Fill Out Your Wells Fargo Direct Deposit Form

The Wells Fargo Direct Deposit form is an essential tool for anyone looking to simplify their financial transactions. This form allows users to set up automatic deposits or payments, ensuring a hassle-free management of their income and outgoing funds. Direct deposit is especially advantageous because it provides a safe, fast, and convenient way to receive money from your employer, government benefits, and other sources. With this service, funds are deposited straight into your Wells Fargo checking or savings account, even when you're unable to visit the bank, such as during illness or vacations. Moreover, automatic payments can help you avoid the pitfalls of missed deadlines and late fees, granting peace of mind. To successfully complete the Wells Fargo Direct Deposit form, you'll need to gather critical account information, including your routing number and account number. Understanding what is required and how to engage with employers or payors is crucial. As you prepare to set up direct deposits or automatic payments, it's vital to monitor your account for any pending transactions to ensure everything occurs smoothly. The convenience of automatic financial management is right at your fingertips with the Wells Fargo Direct Deposit form, but swift action is key to getting started today.

Wells Fargo Direct Deposit Example

Clear/Reset

Direct Deposit/Automatic Payments

Information to help you arrange automatic deposits or payments to/from third parties

How to take advantage of the fastest, and most convenient and secure way to manage receiving regular deposits to, or making regular payments from your account.

Key Benefits of Direct Deposit:

Direct Deposit is a free service that automatically deposits qualifying recurring income* into any Wells Fargo checking, savings, or prepaid card account you choose.

•Convenient – Your money is deposited into your account, even when you are ill, on vacation or too busy to get to the bank.

•Fast – You have immediate access to your money on the day of deposit

•Safe – You never have to worry about checks getting lost, delayed or stolen.

•Opportunity for automatic saving – You can watch your savings grow by directing at least part of your pay to a savings account

*Income you receive from your employer, Social Security, pension and retirement plans, the Armed Forces, VA Benefits, and annuity or dividend payments may all qualify for Direct Deposit.

Key Benefits of automatic payments:

Never worry about missing a payment or possible late fees or other consequences. You will need to have the required available funds in your account at the time of the payment. Note that you can also make recurring payments through Wells Fargo Online with Bill Pay.

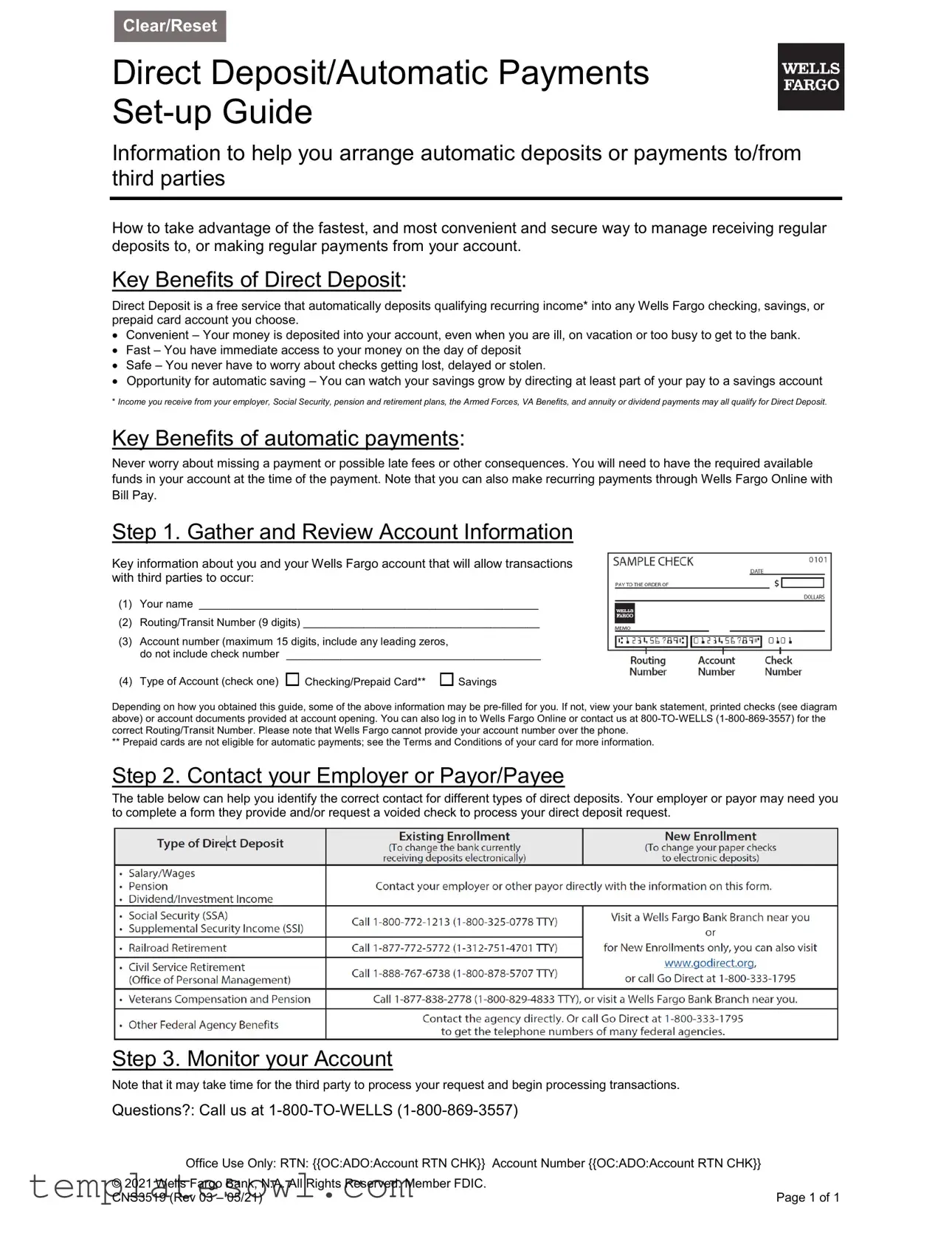

Step 1. Gather and Review Account Information

Key information about you and your Wells Fargo account that will allow transactions with third parties to occur:

(1)Your name ________________________________________________________

(2)Routing/Transit Number (9 digits) _______________________________________

(3)Account number (maximum 15 digits, include any leading zeros,

do not include check number __________________________________________

(4) Type of Account (check one) |

Checking/Prepaid Card** |

Savings |

Depending on how you obtained this guide, some of the above information may be

** Prepaid cards are not eligible for automatic payments; see the Terms and Conditions of your card for more information.

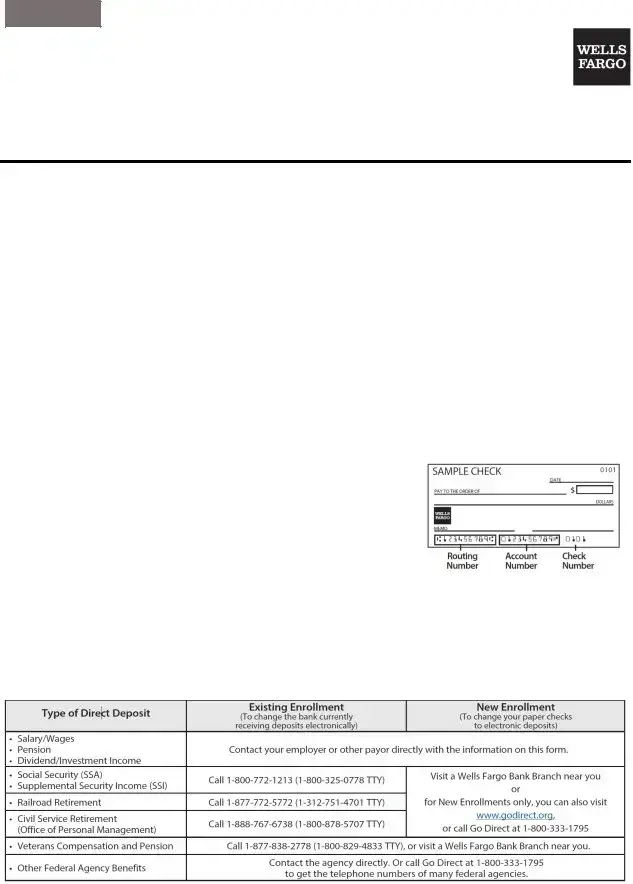

Step 2. Contact your Employer or Payor/Payee

The table below can help you identify the correct contact for different types of direct deposits. Your employer or payor may need you to complete a form they provide and/or request a voided check to process your direct deposit request.

Step 3. Monitor your Account

Note that it may take time for the third party to process your request and begin processing transactions. Questions?: Call us at

Office Use Only: RTN: {{OC:ADO:Account RTN CHK}} Account Number {{OC:ADO:Account RTN CHK}} |

|

© 2021 Wells Fargo Bank, N.A. All Rights Reserved. Member FDIC. |

|

CNS3519 (Rev 03 – 05/21) |

Page 1 of 1 |

Form Characteristics

| Fact Name | Detail |

|---|---|

| Direct Deposit Service | Wells Fargo offers Direct Deposit as a free service to automatically deposit qualifying income into any Wells Fargo account. |

| Convenience | Your money gets deposited even if you are unable to visit the bank due to illness, vacation, or a busy schedule. |

| Immediate Access | You receive immediate access to your funds on the day of deposit, ensuring prompt availability. |

| Security | Direct Deposit eliminates worries about lost, delayed, or stolen checks since transactions are entirely digital. |

| Income Eligibility | Eligible income includes pay from employers, Social Security, retirement funds, armed forces pay, VA Benefits, and more. |

| Automatic Payments | Automatic payments let you avoid missing due dates, but you must ensure sufficient funds are available in your account. |

| Required Information | You need to provide your name, Routing/Transit number, account number, and account type to set up Direct Deposit. |

| Monitoring Your Account | Once a Direct Deposit request is made, monitor your account closely as it can take time for processing to begin. |

Guidelines on Utilizing Wells Fargo Direct Deposit

Filling out the Wells Fargo Direct Deposit form is an essential step to ensure your funds are deposited efficiently and securely. After completing the form, you will need to submit it to your employer or payor to set up direct deposits into your account. Follow the steps below to fill out the form accurately.

- Gather your personal and account information. You will need:

- Your name

- Your Routing/Transit Number (9 digits)

- Your Account Number (maximum 15 digits, including leading zeros; do not include the check number)

- Your Account Type (indicate whether it’s a Checking/Prepaid Card or Savings)

- If you do not have the account information, check your bank statement, printed checks, or account documents from the time you opened your account. You can also log in to Wells Fargo Online or call 800-TO-WELLS (1-800-869-3557) for assistance.

- Contact your Employer or Payor. They may require you to fill out their form and may also ask for a voided check to process your direct deposit request.

- Double-check all your provided information for accuracy before submitting the form.

- Submit the completed form to your employer or payor, and keep a copy for your records.

- Monitor your account. It may take some time for the third party to process your request and start the direct deposits.

What You Should Know About This Form

What is the Wells Fargo Direct Deposit form used for?

The Wells Fargo Direct Deposit form is used to set up automatic deposits into your Wells Fargo account from various sources such as your employer, Social Security, or pension plans. This form helps streamline your banking process by ensuring that your money is deposited directly into your account without the need for you to visit a bank. It saves time and reduces the risk of lost or delayed checks.

What are the key benefits of using direct deposit?

Direct deposit offers several benefits. First, it’s convenient. Your funds will be available in your account even if you are unable to go to the bank due to illness or travel. Second, it's fast. You gain immediate access to your money on the deposit day. Finally, it’s safe, protecting you from the possibility of checks being lost or stolen. Additionally, you can also set up automatic savings by directing part of your deposits to a savings account.

What types of income can be set up for direct deposit?

You can use direct deposit for various types of income, including payments from employers, Social Security benefits, pension and retirement plans, payments from the Armed Forces, VA benefits, and dividends. If you receive recurring income, it likely qualifies for direct deposit.

What information do I need to fill out the Direct Deposit form?

To fill out the Direct Deposit form, you need to provide some key information. This includes your name, the 9-digit routing/transit number, your account number (which can be up to 15 digits), and the type of account (either checking or savings). Check your bank documents or online banking for accurate information if you're not sure.

How do I contact my employer or payor to set up direct deposit?

To initiate the direct deposit process, reach out to your employer or payor. They may have their own form you need to complete, or they might require a voided check from your account. Ensure you follow their specific instructions to make the process smooth.

How can I monitor my direct deposit once it is set up?

After you set up your direct deposit, it is essential to keep an eye on your bank account. Check your account regularly to confirm that your deposits are being made as expected. Note that it may take some time for the third party to process your direct deposit request and start sending transactions.

Are there any fees associated with direct deposit?

No, direct deposit is a free service offered by Wells Fargo. There are no charges for setting it up or for having your income automatically deposited into your account. This makes it an economical choice for managing your banking needs.

Can I use direct deposit for prepaid cards?

Prepaid cards cannot be used for automatic payments. However, regular direct deposits can go into a prepaid card account. For complete details, check the Terms and Conditions of your prepaid card, as they may have specific rules regarding deposits.

What should I do if I have more questions about direct deposit?

If you have further questions or need assistance, don't hesitate to reach out to Wells Fargo directly. You can call their customer service at 1-800-TO-WELLS (1-800-869-3557) for help with your direct deposit inquiries.

Common mistakes

Filling out the Wells Fargo Direct Deposit form is a straightforward process, but mistakes can happen easily. One common error occurs when people fail to provide their name accurately. Your name should match the one on your bank account to avoid any delays or complications. Double-check the spelling and make sure to include any middle initial if applicable.

Another frequent mistake involves the Routing/Transit Number. It's essential that you enter the correct 9-digit number. Many individuals mistakenly assume that this number is the same as their account number or believe it is pre-filled correctly. This can cause deposits to go to the wrong account.

The account number section often leads to confusion as well. Some may inadvertently leave out leading zeros or confuse it with their check number. Remember, the account number must not exceed 15 digits, and accuracy here is vital for ensuring your deposits arrive as expected.

Additionally, individuals sometimes neglect to select the type of account. When filling out the form, it’s imperative to check the appropriate box for either a Checking/Prepaid Card or Savings account. Forgetting this step can lead to processing errors that delay direct deposits or automatic payments.

People also overlook the importance of contacting their employer or payor/payee after submitting the form. Your employer might require a separate form or a voided check to process your direct deposit request. Failing to follow up can result in delays while your request is processed.

Some users mistakenly believe that they can receive direct deposits on prepaid cards. However, prepaid cards are not eligible for automatic payments. This misunderstanding can complicate transactions and create unnecessary frustration.

Monitoring your account after submitting the application is crucial. Many individuals forget to check their accounts to confirm that the direct deposit has started. It may take some time for the third party to process requests, but staying vigilant can help you catch any potential issues early on.

Lastly, not having adequate funds in your account at the time of payment can lead to declined transactions. This situation is preventable by regularly reviewing your available balance and planning accordingly. Keeping track of scheduled payments allows you to avoid any late fees or other consequences.

Avoiding these mistakes can lead to a seamless experience with Wells Fargo’s Direct Deposit. Take your time to fill out the form carefully, and you can enjoy the benefits of fast, convenient, and secure banking.

Documents used along the form

When setting up direct deposits with Wells Fargo, you may need several additional forms and documents. Each of these plays a crucial role in ensuring your banking transactions go smoothly. Here’s a handy list of documents you might encounter:

- Voided Check: This check is necessary for providing your account and routing numbers. It allows employers or payors to verify your banking information.

- Employer Direct Deposit Form: Many employers require their employees to fill out this specific form to facilitate direct deposit arrangements.

- Automatic Payment Authorization Form: This form authorizes the automatic withdrawal of payments from your account. It’s commonly used for recurring bills.

- W-4 Form: Completing this form is essential for your employer to understand your tax withholding preferences, which may impact your income for direct deposit.

- Bank Statement: You may need to provide recent bank statements to verify your account, especially for setting up new direct deposits.

- ID Verification: A government-issued ID might be necessary to confirm your identity when setting up direct deposits in person.

- Change of Bank Notification: If you are changing your direct deposit to a new account, notify your payor with this form to prevent any disruption in payment.

- Benefits Enrollment Form: If you're enrolling for social security or pension payments, this form sets up your benefits, potentially allowing for direct deposit as well.

- Direct Deposit Authorization Agreement: This document outlines the agreement between you and your employer or payor regarding direct deposit terms and conditions.

Gather these documents as needed to facilitate a smooth direct deposit setup with Wells Fargo. Each of these forms supports a more efficient banking experience, ensuring that your funds are transferred securely and promptly.

Similar forms

Paycheck Authorization Form: This document allows employees to authorize their employer to deposit their paycheck directly into their bank account. Similar to the Wells Fargo Direct Deposit form, it collects bank account details and ensures timely payments without the need for physical checks.

Automatic Bill Payment Authorization: A document that permits automatic deductions from a bank account for recurring bills, like utilities or subscriptions. This works like the direct deposit form by requiring account information and streamlining payment processes to avoid late fees.

IRS Direct Deposit Form: Used for taxpayers to set up direct deposit for tax refunds. Like the Wells Fargo form, it includes necessary banking details to ensure that refunds arrive quickly and safely in the selected account.

Social Security Direct Deposit Enrollment: This document enrolls individuals in receiving Social Security benefits via direct deposit. It parallels the Wells Fargo form by requesting specific account information to deliver benefits efficiently.

Pension Direct Deposit Form: This form allows retirees to receive their pension payments directly into their bank accounts. Similar to the Wells Fargo Direct Deposit form, it minimizes delays and risks associated with physical checks.

Automatic Loan Payment Authorization: A form used to set up automatic payments for loans from a checking or savings account. It mirrors the direct deposit process, ensuring regular payments without the need for manual intervention.

Insurance Premium Payment Authorization: This document allows policyholders to set up automatic premium payments from their account. Like the Wells Fargo form, it ensures that payments are made on time and reduces the risk of lapses in coverage.

Dos and Don'ts

When filling out the Wells Fargo Direct Deposit form, it is important to follow specific guidelines to ensure prompt processing and avoid issues. Here is a list of recommendations on what you should and shouldn't do.

- Do gather all necessary account information, including your name, routing number, and account number.

- Do double-check the routing number and account number for accuracy before submission.

- Do contact your employer or payor to understand their requirements for setting up direct deposit.

- Do monitor your account after submitting the form to verify that the deposit has been processed.

- Don't submit the form without ensuring all fields are completed and accurate.

- Don't forget to provide any additional documentation requested by your employer or payor.

Misconceptions

Understanding the Wells Fargo Direct Deposit form can be essential for efficient banking. However, several misconceptions often arise. Here are seven common myths and the facts that clarify them:

- Direct deposit is only for employee paychecks. Many believe that direct deposit is limited to salary deposits. In fact, it can also accommodate government benefits, pension payments, and other recurring income sources.

- Direct deposit is not secure. Some worry about the safety of direct deposits. However, direct deposits eliminate the risks associated with lost or stolen checks, making them a safer option for receiving funds.

- You cannot change your direct deposit account once it’s set up. This misconception suggests that the setup is permanent. You have the option to change your direct deposit details whenever necessary, ensuring your funds go where you want them.

- All accounts are eligible for direct deposit. Many individuals believe any account can receive direct deposits. However, certain accounts, like prepaid cards, are not eligible for automatic payments.

- Direct deposit means immediate access to funds. There's a belief that all funds from direct deposits are instantly available. While access is generally provided on the day of deposit, verify with your bank for any specific timelines or holds.

- You don't need to monitor your account once you set up direct deposit. It’s crucial to keep an eye on your account after setting up direct deposits. Occasionally, third parties may take time to establish your deposits, and checking ensures everything processes smoothly.

- Setting up direct deposit is complicated. Many feel intimidated by the process. However, it typically involves straightforward steps, including gathering your account information and contacting your employer or payor.

Understanding these misconceptions can help you make informed decisions about managing your finances effectively with Wells Fargo's Direct Deposit service.

Key takeaways

Filling out and using the Wells Fargo Direct Deposit form can streamline how you receive payments. Here are key takeaways to help you navigate the process effectively:

- Direct Deposit is Free: This service allows you to receive qualifying recurring income directly into your Wells Fargo account without charge.

- Convenience is Key: Even if you’re unable to visit the bank due to illness or travel, your funds will still be deposited automatically.

- Immediate Access: You will have access to your money as soon as it is deposited, eliminating waiting times.

- Safety First: Direct deposits minimize the risks of losing checks or having them stolen, enhancing security for your funds.

- Easy Account Setup: Gather your account information—such as your name, routing number, and account number—before starting the process.

- Monitor Transactions: After setting up direct deposit, keep an eye on your account to ensure everything processes smoothly.

By understanding these points, you can optimize your experience with Wells Fargo Direct Deposit.

Browse Other Templates

Renew Rn License - Controlled Substance Prescriptive Authority renewal is $50.

Statement of Information California - Ensure to enter the name and address of the agent responsible for receiving legal documents.