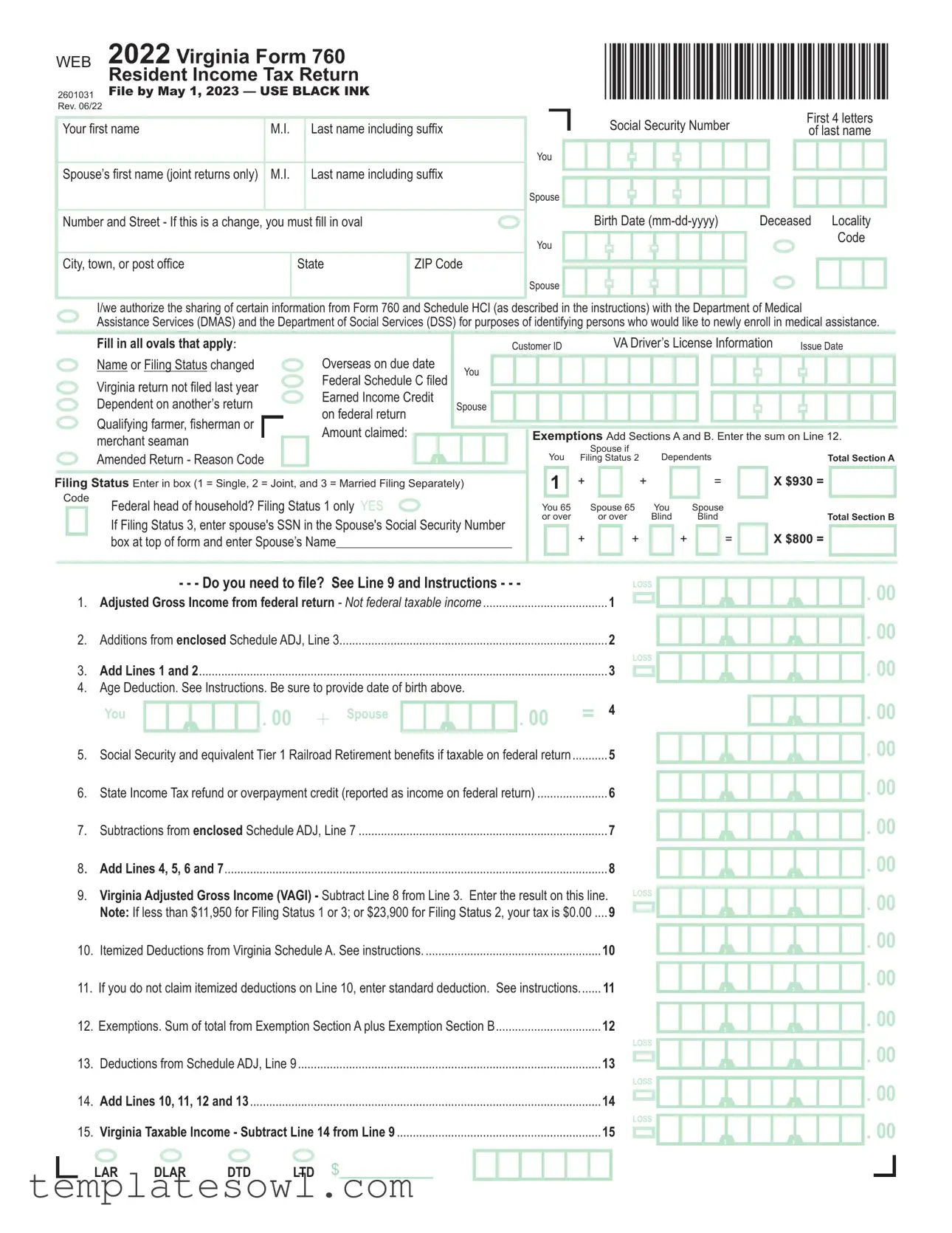

Fill Out Your Virginia State Tax Return 760 Form

The Virginia State Tax Return 760 form is an essential document for residents of Virginia when it comes to filing income taxes. It allows individuals and couples to report their income, deductions, and credits accurately to the state tax authority. The form covers various aspects, including personal information such as Social Security numbers and filing status, and deductions to which filers may be entitled. It also encompasses sections for calculating Virginia Adjusted Gross Income (VAGI) and Virginia Taxable Income, ensuring all necessary components for an accurate tax calculation are addressed. Taxpayers should take care to report exemptions and include relevant income sources, such as wages and state tax refunds, while also applying for available credits. Moreover, the form has provisions for claiming overpayments and making voluntary contributions towards different initiatives. Filing this form accurately by May 1st is crucial, as it helps determine whether a taxpayer owes additional tax or is due a refund. Completing the 760 form correctly can make the tax-filing process smoother and is a significant step toward fulfilling one’s civic responsibilities.

Virginia State Tax Return 760 Example

2601031 |

File by May 1, 2023 — USE BLACK INK |

*VA0760122888* |

WEB |

2022 Virginia Form 760 |

|

|

Resident Income Tax Return |

|

Rev. 06/22 |

|

|

|

|

|

|

|

|

|

|

|

|

Social Security Number |

|

|

First 4 letters |

||||||||||||

Your first name |

M.I. |

|

Last name including suffix |

|

|

|

|

|

|

of last name |

||||||||||||||||||

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

You |

|

|

|

|

|

|

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

|

||

Spouse’s first name (joint returns only) |

M.I. |

|

Last name including suffix |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

Spouse |

|

|

|

|

|

|

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Number and Street - If this is a change, you must fill in oval |

|

|

|

|

|

|

|

Birth Date |

Deceased |

Locality |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Code |

||

|

|

|

|

|

You |

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

City, town, or post office |

|

State |

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

Spouse |

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I/we authorize the sharing of certain information from Form 760 and Schedule HCI (as described in the instructions) with the Department of Medical

Assistance Services (DMAS) and the Department of Social Services (DSS) for purposes of identifying persons who would like to newly enroll in medical assistance.

|

|

|

Fill in all ovals that apply: |

|

Overseas on due date |

|

|

|

|

|

Customer ID |

|

|

|

|

VA Driver’s License Information |

|

|

Issue Date |

||||||||||||||||||||||||||||

|

|

|

Name or Filing Status changed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

You |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|||||||||

|

|

|

|

Federal Schedule C filed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

Virginia return not filed last year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

Earned Income Credit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Dependent on another’s return |

|

Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|||||||

|

|

|

|

on federal return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

Qualifying farmer, fisherman or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

merchant seaman |

|

|

Amount claimed: |

|

|

|

|

|

|

|

|

|

Exemptions Add Sections A and B. Enter the sum on Line 12. |

|||||||||||||||||||||||||||||||

|

|

|

|

|

, |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

Amended Return - Reason Code |

|

|

|

|

|

|

|

|

|

|

|

You |

|

|

Spouse if |

Dependents |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Filing Status 2 |

|

|

|

|

|

Total Section A |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Filing Status Enter in box (1 = Single, 2 = Joint, and 3 = Married Filing Separately) |

|

|

|

1 |

|

|

+ |

|

|

|

+ |

|

|

= |

|

|

|

|

|

X $930 = |

|||||||||||||||||||||||||||

Code |

Federal head of household? Filing Status 1 only YES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

You 65 |

|

|

Spouse 65 |

You |

Spouse |

|

|

|

|

|

Total Section B |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

If Filing Status 3, enter spouse's SSN in the Spouse's Social Security Number |

|

|

or over |

|

|

|

or over |

Blind |

|

Blind |

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

+ |

|

|

|

+ |

|

+ |

|

|

|

= |

|

|

|

|

|

X $800 = |

|

|

|

|

||||||||||||||||||

|

|

|

box at top of form and enter Spouse’s Name_______________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- - - Do you need to file? See Line 9 and Instructions - - - |

|

|

|

|

|

loss |

|||||||||||||||

1. |

........................................Adjusted Gross Income from federal return - Not federal taxable income |

|

1 |

|

|

|

|||||||||||||||||||

|

|

|

|||||||||||||||||||||||

2. |

Additions from enclosed Schedule ADJ, Line 3 |

|

|

|

|

|

|

|

2 |

|

|

|

|||||||||||||

3. |

Add Lines 1 and 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

loss |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

4. |

Age Deduction. See Instructions. Be sure to provide date of birth above. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

You |

|

|

|

|

|

. 00 |

+ |

Spouse |

|

|

|

|

|

. 00 |

|

= |

4 |

|

|

|

|||

|

|

|

, |

|

|

|

|

|

, |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

............ |

|

5 |

|

|

|

|||||||

5. |

Social Security and equivalent Tier 1 Railroad Retirement benefits if taxable on federal return |

|

|

|

|

|

|||||||||||||||||||

6. |

State Income Tax refund or overpayment credit (reported as income on federal return) |

|

6 |

|

|

|

|||||||||||||||||||

7. |

Subtractions from enclosed Schedule ADJ, Line 7 |

|

|

|

|

|

|

|

7 |

|

|

|

|||||||||||||

8. |

Add Lines 4, 5, 6 and 7 |

........................................................................................................................ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|||||

9. |

Virginia Adjusted Gross Income (VAGI) - Subtract Line 8 from Line 3. |

Enter the result on this line. |

loss |

||||||||||||||||||||||

|

|

Note: If less than $11,950 for Filing Status 1 or 3; or $23,900 for Filing Status 2, your tax is $0.00 |

9 |

|

|

|

|||||||||||||||||||

|

|

|

|

||||||||||||||||||||||

10. |

Itemized Deductions from Virginia Schedule A. See instructions |

|

|

|

|

|

|

|

10 |

|

|

|

|||||||||||||

11. If you do not claim itemized deductions on Line 10, enter standard deduction. See instructions |

|

11 |

|

|

|

||||||||||||||||||||

12. Exemptions. Sum of total from Exemption Section A plus Exemption Section B |

|

12 |

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

loss |

13. |

Deductions from Schedule ADJ, Line 9 |

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

loss |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. |

Add Lines 10, 11, 12 and 13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

loss |

|||||||||||

15. |

Virginia Taxable Income - Subtract Line 14 from Line 9 |

|

|

|

|

|

|

|

|

15 |

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

LAR |

DLAR |

DTD |

LTD |

|

$_________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

, |

, |

, |

, |

, |

|

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

WEB Page 2 |

*VA0760222888* Your SSN |

2022 Form 760 |

-

-

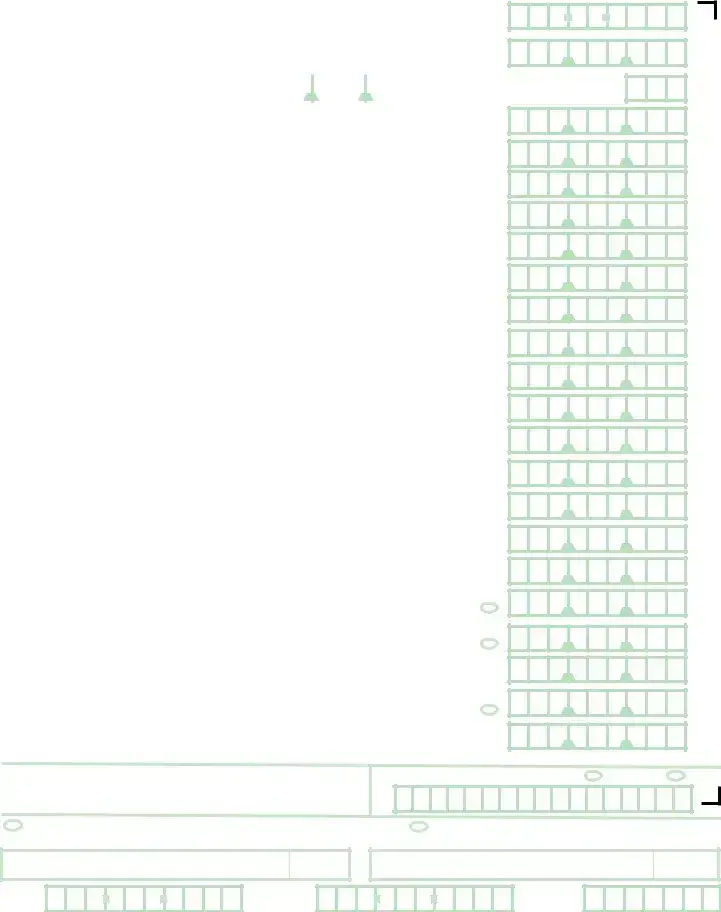

16. |

Amount of Tax from Tax Table or Tax Rate Schedule (round to whole dollars) |

.................................... |

|

|

|

16 |

||||||||||||

17. |

Spouse Tax Adjustment (STA). Filing Status 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

. 00 17 |

|||

|

only. Enter Spouse’s VAGI in box here |

è |

loss |

|

|

|

, |

|

|

|

, |

|

|

|

||||

|

and STA amount on Line 17. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

18. |

Net Amount of Tax - Subtract Line 17 from Line 16 |

|

|

|

|

|

|

|

|

18 |

||||||||

19. |

Virginia income tax withheld for 2022. Enclose copies of Forms |

|||||||||||||||||

|

19a. |

Your Virginia withholding |

........................................................................................................... |

|

|

|

|

|

|

|

|

|

|

|

|

|

19a |

|

|

19b. |

Spouse’s Virginia withholding (Filing Status 2 only) |

|

|

|

|

|

|

|

|

19b |

|||||||

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

.................................................... |

|

|

|

|

|

|

|

20 |

||||

20. |

Estimated tax payments for taxable year 2022 (from Form 760ES) |

|

|

|

|

|||||||||||||

21. |

Amount of 2021 overpayment applied toward 2022 estimated tax |

|

|

|

21 |

|||||||||||||

22. |

Extension Payments (from Form 760IP) |

|

|

|

|

|

|

|

|

|

|

|

|

|

22 |

|||

23. |

Tax Credit for |

23 |

||||||||||||||||

24. |

Credit for Tax Paid to Another State from Schedule OSC, Line 21 |

|

|

|

24 |

|||||||||||||

|

You must enclose Schedule OSC and a copy of all other state returns. |

|

|

|

|

|||||||||||||

25. |

Credits from enclosed Schedule CR, Section 5, Part 1, Line 1A |

|

|

|

25 |

|||||||||||||

26. |

Add Lines 19a through 25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26 |

||

27. |

If Line 26 is less than Line 18, subtract Line 26 from Line 18. |

This is the Tax You Owe |

27 |

|||||||||||||||

28. |

If Line 18 is less than Line 26, subtract Line 18 from Line 26. |

This is Your Tax Overpayment |

........... 28 |

|||||||||||||||

29. |

Amount of overpayment you want credited to next year’s estimated tax |

|

|

|

29 |

|||||||||||||

30. |

Virginia529 and ABLE Contributions from Schedule VAC, Section I, Line 6 |

|

|

|

30 |

|||||||||||||

31. |

Other Voluntary Contributions from Schedule VAC, Section II, Line 14 |

|

|

|

31 |

|||||||||||||

32. |

Addition to Tax, Penalty, and Interest from enclosed Schedule ADJ, Line 21 |

|

|

|

32 |

|||||||||||||

|

See instructions |

enclose 760C or 760F and fill in oval. |

|

|

|

|

||||||||||||

33. Sales and Use Tax is due on Internet, mail order, and

|

See instructions. |

............................ fill in oval if no sales and use tax is due |

33 |

|

34. |

Add Lines 29 through 33 |

34 |

||

35. |

If you owe tax on Line 27, add Lines 27 and 34. OR If Line 28 is less than Line 34, subtract Line 28 |

|

||

|

from Line 34. Enclose payment or pay at www.tax.virginia.gov |

AMOUNT YOU OWE |

35 |

|

|

|

fill in oval if paying by credit or debit card - see instructions |

|

|

36. If Line 28 is greater than Line 34, subtract Line 34 from Line 28 |

YOUR REFUND |

36 |

||

|

If the Direct Deposit section below is not completed, your refund will be issued by check. |

|

||

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

DIRECT BANK DEPOSIT |

Bank Routing Transit Number |

||||||||

Domestic Accounts Only. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No International Deposits. |

|

|

|

|

|

|

|

|

|

I (We) authorize the Dept. of Taxation to discuss this return with my (our) preparer.

Bank Account Number |

Checking |

Savings |

I agree to obtain my Form

I (We), the undersigned, declare under penalty of law that I (we) have examined this return and to the best of my (our) knowledge, it is a true, correct, and complete return.

Your Signature |

Date |

Spouse’s Signature |

Date |

Your |

- |

- |

Spouse‘s |

- |

- |

ID Theft |

Phone |

Phone |

PIN |

|

|

Preparer’s Name |

Firm Name |

Phone Number |

Filing Election |

|

|

|

Preparer’s PTIN |

||||||

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Filing Deadline | The Virginia Form 760 must be filed by May 1 for the previous tax year. |

| Filing Status Options | Taxpayers can choose from three filing statuses: Single, Married Filing Jointly, and Married Filing Separately. |

| Standard Deduction | The standard deduction amounts for the 2022 tax year are $930 for Single or Married Filing Separately, and $1,860 for Married Filing Jointly. |

| Taxable Income Calculation | Virginia taxable income is calculated by subtracting deductions and exemptions from Virginia Adjusted Gross Income. |

| Age Deduction | Individuals who are 65 years or older can claim additional deductions. Refer to specific instructions for detailed information. |

| Locality Code | Taxpayers must include a Locality Code, which corresponds to their residential locality in Virginia. |

| Virginia Adjusted Gross Income (VAGI) | VAGI is derived from adjusting the federal adjusted gross income by adding or subtracting certain Virginia-specific adjustments. |

| Tax Credits | Form 760 allows for various tax credits, including earnings credits for low-income individuals and credits for taxes paid to other states. |

| Refund Options | Taxpayers can choose to receive their refund via check or direct deposit by completing the necessary sections on the form. |

| Governing Law | The Virginia Form 760 is governed by Title 58.1 of the Code of Virginia, which outlines income taxation within the state. |

Guidelines on Utilizing Virginia State Tax Return 760

Filing your Virginia State Tax Return Form 760 requires attention to detail and careful completion of each section. Below are step-by-step instructions to guide you through the process.

- Start by obtaining the Virginia Form 760 from the Virginia Department of Taxation website or your tax preparer.

- Use black ink for all entries on the form to ensure clarity.

- Enter your Social Security Number in the designated space at the top of the form.

- Fill in your first name, middle initial, and last name accordingly. If filing jointly, enter your spouse's information in the next section.

- Provide your birth date in the format mm-dd-yyyy, along with any applicable information about deceased status.

- Complete the address section with your number and street, followed by the city, state, and ZIP code.

- Specify the filing status by filling in the correct oval. You can select from Single, Joint, or Married Filing Separately.

- If applicable, indicate if either you or your spouse is blind or over 65.

- For line 1, enter your Adjusted Gross Income from your federal return.

- Complete the entries for additional income or deductions per the instructions on Lines 2 through 14.

- Subtract the total deductions from your Virginia Adjusted Gross Income in Line 15 to find your Virginia Taxable Income.

- Determine your tax amount using the Tax Table or Tax Rate Schedule and enter this on Line 16.

- Complete any necessary sections for credits, withholdings, or estimated tax payments as applicable.

- Calculate your total payments and any amount you owe or expect as a refund, which will be indicated on Lines 27 through 36.

- If expecting a refund, complete the Direct Deposit section by providing your bank account details.

- Sign the form with your name, date, and if filing jointly, your spouse's signature and date as well.

- Keep copies of all documents and necessary schedules for your records.

Ensure that you file your completed form by May 1, 2023. If you have any questions while filling out the form, please refer to the instructions provided by the Virginia Department of Taxation for detailed guidance.

What You Should Know About This Form

What is the Virginia State Tax Return 760 Form?

The Virginia State Tax Return 760 form is the primary income tax return used by residents of Virginia to report their income and calculate their state tax liability. It's designed for individuals who meet certain filing criteria based on their income and filing status. This form includes various sections that allow taxpayers to account for income, deductions, exemptions, and credits. Accurate completion of the form can help individuals determine whether they owe tax, are due a refund, or qualify for possible credits.

When is the deadline for filing the Virginia 760 Form?

Taxpayers must file the Virginia State Tax Return 760 by May 1 each year. However, if May 1 falls on a weekend or holiday, the deadline extends to the next business day. It's crucial to file on time to avoid penalties and interest on any taxes owed. Taxpayers can request an extension, but they still must pay any estimated tax due to avoid additional charges.

Can I file the Virginia 760 Form electronically?

Yes, taxpayers have the option to file the Virginia 760 Form electronically. E-filing is generally more efficient and can result in faster processing times for refunds. Various tax preparation software programs can accurately fill out the form and guide users through the filing process. Those who prefer filing by mail can still print the completed form and send it to the Virginia Department of Taxation.

What if I need to amend my Virginia State Tax Return 760?

If you need to amend your Virginia State Tax Return 760, you can do so by completing a new form and marking it as "Amended." It is important to clearly indicate the reason for the amendment in the "Reason Code" section on the form. Once amended, ensure that you submit the necessary documentation to support any changes you’ve made. Be aware that the processing time for amended returns may take longer than for standard filings, so patience is key.

Common mistakes

When completing the Virginia State Tax Return 760 form, individuals frequently encounter challenges that can lead to significant mistakes. One common error is failing to fill in all required fields. Missing information, such as Social Security numbers or dates of birth, can result in the processing of the return being delayed or rejected. Ensuring that every applicable section is completed is crucial for a smooth filing experience.

Another mistake often made is neglecting to double-check the math. Taxpayers may add or subtract incorrectly when calculating their total income or deductions. Simple arithmetic errors can lead to incorrect tax liability amounts. It is advisable to verify calculations line by line to avoid discrepancies that could undermine the integrity of the return.

In addition, some taxpayers do not consider their filing status carefully. Selecting the incorrect status, such as filing as single when married, can influence tax rates, deductions, and credits. Understanding the implications of each filing status is essential in ensuring that the tax return accurately reflects the taxpayer's situation.

Another prevalent issue is not being aware of the applicable deductions and credits. Taxpayers might miss opportunities to reduce their taxable income or claim pertinent credits simply because they do not review the instructions thoroughly. A better understanding of available deductions, such as the age deduction for older filers, can provide substantial benefits.

Additionally, failure to include required attachments can complicate the submission process. Forms such as W-2s or 1099s must be included, as they provide necessary documentation of income. Omitting these can delay processing and result in penalties or audits. Ensuring that all required documents accompany the tax return is vital.

Finally, many filers overlook the importance of deadlines. Submitting the return after the due date leads to potential penalties and interest on unpaid taxes. Being aware of critical deadlines promotes timely filing and helps taxpayers avoid unnecessary financial burdens that come with late submissions.

Documents used along the form

In addition to the Virginia State Tax Return form 760, several other documents and forms may be required or helpful when filing your taxes in Virginia. Below are common forms that taxpayers often use alongside the 760 to ensure accurate reporting and compliance. Understanding each of these forms will streamline the filing process.

- Form W-2: This form reports the annual wages paid to an employee and the taxes withheld from those wages. Employers must provide this document to employees by January 31 each year.

- Form 1099: A variety of 1099 forms exist to report various types of income earned throughout the year, other than wages. For example, 1099-MISC is used for freelance or contract income.

- Form 760ES: This is the estimated income tax payment voucher for Virginia. Taxpayers use it to make quarterly estimated tax payments if they expect to owe tax during the year.

- Schedule OSC: This schedule is used to claim a credit for taxes paid to another state. If a taxpayer worked in another state and paid state income taxes there, they may be eligible for a credit on their Virginia return.

- Schedule CR: This form is used to report various tax credits that a taxpayer may claim. Examples include the credit for low-income individuals and the earned income credit.

- Schedule ADJ: This form summarizes adjustments to income, such as additions and subtractions to calculate the Virginia adjusted gross income.

- Form 760IP: Used for requesting an extension to file the Virginia state tax return, taxpayers must submit this form along with payment of any estimated tax owed.

- Form 760C: This form is for the request of a reconsideration of a prior year’s tax return. Taxpayers use it if they disagree with a tax assessment or alleged underpayment.

- Form 540: This is the Veterans’ and Surviving Spouses’ exemption form, allowing eligible individuals to claim exemptions on specific property taxes.

- Form 1098: This form reports mortgage interest paid, which may be deductible. It provides essential information for those itemizing deductions on their state tax return.

Each of these documents plays a unique role in the tax filing process. Proper collection and preparation of these forms can help ensure a smooth and accurate submission of your tax return. Always consider reviewing each requirement carefully and consult with a tax professional if needed to address specific circumstances or questions.

Similar forms

Federal Form 1040: Like the Virginia State Tax Return 760, the Federal Form 1040 is a comprehensive document used by residents to report their income to the federal government. Both forms require similar personal information, income details, and deductions to calculate taxes owed or refunds.

California Form 540: This form serves a similar purpose for California residents. Both the Virginia Form 760 and California Form 540 involve filing state taxes, include sections for exemptions, and allow for standard or itemized deductions.

New York State Form IT-201: Similar to the Virginia Form 760, the New York IT-201 is used for resident income tax filing. Both forms ask for information on sources of income, applicable credits, and any tax due or refunds, making them comparable in function.

Florida Form DR-015: Although Florida has no state income tax, the DR-015 is filed by certain residents for specific exemptions. While it differs in tax calculation, the DR-015 shares reporting requirements and personal information fields with the Virginia Form 760.

Dos and Don'ts

When completing the Virginia State Tax Return 760 form, it’s essential to follow some guiding principles. Here are ten things to consider:

- Do use black ink when filling out the form to ensure it scans properly.

- Don’t leave any sections blank; fill in all applicable ovals and fields.

- Do double-check your Social Security Number for accuracy.

- Don’t forget to report your filing status; choose the appropriate option accurately.

- Do calculate your total exemptions correctly and enter them on the form.

- Don’t forget to include copies of all necessary documents, such as W-2s and 1099s.

- Do provide your bank details for direct deposit to expedite any potential refund.

- Don’t neglect the deadline; file by May 1 to avoid penalties.

- Do keep a copy of your completed return for your records.

- Don’t hesitate to ask for assistance if you encounter any confusion or uncertainty.

Misconceptions

Misconception 1: The Virginia State Tax Return 760 form must be submitted by April 15.

Many people believe this, but the actual deadline for filing is May 1 each year. Make sure to mark your calendar to avoid late penalties.

Misconception 2: Only high earners need to file a Virginia tax return.

This is not true. If your income is below certain thresholds, you may not need to file, but it can still be beneficial to do so, especially if you qualify for tax credits or want to claim a refund.

Misconception 3: Filing jointly always benefits couples financially.

While many couples do benefit from filing jointly, it’s essential to evaluate your specific situation. In some cases, filing separately can provide a more significant tax advantage.

Misconception 4: The form is only for residents of Virginia.

This is misleading. Non-residents who earn income in Virginia must also file a return. Make sure to understand your residency status to comply with the requirements.

Misconception 5: The Virginia form is complicated and difficult to fill out.

While the form might seem overwhelming at first, it’s structured to be user-friendly. Take it step by step, and you’ll find that many sections are straightforward, especially if you have your federal information handy.

Key takeaways

When completing and using the Virginia State Tax Return 760 form, keep the following key points in mind:

- Filing Deadline: Ensure you file by May 1 each year to avoid penalties.

- Accurate Information: Fill in your and your spouse’s Social Security numbers accurately to prevent processing delays.

- Select the Correct Filing Status: Choose whether to file as single, married filing jointly, or married filing separately based on your situation.

- Exemptions: Calculate your exemptions correctly. Line 12 should reflect the total from Sections A and B of the form.

- Deductions: Decide whether to claim itemized deductions or the standard deduction, as this impacts your taxable income.

- Virginia Adjusted Gross Income (VAGI): Calculate correctly by subtracting applicable deductions from your total income.

- Tax Credits: Explore available tax credits that could reduce your liability, especially for low-income individuals or those claiming earned income tax credits.

- Refund Options: Opt for direct deposit by completing the relevant section for a faster refund, if applicable.

Browse Other Templates

Steer Clear Program State Farm - The policy ensures fairness by linking discounts to driving behavior.

Where Can I Get a Beneficiary Planner - Designate someone who can assist in carrying out your instructions.