Fill Out Your Vtr130 Sof Form

In the process of dealing with vehicle titles, navigating the complexities can be overwhelming, especially for those seeking to establish ownership under unique circumstances. The VTR130 Sof form, officially known as the Bonded Title Application or Tax Collector Hearing Statement of Fact, serves as a critical tool for individuals aiming to obtain a bonded title for their vehicle in Texas. It captures essential vehicle details, including the Vehicle Identification Number (VIN), make, model, and purchase information, ensuring clarity in ownership verification. Additionally, the form requires applicants to provide their personal information and a detailed explanation for requesting a bonded title, which is vital for the review process. Various application questions aim to ascertain the applicant's legal status regarding the vehicle, whether it is salvage or nonrepairable, and if it meets the necessary requirements for titling. Completing this form accurately and submitting it with appropriate documentation—such as evidence of ownership and any required inspections—is the first step in resolving title issues and securing a legal title. By following the guidelines outlined in the VTR130 Sof form, applicants can work towards achieving peace of mind and rightful ownership of their vehicles.

Vtr130 Sof Example

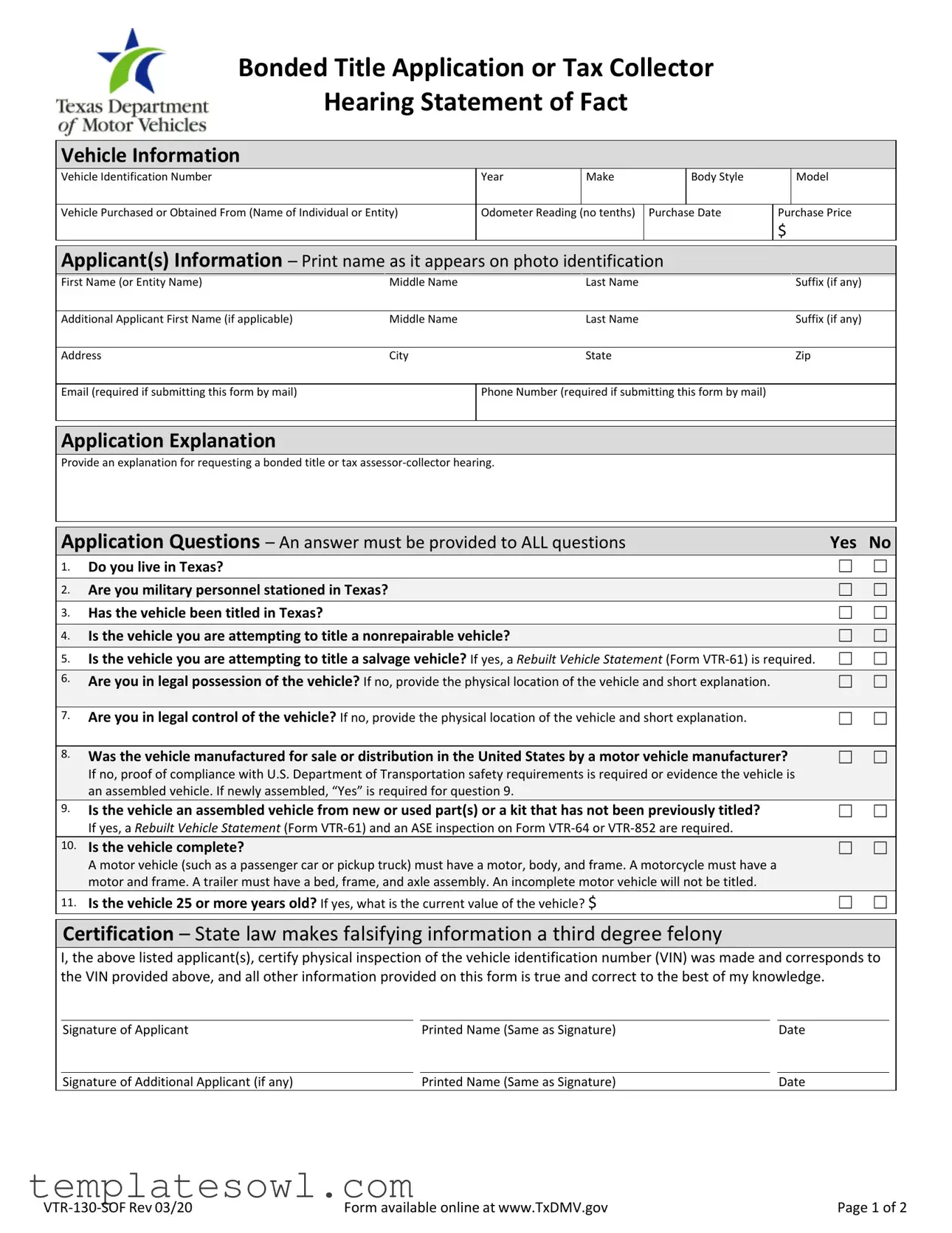

Bonded Title Application or Tax Collector

Hearing Statement of Fact

Vehicle Information

Vehicle Identification Number |

|

Year |

Make |

|

Body Style |

|

Model |

|

|

|

|

|

|

|

|

Vehicle Purchased or Obtained From (Name of Individual or Entity) |

Odometer Reading |

(no tenths) |

Purchase |

Date |

Purchase Price |

||

|

|

|

|

|

|

$ |

|

|

|

|

|||||

Applicant(s) Information – Print name as it appears on photo identification |

|

|

|||||

First Name (or Entity Name) |

Middle Name |

|

Last Name |

|

|

|

Suffix (if any) |

|

|

|

|

|

|

|

|

Additional Applicant First Name (if applicable) |

Middle Name |

|

Last Name |

|

|

|

Suffix (if any) |

|

|

|

|

|

|

|

|

Address |

City |

|

State |

|

|

|

Zip |

Email (required if submitting this form by mail)

Phone Number (required if submitting this form by mail)

Application Explanation

Provide an explanation for requesting a bonded title or tax

Application Questions – An answer must be provided to ALL questions |

Yes |

No |

|

1. |

Do you live in Texas? |

☐ ☐ |

|

2. |

Are you military personnel stationed in Texas? |

☐ |

☐ |

3. |

Has the vehicle been titled in Texas? |

☐ ☐ |

|

4. |

Is the vehicle you are attempting to title a nonrepairable vehicle? |

☐ |

☐ |

5. |

Is the vehicle you are attempting to title a salvage vehicle? If yes, a Rebuilt Vehicle Statement (Form |

☐ ☐ |

|

6. |

Are you in legal possession of the vehicle? If no, provide the physical location of the vehicle and short explanation. |

☐ ☐ |

|

|

|||

|

|

|

|

7. |

Are you in legal control of the vehicle? If no, provide the physical location of the vehicle and short explanation. |

☐ ☐ |

|

|

|

|

|

8. |

Was the vehicle manufactured for sale or distribution in the United States by a motor vehicle manufacturer? |

☐ |

☐ |

|

|||

|

If no, proof of compliance with U.S. Department of Transportation safety requirements is required or evidence the vehicle is |

|

|

|

an assembled vehicle. If newly assembled, “Yes” is required for question 9. |

|

|

9. |

Is the vehicle an assembled vehicle from new or used part(s) or a kit that has not been previously titled? |

☐ ☐ |

|

|

If yes, a Rebuilt Vehicle Statement (Form |

|

|

10. |

Is the vehicle complete? |

☐ |

☐ |

|

A motor vehicle (such as a passenger car or pickup truck) must have a motor, body, and frame. A motorcycle must have a |

|

|

|

motor and frame. A trailer must have a bed, frame, and axle assembly. An incomplete motor vehicle will not be titled. |

|

|

11. |

Is the vehicle 25 or more years old? If yes, what is the current value of the vehicle? $ |

☐ ☐ |

|

Certification – State law makes falsifying information a third degree felony

I, the above listed applicant(s), certify physical inspection of the vehicle identification number (VIN) was made and corresponds to the VIN provided above, and all other information provided on this form is true and correct to the best of my knowledge.

Signature of Applicant |

|

Printed Name (Same as Signature) |

|

Date |

|

|

|

|

|

Signature of Additional Applicant (if any) |

Printed Name (Same as Signature) |

Date |

Form available online at www.TxDMV.gov |

Page 1 of 2 |

Bonded Title Application or Tax Collector Hearing Statement of Fact

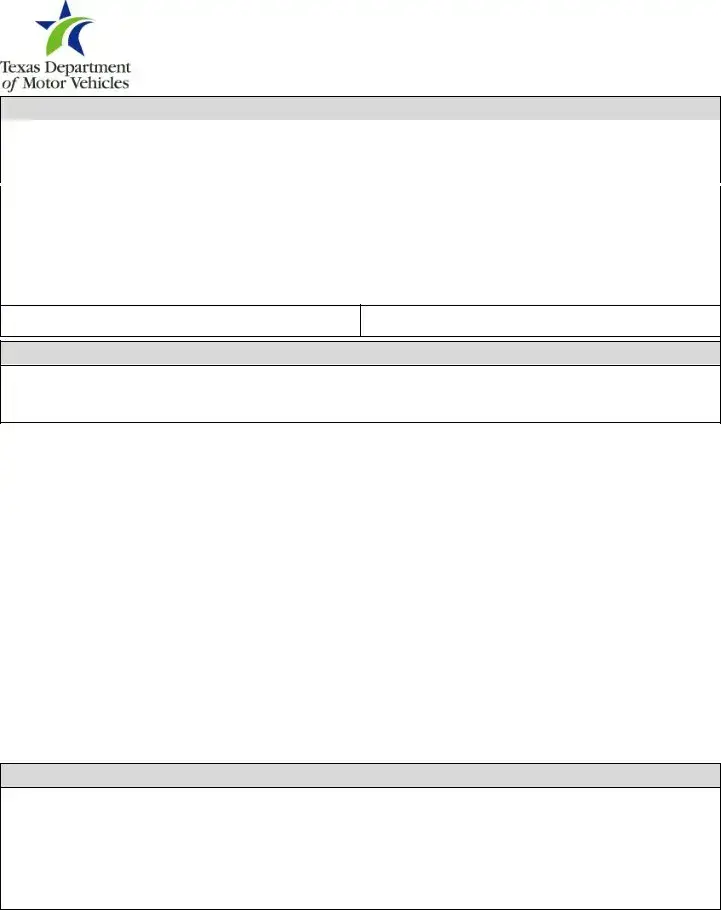

Part 1: Requirements for Obtaining a Notice of Determination for a Bonded Title

Complete page 1 of this form and submit the following to a TxDMV Regional Service Center:

1.Both pages of this form, Bonded Title Application or Tax Collector Hearing Statement of Fact

2.The $15.00

3.Any evidence of ownership (such as a title, bill of sale, or canceled check) and any other available documentation.

4.The following additional documents, if applicable:

•Rebuilt Vehicle Statement (Form

•ASE inspection on Form

5.If the vehicle does not have a Texas record, a vehicle identification number inspection completed by law enforcement on Form

6.If mailing this application to a TxDMV Regional Service Center, an email or phone number must be provided.

Each person signing this form must provide a copy of current government issued photo identification (ID). An ID that is expired not more than 12 months is considered current. An agent of the applicant must provide 1) a letter of signature authority on letterhead, printed business card, or an employee identification (all may be copies) and 2) a copy of their current government issued photo ID.

You may be required to leave this application and any additional documentation for processing.

Determining the Value of a Vehicle

Vehicle value is determined by the department using the Standard Presumptive Value (SPV) calculator found on the department’s website at www.TxDMV.gov. If the SPV calculator does not return a value, the department will use a value from a national reference guide. If the department is unable to determine a value, you must obtain an appraisal from a licensed dealer or licensed insurance adjuster on a Motor Vehicle Appraisal for Tax Collector Hearing / Bonded Title (Form

Part 2: Filing an Application for Texas Title and/or Registration

After this form is processed by a TxDMV Regional Service Center, the following must be submitted to your county tax assessor- collector’s office for the bonded title to be processed or for the tax

1.Application for Texas Title and/or Registration (Form

2.Both pages of this form, Bonded Title Application or Tax Collector Hearing Statement of Fact

3.Notice of Determination for a Bonded Title or Tax

4.If proceeding with a bonded title, the original bond

5.Any evidence of ownership (such as a title, bill of sale, or canceled check) and any other available documentation.

6.If applying for registration:

•Vehicle Inspection Report issued by a Texas vehicle safety inspection station or

•Vehicle Identification Number Certification (Form

7.Proof of financial responsibility (liability insurance) in the applicant’s name if applying for registration.

8.Acceptable government issued photo ID (such as a driver license, ID card, or U.S. or foreign passport).

9.A certified weight certificate for any out of state commercial vehicle or any vehicle whose weight cannot be determined.

TxDMV Department Use Only

TxDMV Representative |

|

Date |

|

MVDI checked? |

Texas record found? |

If no Texas record, STOLEN checked? |

|||||||

|

|

|

|

|

☐ Yes ☐ No |

☐ Yes |

☐ No |

☐ Yes |

☐ No |

||||

If no Texas record, ISO Claim Search (VIN decoding) |

checked? |

|

If no Texas record, was |

Is there a lien less than 10 years old? |

|||||||||

|

☐ Yes |

☐ No |

|

|

|

☐ Yes |

☐ No |

☐ Yes |

☐ No |

||||

NMVTIS checked? |

NMVTIS brands found? |

|

|

|

|

|

|

|

|

|

|

||

☐ Yes |

☐ None |

☐ Salvage ☐ Junk |

☐ Flood Damage ☐ Replica |

☐ Rebuilt Salvage ☐ Reconstructed |

|||||||||

☐ No |

☐ Manufacturer’s Buyback |

☐ Other: |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

||||||

TxDMV $15 receipt for |

administrative processing fee provided? |

|

|

|

|

||||||||

|

☐ Yes |

☐ No |

|

|

|

|

|

☐ Yes |

☐ No |

|

|

||

Vehicle Value Established by: |

|

|

|

Vehicle |

Value |

|

|

Bond Amount (vehicle value x 1.5) |

|

|

|||

☐ SPV ☐ Guide ☐ Appraisal ☐ 25+ years old |

|

$ |

|

|

|

|

$ |

|

|

|

|||

Form available online at www.TxDMV.gov |

Page 2 of 2 |

Form Characteristics

| Fact | Description |

|---|---|

| Form Purpose | The VTR-130-SOF serves as a Bonded Title Application or Tax Collector Hearing Statement of Fact in Texas. |

| Submission Requirements | To submit the form, applicants must include ownership evidence, pay a $15 processing fee, and provide additional documents if applicable. |

| Governing Laws | This form is regulated under the Texas Transportation Code, specifically for situations involving vehicle titles. |

| Application Questions | All questions must be answered, addressing factors like residency in Texas and legal possession of the vehicle. |

| Acknowledgment | Applicants must certify that all information provided is true, with falsification constituting a third-degree felony under Texas law. |

Guidelines on Utilizing Vtr130 Sof

Completing the VTR130 SOF form is essential for securing a bonded title or initiating a tax assessor-collector hearing concerning your vehicle. Follow these steps carefully to ensure your application is accurate and complete.

- Gather necessary information about your vehicle, including the Vehicle Identification Number (VIN), year, make, model, odometer reading, purchase date, and purchase price.

- Fill out the vehicle information section on the form. Include the name of the individual or entity from whom you purchased or obtained the vehicle.

- Provide your information as the applicant. Print your name exactly as it appears on your photo ID.

- If there is an additional applicant, fill in their information as well.

- Enter your mailing address, city, state, and zip code. Include your email address and phone number; both are required if you submit the form by mail.

- Write a brief explanation of why you are requesting a bonded title or a tax assessor-collector hearing.

- Answer all application questions. Ensure that you provide a response of "Yes" or "No" for each question listed.

- Sign certifying that all information provided is true. Include the date and print your name beneath your signature. If applicable, have the additional applicant do the same.

- Submit both pages of the form along with the required supporting documentation to a TxDMV Regional Service Center.

- Pay the $15 non-refundable processing fee using cash, check, or money order—but do not mail cash.

- Ensure you attach any evidence of ownership and other relevant documents, such as a Rebuilt Vehicle Statement or Vehicle Inspection Report, if applicable.

After submission, a TxDMV representative will process your application. Next, you’ll need to follow up with your county tax assessor-collector for any additional steps required to complete the title transfer or hearing process.

What You Should Know About This Form

What is the purpose of the VTR130 Sof form?

The VTR130 Sof form, officially known as the Bonded Title Application or Tax Collector Hearing Statement of Fact, is used for individuals seeking to obtain a bonded title for a vehicle in Texas. This form provides necessary vehicle and applicant information, as well as an explanation for the title request. Additionally, it includes a series of questions that must be answered to determine eligibility for the bonded title process. Submitting this form correctly can facilitate the issuance of a title or initiate a tax collector hearing if needed.

What information is required to complete the VTR130 Sof form?

To complete the VTR130 Sof form, applicants need to provide specific details about both the vehicle and themselves. This includes the vehicle identification number (VIN), year, make, model, and odometer reading. Information about the applicant(s) such as names, address, email, and phone number is also required. Additionally, applicants must provide an explanation for their request, answer a series of questions regarding their residency and vehicle status, and certify that all information is accurate. Supporting documents may also need to be submitted alongside the form.

What are the fees associated with submitting the VTR130 Sof form?

Submitting the VTR130 Sof form requires a non-refundable processing fee of $15. This fee can be paid in cash, check, or money order when submitting the application to a TxDMV Regional Service Center. It is important to avoid mailing cash. Applicants should ensure they meet any additional documentation requirements based on their specific situation to avoid delays.

What happens after the form is submitted?

Once the VTR130 Sof form is submitted and processed by a TxDMV Regional Service Center, applicants must follow up by submitting further documentation to their county tax assessor-collector’s office to complete the bonding process or to schedule a hearing. This includes submitting the application for Texas Title and/or Registration and any required evidence of ownership or inspection reports. The processing of the bonded title will not be completed until all required steps have been satisfied and documentation reviewed.

Common mistakes

When filling out the VTR-130-SOF form, many applicants make critical mistakes that can delay their application process. One common error involves missing or incorrect Vehicle Identification Numbers (VIN). This number is crucial for identifying your vehicle. If it’s mistyped, your application can be rejected, causing frustration and unnecessary waiting time.

Another frequent mistake occurs in the Vehicle Information section. Applicants sometimes leave out vital details, such as the year, make, and model. This lack of information can prevent your application from moving forward. Remember, every field is important, and providing incomplete information can lead to delays.

It's also essential to pay attention to the Odometer Reading. Many people forget that the reading should be inputted without tenths. Even a small detail like this can lead to complications, so make sure to follow the instructions closely.

When listing your name and address, applicants occasionally make spelling errors or use nicknames. It’s important to print your name as it appears on your photo identification. If the names don’t match, it can create issues during processing.

Missing signatures are another common oversight. It seems simple, but many forget to sign the Certification section or provide the printed name that matches their signature. This omission is a surefire way to receive a rejection notice.

Providing contact information can also be a pitfall. Some forget to include an email or phone number when submitting by mail, which is required. Ensure this information is not overlooked. If something needs clarification, your contact details are vital for the agency to reach you.

In the section regarding whether the vehicle has been titled in Texas, confusion often arises. Applicants may answer incorrectly, thinking the previous owner’s title still counts. If you are unsure, verify the vehicle's title history before proceeding.

Checking the application questions can reveal another potential problem. Some applicants skip answering these questions or fail to provide explanations when answering "no." Each question must be answered, and if you answer "no," an explanation is often necessary.

Lastly, neglecting to gather and submit required supporting documents can lead to rejection. Providing insufficient evidence of ownership or lacking additional documentation like the Rebuilt Vehicle Statement when necessary is a frequent stumbling block. Make a checklist to ensure that you submit everything needed for a smooth process.

Documents used along the form

When applying for a bonded title in Texas, various forms and documents may accompany the VTR-130-SOF form. Each document serves a specific purpose in the process, ensuring that all necessary information is collected efficiently and accurately. Below is a list of commonly used forms you may need to consider.

- Application for Texas Title and/or Registration (Form 130-U) - This form initiates the title and registration process for a vehicle in Texas. It requires basic vehicle information and details about the owner.

- Notice of Determination for a Bonded Title (Form VTR-130-ND) - Issued by the TxDMV Regional Service Center, this notice confirms the decision regarding the bonded title application and includes all related documentation.

- Rebuilt Vehicle Statement (Form VTR-61) - Required if the vehicle has been salvaged and repaired. This statement provides verification of the vehicle's restoration and necessary compliance with safety standards.

- ASE Inspection Forms (VTR-64 or VTR-852) - These forms are needed for vehicles that have been newly assembled. They ensure that the vehicle meets all safety inspection requirements.

- Vehicle Identification Number Inspection (Form VTR-68-A) - This form is necessary when a vehicle does not have a Texas record. A law enforcement officer must complete it to verify the VIN.

- Proof of Financial Responsibility - This document shows that the applicant has liability insurance in their name, which is mandatory when applying for vehicle registration.

- Government Issued Photo ID - Acceptable forms of identification include a driver's license, ID card, or passport. This ID must accompany the application to verify the applicant’s identity.

- Motor Vehicle Appraisal for Tax Collector Hearing/Bonded Title (Form VTR-125) - Required when the vehicle’s value cannot be established through other means. It must be completed by a licensed dealer or insurance adjuster.

Collecting these documents can streamline the bonded title application process. Making sure all requirements are met will help avoid unnecessary delays and ensure compliance with Texas motor vehicle laws.

Similar forms

- Application for Texas Title and/or Registration (Form 130-U) – This form serves as the primary application required to request a title or register a vehicle in Texas. Similar to the VTR-130-SOF, it collects vehicle details, owner information, and relevant circumstances surrounding the title request. Both forms must be submitted to the tax assessor-collector's office in a title application context.

- Rebuilt Vehicle Statement (Form VTR-61) – This document is necessary if the vehicle has been classified as salvage and is being repaired or reconstructed. Like the VTR-130-SOF, it ensures that the responsible parties certify the condition and ownership status of the vehicle, emphasizing proper documentation for the approval of a bonded title.

- ASE Inspection Forms (VTR-64 or VTR-852) – These inspection forms are required for newly assembled vehicles, confirming that they meet safety standards. While the VTR-130-SOF collects information about the vehicle's status and ownership, these inspection forms aim to provide evidence of the vehicle's compliance with regulatory requirements before titling.

- Vehicle Identification Number Inspection (Form VTR-68-A) – This form is needed if the vehicle lacks a Texas title record. Like the VTR-130-SOF, it verifies the vehicle’s identity through its VIN, ensuring that all submitted information is accurate and legitimate before proceeding with any title application.

- Motor Vehicle Appraisal for Tax Collector Hearing / Bonded Title (Form VTR-125) – This document is used to obtain a professional appraisal for vehicles valued through the SPV calculator. The process is similar to that of the VTR-130-SOF, in which verifiable financial documents and ownership evidence play crucial roles in substantiating a request for a bonded title.

Dos and Don'ts

- Do read all instructions carefully before filling out the VTR-130-SOF form.

- Don’t leave any questions unanswered; provide responses to all questions.

- Do provide accurate vehicle information, including the Vehicle Identification Number (VIN).

- Don’t submit cash; use a check or money order for the application fee.

- Do include all necessary supporting documents, such as proof of ownership.

- Don’t forget to sign the application; your signature is required.

- Do ensure your contact information is current, especially if submitting by mail.

Misconceptions

Understanding the VTR-130 SOF form, which is used for bonding titles in Texas, can be challenging. Below is a list of common misconceptions about this form:

- It’s only for salvage vehicles. Many believe the VTR-130 SOF form is exclusively for salvage vehicles. In reality, it is also applicable for vehicles without titles, assembled vehicles, and those over 25 years old.

- You need a lawyer to complete the form. There’s a misconception that legal expertise is necessary to fill out the VTR-130 SOF. While it's a good idea to consult an expert if you have specific questions, most applicants can complete it themselves using the guidance provided in the instructions.

- All questions on the form must be answered 'yes.' Some applicants worry that all application questions should be answered affirmatively. However, the key is to answer each question accurately based on your unique situation, whether that means 'yes' or 'no.'

- Submitting online is the only option. Many think the form can only be submitted online, but it can be mailed to a TxDMV Regional Service Center. Additionally, in-person submission is often possible.

- Only cash payments are accepted. While cash is one option, the application fee of $15 can also be paid via check or money order. Therefore, there’s flexibility in payment methods.

- You can’t submit additional documents later. Some individuals assume that all documentation must be submitted at once. In fact, you can provide additional documents if required or if new information comes to light.

- The process is the same for every vehicle. This form does not operate under a one-size-fits-all approach. The requirements may vary depending on the type of vehicle, ownership history, and specific circumstances surrounding each case.

By addressing these misconceptions, applicants can navigate the bonded title process with greater confidence and clarity.

Key takeaways

When filling out the VTR-130-SOF form, keep these important points in mind:

- Ensure that all vehicle information is complete. This includes the Vehicle Identification Number (VIN), purchase date, and odometer reading without tenths.

- Provide accurate applicant information. Print names as they appear on photo identification, including any additional applicants.

- Clearly explain why you need a bonded title or a tax collector hearing. A well-stated reason helps in the decision-making process.

- Answer all application questions honestly. All questions must have an answer, even if the answer is "no".

- Include necessary documents when submitting the form. This could be titles, bills of sale, or any other evidence of ownership.

- Be prepared to submit additional paperwork if your vehicle meets certain criteria, such as being a salvage or newly assembled vehicle.

- Submit the required non-refundable fee of $15. This fee can be paid by cash, check, or money order, but do not mail cash.

Browse Other Templates

Frannie Mae - Photographs and appropriate invoices need to be collected to support the reimbursement request.

Dmv Forms Florida - Contact phone numbers and fax numbers are needed.