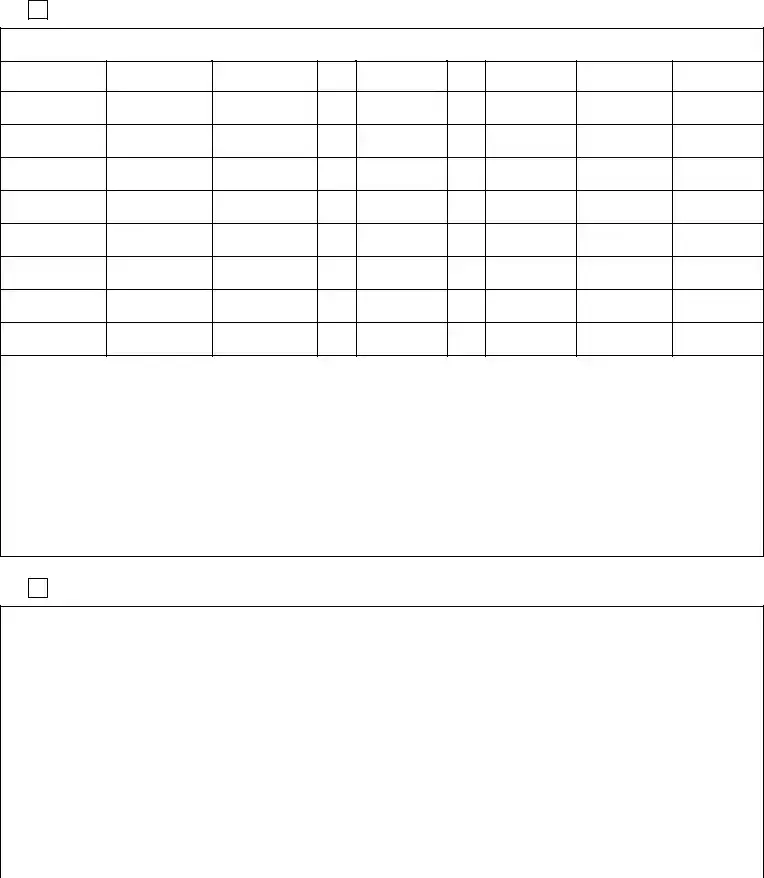

Section III – RECORD OF PAY RECEIVED

List the gross amounts and dates of checks or cash, which were paid for the last eight weeks in the space below.

Pay Period Ending Date Pay Received GROSS Earnings

No. of

Regular

Hours

Worked

Rate of Pay

No. of

Overtime

Hours

Rate of Pay for

Overtime

Tips $$

Earned Income

Credit (EIC)

If hours or rate of pay has varied in the above period, please state why.

Section IV – EMPLOYER INFORMATION

What I have written on this form is true to the best of my knowledge. I know that if I give false information on purpose, I may be subject to prosecution for fraud.

_______________________________________________________ |

____________________________________ |

|

|

Signature of Employer |

Employer’s Title |

_______________________________________________________ |

____________________________________ |

|

|

Name of Business |

Telephone Number |

_______________________________________________________ |

____________________________________ |

|

|

Address |

Date Completed |

_______________________________________________________ |

|

|

|

|

|

Back to |

|

|

Page 2 of 2

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Verification of Employment Loss form is used to determine eligibility for public assistance. |

| General Information | This section collects basic details about the employee, including their name, social security number, and job title. |

| Loss of Income Section | This part captures specifics about the employee’s employment termination, including the reason and whether the income loss is permanent or temporary. |

| Employer's Assertion | The form requires the employer to affirm that the information provided is truthful, with a warning regarding consequences for false statements. |

| State-Specific Forms | Some states may have additional requirements or variations of this form based on local laws governing public assistance. |

| Submission Deadline | The form specifies a deadline for submission, ensuring timely processing of assistance eligibility. |

| Dependent Information | Employers must report the number of dependents covered under health insurance to assess benefit eligibility. |

| Documentation of Employment | It is essential to include the date when employment began and ended, along with the final paycheck amount. |

| Record of Pay | The form includes a section to list gross earnings and pay received over the last eight weeks, providing a detailed income record. |

| Health Insurance Benefits | Details of health insurance coverage and any eligible benefits, such as workers' compensation, must be disclosed. |

Guidelines on Utilizing Verification Of Employment Loss

Completing the Verification of Employment Loss form requires careful attention to detail to ensure that all necessary information is accurately recorded. After filling out the form, it is important to return it by the specified deadline, as this will be crucial for processing the eligibility for public assistance.

- Date: Write the current date at the top of the form.

- Employee Information: Fill in the name of the employee, their Social Security Number, and their address in Section I.

- Job Details: Include the job title and a brief description of the type of work performed.

- Hours Worked: State the number of hours and days the employee worked each week.

- Payment Frequency and Rate: Indicate how often the employee was paid (daily, weekly, bi-weekly, or monthly) and specify the pay rate.

- Employment Dates: Note both the start date of current employment and the dates for any previous employment.

- Tips and Seasonal Employment: Answer whether the employee received tips and if the employment was seasonal. Provide the relevant details if applicable.

- Health Insurance: Confirm if the employee was covered by health insurance and name the insurance company if so.

- Dependents: Mention the number of dependents covered under the insurance policy.

- Payroll Savings or Profit Sharing: Indicate if the employee participated in any payroll savings or profit-sharing plans, and provide the balance if applicable.

- Work Location: Specify where the employee performs their job duties.

- Employment Termination: In Section II, record the date employment ended and the reason for termination.

- Loss of Income Type: State whether the loss of income is permanent or temporary, providing an expected return date for temporary losses.

- Final Check: Fill in the date the final check was received and the gross amount, as well as the last eight weeks of pay in Section III.

- Vacation Pay and Benefits: Mention whether the employee will receive vacation pay or any other benefits, and provide the details.

- Employer Verification: In Section IV, confirm the accuracy of the information provided by signing in the designated space. Input your title, the business name, and contact details.

What You Should Know About This Form

What is the Verification of Employment Loss form used for?

The Verification of Employment Loss form is designed to gather essential information about an employee's work history and income. This information helps determine eligibility for public assistance programs. When completed accurately by the employer, the form provides a snapshot of the employee's employment status and income details necessary for the assessment process.

Who needs to fill out this form?

This form must be filled out by the employee's employer or a representative from the employer's human resources department. It is crucial that the person completing the form has access to the employee's work records and income details to ensure accurate information is provided.

What information is required in Section I of the form?

Section I requests general information about the employee, such as their name, Social Security number, job title, type of work performed, and hours worked per week. Additionally, it asks for details about payment frequency, rate of pay, employment dates, and benefits like health insurance and tips received. Completing this section thoroughly is vital for assessing the overall employment situation of the individual.

How does Section II address the loss of income?

Section II focuses specifically on the circumstances surrounding the employee's loss of income. It requires details such as the date employment ended, the reason for termination, and whether the loss of income is permanent or temporary. This section is crucial for understanding how and why the individual is seeking assistance, providing a clearer context for their situation.

What should be included in Section III?

Section III is dedicated to outlining the record of pay received over the last eight weeks of employment. Employers should include gross amounts, pay dates, hours worked, and any overtime or tips earned. If there were variations in hours or pay rates, it's essential to explain the reasons for these changes. This detailed record helps assess the employee's financial situation accurately.

What happens if the information provided is inaccurate or misleading?

Employers must ensure that all information on the form is true and accurate. Providing false information, whether intentional or not, can lead to serious consequences, including prosecution for fraud. It is critical for employers to double-check the information before submitting the form to avoid potential legal repercussions and ensure fair assistance for eligible employees.

Common mistakes

Filling out the Verification Of Employment Loss form is crucial for determining eligibility for public assistance. Mistakes made during this process can delay approvals and create additional stress for individuals seeking aid. Understanding common errors is the first step toward submitting a thorough and accurate form.

One common mistake is failing to provide complete information in the General Information section. For instance, leaving out critical details such as the employee’s Social Security Number or job title complicates the verification process. Each piece of information is essential for ensuring that the caseworker can easily assess the application without having to reach out for clarification.

Additionally, incorrectly marking the frequency of payment can lead to misunderstandings concerning income. If the employee is paid bi-weekly, but the form is filled out as weekly, it can cause discrepancies in perceived earnings. Accurate recording of both the rate of pay and how often an employee is paid is essential.

Another error occurs when individuals misclassify the reason for termination. The mother of all confusion may stem from vague terms or unclear descriptions. It's vital to provide a specific reason, as this information plays a significant role in understanding the nature of the employment loss.

Not specifying whether the loss of income is Permanent or Temporary is also a notable mistake. The response to this question can impact benefit eligibility significantly. If the employee intends to return to work, providing an expected return date will also help caseworkers assess the situation accurately.

When listing income received in Section III, another common oversight is to omit important details of the last eight weeks of earnings. Each gross amount and corresponding pay period must be recorded accurately. Missing this information can paint a misleading picture of the employee's financial situation.

Lastly, neglecting to sign the form can render it incomplete. A signature serves as a certification of the truthfulness of the information provided, and without it, the form cannot be processed. Therefore, ensuring the employer’s signature is present is crucial for moving forward with benefit evaluations.

By being aware of these common pitfalls, individuals can approach the Verification Of Employment Loss form with a more informed perspective, ultimately aiding in a smoother application process for public assistance.

Documents used along the form

When submitting the Verification of Employment Loss form, various supporting documents may enhance the review process. Each of these documents serves a specific purpose and helps provide a clearer picture of the individual’s employment history and income status. Below is a list of commonly used forms and documents that can accompany the verification form.

- Pay Stubs: These documents provide proof of income over a specified period. They typically include details such as the employee's earnings, hours worked, and any deductions taken.

- Termination Letter: A document issued by the employer that details the reason for a person's termination. It solidifies the claims made in the verification form regarding the employee’s end of work status.

- Unemployment Benefits Application: This form demonstrates that the individual has applied for unemployment assistance. It can show the intent to secure financial support after a loss of income.

- W-2 Forms: These tax documents summarize an employee's earnings and withholding for the entire year. They can validate annual income before the loss occurred.

- Bank Statements: These statements can reveal income streams and expenses during the past few months. They provide insight into the individual's financial situation after employment ends.

- Health Insurance Information: Documentation regarding the individual's insurance coverage, particularly if it relates to employment benefits. It clarifies any potential coverage after loss of employment.

- Letters of Recommendation: Although not directly related to income, these letters can provide insight into the employee's work ethic and character, which can be relevant in assessing their employability.

- Proof of Job Search: Documentation that shows efforts made to find new employment, such as applications submitted or interviews scheduled. This can support claims of active job searching following a job loss.

Providing these supplementary documents with the Verification of Employment Loss form can streamline the assistance process. Each piece adds valuable context and helps ensure an accurate assessment of the individual’s situation.

Similar forms

The Verification of Employment Loss form serves a specific purpose in assessing an individual’s eligibility for public assistance. There are several other documents that share similarities with this form, each designed to facilitate the verification of employment and income status. Below is a list of documents that are comparable in nature:

- Employment Verification Letter: This document is typically provided by an employer to confirm an individual's employment status, including job title, duration of employment, and salary. Like the Verification of Employment Loss form, it requires details about the employee's position and compensation.

- Unemployment Benefits Application: Individuals applying for unemployment benefits must provide information regarding their previous employment and the circumstances of termination. This application often parallels the income loss form in its request for details about employment duration and reason for job loss.

- Income Statement: This form provides a summary of an employee's earnings over a specific period. Like the Verification of Employment Loss form, it may outline gross pay, hours worked, and any deductions, offering a comprehensive view of income during employment.

- Pay Stubs: Pay stubs serve as a record of earnings and deductions for each pay period. Similar to the verification form, they provide information about the amount paid, hours worked, and the frequency of payment, thus illustrating the employee’s income status.

- Tax Returns: Individuals may submit tax returns to demonstrate their annual income. These documents, similar to the Verification of Employment Loss form, provide insights into income sources, amount earned, and the individual's financial situation over a specified period.

- W-2 Forms: Employers provide W-2 forms to report an employee's annual wages and taxes withheld. This document shares similarities with the income loss form in that it confirms the total income received within a year, further validating income claims.

- Health Insurance Verification Form: This document is used to confirm an individual's health insurance coverage status through their employer. It contains data about coverage duration and is often used alongside employment verification forms to assess benefits related to loss of income.

Dos and Don'ts

When filling out the Verification Of Employment Loss form, following certain best practices can make the process smoother. Here’s a list of things you should and shouldn’t do:

- Do fill out the form completely and accurately. Missing information can delay processing.

- Do provide the correct dates of employment and termination. Accuracy is crucial.

- Do clearly indicate whether the loss of income is permanent or temporary.

- Do sign and date the form. Your signature confirms the truthfulness of the information provided.

- Don't leave any sections blank unless they are marked as optional. Incomplete forms may not be accepted.

- Don't provide false information. Misrepresentation can lead to serious consequences.

- Don't forget to submit the form by the designated deadline. Timeliness is key for assistance eligibility.

Misconceptions

Understanding the Verification of Employment Loss form is critical, especially for individuals seeking public assistance. However, several misconceptions often arise regarding its purpose and requirements. Here are four prevalent misunderstandings:

- This form is only for those who have been fired. Many people mistakenly believe that the Verification of Employment Loss form is exclusively for individuals who were terminated from their jobs. In reality, this form applies to anyone who has lost income, regardless of the reason. This includes voluntary resignations, layoffs, and those who may have left employment for personal reasons.

- Completing the form is optional for employers. Some employers may think that they can choose whether or not to fill out this form. However, cooperation is necessary as it provides essential information for assessing an employee's eligibility for assistance. Without accurate and complete information, processing benefits can be delayed or denied.

- The form only requires basic employment information. A common misconception is that the form only asks for simple employment details. In fact, the form necessitates comprehensive information concerning the employee’s work history, wages, and reasons for income loss. Failing to include this information can lead to challenges in verifying eligibility and may affect the outcome of assistance requests.

- All employers are aware of the form’s significance. It is often assumed that all employers understand the importance of the Verification of Employment Loss form. However, some employers may not fully recognize how crucial their input is for the employee's assistance application. It is essential for employers to be informed about the implications of the form to ensure that they provide accurate and timely information.

Clarifying these misconceptions helps streamline the process and ensures that individuals in need receive the assistance they deserve.

Key takeaways

Using the Verification of Employment Loss form accurately is crucial for determining eligibility for public assistance. This form is designed to gather essential information about an employee’s work history and current income status. Here are some key takeaways:

- Complete All Sections: Every section on PAGE 1 and PAGE 2 must be filled out. Missing details can lead to delays in processing.

- Provide Accurate Dates: The exact dates of employment, including when employment started and ended, are essential for assessing eligibility.

- Clarify the Reason for Termination: Clearly stating the reason for the employee's loss of income helps determine the type of assistance that may be available.

- Include Payment History: Documenting the last eight weeks of pay and hours worked provides a clear financial picture. This is important for calculating benefits.

- Acknowledge Temporary vs. Permanent Loss: Distinguishing whether the loss of income is permanent or temporary can influence the kind of support the employee may receive.

- Signed and Dated: The form must be signed and dated by the employer. A signature signifies that the information provided is truthful and accurate.

Be mindful that providing incorrect information can lead to serious consequences, including legal action. Completing this form thoroughly ensures that applicants receive the appropriate assistance they need in a timely manner.

Browse Other Templates

Do Independent Contractors Charge Sales Tax - Any errors or omissions in the form may lead to penalties or invalidation of the exemption.

Partcity - Salary needs should align with the industry standard for the desired position.

What Is a Certificate of Compliance Maryland - The form captures important details, including the name and address of the company.