Fill Out Your Wells Fargo Checking Beneficiary Form

The Wells Fargo Checking Beneficiary form is an important document for participants who wish to ensure that their benefits are distributed according to their wishes in the event of their passing. Completing this form accurately is crucial, as it allows you to designate primary and contingent beneficiaries who will receive any funds due under the plan. Participants must use a black ink pen and return the signed form to Wells Fargo at the specified address. Instructions provide guidance on filling out the requisite information, including the names, social security numbers, and current addresses of the chosen beneficiaries. It is important to note that if any fields are left incomplete, the form will be returned, causing potential delays. The general provisions included with the form detail the distribution of benefits, emphasizing that primary beneficiaries will receive their share first, followed by contingent beneficiaries if no primary ones survive. Additionally, the participant retains the right to revoke or change their beneficiary designations at any time, subject to certain conditions. Understanding these aspects ensures a smoother process while securing peace of mind regarding the management of one’s estate planning needs.

Wells Fargo Checking Beneficiary Example

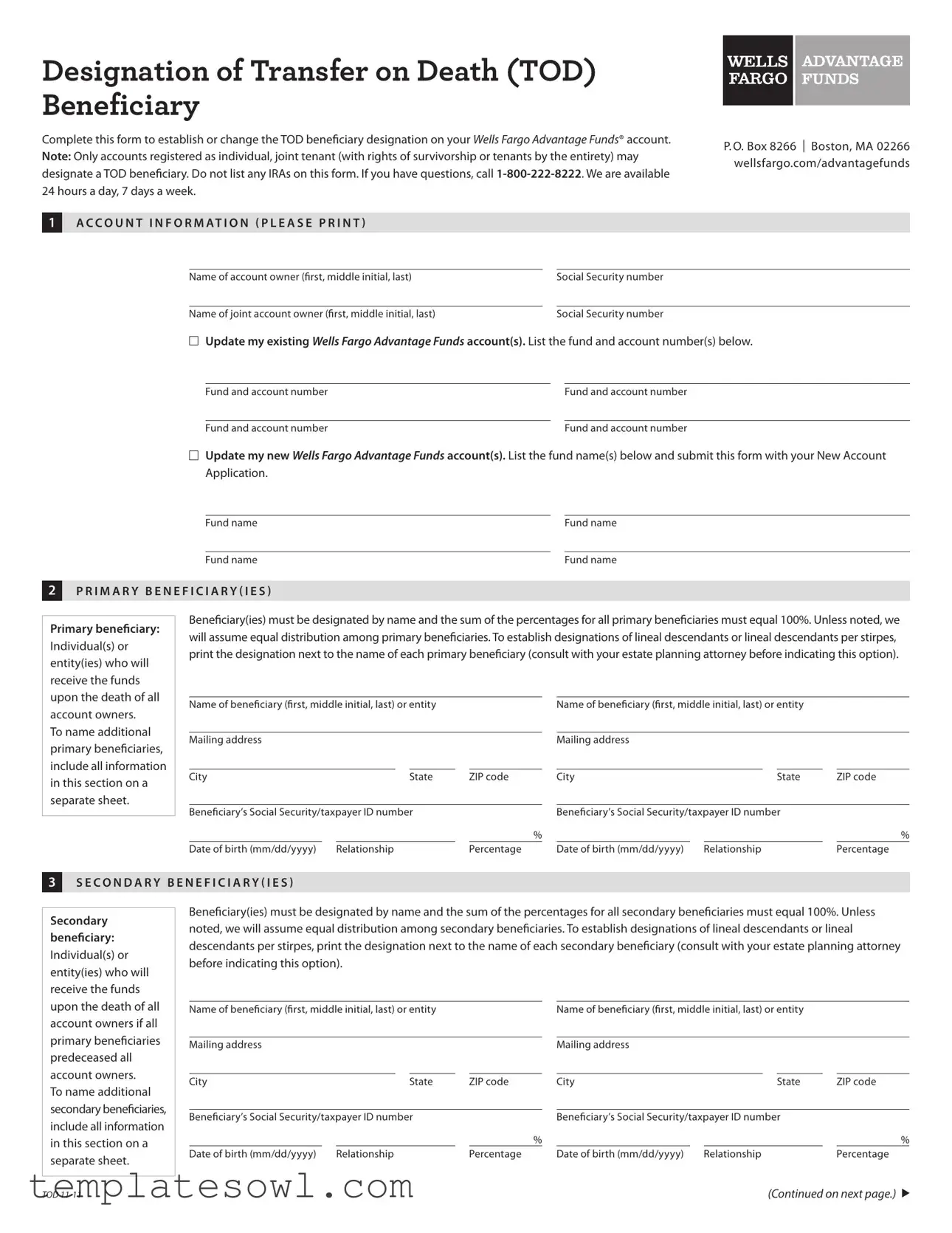

Designation of Transfer on Death (TOD) Beneficiary

Complete this form to establish or change the TOD beneficiary designation on your Wells Fargo Advantage Funds® account. Note: Only accounts registered as individual, joint tenant (with rights of survivorship or tenants by the entirety) may designate a TOD beneficiary. Do not list any IRAs on this form. If you have questions, call

1 A C C O U N T I N F O R M AT I O N ( P L E A S E P R I N T )

P. O. Box 8266 | Boston, MA 02266 wellsfargo.com/advantagefunds

Name of account owner (first, middle initial, last) |

|

Social Security number |

|

|

|

Name of joint account owner (first, middle initial, last) |

|

Social Security number |

Update my existing Wells Fargo Advantage Funds account(s). List the fund and account number(s) below.

Fund and account number

Fund and account number

Fund and account number

Fund and account number

Update my new Wells Fargo Advantage Funds account(s). List the fund name(s) below and submit this form with your New Account Application.

Fund name

Fund name

Fund name

Fund name

2P R I M A R Y B E N E F I C I A R Y ( I E S )

Primary beneiciary:

Individual(s) or entity(ies) who will receive the funds upon the death of all account owners.

To name additional primary beneficiaries, include all information in this section on a separate sheet.

Beneficiary(ies) must be designated by name and the sum of the percentages for all primary beneficiaries must equal 100%. Unless noted, we will assume equal distribution among primary beneficiaries. To establish designations of lineal descendants or lineal descendants per stirpes, print the designation next to the name of each primary beneficiary (consult with your estate planning attorney before indicating this option).

Name of beneficiary (first, middle initial, last) or entity |

|

|

|

Name of beneficiary (first, middle initial, last) or entity |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address |

|

|

|

|

|

|

|

Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

State |

|

ZIP code |

City |

|

|

|

State |

|

ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Beneficiary’s Social Security/taxpayer ID number |

|

|

|

Beneficiary’s Social Security/taxpayer ID number |

|

|

||||||||

|

|

|

|

|

|

% |

|

|

|

|

|

% |

||

Date of birth (mm/dd/yyyy) |

|

Relationship |

|

Percentage |

|

Date of birth (mm/dd/yyyy) |

|

Relationship |

|

Percentage |

||||

3S E C O N D A R Y B E N E F I C I A R Y ( I E S )

Secondary beneiciary:

Individual(s) or entity(ies) who will receive the funds upon the death of all account owners if all primary beneficiaries predeceased all account owners.

To name additional secondary beneficiaries, include all information in this section on a separate sheet.

Beneficiary(ies) must be designated by name and the sum of the percentages for all secondary beneficiaries must equal 100%. Unless noted, we will assume equal distribution among secondary beneficiaries. To establish designations of lineal descendants or lineal descendants per stirpes, print the designation next to the name of each secondary beneficiary (consult with your estate planning attorney before indicating this option).

Name of beneficiary (first, middle initial, last) or entity |

|

|

|

Name of beneficiary (first, middle initial, last) or entity |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address |

|

|

|

|

|

|

|

Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

State |

|

ZIP code |

City |

|

|

|

State |

|

ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Beneficiary’s Social Security/taxpayer ID number |

|

|

|

Beneficiary’s Social Security/taxpayer ID number |

|

|

||||||||

|

|

|

|

|

|

% |

|

|

|

|

|

% |

||

Date of birth (mm/dd/yyyy) |

|

Relationship |

|

Percentage |

|

Date of birth (mm/dd/yyyy) |

|

Relationship |

|

Percentage |

||||

TOD

(Continued on next page.)

▲

4S I G N AT U R E ( S )

All account owners must sign and date this form

to complete this request.

I understand that this TOD beneficiary designation shall replace any previous TOD beneficiary designation(s) I have made for the Wells Fargo Advantage Funds accounts listed in section 1 of this form. I acknowledge that this designation is effective upon receipt in good order by the fund’s transfer agent and will remain in effect until I deliver written notice of a change or revocation of beneficiary(ies) to the fund’s transfer agent. I agree to be bound by the Boston Financial Data Services (BFDS) TOD Rules, which BFDS may amend from time to time or may be altered, modified, or supplemented by Wells Fargo Advantage Funds. I further understand that Wells Fargo Advantage Funds reserves the right, at any time without prior notice, to suspend, limit, modify, or terminate the TOD registration.

I, my successors and assigns, do hereby agree to indemnify and hold harmless Wells Fargo Advantage Funds, Wells Fargo Funds Management, LLC, their affiliates, and

7

Signature of account ownerPrint nameDate

7

Signature of joint account owner |

Print name |

Date |

5T R A N S F E R O N D E AT H ( T O D ) L I M I TAT I O N S A N D M O D I F I C AT I O N S

TOD registrations are governed by the fund’s transfer agent, BFDS TOD Rules, except as altered, modified, or supplemented by Wells Fargo Advantage Funds. The phrase “Subject to BFDS TOD Rules” in an account registration shall incorporate the modifications adopted by Wells Fargo Advantage Funds. The following guidelines are currently in effect:

1.The TOD registration requested on this application complies with the applicable laws of the state of Massachusetts. If there is a dispute regarding the right of a TOD beneficiary to receive assets pursuant to this TOD registration, Wells Fargo Advantage Funds cannot assure you that the party or court hearing the dispute will apply Massachusetts law when making its determination.

2.The designation Payable on Death (POD) may be substituted for TOD at the account owner’s request.

3.Beneficiary designations will only apply to the account(s) as designated in section 1 of this form and any new accounts established by subsequent exchange from one of the designated TOD beneficiary accounts. In the event that a named primary beneficiary predeceases all account owners, the deceased beneficiary’s designated portion of the account will be allocated among the surviving primary beneficiaries on a pro rata basis, except for designations of lineal descendants or lineal descendants per stirpes. If all primary beneficiaries predecease all account owners, and lineal descendants or lineal descendants per stirpes were not designated, then the assets will be allocated among the designated secondary beneficiaries.

4.You can change your designation of beneficiary at any time by:

a.submitting a new Designation of Transfer on Death (TOD) Beneficiary form;

b.submitting a letter of instruction detailing the same information requested on this form; or

c.submitting a letter of instruction to revoke the beneficiary designation.

5.A TOD registration may not be changed or revoked by will, codicil, or telephone conversation.

6.A custodian under the Uniform Gift to Minors Act (UGMA) may not be designated as a beneficiary because the UGMA applies only to gifts made during the lifetime of the donor. A custodian under the Uniform Transfer to Minors Act (UTMA) may be designated

as a beneficiary.

7.In the event of divorce and a former spouse is a designated beneficiary at the time of death of the account owner, applicable state law may dictate that this designation is automatically revoked unless the designation was made after the divorce.

8.The legend “Subject to BFDS TOD Rules” must appear in the account registration at all times. For example:

John H. Smith & Mary M. Smith JT Ten Subject to BFDS TOD Rules Address

City, State ZIP

Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Advantage Funds. Other affiliates of Wells Fargo & Company provide subadvisory and other services for the funds. The funds are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company.

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Completion | Participants must complete the form using a black ink pen to ensure clarity and readability. |

| Submission Address | The completed form should be sent to Wells Fargo Shareowner Services at the specified mailing address or via fax to ensure timely processing. |

| Beneficiary Documentation | A separate account will be established for each Beneficiary upon the Participant’s death, supported by a certified death certificate or acceptable proof of death. |

| Designating Beneficiaries | Participants can list Primary and Contingent Beneficiaries. All fields must be complete; otherwise, the form will be returned. |

| Benefit Distribution | If a Participant passes, the death benefit is distributed in equal shares among surviving Primary Beneficiaries or, if none survive, among Contingent Beneficiaries. |

| Change of Beneficiary | Participants have the right to change their Beneficiary designations at any time without needing the consent of the previously designated Beneficiaries (except for a spouse). |

| Effective Date | Any changes made to the designation will only take effect if filed with Wells Fargo before the Participant’s death. |

| Governing Plan Terms | The Designation of Beneficiary is subject to the terms of the Plan, which may be amended, and these amendments can be made without notice to Participants or Beneficiaries. |

Guidelines on Utilizing Wells Fargo Checking Beneficiary

Filling out the Wells Fargo Checking Beneficiary form is a straightforward process. Completing this form ensures that your designated beneficiaries will receive any benefits in accordance with the instructions outlined. It's essential to provide all required information accurately, as incomplete forms may be returned, causing delays.

- Obtain the Wells Fargo Checking Beneficiary form and a black ink pen.

- Read the General Provisions section on the reverse side of the form carefully.

- Write the name of the Plan at the top, which is the Employee Stock Purchase Plan (LPS1).

- Enter your name and Social Security number in the designated spaces.

- State that you revoke any previous designations of beneficiaries under this Plan.

- List the Primary Beneficiaries by completing the following details for each one:

- Name

- Social Security Number

- Date of Birth

- Relationship to you

- Current Address

- Percentage of the benefit (make sure the total equals 100%)

- Provide details for Contingent Beneficiaries in the same manner as the Primary Beneficiaries.

- Sign the form in the space provided to validate your designation.

- Return the completed form to Wells Fargo at the address on the reverse side or fax it, as per your preference.

What You Should Know About This Form

What is the purpose of the Wells Fargo Checking Beneficiary form?

The Wells Fargo Checking Beneficiary form serves to designate individuals who will inherit the funds from your checking account upon your passing. By completing this form, you ensure that your financial assets are distributed according to your wishes, providing peace of mind for both you and your loved ones.

How do I complete the form?

To fill out the form, use a black ink pen for clarity. Begin by providing your personal information, including your name and Social Security number. Then, list your primary and contingent beneficiaries, including their names, relationship to you, current addresses, and Social Security numbers. It's crucial to complete all requested fields for each beneficiary to avoid delays in processing.

What happens if I don’t fill out all the fields?

If any fields for the beneficiaries are left incomplete, Wells Fargo will return the form to you. This means your designation will not be processed, potentially leaving your account balances subject to default distribution processes. Thus, it is essential to ensure all information is complete and accurate before submission.

Can I change my beneficiary designation after submitting the form?

Yes, you may change your designation at any time. This flexibility allows you to adapt your beneficiary choices according to life changes, such as marriage, divorce, or the birth of a new child. However, bear in mind that any changes must be filed with Wells Fargo prior to your death to be effective.

How are the benefits distributed among the beneficiaries?

Upon your death, the benefits are distributed according to the designations you provided. If there are surviving primary beneficiaries, the death benefit will be shared equally among them. If no primary beneficiaries survive, contingent beneficiaries will receive equal shares of the benefit. If no beneficiaries are alive, the distribution will follow the terms outlined in the Plan.

Where do I send the completed form?

You can return the completed form by mail or fax. For mailing, send it to Wells Fargo Shareowner Services, Attention: Enrollment Specialist, P.O. Box 64856, South Saint Paul, MN 55164-0856. If you prefer faxing, send it to 866-729-7694. Make sure to keep a copy for your records.

Who should I contact if I have questions about the form?

If you have any inquiries or need assistance with the form, you can reach out to Wells Fargo Shareowner Services at 866-927-3881. They are available to help guide you through the process, ensuring that your beneficiary designations are accurately submitted and recorded.

Common mistakes

Filling out the Wells Fargo Checking Beneficiary form requires careful attention to detail. One common mistake occurs when individuals fail to list all required information for each beneficiary. It is essential to provide the full name, Social Security number, date of birth, share percentage, and relationship for both primary and contingent beneficiaries. If any field is incomplete, the form will simply be returned. This can delay the intended distribution of benefits, which only adds stress during an already difficult time.

Another mistake people often make is not carefully reading the instructions provided on the reverse side of the form. The General Provisions section contains crucial information about how benefits will be distributed upon the participant's death. Ignoring these instructions can lead to misunderstandings about who will receive benefits and how shares will be divided. Every participant deserves to ensure that their wishes are accurately reflected in this document.

Some individuals also overlook the importance of signing and dating the form. A signature is a critical component that validates the form and signals that the participant understands and agrees to the terms outlined. If the form is unsigned or improperly dated, it can be rejected. This situation could result in a benefactor being unable to claim their rightful inheritance until the error is resolved.

Lastly, a common oversight is neglecting to keep a copy of the completed form. Once the document is sent to Wells Fargo, it is wise to retain a personal record. In the event of any disputes or issues regarding the distribution of benefits, having a copy can serve as a valuable reference. Taking this simple step can help clarify intentions and protect the rights of beneficiaries, ensuring that their needs are addressed during what may be a challenging time.

Documents used along the form

When designating a beneficiary for your Wells Fargo checking account, several other forms and documents might also be useful. Gathering the proper paperwork can help ensure a smooth process during potentially emotional times. Here are some documents often needed alongside the Wells Fargo Checking Beneficiary form:

- Will: This legal document outlines how your assets will be distributed upon death. It provides clear directives that can complement your beneficiary designations.

- Trust Agreement: If you have set up a living trust, this document outlines the terms of the trust and its management. It can serve as a container for assets, including those in checking accounts.

- Power of Attorney: This document allows you to designate an individual to manage your financial affairs in case you become unable to do so. It is crucial for ensuring your financial decisions are handled per your wishes.

- Death Certificate: This official document confirms the death of a person. It may be required by Wells Fargo or other institutions to process beneficiary claims.

- Tax Identification Number: When dealing with estates or trusts, a Tax ID number may be necessary for tax filings or during asset distribution processes.

- Beneficiary Designation Form: Different accounts may require separate beneficiary forms. Ensure you have the right one for each account type.

- Account Statement: A recent statement can provide important account details necessary for filling out beneficiary forms accurately.

- Financial Disclosure Form: Some institutions require this form to disclose asset information upon beneficiary designation, ensuring everyone is informed about the account values.

Having these documents ready can expedite the process and minimize stress during a time of loss. Make sure to review each document for accuracy and completeness to avoid delays. Stay proactive in your planning, and ensure your wishes are honored.

Similar forms

- Last Will and Testament: This legal document specifies how a person's assets and affairs should be handled after their death. Similar to the Wells Fargo Checking Beneficiary form, it allows individuals to designate beneficiaries for specific assets, ensuring that their wishes are honored.

- Payable on Death (POD) Accounts: A POD account allows individuals to name beneficiaries who will receive the funds directly upon the account holder's death. Like the beneficiary form, it provides a straightforward way to transfer assets without going through probate.

- Trust Documents: Trusts are estate planning tools that hold assets for beneficiaries, managed by a trustee. Similar to the Designation of Beneficiary, trusts can clearly define how and when assets are distributed after an individual's passing.

- Retirement Account Beneficiary Designations: These forms, often for 401(k) or IRA accounts, allow account holders to specify who will receive their retirement savings upon their death. This process mirrors the Wells Fargo Checking Beneficiary form in ensuring intended beneficiaries receive the assets directly.

- Life Insurance Beneficiary Designation: Like the Wells Fargo Checking Beneficiary form, life insurance policies require the policyholder to name beneficiaries who will receive the payout after their death. This designation is crucial for ensuring that the intended recipients benefit from the policy without delays or complications.

Dos and Don'ts

When filling out the Wells Fargo Checking Beneficiary form, consider the following important guidelines:

- Do: Use a black ink pen for clarity and legibility.

- Do: Complete all fields for each beneficiary. Incomplete forms will be returned.

- Do: Read the General Provisions carefully to understand the implications of your beneficiary designations.

- Do: Ensure to provide accurate personal information, including Social Security numbers and addresses.

- Do: Mail the form to the address specified, or fax it to the provided number for timely processing.

- Don't: Leave any sections blank, as this could delay the processing of your form.

- Don't: Use any ink color other than black, as other colors may not be accepted.

- Don't: Forget to sign the form, as an unsigned form will not be processed.

- Don't: Assume your previous designations remain valid unless you explicitly revoke them in this form.

- Don't: Alter the form in any way that is not specified, as this may invalidate your designations.

Misconceptions

There are several misunderstandings surrounding the Wells Fargo Checking Beneficiary form that can lead to confusion. Here are some common misconceptions:

- Misconception 1: The form can be completed in any color ink.

- Misconception 2: I can designate a beneficiary without any details.

- Misconception 3: Once I submit the form, I cannot change my beneficiaries.

- Misconception 4: My beneficiaries will automatically inherit everything from my account.

- Misconception 5: I don't need to follow up after I submit my form.

This is not the case. The form must be filled out using a black ink pen. Using any other color may result in the form being rejected and returned.

It’s essential to complete all required fields for each beneficiary. If you leave any fields blank, Wells Fargo will return the form to you, which may delay the process.

Participants have the right to change their designation at any time without needing consent from the designated beneficiaries. However, changes must be made before the participant’s death and submitted to Wells Fargo.

Not necessarily. If no primary beneficiaries survive the participant, the benefits will instead be divided among the contingent beneficiaries. If no designated beneficiaries exist, distribution will follow the terms of the Plan.

It’s important to ensure that your form has been received and accepted by Wells Fargo. Contacting them to confirm your submission will provide peace of mind and ensure everything is in order.

Key takeaways

Key Takeaways for Using the Wells Fargo Checking Beneficiary Form:

- The form must be completed using a black ink pen and sent to the designated address. Incomplete forms will be returned.

- Upon the Participant’s death, separate accounts will be created for each designated Beneficiary as long as valid proof of death is provided.

- Changes to the Designation of Beneficiary can be made at any time by the Participant without needing consent from the designated Beneficiaries, although spousal consent may be required.

- Ensure the form is submitted to Wells Fargo before the Participant’s death for it to be considered valid. Lasting changes depend on timely filing.

Browse Other Templates

Ca/n Form - Attachments may include documentation or additional personal information.

Land Contract Template - The agreement specifies that time is of the essence, meaning punctual payments are crucial for the purchaser.

Long and Foster Rental Application - Complete the Rental Application LF182 thoroughly and legibly.