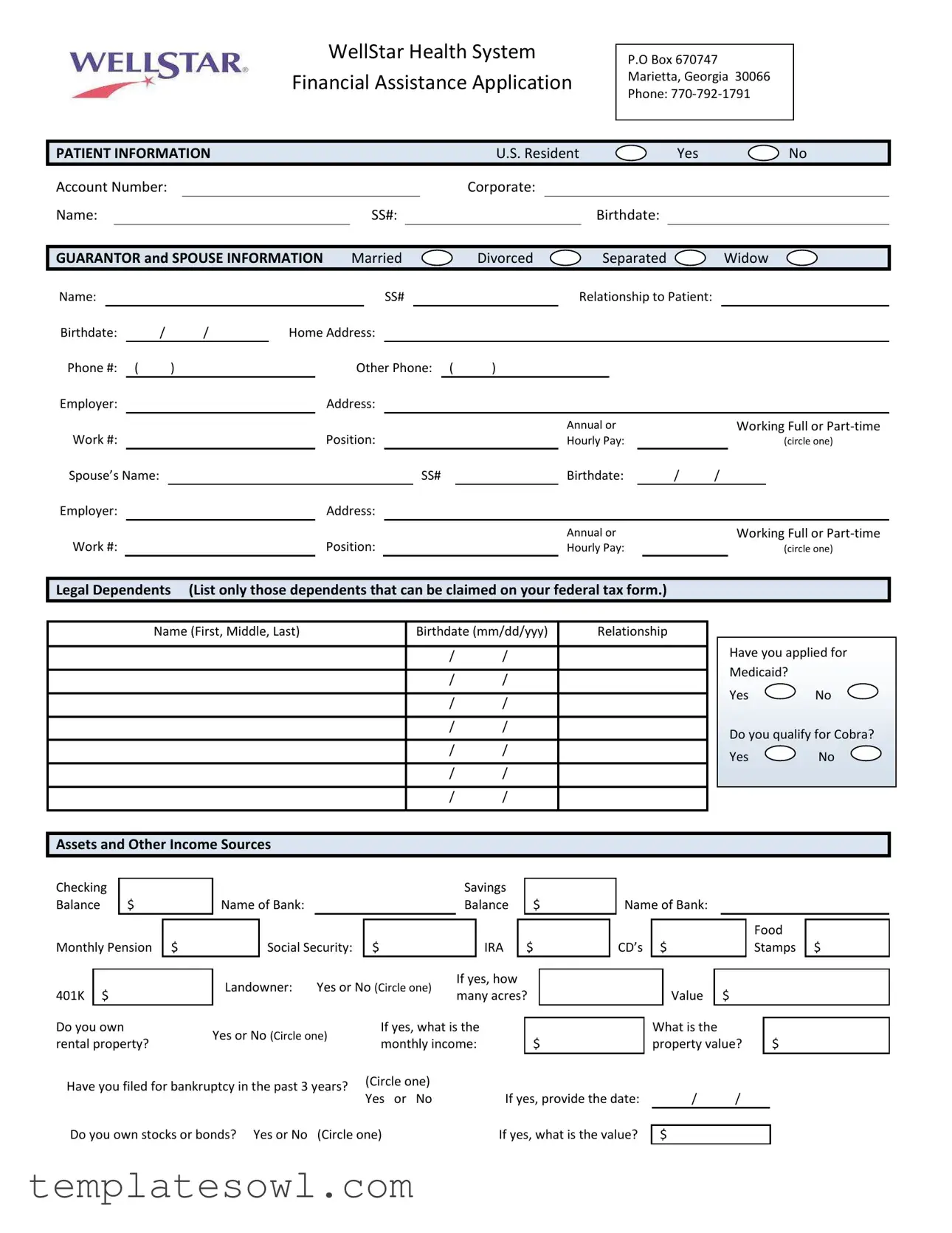

Fill Out Your Wellstar Financial Assistance Application Form

The Wellstar Financial Assistance Application form is a crucial tool for patients seeking help with medical expenses incurred at Wellstar Health System. This form collects essential information regarding the applicant’s financial situation, including details about income, assets, and dependents. It requires personal identifiers, such as account numbers, Social Security numbers, and birthdates for both the patient and any guarantors or spouses. Patients must provide documentation to support their application, including tax returns, pay stubs, and bank statements. The process aims to ensure that individuals with limited or no financial means can access necessary medical care. Additionally, compliance with information submission is key; without timely and accurate documentation, Wellstar cannot process the application for financial assistance. An understanding of one's financial situation, including any past bankruptcies or property ownership, is also integral to the assessment. Ultimately, Wellstar’s commitment to helping those in need reflects its dedication to providing equitable healthcare services to the community.

Wellstar Financial Assistance Application Example

WellStar Health System

Financial Assistance Application

P.O Box 670747

Marietta, Georgia 30066

Phone:

PATIENT INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Resident |

|

|

|

|

Yes |

|

|

|

No |

|||||||||

Account Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name: |

|

|

|

|

|

|

|

SS#: |

|

|

|

|

|

Birthdate: |

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

GUARANTOR and SPOUSE INFORMATION |

|

Married |

|

Divorced |

|

|

|

Separated |

|

|

Widow |

|||||||||||||||||||||

Name: |

|

|

|

|

|

|

|

|

|

SS# |

|

|

|

|

|

Relationship to Patient: |

|

|

|

|

||||||||||||

Birthdate: |

|

/ |

|

/ |

Home Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Phone #: ( |

) |

|

|

|

|

Other Phone: ( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Employer: |

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual or |

|

|

|

Working Full or |

|||||

Work #: |

|

|

|

|

|

|

Position: |

|

|

|

|

|

Hourly Pay: |

|

|

|

|

|

(circle one) |

|||||||||||||

Spouse’s Name: |

|

|

|

|

|

|

|

|

|

|

|

|

SS# |

|

|

|

|

|

Birthdate: |

|

/ |

/ |

|

|

|

|||||||

Employer: |

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual or |

|

|

|

Working Full or |

|||||

Work #: |

|

|

|

|

|

|

Position: |

|

|

|

|

|

Hourly Pay: |

|

|

|

|

|

(circle one) |

|||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||||||||||

Legal Dependents |

(List only those dependents that can be claimed on your federal tax form.) |

|

|

|

|

|

||||||||||||||||||||||||||

Name (First, Middle, Last) |

Birthdate (mm/dd/yyy) |

Relationship |

/ /

/ /

/ /

/ /

/ /

/ /

/ /

Have you applied for Medicaid?

Yes No

Do you qualify for Cobra?

Yes No

Assets and Other Income Sources

Assets and Other Income Sources

Checking |

|

Balance |

$ |

Monthly Pension $

|

|

|

|

Savings |

|

|

||

Name of Bank: |

|

Balance |

$ |

|

||||

|

|

|

|

|

|

|

|

|

|

Social Security: |

$ |

|

IRA |

|

$ |

|

|

Name of Bank:

CD’s $

Food Stamps $

|

|

Landowner: |

Yes or No (Circle one) |

If yes, how |

|

|||

401K |

$ |

many acres? |

|

|||||

|

|

|

|

|||||

Do you own |

Yes or No (Circle one) |

If yes, what is the |

|

|

|

|||

|

|

|

||||||

rental property? |

monthly income: |

|

$ |

|||||

|

|

|

||||||

Have you filed for bankruptcy in the past 3 years? |

(Circle one) |

|

|

|

|

|||

Yes or No |

|

If yes, provide the date: |

||||||

|

|

|

|

|

||||

|

Value |

|

$ |

|

|

What is the |

|

|

|

||

|

|

|

|||

property value? |

$ |

||||

/ |

|

/ |

|

|

|

Do you own stocks or bonds? Yes or No (Circle one) |

If yes, what is the value? |

$ |

WellStar Health System is committed to providing financial assistance to patients who have sought medically necessary care at WellStar Health System but have limited or no means to pay for that care. WellStar Health will provide emergency medical care to all individuals, regardless of their ability to pay or eligibility under the Community Financial Assistance Policy.

In order to qualify for financial assistance, cooperation with WellStar Health is necessary in identifying and determining alternative sources of payment or coverage from public and private payment programs. In order to qualify for financial assistance, the following is necessary:

Required information:

Submit a true, accurate, signed and completed application for financial assistance; and

Provide a copy of the prior year Federal Income Tax Return and W2/1099 (including all schedules)

Provide two of the following if unable to provide a copy of the most recent Federal Income Tax Return:

Provide 3 months of the most recent pay stubs (or certification of unemployment); or

Separation Notice or unemployment claim if unemployed; or

Provide 3 current bank statements for all checking and savings accounts; or

Provide award letter from Social Security Office; or

Provide Current Profit and Loss report for all

Current CD, 401k, 403b, IRA and other investment statements; or

Provide Asset Statement, with equity adjustments (Rental property, land, second houses)

This information must be received in order to process your application. If you fail to be compliant in returning the above information within 10 business days, WellStar Health System will not process your account for Community Financial Assistance approval. You may contact

Comments:

I hereby request that WellStar determine my eligibility for Community Financial Assistance. I understand that the information which I submit regarding my annual income and family size must be verified. I also understand that if the information I submit is determined to be false, such a determination will result in a denial of eligibility for Community Financial Assistance. I further agree to make application for any assistance (i.e., Medicaid, Medicare, State Aid (for cancer), Vocational Rehab, Insurance, etc.) that may be available for payment of my WellStar account charges. I will fully cooperate in taking whatever actions may be deemed necessary to obtain such assistance, and will assign or pay WellStar the amount recovered for WellStar charges. I agree to pay any balances remaining after the Community Financial Assistance adjustment is made. Failure to do so will result in a reversal of any Community Financial Assistance

I affirm that the above information is true and correct to the best of my knowledge. |

|

|

|

|

Guarantor Signature: |

Date: |

|

|

|

Date: |

||||

|

|

|

|

|

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Application Purpose | The form is used to assess eligibility for financial assistance for medically necessary care at WellStar Health System. |

| U.S. Residency Requirement | Applicants must confirm their status as U.S. residents by answering "Yes" or "No" on the form. |

| Financial Information Submission | Applicants must provide a true, accurate, signed, and completed application along with a copy of their prior year Federal Income Tax Return and relevant W2/1099 forms. |

| Alternative Documentation | If unable to provide a tax return, applicants must submit two of various forms of documentation, such as pay stubs or bank statements. |

| Community Financial Assistance Policy | WellStar provides emergency medical care to all individuals, regardless of payment ability, under the Community Financial Assistance Policy. |

| Bankruptcy Disclosure | Applicants must report if they have filed for bankruptcy in the past three years, as well as the date of filing if applicable. |

| Cooperation Requirement | To qualify for financial assistance, applicants must cooperate with WellStar in identifying alternative sources of payment or coverage. |

| Compliance Timeline | All required information must be submitted within 10 business days of application to avoid account processing denial. |

Guidelines on Utilizing Wellstar Financial Assistance Application

Filling out the Wellstar Financial Assistance Application is a straightforward process, designed to gather essential information to assess eligibility for assistance. To ensure a smooth submission, follow the steps outlined below carefully. All required information must be provided to move forward with the application.

- Begin with the Patient Information section. Indicate whether you are a U.S. resident by marking 'Yes' or 'No'. Fill in the account number, corporate affiliation, your full name, Social Security number, and birthdate.

- Next, complete the Guarantor and Spouse Information section. State your marital status (Married, Divorced, Separated, or Widow). Enter the name of the guarantor, their Social Security number, relationship to the patient, and their birthdate. Provide the home address and phone numbers for both the guarantor and the spouse if applicable. Include employer details, job position, and hourly pay.

- List any Legal Dependents who can be claimed on your federal tax form. Record their names, birthdates, and relationship to you.

- Indicate if you have applied for Medicaid and if you qualify for Cobra. Answer these questions with 'Yes' or 'No'.

- Detail your Assets and Other Income Sources. Provide the balance for checking and savings accounts. Include any other income sources, such as pensions, Social Security, food stamps, and rental income.

- Answer whether you’ve filed for bankruptcy in the last three years and provide the date if applicable.

- Specify the value of any properties, stocks, or bonds you own.

- Sign and date the application, affirming that the information provided is accurate and complete. Include a co-guarantor signature if applicable.

Once the form is completed, submit it along with the required documentation, such as the prior year’s Federal Income Tax Return, W2/1099 forms, or other proof of income. It’s essential to comply with these requirements promptly to ensure your application is processed efficiently. For any questions, contact WellStar Health System directly.

What You Should Know About This Form

What is the Wellstar Financial Assistance Application form?

The Wellstar Financial Assistance Application form is a document that individuals can use to apply for financial assistance for medical care received at Wellstar Health System. It gathers essential information about the patient and the guarantor to determine eligibility for financial support based on their financial situation.

Who is eligible to apply for financial assistance?

Patients who have sought medically necessary care at Wellstar Health System and have limited or no means to pay for that care are eligible to apply for financial assistance. Wellstar is committed to helping those who require emergency medical treatment regardless of their ability to pay.

What information do I need to provide with my application?

To complete the application for financial assistance, you must provide accurate and true information. This includes a copy of your prior year Federal Income Tax Return and W2/1099. If you cannot provide your most recent tax return, you can submit three months of pay stubs, an unemployment claim, bank statements, a Social Security award letter, or other financial documentation as specified in the application form.

What happens if I don't submit the required information?

If you fail to provide the necessary information within ten business days, Wellstar Health System will not process your application for financial assistance. It is vital to ensure all required documentation is submitted on time to avoid denial.

How can I contact Wellstar if I have questions about my application?

You can contact Wellstar Customer Service at 678-838-5750 if you have any questions about the financial assistance application or specific requirements. They are available to assist with any concerns you may have.

Will my application information be kept confidential?

Yes, Wellstar Health System takes your privacy seriously. All information submitted with your application will be kept confidential and used solely for the purpose of determining your eligibility for financial assistance.

What should I do if my financial situation changes after submitting my application?

It is important to inform Wellstar about any changes in your financial situation as soon as possible. Changes may affect your eligibility for financial assistance. Keeping Wellstar informed will help ensure that your application remains valid and accurately reflects your current circumstances.

What is the significance of the guarantor's signature on the application?

The guarantor's signature on the application confirms that all information provided is true and accurate to the best of their knowledge. It also indicates their commitment to cooperate with Wellstar in seeking any available financial assistance and their responsibility for any remaining balances after assistance is applied.

Common mistakes

Filling out the Wellstar Financial Assistance Application can be a daunting task, and mistakes can lead to delays or even the denial of assistance. One common error is inadequate or incomplete patient information. Failing to provide essential details such as the account number or Social Security number may hinder the processing of the application. Incomplete sections can create uncertainty about the applicant's situation, and Wellstar might require resubmission of the application, which delays financial support.

Another frequent misstep is inconsistent income reporting. Applicants may forget to include all sources of income or misreport their hourly pay. This can lead to a false picture of the applicant's financial status. Clear and accurate reporting is crucial. If income fluctuates, it is important to reflect that accurately over the specified time period. Misleading information can result in a denial of financial assistance.

Additionally, many individuals do not attach all required documentation. Wellstar expects several key documents, such as a Federal Income Tax Return and W2/1099 forms. Skipping these can result in immediate rejection of the application. Applicants often assume they can provide this later, but delays in documentation can slow down the process. It is essential to gather all necessary paperwork to prevent any unnecessary setbacks.

Failure to adhere to the submission timeline is yet another mistake. Wellstar specifies that all required information must be submitted within 10 business days. Missing this deadline can lead to the application being disregarded altogether. Timeliness is essential in receiving assistance. Therefore, being aware of the deadline and planning ahead is vital for successful application processing.

Lastly, applicants sometimes fail to verify their information before submitting the application. Errors in names, dates, and other personal details can lead to complications. Submitting a form that contains inaccuracies can undermine the trustworthiness of the entire application. It is crucial to double-check all entries to ensure that everything aligns with official documents, thereby enhancing the application's credibility.

Documents used along the form

The Wellstar Financial Assistance Application is an important document for those seeking financial aid for medical care. Several other forms and documents may be needed alongside it to ensure a complete and accurate application. Below is a list of commonly required documents that can support the application process.

- Federal Income Tax Return - A copy of the most recent federal tax return is necessary for assessing income levels.

- W-2 or 1099 Forms - These forms show your annual income and help verify employment status for the relevant year.

- Pay Stubs - Provide three months’ worth of recent pay stubs to demonstrate ongoing income if tax documents are unavailable.

- Separation Notice - If unemployed, a separation notice or unemployment claim can verify your current status and lack of employment.

- Bank Statements - Submit three current statements from checking and savings accounts to give a clearer picture of financial status.

- Social Security Award Letter - This document is needed if you receive Social Security benefits and helps confirm your income source.

- Current Profit and Loss Statement - Applicable to self-employed applicants, this report outlines income and expenses to verify financial standing.

- Investment Statements - Recent statements from accounts like CD, 401k, and IRA can provide insight into your financial assets.

- Asset Statement - This document shows the value of owned property and other significant assets, which may be necessary for financial assessment.

Ensure all necessary documents are prepared and submitted on time to avoid any delays in processing your application for financial assistance. Each document plays a vital role in clarifying your financial situation, which is crucial for getting the support you need.

Similar forms

- Medicaid Application Form: Similar to the Wellstar Financial Assistance Application, the Medicaid application requests detailed information about the individual's income, assets, and household composition to determine eligibility for state-funded healthcare assistance.

- Medicare Application Form: This document also collects personal and financial information. It aims to establish eligibility for federal health insurance for seniors and certain disabled individuals, similar to Wellstar's focus on financial support.

- Community Health Network Financial Assistance Application: Like Wellstar, this form assesses income and assets to determine a patient's need for financial help with medical bills. It requires proof of income and household size.

- Charity Care Application: Offered by various hospitals, this application resembles Wellstar's by seeking extensive financial details to evaluate whether the applicant qualifies for free or reduced-cost healthcare services.

- Nonprofit Health Provider Financial Aid Application: This document serves the same purpose as Wellstar’s form, collecting personal and financial information to assist patients in accessing necessary medical care without the burden of costs.

- State Aid Financial Assistance Application: Just like Wellstar's application, this form evaluates an individual’s financial situation to determine eligibility for state programs that help cover medical expenses.

- Unemployment Benefits Application: This application shares a similar structure, gathering details about income and employment status to assess eligibility for financial assistance during periods of unemployment.

- Food Assistance Program Application: Also collecting financial and household information, this form helps determine eligibility for food support programs, paralleling Wellstar's aim to assist those in financial distress.

- Personal Loan Application: Although different in purpose, this financial application also needs information about income, assets, and debts, reflecting a person’s financial situation, much like the financial assistance application.

Dos and Don'ts

When filling out the Wellstar Financial Assistance Application form, it is essential to follow certain guidelines to ensure a smooth process. Below is a list of things you should and shouldn't do:

- Do read the application instructions carefully before starting.

- Do provide accurate and truthful information in all sections of the application.

- Do include all required documentation along with your application.

- Do double-check your application for any omissions or errors before submission.

- Do keep a copy of your completed application for your records.

- Don't leave any sections blank; provide answers to all questions.

- Don't submit false information, as it can lead to denial of assistance.

- Don't ignore requests for additional documentation or clarification from Wellstar.

- Don't wait until the last minute to submit your application and supporting documents.

Misconceptions

Misconceptions about the Wellstar Financial Assistance Application form can lead to misunderstandings for those seeking help. Here are five common myths and clarifications:

-

Myth: Only low-income individuals can apply for financial assistance.

While income is a significant factor, Wellstar Financial Assistance is available to anyone who needs help covering medically necessary care. Eligibility considers various circumstances, not just income level.

-

Myth: The application process is complicated and time-consuming.

The application requires specific documents, but the process is straightforward. Applicants need to provide certain information, and Wellstar has resources available to assist with questions.

-

Myth: Submitting false information will not impact eligibility.

Honesty is crucial. Providing inaccurate information can lead to a denial of assistance. Wellstar verifies the details of the application to ensure fairness in the process.

-

Myth: Financial assistance covers all medical bills without any obligation.

While Wellstar provides assistance, applicants may still be responsible for some balances after the adjustment. Applicants must also apply for any other available assistance programs.

-

Myth: The Financial Assistance application is only for people who have no other insurance options.

Even individuals with insurance might qualify for financial assistance if they face high out-of-pocket costs. Wellstar encourages all patients who need help to apply, regardless of their insurance status.

Key takeaways

Key Takeaways for Filling Out the WellStar Financial Assistance Application:

- Follow instructions closely. Ensure you read all sections of the application thoroughly before you begin filling it out.

- Provide accurate patient information. Include all required details, such as the patient’s account number, social security number, and birthdate.

- Complete the guarantor and spouse section, if applicable. If you are married or have a spouse, their information must be included.

- List all legal dependents. Only include dependents that you can claim on your federal tax form, and provide their birthdates and relationship to you.

- Document your income sources. Include information about all financial resources, such as pay stubs, Social Security benefits, and any other relevant income.

- Prepare required documentation. Be ready to submit your prior year’s Federal Income Tax Return, W2/1099 forms, and any additional documents that prove your income.

- Meet the deadlines. Ensure you return the application and required documents within 10 business days to avoid delays in processing.

- Cooperate fully with the process. If requested, apply for any available assistance programs, and provide necessary information for verification.

Understanding these points can help you navigate the application process more effectively and enhance your chances of receiving the financial assistance you may need.

Browse Other Templates

Lic 308 - Every change in the structure requires timely updates to maintain licensing integrity.

OHR Leave Application - Employees must consider the impact of their leave on their positions when applying.