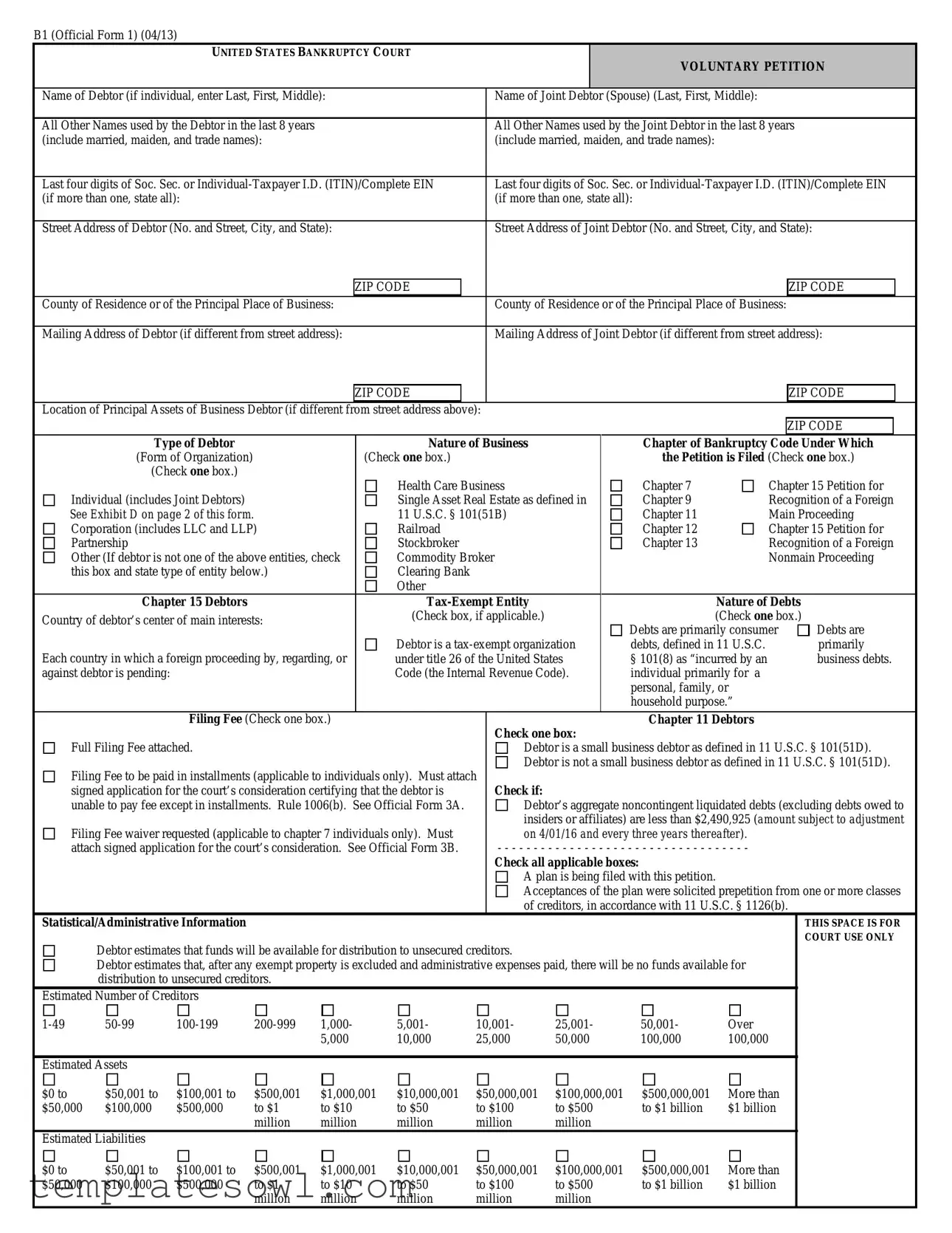

Fill Out Your Voluntary Petition Form

Filing for bankruptcy is a significant step that individuals and businesses take to address overwhelming debts and regain financial stability. A key document in this process is the Voluntary Petition form, officially designated as B1. This form serves as the initial filing for individuals and entities looking to seek relief under the Bankruptcy Code. Within the form, a range of critical information is required—such as the names of the debtor and any joint debtor, social security numbers or taxpayer IDs, and addresses. It also specifies the nature of debts, whether they are primarily consumer or business-related. Selection of the bankruptcy chapter under which the petition is filed is a vital component, with options including Chapter 7, Chapter 11, and Chapter 13, each catering to different financial scenarios and types of debtors. The form requires the declaration of the debtor's financial circumstances, including estimated assets and liabilities, as well as the number of creditors involved. Additionally, it provides a section for the debtor to affirm prior bankruptcy filings and related actions. Understandably, accurate completion of the Voluntary Petition is a critical prerequisite for the smooth progression of bankruptcy proceedings.

Voluntary Petition Example

B1 (Official Form 1) (04/13)

|

|

UNITED STATES BANKRUPTCY COURT |

|

|

|

|

|

VOLUNTARY PETITION |

||||||||||||

|

|

__________ District of __________ |

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Name of Debtor (if individual, enter Last, First, Middle): |

|

|

|

Name of Joint Debtor (Spouse) (Last, First, Middle): |

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

All Other Names used by the Debtor in the last 8 years |

|

|

|

|

|

|

All Other Names used by the Joint Debtor in the last 8 years |

|

|

|

||||||||||

(include married, maiden, and trade names): |

|

|

|

|

|

|

(include married, maiden, and trade names): |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Last four digits of Soc. Sec. or |

|

Last four digits of Soc. Sec. or |

||||||||||||||||||

(if more than one, state all): |

|

|

|

|

|

|

|

(if more than one, state all): |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||

Street Address of Debtor (No. and Street, City, and State): |

|

|

|

Street Address of Joint Debtor (No. and Street, City, and State): |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

ZIP CODE |

|

|

|

|

|

|

|

|

ZIP CODE |

|

|||||

County of Residence or of the Principal Place of Business: |

|

|

|

|

|

County of Residence or of the Principal Place of Business: |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||

Mailing Address of Debtor (if different from street address): |

|

|

|

Mailing Address of Joint Debtor (if different from street address): |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

ZIP CODE |

|

|

|

|

|

|

|

|

ZIP CODE |

|

|||||

Location of Principal Assets of Business Debtor (if different from street address above): |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ZIP CODE |

|

|||

|

Type of Debtor |

|

|

|

|

Nature of Business |

|

|

|

Chapter of Bankruptcy Code Under Which |

||||||||||

|

(Form of Organization) |

|

|

|

(Check one box.) |

|

|

|

|

|

the Petition is Filed (Check one box.) |

|||||||||

|

(Check one box.) |

|

|

|

|

Health Care Business |

|

|

|

Chapter 7 |

Chapter 15 Petition for |

|||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||

Individual (includes Joint Debtors) |

|

|

|

|

Single Asset Real Estate as defined in |

|

Chapter 9 |

Recognition of a Foreign |

||||||||||||

See Exhibit D on page 2 of this form. |

|

|

|

|

11 U.S.C. § 101(51B) |

|

|

|

Chapter 11 |

Main Proceeding |

||||||||||

Corporation (includes LLC and LLP) |

|

|

|

Railroad |

|

|

|

|

|

Chapter 12 |

Chapter 15 Petition for |

|||||||||

Partnership |

|

|

|

|

|

Stockbroker |

|

|

|

|

|

Chapter 13 |

Recognition of a Foreign |

|||||||

Other (If debtor is not one of the above entities, check |

|

Commodity Broker |

|

|

|

|

Nonmain Proceeding |

|||||||||||||

this box and state type of entity below.) |

|

|

|

Clearing Bank |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chapter 15 Debtors |

|

|

|

|

|

|

|

|

Nature of Debts |

|

|

|

|||||||

Country of debtor’s center of main interests: |

|

|

|

(Check box, if applicable.) |

|

|

|

|

(Check one box.) |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

Debts are primarily consumer |

Debts are |

|||||||||

|

|

|

|

|

|

|

Debtor is a |

|

||||||||||||

Each country in which a foreign proceeding by, regarding, or |

|

|

debts, defined in 11 U.S.C. |

primarily |

||||||||||||||||

|

under title 26 of the United States |

|

§ 101(8) as “incurred by an |

business debts. |

||||||||||||||||

against debtor is pending: |

|

|

|

|

|

Code (the Internal Revenue Code). |

|

individual primarily for a |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

personal, family, or |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

household purpose.” |

|

|

|

|||

|

|

Filing Fee (Check one box.) |

|

|

|

|

Check one box: |

Chapter 11 Debtors |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Full Filing Fee attached. |

|

|

|

|

|

|

|

Debtor is a small business debtor as defined in 11 U.S.C. § 101(51D). |

||||||||||||

Filing Fee to be paid in installments (applicable to individuals only). Must attach |

Debtor is not a small business debtor as defined in 11 U.S.C. § 101(51D). |

|||||||||||||||||||

Check if: |

|

|

|

|

|

|

|

|

|

|

||||||||||

signed application for the court’s consideration certifying that the debtor is |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

unable to pay fee except in installments. Rule 1006(b). See Official Form 3A. |

|

Debtor’s aggregate noncontingent liquidated debts (excluding debts owed to |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

insiders or affiliates) are less than $2,490,925 (amount subject to adjustment |

||||||||||

Filing Fee waiver requested (applicable to chapter 7 individuals only). Must |

|

on 4/01/16 and every three years thereafter). |

|

|

|

|||||||||||||||

attach signed application for the court’s consideration. See Official Form 3B. |

|

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - |

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

Check all applicable boxes: |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

A plan is being filed with this petition. |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

Acceptances of the plan were solicited prepetition from one or more classes |

||||||||||

|

|

|

|

|

|

|

|

|

|

of creditors, in accordance with 11 U.S.C. § 1126(b). |

|

|

|

|||||||

Statistical/Administrative Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

THIS SPACE IS FOR |

||||

|

Debtor estimates that funds will be available for distribution to unsecured creditors. |

|

|

|

|

|

|

|

COURT USE ONLY |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Debtor estimates that, after any exempt property is excluded and administrative expenses paid, there will be no funds available for |

|

|

|

|

|||||||||||||||

|

distribution to unsecured creditors. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Estimated Number of Creditors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

1,000- |

|

|

5,001- |

|

10,001- |

25,001- |

|

50,001- |

Over |

|

|

|

|

|||||||

|

|

|

|

5,000 |

|

|

10,000 |

|

25,000 |

50,000 |

|

|

100,000 |

100,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Estimated Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$0 to |

$50,001 to |

$100,001 to |

$500,001 |

$1,000,001 |

$10,000,001 |

|

$50,000,001 |

$100,000,001 |

$500,000,001 |

More than |

|

|

|

|

||||||

$50,000 |

$100,000 |

$500,000 |

to $1 |

to $10 |

to $50 |

to $100 |

to $500 |

to $1 billion |

$1 billion |

|

|

|

|

|||||||

|

|

|

million |

million |

million |

million |

million |

|

|

|

|

|

|

|

||||||

Estimated Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$0 to |

$50,001 to |

$100,001 to |

$500,001 |

$1,000,001 |

$10,000,001 |

|

$50,000,001 |

$100,000,001 |

$500,000,001 |

More than |

|

|

|

|

||||||

$50,000 |

$100,000 |

$500,000 |

to $1 |

to $10 |

to $50 |

to $100 |

to $500 |

to $1 billion |

$1 billion |

|

|

|

|

|||||||

|

|

|

million |

million |

million |

million |

million |

|

|

|

|

|

|

|

||||||

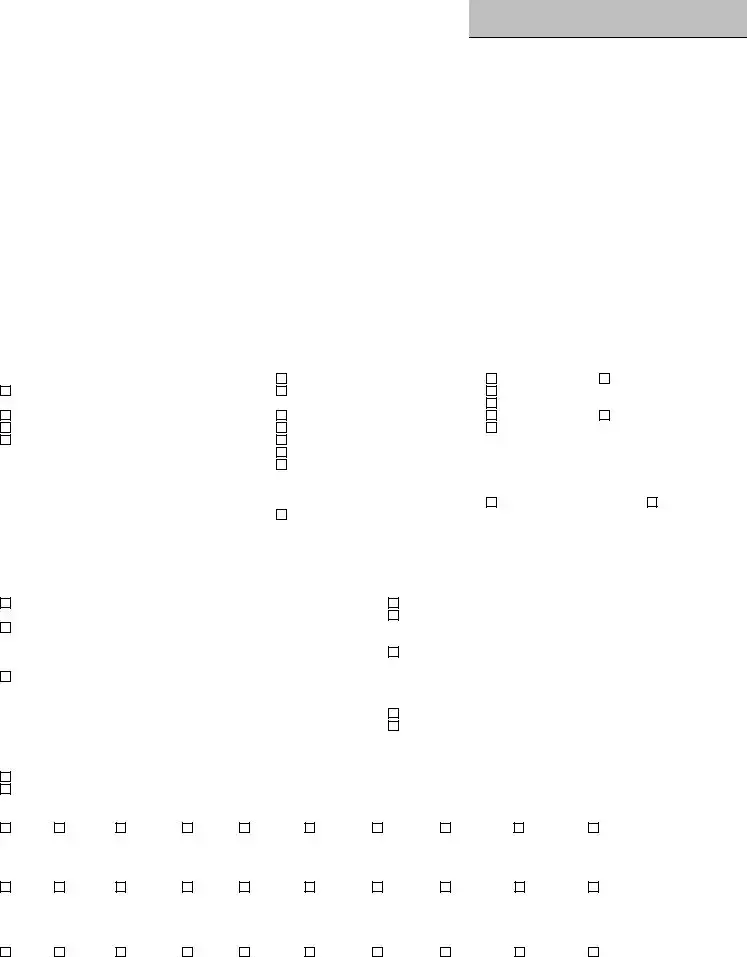

B1 (Official Form 1) (04/13) |

Page 2 |

Voluntary Petition |

Name of Debtor(s): |

(This page must be completed and filed in every case.) |

|

All Prior Bankruptcy Cases Filed Within Last 8 Years (If more than two, attach additional sheet.)

Location |

|

Case Number: |

Date Filed: |

Where Filed: |

|

|

Date Filed: |

Location |

|

Case Number: |

|

Where Filed: |

|

|

|

|

Pending Bankruptcy Case Filed by any Spouse, Partner, or Affiliate of this Debtor (If more than one, attach additional sheet.) |

||

Name of Debtor: |

|

Case Number: |

Date Filed: |

|

|

|

Judge: |

District: |

|

Relationship: |

|

|

|

|

|

Exhibit A |

Exhibit B |

|

(To be completed if debtor is required to file periodic reports (e.g., forms 10K and |

(To be completed if debtor is an individual |

|

10Q) with the Securities and Exchange Commission pursuant to Section 13 or 15(d) |

whose debts are primarily consumer debts.) |

|

of the Securities Exchange Act of 1934 and is requesting relief under chapter 11.) |

I, the attorney for the petitioner named in the foregoing petition, declare that I have |

|

|

||

|

informed the petitioner that [he or she] may proceed under chapter 7, 11, 12, or 13 |

|

|

of title 11, United States Code, and have explained the relief available under each |

|

|

such chapter. I further certify that I have delivered to the debtor the notice required |

|

Exhibit A is attached and made a part of this petition. |

by 11 U.S.C. § 342(b). |

|

X |

|

|

|

|

|

|

Signature of Attorney for Debtor(s) |

(Date) |

Exhibit C

Does the debtor own or have possession of any property that poses or is alleged to pose a threat of imminent and identifiable harm to public health or safety?

Yes, and Exhibit C is attached and made a part of this petition.

No.

Exhibit D

(To be completed by every individual debtor. If a joint petition is filed, each spouse must complete and attach a separate Exhibit D.)

Exhibit D, completed and signed by the debtor, is attached and made a part of this petition.

If this is a joint petition:

Exhibit D, also completed and signed by the joint debtor, is attached and made a part of this petition.

Information Regarding the Debtor - Venue

(Check any applicable box.)

Debtor has been domiciled or has had a residence, principal place of business, or principal assets in this District for 180 days immediately preceding the date of this petition or for a longer part of such 180 days than in any other District.

There is a bankruptcy case concerning debtor’s affiliate, general partner, or partnership pending in this District.

Debtor is a debtor in a foreign proceeding and has its principal place of business or principal assets in the United States in this District, or has no principal place of business or assets in the United States but is a defendant in an action or proceeding [in a federal or state court] in this District, or the interests of the parties will be served in regard to the relief sought in this District.

Certification by a Debtor Who Resides as a Tenant of Residential Property

(Check all applicable boxes.)

Landlord has a judgment against the debtor for possession of debtor’s residence. (If box checked, complete the following.)

(Name of landlord that obtained judgment)

(Address of landlord)

Debtor claims that under applicable nonbankruptcy law, there are circumstances under which the debtor would be permitted to cure the entire monetary default that gave rise to the judgment for possession, after the judgment for possession was entered, and

Debtor has included with this petition the deposit with the court of any rent that would become due during the

Debtor certifies that he/she has served the Landlord with this certification. (11 U.S.C. § 362(l)).

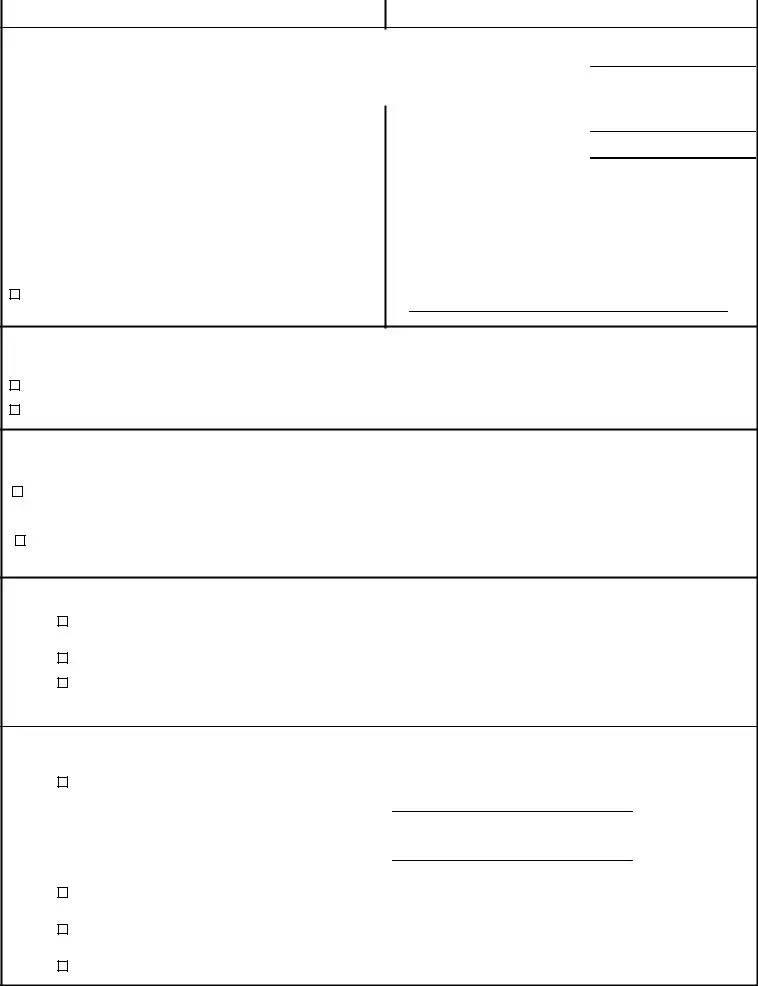

B1 (Official Form 1) (04/13) |

Page 3 |

Voluntary Petition |

Name of Debtor(s): |

(This page must be completed and filed in every case.)

Signatures

|

Signature(s) of Debtor(s) (Individual/Joint) |

|

Signature of a Foreign Representative |

||||

I declare under penalty of perjury that the information provided in this petition is true |

I declare under penalty of perjury that the information provided in this petition is true |

||||||

and correct. |

and correct, that I am the foreign representative of a debtor in a foreign proceeding, |

||||||

[If petitioner is an individual whose debts are primarily consumer debts and has |

and that I am authorized to file this petition. |

||||||

chosen to file under chapter 7] I am aware that I may proceed under chapter 7, 11, 12 |

(Check only one box.) |

|

|

||||

or 13 of title 11, United States Code, understand the relief available under each such |

|

|

|||||

|

|

|

|

||||

chapter, and choose to proceed under chapter 7. |

|

I request relief in accordance with chapter 15 of title 11, United States Code. |

|||||

[If no attorney represents me and no bankruptcy petition preparer signs the petition] I |

|

||||||

|

Certified copies of the documents required by 11 U.S.C. § 1515 are attached. |

||||||

have obtained and read the notice required by 11 U.S.C. § 342(b). |

|

||||||

|

|

|

|

||||

I request relief in accordance with the chapter of title 11, United States Code, |

|

Pursuant to 11 U.S.C. § 1511, I request relief in accordance with the |

|||||

chapter of title 11 specified in this petition. A certified copy of the |

|||||||

specified in this petition. |

|

order granting recognition of the foreign main proceeding is attached. |

|||||

X |

|

|

X |

|

|

||

|

Signature of Debtor |

|

(Signature of Foreign Representative) |

|

|

||

X |

|

|

|

|

|

|

|

|

Signature of Joint Debtor |

|

(Printed Name of Foreign Representative) |

||||

|

|

|

|

|

|

|

|

|

Telephone Number (if not represented by attorney) |

|

Date |

|

|

||

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

Signature of Attorney* |

|

Signature of |

||||

X |

|

|

I declare under penalty of perjury that: |

(1) I am a bankruptcy petition preparer as |

|||

|

Signature of Attorney for Debtor(s) |

defined in 11 U.S.C. § 110; (2) I prepared this document for compensation and have |

|||||

|

|

|

|

provided the debtor with a copy of this document and the notices and information |

|||

|

Printed Name of Attorney for Debtor(s) |

required under 11 U.S.C. §§ 110(b), 110(h), and 342(b); and, (3) if rules or |

|||||

|

|

|

|

guidelines have been promulgated pursuant to 11 U.S.C. § 110(h) setting a maximum |

|||

|

Firm Name |

fee for services chargeable by bankruptcy petition preparers, I have given the debtor |

|||||

|

|

|

|

notice of the maximum amount before preparing any document for filing for a debtor |

|||

|

|

|

|

or accepting any fee from the debtor, as required in that section. Official Form 19 is |

|||

|

|

|

|

attached. |

|

|

|

|

Address |

|

|

|

|

||

|

|

|

|

|

|

||

|

Telephone Number |

|

Printed Name and title, if any, of Bankruptcy Petition Preparer |

||||

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

||

*In a case in which § 707(b)(4)(D) applies, this signature also constitutes a |

|

||||||

|

state the |

||||||

certification that the attorney has no knowledge after an inquiry that the information |

|

partner of the bankruptcy petition preparer.) (Required by 11 U.S.C. § 110.) |

|||||

in the schedules is incorrect. |

|

|

|

|

|||

|

|

|

|

|

|

||

|

Signature of Debtor (Corporation/Partnership) |

|

|

|

|

||

I declare under penalty of perjury that the information provided in this petition is true |

|

|

|

|

|||

|

Address |

|

|

||||

and correct, and that I have been authorized to file this petition on behalf of the |

|

|

|

|

|||

debtor. |

X |

|

|

||||

The debtor requests the relief in accordance with the chapter of title 11, United States |

|

|

|||||

|

Signature |

|

|

||||

Code, specified in this petition. |

|

|

|

|

|||

X |

|

|

|

|

|||

|

Date |

|

|

||||

|

Signature of Authorized Individual |

|

|

|

|

|

|

|

|

|

|

Signature of bankruptcy petition preparer or officer, principal, responsible person, or |

|||

|

Printed Name of Authorized Individual |

||||||

|

partner whose |

||||||

|

|

|

|

|

|

|

|

|

Title of Authorized Individual |

Names and |

|||||

|

|

|

|

||||

|

|

|

|

in preparing this document unless the |

bankruptcy petition preparer is not an |

||

|

Date |

||||||

|

individual. |

|

|

||||

|

|

|

|

|

|

||

|

|

|

|

If more than one person prepared this document, attach additional sheets conforming |

|||

|

|

|

|

to the appropriate official form for each person. |

|||

|

|

|

|

A bankruptcy petition preparer’s failure to comply with the provisions of title 11 and |

|||

|

|

|

|

the Federal Rules of Bankruptcy Procedure may result in fines or imprisonment or |

|||

|

|

|

|

both. 11 U.S.C. § 110; 18 U.S.C. § 156. |

|

|

|

Reset

Save As...

Form Characteristics

| Fact Name | Details |

|---|---|

| Name of Debtor | The Voluntary Petition form requires the full name of the debtor, including last, first, and middle names if applicable. If a joint petition is filed, the name of the joint debtor must also be included. |

| Type of Debtor | The form allows debtors to specify their business type, which can include individual, corporation, partnership, or various other classifications. This designation helps to establish the context of the bankruptcy filing. |

| Filing Fee | The petition includes options regarding the payment of the filing fee. The debtor can choose to submit the full fee, pay in installments, or request a fee waiver, depending on specific conditions. |

| Governing Laws | The Voluntary Petition is governed by Title 11 of the United States Code. Each state may have its own supplemental rules and regulations regarding its filing procedures, which can vary. |

Guidelines on Utilizing Voluntary Petition

Once you have gathered the required information, you can begin filling out the Voluntary Petition form. It's essential to approach this process with care, as the details you provide will be used in your bankruptcy filing. After completing the form, you will be instructed to submit it to the appropriate court, which will then handle your case further.

- Begin by writing the name of the debtor. If the debtor is an individual, enter the last name first, followed by the first and middle names.

- If applicable, fill in the name of the joint debtor (spouse) in the same format.

- List all other names used by the debtor for the past eight years, including any married or maiden names, as well as trade names for the business.

- Enter the last four digits of the debtor’s Social Security number or Individual-Taxpayer Identification Number. If there are multiple, include all of them.

- Provide the street address of the debtor, including the city, state, and ZIP code.

- If the joint debtor has a different address, fill in their street address, city, state, and ZIP code as well.

- Indicate the county of residence or the principal place of business.

- In case the mailing address differs from the street address, fill it in for both debtors. Provide their respective ZIP codes too.

- State the location of principal assets for a business debtor if applicable.

- Check the appropriate box that matches the type of debtor (individual, corporation, partnership, etc.).

- Specify the chapter of bankruptcy code under which you're filing—options generally include Chapter 7, Chapter 11, Chapter 12, or Chapter 13.

- Indicate whether debts are primarily consumer or business debts by checking the appropriate boxes.

- If filing under Chapter 11, indicate if it is a small business debtor by checking the relevant box.

- Discuss the filing fee payment preference, selecting from options available based on your situation.

- For statistical purposes, estimate the number of creditors by choosing from the given ranges.

- Provide estimates for the debtor’s total assets and liabilities by selecting the relevant ranges offered.

- Complete sections regarding prior bankruptcy cases if applicable, ensuring to provide all required details including case numbers and dates.

- If filing jointly, complete an Exhibit D for both debtors.

- Sign and date the petition where indicated for both the debtor and joint debtor, ensuring all signatures are gathered as required.

Upon completion, review the form to confirm the accuracy of all entries, then file it with the bankruptcy court designated for your case. The court will thereafter provide further guidance on your proceedings.

What You Should Know About This Form

What is a Voluntary Petition form?

The Voluntary Petition form is a legal document used to initiate bankruptcy proceedings. It is filed with a bankruptcy court and starts the process for individuals or entities seeking financial relief under U.S. bankruptcy laws. The form collects essential information about the debtor, including their personal details, debts, assets, and other relevant information necessary to assess the bankruptcy case.

Who should file a Voluntary Petition?

Individuals, partnerships, corporations, or other business entities facing financial difficulties and unable to meet their debt obligations may file a Voluntary Petition. It is advisable for those considering bankruptcy to consult with legal or financial advisors to explore their options and determine the most suitable course of action for their specific circumstances.

What information is required on the form?

The form requires a variety of information, including the debtor's name, address, contact details, and identification numbers. Additionally, it asks for all other names used by the debtor in the past eight years, details about joint debtors if applicable, and information regarding the nature of debts and the type of bankruptcy being filed. Complete transparency in disclosing assets, liabilities, and any prior bankruptcy filings is crucial.

What are the different chapters of bankruptcy available?

There are several chapters under which individuals and entities may file for bankruptcy. Chapter 7 involves liquidation of assets to pay creditors. Chapter 11 enables business reorganization, allowing companies to continue operations while paying off debts. Chapter 13 is often used by individuals with regular income, permitting a restructuring plan to pay back debts over time. Each chapter has specific eligibility criteria and implications for the debtor.

Is there a filing fee associated with the Voluntary Petition?

Yes, there is a filing fee that must be paid when submitting the Voluntary Petition. The fee varies depending on the chapter of bankruptcy filed. It is possible to request a fee waiver or to pay the fee in installments, but certain conditions apply. Debtors should refer to the court's guidelines regarding fees before filing.

How does the Voluntary Petition impact creditors?

Once a Voluntary Petition is filed, an automatic stay goes into effect, which temporarily halts most collection activities by creditors. This means that creditors may not pursue debts or foreclosures during the bankruptcy process, providing the debtor with relief and a chance to reorganize or discharge debts according to bankruptcy laws.

Do I need an attorney to file a Voluntary Petition?

While it is not legally required to have an attorney when filing a Voluntary Petition, it is highly advisable. Navigating bankruptcy laws can be complex, and an experienced attorney can provide valuable guidance. They can help ensure that the petition is filled out accurately, necessary documents are submitted, and the debtor's rights are protected throughout the bankruptcy process.

What happens after filing the Voluntary Petition?

After filing the Voluntary Petition, the court will assign a bankruptcy case number and a trustee. A meeting of creditors, known as a 341 meeting, will be scheduled where creditors can question the debtor about their finances. The process continues with the evaluation of the case, determining the debtor's eligibility for relief, and working towards a resolution, such as liquidation, discharge of debts, or a repayment plan.

Common mistakes

When completing the Voluntary Petition form, many individuals make common mistakes that can lead to complications in their case. One frequent error is omitting previous names used by the debtor and the joint debtor. It is essential to include all names used in the last eight years, as failure to disclose this information may affect the bankruptcy proceedings.

Another mistake involves inaccuracies in the Social Security Number or Individual Taxpayer Identification Number (ITIN). The last four digits must be entered correctly for both the debtor and joint debtor. Incorrect information can cause delays in processing the petition or issues during creditor claims.

Additionally, many people neglect to provide the correct mailing address if it differs from the street address. Ensuring that the court and creditors have the right mailing address is vital for receiving important documents and notices throughout the bankruptcy process.

Some filers also fail to select the correct chapter of bankruptcy under which they are filing. Choosing the wrong chapter can lead to administrative challenges and might hinder access to the desired relief. Each chapter has specific eligibility criteria and implications, so it is crucial to make the right choice.

Listing assets and liabilities improperly is another common error. Filers must report all assets and debts accurately to reflect the true financial situation. Underreporting can result in denial of the bankruptcy petition, while overreporting may complicate proceedings unnecessarily.

People often forget to indicate whether they are a small business debtor. This designation can significantly impact the case and determine the type of relief available. Marking this option correctly is essential, as it influences how the bankruptcy will proceed.

Finally, signatures are sometimes missing on the petition. All required parties must sign the document to validate it. Skipping this step may result in the petition being rejected, leading to further delays in seeking relief.

Documents used along the form

When filing for bankruptcy through the Voluntary Petition form, several other documents may be required to support the process. Each document plays an important role in providing necessary information to the court and ensuring that your case is handled efficiently. Here’s a brief overview of some key forms often used alongside the Voluntary Petition.

- Exhibit A: This document is required if the debtor must file periodic reports with the Securities and Exchange Commission. It provides additional information about the debtor's financial status and compliance with reporting obligations.

- Exhibit B: Specifically for individual debtors with primarily consumer debts, this form must be completed to indicate whether the debtor has completed credit counseling prior to filing. It helps the court assess the debtor’s financial education.

- Exhibit C: This exhibit is necessary when there is any property that could pose a threat to public health or safety. It ensures that the court is aware of potential hazards that may need to be addressed immediately.

- Exhibit D: Every individual debtor must complete this exhibit, which involves disclosing personal financial information. For joint petitions, both spouses must complete and attach separate forms, providing comprehensive financial transparency to the court.

Incorporating these documents alongside the Voluntary Petition helps paint a clearer picture of your financial situation and lays the groundwork for your bankruptcy case. Gathering and submitting the appropriate forms can create a smoother process, giving you the chance to begin anew with confidence.

Similar forms

- Bankruptcy Schedules: Like the Voluntary Petition form, bankruptcy schedules document the financial state of the debtor, detailing assets, liabilities, income, and expenses. Both forms are preparatory steps in filing for bankruptcy.

- Statement of Financial Affairs: This document requires detailed information about financial transactions, income sources, and assets. Both the Statement of Financial Affairs and the Voluntary Petition provide context about the debtor's financial situation.

- Notice of Chapter 7 Bankruptcy Case: Similar to the Voluntary Petition, this notice informs relevant parties about the filing of the case under Chapter 7. Both serve to announce the bankruptcy proceedings officially.

- Chapter 13 Plan: A Chapter 13 Plan outlines how the debtor intends to repay creditors over time. The Voluntary Petition initiates the process, while the plan presents the repayment structure.

- Monthly Operating Reports: These reports might be required for certain debtors during Chapter 11 proceedings. Like the Voluntary Petition, they provide a financial snapshot and ongoing disclosures of the debtor's financial activities.

- Creditor Matrix: This document lists all creditors owed money by the debtor. The Voluntary Petition also requires creditor information, establishing a comprehensive view of the debtor's obligations.

- Proof of Claim: Creditors use this document to assert their right to receive payment. Its function parallels the Voluntary Petition in establishing claims and rights within the bankruptcy process.

- Fee Application: Similar in purpose, this form requests the court to approve fees for services rendered during the bankruptcy case. The Voluntary Petition similarly initiates a formal request for court involvement.

- Discharge Application: This document requests a discharge of debts after fulfilling obligations. Both it and the Voluntary Petition signify distinct phases in the bankruptcy journey, with the latter marking the beginning.

Dos and Don'ts

When filling out the Voluntary Petition form, follow these guidelines to ensure the process goes smoothly:

- Read the instructions carefully before beginning to fill out the form.

- Use clear and legible handwriting, or fill the form out digitally if possible.

- Provide accurate and complete information for all required fields.

- Review the form thoroughly before submission to catch any potential errors.

- Ensure you include all necessary supplemental documents as required by the court.

Equally important are the things to avoid while completing the form:

- Do not leave any required fields blank; ensure that every section is completed.

- Avoid using jargon or abbreviations that might confuse the court.

- Do not submit the form with incomplete or incorrect signatures.

- Do not provide falsified or misleading information in any part of the petition.

- Refrain from submitting the form without checking for clarity and coherence.

Misconceptions

Understanding the Voluntary Petition form is crucial for those considering filing for bankruptcy. However, several misconceptions can create confusion. Below are some common misunderstandings, along with clarifications to help individuals navigate this important process.

- The Voluntary Petition Form is only for individuals. On the contrary, this form is applicable to both individuals and businesses. It accommodates various types of debtors, including corporations and partnerships.

- Filing a Voluntary Petition means you will automatically lose all your assets. This is not the case. While some assets may be sold to pay creditors, many individuals can retain essential property by claiming exemptions, depending on state laws.

- Once you file the Voluntary Petition, creditors cannot contact you at all. While the filing triggers an automatic stay that stops most creditor actions, there are exceptions. Certain creditors may still communicate regarding ongoing legal actions or secured debts.

- The Voluntary Petition only affects the person filing. This is a misconception. If a joint petition is filed, it involves both individuals and their shared debts. The financial situation of both individuals can be impacted.

- Completing the Voluntary Petition is simple and can be done without assistance. While some may attempt to fill out the form independently, it is often complex. Consulting a bankruptcy attorney can ensure accurate completion and adherence to legal requirements.

- Filing the Voluntary Petition is the final step in the bankruptcy process. In reality, this form initiates the bankruptcy process. After filing, debtors must follow up with additional documentation, attend hearings, and complete required financial counseling.

- The filing fee is always the same for every type of bankruptcy. This is misleading. Fees vary based on the chapter under which the petition is filed. Additionally, some individuals may qualify for installment payments or fee waivers.

Key takeaways

Filling out the Voluntary Petition form is essential for individuals or businesses seeking bankruptcy relief. This form initiates the bankruptcy process and must include accurate information.

Provide your personal information meticulously, including the full names of debtors and any joint debtors. Be sure to note all names used in the past eight years, as this helps establish a complete financial history.

It is crucial to include the correct Social Security number or Employer Identification Number (EIN). This number plays a significant role in identifying the debtor in bankruptcy proceedings.

Indicate the type of debtor by selecting the appropriate classification on the form. This could include options like individual, corporation, or partnership, affecting the bankruptcy process you will follow.

Be prepared to indicate the nature of your debts. Check whether they are primarily consumer or business debts, as this categorization influences the bankruptcy chapter you may qualify for.

Filing fees can vary based on the chapter under which you file. You may choose to pay the full filing fee, apply for a fee waiver, or request to pay in installments. Make sure to follow the requirements for whichever option you select.

Browse Other Templates

Dea Form 41 Example - The firm is responsible for disclosing any commissions or incentives it receives from listings.

Rpie Form - Each property should be assessed for qualifying criteria before filing.

Maryland Child Care Credential Form,Early Childhood Development Credential Application,Child Care Provider Credentialing Application,Maryland Early Childhood Credential Application,Application for Maryland Child Care Certification,Child Care Central - Contact information is vital; applicants need to provide their mailing address, phone number, and email address.