Fill Out Your Vtr 136 Form

The VTR-136 form plays a crucial role in the process of title issuance and vehicle registration for motor vehicle dealers in Texas. Designed specifically for licensed dealers, this form aligns with Texas Transportation Code, §501.0234, which mandates that dealers must apply for the title and initial registration based on the county selected by the purchaser. It is important to note that dealers are not allowed to pre-fill the county selection; this is a responsibility left to the purchaser. When filling out the form, purchasers must select a Texas county for their title application, and this choice can impact factors such as sales tax and registration fees. If the preferred county is not operational, dealers can submit applications to alternative counties willing to process them. Furthermore, the form retains its significance if a vehicle is sold or traded, as it also enables purchasers to protect themselves through notification processes available at state DMV resources. Proper completion of this form ensures that vehicle owners receive timely registration renewal notifications and that transactions comply with Texas regulations, making it essential for a smooth transaction in the motor vehicle marketplace.

Vtr 136 Example

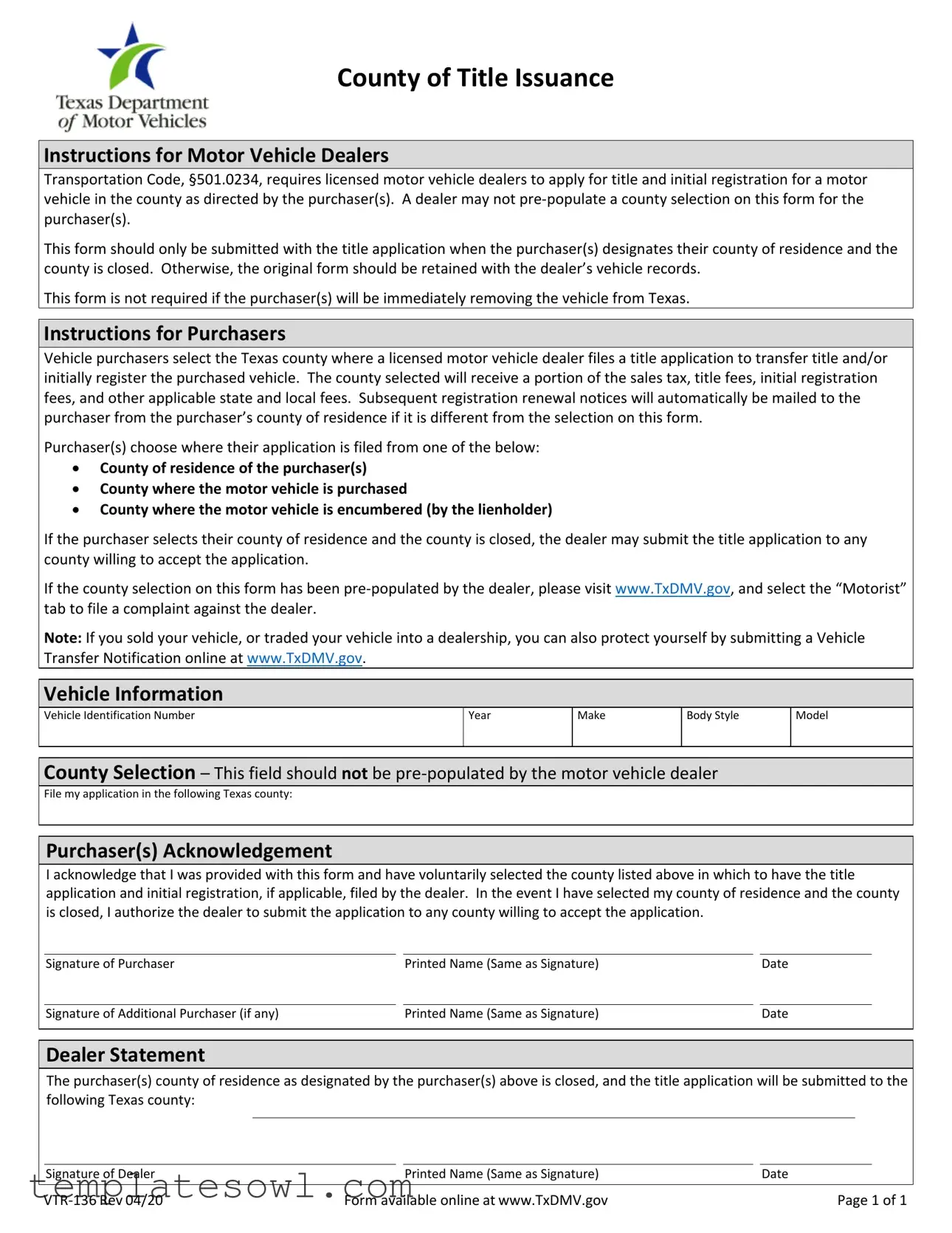

County of Title Issuance

Instructions for Motor Vehicle Dealers

Transportation Code, §501.0234, requires licensed motor vehicle dealers to apply for title and initial registration for a motor vehicle in the county as directed by the purchaser(s). A dealer may not

This form should only be submitted with the title application when the purchaser(s) designates their county of residence and the county is closed. Otherwise, the original form should be retained with the dealer’s vehicle records.

This form is not required if the purchaser(s) will be immediately removing the vehicle from Texas.

Instructions for Purchasers

Vehicle purchasers select the Texas county where a licensed motor vehicle dealer files a title application to transfer title and/or initially register the purchased vehicle. The county selected will receive a portion of the sales tax, title fees, initial registration fees, and other applicable state and local fees. Subsequent registration renewal notices will automatically be mailed to the purchaser from the purchaser’s county of residence if it is different from the selection on this form.

Purchaser(s) choose where their application is filed from one of the below:

•County of residence of the purchaser(s)

•County where the motor vehicle is purchased

•County where the motor vehicle is encumbered (by the lienholder)

If the purchaser selects their county of residence and the county is closed, the dealer may submit the title application to any county willing to accept the application.

If the county selection on this form has been

Note: If you sold your vehicle, or traded your vehicle into a dealership, you can also protect yourself by submitting a Vehicle Transfer Notification online at www.TxDMV.gov.

Vehicle Information

Vehicle Identification Number

Year

Make

Body Style

Model

County Selection – This field should not be

File my application in the following Texas county:

Purchaser(s) Acknowledgement

I acknowledge that I was provided with this form and have voluntarily selected the county listed above in which to have the title application and initial registration, if applicable, filed by the dealer. In the event I have selected my county of residence and the county is closed, I authorize the dealer to submit the application to any county willing to accept the application.

Signature of Purchaser |

Printed Name (Same as Signature) |

Date |

Signature of Additional Purchaser (if any) |

Printed Name (Same as Signature) |

Date |

Dealer Statement

The purchaser(s) county of residence as designated by the purchaser(s) above is closed, and the title application will be submitted to the following Texas county:

Signature of Dealer |

|

Printed Name (Same as Signature) |

|

Date |

Form available online at www.TxDMV.gov |

Page 1 of 1 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Statutory Requirement | The VTR-136 form is governed by Transportation Code, §501.0234, which mandates that licensed motor vehicle dealers must apply for title and initial registration in the designated county by the purchaser. |

| County Selection | Purchasers are responsible for selecting the Texas county for title application. The selection may influence where sales tax and registration fees are allocated. |

| Pre-Population Prohibition | Dealers are prohibited from pre-populating the county selection on the VTR-136 form; the county must be chosen by the purchaser themselves. |

| Submission Acceptance | The VTR-136 form should only be submitted if the purchaser's county of residence is closed; otherwise, it should be retained by the dealer. |

| Transactions Outside Texas | This form is not needed if the purchaser plans to immediately remove the vehicle from Texas after the transaction. |

| Notification for Vehicle Transfer | If vehicle sellers or traders want to protect themselves, they can submit a Vehicle Transfer Notification through the Texas DMV website. |

| Major Sections | The form includes sections for vehicle information, purchaser acknowledgements, and dealer statements that confirm county closure and application submission. |

Guidelines on Utilizing Vtr 136

Upon completion of the VTR 136 form, it will be submitted with the title application when purchasers designate their county of residence and that county is closed. If not, the dealer will retain the original form in their vehicle records. This is a vital process in ensuring that the title and registration are appropriately filed.

- Obtain the VTR 136 form from the Texas Department of Motor Vehicles website or your motor vehicle dealer.

- Fill in the vehicle information, including:

- Vehicle Identification Number (VIN)

- Year

- Make

- Body Style

- Model

- Select the county where you want your application to be filed. This must be the county of your residence, where the vehicle was purchased, or where it is encumbered.

- Review the county selection and ensure it is not pre-populated by the dealer.

- Acknowledge your selection by signing and printing your name in the designated areas.

- If there is an additional purchaser, ensure they also sign and print their name and date as required.

- Have the dealer sign and print their name and date the form, indicating that the selected county is closed, if applicable.

- Submit the form along with your title application if the designated county is closed.

- Retain a copy of the completed form for your records.

What You Should Know About This Form

What is the VTR 136 form used for?

The VTR 136 form is a document required by the Texas Transportation Code for licensed motor vehicle dealers. It is used to determine the county where the title application and initial registration for a purchased vehicle will be filed. This form ensures that the dealer adheres to the purchasers' designated county, especially if their county of residence is closed.

When should a dealer submit the VTR 136 form?

A dealer should submit the VTR 136 form when the purchaser designates a county for their title application, and that selected county is closed. In this case, the dealer can submit the title application to another willing county. If the form is not needed, it should be retained with the dealer's vehicle records.

Can a dealer pre-populate the county selection on the VTR 136 form?

No. The dealer cannot pre-populate the county selection on the VTR 136 form. The purchaser must make their own selection regarding the filing county. If a dealer does pre-populate the county, the purchaser can file a complaint at www.TxDMV.gov.

What happens if the purchaser immediately removes the vehicle from Texas?

If the purchaser is immediately removing the vehicle from Texas, the VTR 136 form is not required. The purchaser can proceed with the transaction without this form in such cases.

How does county selection affect taxes and fees?

The selected county will receive a portion of sales tax, title fees, and registration fees. This means that where the application is filed impacts the revenue distribution. It’s important to choose carefully to ensure tax and fee obligations are handled correctly.

What options do purchasers have for selecting a county?

Purchasers can select from three options for filing their title application: the county of their residence, the county where the vehicle is purchased, or the county where the vehicle is encumbered by a lienholder. This gives flexibility based on the purchaser’s situation.

What should a purchaser do if they sold or traded their vehicle?

If a purchaser sold or traded their vehicle, they should submit a Vehicle Transfer Notification online at www.TxDMV.gov. This helps protect them from potential issues related to the previous vehicle ownership.

What information is required on the VTR 136 form?

Essential information includes the Vehicle Identification Number (VIN), year, make, body style, model of the vehicle, and the purchaser’s selected county. Accurate details are crucial to ensure the title application is processed correctly.

What is required from the purchaser regarding the acknowledgment section?

Purchasers must sign and print their name in the acknowledgment section of the VTR 136 form. This indicates that they have received the form and voluntarily selected the filing county. If there’s an additional purchaser, they must also provide their signature and printed name.

Common mistakes

Filling out the VTR 136 form is crucial for a successful title application, but many people stumble due to common mistakes. One frequent error is failing to select the correct county of residence. Purchasers must ensure they choose the county where they live. If they confuse this with the county where they bought the vehicle, it can lead to complications in the registration process.

Another common mistake occurs when the dealer pre-populates the county selection. The form clearly instructs dealers not to do this. If the county is selected without the buyer's input, it may invalidate the application. Buyers must check this field and ensure it is blank before signing the form.

Not signing the form correctly is yet another mistake that people make. Both the primary purchaser and any additional purchasers need to sign and print their names as they appear on the form. Missing a signature could delay the processing of the title application or even result in its rejection.

Some purchasers forget to specify the vehicle information accurately. Details such as the Vehicle Identification Number, year, make, body style, and model must all be correct. Providing incorrect or incomplete information can cause significant delays and issues in receiving the title.

Lastly, some individuals fail to retain a copy of the completed form for their records. Keeping a copy is essential for tracking the application and resolving any issues that might arise later. This simple step can save time and provide peace of mind during the registration process.

Documents used along the form

The VTR-136 form is an essential document used by motor vehicle dealers when handling title applications in Texas. Along with this form, several other documents and forms are often utilized to ensure a smooth and compliant title transfer process. Here’s an overview of some important forms that may accompany the VTR-136.

- Title Application (Form VTR-130): This form is used to officially apply for a new title for a vehicle. It contains necessary details like the vehicle identification number (VIN), the owner's information, and the type of title being applied for.

- Registration Application (Form VTR-101): This document registers a vehicle in Texas. It includes information about the vehicle and the owner, and it must be submitted to obtain a license plate and registration sticker.

- Vehicle Transfer Notification (Form VTR-346): This form notifies the Texas Department of Motor Vehicles (TxDMV) that a vehicle has been sold or transferred. It's crucial for protecting sellers from future liabilities related to the vehicle.

- Sales Tax Receipt: This receipt provides proof of payment of the sales tax associated with the vehicle purchase. It is usually required to complete the title and registration process.

- Odometer Disclosure Statement (Form VTR-40): This statement is necessary to disclose the vehicle’s mileage at the time of sale. It helps prevent odometer fraud and protects both the buyer and seller.

- Release of Lien (Form VTR-264): If a vehicle has been financed, this form releases the lienholder's interest in the vehicle once it has been paid off. This is essential for transferring clear title to a new owner.

- Dealer's Bill of Sale: This document serves as a sales contract between the dealer and the buyer. It outlines the terms of the sale and details about the vehicle, providing legal backing for ownership transfer.

Each of these documents plays a vital role in the vehicle title and registration process, ensuring that buyers, sellers, and dealers are protected and compliant with Texas regulations. Being familiar with them can help streamline the transaction and avoid potential hurdles along the way.

Similar forms

-

VTR-121: Application for Texas Title - This form is utilized by individuals or dealers to apply for a title to a vehicle. Similar to the VTR-136, it requires information about the vehicle and the purchaser, serving as a crucial document in the title transfer process.

-

VTR-40: Vehicle Transfer Notification - When a vehicle is sold or transferred, this form notifies the Texas Department of Motor Vehicles of the change in ownership. Like the VTR-136, it protects the seller by documenting the transaction, ensuring that they are not held liable for future actions related to the vehicle.

-

VTR-130: Texas Title Application for Motor Vehicles - This application is specifically for motor vehicles that require a new title due to reasons such as moving to Texas or obtaining a vehicle from another state. It shares similarities with the VTR-136 in that both forms involve title applications and help establish ownership.

-

Form 130-U: Application for Texas Title - This document serves a similar function in processing vehicle titles and registrations, particularly for used vehicles. It requires purchaser details and vehicle information, paralleling the intent and purpose of the VTR-136 in the title issuance process.

Dos and Don'ts

When filling out the VTR 136 form, there are important practices to follow and avoid. Here's a helpful guide:

Do:- Clearly select the correct county of residence for the title application.

- Ensure that the county selection field is left blank if the dealer has pre-populated it.

- Provide accurate vehicle information, including the Vehicle Identification Number and model details.

- Sign and date the form to acknowledge your selections.

- Allow the dealer to input your county information without your confirmation.

- Submit the form if you plan to remove the vehicle from Texas immediately.

- Forget to retain a copy of the form for your records if the application is not submitted.

- Overlook filing a complaint if the dealer pre-populates your county selection.

Misconceptions

Understanding the VTR 136 form is essential for smooth transactions when purchasing a vehicle from a dealer. However, several common misconceptions can create confusion. Here are five of them, explained for clarity:

- Misconception 1: The dealer can pre-populate the county selection.

- Misconception 2: The form is required if a purchaser is removing the vehicle instantly from Texas.

- Misconception 3: The selected county impacts my vehicle’s sales tax.

- Misconception 4: The form can be submitted to any county by the dealer.

- Misconception 5: Once I fill out the form, I am locked into that county forever.

This is not true. Dealers are prohibited from filling in the county selection on the VTR 136 form. It's essential for purchasers to choose the appropriate county themselves to ensure accurate processing.

The opposite is the case. If a purchaser plans to take a vehicle out of Texas immediately, they do not need to submit the VTR 136 form. It only needs attention when the vehicle remains in Texas.

While the selected county does receive a portion of the associated fees, it doesn’t change the overall rate of sales tax. Knowing where to file can help in understanding how funds are distributed but won’t alter your tax obligations.

That’s not accurate. If a purchaser’s chosen county is closed, the dealer can submit to a different county willing to accept the application. This flexibility exists only under specific conditions.

Filling out the form does not bind you to that county indefinitely. If you move or change circumstances, you can reassess your county selection at the time of your next renewal or transfer.

Clarifying these misconceptions can prevent misunderstandings and help you navigate the vehicle purchasing process more confidently. Always refer to the official resources available, like the Texas DMV website, if in doubt.

Key takeaways

Understanding the VTR-136 form is crucial for motor vehicle dealers and purchasers alike. Here are key takeaways that will guide you in filling out and using this form effectively:

- County Selection: The form allows purchasers to select the Texas county where the title application is filed; however, dealers cannot pre-populate this information.

- Pursuant to Regulations: Texas Transportation Code, §501.0234 requires compliance with specific procedures when applying for a motor vehicle title.

- Submission Requirement: This form is to be submitted only when a purchaser designates a county of residence and that county is closed.

- Retention of Form: If the form is not submitted with a title application, it should be retained in the dealer’s vehicle records.

- Immediate Removal: There is no need to fill out this form if the vehicle will be immediately taken out of Texas.

- Tax Distribution: The selected county will receive a portion of applicable sales tax, title fees, and registration fees.

- Renewal Notices: If the purchaser’s county of residence differs from the selected county, renewal notices will be mailed from the county of residence.

- Options for Selection: Purchasers can choose from their county of residence, the county where the vehicle is bought, or where it is encumbered.

- Complaints Against Dealers: If the county selection is pre-populated by the dealer, purchasers have the option to file a complaint via the DMV website.

- Protection for Sellers: Vehicle sellers can submit a Vehicle Transfer Notification to protect themselves after selling or trading in a vehicle.

Each of these points emphasizes the importance of proper execution and compliance with the VTR-136 form. Following these guidelines can ensure a smoother transaction process while securing the interests of all parties involved.

Browse Other Templates

Deli Delicious Application - List the name and location of your highest attended school.

How Long Does It Take the Dmv to Get Notice of a Seizure? - The DMV holds the responsibility for making licensing decisions based on provided information.

Government Security Clearance Levels Chart - Time spent unemployed must also be documented as part of your history.