Fill Out Your Wce 1 Form

The WCE 1 form is a crucial document for independent contractors in Indiana seeking to establish their exemption from worker's compensation coverage. This application is designed to provide vital information about the contractor—including their name, business details, and specific trade—while also confirming their status as an independent entity rather than an employee. Completing this form requires attention to detail, as various components must be properly filled out, such as the contractor's social security number and state residency status. Additionally, the form comes with a $20 filing fee, which must be submitted via a certified check or money order. It’s essential to note that the application process involves careful verification by the Indiana Department of Revenue, ensuring that applicants meet specific criteria before they can receive certification. Once approved, which can take several weeks, contractors receive a Certificate of Exemption, allowing them to operate without mandatory worker's compensation coverage for themselves, although they must still cover any employees they hire. As independent contractors play a significant role in the workforce, understanding the implications and requirements associated with the WCE 1 form is vital for compliance and financial planning.

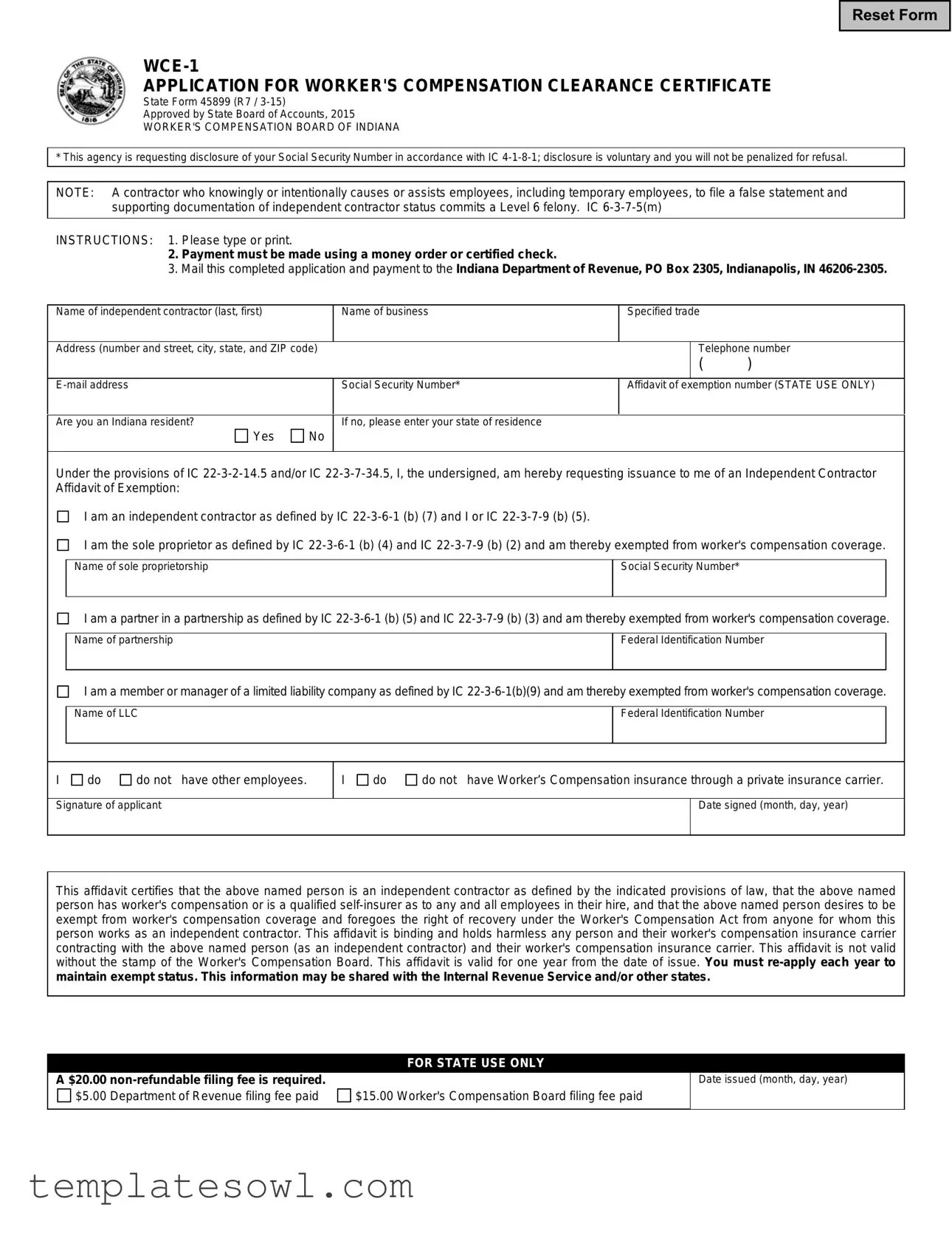

Wce 1 Example

Reset Form

APPLICATION FOR WORKER'S COMPENSATION CLEARANCE CERTIFICATE

State Form 45899 (R7 /

Approved by State Board of Accounts, 2015

WORKER'S COMPENSATION BOARD OF INDIANA

* This agency is requesting disclosure of your Social Security Number in accordance with IC

NOTE: A contractor who knowingly or intentionally causes or assists employees, including temporary employees, to file a false statement and supporting documentation of independent contractor status commits a Level 6 felony. IC

INSTRUCTIONS: 1. Please type or print.

2.Payment must be made using a money order or certified check.

3.Mail this completed application and payment to the Indiana Department of Revenue, PO Box 2305, Indianapolis, IN

Name of independent contractor (last, first) |

Name of business |

Specified trade |

|

|

|

|

|

Telephone number |

|

Address (number and street, city, state, and ZIP code) |

|

|

||

|

|

|

( |

) |

|

|

|

exemption number (STATE USE ONLY) |

|

Social Security Number* |

Affidavit of |

|||

|

|

|

|

|

Are you an Indiana resident? |

If no, please enter your state of residence |

|

|

|

Yes

Yes  No

No

Under the provisions of IC

I am an independent contractor as defined by IC

I am the sole proprietor as defined by IC

Name of sole proprietorship

Social Security Number*

I am a partner in a partnership as defined by IC

Name of partnership

Federal Identification Number

I am a member or manager of a limited liability company as defined by IC

Name of LLC

Federal Identification Number

I |

do |

do not have other employees. |

Signature of applicant

I |

do |

do not have Worker’s Compensation insurance through a private insurance carrier. |

|

|

|

|

Date signed (month, day, year) |

|

|

|

|

|

|

|

|

This affidavit certifies that the above named person is an independent contractor as defined by the indicated provisions of law, that the above named person has worker's compensation or is a qualified

|

FOR STATE USE ONLY |

A $20.00 |

|

$5.00 Department of Revenue filing fee paid |

$15.00 Worker's Compensation Board filing fee paid |

|

|

Date issued (month, day, year)

APPLICATION CHECKLIST

Part of State Form 45899

This Application for Certification of Exemption represents a statement by you that you are an independent contractor or otherwise not required to carry Worker's Compensation insurance on yourself under the Worker's Compensation Act of Indiana. The Indiana Department of Revenue may share this information with the Internal Revenue Service (IRS) and /or other states.

The statutes establishing this registration process state that an independent contractor is defined similarly to the IRS tax guidelines for determining independent contractor status. The IRS uses several factors to determine whether an individual is an independent contractor or an employee. Listed below are some of the characteristics of each. If you fail to meet these qualifications, you will not receive certification.

An independent contractor generally:

directs his own work and performs the work in the manner he chooses, without direction from a boss or general contractor;

sets his own hours;

may hire assistants;

provides his own tools and materials;

is paid by the job rather than by the hour;

may make a profit or suffer a loss on a job; and

is free to work for more than one person or firm and to offer his services to the general public.

An employee generally:

is under the control of his employer;

has income taxes withheld from his pay;

must work the hours specified by the employer;

receives pay on an hourly basis;

must perform the work in the manner indicated by the employer;

receives training, tools and equipment provided by the employer;

is not free to offer his services to any persons or firms or to the general public; and

can be fired at any time.

Are you new to the state of Indiana or the United States? If so, you will be required to submit verification of your residency. Some examples include:

valid Indiana Driver's License;

permanent Resident Card (green card);

copy of income tax return from another state;

copy of rental or property tax agreement;

voter's registration card;

Individual Tax Identification Number (ITIN) (resident aliens)

This application for a Certification of Exemption from worker's compensation in Indiana will be processed by verifying your status as an Independent Contractor. The Indiana Department of Revenue will examine your past tax records to determine if you have identified yourself as an independent contractor in past years and are current on your individual tax filings. Failure to comply will result in denial of certification.

IC

Your certification is not valid until the Worker's Compensation Board has stamped it. Mail your application to the Indiana Department of Revenue for processing. Upon approval of both the Department of Revenue and the Worker's Compensation Board, you will receive your validated Certificate of Exemption and a copy of Income Tax Information Bulletin #86 in the mail.

Note: Until/unless you receive a Certificate of Exemption from the Indiana Worker's Compensation Board, you are required to be covered by a Worker's Compensation policy under Indiana law. Even if you are exempt, you must cover any employees of your business.

Form Characteristics

| Fact Name | Description |

|---|---|

| Title | WCE-1 Application for Worker's Compensation Clearance Certificate |

| Governing Laws | Indiana Code IC 22-3-2-14.5 and IC 22-3-7-34.5 |

| Issuing Authority | Indiana Department of Revenue and Worker's Compensation Board of Indiana |

| Filing Fees | A total of $20.00, with $5.00 for the Department of Revenue and $15.00 for the Worker's Compensation Board |

| Application Processing Time | Processing typically takes 2 to 3 weeks for the Department of Revenue and an additional 7 days for the Worker's Compensation Board |

| Validity | The exemption certificate is valid for one year, requiring annual re-application to maintain status |

Guidelines on Utilizing Wce 1

Completing the WCE-1 form is a necessary step in obtaining a Certification of Exemption from Worker’s Compensation coverage in Indiana. After submission, the Indiana Department of Revenue will verify your status as an independent contractor, followed by processing your request with the Worker's Compensation Board. Expect to receive your validated Certificate of Exemption in the mail, pending approval.

- Type or print the necessary information clearly in the designated fields.

- Provide your name, business name, and specified trade.

- Include your telephone number and complete address (number and street, city, state, and ZIP code).

- Enter the exemption number (for state use only), if applicable.

- Fill in your email address and Social Security Number, noting that disclosure is voluntary.

- Indicate your residency status in Indiana by selecting “Yes” or “No”. If you answer “No”, enter your state of residence.

- Complete the affidavit section, marking the appropriate exemption type (sole proprietor, partner in a partnership, or member/manager of an LLC). Indicate the names and Social Security or Federal Identification Number as required.

- State whether you have other employees and if you have Worker’s Compensation insurance through a private carrier.

- Sign and date the application in the appropriate field.

- Prepare payment using a certified check or money order for the total required fee of $20.00.

- Mail the completed form along with the payment to the Indiana Department of Revenue at PO Box 2305, Indianapolis, IN 46206-2305.

What You Should Know About This Form

What is the WCE 1 form?

The WCE 1 form is an application for a Worker's Compensation Clearance Certificate in the state of Indiana. This form allows independent contractors to apply for a certification of exemption from having to carry worker's compensation insurance. The information provided in this application will be used to determine the applicant’s status as an independent contractor under state law.

Who needs to complete the WCE 1 form?

The WCE 1 form must be completed by contractors who believe they meet the criteria of an independent contractor as defined by Indiana law. This form is particularly relevant for those who do not wish to carry worker's compensation insurance. Individuals operating as sole proprietors, partners, or members of limited liability companies may also use this form to seek exemption.

What information is required on the WCE 1 form?

Applicants must provide personal information, including their name, business name, address, and Social Security Number. They will need to indicate if they are an Indiana resident. Additional information about the type of business structure—such as sole proprietorship, partnership, or LLC—must also be included. It is essential to sign the application and, if applicable, disclose if there are other employees or existing worker’s compensation insurance.

What are the fees associated with the WCE 1 form?

A total fee of $20 is due when submitting the WCE 1 form. This consists of a $5 non-refundable filing fee for the Indiana Department of Revenue and a $15 filing fee for the Worker's Compensation Board. Payment must be made by money order or certified check. Failure to include the fee may result in delays or denial of the application.

How long does it take to process the WCE 1 form?

Processing the WCE 1 form typically takes about two to three weeks by the Indiana Department of Revenue. After that, an additional seven days may be required for the Worker's Compensation Board to finalize the application. Applicants are advised to allow adequate time for processing before inquiring about their status.

What happens if my WCE 1 application is denied?

If the application is denied, the applicant will be contacted with instructions on how to provide additional information or explanation. It is important to ensure all information is accurate and meets the criteria for independent contractor status. Until the applicant receives a valid Certificate of Exemption from the Worker's Compensation Board, worker's compensation insurance coverage is legally required.

Common mistakes

Filling out the WCE 1 form for a Worker’s Compensation Clearance Certificate can be a straightforward process, but many people make common mistakes that can lead to delays or denials. One key mistake is not including the correct payment method. The instructions clearly state that payment must be made using a money order or certified check. Using personal checks or cash will result in an immediate rejection of your application.

Another frequent error is neglecting to provide complete and accurate information. It’s essential to include your full name, business name, address, and Social Security Number. Omitting any of these details can hinder the processing of your application. Double-check every section before sending it off to prevent future complications.

Many applicants mistakenly think that the application can be submitted electronically. The form specifies that it must be mailed to the Indiana Department of Revenue, so be sure to print it out and send it through the postal service. This misunderstanding can lead to unnecessary confusion and delays.

Additionally, failing to indicate residency status can pose problems. If you are not an Indiana resident, you must specify your current state of residence. Forgetting this step could raise questions and delay the approval process. Thoroughly read the residency section to ensure this information is clearly communicated.

One more common pitfall is assuming you do not need to reapply each year. The form explicitly states that certification is only valid for one year. Mark your calendar to remind yourself to reapply, so you maintain your exempt status without interruptions.

Another mistake is not verifying your independent contractor status. The application requires that you meet specific criteria to qualify. Failing to check your eligibility may lead to denial of your application. Make sure to familiarize yourself with the definitions and requirements of an independent contractor before submitting.

Finally, potential applicants often overlook the checklist at the end of the form. This checklist is vital for ensuring that all necessary documents and information are included. A missed document could mean restarting the application process. Always prioritize reviewing the checklist to save time and effort.

Documents used along the form

When applying for a Worker’s Compensation Clearance Certificate using the WCE-1 form, there are several other documents that are essential for a smooth application process. Understanding these documents can help ensure that you are well-prepared and informed. Here’s a brief overview of these additional forms and documents.

- Independent Contractor Affidavit: This affidavit verifies that the applicant is indeed an independent contractor and not an employee. It details the nature of the work relationship and outlines the responsibilities of both parties in accordance with Indiana law.

- Payment Authorization Form: This form is necessary to process payments associated with filing fees. It typically includes essential payment details, including the amount to be paid and the method of payment, such as a money order or certified check.

- Proof of Residency: If you're new to Indiana, you may need to provide documentation proving your residency. Acceptable forms include a valid Indiana driver's license or a rental agreement. This verification is crucial in determining eligibility for the exemption.

- Tax Records: Past tax documents, such as income tax returns, may be requested to establish your status as an independent contractor. These records help the Indiana Department of Revenue confirm that you’ve consistently identified as an independent contractor in prior filings.

- Certificate of Insurance: If applicable, this certificate provides proof of your current worker’s compensation coverage through a private insurance carrier. This document is essential for those who maintain insurance policies despite claiming exemption status.

- Income Tax Information Bulletin #86: Once your application is approved, this bulletin accompanies your Certificate of Exemption. It provides important guidelines and additional information about your exemption status and obligations under Indiana law.

Being knowledgeable about these documents will equip you to navigate the application process confidently. Thorough preparation and understanding can make a significant difference in achieving a successful outcome for your worker’s compensation clearance.

Similar forms

- IRS Form 1099-MISC: This document is used to report payments made to independent contractors. Similar to the WCE 1 form, it establishes the independent contractor’s work status and tax obligations.

- Independent Contractor Agreement: This contract outlines the terms and conditions between a business and an independent contractor. Like the WCE 1 form, it confirms the status of the contractor and protects both parties legally.

- Certificate of Insurance: This document proves that a contractor has liability insurance. It parallels the WCE 1 form by confirming the contractor’s coverage and compliance with state requirements.

- State Business License Application: This application is necessary for businesses to operate legally within a state. It shares similarities with the WCE 1 form as both require the disclosure of business status and compliance with state regulations.

- Form SS-4 (Application for Employer Identification Number): This IRS form is used to apply for a federal tax ID. Like the WCE 1, it is required for independent contractors to comply with tax regulations.

- Worker's Compensation Policy Declaration Page: This document outlines the terms of a worker’s compensation insurance policy. It is related to the WCE 1 form as it details coverage requirements for independent contractors.

- Business Entity Registration Form: This form is used to register a business entity with the state. Similar to the WCE 1 form, it establishes the official status of a business entity and its operating compliance.

- State Tax Registration Form: This form is needed to register a business for state tax purposes. It parallels the WCE 1 form as both ensure compliance with state laws regarding business operations and taxes.

Each of these documents plays a crucial role in establishing the significant facets of independent contractor status and compliance with tax and insurance obligations. As such, they help determine legal and financial responsibilities in a professional setting.

Dos and Don'ts

Filling out the WCE-1 form can seem daunting. Here are some clear do's and don'ts to assist you in the process:

- Do type or print clearly to ensure readability.

- Do include all required information: your name, business name, address, and Social Security Number.

- Do use a money order or certified check for payment to avoid delays.

- Do mail the completed form to the Indiana Department of Revenue as specified.

- Do double-check for any missing signatures before submitting.

- Don't leave any required fields blank, as this could lead to processing delays.

- Don't use personal checks, as they are not accepted.

- Don't forget to include the proper filing fees to ensure your application is processed.

- Don't submit your application without verifying your residency status if you are new to Indiana.

- Don't rely on your application being processed without confirmation from the Indiana Department of Revenue.

Misconceptions

Misconceptions can often lead to confusion regarding legal processes. Below are some common misunderstandings about the WCE-1 form, the Application for Worker’s Compensation Clearance Certificate in Indiana.

- Misconception 1: The WCE-1 form is only for large corporations.

- Misconception 2: Independent contractors do not need to worry about worker’s compensation.

- Misconception 3: The application process is quick and does not require payment.

- Misconception 4: The Social Security Number is mandatory for all applicants.

- Misconception 5: Once certified, there is no need to reapply.

- Misconception 6: A Certification of Exemption means complete immunity from liability.

This form is actually available for any independent contractor, regardless of business size. Even sole proprietors or small businesses need to apply for certification if they meet the criteria.

While it is true that independent contractors can apply for an exemption, they must still fill out the WCE-1 form to certify their status. Without the certificate, they may be required to carry worker’s compensation coverage.

In fact, there is a total fee of $20 for applying. This amount includes a $5 non-refundable filing fee and a $15 fee for the Worker’s Compensation Board. Processing also takes time, often around two to three weeks.

Disclosure of the Social Security Number is voluntary. While it can help with the processing, applicants will not face penalties for refusing to provide it.

This is incorrect. The certification is only valid for one year. Therefore, individuals must reapply annually to maintain their exempt status.

Receiving a certificate does not entirely absolve an independent contractor from liability. It only serves to designate their status within the scope of worker’s compensation laws.

Key takeaways

Filling out the WCE-1 form accurately is crucial. Errors in information can lead to delays or denial of your application. Ensure that you provide all requested details, including names, addresses, and exemption numbers. Double-check spelling and accuracy before submission.

Payment is required to process the application. You must use a money order or a certified check for the $20 filing fee. Failure to include the proper payment can result in rejection of the application.

The WCE-1 form serves a specific purpose. It is used to apply for a Certification of Exemption from worker's compensation coverage in Indiana. If approved, this certificate allows independent contractors to operate without required worker's compensation insurance.

After submission, the processing time ranges from two to three weeks by the Department of Revenue, followed by an additional week for the Worker's Compensation Board. Patience is necessary, as certification is not immediate.

You must renew your certification every year. The exemption remains valid for one year from the date of issuance. To avoid any lapse in coverage or legal requirements, re-apply before the certification expires.

Browse Other Templates

Certificate of Foreign Limited Partnership Amendment,Amendment Application for Limited Partnership,Foreign Partnership Name Change Certificate,New York Limited Partnership Amendment Form,Limited Partnership Authority Modification Certificate,Certific - The amendment can reflect changes in the scope or nature of the business.

Cooking Merit Badge - This workbook assists in organizing thoughts for the Cooking Merit Badge.