Fill Out Your Wc Rfi Form

The WC RFI form plays a critical role in the realm of workers' compensation insurance, specifically in Texas. This form is utilized primarily to determine premiums for coverage under the Experience Rating Plan, making it essential for businesses of varying structures, including corporations and partnerships. When completing the WC RFI form, it is vital to answer all questions thoroughly, as any omissions could lead to complications in premium calculations. The form serves multiple purposes: it can document a name change, facilitate the combination of different entities, record a sale or transfer of ownership, or even reflect a merger or the formation of a new entity. Each situation demands specific information, requiring detailed ownership statements and the legal status of entities involved. Furthermore, the form collects additional data, such as the name and address of the entity, the history of operations under different names, and any related ownership in other entities. By providing clear and accurate information, businesses can ensure proper handling of their workers' compensation insurance needs.

Wc Rfi Example

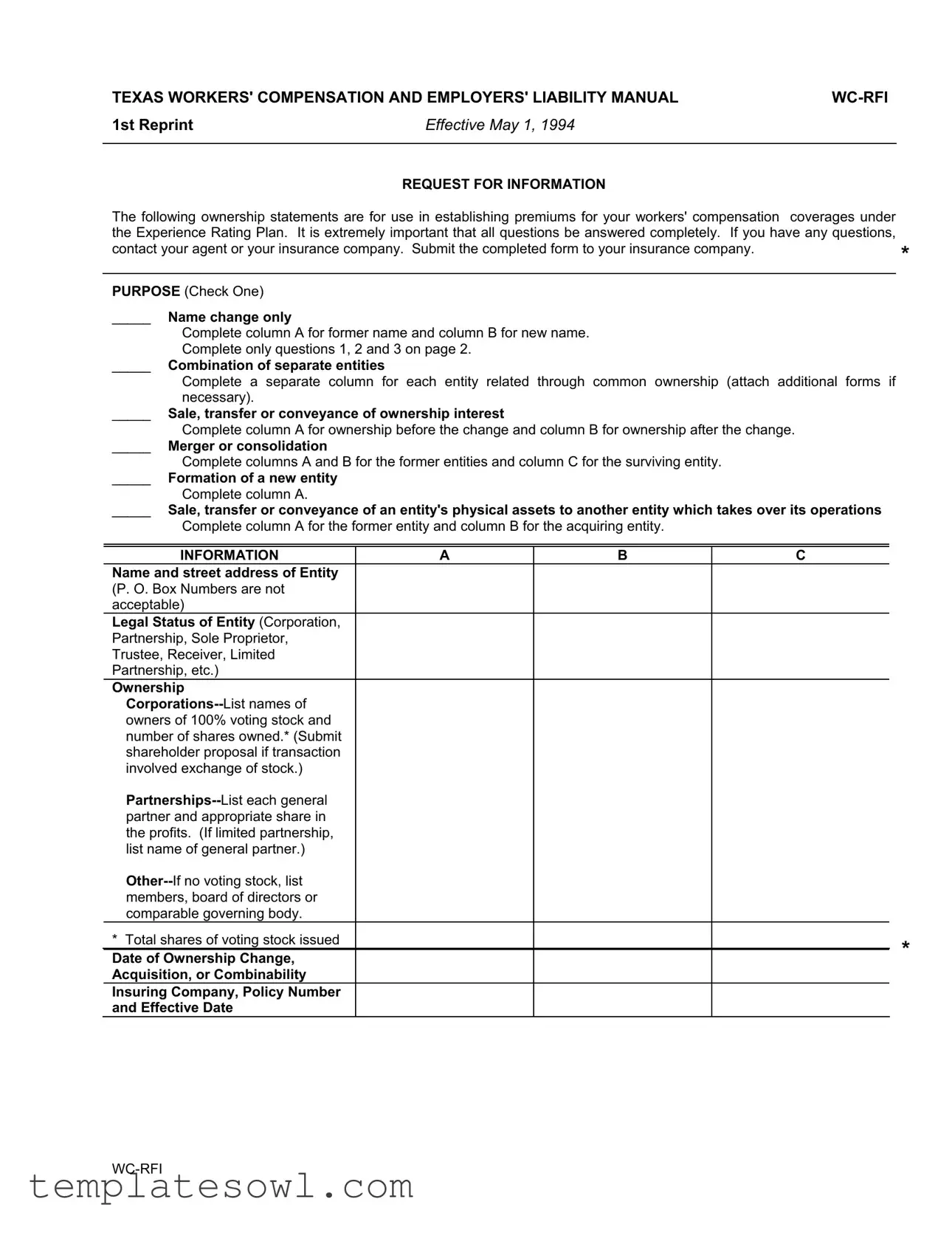

TEXAS WORKERS' COMPENSATION AND EMPLOYERS' LIABILITY MANUAL |

||

1st Reprint |

Effective May 1, 1994 |

|

|

|

|

|

REQUEST FOR INFORMATION |

|

The following ownership statements are for use in establishing premiums for your workers' compensation |

coverages under |

|

the Experience Rating Plan. It is extremely important that all questions be answered completely. If you have any questions, |

|

|

contact your agent or your insurance company. Submit the completed form to your insurance company. |

* |

|

|

|

|

|

|

|

PURPOSE (Check One) |

|

|

_____ |

Name change only |

|

|

Complete column A for former name and column B for new name. |

|

|

Complete only questions 1, 2 and 3 on page 2. |

|

_____ Combination of separate entities |

|

|

|

Complete a separate column for each entity related through common ownership (attach additional forms if |

|

|

necessary). |

|

_____ Sale, transfer or conveyance of ownership interest |

|

|

|

Complete column A for ownership before the change and column B for ownership after the change. |

|

_____ |

Merger or consolidation |

|

|

Complete columns A and B for the former entities and column C for the surviving entity. |

|

_____ Formation of a new entity |

|

|

|

Complete column A. |

|

_____ Sale, transfer or conveyance of an entity's physical assets to another entity which takes over its operations

Complete column A for the former entity and column B for the acquiring entity.

INFORMATION |

A |

B |

C |

|

Name and street address of Entity |

|

|

|

|

(P. O. Box Numbers are not |

|

|

|

|

acceptable) |

|

|

|

|

Legal Status of Entity (Corporation, |

|

|

|

|

Partnership, Sole Proprietor, |

|

|

|

|

Trustee, Receiver, Limited |

|

|

|

|

Partnership, etc.) |

|

|

|

|

Ownership |

|

|

|

|

|

|

|

|

|

owners of 100% voting stock and |

|

|

|

|

number of shares owned.* (Submit |

|

|

|

|

shareholder proposal if transaction |

|

|

|

|

involved exchange of stock.) |

|

|

|

|

|

|

|

|

|

partner and appropriate share in |

|

|

|

|

the profits. (If limited partnership, |

|

|

|

|

list name of general partner.) |

|

|

|

|

|

|

|

|

|

members, board of directors or |

|

|

|

|

comparable governing body. |

|

|

|

|

* Total shares of voting stock issued |

|

|

|

* |

Date of Ownership Change, |

|

|

|

|

|

|

|

|

|

Acquisition, or Combinability |

|

|

|

|

Insuring Company, Policy Number |

|

|

|

|

and Effective Date |

|

|

|

|

REQUEST FOR INFORMATION

1.Has this entity operated under another name in the last four years? _________

2.Is the entity currently related through common majority ownership to any entity not listed on the front of the form?

_________

3.Has this entity been previously related through common majority ownership to any other entities in the last four years?

________

If you answered yes to 1, 2, or 3 above, please provide the following information:

Name of |

Principal |

Carrier and |

Effective |

Business |

Location |

Policy Number |

Date |

|

|

|

|

|

|

|

|

|

|

|

|

4.Were the assets and/or ownership interest (all or a portion) of this entity acquired from a previously existing business?

If yes, you must provide complete ownership information of the prior owner in column A and ownership information on the new owner in column B on the reverse side of this form.

5.Did the entity involved also undergo a change in operations sufficient to result in a change to its governing classification? If yes, attach a detailed explanation supporting these changes.

6.If this is a partial sale, transfer, or conveyance of an existing business (i.e., sale of one or more plans or locations): a. Explain what portion or location of the entire operation was sold, transferred, or conveyed.

b. Was this entity insured under a separate policy from the remaining portion? |

|

If not, specify the |

||

|

entities with which it was combined: |

|

|

|

|

|

|

|

|

c. What entities will the seller maintain majority ownership of after this change?

This is to certify that the information contained on this form is complete and correct.

Name of insured:

Name of person completing form:

Signature of Owner, Partner or |

|

Title |

Executive Officer |

|

|

|

|

|

Print name of above signature |

|

Date |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of Form | The WC-RFI form is used to request information necessary for establishing premiums for workers' compensation insurance under the Experience Rating Plan. |

| Submission | After completing the form, it should be submitted to the insurance company for processing. |

| Categories of Changes | Entities can report various ownership changes, including name changes, mergers, or sales of assets. |

| Ownership Information | Entities must provide detailed ownership information, including names of owners and shares owned in the case of corporations. |

| Related Entities | The form asks if the entity is currently or has been related through common majority ownership to other entities within the last four years. |

| Date of Change | It requires the date of any ownership changes or acquisitions for accurate premium calculations. |

| Signature Requirement | A signature from the owner, partner, or executive officer is mandatory to certify that the information provided is complete and correct. |

| Texas Governing Law | This form adheres to the regulations outlined in the Texas Workers' Compensation Act. |

| Insurance Company Info | It requires details of the insuring company, policy number, and effective date to ensure proper identification and processing of the policy. |

Guidelines on Utilizing Wc Rfi

To fill out the WC RFI form, you will need to gather relevant information regarding the ownership and operational structure of your entity. This information is necessary for processing your request accurately. Carefully follow the steps outlined below to ensure completeness before submitting the form to your insurance company.

- Check the box for the purpose of the form, selecting one of the following: name change, combination of entities, sale of ownership, merger or consolidation, formation of a new entity, or transfer of assets.

- Fill out Column A with the name and street address of the entity, its legal status, and ownership information as applicable.

- If your entity has operated under another name in the last four years, answer question 1 on page 2 and provide the requested information.

- For question 2, indicate if the entity is currently related through common majority ownership to any entity not listed; provide details if applicable.

- Answer question 3 regarding previous majority ownership relationships within the last four years, supplying necessary details.

- For questions 4, 5, and 6, respond truthfully regarding asset acquisition, changes in operations, or partial sales, and provide explanations as required.

- Certify the accuracy of the information by printing the name of the insured, signing the form, and including the title of the signer along with the date.

Once completed, make sure to double-check all entries for accuracy before submitting the form to your insurance company. This helps ensure a smooth evaluation and accurate processing of your request.

What You Should Know About This Form

What is the purpose of the WC RFI form?

The WC RFI form is used to gather information regarding business ownership that affects workers' compensation premiums. It helps insurance companies establish rates under the Experience Rating Plan. Completing this form accurately is crucial for proper premium determination.

How do I know which sections to fill out on the form?

The form has specific sections for various situations such as name changes, mergers, or asset transfers. Check the box that corresponds to your situation to determine which columns and questions apply. If your situation involves multiple entities, additional forms may be necessary.

What information is required about ownership?

Ownership details vary based on the legal structure of the business. Corporations must list owners of voting stock, partnerships must identify general partners, and for other entities, relevant governing body members should be provided. Ensure all owners are accurately documented.

What should I do if I have questions while filling out the form?

If you encounter any uncertainties while completing the form, contact your insurance agent or the insurance company directly. They can provide clarification and ensure you fill out the form correctly.

What is meant by "common majority ownership"?

Common majority ownership refers to situations where two or more entities are owned or controlled by the same individual or group. It's important to disclose any relationships with other entities that may not be listed on the form, as they can affect your premium calculations.

Are there consequences for providing incomplete or inaccurate information?

Providing incomplete or inaccurate information can lead to incorrect premium assessments, insurance coverage issues, or potential penalties. It's vital to ensure all information is accurate and complete before submission.

How do I submit the completed WC RFI form?

The completed form should be submitted directly to your insurance company. Follow any specific submission instructions provided by your insurer to ensure it is processed efficiently.

Common mistakes

Submitting the WC RFI form can be tricky. Many people make mistakes that can delay their workers' compensation coverage. Here are some common pitfalls to avoid when filling out the form.

One mistake is failing to select the correct purpose. The form requires you to choose from several options like name change, merger, or sale of ownership. If you check the wrong box, it can lead to confusion and delays. Take a moment to read each purpose carefully and choose accordingly.

Another common error is incomplete answers. Some individuals skip questions that might seem minor but are essential for the overall context. Each question, including those about previous names or related entities, plays a big role in determining your insurance premium. Make sure every question is answered fully before submitting the form.

Next, failing to provide correct ownership details is another frequent issue. If you do not accurately list all owners, especially in partnerships or corporations, your application could be rejected. Include all necessary names and statuses. This ensures that your coverage reflects the correct ownership structure.

Using a P.O. Box instead of a physical address is also a mistake. The form specifically states that P.O. Box numbers are not acceptable. Using an accurate street address is vital for your application to be taken seriously. Make sure to double-check this detail.

Lastly, many people forget to sign and date the form. Without a signature, the document is not valid. It’s the last step, yet often overlooked. Make sure that the person completing the form provides their name, title, and date of completion to ensure everything is in order.

By avoiding these mistakes, you can help ensure your WC RFI form is processed smoothly and efficiently.

Documents used along the form

The WC RFI form is a crucial document in the Texas workers' compensation system, designed to request important ownership information needed to calculate premiums. Alongside this form, several other documents are often utilized to provide comprehensive details during ownership changes or business transitions. Each document serves a unique purpose, helping to clarify the nature of business relationships and ensure compliance with regulations.

- Experience Modification Rate (EMR) Worksheet: This document outlines an employer's past workers' compensation claim history and is used to calculate the EMR. A lower EMR can lead to reduced premiums, making it essential for businesses to have accurate reporting of their claims.

- Ownership Change Notification: Used to officially notify the insurance company about significant changes in ownership, this document includes details about the new owners and their respective shares. Timely notification can help avoid disruptions in coverage.

- Certification of Prior Coverage: This form provides proof that a business had workers' compensation coverage prior to a change in ownership. It's important when determining if a new entity qualifies for any credits related to prior claims.

- Entity Operating Agreement: This document specifies the operational procedures and ownership interests of business partners. It lays out how profits, losses, and responsibilities are shared among partners, guiding day-to-day management after ownership changes.

- Shareholder Agreement: For corporations, this agreement defines the relationship among shareholders. It can outline buy-sell provisions, voting rights, and other important facets of corporate governance, ensuring smooth transitions during ownership changes.

- Asset Purchase Agreement: This legal document details the terms and conditions under which a company sells its physical assets. It is vital when only certain assets are transferred rather than the entire business, clarifying the specifics of the deal.

Collectively, these documents provide a thorough framework for understanding ownership dynamics and ensuring compliance throughout the business lifecycle. The clarity they offer helps protect all parties involved, from employees to stakeholders, fostering a healthier business environment.

Similar forms

- RFI (Request for Information): Similar to the WC-RFI, an RFI form collects information needed to clarify uncertainties in a contract or project. It often seeks details about a vendor's capabilities or qualifications, helping decision-makers gather necessary insights before proceeding.

- Change Order: Both the WC-RFI and change orders document changes in project scope or ownership. A change order outlines additional work to be completed, while the WC-RFI clarifies details required for proper coverage and compliance.

- Certificate of Insurance: This document serves a similar purpose by providing proof of insurance coverage. While the WC-RFI seeks ownership details for employees' compensation insurance, the certificate summarizes current coverage status and limits.

- Ownership Disclosure Statement: This form requires entities to disclose significant ownership changes. Both documents emphasize clarity on ownership relationships to ensure proper liability coverage and regulatory compliance.

- Annual Business Report: The WC-RFI and annual business report share the goal of maintaining transparency in business operations. Both documents require information on ownership, financial status, and operational changes, reinforcing the entities' commitments to accurate reporting.

Dos and Don'ts

When completing the WC RFI form, it is essential to ensure accuracy and clarity. Here is a list of dos and don'ts to keep in mind:

- Do answer all questions completely and accurately to avoid delays in processing.

- Do use the correct name and address for the entity. Avoid using P.O. Box numbers.

- Do provide detailed information on ownership changes, including previous and new owners.

- Do contact your insurance agent or company if you have questions before submitting the form.

- Don't leave any sections blank. Incomplete forms may lead to rejection.

- Don't submit the form without checking for typos and grammatical errors.

- Don't confuse ownership types; be clear on whether the entity is a corporation, partnership, etc.

- Don't forget to sign the form. An unsigned form will not be considered valid.

Misconceptions

Misconceptions about the WC RFI Form

- It is only for name changes. Many believe this form is solely for reporting name changes. In reality, it serves multiple purposes including reporting combinations of entities, sales of ownership interests, and mergers.

- It can be completed without full information. Some think they can fill out the form quickly without complete information. However, all questions must be answered fully to ensure accurate premium calculations.

- Only large companies need to submit this form. This is incorrect. Any business that has undergone changes in ownership, structure, or operations must submit this form, regardless of its size.

- The insurer does not require this form for premium adjustment. This is a misconception. Insurance companies use this information to establish and adjust premiums under the Experience Rating Plan, making it critical for accurate reporting.

- It can be submitted anytime. Some people think the timing of the submission is flexible. In truth, the form should be submitted promptly to avoid potential delays in processing and premium assessments.

Key takeaways

Understanding the WC RFI form is essential for businesses operating in Texas. Here are some key takeaways to help guide you through the process.

- Comprehensive Responses Are Crucial: Ensure that every question is thoroughly answered. Incomplete forms can lead to delays in processing and potential issues with your workers' compensation coverage.

- Purpose Selection: Choose the correct purpose on the form. Indicate whether it's for a name change, a merger, or another purpose to help your insurance company categorize your request accurately.

- Provide Accurate Entity Information: List complete names and addresses, avoiding P.O. Box numbers. Include the legal status of the entity—this could be a corporation, partnership, or sole proprietor.

- Ownership Details Matter: Clearly outline ownership structures, including voting stock and share distributions. This transparency is vital for premium calculations under the Experience Rating Plan.

- Common Ownership Awareness: Be mindful of any existing relationships with other entities. Answering questions about common majority ownership accurately helps in establishing your entity's risk profile.

- Owner Certification: The form requires a signature from an authorized person. Make sure that the name and title of the signatory are clear to validate the information provided.

Filling out the WC RFI form with attention to detail not only streamlines the process but also sets a solid foundation for your business's workers' compensation coverage. Take your time and ensure everything is correct before submission.

Browse Other Templates

Optometry Superbill - 3-part NCR forms provide multiple copies for patient records and billing purposes.

Da Form 4126-r - Soldiers must also be made aware of their record, including any court-martial convictions or non-judicial punishments.

DHgate Payment Authorization Form,Credit Card Payment Consent Form,DHgate Transaction Approval Form,Credit Card Charge Authorization Document,DHgate Purchase Authorization Sheet,Approval Form for Credit Card Transactions,DHgate Escrow Payment Authori - The form requires essential details like name and order number.