Fill Out Your Wells Fargo Authorization Form

The Wells Fargo Authorization form serves as a crucial tool for borrowers who wish to grant permission for their loan information to be shared with third parties. This document must be completed and returned, and it requires detailed information such as the borrower's name, property address, and loan number. Once filled out, it allows Wells Fargo to release information about the loan to a designated individual, which could include attorneys, real estate agents, or other entities involved in the transaction. The form prompts the borrower to specify the third party’s contact details, including their address, email, and phone number, ensuring that communication flows smoothly. Additionally, the borrower must indicate what specific privileges are being granted, such as the ability to receive information or update tax and insurance details. It is important to note that authorizations tied to real estate agents expire after one year, whereas other third-party authorizations may last throughout the life of the loan unless a specific expiration date is provided. Borrowers also accept responsibility for any actions taken by the authorized party and may cancel this authorization whenever necessary, ensuring oversight over their loan management. Understanding this form is indispensable for borrowers looking to navigate their loan management effectively while involving trusted advocates.

Wells Fargo Authorization Example

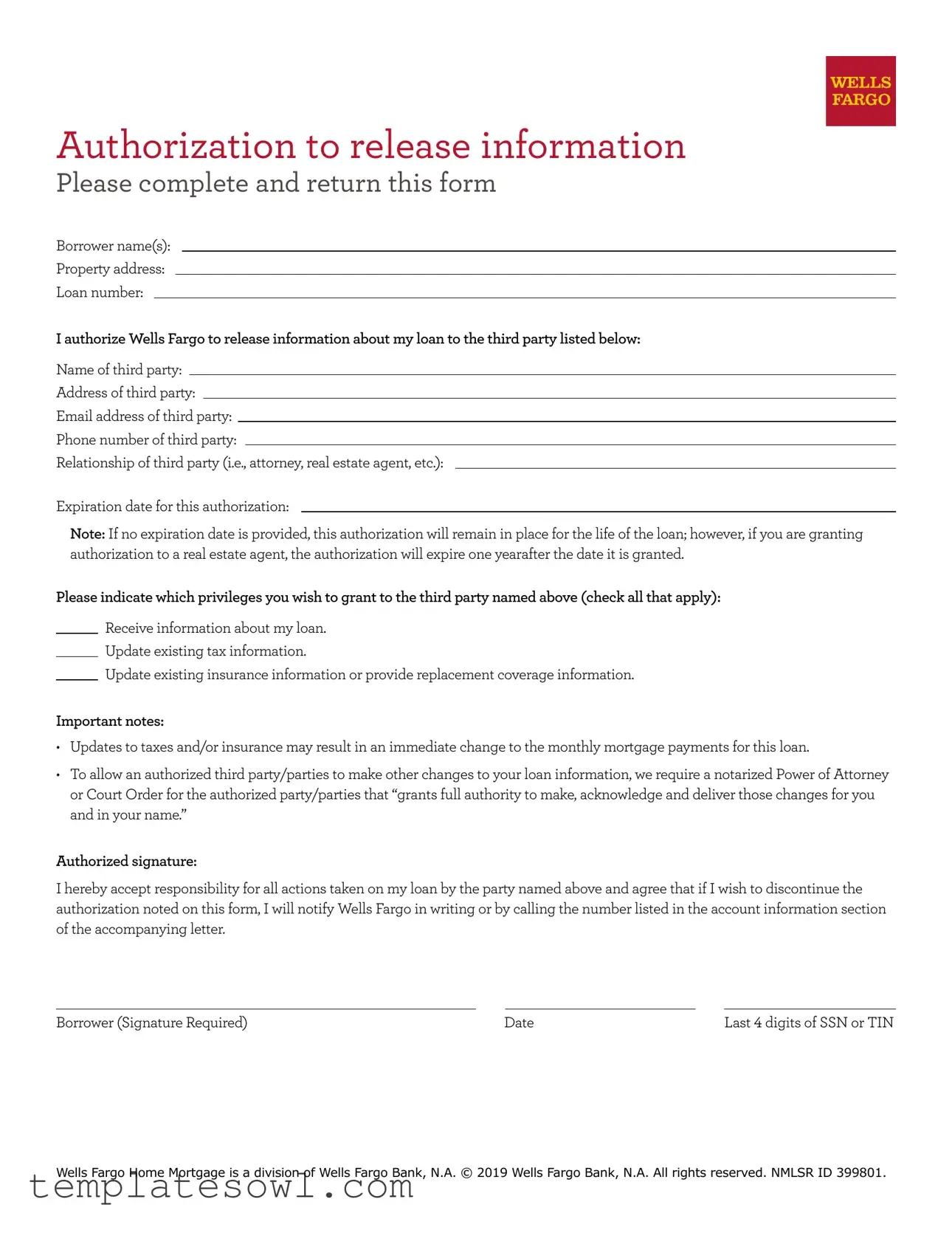

Authorization to release information

Please complete and return this form

Borrower name(s):

Property address:

Loan number:

I authorize Wells Fargo to release information about my loan to the third party listed below:

Name of third party:

Address of third party:

Email address of third party:

Phone number of third party:

Relationship of third party (i.e., attorney, real estate agent, etc.):

Expiration date for this authorization:

Note: If no expiration date is provided, this authorization will remain in place for the life of the loan; however, if you are granting authorization to a real estate agent, the authorization will expire one yearafter the date it is granted.

Please indicate which privileges you wish to grant to the third party named above (check all that apply):

Receive information about my loan.

Update existing tax information.

Update existing insurance information or provide replacement coverage information.

Important notes:

•Updates to taxes and/or insurance may result in an immediate change to the monthly mortgage payments for this loan.

•To allow an authorized third party/parties to make other changes to your loan information, we require a notarized Power of Attorney or Court Order for the authorized party/parties that “grants full authority to make, acknowledge and deliver those changes for you and in your name.”

Authorized signature:

I hereby accept responsibility for all actions taken on my loan by the party named above and agree that if I wish to discontinue the authorization noted on this form, I will notify Wells Fargo in writing or by calling the number listed in the account information section of the accompanying letter.

Borrower (Signature Required) |

Date |

Last 4 digits of SSN or TIN |

Wells Fargo Home Mortgage is a division of Wells Fargo Bank, N.A. © 2019 Wells Fargo Bank, N.A. All rights reserved. NMLSR ID 399801.

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Authorization Purpose | This form allows borrowers to authorize Wells Fargo to release their loan information to a specified third party, such as an attorney or real estate agent. |

| Expiration of Authorization | If the authorization does not specify an expiration date, it will remain valid for the life of the loan. However, if granted specifically to a real estate agent, the authorization will expire one year after its grant. |

| Privileges Granted | Borrowers can select multiple privileges to grant to the third party, including receiving loan information and updating tax and insurance details. |

| Regulatory Compliance | The form’s use is governed by applicable state laws regarding privacy and loan authorization procedures, ensuring compliance throughout the authorization process. |

Guidelines on Utilizing Wells Fargo Authorization

After completing the Wells Fargo Authorization form, you will be able to grant permission for certain third parties to access information about your loan. This can help facilitate communication and ensure those involved in the process have the necessary information. Ensure that all details are accurate to avoid any delays.

- Begin by providing your name(s) in the space labeled "Borrower name(s)".

- Fill in the "Property address" where the loan is secured.

- Enter your "Loan number" in the designated field.

- Identify and write the name of the third party you are authorizing to receive information.

- Provide the "Address of third party" clearly.

- Include the "Email address of third party" for electronic communication.

- List the "Phone number of third party" to ensure they can be contacted easily.

- Specify the "Relationship of third party" to you, such as attorney or real estate agent.

- If applicable, set an "Expiration date for this authorization". If you leave this blank, it will remain valid for the life of the loan.

- Check any privileges you wish to grant to the third party from the options provided, such as receiving loan information or updating tax information.

- Sign the form where indicated under "Authorized signature".

- Date the form next to your signature.

- Finally, write the last four digits of your Social Security Number or Tax Identification Number in the space provided.

What You Should Know About This Form

What is the purpose of the Wells Fargo Authorization form?

The Wells Fargo Authorization form allows borrowers to grant permission for Wells Fargo to share specific information about their loan with a designated third party. This could include real estate agents, attorneys, or other individuals who may need access to loan details for various transactions or consultations.

Who can I authorize using this form?

You can authorize any third party relevant to your loan needs. Common choices include real estate agents, attorneys, or financial advisors. When completing the form, provide the name, address, email, and phone number of the third party so Wells Fargo can contact them directly.

What information can I allow the third party to receive?

On the form, you can specify privileges such as receiving information about your loan, updating tax information, or adjusting insurance details. Carefully check all permissions you wish to grant to ensure the third party can assist you as needed.

How long is the authorization valid?

Unless you specify an expiration date, the authorization remains effective for the life of the loan. However, if you authorize a real estate agent, the authorization will expire one year from the date it’s granted. It is important to monitor any timelines to ensure continued access as required.

What happens if I need to cancel the authorization?

If you want to revoke the authorization granted to the third party, you must inform Wells Fargo in writing. Alternatively, you can call the customer service number provided in your account information. It's crucial to keep this process documented for your records.

Are there any implications on my loan if I update tax or insurance information?

Yes, updating tax or insurance information may result in immediate changes to your monthly mortgage payments. Therefore, it's advisable to consider the potential financial implications before granting updates through a third party.

What if I need someone to make changes to my loan other than the ones listed?

If you need to allow a third party to make other changes to your loan, you must provide a notarized Power of Attorney or a Court Order that grants full authority to act on your behalf. This additional requirement ensures that Wells Fargo can legally recognize the third party's right to make such changes.

Common mistakes

Filling out the Wells Fargo Authorization form may seem straightforward, but there are common mistakes that people often make. Understanding these errors can save time and prevent delays in the processing of your request.

One frequent mistake is leaving essential fields blank. Information like the borrower’s name, loan number, and the third party’s contact details is crucial. If you skip these sections, the form may be rejected or cause confusion, leading to delays in communication.

Another common issue is failing to specify the expiration date for the authorization. If you do not provide an expiration date, the authorization remains valid for the life of the loan. However, granting authorization to a real estate agent without specifying an expiration means the authorization could unnecessarily extend beyond a year.

Some individuals mistakenly assume that checking all privileges is necessary. It’s important to only check what you truly want the third party to handle. Over-authorizing can lead to complications, leaving your personal information vulnerable or causing confusion regarding who has access to what.

Not including the relationship of the third party on the form is another common oversight. This information helps Wells Fargo understand the context and trust level of the third-party request. Without it, processing may take longer as the institution seeks clarification.

Additionally, people often forget to sign the form. The authorized signature is a critical step in the process. Neglecting this can result in the form being deemed incomplete, causing unnecessary delays.

Another mistake involves providing outdated or incorrect contact information for the third party. Always double-check the accuracy of the address, email, and phone number listed. Incorrect details can lead to failed communications, leaving your loan updates in limbo.

Some individuals misunderstand the nature of the authorization. They may think this form grants broader powers than it actually does. The form only allows specific actions as indicated; granting a Power of Attorney is necessary for more extensive changes.

People sometimes overlook the potential impact of updates on their loan. It is vital to remember that changing tax or insurance information can lead to immediate adjustments in monthly payments. Ignoring this can create financial surprises later on.

Finally, a lack of attention to the instructions can lead to misinterpretation of the form’s requirements. Always read the important notes carefully to understand what needs to be done. Missteps here can result in incomplete or incorrect submissions.

By staying alert to these common pitfalls, borrowers can ensure that their authorization requests are processed smoothly, keeping the lines of communication open with Wells Fargo.

Documents used along the form

When working with the Wells Fargo Authorization form, several other documents may often be required to support the authorization process or gather further information. Below is a list of common forms that can be useful in conjunction with the Wells Fargo Authorization form.

- Power of Attorney: This legal document allows another individual to make decisions on behalf of the borrower. It is especially important when ongoing management of the loan is needed by a third party.

- Real Estate Purchase Agreement: This contract outlines the terms of a property sale. It includes details like purchase price and closing date, and may be necessary for closing processes involving the borrower’s loan.

- Loan Modification Request: This form is used when a borrower seeks to alter the terms of their existing loan. It usually requires documentation of the borrower's financial situation and the reason for the modification.

- Credit Authorization Form: This document grants permission to a lender or third party to check the borrower’s credit report. It ensures that the borrower is aware of any credit checks made during the process.

- Statement of Information: This form is often required to verify an individual's identity and protect against fraud. It typically includes personal details that assist lenders in processing and approving loans.

- Third-Party Payment Authorization: This document allows a third party to make payments on behalf of the borrower. It can be useful for individuals who need assistance managing loan payments.

Understanding these forms can facilitate smoother communication and processes when dealing with loan information and related situations. Each document serves a specific purpose and ensures that all parties involved are clearly informed and authorized to act appropriately.

Similar forms

Power of Attorney: Like the Wells Fargo Authorization form, a Power of Attorney grants permission for a designated individual to make decisions and perform actions on behalf of another person, particularly in financial matters. It often requires notarization and is broader in scope.

Medical Release Form: This document allows a healthcare provider to share a patient’s medical information with another individual, similar to how the Wells Fargo form allows the sharing of loan information. It also specifies the information to be shared and can include an expiration date.

Authorization for Release of Educational Records: This form permits educational institutions to disclose a student's records to a designated third party. Like the Wells Fargo form, it identifies the parties involved and often includes conditions under which information can be released.

Third-Party Authorization Form: Used in many industries, this form allows one party to authorize another to manage their affairs, paralleling the Wells Fargo form by designating specific actions and types of information that can be accessed or modified.

Consent for Background Check: This document gives permission for an employer or organization to conduct a background check on an individual, similar to the loan authorization where consent is required to share personal information. It includes details about what information can be collected.

Dos and Don'ts

When completing the Wells Fargo Authorization form, it is essential to follow specific guidelines to ensure a smooth process. Here are four do's and don'ts to keep in mind:

- Do provide accurate borrower information, including your full name and the property address, to avoid processing delays.

- Do clearly indicate the name and contact information of the third party you wish to authorize. Ensure their email address and phone number are correct.

- Don't skip the section on the relationship of the third party. This information helps Wells Fargo understand the context of the authorization.

- Don't forget to specify an expiration date for the authorization if you do not want it to last for the life of the loan. If left blank, it will remain active indefinitely.

By paying close attention to these details, you can ensure that your authorization form is processed efficiently. Properly filling out the form not only saves time but also helps prevent any misunderstandings in the future.

Misconceptions

Misconceptions can often lead to confusion, especially regarding important documents like the Wells Fargo Authorization form. Here are eight common misconceptions explained:

- This form is only for real estate agents. Many people believe that only real estate agents require authorization. However, the form can authorize any third party, including attorneys and financial advisors, to access information about your loan.

- The authorization is permanent. Some think that once they sign the form, it lasts indefinitely. In fact, if no expiration date is specified, the authorization lasts for the life of the loan. However, if you designate a real estate agent, the authorization automatically expires one year after it is granted.

- I have to provide all my personal information. While some details are necessary for verification purposes, you only need to provide information relevant to the third party you are authorizing. It’s important not to overload the form with unnecessary personal data.

- The third party has complete control over my loan. Signing this form does not give the third party full control. They can only receive information or make updates that you’ve specifically authorized. For more extensive changes, additional documentation like a notarized Power of Attorney is required.

- Once signed, I cannot reverse the authorization. Many believe they are stuck once they authorize someone. However, you can revoke the authorization at any time by notifying Wells Fargo in writing or by phone.

- This form is purely optional and has no consequences. This is misleading. Depending on the privileges granted, updates to your loan information may lead to immediate changes in your mortgage payments. Understanding the implications is essential.

- Only one authorization form is needed for multiple parties. If you wish to authorize several different third parties, you must fill out a separate authorization form for each. This ensures that each party's access is clearly defined.

- I can't contact Wells Fargo directly if I grant authorization. Some people fear that granting a third party access means they lose contact with Wells Fargo. In reality, you can still reach out and manage your loan inquiries directly, regardless of any authorizations in place.

Understanding these misconceptions helps clarify the purpose and limitations of the Wells Fargo Authorization form, ensuring more informed decisions for borrowers.

Key takeaways

The Wells Fargo Authorization form is a critical document for borrowers wishing to share their loan information. Here are key takeaways regarding its use and completion:

- Complete Required Fields: Ensure that all sections of the form, such as borrower names, property address, and loan number, are filled in accurately.

- Identify the Third Party: Clearly indicate the name, address, email, and phone number of the individual or entity to whom the authorization is granted.

- Specify the Relationship: It is important to state the relationship of the third party. This could be an attorney, real estate agent, or other designated individual.

- Expiration Date: Provide an expiration date for the authorization. If none is indicated, it will remain effective for the life of the loan, with a one-year limit for real estate agents.

- Select Privileges: Choose which actions the third party can perform by checking the appropriate boxes on the form.

- Understand Changes: Be aware that updates to tax and insurance information may lead to changes in monthly mortgage payments.

- Power of Attorney Requirement: To allow additional changes, a notarized Power of Attorney or Court Order is needed to grant full authority to the third party.

- Authorized Signature: The borrower must sign the form, accepting responsibility for actions taken by the authorized party.

- Discontinuation Process: If you wish to end the authorization, notify Wells Fargo in writing or via phone as detailed in the accompanying letter.

By understanding these aspects, borrowers can effectively manage their loan information and maintain control over who can access it.

Browse Other Templates

Fl-150 Example - It's essential to review each section carefully, ensuring completeness and accuracy of the information provided.

United Health Care Eap - Document the length of the session to justify the charges made.