Fill Out Your Verification Rent Mortgage Form

The Verification Rent Mortgage form is an essential document often utilized during the loan application process. It facilitates communication between lenders and landlords or creditors, ensuring accurate verification of a borrower's renting or mortgage history. This form is divided into two main parts, each serving a specific purpose. In the first part, the lender requests essential details from the landlord or creditor, including the address of the rental property, the amount of monthly rent, and whether the rent is current or in arrears. It also captures information about the applicant, such as their name and the rental or mortgage account number. Part II, to be completed by the landlord or creditor, provides a deeper insight into the rental status and mortgage specifics, including the mortgage origination date, current balance, and payment history. The landlord is also asked to provide additional information that may assist in determining the applicant's creditworthiness. Finally, this verification process emphasizes confidentiality, where the information shared is protected by law, and requires direct transmission to the lender rather than through the applicant. Through this structured approach, the form ensures that all necessary financial information is accurately captured, aiding lenders in making informed decisions.

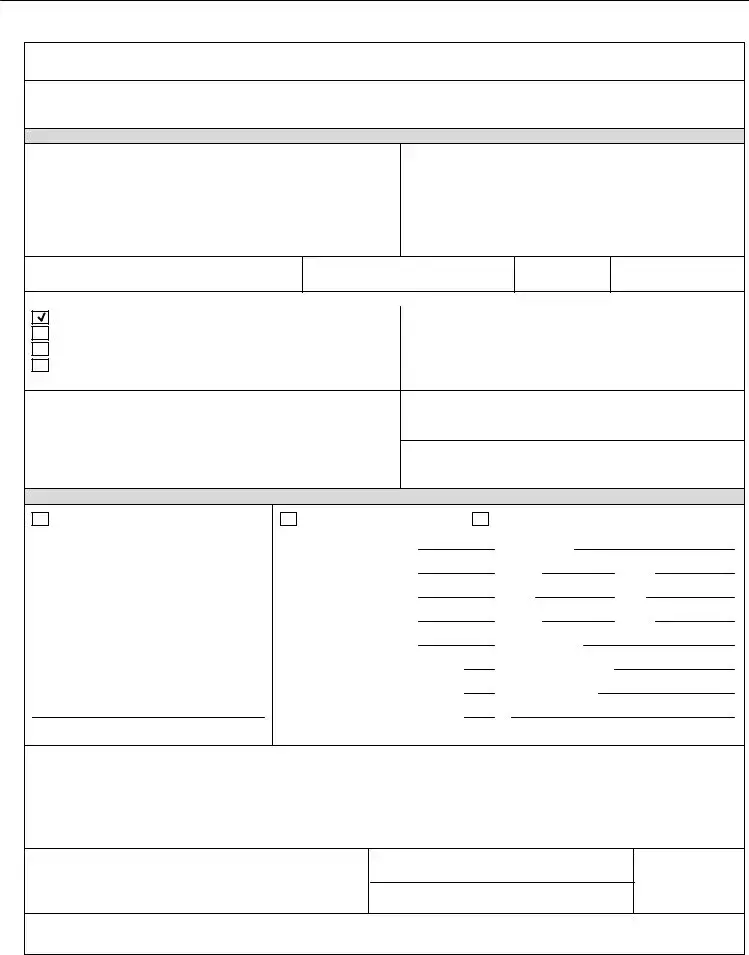

Verification Rent Mortgage Example

GOLDENLOAN.COM, NMLS# 357267

REQUEST FOR VERIFICATION OF RENT OR MORTGAGE

We have received an application for a loan from the applicant listed below, to whom we understand you rent or have extended a loan. INSTRUCTIONS: LENDER - Complete items 1 thru 8. Have applicant(s) complete item 9. Forward directly to ??lender?? named in Item 1.

LANDLORD/CREDITOR - Please complete Part II as applicable. Sign and return directly to the lender named in Item 2.

PART I - REQUEST

1. TO (Name and address of Landlord/Creditor)

2. FROM (Name and address of lender)

GOLDENLOAN.COM

202 FASHION LN SUITE 223 TUSTIN, CA 92780

(P)

(F)

3. SIGNATURE OF LENDER

4. TITLE

5. DATE

6. LENDER'S NUMBER

7. INFORMATION TO BE VERIFIED.

MORTGAGE |

PROPERTY ADDRESS |

ACCOUNT IN THE NAME OF: |

ACCOUNT NO. |

LAND CONTRACT |

|

|

|

RENTAL |

|

|

|

|

|

|

|

8. NAME AND ADDRESS OF APPLICANT(S) |

9. SIGNATURE OF APPLICANT(S) |

|

|

X

X

PART II - TO BE COMPLETED BY LANDLORD/CREDITOR

RENTAL ACCOUNT

Tenant has rented since |

|

|

|

|

|

||||||||

|

|

to |

|

|

|

|

|||||||

Amount of rent $ |

|

|

|

|

per |

|

|

|

|

||||

Is rent in arrears? Yes |

|

|

|

|

|

|

|

No |

|

||||

Amount $ |

|

Period |

|

|

|

|

|

||||||

Number of times 30 days past due* |

|

|

|

|

|

||||||||

Is account satisfactory? |

Yes |

|

|

|

No |

|

|||||||

MORTGAGE ACCOUNT

Date mortgage originated |

|

|

|

|

Original mortgage amount |

$ |

|

||

Current mortgage balance |

$ |

|

||

Monthly Payment P & I only $ |

|

|||

Payment with taxes & ins. |

$ |

|

||

Is mortgage current? |

Yes |

|

No |

|

Is mortgage assumable? Yes |

|

No |

||

Satisfactory account? |

Yes |

|

No |

|

LAND CONTRACT

Interest rate

FIXEDARM

FHAVA

FNMACONV

Next pay date

No of late payments*

Insurance agent:

* Number of times account has been 30 days overdue in last 12 months

ADDITIONAL INFORMATION WHICH MAY BE OF ASSISTANCE IN DETERMINING APPLICANT(S) CREDIT WORTHINESS

SIGNATURE OF CREDITOR

TITLE

PHONE NO.

DATE

The confidentiality of the information you have furnished will be preserved except where disclosure of this information is required by applicable law. The form is to be transmitted directly to the lender and is not to be transmitted through the applicant or any other party.

Calyx Form - vom.frm (11/07)

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Verification Rent Mortgage form is used to verify the rental or mortgage history of a loan applicant. |

| Parties Involved | The form involves three main parties: the lender, the landlord or creditor, and the applicant. |

| Completion Instructions | The lender must complete items 1 through 8, while the applicant must fill out item 9. |

| Confidentiality | The information provided in this form will remain confidential, except as required by law. |

| State-Specific Rules | In California, the form is governed by applicable state laws regarding tenant and creditor disclosure. |

| Landlord/Creditor Responsibility | The landlord or creditor must complete Part II and return it directly to the lender. |

| Information Required | Details needed include rental account information, mortgage account data, and an evaluation of the applicant’s credit worthiness. |

| Contact Information | The form provides specific contact details for GoldenLoan.com, including their address and phone number. |

| Due Dates and Payments | Creditors must report any outstanding rent, mortgage balances, and payment history, including late payments. |

Guidelines on Utilizing Verification Rent Mortgage

After gathering all the necessary information, you will need to fill out the Verification Rent Mortgage form to provide verification of rent or mortgage status for the applicant. This form must be completed accurately and forwarded to the appropriate lender. Follow the steps outlined below for proper completion.

- Begin with the header section. Write the name and address of the landlord/creditor in item 1.

- In item 2, write the name and address of the lender, which is GOLDENLOAN.COM, 202 Fashion Ln, Suite 223, Tustin, CA, 92780.

- Sign in item 3 where indicated as the lender.

- Provide the lender's title in item 4.

- Fill in the date in item 5.

- Enter the lender's number in item 6.

- In item 7, specify the information to be verified, including the mortgage property address, the account name, and the account number or rental information.

- List the name and address of the applicant(s) in item 8.

- Have the applicant(s) sign in item 9 to authorize the verification.

- Complete Part II if you are the landlord/creditor. Fill out the details regarding the rental account or mortgage account.

- Make sure to add any additional information that could help in determining the applicant's creditworthiness.

- Sign the form, include your title, phone number, and the date.

Once completed, send the form directly to the lender indicated in item 2. Ensure that no other parties, including the applicant, handle the form to maintain confidentiality.

What You Should Know About This Form

What is the Verification Rent Mortgage form used for?

This form is used to verify the rental or mortgage information for individuals who are applying for a loan. The lender requests specific details from the landlord or creditor to assess the applicant's credit worthiness before approving the loan application.

Who fills out the Verification Rent Mortgage form?

The form is completed by two parties: the lender and the landlord or creditor. The lender fills out parts of the form, including the details related to the applicant and the lender's information. The landlord or creditor is then responsible for completing their section, providing rental or mortgage details about the applicant.

What should I do if I am the landlord or creditor receiving this form?

As a landlord or creditor, you should fill out Part II of the form accurately, detailing the tenant's rental history or mortgage account. After completion, sign the form and return it directly to the lender named in the document, avoiding any communication with the applicant during this process.

What information will I need to provide on the form?

You will need to provide information such as the rental amount, any arrears on the rent, the date the mortgage originated (if applicable), the current mortgage balance, and details on whether the account is satisfactory. Specific questions about payment history and late payments are also included.

Is my information confidential when I fill out this form?

Yes, the information you provide will be kept confidential. It will only be disclosed if required by law. The form is intended to be submitted directly to the lender without passing through the applicant or any other parties, ensuring your responses remain private.

How is the information from this form used?

The completed Verification Rent Mortgage form is utilized by the lender to make an informed decision about the applicant's creditworthiness. This evaluation helps the lender determine the risk of lending to the applicant, which can ultimately influence the loan approval process.

Common mistakes

Filling out the Verification Rent Mortgage form can be a straightforward process, yet several common mistakes can arise. One frequent error is failing to provide complete and accurate contact information for both the landlord and lender. Missing details can delay the verification process and may lead to misunderstandings. Ensure that the names, addresses, and phone numbers are clearly listed. Double-checking this information can save time later.

Another mistake involves not signing the form in the appropriate sections. Both the lender and the applicant are required to provide their signatures. Omitting a signature can result in the form being rejected or returned for corrections. Make sure each party involved has signed where indicated.

Many also overlook the importance of specifying the correct rental or mortgage account information. Incomplete or incorrect details, such as account numbers or property addresses, can hinder the verification process. Providing accurate data helps ensure a smooth review and approval of the application.

Additionally, some may incorrectly indicate the status of rent payments or mortgage balances. Being honest about current situations is vital. Misrepresenting these details, whether intentionally or accidentally, could lead to issues later in the application process.

Providing insufficient information about any arrears can be another mistake. If there are past dues, it is crucial to specify amounts and durations clearly. Inconsistent or unclear information regarding payment history might raise red flags for lenders.

Likewise, failing to complete the landlord's part of the form properly can also create complications. The landlord must provide accurate data regarding rental history and payment status. Incomplete sections may result in prolonged verification or require further communication to clarify the missing information.

It is also essential to ensure that the answers in the additional information section are thorough and relevant. Providing vague details may not adequately convey the applicant's creditworthiness. Clear, concise information can facilitate a better understanding of the applicant's financial situation.

Timed assumptions can also lead to mistakes. When responding to questions about the mortgage, applicants must ensure they indicate whether the mortgage is assumable correctly. Misrepresentation of such details could affect the approval process.

Preparing these documents under tight timelines can sometimes lead to oversight. Rushing through the form may result in overlooked errors. Setting aside ample time to review and complete the form can minimize mistakes significantly.

Finally, failing to understand the form’s purpose can be detrimental. Each section serves a specific function, and understanding what information is required for each part can lead to a more effective completion of the form. Taking the time to read the instructions thoroughly can prevent many common errors.

Documents used along the form

The Verification Rent Mortgage form is an essential document used in the loan application process. Several other forms and documents may accompany it to provide additional information and verification. Below is a list of commonly used documents that may be required.

- Loan Application: This is a comprehensive form that collects personal and financial information from the applicant. It details employment history, income, debts, and assets, helping lenders assess the borrower’s creditworthiness.

- Credit Report Authorization: Applicants often need to complete this document to permit lenders to obtain their credit reports. The report provides a detailed history of the applicant's borrowing, payment patterns, and credit score.

- Income Verification Documents: These may include pay stubs, tax returns, or W-2 forms, which confirm the applicant's income. Accurate income verification helps lenders determine the applicant's ability to repay the loan.

- Asset Verification: This form or documentation highlights the applicant's financial reserves. It typically includes bank statements or investment account summaries, demonstrating the assets available to cover the mortgage payments.

- Appraisal Report: An appraisal document assesses the property’s market value. Lenders require this to ensure the home's value aligns with the loan amount, protecting their investment.

- Closing Disclosure: Provided prior to finalizing the loan, this document outlines the final terms of the mortgage, including interest rates, monthly payments, and closing costs. It ensures the applicant is fully informed before completing the transaction.

Incorporating these documents alongside the Verification Rent Mortgage form streamlines the loan process and enhances the application's thoroughness. Each document plays a crucial role in ensuring the lender has a complete picture of the borrower's financial situation.

Similar forms

- Verification of Employment (VOE) Form: Similar to the Verification Rent Mortgage form, this document requests confirmation of a borrower's employment status, income, and job stability from an employer. Both forms focus on verifying essential financial information needed to assess a borrower's ability to repay a loan.

- Credit Report Authorization: This form allows a lender to obtain a borrower's credit history from credit bureaus. It shares the goal of evaluating the applicant's financial responsibility and reliability, akin to the rent or mortgage verification process.

- Asset Verification Form: This document requests details about the borrower's assets, like bank statements and investment accounts. Like the Verification Rent Mortgage form, it is used to determine the financial stability of the borrower.

- Loan Application Form (1003): This comprehensive form collects essential information about the borrower, including income, assets, and debts. It helps establish a complete financial picture, including housing-related expenses.

- Debt Verification Form: This form is used to confirm the borrower's outstanding debts, similar to how the rent mortgage form verifies financial obligations related to housing.

- Bank Verification Form: This document verifies the borrower's bank account balances and history, assisting lenders in assessing liquidity while aligning with the broader goal of determining financial reliability.

- Property Inspection Report: This report assesses the condition of the property being financed. It complements the Verification Rent Mortgage form by confirming that the property serves as a reliable collateral asset.

- Mortgage Pre-Approval Letter: This letter outlines the lender's readiness to approve a loan based on preliminary financial information. Both documents serve to facilitate the approval process for mortgage financing.

- Lease Agreement: This legally binding contract outlines the terms of rental between a tenant and landlord. It is relevant to the Verification Rent Mortgage form by providing a formal record of rental obligations that need verification.

Dos and Don'ts

When filling out the Verification Rent Mortgage form, it’s essential to follow certain guidelines to ensure accuracy and compliance. Here are some do's and don'ts to keep in mind:

- DO double-check all information before submission.

- DO ensure that all required sections are complete.

- DO provide accurate contact details for both the landlord and the lender.

- DO use clear and legible handwriting or type the information.

- DON'T leave any sections blank unless instructed.

- DON'T alter the form in any way that could cause confusion.

- DON'T share the form with unauthorized individuals.

- DON'T forget to sign the form where required.

Misconceptions

Here are five misconceptions about the Verification Rent Mortgage form:

- Everyone needs to fill out the form. Not every applicant requires this form. It's specifically for those who are renting or have a mortgage that needs verification.

- The form can be sent through the applicant. This is incorrect. The form must be transmitted directly to the lender and not passed through the applicant or any other party.

- Only landlords need to sign. Both the lender and the landlord/creditor must provide signatures. This is necessary to validate the information provided.

- All questions on the form are mandatory. While many fields are essential, some may depend on specific circumstances and may not be applicable to every situation.

- It’s the bank’s responsibility to verify all data. While the bank facilitates the process, it is ultimately the landlord or creditor's duty to provide accurate information regarding the rental or mortgage details.

Key takeaways

When filling out and using the Verification Rent Mortgage form, keep these key points in mind:

- Understand the purpose: This form is used to verify the rental or mortgage history of an applicant seeking a loan.

- Gather necessary information: Ensure that all relevant details regarding the applicant, lender, and rental or mortgage information are included.

- Complete the correct sections: Lenders should fill out Parts I and II, while landlords or creditors must complete the second section.

- Obtain signatures: Make sure both the lender and the landlord/creditor sign the form to validate the information provided.

- Submit promptly: Send the completed form directly to the lender mentioned in the document to avoid delays.

- Maintain confidentiality: The information shared on this form must be kept private, complying with applicable laws.

Browse Other Templates

Trampoline Arena Participant Waiver,Airheads Liability Release Form,Trampoline Activity Agreement,Airheads Safety and Risk Acknowledgment,Trampolining Participation Agreement,Airheads Risk Acceptance Form,Trampoline Arena Waiver of Liability,Airheads - Participants release Airheads from liability for any personal property damage.

New York Court Forms - Applicants are asked to confirm their citizenship and work eligibility in the United States.