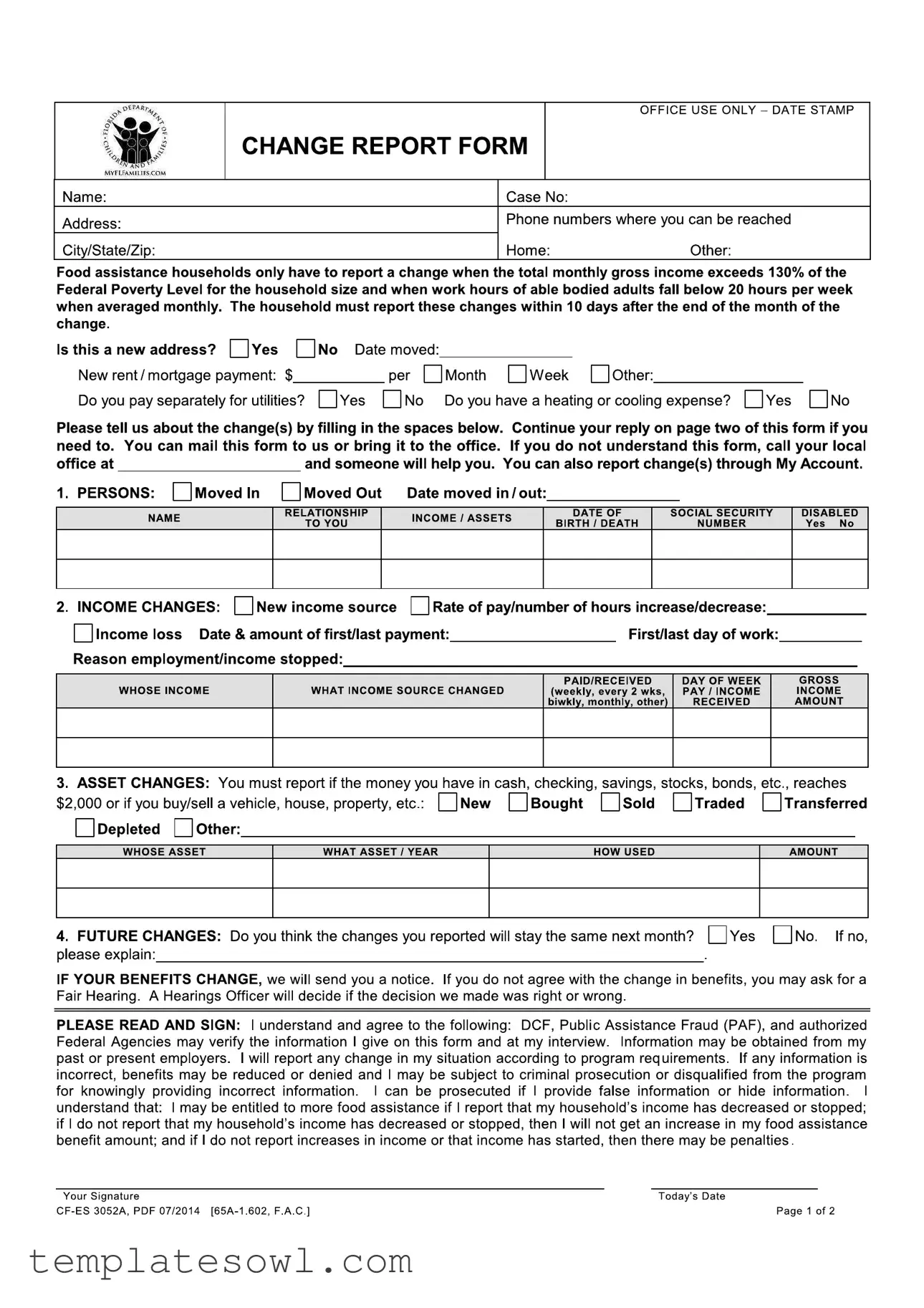

Fill Out Your Welfare Change Report Form

The Welfare Change Report form plays a vital role in the management of public assistance programs, particularly for households receiving food assistance. Accurate completion of this form is crucial, as it allows the relevant authorities to acknowledge and address any significant changes in a household's financial circumstances. Households are required to report specific changes, such as an increase in total monthly gross income exceeding 130% of the Federal Poverty Level or a decrease in work hours for able-bodied adults below 20 hours per week. Timely reporting within 10 days after the month of change is essential for continued eligibility and benefit adjustments. The form also addresses various aspects of a household's situation, including address changes, income alterations, and asset updates. Moreover, it asks important questions about utilities, heating, and cooling expenses. Guidance is provided for individuals who may find the form overwhelming, with options for direct assistance through local offices or online resources. Understanding and complying with these requirements can significantly affect the amount of assistance a household may receive, making it imperative for individuals to respond accurately and honestly.

Welfare Change Report Example

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The Welfare Change Report form is used to inform authorities of changes in a household's situation that may affect food assistance benefits. |

| Income Reporting Requirement | Households must report if their total monthly gross income exceeds 130% of the Federal Poverty Level. |

| Work Hours Reporting Requirement | Changes in work hours for able-bodied adults must be reported if they fall below an average of 20 hours per week. |

| Reporting Deadline | Changes must be reported within 10 days following the end of the month in which the change occurs. |

| Utility Payment Inquiry | The form inquires whether the household pays separately for utilities, which can affect the benefits granted. |

| Asset Reporting Requirement | Households must report if cash or assets exceed $2,000 or if there are changes to vehicles or property. |

| Legal Reference | This form is governed by Section 65A-1.602 of the Florida Administrative Code, which regulates public assistance programs. |

Guidelines on Utilizing Welfare Change Report

After completing the Welfare Change Report form, you’ll need to submit it either by mailing it or delivering it to your local office. Be sure to keep a copy for your records. If you require assistance at any point during this process, don't hesitate to reach out for help.

- Begin by acquiring the Welfare Change Report form from your local office or the designated website.

- Fill in your personal information at the top of the form, including your Name, Case Number, Address, and Phone Numbers.

- Indicate whether your address has changed by selecting Yes or No in the appropriate section. If yes, provide the Date Moved and your New Rent/Mortgage Payment.

- Answer the questions regarding your utility payments and heating or cooling expenses, marking Yes or No as applicable.

- Detail any changes in your household members by listing their Name, Relationship to You, Income/Assets, Date of Birth/Death, and Social Security Number. Mark if the individual is Disabled with a Yes or No.

- For income changes, specify the New Income Source, the Rate of Pay, and any loss of income by indicating the Date & Amount of First/Last Payment and reasons behind the employment stop, if applicable.

- Report any asset changes, including cash, checking, savings, and investments, detailing what changes occurred and their respective amounts.

- Address future changes by indicating whether you believe these changes will stay the same next month. Provide an explanation if you answer No.

- Read the final terms of agreement carefully. It’s crucial to understand the implications of providing accurate information.

- Sign and date the form to certify that the information provided is true to the best of your knowledge.

- Make a copy of the completed form for your personal records before submitting it to your local office.

Ensure that the completed form reaches the correct office address as soon as possible to meet the reporting deadline.

What You Should Know About This Form

What is the purpose of the Welfare Change Report form?

The Welfare Change Report form is designed to collect information about changes in circumstances that may affect a household's eligibility for food assistance. Households are required to report significant changes such as moving to a new address, changes in income, and asset fluctuations. Timely reporting of these changes helps ensure that benefits are adjusted appropriately and that recipients receive the correct amount of assistance based on their current situation.

When should I report changes to my household's situation?

How can I submit the Welfare Change Report form?

You can submit the completed Welfare Change Report form in two ways: by mailing it to your local office or by delivering it in person. Ensure that all relevant information is filled out accurately to facilitate a smooth processing of your changes. If you have questions or need assistance, you can also contact your local office for help.

What happens after I submit my report?

Upon receiving your report, the relevant agency will review the information provided. If your benefits are affected by the changes you reported, a notification will be sent to you outlining any adjustments. If you disagree with this decision, you have the right to request a Fair Hearing, where a Hearings Officer will determine whether the agency’s decision was appropriate based on the circumstances.

Common mistakes

When completing the Welfare Change Report form, individuals often make mistakes that can lead to delays or denials of benefits. One common error is failing to report changes within the required timeframe. It is crucial to inform the relevant office of any changes within **10 days** after the change occurs. If this deadline is missed, benefits may be adversely affected.

Another typical oversight involves inaccuracies in the information provided. Omitting essential details such as income changes or asset values can lead to significant complications. Be precise when stating income sources, especially if there are multiple streams or if any income is on a fluctuating basis.

Many people neglect to update their contact information. Providing the correct address and phone numbers ensures that necessary communications reach them. If a recipient has moved, indicating the new address clearly on the form is vital. This helps avoid missed notifications regarding benefits or required follow-ups.

Submitting incomplete sections of the form is another frequent mistake. Each part should be filled out entirely. Sections regarding household members, income fluctuations, and asset changes should be approached with thoroughness. Leaving spaces blank can trigger delays and require additional follow-up from the eligibility workers.

Individuals sometimes misunderstand the requirements for reporting utility payments, housing expenses, or heating and cooling costs. If applicable, these details must be filled out accurately. Providing misleading or unclear information could result in incorrect benefit decisions.

Failing to indicate whether changes are expected to last beyond the next month is also a misstep. While forecasting can be challenging, it is necessary to provide this information to help determine ongoing eligibility accurately.

Misreading the form's instructions can lead to confusion about what to report, particularly concerning asset thresholds. Understanding that cash or assets reaching **$2,000** must be reported is crucial to avoid penalties or loss of benefits.

Lastly, people often forget to sign and date the form before submission. Not completing this final step can lead to the form being deemed invalid. Remember, every section is important, and a simple signature can make a significant difference in ensuring your changes are processed correctly.

Documents used along the form

The Welfare Change Report form is a critical document for reporting changes in income, address, or household composition that affect eligibility for assistance programs. When using this form, there are several other documents and forms that may be required or helpful in the process. Below is a list of documents commonly associated with the Welfare Change Report form.

- Application for Benefits: This form is used by individuals to apply for government assistance programs. It collects information on household income, assets, and expenses to determine eligibility.

- Budget Worksheet: A budget worksheet helps households outline their monthly income and expenses. This can be a useful tool when reporting changes to ensure accurate documentation of financial status.

- Verification of Income Statement: This document is often requested to verify sources of income, such as pay stubs or tax documents. It provides proof of earnings over a specified period.

- Notice of Adverse Action: Issued by the agency, this notice informs beneficiaries of any changes in their assistance status, including reductions or terminations of benefits. It explains the reasons for the decision and options for appeal.

- Fair Hearing Request Form: If a beneficiary disagrees with a decision made regarding their benefits, they can use this form to request a fair hearing to contest the action taken by the agency.

- Change of Address Form: This form is used to officially report a change of address to the assistance agency. Properly updating this information is crucial for uninterrupted benefit delivery.

- Asset Declaration Form: When there are significant changes in assets, this form may be required to report items such as savings or investments that could impact eligibility for assistance programs.

Collecting and submitting these forms alongside the Welfare Change Report can aid in ensuring proper processing of changes and maintaining eligibility for assistance programs. Accurate and timely reporting is essential to avoid any delays or complications with benefits.

Similar forms

- Change of Address Form: Similar to the Welfare Change Report form, this document requests updated information on an individual's address along with reasons for the change. Timelines for reporting the new address are often included, making it essential for maintaining accurate records.

- Income Reporting Form: This form requires individuals to provide details about their income, similar to how the Welfare Change Report captures income changes affecting assistance. Both emphasize the importance of timely reporting to avoid penalties or discrepancies.

- Household Composition Form: Like the Welfare Change Report, this document collects information about who lives in the household and their relationships. Changes in household composition can impact eligibility and benefit amounts, requiring immediate reporting.

- Asset Disclosure Form: This form typically asks for details about assets in a manner akin to the Welfare Change Report. Both documents stipulate thresholds for reporting changes in assets, as they can directly affect a person's benefits.

- Recertification Form: Similar in purpose, this document requires clients to update their information at set intervals. The focus is on verifying ongoing eligibility for benefits, which parallels the reporting requirements outlined in the Welfare Change Report.

Dos and Don'ts

Filling out the Welfare Change Report form can be a crucial step in maintaining your benefits. Here are some key do's and don'ts to keep in mind to ensure the process goes smoothly:

- Do provide accurate personal information, including your name, address, and case number.

- Don't leave any sections blank that are applicable to your situation—fully completed forms reduce delays.

- Do report any income changes within 10 days of the end of the month when the change occurred.

- Don't underestimate your income; always report changes in a timely manner.

- Do indicate if you have moved, and provide details about your new living situation.

- Don't omit critical information about changes in assets, such as cash or property sales.

- Do sign and date your report, acknowledging that the information is complete and truthful.

- Don't provide false information; doing so can lead to severe consequences, including loss of benefits.

By keeping these guidelines in mind, you can navigate the reporting process more effectively and help ensure that your benefits are calculated accurately.

Misconceptions

Misconceptions about the Welfare Change Report form can lead to confusion for those who need to use it. Understanding the truths behind these misconceptions is crucial for ensuring that assistance programs run smoothly. Here are six common misconceptions:

- It's only necessary to report income changes. Many believe that only changes in income need to be reported. However, it's essential to report various changes, including those related to assets, household composition, and expenses, not just income.

- You can report changes anytime without consequences. Some individuals think they can delay reporting changes. In reality, there is a strict timeline for reporting. Households must report changes within 10 days after the month the change occurred, or they risk penalties or delays in assistance.

- Reporting a change will always lead to a decrease in benefits. This is a common fear. While some changes may result in a reduction, reporting income decreases or loss can actually increase food assistance benefits. Transparency can lead to better support.

- You must fill out the entire form for every change. Many believe that every section must be completed for every change reported. However, only the relevant sections need to be filled out based on the specific changes. This makes the process more manageable.

- Only the head of the household can report changes. It is a misconception that only one person is responsible for reporting. Any adult member of the household can report changes, ensuring that vital information is communicated promptly.

- The form must be submitted in person. While individuals can bring the form into the office, it can also be mailed. Some believe that in-person submission is the only option, which is not true. This flexibility can ease the process for many.

By addressing these misconceptions, people can better navigate the Welfare Change Report form and ensure they are compliant with reporting requirements, potentially improving their access to the assistance they need.

Key takeaways

When filling out and using the Welfare Change Report form, it is important to keep the following key points in mind:

- Timeliness is essential. Report changes within 10 days following the month the change occurs.

- Income thresholds matter. Only report changes if your household income exceeds 130% of the Federal Poverty Level or if able-bodied adults work less than 20 hours per week.

- Accurate information is critical. Ensure all details regarding income, assets, and future changes are correct to avoid penalties or prosecution.

- Communication is key. If you do not understand the form, contact your local office for assistance.

- Changes may affect benefits. Keep in mind that reporting decreases in income could lead to increases in food assistance amounts.

Completing this form accurately and promptly can help maintain correct benefit levels. Always ensure to provide clear and truthful information to avoid complications with your benefits.

Browse Other Templates

Request C-file on Ebenefits - Submit the VA 10091 promptly to avoid any delays in processing your vendor status.

Sample Order to Show Cause California - This form is used to request a hearing for someone accused of disobeying a court order.