Fill Out Your Virginia 801 Form

The Virginia 801 form is an essential tool for surplus lines brokers operating within the state, designed to facilitate transparency and compliance in tax reporting. This quarterly tax report must be submitted if a broker anticipates an annual premiums tax liability of more than $1,500 and has earned direct gross premium income from policies involving insureds whose home state is Virginia. It provides a comprehensive breakdown of gross and additional premiums, returned premiums, and the applicable premiums tax, calculated at 2.25% of taxable premiums. Understanding the various lines on the form is crucial; for example, brokers need to report gross premiums collected during the quarter and any credits from prior periods that may affect their current tax obligation. Timely filing is critical—forms must be submitted within 30 days following the end of each quarter to avoid penalties. Additionally, when the total amount due on the report is $0, filing is not necessary for that quarter. For those managing multiple facets of their business, the Virginia Department of Taxation’s website offers valuable resources such as online filing and payment options, as well as guidelines for submitting the Virginia Surplus Lines Broker’s Annual Reconciliation Tax Report, Form 802, due by March 1 of the following year. Following these steps diligently ensures that brokers can maintain compliance while minimizing potential issues with tax obligations.

Virginia 801 Example

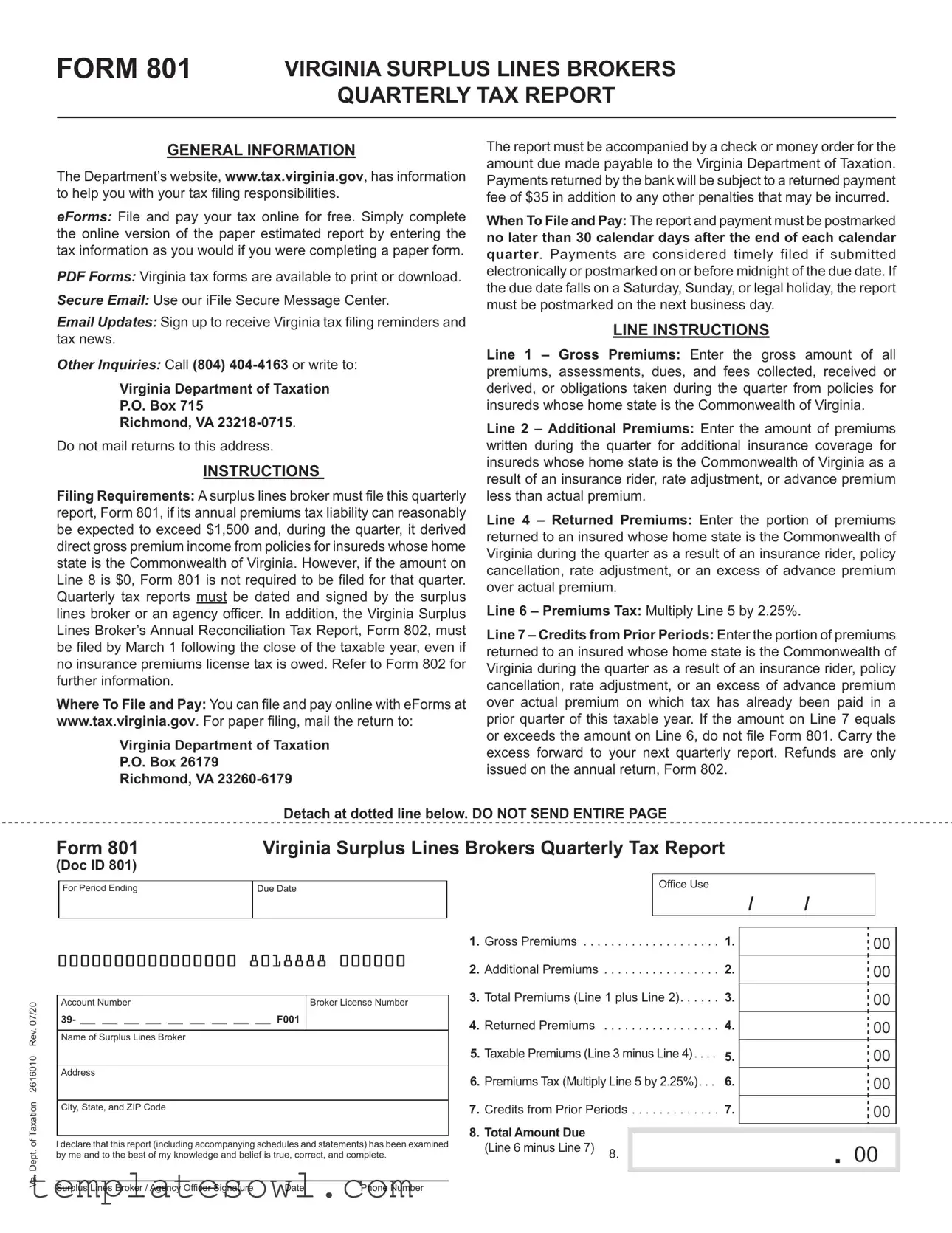

FORM 801 |

VIRGINIA SURPLUS LINES BROKERS |

|

QUARTERLY TAX REPORT |

GENERAL INFORMATION

The Department’s website, www.tax.virginia.gov, has information to help you with your tax filing responsibilities.

eForms: File and pay your tax online for free. Simply complete the online version of the paper estimated report by entering the tax information as you would if you were completing a paper form.

PDF Forms: Virginia tax forms are available to print or download.

Secure Email: Use our iFile Secure Message Center.

Email Updates: Sign up to receive Virginia tax filing reminders and tax news.

Other Inquiries: Call (804)

Virginia Department of Taxation

P.O. Box 715

Richmond, VA

Do not mail returns to this address.

INSTRUCTIONS

Filing Requirements: A surplus lines broker must file this quarterly report, Form 801, if its annual premiums tax liability can reasonably be expected to exceed $1,500 and, during the quarter, it derived direct gross premium income from policies for insureds whose home state is the Commonwealth of Virginia. However, if the amount on Line 8 is $0, Form 801 is not required to be filed for that quarter. Quarterly tax reports must be dated and signed by the surplus lines broker or an agency officer. In addition, the Virginia Surplus Lines Broker’s Annual Reconciliation Tax Report, Form 802, must be filed by March 1 following the close of the taxable year, even if no insurance premiums license tax is owed. Refer to Form 802 for further information.

Where To File and Pay: You can file and pay online with eForms at www.tax.virginia.gov. For paper filing, mail the return to:

Virginia Department of Taxation

P.O. Box 26179

Richmond, VA

The report must be accompanied by a check or money order for the amount due made payable to the Virginia Department of Taxation. Payments returned by the bank will be subject to a returned payment fee of $35 in addition to any other penalties that may be incurred.

When To File and Pay: The report and payment must be postmarked no later than 30 calendar days after the end of each calendar quarter. Payments are considered timely filed if submitted electronically or postmarked on or before midnight of the due date. If the due date falls on a Saturday, Sunday, or legal holiday, the report must be postmarked on the next business day.

LINE INSTRUCTIONS

Line 1 – Gross Premiums: Enter the gross amount of all premiums, assessments, dues, and fees collected, received or derived, or obligations taken during the quarter from policies for insureds whose home state is the Commonwealth of Virginia.

Line 2 – Additional Premiums: Enter the amount of premiums written during the quarter for additional insurance coverage for insureds whose home state is the Commonwealth of Virginia as a result of an insurance rider, rate adjustment, or advance premium less than actual premium.

Line 4 – Returned Premiums: Enter the portion of premiums returned to an insured whose home state is the Commonwealth of Virginia during the quarter as a result of an insurance rider, policy cancellation, rate adjustment, or an excess of advance premium over actual premium.

Line 6 – Premiums Tax: Multiply Line 5 by 2.25%.

Line 7 – Credits from Prior Periods: Enter the portion of premiums returned to an insured whose home state is the Commonwealth of Virginia during the quarter as a result of an insurance rider, policy cancellation, rate adjustment, or an excess of advance premium over actual premium on which tax has already been paid in a prior quarter of this taxable year. If the amount on Line 7 equals or exceeds the amount on Line 6, do not file Form 801. Carry the excess forward to your next quarterly report. Refunds are only issued on the annual return, Form 802.

Detach at dotted line below. DO NOT SEND ENTIRE PAGE

Form 801 |

Virginia Surplus Lines Brokers Quarterly Tax Report |

|

|

|||

(Doc ID 801) |

|

|

|

|

|

|

|

|

|

|

Office Use |

|

|

|

For Period Ending |

Due Date |

|

/ |

/ |

|

|

|

|

||||

|

|

|

|

|

||

|

|

|

|

|

|

|

Va. Dept. of Taxation 2616010 Rev. 07/20

0000000000000000 8018888 000000

Account Number |

Broker License Number |

39- ___ ___ ___ ___ ___ ___ ___ ___ ___ F001

Name of Surplus Lines Broker

Address

City, State, and ZIP Code

I declare that this report (including accompanying schedules and statements) has been examined by me and to the best of my knowledge and belief is true, correct, and complete.

Surplus Lines Broker / Agency Officer Signature |

Date |

Phone Number |

1. |

Gross Premiums |

1. |

00 |

||

2. |

Additional Premiums |

2. |

00 |

||

3. |

Total Premiums (Line 1 plus Line 2). . . . |

3. |

00 |

||

4. |

Returned Premiums |

4. |

00 |

||

5. Taxable Premiums (Line 3 minus Line 4). . . |

5. |

00 |

|||

6. |

Premiums Tax (Multiply Line 5 by 2.25%). . |

6. |

00 |

||

7. |

Credits from Prior Periods |

7. |

00 |

||

8. |

Total Amount Due |

|

|

|

|

|

|

|

|

||

|

(Line 6 minus Line 7) |

8. |

|

|

. 00 |

|

|

|

|

||

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The Virginia 801 form is used by surplus lines brokers to report quarterly tax liabilities based on gross premium income derived from policies for Virginia residents. |

| Filing Requirement | A surplus lines broker must file Form 801 if their annual premiums tax liability is expected to exceed $1,500 and they received direct gross premium income from Virginia policies during the quarter. |

| Exemption Condition | If the amount on Line 8 of Form 801 is $0, the broker does not need to file for that quarter. |

| Filing Deadline | The report must be postmarked within 30 calendar days after the end of each calendar quarter. If the due date falls on a weekend or holiday, the report is due the next business day. |

| Governing Laws | The requirements for the Virginia 801 form are outlined under Virginia state tax laws regarding surplus lines brokers. |

| Where to File | Form 801 can be filed online at www.tax.virginia.gov or mailed to the Virginia Department of Taxation at P.O. Box 26179, Richmond, VA 23260-6179. |

Guidelines on Utilizing Virginia 801

Filing out the Virginia 801 form is an important task for surplus lines brokers to ensure compliance with tax obligations. The following steps will guide you through the process of completing the form accurately.

- Obtain the Virginia 801 form from the Virginia Department of Taxation website or use an online version if preferred.

- Fill in the broker account number located at the top of the form.

- Provide your broker license number, followed by the name of the surplus lines broker.

- Enter your address, including the city, state, and ZIP code.

- In the Gross Premiums (Line 1) section, enter the total gross amount received from premiums during the quarter.

- Add any Additional Premiums (Line 2) that were written for extra coverage within the same period.

- Calculate the Total Premiums (Line 3) by summing Lines 1 and 2, and record this amount.

- For Returned Premiums (Line 4), input the amount of premiums returned to insureds in Virginia during the quarter.

- Subtract Line 4 from Line 3 to find the Taxable Premiums (Line 5), and enter this figure.

- Calculate the Premiums Tax (Line 6) by multiplying the amount on Line 5 by 2.25% and put this in the corresponding space.

- If applicable, list any Credits from Prior Periods (Line 7) which you’re carrying forward from taxes previously paid.

- Deduct Line 7 from Line 6 to get the Total Amount Due (Line 8).

- Sign and date the form to declare that the report is true and complete.

- If filing by mail, include a check or money order for the amount due and send the form to the address specified for paper filing.

What You Should Know About This Form

What is the Virginia Form 801?

The Virginia Form 801 is the Surplus Lines Brokers Quarterly Tax Report. This form is required for surplus lines brokers who expect their annual premiums tax liability to exceed $1,500. It reports gross premium income from policies for insureds based in Virginia during each calendar quarter.

Who needs to file Form 801?

Surplus lines brokers must file Form 801 if they anticipate an annual premiums tax liability of over $1,500. Additionally, the broker must have derived direct gross premium income from insureds whose home state is Virginia during the reporting quarter. If no premiums are collected (Line 8 shows $0), filing is not necessary for that quarter.

When is Form 801 due?

The completed Form 801 must be postmarked no later than 30 days after the end of each calendar quarter. If the due date falls on a weekend or legal holiday, the report can be postmarked on the next business day and still be considered timely.

How do I file and pay for Form 801?

You can file and pay online for free through Virginia’s eForms at www.tax.virginia.gov. For paper filing, send the completed form and a check or money order to the Virginia Department of Taxation at P.O. Box 26179, Richmond, VA 23260-6179. Ensure that the payment is made payable to the Virginia Department of Taxation.

What if I miss the filing deadline?

Late filing may result in penalties. If you do not submit your Form 801 by the due date, you could incur additional fees. It is important to file on time to avoid these complications.

What information do I need to complete Form 801?

To fill out Form 801, you will need to provide information about gross premiums, additional premiums, returned premiums, and the corresponding tax calculations. Ensure all amounts are accurate, as you must sign to attest to the truthfulness of the information provided.

What is the tax rate applied on premiums reported in Form 801?

The premiums tax rate is 2.25%. You will calculate your premiums tax by multiplying the taxable premiums (Line 5) by this rate to determine the amount due (Line 6).

What happens if I have credits from prior periods?

If you have credits from previous periods, enter this amount on Line 7. If the credits equal or exceed the premium tax owed (Line 6), do not file Form 801 for that quarter. Carry over any remaining credits to the next quarterly report. Refunds are only processed through the annual reconciliation tax report, Form 802.

Where can I find assistance with Form 801?

You can visit the Virginia Department of Taxation’s website for additional information. If you have questions, contact them by phone at (804) 404-4163 or send correspondence to P.O. Box 715, Richmond, VA 23218-0715. However, do not mail your returns to this address.

Common mistakes

Completing the Virginia 801 form can appear straightforward, yet many individuals make common mistakes that can lead to complications down the line. One prevalent error occurs when people fail to file the form altogether. If a surplus lines broker expects their annual premiums tax liability to surpass the $1,500 threshold, they must file. However, if the broker derives no gross premium income during the quarter, they are not required to submit the form. It's crucial to assess the need for filing based on the specific circumstances of that quarter.

Another frequent mistake involves miscalculating the gross premiums. On Line 1, brokers should carefully enter the total amount of all premiums, assessments, dues, and fees collected. Omitting any components or mistakenly adding unrelated figures can result in inaccuracies that may trigger additional scrutiny or penalties. Double-checking this line before submission can save time and stress.

Line 2 requires careful attention as well. Mistakes often happen when brokers miscalculate additional premiums, sometimes forgetting to consider any insurance riders or adjustments. Clearly documenting all these details during the quarter can help ensure that Line 2 is completed accurately. The same principle applies to Line 4, which addresses returned premiums. Failing to report returned amounts correctly can lead to inflated figures on the taxable premium line, further complicating the filing process.

Many brokers also overlook Line 6, where the premiums tax is calculated by multiplying the taxable premiums from Line 5 by 2.25%. This may seem simple, yet mistakes arise when the calculations are rushed or done without precise attention to detail. Errors at this stage can lead to significant discrepancies in tax owed.

The handling of Line 7, which covers credits from prior periods, is another area prone to mistakes. Brokers sometimes misinterpret which amounts qualify for credits and may report excessive amounts. If the total on Line 7 equals or exceeds that on Line 6, brokers must remember not to file Form 801. Maintaining careful records and consulting prior tax reports can help avoid this issue.

Signing the form also requires mindful consideration. Some brokers forget to include their signature or the date on the report. This seemingly minor omission can result in rejection of the form or delay in processing. Therefore, a final review to ensure completeness is always wise before submission.

Additionally, when filing on paper, brokers must remember the correct postal address. Mistakenly sending the form to the incorrect address can delay processing and result in late fees. It is beneficial for brokers to be familiar with the address for paper submissions to avert this issue.

Timeliness represents another key aspect. The report should be postmarked no later than 30 calendar days after the end of each calendar quarter. Missing this deadline can lead to penalties. To avoid paying additional fees, brokers should set reminders for filing dates to ensure the report is submitted on time.

Lastly, a common misstep occurs with payment methods. Brokers must ensure they include payment with their filing when submitting a paper form. Failing to send a check or money order along with the return can lead to processing delays and potential penalties. Being thorough in payment arrangements is crucial.

In summary, careful attention to each line of the Virginia 801 form, along with a comprehensive understanding of the filing process, can help surplus lines brokers avoid these common mistakes. A meticulous approach can reduce stress and ensure compliance with state requirements.

Documents used along the form

In Virginia, multiple documents complement the Virginia 801 form, ensuring that surplus lines brokers stay compliant with tax regulations. Familiarizing yourself with these forms can streamline your reporting and tax responsibilities. Here’s a list of related forms and their brief descriptions.

- Form 802: Virginia Surplus Lines Broker's Annual Reconciliation Tax Report - This form reconciles the quarterly filings for the entire year. It is due by March 1 following the close of the taxable year, even if there’s no tax owed.

- Form VA-760: Virginia Individual Income Tax Return - Though unrelated to surplus lines specifically, this form is necessary for individual brokers filing their own income tax returns.

- Form W-2: Wage and Tax Statement - Employers provide this form to employees to report wages and taxes withheld. It's essential for brokers with employees.

- Form 1099: Miscellaneous Income - This form is required for reporting payments made to independent contractors. Brokers utilizing freelance help must issue these forms when payments exceed certain thresholds.

- Form 120: Business or Professional License Application - Brokers may need this form to apply for local business licenses that are required by their municipality.

- Form 1310: Statement of Person Claiming Refund Due a Deceased Taxpayer - Use this form if a surplus lines broker pass away and the executor needs to claim any tax refund.

- Form 740: Virginia Corporation Income Tax Return - If the brokerage is structured as a corporation, this form must be completed for corporate income tax obligations.

- Form ST-9: Virginia Sales and Use Tax Certificate of Exemption - Brokers supplying certain services might need this certificate to exempt themselves from paying sales tax on qualifying purchases.

Staying organized with these documents is essential for meeting tax obligations as a surplus lines broker in Virginia. Each form serves a specific purpose and helps maintain compliance with state regulations, ensuring smooth operations in your brokerage business.

Similar forms

- Virginia Surplus Lines Broker’s Annual Reconciliation Tax Report (Form 802): Like Form 801, Form 802 is essential for surplus lines brokers. It reconciles the quarterly tax payments from Form 801 and is due by March 1 of the following year. This ensures that all taxes paid throughout the year align with actual premium receipts.

- Virginia Sales Tax Return (Form ST-9): This form is used to report and pay sales tax collected during a specific period. Both Form ST-9 and Form 801 share a quarterly reporting requirement, aimed at ensuring compliance with state tax obligations.

- Virginia Corporate Income Tax Return (Form 500): Corporations must file this annual return to report income and calculate taxes owed. Similar to Form 801, it holds businesses accountable for accurate financial reporting and timely submissions, albeit on an annual basis.

- Virginia Individual Income Tax Return (Form 760): This form is completed by individuals to report personal income. Like Form 801, it involves assessing income and corresponding tax liabilities, ensuring individuals pay their due taxes.

- Virginia Estimated Tax for Corporations (Form 500 ES): This form assists corporations in estimating their tax liabilities for the year. It is akin to Form 801 since both require estimates and timely payments, allowing for better financial planning.

Dos and Don'ts

- Do double-check your calculations before submitting the form to avoid any errors.

- Do ensure you include all required tax information as instructed in the guidelines.

- Do verify the filing deadline and postmark your report on or before this date.

- Don't forget to sign and date the report; an unsigned form will be considered incomplete.

- Don't use the mailing address for inquiries to submit your form; use the designated address instead.

- Don't mail your payment to the incorrect address; make sure it goes to the Virginia Department of Taxation.

- Don't wait until the last minute to file; aim to submit well before the deadline to avoid issues.

Misconceptions

Misconception 1: Form 801 only needs to be filed if the surplus lines broker owes a tax.

In reality, Form 801 must be filed whenever a surplus lines broker can reasonably expect their annual premiums tax liability to exceed $1,500, regardless of whether they owe any tax in a particular quarter.

Misconception 2: If a broker’s income for a quarter is $0, they still have to file Form 801.

This is incorrect. If the amount reported on Line 8 is $0, Form 801 is not required for that quarter, eliminating the need for unnecessary paperwork.

Misconception 3: Filing and payment can take place at any time after the end of the quarter.

Filing and payment must be completed no later than 30 calendar days after the end of each quarter. Marking the due date on the calendar is essential to remain compliant.

Misconception 4: Payments can be mailed to the same address where forms are submitted electronically.

This is a common error. While returns can be filed electronically, payments must be mailed to a different address for processing various tax obligations accurately.

Misconception 5: Refunds for overpayments can be obtained through Form 801.

Refunds are not issued via Form 801. They are only processed through the annual return, Form 802, emphasizing the importance of understanding the correct filing processes for any potential credits.

Key takeaways

Filing the Virginia 801 form, also known as the Surplus Lines Brokers Quarterly Tax Report, is essential for brokers operating in Virginia. Here are some key takeaways to guide you through the process:

- Who Must File: Only surplus lines brokers with an estimated annual premium tax liability of more than $1,500 need to complete this report. If there were no gross premiums during the quarter (Line 8 is $0), filing is not required.

- Deadlines Are Key: Ensure that your report and payment are postmarked within 30 days of the end of each quarter. If the due date falls on a weekend or holiday, you may submit it on the next business day.

- Payment Methods: You can file online through the Virginia Department of Taxation’s eForms system. If opting for paper filing, send your payment along with a check or money order made out to the Virginia Department of Taxation.

- Correct Information is Crucial: Accurate completion of the lines is important, especially Lines 1 (Gross Premiums) and 6 (Premiums Tax). Double-check for any miscalculations to avoid issues later.

- Credits from Prior Periods: If you have credits from previous periods, accurately reporting this on Line 7 can affect your total amount due on Line 8. If your credits exceed your taxable premium, refrain from filing Form 801 until the next quarter.

- Annual Reporting: Don’t forget about the Virginia Surplus Lines Broker’s Annual Reconciliation Tax Report, Form 802, which is due by March 1 of the following year. This is crucial, even if no tax is owed.

Browse Other Templates

How to Get Letters of Administration in California - A search for a will must be documented within the form.

Aldi Job Application Online - Your referral source can help us understand how you learned about the opportunity.

Tennessee Llc Formation - A Series LLC designation requires a certification regarding specific legal requirements.