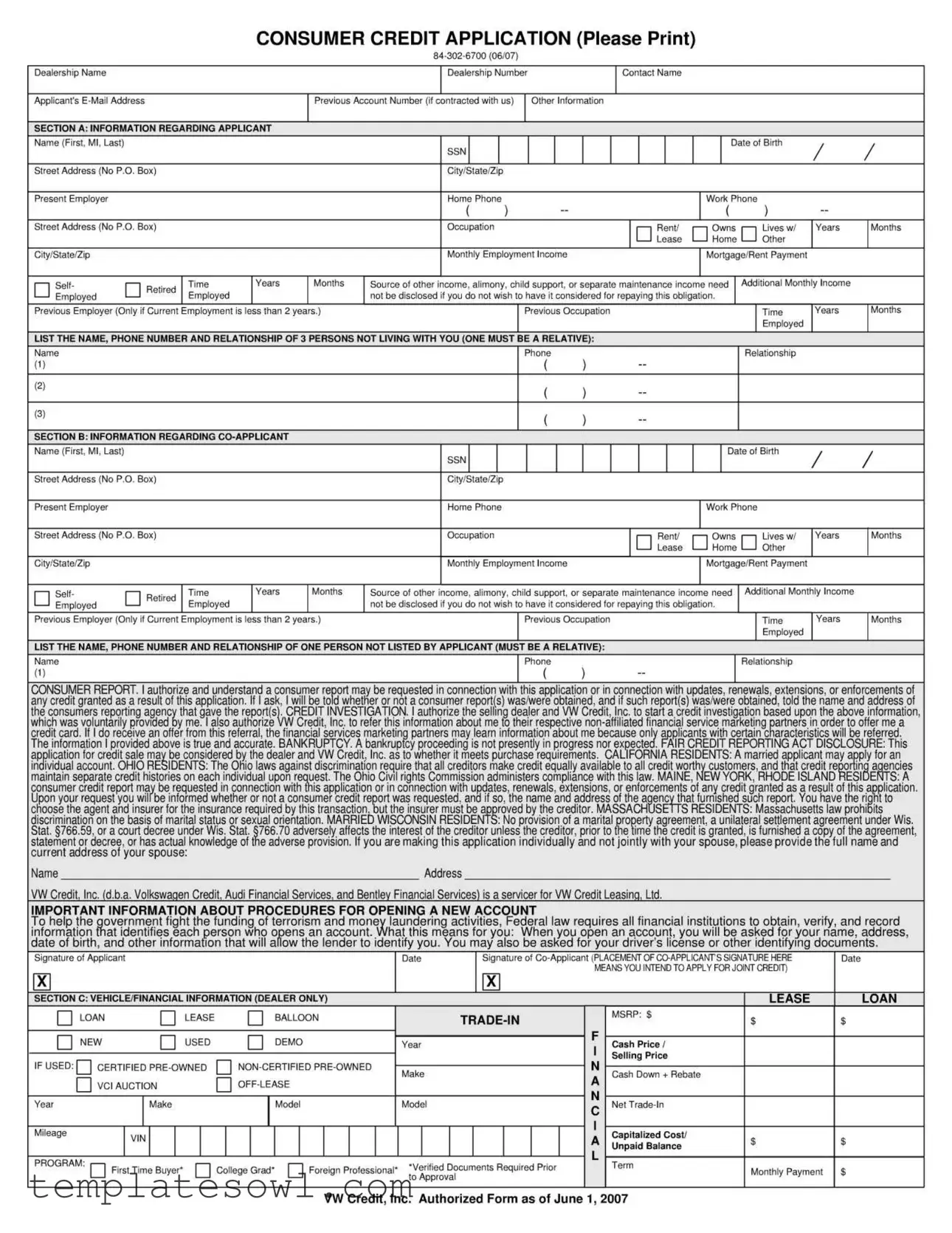

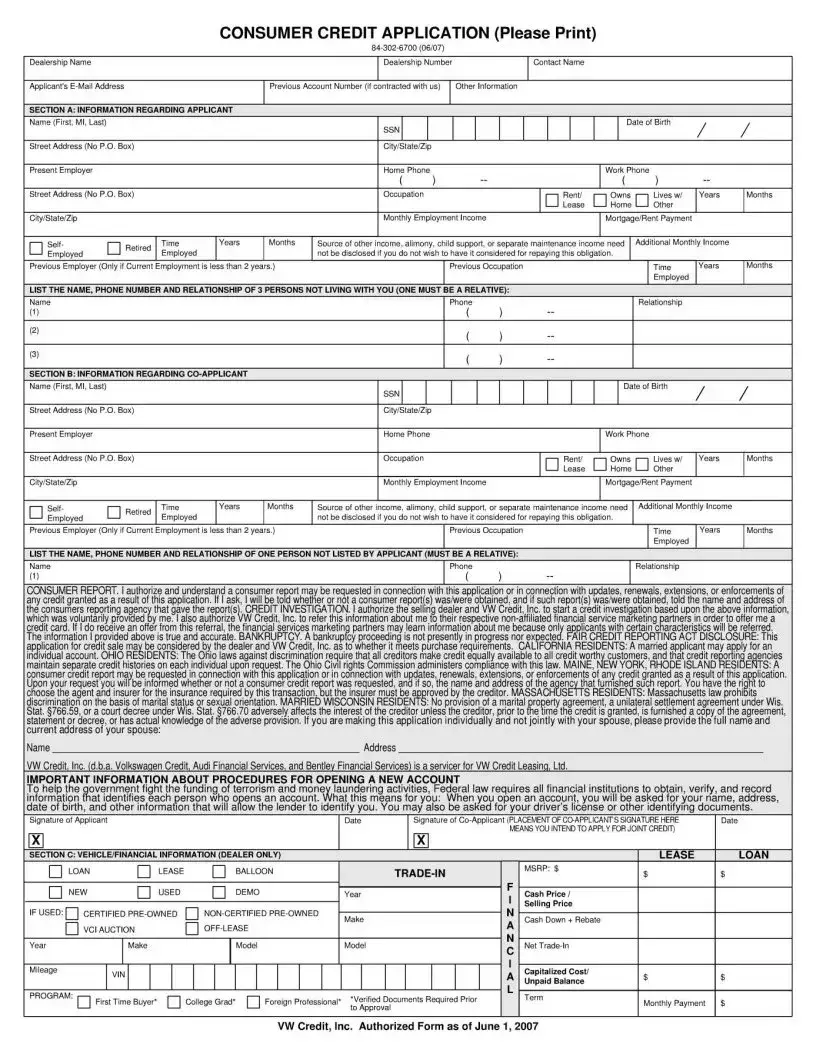

Fill Out Your Vw Credit Application Form

The VW Credit Application form is a vital document for individuals seeking to finance their vehicle purchases through Volkswagen Credit, Inc. It is structured to gather essential information about the applicant and, if applicable, a co-applicant. The first section is dedicated to personal details such as the applicant’s name, address, and employment information, as well as their monthly income and housing status. If the applicant has been employed for less than two years, details regarding previous employment are required. Additionally, the form requests contact information for three individuals who do not live with the applicant, reinforcing the need for accountability and creditworthiness. As credit applications often involve financial investigations, the form includes authorizations for credit checks and specifies that a consumer report may be obtained. Specific sections cater to various states’ requirements, emphasizing legal compliance rooted in anti-discriminatory laws. The document also addresses particulars about vehicle financing options, distinguishing between leasing and purchasing, which underpins the financing process. Moreover, regulatory stipulations around identity verification reflect broader governmental mandates to combat financial fraud and ensure accurate record-keeping in the lending ecosystem. By assembling all of this information, the VW Credit Application form plays a crucial role in the decision-making process for both the dealer and the financial institution.

Vw Credit Application Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Applicant Information | The form collects comprehensive details about the applicant, including personal information, employment status, and financial history. |

| Consumer Report Authorization | The applicant authorizes VW Credit, Inc. to obtain a consumer report for credit assessments, providing transparency regarding the reporting agency used. |

| State-Specific Requirements | California residents can apply for individual accounts, while Ohio mandates equal credit availability and separate credit histories upon request. |

| Bankruptcy Disclosure | Applicants must disclose if a bankruptcy proceeding is currently ongoing or anticipated, ensuring credit decisions are informed. |

| Federal Compliance | To combat terrorism and money laundering, applicants will need to provide identifying information when opening a new account, as required by federal law. |

Guidelines on Utilizing Vw Credit Application

Once you have the VW Credit Application form ready, the next step is to fill it out accurately. Make sure you have all necessary information at hand. Each section requires your current details, employment status, and some personal contacts. Pay attention to the information you provide, as it will be used for credit consideration.

- Start by writing the dealership name at the top of the form.

- In the first section, fill in your name in the format of First, Middle Initial, and Last.

- Enter your street address. Remember, do not use a P.O. Box.

- Provide the name and address of your present employer. Again, no P.O. Box.

- Fill in the city, state, and zip code for each address you've entered.

- List your Social Security Number (SSN) and home phone number.

- Write your date of birth and occupation.

- Select whether you rent, own, live with someone, or lease your home.

- Provide details about your monthly employment income and mortgage or rent payment.

- If you have been employed for less than two years, fill in details about your previous employer and occupation.

- List the name, phone number, and relationship of three people who do not live with you. One must be a relative.

- Now, move to the co-applicant section. Fill in their name in the same format as yours.

- List their street address and employer, just as you did for yourself.

- Provide their SSN, home phone, and occupation.

- Indicate whether the co-applicant rents or owns their home.

- Fill in their monthly income and mortgage or rent payment details.

- If applicable, provide information on the co-applicant's previous employer and occupation.

- List the name, phone number, and relationship of one relative who is not already mentioned.

- Read and understand the authorization sections regarding consumer reports and credit investigations.

- Sign and date the application as the applicant.

- If there is a co-applicant, they should sign and date in the designated area.

After completing these steps, double-check your entries for accuracy. This will help ensure a smoother processing of your application.

What You Should Know About This Form

1. What is the VW Credit Application form used for?

The VW Credit Application form is used to collect essential information from individuals looking to obtain credit for the purchase or lease of a Volkswagen vehicle. This application helps VW Credit assess your creditworthiness and determine if you qualify for financing options.

2. Who needs to fill out this application?

Both the primary applicant and the co-applicant, if applicable, must fill out the VW Credit Application form. This ensures that all necessary information about each individual's financial situation and credit history is evaluated during the application process.

3. What information is required in the application?

You'll need to provide personal information such as your name, address, Social Security number, employment details, monthly income, and housing status. Additionally, contact information for three people not living with you, including one relative, is required. If there is a co-applicant, their information will also be needed.

4. Is my credit report checked when I apply?

Yes, when you submit the VW Credit Application, a credit report will be requested to assess your credit history. This report helps VW Credit make informed decisions regarding your credit application.

5. Can I apply if I have a bankruptcy on my record?

While having a bankruptcy does not automatically disqualify you, it's essential to disclose that a bankruptcy proceeding is not currently in progress nor expected. Each application will be evaluated on its own merits, considering your financial history and current circumstances.

6. What if I do not wish to disclose all income sources?

If you have sources of income such as alimony or child support that you do not want considered for repayment, you are not required to disclose these. Your application can still be processed without providing this information, but all other required details must be complete and accurate.

7. Do I need to provide any identification?

Yes, when you open an account, you'll be asked for information to verify your identity. This may include your driver's license or other identifying documents. This step is part of federal laws aimed at preventing fraud and money laundering.

8. How do I know if my application is approved?

Once you've submitted the application, VW Credit will review it, perform a credit check, and then notify you of the outcome. They will contact you directly, typically via email or phone, to inform you about the approval status and any next steps.

9. What happens to my information after I submit the application?

Your information will be kept confidential but will be used to process your application and potentially referred to VW Credit's financial service marketing partners for credit offers. VW Credit takes your privacy seriously and complies with relevant regulations related to consumer reporting.

Common mistakes

When filling out the VW Credit Application form, many applicants inadvertently make mistakes that can delay or complicate the financing process. One common error is not providing complete or accurate personal information. Missing details such as a full name, correct address, or Social Security number can lead to confusion during identity verification. Always double-check the accuracy of the information provided.

Another frequent mistake is the omission of the phone number for the applicant and co-applicant. This information is crucial for communication between the dealership and the applicant. Without a valid phone number, the dealership may struggle to reach out for any updates or additional information needed to process the application efficiently.

Many applicants underestimate the importance of including employment details. Failing to list the current employer, or providing an incorrect employment duration, can raise red flags during the credit investigation. It is essential to ensure that the employment history is accurate and detailed, as this information plays a significant role in assessing creditworthiness.

Some applicants ignore the section regarding additional income. If there are sources of income that could positively impact the financing decision—such as child support or rental income—these should be disclosed. While it is optional to include this information, it can provide a fuller picture of the applicant's financial situation, which may enhance the approval chances.

Another common oversight is forgetting to list emergency contacts. The application requires the names and phone numbers of individuals not living with the applicant. Providing this information helps verify identity and can be beneficial in case follow-up communication is needed.

Inaccurately marking the ownership status of the applicant's residence also leads to mistakes. Whether renting, owning, or leasing, accurately depicting housing arrangements is necessary. Misrepresentation can affect both the application review and the terms of the loan offered.

Some people may rush and submit the application without reviewing it thoroughly. This leads to typos and errors that could have easily been corrected. Take the time to review all entries carefully. A quick review can often prevent unnecessary delays caused by avoidable mistakes.

Ignoring the required signatures is another significant error. Both the applicant and co-applicant must provide signatures where indicated. Missing signatures can result in outright rejection of the application, so ensure all necessary places are signed prior to submission.

Finally, applicants often forget to disclose prior account numbers if they have contracted with the lending service before. Filling in this section, if applicable, helps the lending institution access existing records, expediting the processing of the current application.

Documents used along the form

The VW Credit Application form is a primary document required when applying for financing through Volkswagen Credit. However, several additional documents may be required to support the application process. Each of these forms plays a crucial role in establishing identity, confirming financial stability, or providing necessary information to complete the financing groundwork.

- Proof of Income: This document verifies an applicant's employment and earnings. It may include recent pay stubs, tax returns, or bank statements demonstrating a stable income.

- Credit Report Authorization: This form allows creditors to access the applicant's credit history. It's essential for evaluating the applicant's creditworthiness and previous financial behavior.

- Vehicle Information Sheet: Information about the specific vehicle being financed, including make, model, year, and vehicle identification number (VIN). This document links the loan to the specific asset.

- Identification Documents: A driver's license or state ID is typically required to verify the applicant's identity and residency. This helps prevent fraud and ensures compliance with financial regulations.

- Co-Applicant Agreement: If applying with a co-applicant, this form outlines the terms of shared liability for the loan. It establishes that both parties are equally responsible for repaying the debt.

- Proof of Residence: Documentation such as a utility bill or lease agreement may be required to confirm the applicant's current address. It's an important verification step for lenders.

- Insurance Information: Proof of insurance is often necessary, showing that the applicant is prepared to protect the financed vehicle. Lenders want to ensure their investment is safeguarded.

- Trade-In Documentation: If the applicant is trading in a vehicle, this document might include the title, registration, and valuation of the trade-in vehicle. It’s vital for determining the final loan amount.

- Fair Credit Reporting Act Notice: This document informs applicants about their rights regarding credit reporting and how their information may be used. It outlines protections available to consumers under the law.

Gathering these forms and documents can streamline the application process for financing through Volkswagen Credit, making it easier to assess eligibility and finalize the loan. Ensuring all required forms are completed accurately will ultimately facilitate a smoother transaction.

Similar forms

Loan Application Form: Similar to the VW Credit Application, a loan application form requires detailed personal and financial information from the applicant. Both documents assess the applicant's ability to repay debt, including employment and income details, and may also involve credit checks to evaluate creditworthiness.

Credit Card Application Form: This document shares similarities with the VW Credit Application by collecting personal information, income data, and consent for a credit inquiry. Both forms are used to evaluate an applicant’s financial status and facilitate a lending decision.

Auto Financing Application: Like the VW Credit Application, this form is specifically designed for individuals seeking financing for a vehicle purchase. It requires information about the applicant’s credit history, employment, and financial obligations, ensuring that lenders can assess the applicant’s financial viability.

Personal Loan Application: This application is similar in that it requests comprehensive financial and personal information from the borrower. Both the VW Credit Application and personal loan applications focus on assessing the borrower’s ability to manage new debt and may include provisions for credit report checks.

Dos and Don'ts

When filling out the VW Credit Application form, it is crucial to ensure accuracy and clarity. Here’s a list of things to keep in mind:

- Do print clearly to ensure all information is legible.

- Do provide accurate and truthful information on all sections of the form.

- Do include all required personal details, including your full name, address, and Social Security Number.

- Do review the form for any errors or omissions before submission.

- Don't use a P.O. Box for your address; provide a physical street address instead.

- Don't leave any sections blank; incomplete applications may lead to delays.

- Don't disclose unnecessary information regarding other income sources if you do not wish it to be considered.

- Don't forget to sign and date the application; a missing signature can invalidate your submission.

Misconceptions

When it comes to the VW Credit Application form, several misconceptions can lead to confusion for applicants. Here are five common myths, along with explanations that provide clarity:

- Misconception 1: The form only applies to car purchases.

- Misconception 2: Submitting the form guarantees approval.

- Misconception 3: Only first-time buyers need to provide extensive information.

- Misconception 4: Income verification can be skipped if employment is stable.

- Misconception 5: Personal references are not necessary on the application.

This is untrue. The VW Credit Application form can also be used for leasing options, so it caters to both purchases and leases.

While the form is a crucial part of the process, submitting it does not guarantee that credit will be approved. Approval depends on various factors, including credit history and income.

This is misleading. All applicants, whether first-time buyers or returning customers, must provide comprehensive information to accurately assess creditworthiness.

It's important to provide income verification regardless of employment stability. This documentation helps lenders ensure that applicants can meet their obligations.

This is false; personal references play a role in the application process, especially for new credit. Providing three references helps lenders assess the applicant’s accountability and reliability.

Key takeaways

When filling out the VW Credit Application form, a few key points are essential for a smooth experience. Understanding each section helps ensure accurate information is provided.

- Accuracy is crucial: Ensure all details, like your name, address, and employment information, are correct. Inaccuracies can delay the processing of your application.

- Required documentation: Be prepared to provide a valid form of identification, such as a driver's license. This information helps verify your identity.

- Co-applicant information: If you are applying with someone else, be sure to complete their section as thoroughly as your own. This includes providing their relationship to you and their employment details.

- Disclosure of income: Report all sources of income openly. You are not required to disclose specific amounts for certain types of income, like alimony, if you prefer not to have it considered.

This application process is designed to be straightforward. Taking the time to fill out the form accurately can make a significant difference.

Browse Other Templates

Florida Physical Form - The form closure requires signatures from both students and their guardians, affirming the truthfulness of the information provided.

1300/22 - Be mindful deadlines when submitting the Navpers 1306 7 to maintain your military trajectory.

Water Pumps Maintenance - This inspection can ultimately save lives and property by ensuring fire pump readiness.