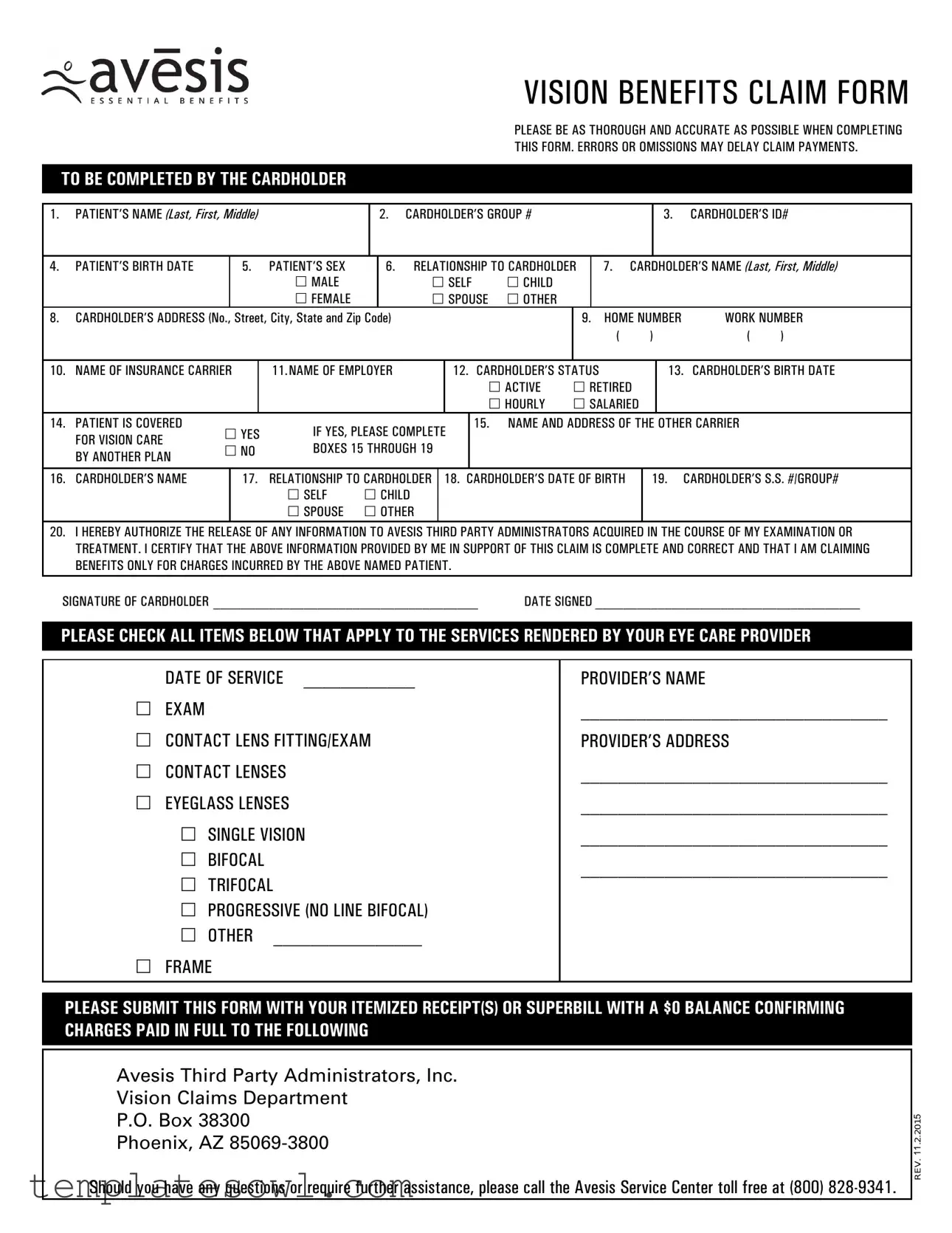

Fill Out Your Vision Benefits Claim Form

When seeking reimbursement for vision-related expenses, a completed Vision Benefits Claim form is essential. This document encompasses several critical sections that require meticulous attention to detail. Begin by providing the patient’s name, the cardholder’s group and ID numbers, and relevant birth and sex information. The form also asks for the cardholder's address and contact numbers, ensuring that the insurance carrier can easily reach them if necessary. It includes sections to identify the insurance provider and the cardholder’s employer, clarifying the validity of the claim. Additionally, the cardholder must confirm their employment status—active or retired—along with their birthdate. If the patient is covered by another insurance plan, relevant details must be provided. Before signing, the cardholder should authorize the release of medical information pertinent to the claim. After listing all applicable services rendered by the eye care provider, including eye examinations, contact lenses, and eyeglass fittings, the form must be submitted alongside itemized receipts. Thorough completion of this form is vital, as any errors or omissions can lead to delays in claim processing.

Vision Benefits Claim Example

VISION BENEFITS CLAIM FORM

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PLEASE BE AS THOROUGH AND ACCURATE AS POSSIBLE WHEN COMPLETING |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

THIS FORM. ERRORS OR OMISSIONS MAY DELAY CLAIM PAYMENTS. |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

TO BE COMPLETED BY THE CARDHOLDER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

1. PATIENT’S NAME (Last, First, Middle) |

|

|

2. |

CARDHOLDER’S GROUP # |

|

|

|

|

3. |

CARDHOLDER’S ID# |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

4. |

PATIENT’S BIRTH DATE |

|

5. |

|

PATIENT’S SEX |

|

6. |

RELATIONSHIP TO CARDHOLDER |

|

7. |

CARDHOLDER’S NAME (Last, First, Middle) |

||||||||||||||

|

|

|

|

|

MALE |

|

|

|

|

SELF |

CHILD |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

FEMALE |

|

|

|

|

SPOUSE |

OTHER |

|

|

|

|

|

|

|

|

|

|||||

8. |

CARDHOLDER’S ADDRESS (No., Street, City, State and Zip Code) |

|

|

|

|

|

|

|

|

9. |

|

HOME NUMBER |

WORK NUMBER |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

10. |

NAME OF INSURANCE CARRIER |

|

11.NAME OF EMPLOYER |

|

|

|

|

12. CARDHOLDER’S STATUS |

|

|

|

|

13. |

CARDHOLDER’S BIRTH DATE |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ACTIVE |

RETIRED |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HOURLY |

SALARIED |

|

|

|

||||||

14. |

PATIENT IS COVERED |

YES |

IF YES, PLEASE COMPLETE |

|

15. NAME AND ADDRESS OF THE OTHER CARRIER |

|

|||||||||||||||||||

|

FOR VISION CARE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

NO |

BOXES 15 THROUGH 19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

BY ANOTHER PLAN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

16. |

CARDHOLDER’S NAME |

|

17. |

|

RELATIONSHIP TO CARDHOLDER |

|

|

18. CARDHOLDER’S DATE OF BIRTH |

|

19. CARDHOLDER’S S.S. #/GROUP# |

|||||||||||||||

|

|

|

|

|

SELF |

CHILD |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

SPOUSE |

OTHER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

20. I HEREBY AUTHORIZE THE RELEASE OF ANY INFORMATION TO AVESIS THIRD PARTY ADMINISTRATORS ACQUIRED IN THE COURSE OF MY EXAMINATION OR |

|||||||||||||||||||||||||

|

TREATMENT. I CERTIFY THAT THE ABOVE INFORMATION PROVIDED BY ME IN SUPPORT OF THIS CLAIM IS COMPLETE AND CORRECT AND THAT I AM CLAIMING |

||||||||||||||||||||||||

|

BENEFITS ONLY FOR CHARGES INCURRED BY THE ABOVE NAMED PATIENT. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

SIGNATURE OF CARDHOLDER ______________________________________ |

DATE SIGNED ______________________________________ |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

PLEASE CHECK ALL ITEMS BELOW THAT APPLY TO THE SERVICES RENDERED BY YOUR EYE CARE PROVIDER |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATE OF SERVICE ____________ |

|

|

|

|

|

|

|

PROVIDER’S NAME |

|

|||||||||||||||

|

EXAM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_________________________________ |

||||||||

|

CONTACT LENS FITTING/EXAM |

|

|

|

|

|

|

|

|

PROVIDER’S ADDRESS |

|

||||||||||||||

|

CONTACT LENSES |

|

|

|

|

|

|

|

|

|

|

|

_________________________________ |

||||||||||||

|

EYEGLASS LENSES |

|

|

|

|

|

|

|

|

|

|

|

_________________________________ |

||||||||||||

|

SINGLE VISION |

|

|

|

|

|

|

|

|

|

|

|

_________________________________ |

||||||||||||

|

BIFOCAL |

|

|

|

|

|

|

|

|

|

|

|

|

_________________________________ |

|||||||||||

|

TRIFOCAL |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

PROGRESSIVE (NO LINE BIFOCAL) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

OTHER |

________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

FRAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PLEASE SUBMIT THIS FORM WITH YOUR ITEMIZED RECEIPT(S) OR SUPERBILL WITH A $0 BALANCE CONFIRMING CHARGES PAID IN FULL TO THE FOLLOWING

Avesis Third Party Administrators, Inc.

Vision Claims Department

P.O. Box 38300

Phoenix, AZ

Should you have any questions or require further assistance, please call the Avesis Service Center toll free at (800)

REV. 11.2.2015

INSURANCE FRAUD STATEMENTS

FRAUD NOTICE: For the states of AL, AZ, AR, CA, CO, DE, DC, FL, GA, IN, KS, KY, LA, MD, ME, NC, NE, NJ, NM, OK, OR, PA, RI, TN, TX, VA, VT, and WV, please refer to the following fraud notices:

Alabama Residents: Any person who knowingly presents a false or fraudulent claim for payment of loss or benefit or who knowingly presents false information in an application for insurance is guilty of a crime and may be subject to restitution, fines or confinement in prison, or any combination thereof.

Arizona Residents: For your protection, Arizona law requires the following statement to appear on this form: Any person who knowingly presents a false or fraudulent claim for payment of a loss is subject to criminal and civil penalties.

Arkansas Residents: Any person who knowingly presents a false or fraudulent claim for payment of loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

California Residents: For your protection, California

law requires the following to appear on this form: Any person who knowingly presents false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

Colorado Residents: It is unlawful to knowingly provide false, incomplete, or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance and civil damages. Any insurance company or agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado Division of Insurance within the Department of Regulatory Agencies.

Delaware Residents: Any person who knowingly, and with intent to injure, defraud or deceive any insurer, files a statement of claim containing any false, incomplete or misleading information is guilty of a felony.

District of Columbia Residents: WARNING: It is a crime to provide false or misleading information to an insurer for the purpose of defrauding the insurer or any other person. Penalties include imprisonment and/or fines. In addition, an insurer may deny insurance benefits if false information materially related to a claim was provided by the applicant.

Florida Residents: Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any false, incomplete, or misleading information is guilty of a felony of the third degree.

Georgia Residents: Any person who with intent to defraud or knowing that he/she is facilitating a fraud against an insurer, submits an application or files a claim containing a false or deceptive statement may be guilty of insurance fraud.

Indiana Residents: A person who knowingly and with intent to defraud an insurer files a statement of claim containing any false, incomplete, or misleading information commits a felony.

Kansas Residents: Any person who with intent to defraud or knowing that he or she is facilitating a fraud against an insurer, submits an application or files a claim containing a false or deceptive statement may be guilty of insurance fraud as determined by a court of law.

Kentucky Residents: Any person who knowingly and with intent to defraud any insurance company or other person files a statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime.

Louisiana Residents: Any person who knowingly presents a false or fraudulent claim for payment of loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

Maryland Residents: Any person who knowingly and willfully presents a false or fraudulent claim for payment of a loss or benefit or who knowingly and willfully presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

Maine Residents: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties may include imprisonment, fines or a denial of insurance benefits.

Nebraska Residents: Any person who, with intent to defraud or knowing that he or she is facilitating a fraud against an insurer, submits an application or files a claim containing a materially false or deceptive statement is guilty of insurance fraud.

New Jersey Residents: Any person who knowingly files a statement of claim containing any false or misleading information is subject to criminal and civil penalties.

New Mexico Residents: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to civil fines and criminal penalties.

North Carolina Residents: Any person with the intent to injure, defraud, or deceive an insurer or insurance claimant is guilty of a crime (Class H felony) which may subject the person to criminal and civil penalties.

Oklahoma Residents: WARNING: Any person who knowingly, and with intent to injure, defraud or deceive any insurer, makes any claim for the proceeds of an insurance policy containing any false, incomplete or misleading information is guilty of a felony.

Oregon Residents: Any person who with intent to defraud or knowing that he/she is facilitating a fraud against an insurer, submits an application or files a claim containing a false or deceptive statement may be guilty of insurance fraud.

Pennsylvania Residents: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

Rhode Island Residents: Any person who knowingly presents a false or fraudulent claim for payment of loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

Tennessee Residents: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties may include imprisonment, fines and denial of insurance benefits.

Texas Residents: Any person who knowingly presents a false or fraudulent claim for payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

Vermont Residents: Any person who with intent to defraud or knowing that he/she is facilitating a fraud against an insurer, submits an application or files a claim containing a false or deceptive statement may be guilty of insurance fraud.

Virginia Residents: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines and denial of insurance benefits.

West Virginia Residents: Any person who knowingly presents a false or fraudulent claim for payment of loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of the Form | The Vision Benefits Claim Form is used to request reimbursement for vision care services received by the patient. |

| Cardholder Information | The form requires comprehensive details from the cardholder, including their Group Number and ID Number. |

| Relation to Patient | The cardholder must specify their relationship to the patient, such as self, spouse, or child. |

| Coverage Confirmation | The form includes a section to determine if the patient is covered under another vision care plan. |

| Submission Requirements | A completed form must be submitted alongside itemized receipts or a Superbill indicating full payment for services. |

| State-Specific Fraud Notices | Specific states, such as Arizona and California, have unique legal requirements regarding false claims and penalties. |

Guidelines on Utilizing Vision Benefits Claim

Filling out the Vision Benefits Claim form requires careful attention to detail to ensure that all necessary information is included. Accuracy is important, as any errors may cause delays in receiving benefits. Follow these steps to complete the form correctly.

- Enter patient's name: Fill in the patient's last name, first name, and middle initial.

- Provide cardholder's group number: Input the group number for the insurance plan.

- Input cardholder’s ID number: Fill in the ID number assigned to the cardholder.

- Fill in patient's birth date: Enter the birth date of the patient in the required format.

- Select patient's sex: Check either male or female based on the patient’s identification.

- Indicate relationship to cardholder: Choose one of the options (self, child, spouse, other).

- Provide cardholder's name: Fill in the cardholder's last name, first name, and middle initial.

- Enter cardholder's address: Include the complete address: number, street, city, state, and zip code.

- Provide home and work numbers: Enter the home phone number and work phone number.

- Enter name of insurance carrier: Fill in the name of the insurance company that provides coverage.

- Fill in employer's name: Provide the name of the employer associated with the cardholder.

- Select cardholder's status: Indicate whether the cardholder is active, retired, hourly, or salaried.

- Is the patient covered? Answer yes or no and if yes, fill in the next required details.

- Provide other carrier’s details (if applicable): Fill in the name and address of any other vision care carrier.

- Complete details of cardholder’s status: Provide the name, relationship to the cardholder, date of birth, and SS#/group# for the other carrier.

- Sign and date the form: The cardholder must sign and date the form at the designated areas.

- Select services rendered: Check all applicable boxes that describe the eye care services provided by the eye care provider.

- Fill in date of service and provider's name: Write the date when services were performed and the name of the eye care provider.

- Complete submission: Attach itemized receipt(s) or superbill with a $0 balance, then mail to the address provided.

Once you have completed the form, make sure it’s accurate and includes all necessary receipts. After mailing it to the specified claims department, keep a copy for your records. If you have questions along the way, don’t hesitate to reach out to the Avesis Service Center for help.

What You Should Know About This Form

What is the purpose of the Vision Benefits Claim form?

The Vision Benefits Claim form is used to request reimbursement for vision care expenses. It allows the insured party to provide necessary details about the patient, the cardholder, and the services received, ensuring that claims are processed accurately and promptly.

Who should complete the Vision Benefits Claim form?

The form should be completed by the cardholder of the vision insurance policy. This is the individual who holds the insurance, and they must provide accurate information regarding themselves and the patient receiving care.

What information is required when filling out the form?

Critical information includes the patient’s name, birth date, sex, and relationship to the cardholder. The cardholder must also provide their ID number, address, contact details, insurance carrier name, and employer information. Each section must be filled out thoroughly to avoid any processing delays.

What should I do if I made a mistake on the form?

If you notice an error after submitting the claim form, contact the Avesis Service Center as soon as possible. Providing accurate information is essential for timely processing, so correcting mistakes swiftly can help avoid delays in your claim's outcome.

Do I need to submit any additional documents with the claim form?

Yes, you must submit an itemized receipt or a superbill that indicates the charges paid in full along with the claim form. This documentation is critical for verifying the expenses claimed and expediting the reimbursement process.

Where do I send the completed claim form?

The completed Vision Benefits Claim form, along with the required documentation, should be mailed to Avesis Third Party Administrators, Inc. at the address provided on the form. Ensure it is sent to the Vision Claims Department to facilitate proper processing.

How can I check the status of my claim?

To check the status of your claim, you can call the Avesis Service Center at the toll-free number provided. Speaking with a representative can clarify any questions you may have regarding your claim's progress.

What happens if my claim is denied?

If your claim is denied, you will receive a notification explaining the reason for the denial. Review the information carefully, and if you believe the denial is unwarranted, you can work with Avesis to appeal the decision or provide additional information for reconsideration.

Are there any penalties for providing false information on the form?

Yes, providing false information can lead to serious penalties, including criminal charges. Each state has its own laws surrounding insurance fraud. Therefore, it is crucial to provide truthful and complete information on the claim form to avoid legal consequences.

How can I ensure that my claim is processed efficiently?

To help ensure efficient processing, fill out the claim form thoroughly, review all sections for accuracy, and include all necessary documentation. Submitting the form promptly after receiving care is also useful in speeding things along.

Common mistakes

Submitting a Vision Benefits Claim form can be straightforward, yet many individuals unintentionally make mistakes that lead to delays or complications. Understanding some common pitfalls can help ensure that claims are processed efficiently and accurately. Here are nine frequent errors that claimants should avoid.

First, omissions are a primary concern. Many people often forget to fill out key fields like the patient's name or the cardholder's ID number. These fields are crucial for accurate processing and any missing information can result in the rejection of the claim.

Another mistake frequently seen is writing the cardholder’s birth date incorrectly. This simple error might seem trivial, but it can cause significant delays when the information does not align with the insurance records.

Not stating the relationship to the cardholder is another common oversight. This information is necessary to establish eligibility for benefits. When this field is left blank or inaccurately filled out, claims can be unnecessarily complicated, leading to further processing issues.

In many cases, mistakes may also arise from providing an incorrect or incomplete insurance carrier name. Ensuring that the exact name of the insurance provider is listed without abbreviations or errors helps in seamless communication between the payer and the provider.

Inadequate details about the services rendered can lead to confusion. Claimants sometimes fail to check all applicable service boxes or include the date of service, which is essential for validating the claim. Each service must be documented clearly to avoid complications during the review process.

Using outdated or incorrect contact information for the eye care provider can also hinder the claim. Ensuring that the provider’s information is accurate and up-to-date allows for efficient communication if the insurance needs further clarification.

Moreover, forgetting to include the itemized receipt or superbill can lead to significant delays. Claims submitted without supporting documents lack the necessary evidence for payment. Always attach the required receipts confirming the charges paid in full.

Misunderstanding the need for coordination of benefits might lead to mistakes, especially when there’s coverage from multiple plans. If a claimant has other vision insurance, they must provide the necessary information about the additional policy. Failing to do so can complicate claims processing.

Finally, individuals sometimes neglect to sign and date the form. Without the cardholder's signature, the claim cannot be processed. This final step, while small, is critical to confirming that all the information provided is indeed correct and that the claimant is entitled to the benefits they are requesting.

By avoiding these common mistakes, individuals can help ensure that their Vision Benefits Claim forms are completed correctly, paving the way for timely reimbursements and a smoother experience with their vision care coverage.

Documents used along the form

When filing a Vision Benefits Claim, several supporting documents may be necessary to ensure a smooth process. Each of these documents plays a vital role in facilitating your claim and confirming the details of your coverage.

- Itemized Receipt or Superbill: This document provides a detailed account of the services performed by your eye care provider. It must show the charges incurred and that they have been paid in full. Submitting this form is crucial for receiving reimbursement.

- Proof of Insurance Coverage: Sometimes, your insurance provider may require additional documentation confirming your coverage. This could include a certificate of coverage or a summary plan description, which outlines what services are covered under your plan.

- Authorization Form: An authorization form may be needed if you are seeking coverage under an additional insurance plan. This document grants the necessary permission for one insurance provider to release information to another.

- Claim History: Providing a history of previous claims can help demonstrate your regular use of vision care services. This might include details about past claims submitted under your current or prior coverage.

- Referral Documents: If your visit required a referral from a primary care physician, including this documentation may be beneficial. It confirms that your eye care visit was pre-approved, adhering to the terms of your insurance plan.

- Plan Maximum Limits Statement: Some insurance plans have limits on the amount of coverage available. Providing a statement showing your current limits may help clarify your eligibility for benefits.

- Dependent Verification Documents: If the claim is for a dependent, you may need to include verification documents, such as birth certificates or guardianship papers, showing the relationship between the patient and the cardholder.

- Contact Lens or Eyeglass Order Confirmation: If the claim involves the purchase of contact lenses or glasses, including a copy of the order confirmation from the provider may be requested by the insurance company for accuracy.

Submitting these documents, along with your Vision Benefits Claim form, can significantly enhance the chances of a successful and timely claim process. Always double-check that everything is correctly filled out and included, as this can prevent delays in receiving your benefits.

Similar forms

The Vision Benefits Claim form is similar in purpose and structure to several other important documents used in the healthcare and insurance fields. Here are six documents that share similarities:

- Health Insurance Claim Form: This form collects patient and cardholder information, services rendered, and requires signatures for claims processing, just like a vision benefits claim.

- Medical Expense Reimbursement Form: Like the Vision Benefits Claim form, this document demands detailed patient information and itemized receipts to confirm the expenses, ensuring correct reimbursements.

- Dental Claim Form: This form, similar to the Vision Benefits Claim, requests details about the patient, the nature of the services, and may require a provider's signature to validate the claim.

- Flexible Spending Account Claim Form: This document is used for reimbursement for medical expenses and follows a similar format by requiring personal information and proof of expenses incurred.

- Expanded Benefits Claim Form: This type of form expands on typical coverage options, collecting information in much the same way as the Vision Benefits Claim to facilitate proper processing.

- Prescription Drug Claim Form: Similar to the Vision Benefits Claim form, this document involves submitting details about the patient, the prescription, and requires documentation to secure reimbursement for medications.

Dos and Don'ts

When completing the Vision Benefits Claim form, consider the following dos and don'ts:

- Do: Double-check all information for accuracy before submitting the form.

- Do: Ensure that the form includes all required signatures and dates.

- Do: Submit the form along with itemized receipts or a superbill.

- Do: Keep a copy of the completed form and receipts for your records.

- Don't: Leave any required fields blank, as this may delay processing.

- Don't: Submit false or misleading information on the claim.

- Don't: Forget to check if the patient is covered under the plan.

- Don't: Wait too long to submit the claim, as there may be deadlines.

Misconceptions

Here are some common misconceptions about the Vision Benefits Claim form:

- Only the cardholder needs to fill it out. This form requires information about both the patient and the cardholder. Make sure to provide details for both parties.

- All questions are optional. Every question on the form is important. Incomplete forms can delay claim processing.

- Any signature is acceptable. The claim must be signed by the cardholder specified on the form. Using someone else’s signature may cause issues.

- Using a generic receipt is fine. You must submit an itemized receipt or superbill that confirms the charges were paid in full to avoid complications.

- The claim will be processed immediately. Processing times can vary. It may take several weeks depending on the claim’s details and the insurance provider.

- The form is the same for all insurance companies. Different insurance providers may have unique forms or requirements. Always check for specific instructions from your carrier.

- Only specific types of services can be claimed. You can claim a variety of services, including exams, fittings, and lens purchases. Be sure to detail all applicable services.

- It’s not necessary to keep copies. Always make a copy of the submitted claim and receipts for your records. This documentation can help if any issues arise.

- Claim forms can be submitted anytime. It’s important to submit your claim within the timeframe set by your insurance provider to ensure coverage.

- Fraud warnings don’t apply to me. All claim forms have fraud warnings. Providing false information is a serious offense and can lead to legal consequences.

Understanding these misconceptions can simplify the process for everyone involved. Being thorough and careful when filling out the Vision Benefits Claim form is essential.

Key takeaways

Filling out the Vision Benefits Claim form can be straightforward if you understand key steps to follow. Attention to detail and accuracy are essential for a smooth claims process.

- Double-check all personal information: Ensure that the patient's name, cardholder's group number, and identification numbers are correct. Mistakes can lead to significant delays.

- Include accurate relationship details: Clearly indicate the relationship of the patient to the cardholder. This information helps in processing the claim efficiently.

- Provide all requested signatures: The cardholder must sign the form to authorize the release of any relevant information. Without a signature, the claim may be deemed incomplete.

- Attach itemized receipts: Submit the form along with itemized receipts or superbills indicating that charges have been paid in full. This documentation supports your claim.

- Be aware of other coverage: If the patient has vision coverage through another carrier, include details in the form. This ensures that claims are coordinated properly between insurers.

- Use the correct carrier address: Mail the completed form to the specified address for Avesis Third Party Administrators. Using the wrong address can cause delays in processing.

- Familiarize yourself with fraud notices: Understand the fraud notifications required for your state. Providing false information can lead to serious legal consequences.

- Keep a copy of your submission: Always retain a copy of the claim form and associated documents. This can be valuable if there are questions or issues later.

Following each of these steps will help facilitate a timely and efficient claims process, ensuring that you receive your vision benefits without unnecessary stress.

Browse Other Templates

How Much Is a Resale License - The resale certificate must be updated or renewed in accordance with state guidelines.

What Is a Fee Waiver for College - Financial aid is available to assist with costs beyond enrollment fees, such as books and transportation.

Devry Transcripts - This is the official request for your academic records.