Fill Out Your W2 Bob Evans Indianapolis Form

Navigating the tax season can be daunting, especially if you've lost important documents like your W-2 form. If you've ever worked for Bob Evans Farms or Mimi’s Café in Indianapolis, there’s a straightforward process in place for obtaining a duplicate W-2. This document not only provides your earnings for the year but is crucial when filing your taxes. The W-2 form encompasses essential information including your name, Social Security number, and the calendar year of earnings. To ensure your request is handled securely, employees—past and present—must complete the designated request form. This step is vital for protecting your privacy. Filling out the form requires printing clearly and providing relevant information, such as your new address if applicable. It’s important to note that duplicates cannot be requested via fax, email, or for third parties, ensuring that your information remains confidential. Once submitted, the payroll department will process your request, typically within five business days. Understanding this process can alleviate some stress during tax season and ensure you have everything you need to file accurately.

W2 Bob Evans Indianapolis Example

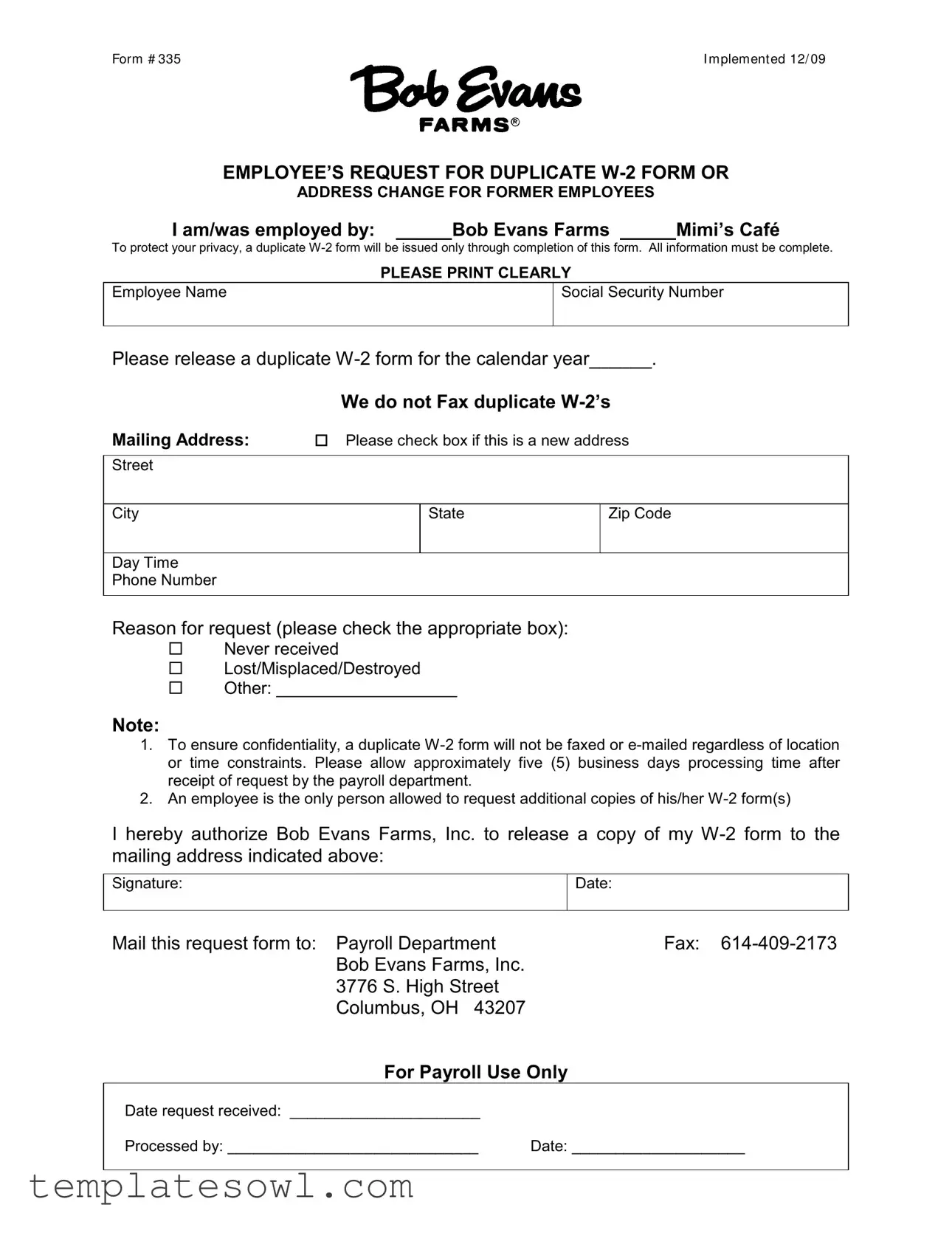

Form # 335 |

I mplement ed 12/ 09 |

EMPLOYEE’S REQUEST FOR DUPLICATE

ADDRESS CHANGE FOR FORMER EMPLOYEES

I am/was employed by: |

|

Bob Evans Farms |

|

Mimi’s Café |

To protect your privacy, a duplicate

PLEASE PRINT CLEARLY

Employee Name

Social Security Number

Please release a duplicate

|

We do not Fax duplicate |

Mailing Address: |

Please check box if this is a new address |

|

|

Street |

|

City

State

Zip Code

Day Time

Phone Number

Reason for request (please check the appropriate box):

Never received

Lost/Misplaced/Destroyed

Other: ___________________

Note:

1.To ensure confidentiality, a duplicate

2.An employee is the only person allowed to request additional copies of his/her

I hereby authorize Bob Evans Farms, Inc. to release a copy of my

Signature:

Date:

Mail this request form to: Payroll Department |

Fax: |

Bob Evans Farms, Inc. |

|

3776 S. High Street |

|

Columbus, OH 43207 |

|

For Payroll Use Only |

|

Date request received: ______________________ |

|

Processed by: _____________________________ |

Date: ____________________ |

|

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Number | 335 |

| Implementation Date | December 2009 |

| Purpose | This form is used to request a duplicate W-2 form or to update the address for former employees. |

| Requestor's Eligibility | Only the employee is allowed to request additional copies of their W-2 form(s). |

| Mailing Address Requirement | The request must include a complete mailing address for the duplicate form to be issued. |

| Processing Time | Requests will be processed approximately five business days after receipt by the payroll department. |

| Privacy Policy | Duplication requests will not be faxed or emailed to protect the employee’s privacy. |

| Governing Law | This form complies with regulations under the Fair Labor Standards Act (FLSA) applicable to payroll documentation. |

Guidelines on Utilizing W2 Bob Evans Indianapolis

Completing the W2 request form is a straightforward process. Ensure you provide accurate details, as this information is essential for receiving your duplicate W-2 form in a timely manner. Below are the steps to fill out the form correctly.

- Employee Name: Write your full name as it appears on your original W-2 form.

- Social Security Number: Enter your Social Security Number (SSN) accurately.

- Calendar Year: Indicate the year for which you are requesting the duplicate W-2 form.

- Mailing Address: Provide your current mailing address. If this is a new address, check the appropriate box.

- Day Time Phone Number: Fill in your contact number for any follow-up if necessary.

- Reason for Request: Check the box that applies to your situation: Never received, Lost/Misplaced/Destroyed, or Other. If "Other," specify the reason.

- Signature: Sign the form to authorize the release of your duplicate W-2 form.

- Date: Write the date when you are signing the form.

After completing the form, mail it to the Payroll Department at the provided address. Be mindful that processing may take approximately five business days. Keep a copy for your records.

What You Should Know About This Form

What is the purpose of the W-2 form from Bob Evans Indianapolis?

The W-2 form reports an employee's annual wages and the amount of taxes withheld from their paycheck. Bob Evans issues this form to employees for tax filing purposes. It is essential for accurately reporting income when preparing federal and state tax returns.

How can I request a duplicate W-2 form?

To request a duplicate W-2 form, you must complete the designated request form. Include your name, Social Security Number, and the tax year for which you need the duplicate. Ensure all information is filled out clearly and accurately. After completing the form, mail it to the Payroll Department at Bob Evans Farms, Inc. Requests are typically processed within five business days.

Is there a charge for obtaining a duplicate W-2?

No, there is no charge for requesting a duplicate W-2 form from Bob Evans. This service is provided to help you receive the necessary documentation for your tax filing needs.

Can I receive my duplicate W-2 form via fax or email?

No. Bob Evans will not send duplicate W-2 forms through fax or email to protect your privacy. The forms will only be mailed to the specified address provided on your request form.

Who is allowed to request a duplicate W-2 form?

Only the employee can request additional copies of their W-2 form. If you are a former employee, ensure you utilize your own personal information when filling out the request form.

What details do I need to include when filling out the request form?

When filling out the request form, include your name, Social Security Number, desired mailing address, and phone number. You should also state the reason for your request, such as if you never received it, lost it, or if there is another reason. Finally, don’t forget to sign and date the form to authorize the request.

Common mistakes

When filling out the W-2 form for Bob Evans in Indianapolis, many people make common mistakes that can delay processing. Ensuring accuracy is critical, so identifying these errors can help simplify the process.

One frequent mistake is not printing clearly. The form requires legible handwriting, and any unclear information may lead to confusion or delays. Always double-check that your name and Social Security Number are easy to read.

Another common error is leaving the calendar year blank. This is vital information that the payroll department needs to process your request efficiently. Without specifying the year, your request could be stalled, causing unnecessary delays.

People often overlook the requirement to indicate a new mailing address. If your address has changed, it must be clearly marked in the designated section. Failure to do so may result in your duplicate W-2 being sent to the wrong location.

Additionally, many individuals forget to sign and date the form. This simple step authenticates your request and without it, the payroll department cannot proceed. Always remember that your signature is essential for verification.

Some individuals also make the mistake of using the fax option, thinking it might expedite the process. However, the policy clearly states that duplicate W-2 forms are not sent via fax or email. Understanding this policy can prevent frustration later.

Lastly, misunderstanding the request reasons can cause confusion. Ensure you check the correct box that accurately reflects why you need a duplicate. This helps the payroll department handle your request in a timely manner.

By avoiding these mistakes, the process of obtaining your duplicate W-2 form can be much smoother and quicker. Take time to review the information before submitting your request.

Documents used along the form

When dealing with your W-2 form from Bob Evans in Indianapolis, several other forms and documents may be helpful in managing your tax and employment-related needs. Each of these documents serves a distinct purpose, ensuring clarity and compliance in your financial records.

- IRS Form 1040: This is the standard individual income tax return form used by residents of the United States. It reports personal income, calculates taxes owed, and determines if additional payments are needed or if a refund will be issued.

- Form 1099: Instead of reporting employment income, this form details payments made to independent contractors and freelancers. If you have done freelance work for Bob Evans or any other entity, you might receive a 1099 form instead of a W-2.

- Form 940: Employers submit this annual report to report their Federal Unemployment Tax Act (FUTA) liability. Although primarily a business document, it's crucial for employees to be aware of it, as it affects unemployment benefits.

- Form 941: This quarterly report is for employers to report income taxes, Social Security tax, and Medicare taxes withheld from employee wages. It shows how much has been paid and ensures compliance with tax laws.

- Request for Duplicate W-2 Form: If the original W-2 is lost or not received, an employee may fill out a specific request form to obtain a duplicate. This process protects employee privacy and requires clear information to issue a new document.

- State Tax Return: Each state has its own tax return form for state income taxes. If you live in a state with income tax, this document is essential for filing your state taxes accurately.

Understanding these documents in conjunction with your W-2 form can greatly aid in a smooth tax filing process. Having the right papers on hand helps ensure compliance and supports personal financial management.

Similar forms

-

Form W-4: This form is similar to the W-2 as it is used for tax purposes. The W-4 allows employees to indicate their tax withholding preferences. Accurate information on the W-4 helps ensure the correct amount of federal income tax is withheld from each paycheck, while the W-2 reports the total wages and taxes withheld for the year.

-

Form 1099: This document is issued to independent contractors and freelancers instead of employees. Like the W-2, the 1099 reports income earned within a calendar year. However, the main difference is that the 1099 does not account for tax withholdings since independent contractors are responsible for paying their own taxes.

-

Form 1040: This is the standard individual income tax return form. The 1040 uses information from the W-2 to help calculate the total income earned during the year and determine any tax liability or refund. Both forms work together for filing federal taxes.

-

Form 8809: This form is an application for an extension of time to file the W-2. While the W-2 is a report of wages and taxes withheld, the Form 8809 provides employers with an opportunity to request additional time to submit the W-2 to the IRS, thus allowing for more accurate information to be reported.

-

Form 941: The quarterly federal tax return reports the employer's payroll tax obligations, including Social Security and Medicare taxes withheld. Similar to the W-2, this form provides detailed reporting about employee earnings and tax withholdings, although it is submitted quarterly rather than annually.

Dos and Don'ts

Things to Do:

- Ensure your name and Social Security number are accurately filled out.

- Print your information clearly to avoid processing delays.

- Indicate the correct year for which you are requesting the duplicate W-2.

- Provide a complete and up-to-date mailing address.

- Check only one reason for your request to clarify your situation.

- Sign and date the form to authorize the request.

- Mail the completed form to the Payroll Department address provided.

Things Not to Do:

- Do not fax or email the request, as it will not be accepted.

- Do not leave any sections blank; all information must be complete.

- Do not check multiple reasons for your request; this may cause confusion.

- Do not send your request to any address other than the specified Payroll Department.

- Do not request a duplicate W-2 if you are not the employee.

- Do not forget to allow approximately five business days for processing.

- Do not change your mailing address after submitting the request without notifying the payroll department.

Misconceptions

- Misconception 1: Any person can request a duplicate W-2 form.

- Misconception 2: W-2 forms can be sent via fax or email.

- Misconception 3: You can get a duplicate W-2 form immediately upon request.

- Misconception 4: The W-2 form is only for tax purposes.

- Misconception 5: The W-2 form must always include the employee's social security number.

- Misconception 6: There is no specific form required to request a duplicate W-2.

Only the employee can request additional copies of their W-2 form. This policy protects privacy and ensures that sensitive information is shared only with the individual to whom it belongs.

Many believe that W-2 forms can be easily sent through fax or email. However, this is not the case. To maintain confidentiality, duplicate W-2 forms are issued only through physical mail.

While it might seem like a straightforward process, requesting a duplicate W-2 form involves processing time. Employees should anticipate about five business days after the request is received by the payroll department.

Although it primarily serves for tax reporting, the W-2 form can also be necessary for verifying income when applying for loans or other financial services. Its importance extends beyond the tax season.

While the social security number is typically required on the W-2 form for tax identification purposes, some may not realize that it is crucial for proper processing and accuracy of the document. Failure to include this information may result in delays or issues in obtaining the W-2.

Many employees mistakenly think they can simply call or email to ask for another W-2. Instead, completing the designated request form is essential to ensure their request is processed properly and securely.

Key takeaways

When filling out the W-2 Bob Evans Indianapolis form, consider the following key takeaways:

- This form is specifically designed for employees requesting a duplicate W-2 or changing their address.

- Only complete information will result in the issuance of a duplicate W-2. It is important to provide details clearly and accurately.

- The form requires employees to check a box indicating the reason for the request. Options include never received, lost/misplaced, or other.

- Processing time for the request can take about five business days once received by the payroll department.

- Employees must submit the request themselves, as no other individual can request additional copies of their W-2.

- To protect privacy, duplicate W-2 forms are not sent via fax or email.

- Ensure the mailing address is up-to-date, as the duplicate form will be sent there after processing.

Fill out the form thoroughly, and mail it to the specified address for timely processing.

Browse Other Templates

Parent Sample Letter to Judge for Child Custody - The MC-031 form serves as a declaration to be attached to other court documents.

Beckett Submission Form - Payment must accompany your cards for processing.