Fill Out Your W 147Q Form

The W 147Q form serves a crucial purpose for individuals living in shared housing arrangements, specifically in verifying the residency and housing costs of a secondary tenant. This form is typically utilized by a primary tenant, who is the individual listed on a lease or rental agreement, to provide necessary details about their living situation. In the document, the primary tenant must confirm various aspects, including their name, the name of the secondary tenant, and the address of the residence. The form includes sections that require clarification on the monthly rent contributed by the secondary tenant, as well as the entity to which the rent is paid—be it directly to the landlord or to the primary tenant themselves. Additionally, the form addresses utility expenses, asking whether the secondary tenant pays separately for heating, air conditioning, or other utilities, which can often be a source of confusion in shared living environments. Lastly, it ensures that the primary tenant affirms their statement under penalty of perjury, attaching any supporting documentation, like a lease agreement, to validate their status as the primary tenant. Understanding the W 147Q form is essential for managing shared housing effectively and ensuring compliance with local housing regulations.

W 147Q Example

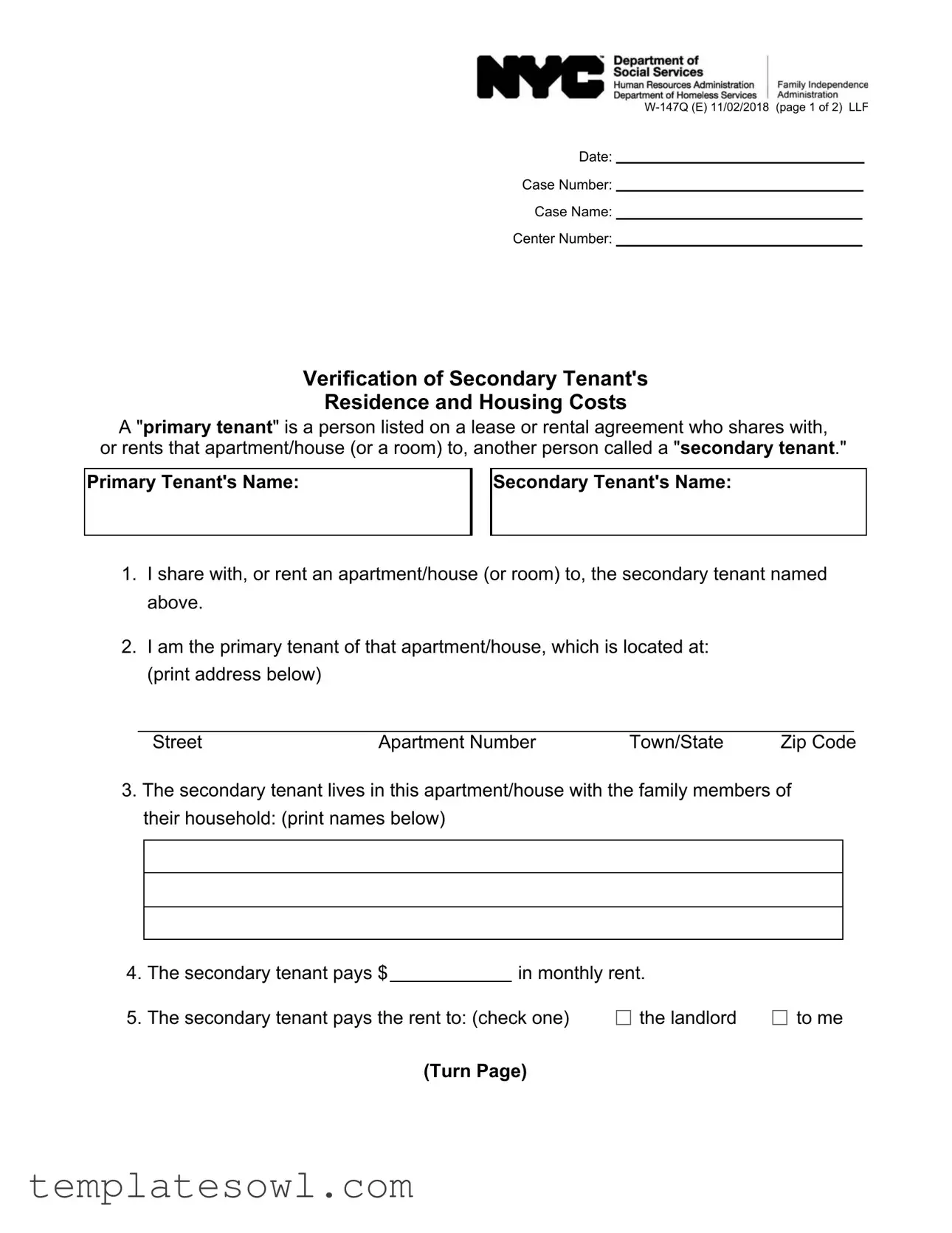

Date:

Case Number:

Case Name:

Center Number:

Verification of Secondary Tenant's

Residence and Housing Costs

A "primary tenant" is a person listed on a lease or rental agreement who shares with, or rents that apartment/house (or a room) to, another person called a "secondary tenant."

Primary Tenant's Name:

Secondary Tenant's Name:

1.I share with, or rent an apartment/house (or room) to, the secondary tenant named above.

2.I am the primary tenant of that apartment/house, which is located at: (print address below)

Street |

Apartment Number |

Town/State |

Zip Code |

3.The secondary tenant lives in this apartment/house with the family members of their household: (print names below)

4.The secondary tenant pays $ in monthly rent.

in monthly rent.

5. The secondary tenant pays the rent to: (check one) |

the landlord |

to me |

(Turn Page)

Human Resources Administration |

|

LLF |

Family Independence Administration |

|

6. The secondary tenant's rent is paid to (must include address):

Name

StreetApartment Number Town/State Zip Code

7. Does the secondary tenant pay an amount separate from the rent for heating or air

conditioning? |

Yes |

No |

If no, does the secondary tenant pay an amount separate from the rent for other

utilities that are not heating or air conditioning? |

Yes |

No |

8.My telephone number is :

9.Attached is a copy of my lease or other documents proving that I am the primary tenant.

I affirm under penalty of perjury that the information I have given on this form is correct and complete to the best of my knowledge.

Signature of Primary Tenant |

Date |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | The form is titled W-147Q and is used to verify the residence and housing costs of a secondary tenant. |

| Governing Law | This form is governed by local housing regulations and tenant laws applicable in the jurisdiction where the property is located. |

| Primary Tenant Definition | A primary tenant is an individual named on a lease or rental agreement who shares a living space with a secondary tenant. |

| Secondary Tenant Information | The form requires the primary tenant to provide details about the secondary tenant, including their name and residence address. |

| Rent Payment Details | The primary tenant must indicate how much the secondary tenant pays in rent and identify the recipient of those payments. |

| Utility Costs | The form asks whether the secondary tenant pays separately for heating, air conditioning, or other utilities. |

| Verification Requirement | The primary tenant must attach a copy of their lease or other proof of primary tenancy when submitting the form. |

Guidelines on Utilizing W 147Q

Once the W-147Q form is completed, it is essential to submit it to the appropriate agency. Ensure all information is accurate and supported by required documentation, as this will expedite processing.

- Begin by writing the Date at the top of the form.

- Next, fill in the Case Number and Case Name.

- Record your Center Number.

- Enter the Primary Tenant's Name and the Secondary Tenant's Name in the designated spaces.

- Confirm the relationship by marking the statement that you share or rent an apartment or house to the secondary tenant.

- Provide the address of the apartment or house where the secondary tenant resides, including Street, Apartment Number, Town/State, and Zip Code.

- List the names of the family members of the secondary tenant who live in the same apartment or house.

- Indicate the monthly rent amount that the secondary tenant pays.

- Mark whether the rent is paid to the landlord or to you.

- For the rent receiver, provide their name and address, ensuring to include any necessary details like Street, Apartment Number, Town/State, and Zip Code.

- Answer whether the secondary tenant pays separately for heating or air conditioning by marking Yes or No.

- If they do not pay for heating or air conditioning, indicate whether they pay for any other utilities by selecting Yes or No.

- Fill in your telephone number.

- Attach a copy of your lease or any other document that proves you are the primary tenant.

- Sign and date the form, affirming the accuracy and completeness of the information provided.

What You Should Know About This Form

What is the purpose of the W 147Q form?

The W 147Q form serves as a verification tool for the residency and housing costs of secondary tenants living with a primary tenant. It is used to confirm the living arrangement between the primary tenant and the secondary tenant, ensuring that the information provided aligns with housing assistance programs or benefits. This form facilitates transparency in housing situations, which is essential for managing rental agreements or benefits related to housing needs.

Who qualifies as a primary tenant and a secondary tenant?

A primary tenant is someone who is officially listed on a lease or rental agreement and holds legal responsibility for the property. This individual typically shares their living space with one or more secondary tenants. A secondary tenant, on the other hand, is someone who rents a room or an apartment from the primary tenant. This relationship can vary depending on the specific living arrangements and agreements made between the parties involved.

What information is required to complete the W 147Q form?

To accurately complete the W 147Q form, a primary tenant must provide specific details, including their name and the secondary tenant's name, the rental property address, the amount of monthly rent paid by the secondary tenant, and how the rent is paid (directly to the landlord or to the primary tenant). Additionally, the form requires information about the heating or air conditioning costs, and any other utility payments made by the secondary tenant, if applicable. A telephone number and a copy of the lease or relevant documents are also necessary for verification purposes.

How does the verification process work?

The verification process is initiated when the W 147Q form is submitted along with supporting documents. Human Resources Administration or Family Independence Administration will review the provided details to confirm the primary tenant's claims. It may involve contacting the listed landlord for additional verification. Ensuring correctness and completeness in the submitted information is crucial, as inaccuracies can affect housing assistance eligibility or other related benefits.

What should a tenant do if the information on the form changes?

If there are any changes in the information provided on the W 147Q form—such as changes in rent, housing arrangements, or tenant status—the primary tenant is responsible for submitting an updated form promptly. It is important to maintain accurate records to avoid complications or issues with housing assistance programs. Keeping open lines of communication with the secondary tenant and relevant housing authorities can help facilitate a smooth process for any necessary updates.

Common mistakes

Filling out the W-147Q form can be tricky, and mistakes can lead to complications. One common error is failing to provide accurate information regarding the secondary tenant’s residence. It’s crucial to list the correct address of the apartment or house where the secondary tenant lives. An incomplete or incorrect address can raise questions and delay the process.

Another mistake people often make is not specifying the amount the secondary tenant pays in monthly rent. This figure must be accurate, as it impacts the calculations for assistance or benefits. People sometimes write down an estimated amount instead of the exact figure, which can create issues later.

A third mistake involves the payment method for rent. Many forget to check the appropriate box indicating whether the secondary tenant pays the landlord directly or pays the primary tenant. This detail is vital for proper record-keeping. If this information is missing, it could lead to misunderstandings.

People also overlook including essential documentation. When submitting the W-147Q form, it's important to attach a copy of the lease or any other document proving your status as a primary tenant. Failing to include this could result in the form being rejected or delayed.

Lastly, individuals sometimes forget to sign and date the form. Without a signature, the submission is incomplete. This simple step can often be overlooked in the rush to fill out the paperwork. Remember, an incomplete form cannot be processed, leading to frustration.

Documents used along the form

The W-147Q form is often accompanied by various other documents that help provide a clear picture of the housing situation for both primary and secondary tenants. Below is a list of commonly used forms and documents that complement the W-147Q form, each serving a specific purpose in the verification process. Understanding these documents is essential for ensuring compliance and clarity in housing arrangements.

- Lease Agreement: This document outlines the terms of the rental arrangement, including the responsibilities of both the primary and secondary tenants, as well as the duration of the lease.

- Rent Receipt: Issued by the landlord or primary tenant, this proof of payment establishes that the secondary tenant has made timely rent payments for the specified period.

- Utility Bill: This helps to verify the utility payments made by the secondary tenant, distinguishing between included services and those that are billed separately.

- Tenant Background Check: This is often requested by landlords to assess the suitability of a secondary tenant based on their rental history and any potential risks.

- Affidavit of Support: A notarized statement from the primary tenant confirming their financial or emotional support for the secondary tenant, especially relevant in cases of familial or friend arrangements.

- Income Verification Documents: Pay stubs or tax returns from the secondary tenant may be required to confirm their ability to pay rent.

- Identification Documents: Copies of government-issued IDs for both the primary and secondary tenants may be needed to verify their identities and legal status.

- Landlord's Contact Information: Providing the contact details of the landlord can ensure quick communication if any issues arise related to the tenancy.

- Secondary Tenant Application: This form may be completed by the secondary tenant to formally request to occupy the rental space, providing personal information and rental history.

When filing the W-147Q form along with these additional documents, it is important to ensure that all information is accurate and up to date. This not only facilitates a smoother verification process but also contributes to a positive rental experience for everyone involved.

Similar forms

The W-147Q form is used to verify the residence and housing costs of a secondary tenant living with a primary tenant. This form shares similarities with several other documents related to tenant and housing verification processes. Below is a list of nine such documents, highlighting their similarities.

- Lease Agreement: A legal document that outlines the terms under which a tenant rents a property. Like the W-147Q, it identifies the primary tenant and details the agreement between landlords and tenants.

- Rental Verification Form: Often used by landlords to confirm a tenant's rental history and cost. This form conducts a similar verification process but focuses more on past rental behavior rather than current living arrangements.

- Tenant Affidavit: A sworn statement from a tenant about their living situation. It serves a similar purpose as the W-147Q in providing verification, although it may include personal declarations made under oath.

- Sublet Agreement: A document that outlines the terms under which a tenant can rent out part or all of their leased property. This agreement parallels the W-147Q in that it pertains to occupancy and financial arrangements between tenants.

- Housing Cost Documentation: This includes various forms of evidence such as utility bills, bank statements, or official letters that confirm residence and costs. Similar to the W-147Q, it serves to provide proof of the living arrangement and associated expenses.

- Income Verification Form: Used to authorize inquiries about income related to housing assistance. Both documents involve verification processes, but the income verification form focuses specifically on finances rather than residency.

- Background Check Consent Form: This form allows landlords to conduct background checks on prospective tenants. While its primary focus is on the tenant’s history, similar verification needs are evident in both forms.

- Statement of Facts: A document where tenants declare specific facts about their situation, similar to the W-147Q’s requirement for tenants to affirm their occupancy details and living costs.

- Rental Assistance Application: A form many seek to complete to apply for rental assistance. This documentation frequently requests similar information about household arrangements and rent obligations.

These documents play essential roles in verifying tenant information, ensuring that landlords and agencies can make informed decisions about housing agreements and support services.

Dos and Don'ts

When filling out the W 147Q form, keep the following do's and don'ts in mind for a smooth process.

- Do carefully read each question before answering.

- Do use clear and accurate information for the primary and secondary tenant's names.

- Do provide complete addresses, including apartment numbers and ZIP codes.

- Do mention the exact monthly rent amount clearly.

- Do check the box indicating to whom the rent is paid.

- Don't leave any fields blank unless specifically instructed.

- Don't forget to include proof of your status as the primary tenant.

- Don't use nicknames or abbreviations for names and addresses.

- Don't sign the form until you have filled it out completely.

- Don't provide false information, as it may lead to penalties.

Misconceptions

Here are seven common misconceptions about the W 147Q form:

- The W 147Q form is only for public housing tenants. This is incorrect. The form can be used by any primary tenant who has a secondary tenant, regardless of whether they are in public housing or private rental.

- Only landlords can fill out the W 147Q form. In reality, it is designed for primary tenants to complete and verify their relationship with secondary tenants.

- All tenants need to verify their household size using this form. The W 147Q specifically focuses on the verification of a secondary tenant, not the entire household's size.

- The information on this form is not legally binding. This is a misconception. The form requires the primary tenant to affirm the information under penalty of perjury, making it legally significant.

- The form needs to be submitted every month. In most cases, the W 147Q form is only required at the time of application or upon changes in the household situation, not monthly.

- Primary tenants cannot receive assistance unless they submit the W 147Q form. While this form is often needed for verification, it is not the only requirement for receiving assistance.

- The W 147Q form can be submitted without supporting documentation. This is false. A copy of the lease or documents proving that the primary tenant is indeed the primary tenant must accompany the form.

Key takeaways

Filling out the W 147Q form is an important process that requires careful attention to detail. Below are some key takeaways to help guide you through this form:

- The form is used to verify the residence and housing costs of a secondary tenant living with a primary tenant.

- Ensure that you provide complete and accurate addresses for the apartment or house in question.

- You must identify both the primary tenant and the secondary tenant clearly by writing their full names.

- It is essential to specify whether the secondary tenant pays rent to the landlord or directly to the primary tenant.

- The amount of monthly rent paid by the secondary tenant must be stated clearly, so double-check this figure.

- If separate payments for utilities are made, specify whether these are for heating or air conditioning, or for other utilities.

- A copy of the lease or a document proving the status of the primary tenant must be attached to the form.

- Be prepared to provide your contact number in case the authorities need to reach you regarding the information supplied.

- This form should be signed and dated to affirm that all provided information is accurate to the best of your knowledge.

- Consider seeking assistance from a trusted individual if you encounter any difficulties while filling out the form.

Completing this form accurately is crucial for the verification process. Take your time to ensure everything is filled out properly.

Browse Other Templates

Ao78 Form - Misrepresentation on the form may lead to disqualification or termination.

License-exempt Child Care California - Enables applicants to outline their proposed hours of operation clearly.