Fill Out Your Weekly Payroll Schedule Form

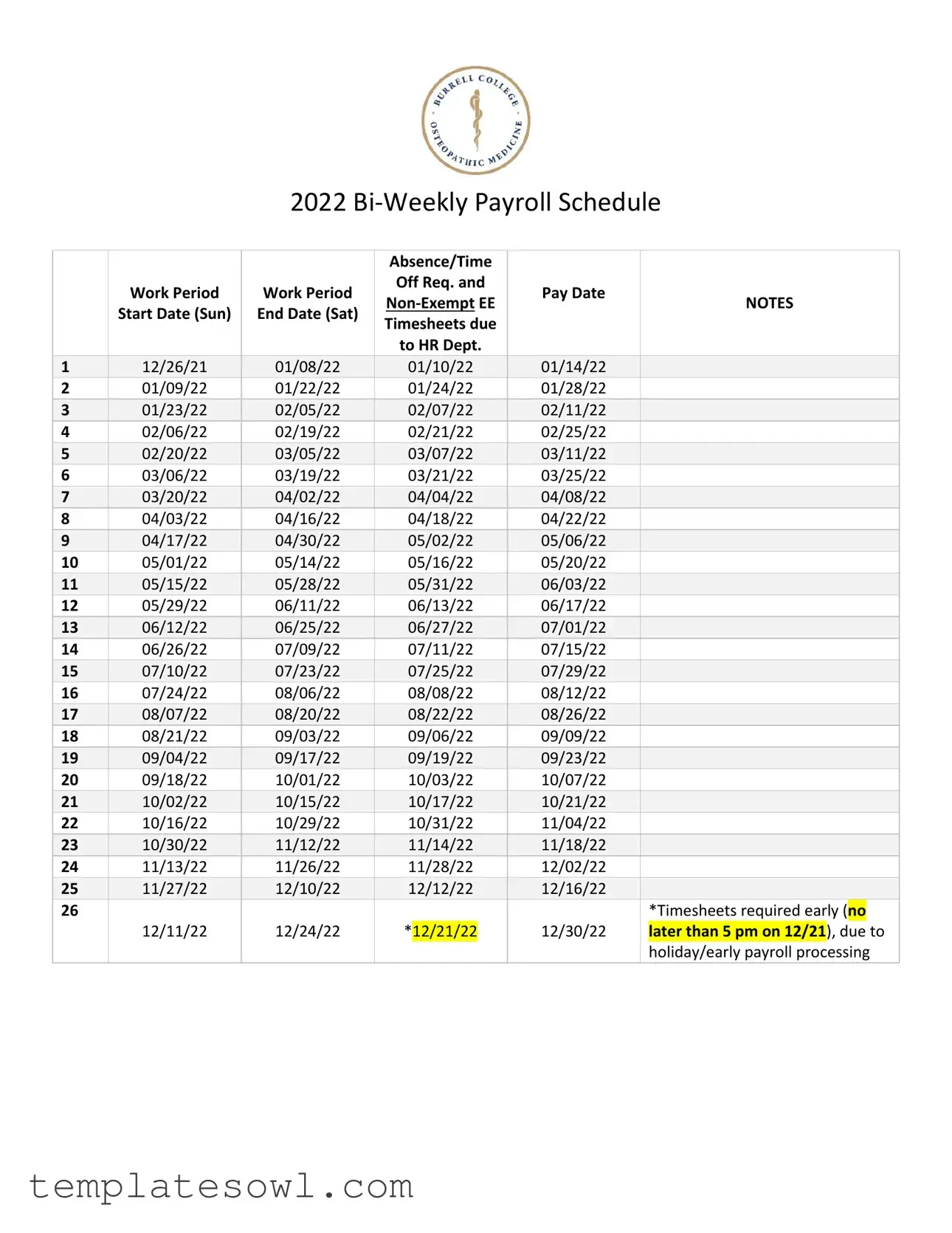

The Weekly Payroll Schedule form outlines crucial timelines for non-exempt employees to ensure accurate pay and compliance with company policies. It delineates the work periods, specifying the starting and ending dates for each payroll cycle, which runs from Sunday to Saturday. Notably, timesheets hold critical importance, as they must be submitted to the Human Resources department by set deadlines to avoid payroll disruptions. Each section of the form provides essential details such as absence request procedures and pay dates, allowing employees to plan accordingly. For instance, understanding the necessity of early timesheet submissions in instances of holiday processing is vital to maintaining an efficient payroll system. Additionally, the form includes clear notes on specific deadlines and requirements, ensuring clarity for all staff involved in the payroll process. By adhering to this schedule, employees can facilitate seamless operations and timely payments, fostering a sense of trust and responsibility within the workplace.

Weekly Payroll Schedule Example

2022

|

|

|

|

|

|

|

|

Absence/Time |

|

|

|

|

|

|

|

|

||

|

|

Work Period |

|

Work Period |

|

Off Req. and |

|

Pay Date |

|

NOTES |

||||||||

|

|

|

|

|

|

|||||||||||||

|

|

Start Date (Sun) |

|

End Date (Sat) |

|

|

|

|

|

|||||||||

|

|

|

|

Timesheets due |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

to HR Dept. |

|

|

|

|

|

|

|

|

||

1 |

|

12/26/21 |

|

|

01/08/22 |

|

|

01/10/22 |

|

|

01/14/22 |

|

|

|

|

|

|

|

2 |

01/09/22 |

|

01/22/22 |

|

01/24/22 |

|

01/28/22 |

|

|

|

|

|

|

|||||

3 |

01/23/22 |

|

02/05/22 |

|

02/07/22 |

|

02/11/22 |

|

|

|

|

|

|

|||||

4 |

02/06/22 |

|

02/19/22 |

|

02/21/22 |

|

02/25/22 |

|

|

|

|

|

|

|||||

5 |

|

02/20/22 |

|

|

03/05/22 |

|

|

03/07/22 |

|

|

03/11/22 |

|

|

|

|

|

|

|

6 |

03/06/22 |

|

03/19/22 |

|

03/21/22 |

|

03/25/22 |

|

|

|

|

|

|

|||||

7 |

03/20/22 |

|

04/02/22 |

|

04/04/22 |

|

04/08/22 |

|

|

|

|

|

|

|||||

8 |

04/03/22 |

|

04/16/22 |

|

04/18/22 |

|

04/22/22 |

|

|

|

|

|

|

|||||

9 |

04/17/22 |

|

04/30/22 |

|

05/02/22 |

|

05/06/22 |

|

|

|

|

|

|

|||||

10 |

05/01/22 |

|

05/14/22 |

|

05/16/22 |

|

05/20/22 |

|

|

|

|

|

|

|||||

11 |

|

05/15/22 |

|

|

05/28/22 |

|

|

05/31/22 |

|

|

06/03/22 |

|

|

|

|

|

|

|

12 |

05/29/22 |

|

06/11/22 |

|

06/13/22 |

|

06/17/22 |

|

|

|

|

|

|

|||||

13 |

|

06/12/22 |

|

|

06/25/22 |

|

|

06/27/22 |

|

|

07/01/22 |

|

|

|

|

|

|

|

14 |

06/26/22 |

|

07/09/22 |

|

07/11/22 |

|

07/15/22 |

|

|

|

|

|

|

|||||

15 |

|

07/10/22 |

|

|

07/23/22 |

|

|

07/25/22 |

|

|

07/29/22 |

|

|

|

|

|

|

|

16 |

07/24/22 |

|

08/06/22 |

|

08/08/22 |

|

08/12/22 |

|

|

|

|

|

|

|||||

17 |

08/07/22 |

|

08/20/22 |

|

08/22/22 |

|

08/26/22 |

|

|

|

|

|

|

|||||

18 |

08/21/22 |

|

09/03/22 |

|

09/06/22 |

|

09/09/22 |

|

|

|

|

|

|

|||||

19 |

09/04/22 |

|

09/17/22 |

|

09/19/22 |

|

09/23/22 |

|

|

|

|

|

|

|||||

20 |

09/18/22 |

|

10/01/22 |

|

10/03/22 |

|

10/07/22 |

|

|

|

|

|

|

|||||

21 |

|

10/02/22 |

|

|

10/15/22 |

|

|

10/17/22 |

|

|

10/21/22 |

|

|

|

|

|

|

|

22 |

10/16/22 |

|

10/29/22 |

|

10/31/22 |

|

11/04/22 |

|

|

|

|

|

|

|||||

23 |

10/30/22 |

|

11/12/22 |

|

11/14/22 |

|

11/18/22 |

|

|

|

|

|

|

|||||

24 |

11/13/22 |

|

11/26/22 |

|

11/28/22 |

|

12/02/22 |

|

|

|

|

|

|

|||||

25 |

|

11/27/22 |

|

|

12/10/22 |

|

|

12/12/22 |

|

|

12/16/22 |

|

|

|

|

|

|

|

26 |

12/11/22 |

|

12/24/22 |

|

* |

|

|

12/30/22 |

|

|

*Timesheets required early ( |

no |

to |

|||||

|

|

|

12/21/22 |

|

|

|

later than 5 pm on 12/21 |

), due |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

holiday/early payroll processing |

|||

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Purpose of the Form | The Weekly Payroll Schedule form outlines the pay dates for employees based on their work periods. |

| Frequency | This schedule follows a bi-weekly payroll process, which means employees are paid every two weeks. |

| Non-Exempt Employees | The schedule specifically pertains to non-exempt employees, who are typically eligible for overtime pay. |

| Work Period Timing | Each work period starts on a Sunday and ends on a Saturday, providing clarity for wage calculation. |

| Timesheet Submission | Timesheets are due to the HR department two business days after the end of each work period. |

| Pay Date | Employees receive their paychecks on the following Friday after the work period ends. |

| Holidays | Specific payroll processing deadlines are adjusted for holidays, as noted for the last pay period in 2022. |

| Governing Laws | The form complies with federal and state labor laws regarding payroll practices and employee payments. |

| Documentation Retention | Employers must retain payroll records for a specified time, generally three years, to comply with labor regulations. |

Guidelines on Utilizing Weekly Payroll Schedule

Understanding how to accurately fill out the Weekly Payroll Schedule form is essential for ensuring that employees receive their pay on time. Once you've completed the form, it will be submitted to the appropriate department, so it is important to follow each step carefully. Adhering to the deadlines provided in the schedule will help maintain a smooth payroll process.

- Obtain the Form: Ensure you have the correct Weekly Payroll Schedule form, which covers the specific work period you are processing.

- Fill in Employee Details: Write the name of the non-exempt employee at the top of the form. Also, indicate their start date.

- Enter Time Period: Locate the relevant work period by referencing the "Work Period" column. This will typically include a start date (Sunday) and an end date (Saturday).

- Document Pay Dates: Under the "Pay Date" section, record the date that payments will be issued. This is usually a few days after the work period ends.

- Submit Timesheets: Mark the timesheets due date in the "Timesheets due to HR Dept." section. This is critical for processing payroll.

- Include Notes if Necessary: If there are any special instructions or notes regarding absences or time off, make sure to include that information. This helps clarify any issues that may arise later.

After completing the form, you will make sure it reaches the HR department by the specified deadlines. This will help facilitate timely payroll processing for all involved parties.

What You Should Know About This Form

What is the purpose of the Weekly Payroll Schedule form?

The Weekly Payroll Schedule form outlines the specific work periods for non-exempt employees, indicating the start and end dates of each pay cycle. It also includes deadlines for timesheet submissions and pay dates, ensuring employees receive their earnings on time.

When are timesheets due for submission to the HR department?

Timesheets must be submitted by 5 PM on the date specified for each work period. For instance, for work period 1, timesheets are due on 01/10/22. Adhering to these deadlines is essential for timely payroll processing.

What happens if a timesheet is submitted late?

Submitting a timesheet late may delay payroll processing, which could result in employees receiving their paychecks later than scheduled. It is crucial for employees to be mindful of submission deadlines to avoid any disruptions in their payment.

How often do employees get paid?

Non-exempt employees are paid every two weeks, following a bi-weekly payroll schedule. Employees can expect to receive their paychecks on the designated pay dates listed in the form, such as 01/14/22 for work period 1.

What should an employee do if they have a question about their payroll?

If an employee has questions regarding their payroll, they should contact the HR department directly. HR can provide assistance with timesheet submission, pay dates, or any discrepancies in pay.

What is the significance of the notes section in the form?

The notes section provides important reminders, such as early submission deadlines during holiday periods. For example, timesheets for the work period ending 12/24/22 must be submitted by 5 PM on 12/21/22 due to holiday processing. This ensures employees are aware of any special requirements.

Can the payroll schedule change throughout the year?

While the payroll schedule is typically consistent, changes may occur due to holidays or special circumstances. Employees will be notified in advance if there are any changes to the usual payroll schedule.

Who qualifies as a non-exempt employee under this schedule?

Non-exempt employees are those who are entitled to overtime pay under federal and state labor laws. These employees are typically paid hourly and are required to submit timesheets to document their hours worked.

What is the pay date for the last work period of the year?

The last work period of the year, which runs from 12/11/22 to 12/24/22, has a pay date of 12/30/22. Employees should ensure that their timesheets are submitted on time to receive their final paycheck of the year without delays.

Common mistakes

Filling out the Weekly Payroll Schedule form is critical for ensuring accurate payment processing. One common mistake is not adhering to the specified work periods. Each work period has defined start and end dates. Failing to align your timesheet with these dates can lead to errors in payroll calculations.

Another frequent error involves the submission deadlines. Timesheets must be submitted to the HR Department by the specified due dates. Missing this deadline can delay payroll processing, affecting employee payouts. Always double-check to ensure that timesheets are submitted on time.

Not completing the absence/time off request section correctly is another concern. It's essential to indicate any absence accurately, as these details directly impact payroll. Incomplete or unclear requests can result in unnecessary complications.

People often overlook the notes section where critical information regarding holiday pay or special processing instructions may be specified. Ignoring this section can cause confusion and lead to payroll discrepancies, especially during holiday weeks.

Accuracy in entering hours worked is paramount. Simple mathematical errors in hours can create significant discrepancies in payroll amounts. Make sure to verify your total hours before submission to avoid misunderstandings.

Additionally, employees sometimes forget to keep a personal record of submitted timesheets. Having a copy can prove useful in case discrepancies arise later. Documentation aids in resolving any payroll issues that could occur.

Another potential pitfall is submitting a timesheet that doesn’t reflect the actual hours worked due to miscommunication about schedules. Regularly confirming schedules with supervisors helps ensure that no hours go unrecorded.

Lastly, many individuals fail to confirm if their timesheets were received by the HR Department. Following up on submission receipt is a simple yet effective way to ensure smooth processing. Confirming receipt can help mitigate potential issues with payroll.

Documents used along the form

The Weekly Payroll Schedule form is an essential document in managing employee payroll efficiently. In addition to this form, several other documents support payroll processing and time tracking. Below is a list of related forms that can streamline the payroll process and ensure compliance with labor regulations.

- Timesheet: This document records the hours worked by each employee during a specific period. Employees fill it out to track their working hours, including overtime, and submit it to their supervisor or human resources.

- Payroll Calculator: A tool used to compute employee wages. It factors in hourly rates, deductions, and any bonuses. This calculator helps ensure accuracy in payroll processing.

- Direct Deposit Authorization Form: Employees complete this form to permit the employer to deposit their pay directly into their bank accounts. It simplifies the payment process and enhances security.

- W-4 Form: This IRS form determines the amount of federal income tax withholding from an employee’s paycheck. New hires must fill it out to ensure correct tax calculations.

- Employee Handbook: This document provides guidelines on workplace policies, including payroll practices, attendance, and employee rights. It's vital for setting expectations regarding compensation and reporting hours.

- Leave Request Form: Employees use this form to formally request time off. This request includes details on the type of leave and duration, ensuring proper planning and payroll adjustment.

- End-of-Year Payroll Summary: This report outlines an employee’s earnings and deductions for the year. It is necessary for tax reporting purposes and provided to employees for their reference during tax season.

- Expense Reimbursement Form: Employees submit this form to request reimbursement for work-related expenses. This form must be processed alongside payroll to ensure timely payments.

Utilizing these forms in conjunction with the Weekly Payroll Schedule will create a more organized payroll processing system. This approach minimizes errors and ensures employees receive their pay accurately and on time.

Similar forms

- Bi-Weekly Payroll Schedule: Similar to the Weekly Payroll Schedule, the Bi-Weekly Payroll Schedule outlines the pay periods but caters to employees paid every two weeks. It includes start and end dates, due dates for timesheets, and pay dates, providing an organized way to track payroll frequency and deadlines.

- Monthly Payroll Schedule: This document consolidates all pay periods within a month. Like the Weekly schedule, it specifies the timeframes for which payroll is processed but does so on a monthly basis. It helps ensure employees know when they will receive payments.

- Overtime Approval Form: The Overtime Approval Form works hand in hand with the Payroll Schedule by requiring supervisors' approval for extra hours worked. It ensures that overtime gets compensated according to the established payroll periods, aligning approval with timesheet submission.

- Time Off Request Form: Employees submit this form to request time off, which directly affects payroll processing. The Weekly Payroll Schedule incorporates these requests to account for absence during pay periods, thus assisting payroll in calculating accurate payments.

- Employee Attendance Record: This form keeps track of employee attendance. It complements the Weekly Payroll Schedule by providing necessary documentation for hours worked, impacting overall payroll calculations and ensuring accuracy in payments.

- Payroll Change Form: Any modifications to an employee's salary, benefits, or withholding are documented through the Payroll Change Form. It is similar to the Weekly Payroll Schedule in that it must be processed before the payroll cut-off dates to ensure accurate compensation.

Dos and Don'ts

When filling out the Weekly Payroll Schedule form, it is crucial to adhere to specific guidelines to ensure accuracy and compliance. Below is a compilation of actions to take and avoid.

- Do double-check the work period dates for accuracy.

- Do submit timesheets by the deadline specified for each period.

- Do ensure that any absence or time-off requests are correctly noted.

- Do review the notes section for any special instructions regarding pay dates.

- Do not leave any sections of the form incomplete.

- Do not submit timesheets late, as this may delay processing.

- Do not forget to verify your employee information for accuracy.

- Do not ignore any specific requests for early submissions, especially around holidays.

Misconceptions

Misconceptions about the Weekly Payroll Schedule form can lead to misunderstandings in payroll processes. Below are common myths paired with factual clarifications.

- It is only for non-exempt employees. Many believe this form is exclusively for non-exempt staff. In fact, it is beneficial for all employees, including exempt ones, to understand payroll timelines.

- Timesheets can be submitted any time before the deadline. Some assume that late submissions will be accepted without penalty. However, late timesheets can delay payment and may lead to additional complications.

- The pay date changes from week to week. People often think the pay date is unpredictable. Conversely, the schedule contains fixed pay dates across the pay periods.

- Pay dates are automatically adjusted for holidays. There is a misconception that pay dates shift automatically when a holiday occurs. In reality, employees should check the schedule for any specified changes.

- All time off must be pre-approved. While many think that any absence requires approval beforehand, some personal absence days can be taken without prior notice as per company policy. Employees should consult their guidelines to clarify.

- The schedule is the same every year. There is a belief that the payroll schedule does not change from one year to another. However, dates and periods may shift annually based on the calendar.

- Submitting timesheets after hours on the due date is acceptable. Some assume that submitting timesheets by the end of the day is fine. Late timesheets, even if submitted on the due date, often require handling the next day and may delay payroll.

- Employees can disregard the NOTES section. A common misunderstanding is that the NOTES section is unimportant. This section contains crucial instructions regarding holidays and early deadlines for timesheet submission.

- You only need to check the pay dates. Many people believe only pay dates are important. The entire form should be reviewed, including work periods and deadlines, to ensure full understanding of the payroll process.

- Payroll errors can be fixed quickly post-processing. There is an expectation that any issues can be resolved easily after payroll has been processed. Correcting errors post-processing can take longer and may require additional steps.

Understanding these misconceptions can help employees navigate the payroll process more effectively and avoid unnecessary stress.

Key takeaways

The Weekly Payroll Schedule form is a vital tool for managing payroll effectively. Here are key takeaways to assist you in filling it out and using it properly:

- Understand the Schedule: Familiarize yourself with the work periods listed, which define the start and end dates for each payroll cycle.

- Timely Submission: Ensure that all timesheets are submitted to the HR department by the specified due dates to avoid delays in processing.

- Recognize Pay Dates: Pay dates are outlined in the form; it is essential to note when employees will receive their payments.

- Manage Absences: The form includes a section for absence requests that must be completed accurately for payroll adjustments.

- Plan for Holidays: Be aware of the holidays that might affect payroll processing. Early submission may be necessary during these times.

- Double-Check Entries: Review all entries for accuracy to prevent any payroll discrepancies that may cause issues for employees.

- Stay Informed: Keep updated on any changes that may occur within payroll scheduling to ensure compliance with new requirements.

- Utilize for Budgeting: The payroll schedule can assist with financial forecasting and budgeting within your department or company.

- Seek Assistance: If there are any uncertainties, do not hesitate to reach out to the HR department for guidance on completing the form correctly.

By keeping these points in mind, you can navigate the Weekly Payroll Schedule form confidently and help ensure a smooth payroll process for all involved.

Browse Other Templates

Schedule C Tax - Your net profit from Schedule C-EZ is reported on your individual tax return Form 1040.

Payvor - If you choose full net pay, write “100%” in the appropriate box.