Fill Out Your Vita Flex Fsa Medical Claim Form

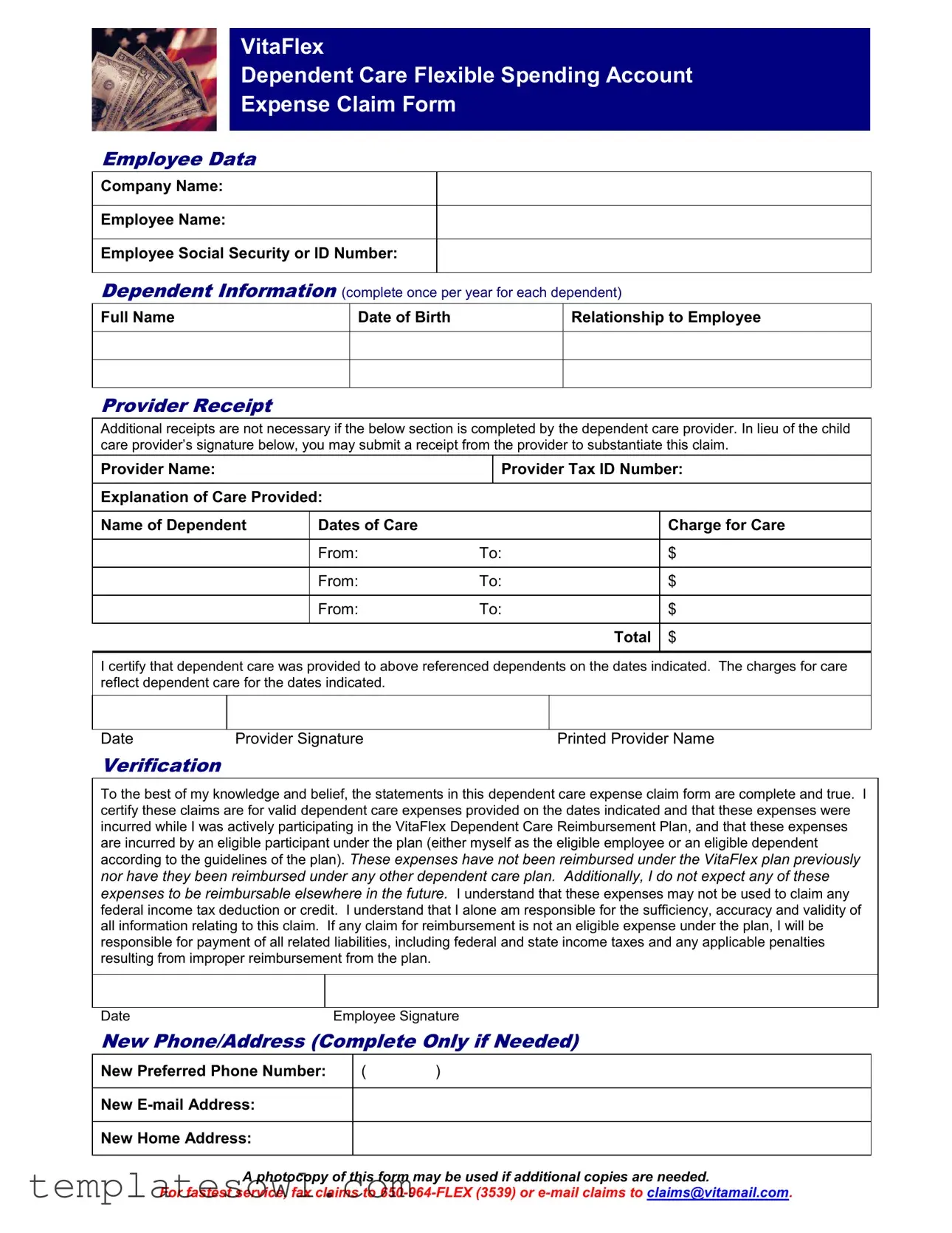

Navigating the world of dependent care can seem daunting, but the Vita Flex FSA Medical Claim form simplifies the process of seeking reimbursement. Designed specifically for employees participating in the VitaFlex Dependent Care Reimbursement Plan, this form is crucial for securing funds for child care expenses incurred while you work. It includes essential sections for employee information, dependent details, and specific care charges. You’ll need to provide the name and birth date of each dependent, alongside a breakdown of the care received—including the dates and costs associated. What's convenient is that if your provider signs the form, additional receipts aren't necessary. However, if they don't sign, submitting a receipt will suffice. You should also be mindful of signing the certification to affirm that all information you provide is accurate and true. Understanding these components will ensure a smoother claims process and help you make the most of your dependent care benefits.

Vita Flex Fsa Medical Claim Example

VitaFlex

Dependent Care Flexible Spending Account

Expense Claim Form

Employee Data

Company Name:

Employee Name:

Employee Social Security or ID Number:

Dependent Information (complete once per year for each dependent)

Full Name

Date of Birth

Relationship to Employee

Provider Receipt

Additional receipts are not necessary if the below section is completed by the dependent care provider. In lieu of the child care provider’s signature below, you may submit a receipt from the provider to substantiate this claim.

|

Provider Name: |

|

|

Provider Tax ID Number: |

|

|

|

|

|

|

|

|

Explanation of Care Provided: |

|

|

|

|

|

|

|

|

|

|

|

Name of Dependent |

Dates of Care |

|

|

Charge for Care |

|

|

|

|

|

|

|

|

From: |

To: |

$ |

|

|

|

|

|

|

|

|

|

From: |

To: |

$ |

|

|

|

|

|

|

|

|

|

From: |

To: |

$ |

|

|

|

|

|

|

|

|

|

|

|

Total |

$ |

|

|

|

|

|

|

I certify that dependent care was provided to above referenced dependents on the dates indicated. The charges for care reflect dependent care for the dates indicated.

Date |

Provider Signature |

Printed Provider Name |

Verification

To the best of my knowledge and belief, the statements in this dependent care expense claim form are complete and true. I certify these claims are for valid dependent care expenses provided on the dates indicated and that these expenses were incurred while I was actively participating in the VitaFlex Dependent Care Reimbursement Plan, and that these expenses are incurred by an eligible participant under the plan (either myself as the eligible employee or an eligible dependent according to the guidelines of the plan). These expenses have not been reimbursed under the VitaFlex plan previously nor have they been reimbursed under any other dependent care plan. Additionally, I do not expect any of these expenses to be reimbursable elsewhere in the future. I understand that these expenses may not be used to claim any federal income tax deduction or credit. I understand that I alone am responsible for the sufficiency, accuracy and validity of all information relating to this claim. If any claim for reimbursement is not an eligible expense under the plan, I will be responsible for payment of all related liabilities, including federal and state income taxes and any applicable penalties resulting from improper reimbursement from the plan.

Date |

Employee Signature |

New Phone/Address (Complete Only if Needed)

New Preferred Phone Number: |

( |

) |

New

New Home Address:

A photocopy of this form may be used if additional copies are needed.

For fastest service, fax claims to

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Purpose | The Vita Flex Dependent Care Flexible Spending Account Expense Claim Form is used to request reimbursement for dependent care expenses. |

| Provider Signature | If the dependent care provider fills out the form, you do not need to include additional receipts. |

| Eligibility | Eligible participants include the employee and their dependents, according to plan guidelines. |

| Certification Requirement | The employee must certify that the claims are for valid dependent care expenses incurred while participating in the plan. |

| Tax Implications | Expenses submitted cannot also be claimed for a federal income tax deduction or credit. |

| Liability Notice | The employee is responsible for any liabilities due to ineligible claims, including taxes and penalties. |

| Submission Methods | You can fax claims to 650-964-FLEX or email them to claims@vitamail.com for faster service. |

| Dependent Information | Complete information for each dependent must be submitted once per year. |

| Document Copies | A photocopy of the form can be used if additional copies are needed. |

Guidelines on Utilizing Vita Flex Fsa Medical Claim

Filling out the Vita Flex FSA Medical Claim form requires careful attention to detail to ensure your claim is processed correctly. This form is necessary to request reimbursement for qualified dependent care expenses. Follow these steps to complete the form accurately.

- Start by filling out the Employee Data section. Enter your company name, your full name, and your social security or ID number.

- In the Dependent Information section, provide details for each dependent. Complete this information once per year for each dependent:

- Full Name

- Date of Birth

- Relationship to Employee

- Next, in the Provider Receipt section, you can opt to include a receipt from the dependent care provider. If not, ensure the provider completes the required sections, including:

- Provider Name

- Provider Tax ID Number

- Explanation of Care Provided

- Indicate the Name of Dependent and list the Dates of Care for each entry. Specify the amount charged for care:

- From: (date) To: (date) – $ (amount)

- After filling in all applicable dates and charges, calculate the Total amount to be claimed.

- Sign and date the form in the area provided to certify that the information is accurate and true.

- If necessary, fill out the New Phone/Address section with updated contact information.

- Once completed, you can submit your claim. For the fastest service, consider faxing the claims to 650-964-FLEX (3539) or emailing claims@vitamail.com.

What You Should Know About This Form

What is the Vita Flex FSA Medical Claim form used for?

The Vita Flex FSA Medical Claim form is designed for employees to claim reimbursement for dependent care expenses. This is part of the Dependent Care Flexible Spending Account (FSA) that allows eligible employees to set aside pre-tax money for child care services. By using this form, you can submit claims for care provided to your dependents while you are working.

What information do I need to fill out on the form?

Your claim form requires several key pieces of information. This includes your personal information such as your company name, employee name, and social security or ID number. You will also need to provide details about your dependents, including their full names, dates of birth, and your relationship to them. Additionally, you’ll need to document the care provided with the provider's name, their tax ID number, and a description of the care given, along with the dates and charges for those services.

Do I need to provide receipts?

How do I certify my claim is accurate?

You must sign the form to certify that all information provided is complete and true. This includes confirming that the dependent care expenses were valid, incurred while you were actively participating in the VitaFlex plan, and that you have not received reimbursement for them from any other plan. Your signature signifies that you understand the responsibilities for accuracy and recognize potential tax implications.

What happens if my claim is not an eligible expense?

If the claim is found to be ineligible, you will be responsible for any related liabilities. This includes federal and state income taxes and any penalties that may arise from improper reimbursement from the VitaFlex plan. It is important to ensure that your claim meets all eligibility requirements to avoid these issues.

How can I submit my claims quickly?

For the fastest processing, you can fax your completed claims to 650-964-FLEX (3539) or email them to claims@vitamail.com. If you need more copies of the form, a photocopy can be used without any issue. Make sure all required information and documentation are included to facilitate quicker reimbursement.

Common mistakes

Filling out the Vita Flex FSA Medical Claim form requires attention to detail. One common mistake is failing to provide complete employee data. Ensure you include your company name, your full name, and your social security or ID number. Missing any of this information can delay the processing of your claim.

Another frequent error involves the dependent information section. People often overlook providing the full name, date of birth, and relationship of each dependent. This section must be filled out accurately to verify eligibility for the claim.

Inaccurate provider information is also a problem. Be sure to include the provider's name and tax ID number. Incomplete or incorrect provider credentials can lead to claim denials.

Many individuals neglect to include a receipt from the provider. If the provider does not sign to substantiate the care provided, a valid receipt is necessary. This oversight can cause unnecessary delays in processing your claim.

Additionally, the explanation of care provided often lacks detail. Make sure to clearly describe the services received and the dates of care. Insufficient explanations can result in complications with reimbursement.

Another common mistake is not listing all care dates and charges correctly. List each charge clearly with accurate date ranges. Any discrepancies may lead to frustration and further inquiries from the claims department.

In the certification section, some individuals forget to sign and date the form. This signature is mandatory for the claim to be considered valid. Missing this step can result in immediate rejection.

Submitting the claim without verifying expenses against eligibility criteria is another error. Each expense must be valid under the plan. Remember that submitting an ineligible claim shifts responsibility back to you for any liabilities that arise.

People also frequently miss updating their contact information. If your phone number or email address changes, include those updates on the form. Failure to do so can hinder communication regarding your claim.

Finally, neglecting to make copies can create problems down the line. Always photocopy your completed form for your records. This practice ensures you have a reference in case of issues with your claim.

Documents used along the form

The Vita Flex FSA Medical Claim form is a key document in submitting claims for medical expenses. However, several other forms and documents often accompany it to ensure a smooth claims process. Each of these documents serves a specific purpose and contributes to the overall clarity and completeness of the claim. Below is a list of these commonly used documents.

- Receipt for Medical Expenses: This document provides proof of payment for services rendered. It should detail the date of service, type of service, and amount paid, helping to validate the claim along with the claim form.

- Dependent Care Provider Certification: This form, often signed by the care provider, confirms the necessary details regarding care provided to dependents. It includes the dates of care and the provider’s information, ensuring legitimacy in the expenses claimed.

- Eligibility Verification Form: Used to confirm that dependents listed on the claim are eligible for benefits under the plan. This form helps prevent fraud and ensures compliance with plan rules.

- Health Insurance Explanation of Benefits (EOB): This document outlines what medical services were covered by a health insurance plan and the amount reimbursed. It is useful when seeking additional reimbursements for out-of-pocket expenses.

- Claim Appeal Form: If a claim is denied, this form allows the claimant to appeal the decision. It provides a structured way to present additional information and request reconsideration.

- Direct Deposit Authorization Form: Many employees prefer to receive reimbursements directly into their bank accounts. This form allows them to set up direct deposits for faster and more efficient transaction processing.

- Statement of Medical Necessity: This document, often completed by a healthcare provider, certifies that a certain medical service or item is necessary for treatment. It may be required for particularly high-cost or unusual claims.

Understanding these documents and their roles in the claims process can greatly enhance the efficiency and accuracy of submitting healthcare reimbursements. Being prepared can provide peace of mind and ensure that all eligible costs are covered under the plan.

Similar forms

The Vita Flex FSA Medical Claim form shares similarities with several other important documents used for managing health-related expenses. Below is a list of four such documents, each highlighting key aspects that relate to the FSA claim process.

- Health Savings Account (HSA) Claim Form: Like the Vita Flex form, this document is used by individuals to claim reimbursement for qualified medical expenses. Both forms require detailed information about the expenses incurred and often ask for receipts or provider signatures to substantiate the claims. They both ensure that the reimbursement is for eligible expenses under their respective plans.

- Flexible Spending Account (FSA) Medical Expense Reimbursement Form: This document serves a similar purpose to the Vita Flex claim form. It also facilitates the request for reimbursement for medical expenses incurred by the employee or their dependents. The information needed includes employee data, details of the expenses, and provider verification, mirroring the requirements outlined in the Vita Flex form.

- Dependent Care FSA Claim Form: Specifically for expenses related to dependent care, this form is directly comparable to the Vita Flex claim form. Both forms require information about dependents and the care providers, along with dates and amounts charged. They emphasize the importance of ensuring that the expenses claimed are valid under the respective plans.

- Medical Expense Receipt Submission Form: This form is often used in conjunction with health reimbursement arrangements. Like the Vita Flex FSA form, it supports providing proof of medical expenses. It typically details the nature of the expenses and requires the participant's certification that the claims are accurate and have not been reimbursed otherwise.

Understanding these documents can help individuals navigate their benefits more effectively and ensure that they are submitting the correct claims for reimbursement.

Dos and Don'ts

When filling out the VitaFlex FSA Medical Claim form, attention to detail is essential. Here’s a guide to ensure you complete the form correctly:

- Do read all instructions carefully before starting. Understanding the requirements will save time and reduce errors.

- Do provide accurate employee and dependent information. This includes names, Social Security numbers, and dates of birth.

- Do list all charges for care clearly. Be sure to provide the date range and total amount for each service.

- Do include the provider’s signature or a receipt. This is crucial for substantiating your claim.

- Do double-check for any missing information. Incomplete forms can delay processing.

- Don't submit claims for expenses that have previously been reimbursed. Ensure these are new and eligible expenses.

- Don't forget to sign the form. Your certification ensures the claims are valid and supportable.

- Don't use this claim form for unrelated expenses. Stick to dependent care to avoid complications.

- Don't wait until the last minute to submit your claim. Allow time for processing by sending it in early.

Following these guidelines will help facilitate a smooth submission process and ensure that your claim is handled efficiently.

Misconceptions

Misunderstandings about the Vita Flex FSA Medical Claim form can lead to confusion when submitting a claim. Here are nine common misconceptions explained:

- The form is only for medical expenses. Many think the Vita Flex form is strictly for medical claims. In reality, it covers dependent care expenses as well.

- You need to submit multiple receipts for every claim. Some believe that a receipt is always necessary. However, if the provider section is filled out correctly, additional receipts are not required.

- Anyone can fill out the form. This form is intended for eligible employees or their eligible dependents. Not everyone qualifies.

- The provider's signature is mandatory. While the provider’s signature is important, you can submit a receipt instead if the form has been properly completed.

- Claims can be submitted anytime. Some think they can submit claims at any point. Claims must be submitted while actively participating in the VitaFlex plan.

- Expenses can be reimbursed multiple times. There is a belief that one can get reimbursed multiple times for the same expense. This is false; expenses can only be reimbursed once.

- I can claim tax deductions for these expenses. Many assume that FSA expenses can also be deducted on tax returns. However, this is not allowed under IRS rules.

- The information provided is not my responsibility. Some individuals think they can give incomplete or inaccurate information. In reality, the employee alone is responsible for the accuracy of all claims.

- A photocopy of the form has no value. Many assume a photocopy is useless. However, a photocopy of the form can be used if additional copies are necessary.

Understanding these misconceptions can streamline the process of submitting a claim and ensure that claims are made correctly and efficiently.

Key takeaways

Here are some key takeaways regarding the Vita Flex FSA Medical Claim form:

- Complete Employee Information: Ensure that you fill in your company name, your name, and your Social Security or ID number accurately to avoid any processing delays.

- Dependent Information: Provide the full name, date of birth, and relationship for each dependent. This section must be completed once per year for each dependent.

- Provider Verification: The dependent care provider must complete the explanation of care section. A signature is not mandatory if a receipt from the provider is submitted instead.

- Certification of Claims: You must certify that the dependent care was provided and that the expenses are valid. Inaccuracies can lead to repayment liabilities, including taxes and penalties.

- Submission Methods: For faster processing, consider faxing your claims to 650-964-FLEX or emailing them to claims@vitamail.com. A photocopy of the form can be used if more copies are needed.

Browse Other Templates

Body Beast Bulk Back Worksheet - This form encourages a structured approach, allowing for varied workouts and fewer mistakes.

Personal Representative Probate - It highlights the need for detailed record-keeping of financial transactions related to the estate.