Fill Out Your Wells Fargo Wire Transfer Form

Understanding the Wells Fargo Wire Transfer form is crucial for anyone looking to send or receive money efficiently. This form serves as a guide for initiating wire transfers, be it for domestic or international transactions, and it outlines essential requirements and procedures. Customers can conveniently start a voice-activated wire transfer by calling Wells Fargo's dedicated service line. The form details the necessary information needed to complete a wire transfer, such as the sender's account number, recipient's bank details, and the transfer amount. It also provides insight into deadlines to ensure that transfers are completed on the same business day. Additionally, it includes specific requirements for international transfers, emphasizing the importance of providing accurate beneficiary information, such as the SWIFT/BIC and IBAN codes, which vary by country. This guide also addresses common issues like the potential for delays if information is incomplete or incorrect. By following the outlined steps, customers can navigate the wire transfer process more smoothly and avoid unexpected fees or delays.

Wells Fargo Wire Transfer Example

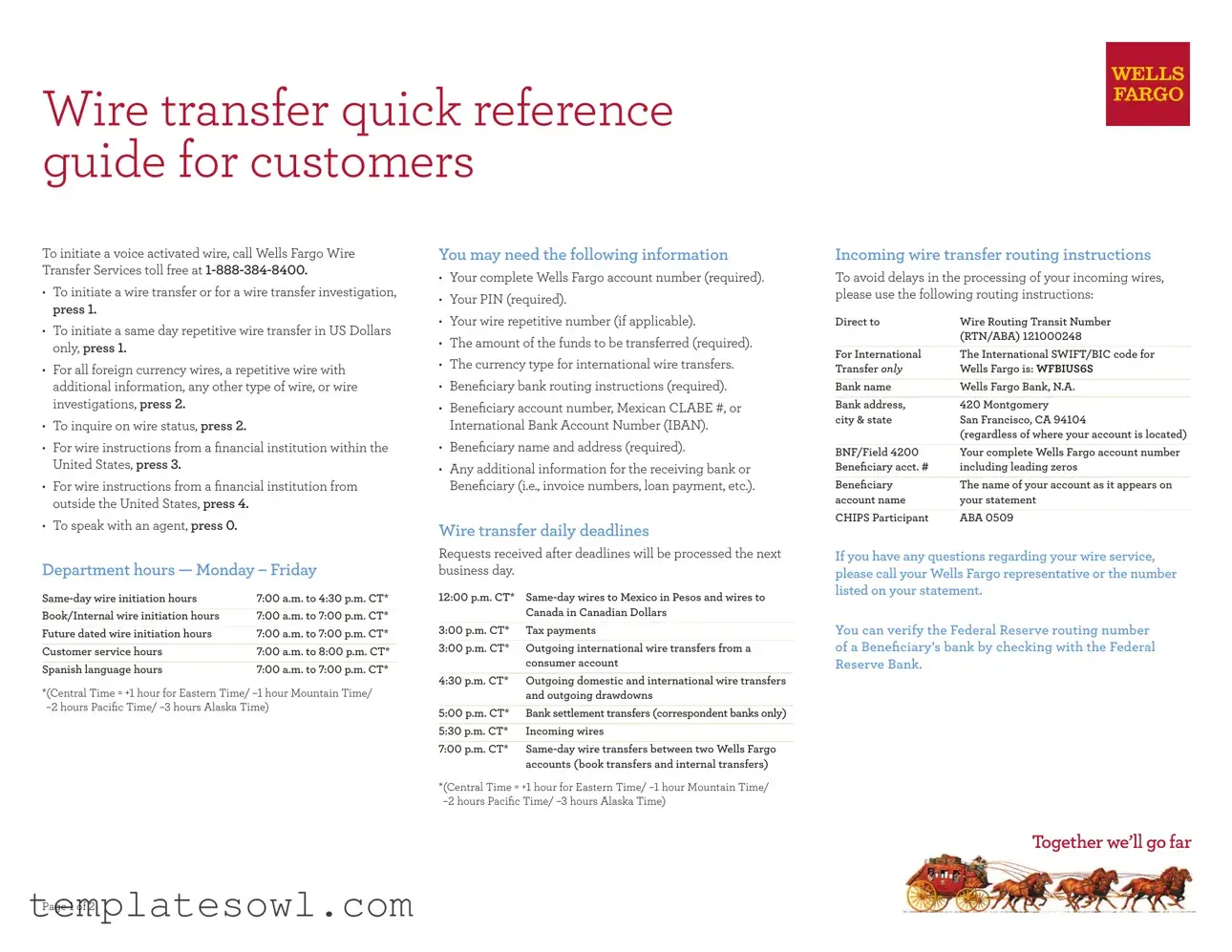

Wire transfer quick reference guide for customers

To initiate a voice activated wire, call Wells Fargo Wire Transfer Services toll free at

•To initiate a wire transfer or for a wire transfer investigation, press 1.

•To initiate a same day repetitive wire transfer in US Dollars only, press 1.

•For all foreign currency wires, a repetitive wire with additional information, any other type of wire, or wire investigations, press 2.

•To inquire on wire status, press 2.

•For wire instructions from a inancial institution within the United States, press 3.

•For wire instructions from a inancial institution from outside the United States, press 4.

•To speak with an agent, press 0.

Department hours — Monday – Friday

7:00 a.m. to 4:30 p.m. CT* |

|

|

|

Book/Internal wire initiation hours |

7:00 a.m. to 7:00 p.m. CT* |

|

|

Future dated wire initiation hours |

7:00 a.m. to 7:00 p.m. CT* |

|

|

Customer service hours |

7:00 a.m. to 8:00 p.m. CT* |

|

|

Spanish language hours |

7:00 a.m. to 7:00 p.m. CT* |

*(Central Time = +1 hour for Eastern Time/

You may need the following information

•Your complete Wells Fargo account number (required).

•Your PIN (required).

•Your wire repetitive number (if applicable).

•The amount of the funds to be transferred (required).

•The currency type for international wire transfers.

•Beneiciary bank routing instructions (required).

•Beneiciary account number, Mexican CLABE #, or International Bank Account Number (IBAN).

•Beneiciary name and address (required).

•Any additional information for the receiving bank or Beneiciary (i.e., invoice numbers, loan payment, etc.).

Wire transfer daily deadlines

Requests received after deadlines will be processed the next business day.

12:00 p.m. CT* |

|

|

Canada in Canadian Dollars |

|

|

3:00 p.m. CT* |

Tax payments |

|

|

3:00 p.m. CT* |

Outgoing international wire transfers from a |

|

consumer account |

|

|

4:30 p.m. CT* |

Outgoing domestic and international wire transfers |

|

and outgoing drawdowns |

|

|

5:00 p.m. CT* |

Bank settlement transfers (correspondent banks only) |

|

|

5:30 p.m. CT* |

Incoming wires |

Incoming wire transfer routing instructions

To avoid delays in the processing of your incoming wires, please use the following routing instructions:

Direct to |

Wire Routing Transit Number |

|

(RTN/ABA) 121000248 |

|

|

For International |

The International SWIFT/BIC code for |

Transfer only |

Wells Fargo is: WFBIUS6S |

|

|

Bank name |

Wells Fargo Bank, N.A. |

|

|

Bank address, |

420 Montgomery |

city & state |

San Francisco, CA 94104 |

|

(regardless of where your account is located) |

|

|

BNF/Field 4200 |

Your complete Wells Fargo account number |

Beneiciary acct. # |

including leading zeros |

|

|

Beneiciary |

The name of your account as it appears on |

account name |

your statement |

|

|

CHIPS Participant |

ABA 0509 |

If you have any questions regarding your wire service, please call your Wells Fargo representative or the number listed on your statement.

You can verify the Federal Reserve routing number of a Beneiciary’s bank by checking with the Federal Reserve Bank.

7:00 p.m. CT*

*(Central Time = +1 hour for Eastern Time/

Page 1 of 2

To avoid delays, additional fees, or loss of principal on outgoing wires

• |

Be sure to provide complete Beneiciary Information |

|

including name and account number. |

• |

Be sure to provide complete Beneiciary Bank information |

|

including name, branch name, address, city, state, country, |

|

and ABA/RTN or SWIFT/BIC Code. |

• |

For international wires be sure to include the International |

|

Routing Code (IRC) and International Bank Account |

|

Number (IBAN) for countries that require it. |

• |

For international wires to Mexican banks be sure to include |

|

the CLABE account number in the Beneiciary instructions |

IRC number can delay the wire, or the receiving bank may return the wire when this number is not included in the payment instructions, and additional fees may be assessed.

3.International Bank Account Number (IBAN): The IBAN varies by country/institution. Warning! Only the bank servicing an account can provide the correct IBAN of that account and must be obtained from the Beneiciary of the wire. Sending a wire to a participating country without the IBAN can delay the wire, or the receiving bank may return the wire when the IBAN is not included in the payment instructions, and additional fees may be assessed.

Participating Countries that require an IBAN:

4.Mexico CLABE Account Number: In addition to the SWIFT/BIC Mexican banks now require an 18 digit CLABE account number be added to the Beneiciary instructions to ensure payment. The CLABE number is required on all Mexican Peso (MXN) and USD payments sent to Mexico. The CLABE account number must be obtained from the Beneiciary. If the Beneiciary does not have the CLABE account number, please have the Beneiciary contact their bank. Wells Fargo does not provide or calculate the CLABE. Sending a wire without a CLABE account number can delay the wire, or the receiving bank may return the wire if the CLABE is not included in the payment instructions, and additional fees may be assessed.

to ensure correct payment. |

• If you are unsure of the Beneiciary information, please |

contact the recipient (Beneiciary) for complete routing |

instructions. |

• When initiating |

Peso wires prior to the daily deadline of 12:00 p.m. CT, |

please be sure to indicate it is a |

Information for international wires

Wires going to foreign countries require diferent numbers depending on the receiving foreign country. All wire transfer payments destined for Europe should include the SWIFT/ Bank Identiier Code (SWIFT/BIC), International Routing Code (IRC) as applicable, and for participating countries the beneiciary’s International Bank Account Number (IBAN). Mexican banks require a CLABE number in addition to the SWIFT/BIC.

1.SWIFT Bank Identiier Code (SWIFT/BIC). The 8 or 11 character SWIFT/BIC is a unique series of alpha numeric characters that help to identify a speciic inancial institution. The SWIFT/BIC should be obtained from the Beneiciary. To ensure timely delivery please be sure that international outgoing wires include the SWIFT/BIC where applicable.

2.International Routing Code (IRC): Some countries throughout the international banking community have created international routing codes, which are used in combination with the SWIFT/BIC to aid in routing the payment through a main oice to a branch. Each country has a speciic name for their routing code (i.e., Sort Code in the United Kingdom, Canadian Payments Association Routing Numbers in Canada). Your Beneiciary must provide the international routing code to facilitate receipt of an international payment. Sending a wire without the

Albania |

Guadeloupe |

|

Andorra |

Guatemala |

|

Austria |

Hungary |

|

Azerbaijan |

Iceland |

|

(Republic of) |

Ireland |

|

|

||

Bahrain |

(Republic of) |

|

Belgium |

Isle of Man |

|

Bosnia and |

Israel |

|

Herzegovina |

Italy |

|

|

||

Brazil |

Jordan |

|

|

||

Bulgaria |

Kazakhstan |

|

|

||

Channel Islands |

Kuwait |

|

|

||

Costa Rica |

Latvia |

|

|

||

Croatia |

Lebanon |

|

|

||

Cyprus |

Liechtenstein |

|

|

||

Czech Republic |

Lithuania |

|

|

||

Denmark |

Luxembourg |

|

|

||

Dominican |

Macedonia |

|

Republic |

||

Malta |

||

Estonia |

||

Martinique |

||

Finland |

||

Mauritania |

||

France |

||

Mauritius |

||

French Guiana |

||

Mayotte |

||

French Polynesia |

||

Moldova |

||

French Southern |

||

(Republic of) |

||

Territories |

||

Monaco |

||

Georgia |

||

Montenegro |

||

Germany |

||

Netherlands |

||

Gibraltar |

||

New Caledonia |

||

Greece |

||

|

Norway

Pakistan

Palestine (State of)

Poland

Portugal

Qatar

Reunion Island

Romania

Saint Barthelemy

Saint Martin

Saint Pierre et Miquelon

San Marino

Saudi Arabia

Serbia

Slovak Republic

Slovenia

Spain

Sweden

Switzerland

Tunisia

Turkey

United Arab

Emirates

United Kingdom

Virgin Islands, British

Wallis and Futuna Islands

5.Wells Fargo recommends that if you do not have a SWIFT/BIC, IBAN, IRC, or Mexican CLABE number, that you contact the beneiciary of the wire. If the Beneiciary does not have the needed information, please have the Beneiciary contact their bank to obtain the appropriate information. Sending International wires without the required information can cause the wire to be delayed, returned, or assessed additional fees. For International outgoing wires only: When sending in foreign currency, please ensure the Beneiciary’s account accepts the designated foreign currency. International foreign currency wires are generally less expensive to send as compared with International USD wires (the Wells Fargo wire fee

is always less when the wire is sent in foreign currency and Wells Fargo does not charge a converting fee; we also ofer competitive exchange rates.) For International wires in foreign currency that are equal to or over $100,000 U.S. equivalent, please call your local Foreign Exchange Specialist at

6.Purpose of payment (i.e., family remittance, personal remittance, salary remittance, export remittance (in settlement of an export), etc.) is required for wire transfers to India, Korea and Bahrain.

•Wires to India and Bahrain require “purpose of payment” in the information for beneiciary ield.

•Wires to Korea require “purpose of payment” in the Beneiciary bank information ield.

•If the “Purpose of payment” information is not provided the inancial institution in India, Korea and Bahrain may withhold wired funds which could delay the wire, take a fee from the wire prior to crediting the account, or they may return the funds back to Wells Fargo less fees.

Page 2 of 2 © 2014 Wells Fargo Bank, N.A. All rights reserved. Deposit products ofered by Wells Fargo Bank, N.A. Member FDIC. WTR3874

Form Characteristics

| Fact | Description |

|---|---|

| Contact Number | Customers can initiate a voice-activated wire transfer by calling Wells Fargo Wire Transfer Services at 1-888-384-8400. |

| Bank Hours | Wells Fargo operates on specific hours for wire services. Same-day wire initiation is available from 7:00 a.m. to 4:30 p.m. CT on weekdays. |

| Necessary Information | To complete a wire transfer, customers must provide their Wells Fargo account number, PIN, amount to be transferred, and beneficiary information, among other details. |

| International Transfers | For foreign wires, the SWIFT/BIC code and International Bank Account Number (IBAN) may be required, depending on the recipient's country. Missing or incorrect information can cause delays. |

| Daily Deadlines | Wire transfer requests received after established deadlines will be processed the next business day. For instance, same-day wires must be requested by 12:00 p.m. CT for specific currencies. |

| Purpose of Payment | Transfers to certain countries, including India, Korea, and Bahrain, require a "purpose of payment" which, if missing, may delay the transaction or incur fees. |

Guidelines on Utilizing Wells Fargo Wire Transfer

Filling out the Wells Fargo Wire Transfer form can seem daunting, but with the right information and careful attention, the process can be straightforward. Begin by gathering all necessary details, as this will help ensure accurate and timely processing of your wire transfer.

- Obtain your complete Wells Fargo account number. This information is required to initiate your transfer.

- Provide your Personal Identification Number (PIN). This is necessary for verification purposes.

- If applicable, enter your wire repetitive number. This will help in processing repetitive transfers.

- Specify the amount of funds you wish to transfer. Ensure the amount is clear and correct.

- If you are sending an international wire, indicate the currency type you wish to use.

- Include the beneficiary bank routing instructions. This is crucial for proper delivery.

- Provide the beneficiary account number, which may include a Mexican CLABE number or International Bank Account Number (IBAN).

- List the beneficiary's name and address. This is important for identifying the recipient.

- If there is additional information required by the receiving bank or for the beneficiary, include it here (e.g., invoice numbers, loan payment details).

- Review all the information you have entered for accuracy. Confirm that everything is complete to prevent delays.

By following these steps carefully, you'll help ensure your wire transfer is processed efficiently and correctly. Whenever you're ready, take the form to your local Wells Fargo branch or initiate the transfer online or over the phone, depending on your preference. If you have further questions during the process, reaching out to Wells Fargo's customer service can provide additional guidance and support.

What You Should Know About This Form

What information do I need to provide to initiate a wire transfer with Wells Fargo?

To initiate a wire transfer, you will need to provide specific information. This includes your complete Wells Fargo account number and your PIN. Additionally, you'll need to specify the amount of funds to be transferred and the currency type for international transfers. You must also provide routing instructions for the beneficiary's bank, the beneficiary's account number (or relevant identification code like IBAN or Mexican CLABE), as well as the beneficiary's name and address.

What are the cut-off times for sending wire transfers?

Wells Fargo has established several deadlines for different types of wire transfers. For same-day wires to Mexico in Pesos and wires to Canada in Canadian Dollars, the deadline is 12:00 p.m. CT. For outgoing international wire transfers from a consumer account, the deadline is 4:30 p.m. CT. Domestic and international transfers and outgoing drawdowns have a cut-off time of 5:00 p.m. CT. Requests received after these hours will be processed the next business day.

What should I do if I do not have the necessary beneficiary information?

If you lack the required beneficiary information, it’s crucial to reach out to the recipient. The beneficiary must provide you with their complete banking details, including their account number and routing instructions. Without accurate beneficiary information, your wire transfer could be delayed or returned, incurring additional fees.

How can I check the status of my wire transfer?

To inquire about the status of your wire transfer, you can call Wells Fargo Wire Transfer Services. By selecting the appropriate option, you can speak to a representative who can assist you with tracking your transfer. Alternatively, you can also initiate a wire transfer investigation if necessary.

What is a CLABE account number, and when is it required?

A CLABE account number is an 18-digit account identifier needed for wire transfers to Mexican banks. This number must be included in the beneficiary information for both Mexican Peso and USD payments. If you don’t have the CLABE number, the beneficiary will need to contact their bank to obtain it. Sending a wire without this number may lead to delays or returns.

What is the purpose of a SWIFT/BIC code in international wire transfers?

The SWIFT/BIC code serves as a unique identifier for financial institutions globally. This code is essential for international wire transfers as it helps ensure that funds are directed to the correct institution. The beneficiary should provide you with this code when initiating an international transfer, and failing to include it can result in delays.

Are wire transfers to certain countries subject to additional information requirements?

Yes, wire transfers to countries like India, Korea, and Bahrain have specific requirements. For example, you must include the "purpose of payment" in the beneficiary information when sending funds to those countries. If this information is not provided, it could result in the recipient's bank withholding the funds or charging fees before releasing them.

What should I know about wire transfer fees?

Wells Fargo charges different fees for domestic and international wire transfers. Generally, sending funds in foreign currency can be more cost-effective compared to using U.S. dollars, as Wells Fargo offers competitive exchange rates and does not impose currency conversion fees. It’s advisable to understand the fee structure before initiating a transfer.

Common mistakes

Filling out the Wells Fargo Wire Transfer form can be straightforward, but common mistakes can lead to delays or complications. One frequent error occurs when individuals fail to provide complete Beneficiary information. This includes the beneficiary's full name, account number, and any additional identifying details. Inadequate information can cause delays, returned wires, or extra fees.

Another common mistake is not including necessary Beneficiary Bank details. Customers often forget to add essential information such as the bank's name, branch location, and specific routing codes like ABA/RTN or SWIFT/BIC. Providing incorrect or incomplete bank details can lead to unsuccessful transfers or further delays.

Some transfer initiators overlook the requirement for country-specific information, such as the International Bank Account Number (IBAN). When sending wires to certain countries, missing the IBAN can result in the receiving bank returning the wire, leading to extra costs and time delays. It’s vital to verify this information beforehand to ensure smooth processing.

Additionally, many people forget about the necessity of including a CLABE account number for transfers to Mexican banks. Without this 18-digit number, payments might not be processed correctly, further complicating the transaction. Always ensure that the beneficiary provides this critical information when applicable.

Another mistake involves the failure to mark a wire as a same-day transfer when required. If the appropriate options aren’t selected early in the process, the wire may be processed as a standard request, missing deadlines and causing unwanted delays. Awareness of these deadlines is crucial for timely transactions.

Finally, neglecting to specify the purpose of payment when sending wires to specific countries can lead to complications. For instance, transfers to India, Korea, and Bahrain require this information, or the financial institution might withhold funds or take fees. Double-checking these details will help in avoiding significant delays and additional costs.

Documents used along the form

When initiating a wire transfer with Wells Fargo, several other documents and forms may be required or beneficial to your transaction. Each of these plays a specific role in ensuring the transfer process is smooth and efficient.

- Wire Transfer Authorization Form: This is a document that authorizes the bank to process your wire transfer. It typically includes details about the sender, recipient, and the amount being transferred.

- Customer Identification Form: Before processing wire transfers, banks often require verification of the customer's identity. This form helps in confirming the identity of the person initiating the transfer.

- Beneficiary Information Form: To avoid delays, this form collects the recipient's banking details, including account numbers, routing numbers, and contact information. Complete and accurate information is crucial.

- International Wire Transfer Form: Required for sending money abroad, this form gathers specific information for international transactions, such as SWIFT/BIC codes and local routing numbers.

- Currency Conversion Authorization: If the transfer involves currency exchange, this document allows the bank to convert the funds at the current exchange rate. Always ensure you understand the rates before authorizing.

- Purpose of Payment Declaration: Certain countries require information about the purpose of the wire transfer. This declaration explains why the funds are being sent, helping ensure compliance with international regulations.

Using the correct forms and understanding their requirements can significantly enhance the efficiency of your wire transfer process. Make sure all details are precise to avoid unnecessary delays or complications. Happy transferring!

Similar forms

The Wells Fargo Wire Transfer form serves specific functions in processing financial transactions. Similar documents also facilitate fund transfers or banking instructions. Here are five documents that share similarities with the Wells Fargo Wire Transfer form:

- ACH Transfer Form: This document is used for Automated Clearing House (ACH) transactions, allowing direct deposit or withdrawals. Like the wire transfer form, it requires specific details such as account numbers and routing information, but operates on a different network for electronic funds transfer.

- International Money Transfer Form: This form is utilized for sending money across borders through various service providers. It requires similar beneficiary information, recipient banks, and can include details about currencies, much like the Wells Fargo form.

- Domestic Money Order: A domestic money order allows individuals to send money securely. While it does not require banking details as extensively as the wire transfer form, both documents serve to authorize funds transfer and both require the sender's identification.

- Deposit Slip: This document is used to deposit funds into a bank account. It requires account identification and amounts, similar to how the wire transfer form needs thorough beneficiary and account information to complete the transaction.

- Bill Payment Authorization Form: This form allows a bank or service provider to process regular bill payments on behalf of a customer. It shares features with the wire transfer form, such as requiring authorization and account details for successful transaction processing.

Dos and Don'ts

When filling out the Wells Fargo Wire Transfer form, taking care and attention to detail is essential. Here’s a list of things you should and shouldn't do to ensure a seamless transfer process.

- Do provide your complete Wells Fargo account number as it is required for processing.

- Do include accurate beneficiary information including their name, address, and account number.

- Do specify the purpose of payment when required for international wires, especially to countries like India, Korea, and Bahrain.

- Do ensure you have the necessary international banking codes such as SWIFT/BIC, IBAN, or CLABE where applicable.

- Do double-check the deadline for your wire transfer to ensure it will be processed on the same day.

- Don't forget to provide complete beneficiary bank information, including the bank's name, address, and routing numbers.

- Don't send international wires without confirming that the beneficiary’s account can accept the designated foreign currency.

- Don't skip providing additional information that might help the receiving bank process the wire correctly. Incomplete instructions can lead to delays or extra fees.

By following these guidelines, you can minimize complications and ensure your wire transfer goes through smoothly. Always remember to reach out to your Wells Fargo representative if you have any questions or require assistance.

Misconceptions

- Misconception 1: The Wells Fargo Wire Transfer form is only necessary for outgoing transfers.

- Misconception 2: You can initiate a wire transfer anytime without any deadlines.

- Misconception 3: All wire transfers are processed instantly.

- Misconception 4: Providing complete beneficiary information is not that crucial.

- Misconception 5: You can rely on Wells Fargo to provide all bank codes like IBAN or CLABE.

- Misconception 6: Only personal information is needed for international wire transfers.

This is not true. While the form is crucial for sending money, it also plays a vital role in incoming wires. Having accurate information ensures that your funds arrive without delays.

Many individuals assume they can make wires at their convenience. However, Wells Fargo has strict deadlines for same-day transfers. Requests submitted after specific times are pushed to the next business day.

People might think that every wire transfer is instantaneous. In reality, processing can take longer, particularly for international wires. Missing critical information can further extend the timeline.

Some may underestimate the importance of precise beneficiary details. Missing information, such as the account number or the name, can lead to additional fees or even a return of the transfer.

Many customers believe Wells Fargo can supply the necessary codes for foreign transactions. However, obtaining the IBAN or Mexican CLABE must come directly from the beneficiary or their respective bank.

While personal information is essential, international wires often necessitate additional data, such as the purpose of the payment. Failing to include this can result in issues at the receiving bank.

Key takeaways

When using the Wells Fargo Wire Transfer form, it is important to keep several key points in mind:

- Gather required information: Ensure you have your complete Wells Fargo account number, PIN, beneficiary information, and wire details before initiating a transfer.

- Adhere to daily deadlines: Be mindful of daily cut-off times to ensure your wire transfer is processed on the same day. Requests made after these times will typically be processed the next business day.

- Provide complete beneficiary details: To avoid delays or additional fees, ensure that all necessary information about the beneficiary is accurate, including their account number and any required banking codes.

- Use correct codes for international transfers: For wires to foreign countries, obtaining the proper SWIFT/BIC, IBAN, or International Routing Code from the beneficiary is essential to facilitate successful transfers.

- Be aware of country-specific requirements: Different countries have specific requirements for wire transfers, such as including a CLABE number for Mexican transfers or indicating the "purpose of payment" for wires to India and Korea.

- Contact Wells Fargo for assistance: If you encounter any issues or have questions regarding your wire transfer, do not hesitate to reach out to Wells Fargo customer service for support.

Browse Other Templates

Adoption Paperwork - The agency will direct the next steps after form submission to initiate the process.

Va Form 22-8691 - This form ensures that all necessary information is collected for eligibility assessment.