Fill Out Your Western Insurance Death Claim Form

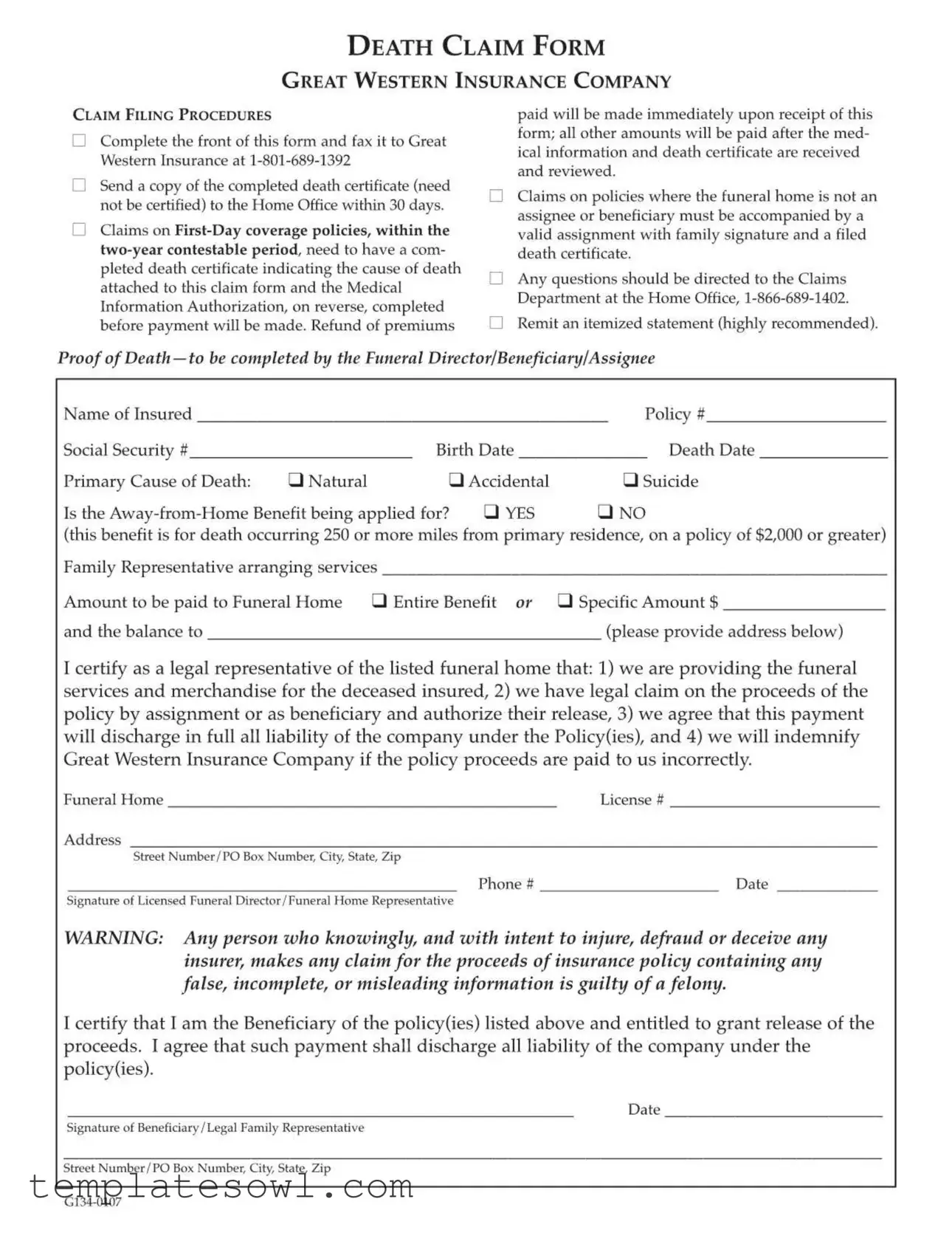

The Western Insurance Death Claim form is an important document that helps ensure beneficiaries receive the financial support they need following the loss of a loved one. To initiate the claim process, it's essential to complete the front of the form and fax it to Great Western Insurance at 1-801-689-1392. In addition to the form, a copy of the death certificate must be sent to the Home Office within 30 days. For claims related to First-Day coverage policies within the two-year contestable period, you will need to attach the death certificate indicating the cause of death, along with a completed Medical Information Authorization. While premiums can be refunded immediately upon receipt of the form, the remaining claims payments will follow after reviewing the relevant medical information and death certificate. If the funeral home is not a beneficiary of the policy, the claim must also include a valid assignment with family signatures and a filed death certificate. This form requires input from the funeral director, beneficiary, or family representative to confirm details such as the insured's name, cause of death, and any benefits being claimed. It is critical that all information provided is accurate to avoid any complications, as submitting misleading information could result in serious legal consequences. Questions regarding the process can be directed to the Claims Department at the Home Office, ensuring that you have support during this difficult time.

Western Insurance Death Claim Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Submission Method | The form must be completed and faxed to Great Western Insurance at 1-801-689-1392. A copy of the death certificate should also be sent to the Home Office within 30 days. |

| First-Day Coverage Requirements | If the policy is within a two-year contestable period, a completed death certificate showing the cause of death must accompany the claim form along with the Medical Information Authorization. |

| Premium Refunds | Refunds of premiums will be issued immediately upon receipt of the form. All other claim amounts will be processed after reviewing the required medical information and death certificate. |

| Funeral Home Claims | For funeral homes not listed as assignees or beneficiaries, a valid assignment with family signatures, along with the death certificate, must be provided. |

| Contact Information | Any questions regarding the claim process can be directed to the Claims Department at 1-866-689-1402. |

Guidelines on Utilizing Western Insurance Death Claim

Filling out the Western Insurance Death Claim form can seem overwhelming, but it is a straightforward process. Following the steps below will guide you through effectively completing the form for submission. Remember to have relevant documents ready, such as a copy of the death certificate and any necessary signatures.

- Obtain a copy of the Western Insurance Death Claim form.

- Begin by completing the front of the form. Fill in the name, policy number, and Social Security number of the deceased.

- Indicate the primary cause of death, selecting from: Natural, Accidental, or Suicide.

- If applicable, please state whether the Away-from-Home Benefit is being claimed. This is for deaths that occur 250 miles or more from the primary residence.

- Provide the name of the family representative arranging the funeral services.

- Specify the amount to be paid to the funeral home—either the entire benefit or a specific amount, and include the balance information.

- Ensure the funeral director or representative signs and includes their license number, phone number, and date.

- Have the beneficiary or legal family representative sign and include their address and date, confirming their right to release the proceeds.

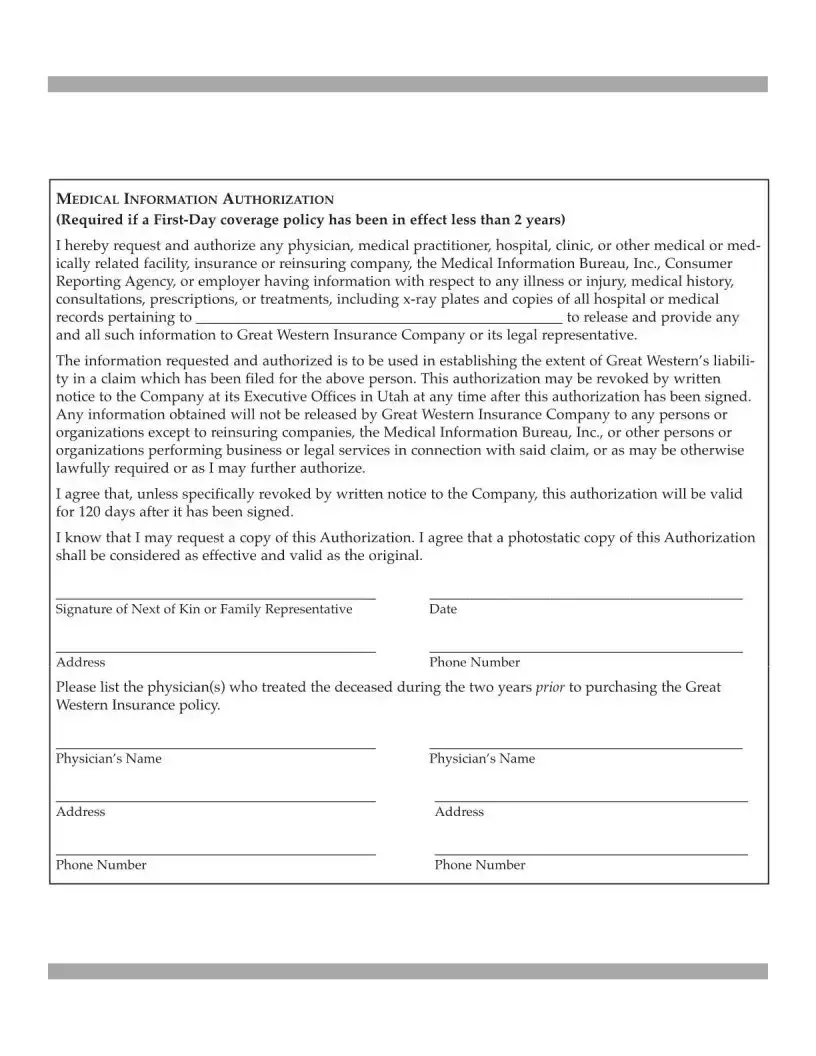

- Complete the Medical Information Authorization section if the policy has been in effect for less than two years.

- List the names and contact information of any physicians who treated the deceased in the two years prior to purchasing the insurance policy.

- Once the form is completed, fax it to Great Western Insurance at 1-801-689-1392.

- Send a copy of the completed death certificate (it need not be certified) to the Home Office within 30 days.

After submitting the form and required documents, wait for Great Western Insurance to review your claim. You can reach out to the Claims Department at 1-866-689-1402 if you have questions or need clarification during this process.

What You Should Know About This Form

1. What should I do first when filing a death claim with Great Western Insurance?

To initiate the claim process, fill out the front of the Death Claim form. After completing it, fax the form to Great Western Insurance at 1-801-689-1392. As an essential next step, send a copy of the deceased's death certificate to the Home Office within 30 days. Remember, the death certificate does not need to be certified.

2. Are there any specific requirements for claims on First-Day coverage policies?

Yes, for claims on First-Day coverage policies that fall within the two-year contestable period, you must attach a completed death certificate indicating the cause of death. Additionally, ensure that the Medical Information Authorization section on the reverse side of the form is completed. Payment will not be processed until these documents are received and reviewed.

3. How quickly can I expect the refund of premiums paid?

The refund of any premiums paid will be issued immediately upon receipt of your completed claim form. However, further payment of other claim amounts will only occur after the necessary medical information and death certificate have been received and assessed by the insurance company.

4. What if the funeral home is not listed as an assignee or beneficiary?

If the funeral home is not designated as an assignee or beneficiary in the policy, you must include a valid assignment with the family's signature along with a filed death certificate when submitting your claim. This step ensures that the funeral home can legally receive payment for services rendered.

5. How can I ensure that my claim is processed smoothly?

To facilitate a smooth processing of your claim, submitting an itemized statement alongside the completed claim form is highly recommended. This itemized statement should detail the costs associated with the funeral services provided.

6. What impact does the Away-from-Home Benefit have on my claim?

The Away-from-Home Benefit applies if the insured passed away 250 or more miles from their primary residence and the policy is for $2,000 or greater. If you are applying for this benefit, make sure to indicate your intention clearly on the claim form, as it may affect payment and coverage decisions.

7. Who should I contact if I have questions about the claim process?

If you have any questions regarding the death claim process, do not hesitate to reach out to the Claims Department at Great Western Insurance. You can contact them at 1-866-689-1402, where representatives will be available to assist you.

8. What is included in the Medical Information Authorization?

The Medical Information Authorization allows Great Western Insurance to obtain any relevant medical history, treatment records, and other necessary health information that may impact the assessment of the claim. This is particularly important for First-Day coverage policies that have been active for less than two years. It’s essential to sign this authorization if required, for the claim to proceed effectively.

Common mistakes

Filling out the Western Insurance Death Claim form can be a delicate task during an emotionally challenging time. One common mistake people make is not attaching a copy of the death certificate. While the instructions state that it does not need to be certified, failing to include it can delay processing. Make sure to send a copy to the Home Office within the required 30 days to avoid any hiccups in your claim.

Another error often seen involves misunderstanding the medical information requirements. For policies with First-Day coverage that have been in effect for less than two years, it’s crucial to complete the Medical Information Authorization section. Omitting this document can prevent the insurance company from determining their liability, ultimately stalling payment. Double-check that all necessary medical information is included and properly authorized.

People frequently forget to specify the amount to be paid to the funeral home. This section asks whether the entire benefit or a specific amount should be directed to the funeral home. Not providing this information can lead to confusion and delays in payment. Be explicit about the amount to ensure that funds are allocated correctly.

Lastly, neglecting signatures is a common oversight. The form requires signatures from both the beneficiary and the licensed funeral director. If any signature is missing, this can result in an incomplete claim. Review the document thoroughly before submission to confirm all necessary signatures are present, ensuring a smoother claims process.

Documents used along the form

When filing a death claim with Great Western Insurance, several additional documents may accompany the main claim form to ensure a smooth and efficient process. Understanding these documents can facilitate timely claims and compliance with insurance requirements. Here are some crucial forms often needed:

- Death Certificate: This official document certifies the death of the insured. It typically includes essential details such as the date and cause of death. While a certified copy is not required, a copy must be submitted to the Home Office within 30 days of the claim.

- Medical Information Authorization: Required for First-Day coverage policies within the contestable period, this form grants permission for medical providers to share relevant health information with the insurance company. It is critical for confirming the extent of the insurer's liability.

- Funeral Assignment Form: If the funeral home is designated to receive payment directly from the insurance proceeds, this form must be completed and signed by the family. It establishes the funeral home's claim to the policy benefits.

- Itemized Funeral Bill: This document outlines all funeral service expenses. Although not mandatory, providing an itemized statement can help ensure that the claims process is processed smoothly and that payment accurately reflects the services rendered.

Incorporating these additional documents when filing a claim can help clarify information and expedite the processing time. Ensuring all required paperwork is included is vital for a successful outcome in claiming benefits.

Similar forms

- Life Insurance Claim Form: Similar to the Death Claim Form, this document is used to file a claim on a life insurance policy. It typically requires personal information about the insured and requests proof of death, ensuring that the insurance company can process the claim efficiently.

- Accidental Death Claim Form: This form is often used for claims related to accidental death policies. It gathers documentation about the incident and death, providing the insurer with the necessary details to assess the claim accurately.

- Beneficiary Claim Form: This document designates who is entitled to receive benefits after a death. It requires signatures from beneficiaries and information about the deceased, similar to the Death Claim Form in its intent to ensure proper payout.

- Funeral Service Agreement: This contract between the funeral home and the family outlines the services to be provided. It is necessary for proving expenses that might be covered by insurance claims, just like the itemized statement requested in the Death Claim Form.

- Medical Authorization Form: This form permits the insurance company to access medical records needed to process a claim. Like the Medical Information Authorization mentioned in the Death Claim Form, it helps establish the cause of death and the extent of liability.

- Proof of Death Certificate: While variations exist, this document serves to confirm the occurrence of death, much like the completed death certificate requirement in the Death Claim Form, supporting claims processing.

Dos and Don'ts

When filling out the Western Insurance Death Claim form, there are important guidelines to follow. Here’s a list of things you should and shouldn’t do:

- Do complete the front of the form accurately.

- Do fax the completed form to Great Western Insurance at 1-801-689-1392.

- Do send a copy of the death certificate within 30 days.

- Do ensure the death certificate includes the cause of death if applicable.

- Do remit an itemized statement of funeral expenses.

- Don't forget to include any required Medical Information Authorization if it’s a First-Day coverage policy.

- Don't submit a claim without a valid assignment if the funeral home is not designated.

- Don't leave out contact information for the funeral home.

- Don't attempt to misrepresent any information on the form.

- Don't hesitate to call the Claims Department if you have questions.

Misconceptions

There are several misconceptions surrounding the Great Western Insurance Death Claim form. Understanding these can help in navigating the claims process more effectively.

- Myth: A certified death certificate is required. In reality, a copy of the death certificate need not be certified. This can ease the burden on families during a difficult time.

- Myth: You must submit the claim form and death certificate simultaneously. While the claim form should be faxed promptly to the company, the completed death certificate can be sent to the Home Office within 30 days.

- Myth: All claims are paid immediately. Refunds for premiums paid may be issued quickly, but all other payments will be made only after a thorough review of the medical information and death certificate.

- Myth: Funeral homes automatically receive payment without any additional documentation. Payments will only be made if a valid assignment is included with the claim form, alongside the filed death certificate if the funeral home is not a beneficiary.

- Myth: There is no need for a medical information authorization if the policy is older than two years. For First-Day coverage policies still within the two-year contestable period, a completed medical information authorization is indeed required.

Key takeaways

When filling out the Western Insurance Death Claim form, several important aspects must be understood to ensure the process goes smoothly. Here are key takeaways to keep in mind:

- Timely Submission: Complete the front of the claim form and fax it to Great Western Insurance within the designated time frame. Along with the form, send a copy of the death certificate to the Home Office within 30 days.

- Documentation Requirements: For claims under First-Day coverage policies within a two-year contestable period, attach a completed death certificate stating the cause of death. This is essential for processing your claim.

- Refund Process: Upon receipt of the claim form, refunds for premiums paid will be processed immediately. However, payments for other claim amounts will only occur after the medical information and death certificate have been reviewed.

- Valid Assignments Needed: If the funeral home is not a beneficiary or assignee, ensure that a valid assignment with the family signature and a filed death certificate accompany the claim.

- Itemized Statements: It is highly recommended to submit an itemized statement along with your claim. This helps clarify the funeral expenses for the insurance company.

- Contact Information: Should you have questions or require assistance, contact the Claims Department at the Home Office using the provided phone number. Support is available for navigating the claims process.

Browse Other Templates

What Is the Easiest Sba Loan to Get - Each section of the form is designed to gather comprehensive data for risk assessment.

How to Make a Transmittal Letter - Encourage efficient feedback on reviewed documents.

Health-Sustaining Medication Evaluation,Employment Medication Assessment Form,Public Assistance Health Medication Assessment,Medication Impact on Employability Form,Medication Necessity Assessment for Work,Employment-Related Medication Evaluation,Sus - Incomplete forms will lead to delays in the application process.