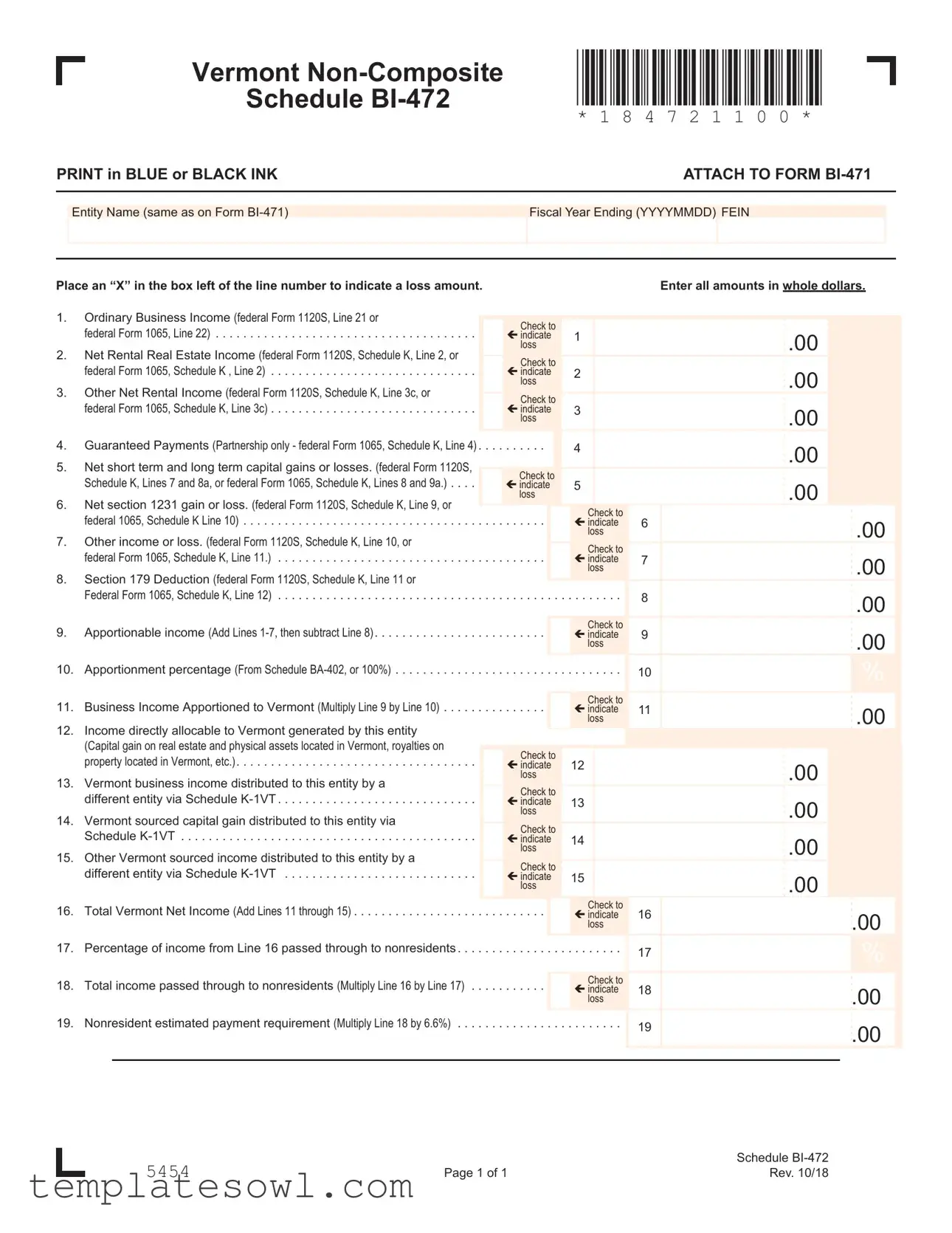

Fill Out Your Vermont Bi 472 Form

The Vermont BI-472 form is an essential document for businesses operating in Vermont, particularly for those filing income statements for partnerships and S corporations. This form helps entities report their business income, net rental income, guaranteed payments, and capital gains or losses. Accurate completion requires attention to detail, as figures from federal tax forms, such as 1120S and 1065, must be reported in whole dollars. The form includes specific lines for each type of income and deductions, including Section 179 deductions and income directly allocable to Vermont. It also facilitates the calculation of apportionable income and assesses the percentage of income from this total that is passed onto non-residents. The final tallies inform the nonresident estimated payment requirements, which are crucial for compliance with Vermont tax obligations. By providing clear instructions and organized sections, the BI-472 supports businesses in fulfilling their reporting responsibilities effectively.

Vermont Bi 472 Example

|

|

|

|

|

Vermont |

|

|

|

*184721100* |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

Schedule |

|

|

|

* 1 8 4 7 2 1 1 0 0 * |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

PRINT in BLUE or BLACK INK |

|

|

|

|

|

|

|

ATTACH TO FORM |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Entity Name (same as on Form |

|

Fiscal Year Ending (YYYYMMDD) |

FEIN |

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Place an “X” in the box left of the line number to indicate a loss amount. |

|

|

|

|

|

|

|

Enter all amounts in whole dollars. |

|

||||||||||||||

1. |

|

Ordinary Business Income (federal Form 1120S, Line 21 or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Check to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

federal Form 1065, Line 22) |

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

ç indicate |

|

|

.00 |

|

|

|

|

|

|

|

||||||||

2. |

|

Net Rental Real Estate Income (federal Form 1120S, Schedule K, Line 2, or |

|

|

loss |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

Check to |

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

federal Form 1065, Schedule K , Line 2) |

|

|

ç indicate |

|

|

.00 |

|

|

|

|

|

|

|

|||||||

3. |

|

Other Net Rental Income (federal Form 1120S, Schedule K, Line 3c, or |

|

|

loss |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

Check to |

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

federal Form 1065, Schedule K, Line 3c) |

|

|

ç indicate |

|

|

.00 |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

loss |

|

|

|

|

|

|

|

|

|

|

|||||

4. |

|

Guaranteed Payments (Partnership only - federal Form 1065, Schedule K, Line 4) |

4 |

|

|

.00 |

|

|

|

|

|

|

|

||||||||||

5. |

|

Net short term and long term capital gains or losses. (federal Form 1120S, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

Check to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Schedule K, Lines 7 and 8a, or federal Form 1065, Schedule K, Lines 8 and 9a.). . . |

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

ç indicate |

|

|

.00 |

|

|

|

|

|

|

|

||||||||

6. |

|

Net section 1231 gain or loss. (federal Form 1120S, Schedule K, Line 9, or |

|

|

loss |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

Check to |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

federal 1065, Schedule K Line 10) |

|

6 |

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

ç indicate |

|

|

.00 |

|

|

||||||||||||||

7. |

|

Other income or loss. (federal Form 1120S, Schedule K, Line 10, or |

|

|

|

loss |

|

|

|

|

|

|

|||||||||||

|

|

|

|

Check to |

7 |

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

federal Form 1065, Schedule K, Line 11.) |

|

ç indicate |

|

|

.00 |

|

|

|||||||||||||

8. |

|

Section 179 Deduction (federal Form 1120S, Schedule K, Line 11 or |

|

|

|

loss |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Federal Form 1065, Schedule K, Line 12) |

8 |

|

|

.00 |

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

9. |

|

Apportionable income (Add Lines |

|

Check to |

9 |

|

|

|

|

|

|

|

|

|

|||||||||

|

|

ç indicate |

|

|

.00 |

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

loss |

|

|

|

|

|

|||||||

10. |

Apportionment percentage (From Schedule |

10 |

|

|

|

|

% |

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

11. |

Business Income Apportioned to Vermont (Multiply Line 9 by Line 10) |

|

Check to |

11 |

|

|

|

|

|

|

|

|

|

||||||||||

|

ç indicate |

|

|

.00 |

|

|

|||||||||||||||||

12. |

Income directly allocable to Vermont generated by this entity |

|

|

|

loss |

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

(Capital gain on real estate and physical assets located in Vermont, royalties on |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

property located in Vermont, etc.) |

|

Check to |

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

ç indicate |

|

|

.00 |

|

|

|

|

|

|

|

|||||||||

13. |

Vermont business income distributed to this entity by a |

|

loss |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Check to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

different entity via Schedule |

|

13 |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

ç indicate |

|

|

.00 |

|

|

|

|

|

|

|

|||||||||

14. |

Vermont sourced capital gain distributed to this entity via |

|

loss |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Check to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

Schedule |

|

14 |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

ç indicate |

|

|

.00 |

|

|

|

|

|

|

|

|||||||||

15. |

Other Vermont sourced income distributed to this entity by a |

|

loss |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Check to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

different entity via Schedule |

|

15 |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

ç indicate |

|

|

.00 |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

loss |

Check to |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

16. |

Total Vermont Net Income (Add Lines 11 through 15) |

|

16 |

|

|

|

|

|

|

|

|

|

|||||||||||

|

ç indicate |

|

|

.00 |

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

loss |

|

|

|

|

|

|

||||||

17. |

Percentage of income from Line 16 passed through to nonresidents |

|

17 |

|

|

|

|

% |

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

18. |

Total income passed through to nonresidents (Multiply Line 16 by Line 17) |

|

Check to |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

ç indicate |

18 |

|

|

.00 |

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

loss |

|

|

|

|

|

|

||||||

19. |

Nonresident estimated payment requirement (Multiply Line 18 by 6.6%) |

|

19 |

|

|

.00 |

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5454 |

|

Schedule |

Page 1 of 1 |

Rev. 10/18 |

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Form Purpose | The Vermont BI-472 form is used to report business income from entities that are taxed as partnerships or S corporations. |

| Governing Law | This form is governed by Vermont Statutes, Title 32, Chapter 151, which outlines taxation requirements for business income. |

| Fiscal Year Requirement | Entities must indicate their fiscal year ending date using the YYYYMMDD format on the form. |

| Entity Name | The entity name reported on BI-472 must match the name on the BI-471 form. |

| Income Reporting | All amounts reported on the form must be in whole dollars, not rounded up or down. |

| Loss Indicators | Spaces are provided to place an “X” next to line numbers where losses are reported. |

| Apportionable Income | Line 9 calculates apportionable income by summing specific income lines and subtracting any Section 179 deductions. |

| Vermont Business Income | Line 11 computes the business income apportioned to Vermont based on the apportionable income and the apportionment percentage. |

| Nonresident Income | The form includes calculations for income passed through to nonresidents, as reflected on Lines 16 to 19. |

| Submission Requirements | The BI-472 form must be attached to the BI-471 form when submitted to the Vermont Department of Taxes. |

Guidelines on Utilizing Vermont Bi 472

Completing the Vermont BI-472 form requires careful attention to detail. It is essential to gather all necessary financial information before starting. The form needs to be filled out accurately to ensure compliance with state tax regulations. Here are the steps for filling out the form:

- Obtain the form: Access the BI-472 form either online or from your tax professional.

- Fill in entity information: Write the entity name, fiscal year ending date (in YYYYMMDD format), and your Federal Employer Identification Number (FEIN) at the top of the form.

- Indicate loss amounts: For each line where there is a loss, mark an “X” in the box to the left of the line number.

- Report income: Start by entering amounts for Ordinary Business Income, Net Rental Real Estate Income, and Other Net Rental Income based on the corresponding federal forms, making sure to indicate losses as necessary.

- Continue with specific income: Enter Guaranteed Payments, Net capital gains or losses, Net section 1231 gain or loss, and Other income as instructed on the form.

- Calculate apportionable income: Add lines 1 through 7 and then subtract Line 8 (Section 179 Deduction) to determine your Apportionable Income.

- Determine apportionment percentage: Write the apportionment percentage, which may be from Schedule BA-402 or simply 100%. Multiply this percentage by your apportionable income to find the Business Income Apportioned to Vermont.

- Enter Vermont sourced income: Report any income directly allocable to Vermont, income distributed to your entity from other entities, and the total Vermont sourced capital gains.

- Calculate Total Vermont Net Income: Add Lines 11 through 15 to find your Total Vermont Net Income.

- Complete nonresident income calculations: Enter the percentage of income from Line 16 that is passed through to nonresidents, and calculate the Total income passed through to nonresidents.

- Estimate payments: Finally, compute the Nonresident estimated payment requirement by multiplying the Total income passed through to nonresidents by 6.6%.

Ensure that all amounts are in whole dollars and accurately reflect your financial situation. Once completed, attach this form to BI-471 and submit it as required by Vermont state tax authorities.

What You Should Know About This Form

What is the Vermont BI-472 form used for?

The Vermont BI-472 form is a Schedule specifically designed for businesses to report their income and deductions. It is often attached to the main Vermont business tax return, Form BI-471. This form helps businesses calculate their net income and any amounts that need to be apportioned to Vermont. It's especially important for partnerships and entities that generate income from activities in Vermont.

Who needs to file the Vermont BI-472 form?

How do I fill out the Vermont BI-472 form?

Filling out the BI-472 form requires careful attention to the various lines on the form. You will begin by entering your entity's name, fiscal year ending date, and federal employer identification number (FEIN). Then, for each line, you will report amounts for ordinary business income, rental income, and other relevant categories. Some lines will ask you to indicate a loss if applicable. Always remember to enter amounts in whole dollars and use blue or black ink to ensure clarity.

What do the numbers on the BI-472 represent?

Each number on the BI-472 form corresponds to specific income or loss types, such as ordinary income, rental income, and capital gains. For example, Line 1 represents your ordinary business income, while subsequent lines detail other types of income or deductions. By accurately reporting this information, you ensure that your taxable income is correctly calculated for Vermont tax purposes, which can ultimately affect your business's tax liability.

What happens if I don't file the BI-472 form?

Neglecting to file the BI-472 can lead to significant consequences for your business. If the form is required and not filed, you may face penalties, interest on unpaid taxes, or an audit. Additionally, your overall tax liability could be miscalculated, which could result in unexpected bills or complications down the line. It's essential to ensure that all necessary forms are completed accurately and submitted on time to avoid these issues.

Where can I find more information about the Vermont BI-472 form?

For more detailed information on the BI-472 form, including specific instructions and guidance on filling it out, you can visit the official Vermont Department of Taxes website. They provide resources, contact information, and additional publications that can help clarify any uncertainties you may have. Seeking help from a tax professional is also a good idea if you need personalized assistance with your business's tax returns.

Common mistakes

Completing the Vermont BI-472 form can be straightforward, but several common mistakes can lead to complications. First and foremost, using the wrong ink color can result in processing delays. It's essential to print in blue or black ink, as specified. A different color might make it hard for scanners to read your entries.

Another frequent error involves entering amounts incorrectly. Some individuals forget to report incomes and losses in whole dollars, or they mistakenly include cents. This form requires you to enter all amounts in whole dollars. Double-check your entries to ensure accuracy.

Failing to correctly indicate loss amounts is a common mistake as well. In several sections, such as lines 1 through 15, you must place an “X” in the box next to the line number if you have a loss. If this step is overlooked, the Vermont Department of Taxes might question your reported figures.

People also often miscalculate their apportionable income. Line 9 requires you to add lines 1 through 7 and then subtract the amount on line 8. Errors in this calculation can lead to inaccuracies that affect your tax obligations. Take your time to verify each calculation.

It’s crucial not to skip necessary supporting documentation. Attach Form BI-471 as required. Many applicants forget this step, causing rejection of their submission. Always ensure you include all required attachments to avoid unnecessary delays.

Lastly, many individuals neglect to properly fill out the income distribution percentages. Line 17 requires you to summarize the percentage of income from line 16 that is passed through to nonresidents. Ensure this percentage reflects your situation accurately to avoid miscalculations on your estimated payment requirements.

Documents used along the form

When completing the Vermont BI-472 form, you may also need to gather additional documents to support your submission and ensure compliance. Below is a list of commonly used forms and documents that may be required alongside the BI-472 in various tax situations.

- Vermont Form BI-471: This is the primary business tax form that provides a comprehensive overview of the entity’s income, deductions, and credits for the fiscal year.

- Federal Form 1120S: Used by S corporations, this form reports income, deductions, and credits to the IRS. It provides detailed financial information relevant to the BI-472.

- Federal Form 1065: Partnerships file this form to report income, deductions, gains, losses, etc. It is essential for determining the partnership's financial results.

- Schedule K-1: Issued by partnerships and S corporations, this document reports each member's or shareholder's share of income, deductions, and credits, which may be relevant for the BI-472 calculations.

- Schedule BA-402: This schedule determines the apportionment percentage for Vermont taxable income, a necessary component for completing the BI-472.

- Federal Form 4562: This form is for claiming deductions for depreciation and amortization. Any depreciation amounts affect the income calculations on the BI-472.

- Schedule C (or C-EZ): Used by sole proprietors, this schedule details profit or loss from business income, which may contribute to figures reported on the BI-472.

- Vermont Form INC-161: This tax form is used for partnerships and limited liability companies. It's necessary for reporting income generated by these entities in Vermont.

- Vermont Form BA-402: This is the Business Apportionment Schedule used alongside the BI-472 to calculate the business income attributable to Vermont.

- Supporting documentation: Financial statements, receipts, and other records detailing business expenses and income may be needed for accurate reporting and verification.

Ensuring you have the right forms and documents can simplify the filing process and help avoid potential issues. Keep these resources handy as you prepare your Vermont BI-472 submission.

Similar forms

- Form 1120S: This form is used by S corporations to report income, deductions, and credits to shareholders. Similar to BI-472, it details business income and losses. Both forms require the reporting of ordinary business income and capital gains or losses.

- Form 1065: This is the form partnerships use to file their annual income tax return. Like the BI-472, it incorporates various types of income and deductions, ensuring that partners report their shares of partnership income, which can also include rental income and capital gains.

- Schedule K-1: Issued alongside Form 1065, this document reports each partner's share of income, deductions, and credits. The BI-472 utilizes similar reporting processes for distributed income, making it vital for understanding how income from different entities gets allocated.

- Form 990: Non-profit organizations employ this form to report their income, expenses, and other financial information. While the BI-472 relates to businesses, both documents aim to transparently report income sources and expenses to relevant authorities.

- Form 1040: This is the individual income tax return used by individuals to report their income to the IRS. While it includes personal income, it also aligns with BI-472 in how it tracks various income types like capital gains, emphasizing the significance of correct accounting.

- Schedule E: Used by individuals and entities to report income or loss from rental real estate, royalties, and similar sources. BI-472 parallels this form in detailing income categories, including rental incomes, enhancing the understanding of taxable earnings.

- Form 5405: This form is utilized for first-time homebuyers to report the repayment of the First-Time Homebuyer Credit. While it targets different taxpayer scenarios, both forms aim to track and manage specific types of income and deductions.

- Form 8862: This document is used by taxpayers to claim the Earned Income Tax Credit (EITC) after it has been denied previously. Its focus on income verification parallels the BI-472’s purpose in ensuring accurate business income reporting.

- Form 1099: This form captures income received from non-employment sources. Similar to the BI-472, it emphasizes the accurate reporting of diverse income streams relevant for tax calculations.

- Schedule C: Sole proprietors use this form to report income and expenses from their business operations. Like BI-472, it seeks to provide a comprehensive view of business income and losses, ensuring compliance with tax laws.

Dos and Don'ts

When filling out the Vermont Bi 472 form, there are several important considerations. Following these tips can help ensure that the process runs smoothly and accurately. Here’s a list of things to do and things to avoid:

- Use blue or black ink. This will ensure your form is legible and clearly stands out on paper.

- Enter all amounts in whole dollars. Fractions or cents can cause confusion and delays.

- Attach the completed form to Form BI-471. This is critical for proper processing of your submission.

- Double-check calculations. Ensure each total is accurate to avoid unnecessary adjustments later.

- Use the entity name exactly as shown on Form BI-471. Consistency is key for proper identification.

- Don’t leave any fields blank unless instructed. Missing information may lead to processing delays.

- Avoid using colored ink or pencil; stick to blue or black only.

- Don’t forget to mark an "X" next to lines where there is a loss amount. This is crucial for clarity.

- Don’t skip sections that pertain to Vermont business income, as each part is important for your total calculations.

- Avoid rushing through the form. Taking your time can help prevent mistakes that could complicate matters later.

Misconceptions

Here are some common misconceptions about the Vermont BI-472 form:

- 1. Only corporations need to file BI-472. This form is intended for partnerships and S corporations, not just corporations.

- 2. All lines need to be filled out regardless of the entity's income. Only complete the lines that are applicable to your entity's income sources.

- 3. The form can be submitted electronically. The BI-472 form must be printed and submitted in paper format.

- 4. Losses cannot be reported. The form allows for the reporting of losses in the appropriate sections.

- 5. The form is only for Vermont-based businesses. While the form pertains to Vermont income, it applies to entities with transactions in Vermont, regardless of location.

- 6. You can use pencil when filling out the form. It is required to use blue or black ink when completing the BI-472.

- 7. Calculations on the form don't need to be verified. It is important to check calculations to ensure accuracy before submission.

- 8. The BI-472 form is the only required document for tax obligations. Businesses must also complete Form BI-471 and other relevant forms.

- 9. You can calculate the Vermont business income without a tax professional. While it's possible, consulting with a tax professional can help avoid errors.

- 10. The form does not require any additional documentation. Supporting documents may be necessary depending on the information reported on the BI-472.

Key takeaways

Filling out the Vermont Bi 472 form is an important task for businesses operating in the state. Here are some key takeaways to help you navigate the process:

- Use blue or black ink: Always print your information using blue or black ink. This ensures that your entries are clear and legible.

- Accurate dollar amounts: Enter all amounts in whole dollars. Do not use cents. Accuracy is crucial.

- Single entity name: Ensure that the entity name matches exactly as it appears on Form BI-471. Consistency helps avoid confusion.

- Fiscal year ending: Clearly state the fiscal year ending date in the format (YYYYMMDD) at the top of the form. This detail is vital for tax records.

- Select loss amounts: If applicable, place an “X” in the box left of the line number to indicate a loss amount. This highlights areas where losses occurred.

- Apportionment calculation: Be attentive when calculating business income apportioned to Vermont. Multiply your apportionable income by the apportionment percentage.

- Estimated payments: If required, remember to calculate the nonresident estimated payment based on your total income passed through to nonresidents.

Following these guidelines can simplify the completion of your Vermont Bi 472 form and help ensure compliance with state requirements. Stay organized, and don't hesitate to double-check your entries for accuracy.

Browse Other Templates

Art Institute of San Antonio - There is a designated area to send the transcripts to an individual or organization.

How to Make a Cover Page on Google Docs - Emergency accident information is logged for additional context during processing.