Fill Out Your Wawa Application Form

The Wawa Application form serves as a vital first step for individuals seeking membership in the Wawa Employees’ Credit Union, located in Wawa, Pennsylvania. This form requires important personal details such as your name, address, and social security number, reflecting a standard practice for financial applications. In addition to these basic identifiers, applicants must provide a date of birth and contact numbers, ensuring accurate record-keeping and future communication. The form emphasizes the need for consent to abide by the Credit Union’s bylaws, highlighting a mutual agreement between the institution and its members. Furthermore, you will need to certify your taxpayer identification status, which is crucial for maintaining compliance with tax regulations. Essential account options, including savings and checking accounts, are also available to select. Members can indicate their preferences for various services, such as ATM access, payroll deductions, and specialty accounts like Christmas or Vacation Clubs. Ultimately, completing this application not only paves the way for accessing financial services but also establishes your relationship with the Wawa Employees’ Credit Union.

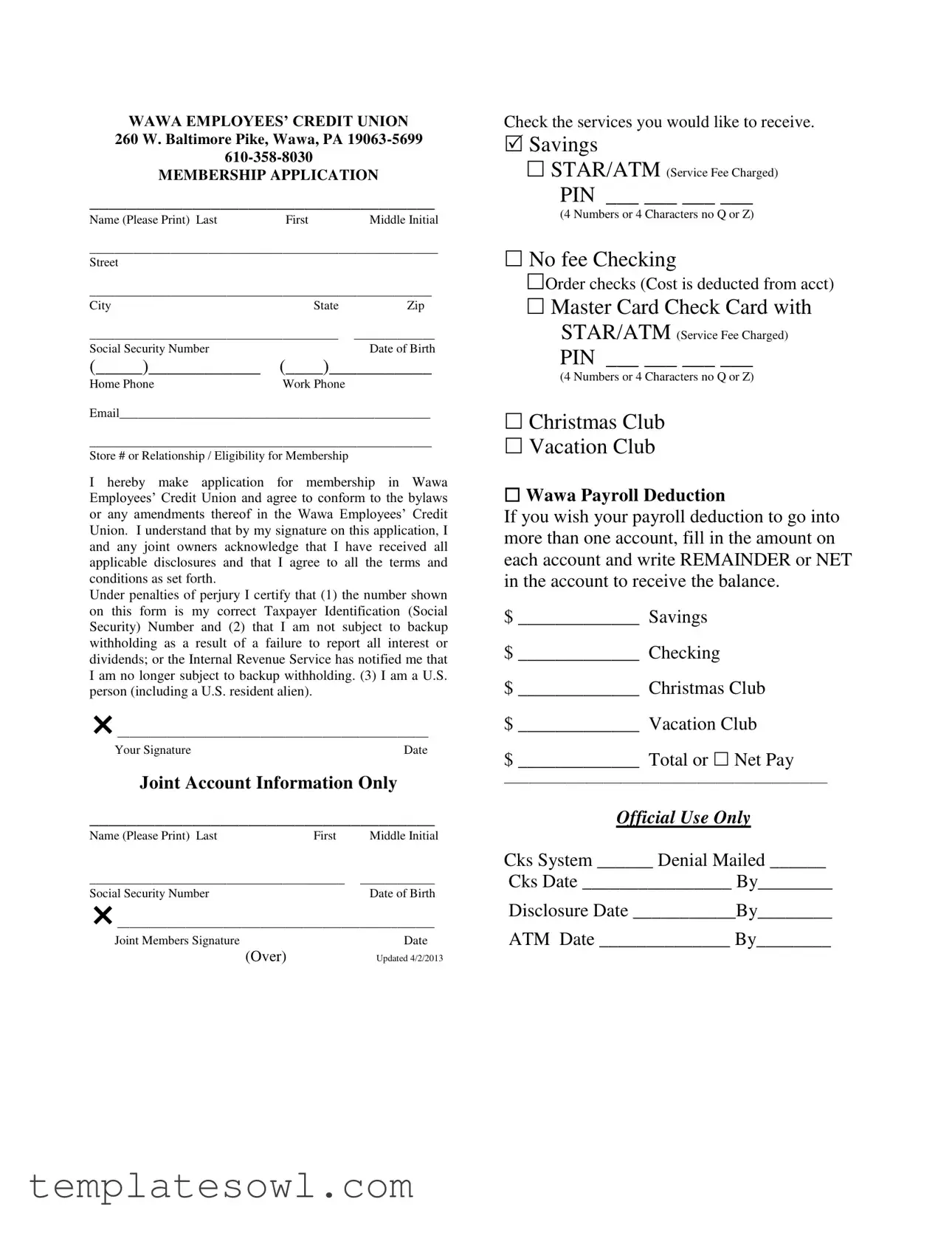

Wawa Application Example

WAWA EMPLOYEES’ CREDIT UNION

260 W. Baltimore Pike, Wawa, PA

MEMBERSHIP APPLICATION

_____________________________________

Name (Please Print) LastFirstMiddle Initial

________________________________________________________

Street

_______________________________________________________

City |

State |

Zip |

________________________________________ |

_____________ |

|

Social Security Number |

|

Date of Birth |

(_____)____________ (____)___________

Home Phone |

Work Phone |

Email__________________________________________________

_______________________________________________________

Store # or Relationship / Eligibility for Membership

I hereby make application for membership in Wawa

Employees’ Credit Union and agree to conform to the bylaws or any amendments thereof in the Wawa Employees’ Credit

Union. I understand that by my signature on this application, I and any joint owners acknowledge that I have received all applicable disclosures and that I agree to all the terms and conditions as set forth.

Under penalties of perjury I certify that (1) the number shown on this form is my correct Taxpayer Identification (Social Security) Number and (2) that I am not subject to backup withholding as a result of a failure to report all interest or dividends; or the Internal Revenue Service has notified me that I am no longer subject to backup withholding. (3) I am a U.S. person (including a U.S. resident alien).

__________________________________________________

Your SignatureDate

Joint Account Information Only

_____________________________________

Name (Please Print) Last |

First |

Middle Initial |

_________________________________________ |

____________ |

|

Social Security Number |

|

Date of Birth |

___________________________________________________

Joint Members Signature |

Date |

(Over) |

Updated 4/2/2013 |

Check the services you would like to receive.

Savings

STAR/ATM (Service Fee Charged)

PIN ___ ___ ___ ___

(4 Numbers or 4 Characters no Q or Z)

No fee Checking

Order checks (Cost is deducted from acct)

Master Card Check Card with

STAR/ATM (Service Fee Charged)

PIN ___ ___ ___ ___

(4 Numbers or 4 Characters no Q or Z)

Christmas Club

Vacation Club

Wawa Payroll Deduction

If you wish your payroll deduction to go into more than one account, fill in the amount on each account and write REMAINDER or NET in the account to receive the balance.

$ _____________ Savings

$ _____________ Checking

$ _____________ Christmas Club

$ _____________ Vacation Club

$ _____________ Total or Net Pay

____________________________________________________

Official Use Only

Cks System ______ Denial Mailed ______

Cks Date ________________ By________

Disclosure Date ___________By________

ATM Date ______________ By________

Form Characteristics

| Fact Name | Details |

|---|---|

| Location | The Wawa Employees' Credit Union is located at 260 W. Baltimore Pike, Wawa, PA 19063. |

| Application Requirement | Applicants must provide their Social Security Number and date of birth on the application form. |

| Member Agreement | By signing the application, the applicant agrees to conform to the bylaws of the Wawa Employees' Credit Union. |

| Disclosure Acknowledgment | Applicants must acknowledge that they have received and understand all applicable disclosures before signing. |

| Consent | Applicants certify their U.S. taxpayer status and that they are not subject to backup withholding. |

Guidelines on Utilizing Wawa Application

After obtaining the Wawa application form, the next step involves filling it out accurately. This form requires personal information and your agreement to the terms laid out by the Wawa Employees’ Credit Union. Careful attention to detail will help ensure that your application is processed smoothly.

- Print your name: In the designated area, clearly write your last name, first name, and middle initial.

- Provide your address: Fill in your street address, city, state, and zip code.

- Enter your Social Security Number and Date of Birth: Write your Social Security Number and then your date of birth.

- List your phone numbers: Include your home phone number and work phone number.

- Email address: Provide your email address in the specified field.

- Store number or relationship: Indicate your store number or describe your eligibility for membership.

- Signature: Sign the application and add the date.

- Joint account information (if applicable): If you wish to include a joint account, fill in the joint member's name, Social Security Number, date of birth, signature, and date.

- Select services: Check the services you wish to receive, such as savings, checking, or payroll deduction.

- Complete payroll deduction information: If applicable, indicate the amounts for each account type. Write "REMAINDER" or "NET" for the account that should receive the remaining balance.

What You Should Know About This Form

What is the Wawa Employees’ Credit Union Membership Application?

The Wawa Employees’ Credit Union Membership Application is a form that individuals must complete to become a member of the credit union. It collects essential information such as your name, address, Social Security number, and date of birth, among other details. By filling out this form, you agree to the terms and conditions of the credit union.

Who is eligible to apply for membership?

Eligibility for membership typically includes current or former Wawa employees and their family members. You need to indicate your relationship or eligibility on the application form to confirm your status.

What information do I need to provide on the application?

You need to provide personal details including your full name, address, Social Security number, date of birth, home and work phone numbers, and email address. If applicable, you should also include information about any joint account holders.

How do I indicate my preferences for services on the application?

The application includes a section where you can check off the services you'd like to receive. Options may include savings accounts, checking accounts, and various club accounts, such as a Christmas Club or Vacation Club. Be sure to check all that apply.

Is there a fee associated with the checking account?

When applying for a checking account, you have the option to choose a no-fee checking account or one that incurs service fees. If you select a check order, note that the cost will be deducted from your account.

What is the process for payroll deductions?

If you wish to set up payroll deductions, you can specify how much money you would like to allocate to different accounts, including savings, checking, and clubs. For any leftover balance, write "REMAINDER" or "NET" next to the account that should receive the rest.

Do I need to sign the application?

Yes, your signature is required on the application form. This confirms that you acknowledge the credit union's bylaws and agree to the terms as outlined. Additionally, you must certify that the information provided is accurate.

What happens after I submit my application?

Once your application is submitted, it will be reviewed by credit union officials. If accepted, you will receive further instruction regarding your membership. In case of denial, you will be notified via mail.

Can I apply for a joint account?

Yes, you can apply for a joint account. The application includes a section where you should fill out the joint account holder's information and have them sign as well. This ensures both parties are aware of the account's terms and responsibilities.

How often is the application form updated?

The application form had its last update on April 2, 2013. While the core information typically remains the same, it’s good practice to check for any new updates or changes by contacting the credit union or visiting their website.

Common mistakes

When applying for membership with the Wawa Employees’ Credit Union, many applicants make simple yet impactful mistakes on their application forms. These errors can lead to delays or even denial of the application. Being aware of these common pitfalls can vastly improve the chances of a successful submission.

One frequent mistake is failing to provide accurate personal information. For instance, many people overlook double-checking their names or contact details. Even a tiny typo in your Social Security Number or date of birth can cause problems. Accuracy is crucial, as these details need to align with official records for verification purposes. Take a moment to carefully review this information before submitting the form.

Another common error is neglecting to provide all required signatures. Applicants often forget to sign the form, assuming that filling it out suffices. Each signature serves as an acknowledgment of the terms and conditions and can signify your consent to the bylaws. Without your signature, the application could be considered incomplete and may lead to rejection.

Some people also fail to correctly fill out their eligibility information. The application inquires about your relationship to the Wawa community, which is vital for determining your eligibility. Misinterpretations or incomplete explanations can lead to confusion and potential denials. Candidates should take care to specify their connection clearly, ensuring that they meet the necessary requirements for membership.

Not checking the service options could also hinder an applicant’s experience. On the application, there are several checkboxes for various services, such as savings accounts, no-fee checking, or payroll deductions. Omitting this section might lead to missed opportunities for additional financial management tools. Therefore, it's essential to review these options and check all that apply to your financial needs.

Lastly, another common oversight is not adhering to the formatting instructions for certain information. The application asks for specific PIN numbers and account designations but does not allow certain characters. Forgetting these details or misusing characters can complicate the account setup process. Always strive to follow the guidelines provided closely.

By avoiding these mistakes and completing your Wawa application form accurately, you significantly increase your chances of a smooth membership process. Remember to double-check every section, provide all necessary signatures, and clarify your eligibility, as these steps can make all the difference in your application’s success.

Documents used along the form

When applying for membership with Wawa Employees' Credit Union, there are several other forms and documents that may be helpful to include alongside your application. Each document serves a specific purpose and can streamline the process of membership and account management.

- Personal Identification Document: A copy of your government-issued ID, such as a driver's license or passport, to verify your identity.

- Social Security Card: Providing your Social Security card can help confirm your identity and taxpayer identification number.

- Proof of Address: A recent utility bill, bank statement, or lease agreement proves your current residence when required.

- Employment Verification Letter: This letter, often from your current employer, can confirm your job status and eligibility for membership at the credit union.

- Direct Deposit Form: If you wish to set up direct deposit for payroll, complete this form to provide your account details and employer information.

- Beneficiary Designation Form: This form allows you to designate who will inherit your assets in the account in the event of your passing.

- Joint Account Application: If opening a joint account, this supplemental application gathers necessary information from all account holders.

- Loan Application (if applicable): If you are seeking a loan, completing this application alongside your membership request can expedite approval.

- Credit Report Authorization: Authorizing a credit check can be crucial if you are applying for loans or credit products through the credit union.

- Account Agreement Document: This document outlines the terms and conditions of your account, ensuring you understand your rights and responsibilities as a member.

By preparing these documents in advance, you can enhance the efficiency of your membership application experience with Wawa Employees’ Credit Union. Ensuring you have everything needed will help facilitate a smooth onboarding process, allowing you to access the services you desire.

Similar forms

The Wawa Application form shares similarities with various other documents that serve similar purposes in financial institutions. Below is a list of those documents and how they align with the Wawa Application form.

- Membership Application for Credit Unions: Like the Wawa Application, this document gathers personal information from applicants and outlines the terms of membership. It often requires a signature to indicate understanding and agreement with the credit union's policies.

- Bank Account Opening Form: This form also collects essential information such as name, address, and identification numbers. Applicants must typically sign to authorize account creation, similar to the Wawa form.

- Loan Application Form: Much like the Wawa Application, this document seeks personal and financial details. Both require the applicant to certify the accuracy of the provided information with their signature.

- Deposit Slip: A deposit slip captures similar information such as account number and amount. While not as comprehensive, it serves the purpose of managing accounts and transactions, akin to the service selections on the Wawa Application.

- Payroll Deduction Authorization Form: This document allows employees to authorize specific deductions from their paychecks, paralleling how the Wawa form outlines payroll deduction preferences for membership services.

- Joint Account Application Form: This form is dedicated to applicants looking to open joint accounts. It requests similar information about both parties, just like the joint account section in the Wawa Application.

- Credit Card Application Form: Comparable to the Wawa Application, this form gathers personal information, including Social Security numbers and eligibility criteria, requiring signatures that confirm understanding of terms.

- Consumer Membership Agreement: This document outlines rights and responsibilities related to membership, similar to the terms and conditions accepted upon signing the Wawa Application.

Dos and Don'ts

When filling out the Wawa application form, keep the following tips in mind to ensure a smooth process.

- Do provide complete and accurate information. Make sure to fill in your name, address, Social Security number, and contact information clearly. Double-check for any typos or missing details.

- Do read the instructions carefully. Take time to understand what each section of the application requires. This can help you avoid mistakes that may delay your application.

- Don’t leave any required fields blank. Missing information can lead to processing delays or even denials. Ensure that you respond to all sections that apply to you.

- Don’t rush through the application. Filling out the form thoughtfully can make a difference. Take your time to avoid errors that may require you to redo the application.

Misconceptions

Here are five misconceptions about the Wawa Application form:

- Misconception 1: The application is only for current Wawa employees.

- Misconception 2: Filling out the application guarantees membership.

- Misconception 3: Social Security numbers are not required.

- Misconception 4: The application process is long and complicated.

- Misconception 5: All services listed in the application are automatically available upon approval.

This is not true. The application is open to anyone eligible, including family members of employees.

Submitting the application does not automatically grant membership. The credit union will review the application and notify the applicant of the decision.

The application explicitly requires a Social Security number. This is necessary for identity verification and compliance with federal regulations.

The application is straightforward. Most sections are simple, and as long as you provide accurate information, it should not take much time.

While you can select services you want on the application, some services may require additional qualifications or fees once you become a member.

Key takeaways

When applying for membership in the Wawa Employees’ Credit Union, it is crucial to pay attention to specific details outlined in the application form. Here are some key takeaways to consider:

- Ensure all personal information is accurate and complete. This includes your name, address, Social Security Number, and contact information.

- Provide your date of birth as it is required for identification purposes.

- In the eligibility section, denote your relationship to Wawa or the reason for your membership application.

- Read and agree to the bylaws of the Wawa Employees’ Credit Union when signing the application.

- Note that you must certify the accuracy of your taxpayer identification number. Incorrect information could lead to penalties.

- Choose the services you wish to receive, such as savings accounts, checking accounts, or a Mastercard check card.

- If you want payroll deductions, specify the amounts for each account and indicate how to handle the remainder.

- Make sure to sign and date the application, as your signature signifies your understanding of the terms and conditions.

Completing the Wawa application form correctly is essential for a successful membership process. Every detail matters.

Browse Other Templates

T4 - Documenting business activity codes helps streamline the reporting process.

Ca $800 Llc Fee Due Date - The application is submitted to the California Franchise Tax Board.