Fill Out Your Vsa24 Form

The VSA 24 form is a vital document used in Virginia to facilitate the transfer of ownership for vehicles when the titled owner has passed away. This form serves as a certification that an heir has the authority to manage the vehicle's title in the absence of an executor or administrator for the deceased's estate. Importantly, it becomes applicable in situations where there are no anticipated qualifications on the estate and there is an assurance that any debts of the deceased have been settled or that the proceeds from the vehicle sale will address them. To complete the VSA 24 form, the heir must provide specific vehicle information, details about the deceased owner, and certify their relationship to the deceased. Additionally, it requires confirmation from other interested parties—those who also have a claim in the vehicle—granting their consent for the title transfer. This streamlined process helps the heir navigate the often complicated landscape of vehicle ownership while honoring the wishes of their loved one. It is essential to ensure correctness and truthfulness throughout the documentation to avoid any complications that might arise from inaccuracies. Properly completing this form is the first step in ensuring that the transfer of ownership proceeds smoothly and without unnecessary delays.

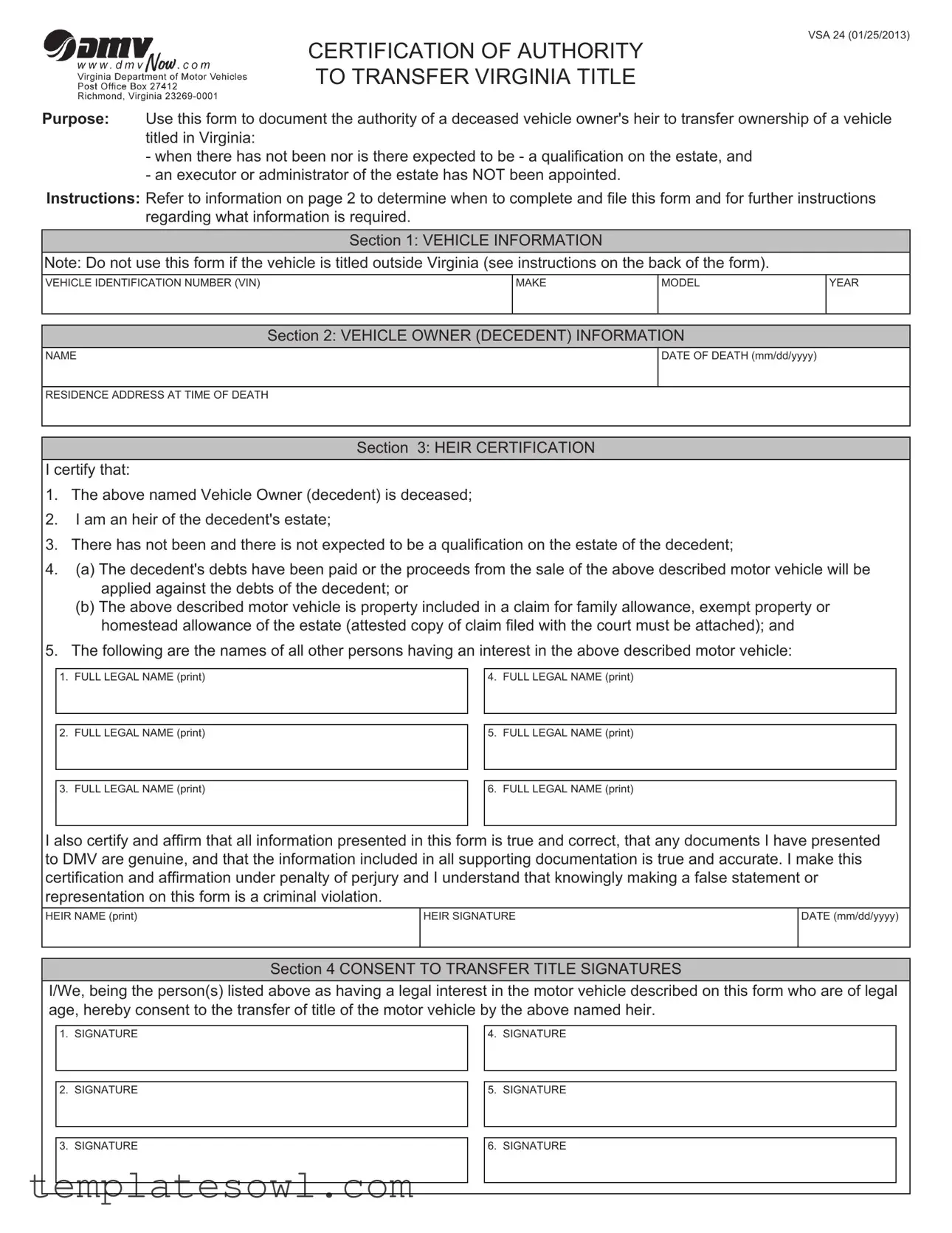

Vsa24 Example

•amv.

WWW. dm vNow .co m

Virgi nia Department of Motor Vehicles Post Office Box 274 12

Richmond, Virgin ia

CERTIFICATION OF AUTHORITY TO TRANSFER VIRGINIA TITLE

VSA 24 (01/25/2013)

Purpose: Use this form to document the authority of a deceased vehicle owner's heir to transfer ownership of a vehicle titled in Virginia:

-when there has not been nor is there expected to be - a qualification on the estate, and

-an executor or administrator of the estate has NOT been appointed.

Instructions: Refer to information on page 2 to determine when to complete and file this form and for further instructions regarding what information is required.

Section 1: VEHICLE INFORMATION

Note: Do not use this form if the vehicle is titled outside Virginia (see instructions on the back of the form).

VEHICLE IDENTIFICATION NUMBER (VIN) |

MAKE |

MODEL |

YEAR |

|

I |

I |

I |

|

|

|

|

|

Section 2: VEHICLE OWNER (DECEDENT) INFORMATION |

|

|

NAME |

|

DATE OF DEATH (mm/dd/yyyy) |

|

|

|

I |

|

RESIDENCE ADDRESS AT TIME OF DEATH

Section 3: HEIR CERTIFICATION

I certify that:

1.The above named Vehicle Owner (decedent) is deceased;

2.I am an heir of the decedent's estate;

3.There has not been and there is not expected to be a qualification on the estate of the decedent;

4.(a) The decedent's debts have been paid or the proceeds from the sale of the above described motor vehicle will be applied against the debts of the decedent; or

(b)The above described motor vehicle is property included in a claim for family allowance, exempt property or homestead allowance of the estate (attested copy of claim filed with the court must be attached); and

5.The following are the names of all other persons having an interest in the above described motor vehicle:

1. FULL LEGAL NAME (print)

4. FULL LEGAL NAME (print)

2.FULL LEGAL NAME (print)

3.FULL LEGAL NAME (print)

5.FULL LEGAL NAME (print)

6.FULL LEGAL NAME (print)

I also certify and affirm that all information presented in this form is true and correct, that any documents I have presented to DMV are genuine, and that the information included in all supporting documentation is true and accurate. I make this certification and affirmation under penalty of perjury and I understand that knowingly making a false statement or representation on this form is a criminal violation.

HEIR NAME (print) |

HEIR SIGNATURE |

DATE (mm/dd/yyyy) |

|

I |

I |

Section 4 CONSENT TO TRANSFER TITLE SIGNATURES

I/We, being the person(s) listed above as having a legal interest in the motor vehicle described on this form who are of legal age, hereby consent to the transfer of title of the motor vehicle by the above named heir.

1. SIGNATURE

4. SIGNATURE

2. SIGNATURE

5. SIGNATURE

3. SIGNATURE

6. SIGNATURE

VSA 24 (01/25/2013)

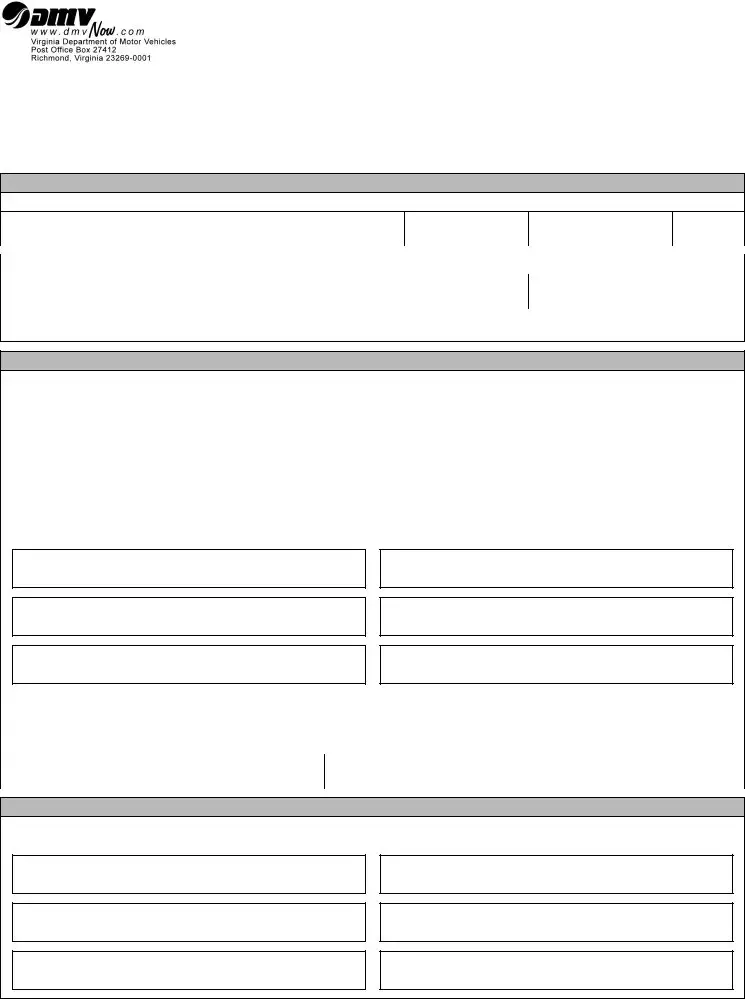

INSTRUCTIONS

DO NOT USE THIS FORM IF:

-an executor or administrator has been appointed for the deceased person's estate,

-the vehicle is an

-there has been a qualification on the estate.

The person submitting this form should:

1.Complete Sections 1 and 2.

2.Complete Section 3:

Print names of all other person(s) who have an interest in the vehicle.

Sign heir certification.

3.Complete Section 4 by securing the signature of those persons identified in Section 3 who are of legal age.

4.Submit the completed form (and any other documentation necessary to transfer vehicle ownership) to any Department of Motor Vehicles (DMV) Customer Service Center, any DMV Select or mail to DMV at the address shown on the front of this form.

ADDITIONAL INFORMATION

THE DECEDENT LEFT A WILL

Each person named in the will (legatee) who has an interest in the vehicle identified in this form must be named in Section 3, and, if of legal age, must sign in Section 4.

THE DECEDENT DIED WITHOUT A WILL (INTESTATE)

If there is a surviving spouse, only the surviving spouse must complete and submit this form unless there are any children (or their descendants) of someone other than the surviving spouse, in which case the spouse and children/descendants must be identified in Section 3 and, if of legal age, must sign their consent in Section 4.

If there is a surviving spouse and the vehicle is included in a claim for family allowance, exempt property or homestead allowance of the estate, only the surviving spouse must complete and submit this form.

If there is no surviving spouse, all persons with an interest in the vehicle must be identified in Section 3 and, if of legal age, must sign their consent in Section 4.

Note: The individual who completes this form should not be included in the list of "other persons having an interest in the vehicle" and should only sign the certification in Section 3.

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The VSA 24 form is used to document the authority of a deceased vehicle owner's heir to transfer ownership of a vehicle titled in Virginia. |

| Eligibility Criteria | This form should be completed when there is no executor or administrator of the estate appointed, and no qualification on the estate is expected. |

| Instructions | The form must not be used if the vehicle is titled outside Virginia or if there has been a qualification on the estate. |

| Sections | The VSA 24 form has four sections: Vehicle Information, Decedent Information, Heir Certification, and Consent to Transfer Title Signatures. |

| Certification | The heir must certify that they are an heir of the deceased, the debts have been addressed, and all information provided is truthful. |

| State-Specific Law | The form is governed by Virginia law, specifically relating to the transfer of ownership after death. |

| Submission Instructions | The completed form should be submitted to any DMV Customer Service Center or mailed to the DMV at the address on the form. |

Guidelines on Utilizing Vsa24

After gathering all necessary information, the next step is to complete the VSA24 form accurately. This process ensures that the authority to transfer ownership of a deceased vehicle owner's title is properly documented. A meticulous approach will help prevent delays and complications during the title transfer process.

- Begin by filling out Section 1, which requires the vehicle's information, including:

- Vehicle Identification Number (VIN)

- Make

- Model

- Year

- Next, proceed to Section 2 to provide details about the deceased vehicle owner. Include:

- Full name of the decedent

- Date of death (formatted as MM/DD/YYYY)

- Residence address at the time of death

- Now, complete Section 3 to certify your status as an heir. You must:

- Indicate that you are an heir of the decedent's estate.

- Confirm that there has not been and is not expected to be a qualification on the estate.

- State that the decedent's debts have been satisfied or that the vehicle will address the debts.

- List the names of all other individuals with an interest in the vehicle.

- Sign your name, affirming the truthfulness of the information.

- In Section 4, gather consent from all individuals listed in Section 3 who are of legal age. Each person must:

- Provide their signature to consent to the title transfer.

- Finally, submit the completed form along with any additional documentation required. This can be done at any Department of Motor Vehicles (DMV) Customer Service Center, DMV Select, or by mailing it to the address specified on the front of the form.

What You Should Know About This Form

What is the purpose of the VSA 24 form?

The VSA 24 form is used to document the authority of an heir to transfer ownership of a vehicle whose title is registered in Virginia. This typically occurs when the vehicle owner has passed away and an executor or administrator of the estate has not been appointed. The form ensures that the rightful heir can complete the transfer without any legal complications.

When should I not use the VSA 24 form?

You must not use the VSA 24 form if an executor or administrator has been appointed for the deceased's estate. Additionally, if the vehicle is titled in another state, transfer must follow the laws of that state. Finally, avoid using this form if there has been a qualification on the estate, as other legal procedures will apply.

Who is eligible to use the VSA 24 form?

This form is available for use by heirs of a deceased vehicle owner when there are no expressions of qualification on the estate. The person completing the form must be an heir and must affirm that they are responsible for the vehicle's ownership transfer after the decedent's passing.

What do I need to include when filling out the form?

You will need to provide specific vehicle information, including the Vehicle Identification Number (VIN), make, model, and year. Additionally, details about the deceased vehicle owner, such as their name and date of death, must be included. Also necessary are the names of any other individuals who have interest in the vehicle, along with their signatures if they are of legal age.

What should I do if the decedent left a will?

If the decedent left a will, each person named in that will who has an interest in the vehicle must be listed in Section 3 of the form. Moreover, they are required to sign Section 4, allowing for their consent to transfer the vehicle title. This confirms that all legal heirs are in agreement regarding the transfer.

What if the decedent died without a will?

In instances where the decedent died intestate (without a will), the process simplifies for a surviving spouse. If there are children or descendants from another relationship, both the spouse and those children must be listed in Section 3. If there is no surviving spouse, all persons with an interest in the vehicle must be included and provide their consent.

How do I submit the completed VSA 24 form?

Once you have completed the VSA 24 form and collected all necessary signatures, submit it at any Department of Motor Vehicles (DMV) Customer Service Center or DMV Select location. Alternatively, you can mail the completed form to the address provided on the front of the document. Be sure to include any additional documentation needed for the title transfer process.

Common mistakes

Filling out the VSA24 form can be a delicate task, especially during a time of loss. However, it’s essential to get it right to ensure a smooth transfer of vehicle ownership. One common mistake people make is forgetting to check whether an executor or administrator has been appointed for the deceased's estate. If one has been appointed, the VSA24 form is not appropriate to use. Making this oversight can lead to delays and complications in the title transfer process.

Another frequent error is failing to accurately record the Vehicle Identification Number (VIN). The VIN must match the vehicle’s title precisely. Skipping this step or entering the wrong number can hinder the processing of the request. It is important to double-check this critical piece of information.

Many people neglect to certify the status of the decedent's debts. In Section 3 of the form, it is required to confirm whether the decedent's debts have been settled. This certification is vital, as it impacts eligibility for the transfer of the title. Inaccuracies or lack of clarity here can result in rejection of the form.

Another common mistake involves leaving out necessary signatures. Everyone listed in Section 3 as having a legal interest in the vehicle must provide their signature in Section 4. Failing to gather these signatures may invalidate the transfer, leading to additional stress for the heir attempting to complete the process.

Completing the residence address section can also pose challenges. Some individuals may enter an old address or omit necessary details. It is crucial to use the accurate residence address at the time of death, as this can affect the verification process.

People sometimes overlook the specific instructions provided on the reverse side of the form. This page includes essential guidelines that dictate when and how to fill out the VSA24. Neglecting these instructions can lead to incomplete submissions.

Moreover, confirming the decedent’s passing with the correct date of death is critical. Errors in this date can create inconsistencies that might raise questions at the DMV and could delay the title transfer.

When listing all other persons having an interest in the vehicle, some might forget to include everyone needed. Each individual with a legal interest must be listed, and those of legal age must sign. Omitting someone can create unnecessary legal complications.

It is also essential to ensure that all supporting documents are genuine and properly attached. Presenting false or unverified documents not only undermines the application but can also lead to legal repercussions.

Finally, one last frequent mistake involves not submitting the form to the correct DMV location or mailing it to the wrong address. The VSA24 form should be delivered to the appropriate DMV Customer Service Center or the correct mailing address as indicated on the form. Double-checking this detail can save a lot of time and frustration.

Documents used along the form

The VSA24 form is an important document used to facilitate the transfer of vehicle ownership when a deceased person’s estate does not have an executor or administrator. Alongside the VSA24 form, several other documents may often be required to ensure a smooth transfer. Below is a brief description of those documents.

- Will: A legally binding document that outlines the deceased person's wishes regarding the distribution of their estate. If a will exists, it may specify how particular assets, including vehicles, should be handled.

- Death Certificate: This official document serves as legal proof of the individual's passing and may be required when submitting the VSA24 form to verify the decedent's death and establish the date of death.

- Affidavit of Heirship: A sworn statement affirming the identities of the decedent's heirs. This document helps clarify the lineage and rightful heirs when determining who can transfer the title.

- Letter of Administration or Executor's Letter: If an executor or administrator has been appointed, this document provides official confirmation of their authority to manage the deceased’s estate, which could include transferring vehicle titles.

- Consent Forms from Heirs: These forms may be necessary if multiple heirs are involved. Each heir may need to provide written consent to confirm agreement on the transfer of the vehicle title.

- Proof of Identity: Photocopies of government-issued identification for everyone involved in the title transfer process to establish identity and legal age.

- DMV Title Application: A standard form that initiates the process of transferring the title, ensuring that the DMV has all necessary information about the vehicle and its new owner.

Ensuring that you have all these documents in order can help simplify the process of transferring vehicle ownership. Each document plays its own critical role in establishing legality and preventing delays, so it's wise to prepare them in advance.

Similar forms

- VSA-26: Application for Duplicate Title - This form is used to obtain a replacement title when the original title has been lost or destroyed. Like the VSA-24, it involves providing personal information and vehicle details but does not require documentation related to the estate of a deceased owner.

- VSA-27: Request for Title Information - Used to request information regarding a vehicle's title status. Similar to the VSA-24 as it pertains to vehicle ownership, but does not deal with ownership transfer or estate matters.

- VSA-28: Notice of Sale - This form notifies the DMV about the sale of a vehicle. Both documents demonstrate a change in vehicle ownership, but the VSA-28 is focused on sales transactions rather than transfers due to the owner's death.

- VSA-30: Statement of Affidavit - This affidavit serves to confirm ownership or to address other declarations regarding a vehicle. Like the VSA-24, it requires signatures and certifications, but it is not specifically for deceased owners.

- DMV-37: Affidavit for Motor Vehicle Registration - This document supports the registration of a vehicle under specific conditions, similar to VSA-24 in that it requires affirmations about ownership but does not involve inheriting a vehicle.

- VSA-11: Application for Title and Registration - Used to create new titles and registration for vehicles, both forms manage vehicle ownership but VSA-11 is about new acquisitions while VSA-24 addresses transfers after a death.

- VSA-45: Application for Special Plate - This form applies for special license plates. Both VSA-24 and VSA-45 require vehicle information, yet VSA-45 involves personalization and plate types instead of ownership transfer.

Dos and Don'ts

When filling out the VSA24 form, following these guidelines can help ensure a smooth process.

- Complete Sections 1 and 2 accurately, providing detailed vehicle and owner information.

- Ensure all signatures are from individuals listed in Section 3 who are of legal age.

- Attach necessary documents that support the transfer of ownership, such as claims for family allowance if applicable.

- Submit the form to the appropriate DMV office, whether in person or via mail.

It is equally important to avoid certain mistakes that can delay the process.

- Do not use the form if an executor or administrator has been appointed for the estate.

- Do not attempt to file the form for vehicles titled outside of Virginia.

- Do not leave any sections incomplete, as this can result in rejection of the form.

- Avoid including yourself in the list of other persons having an interest in the vehicle.

Misconceptions

Understanding the VSA 24 form can be complex, and several misconceptions may arise regarding its purpose and usage. Below are common misunderstandings:

- This form is only for vehicles owned by individuals who left a will. The VSA 24 form can be used whether the decedent died with a will or without one. It is applicable in cases where no executor has been appointed.

- A vehicle cannot be transferred if the decedent had any debts. The form allows for transfer as long as the debts have been paid or will be covered by the proceeds from the sale of the vehicle.

- The form is valid for vehicles titled outside of Virginia. This form is strictly for vehicles titled in Virginia. Vehicles with titles from other states require different procedures.

- All heirs must sign the form to transfer the vehicle. Only the heir completing the form needs to sign. However, other interested parties aged 18 or over must also provide their consent.

- The VSA 24 form cannot be used if there are multiple heirs. The form can indeed be used in cases with multiple heirs, as long as all interested parties are identified and their consent is obtained.

- The VSA 24 form is not needed if an estate qualification is expected. If there is a qualification on the estate, the VSA 24 cannot be utilized. This form is only for estates without qualifiers.

- This form can be completed by any family member. Only legal heirs of the decedent, as indicated by the circumstances of the estate, should complete this form.

- The DMV does not require any additional documents with the VSA 24 form. Supporting documentation may be required alongside this form, depending on the specific circumstances of the estate and vehicle.

Awareness of these misconceptions can help improve the understanding of the VSA 24 form and ensure proper usage while transferring vehicle ownership after a death.

Key takeaways

Here are some key takeaways for filling out and using the VSA24 form:

- Purpose of the Form: It documents the authority of an heir to transfer ownership of a vehicle when there is no qualification on the estate.

- Eligibility: Only use this form if an executor or administrator has not been appointed, and the vehicle is titled in Virginia.

- Information Needed: You'll need to provide the vehicle identification number (VIN), make, model, year, and the decedent's details.

- Certification Requirements: The heir must certify their relationship to the decedent and confirm there are no expected qualifications on the estate.

- Debt Resolution: Ensure the decedent's debts have been settled, or explain how proceeds from the vehicle sale will be used to address debts.

- Heir Information: List the names of all other individuals who have an interest in the vehicle.

- Pursuing Accuracy: Double-check all information for accuracy, as any false statement can lead to serious consequences.

- Signatures Required: All individuals listed as having an interest in the vehicle must sign off on the title transfer.

- Submission Process: Submit the completed form and any necessary documentation to a DMV Customer Service Center or mail it to the provided address.

- Wills vs. No Wills: If the decedent left a will, all interested parties must be listed. Without a will, follow specific rules based on surviving family members.

Browse Other Templates

What Is a 1003 Form in Mortgage - The AMC 1003 form functions as a surety bond for Appraisal Management Companies in Illinois.

Ga New Hire - Confidentiality of the information submitted is protected under state regulations.