Fill Out Your Western National Annuity Form

The Western National Annuity form is a crucial document designed for individuals seeking to undertake partial surrenders from their annuity policies. This form is necessary to initiate a request for withdrawal, whether in the form of a specified dollar amount or through a penalty-free option. Users must decide between a net or gross withdrawal, which directly impacts the amount received after accounting for any applicable charges and taxes. Proper attention to details, such as the policy number and the insured owner's information, is essential for accurate processing. Tax implications also play a significant role in usage of the form, as individuals must make a federal income tax withholding election. Options here include choosing to withhold a portion for taxes or opting out of the withholding entirely, each with its own consequences. In addition, the form requires important signatures and dates to ensure compliance with ownership and assignment rights. Users should note how the chosen method of delivery affects the time it takes to receive funds, where a range of shipping options exists. Understanding these aspects of the Western National Annuity form can simplify the process and help ensure that your requests are accurately and efficiently handled.

Western National Annuity Example

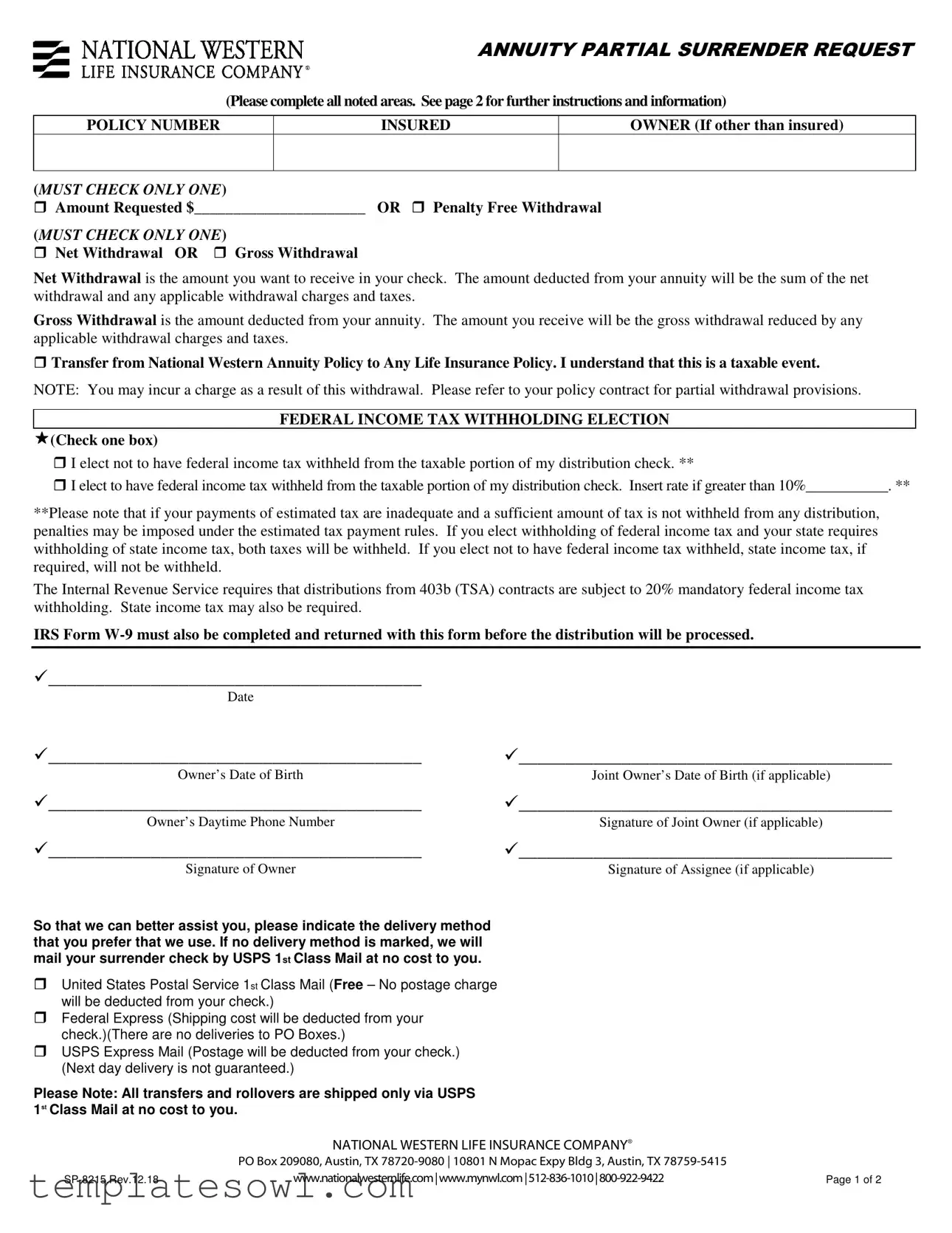

ANNUITY PARTIAL SURRENDER REQUEST

(Please complete all noted areas. See page 2 for further instructions and information)

POLICY NUMBER

INSURED

OWNER (If other than insured)

(MUST CHECK ONLY ONE)

Amount Requested $______________________ OR Penalty Free Withdrawal

(MUST CHECK ONLY ONE)

Net Withdrawal OR Gross Withdrawal

Net Withdrawal is the amount you want to receive in your check. The amount deducted from your annuity will be the sum of the net withdrawal and any applicable withdrawal charges and taxes.

Gross Withdrawal is the amount deducted from your annuity. The amount you receive will be the gross withdrawal reduced by any applicable withdrawal charges and taxes.

Transfer from National Western Annuity Policy to Any Life Insurance Policy. I understand that this is a taxable event.

NOTE: You may incur a charge as a result of this withdrawal. Please refer to your policy contract for partial withdrawal provisions.

FEDERAL INCOME TAX WITHHOLDING ELECTION

(Check one box)

I elect not to have federal income tax withheld from the taxable portion of my distribution check. **

I elect to have federal income tax withheld from the taxable portion of my distribution check. Insert rate if greater than 10%___________. **

**Please note that if your payments of estimated tax are inadequate and a sufficient amount of tax is not withheld from any distribution, penalties may be imposed under the estimated tax payment rules. If you elect withholding of federal income tax and your state requires withholding of state income tax, both taxes will be withheld. If you elect not to have federal income tax withheld, state income tax, if required, will not be withheld.

The Internal Revenue Service requires that distributions from 403b (TSA) contracts are subject to 20% mandatory federal income tax withholding. State income tax may also be required.

IRS Form

________________________________________

Date

________________________________________ |

________________________________________ |

Owner’s Date of Birth |

Joint Owner’s Date of Birth (if applicable) |

________________________________________ |

________________________________________ |

Owner’s Daytime Phone Number |

Signature of Joint Owner (if applicable) |

________________________________________ |

________________________________________ |

Signature of Owner |

Signature of Assignee (if applicable) |

So that we can better assist you, please indicate the delivery method that you prefer that we use. If no delivery method is marked, we will mail your surrender check by USPS 1st Class Mail at no cost to you.

United States Postal Service 1st Class Mail (Free – No postage charge will be deducted from your check.)

Federal Express (Shipping cost will be deducted from your check.)(There are no deliveries to PO Boxes.)

USPS Express Mail (Postage will be deducted from your check.) (Next day delivery is not guaranteed.)

Please Note: All transfers and rollovers are shipped only via USPS 1st Class Mail at no cost to you.

NATIONAL WESTERN LIFE INSURANCE COMPANY®

PO Box 209080, Austin, TX

www.nationalwesternlife.com|www.mynwl.com |

Page 1 of 2 |

ANNUITY PARTIAL SURRENDER REQUEST

INSTRUCTIONS AND INFORMATION

The cash value is payable at the Home Office of the Company at Austin, Texas.

HOW TO SIGN – The request must be dated. All signatures must be written in full exactly as they appear in the policy and must be in ink.

WHO MUST SIGN – This request must be signed by (1) the person or persons who, under the terms of the policy, have the rights of ownership, (2) by an assignee, and (3) by any other party who, by legal proceedings or statutes, may have an interest in the policy.

If signed for: (1) A corporation, the corporate name should be written followed by the signature and title of an authorized officer; (2) A partnership, the full name of the partnership should be written followed by the signature of any partner other than the insured.

FEDERAL INCOME TAX WITHHOLDING INSTRUCTIONS AND INFORMATION

As a result of the Tax Equity and Fiscal Responsibility Act of 1982, we are required to inform you of and give you an opportunity to make a tax withholding election. The new provisions apply to distributions from qualified and

If your check is a nonperiodic payment, the rate of withholding will be either: (a) determined according to computational procedures or tables provided in the Treasury Regulations accompanying Internal Revenue Code Section 3405 if the distribution is either a qualified total distribution or a total distribution by reason of death of the participant; or (b) 10% for any other nonperiodic payment, unless a higher rate is requested.

Please note: If you elect not to have withholding apply to your payment, or if you do not have enough federal income tax withheld, you may be responsible for payment of estimated tax. You may incur penalties under the estimated tax rules if your withholding and estimated tax payment are not sufficient.

NATIONAL WESTERN LIFE INSURANCE COMPANY®

PO Box 209080, Austin, TX

www.nationalwesternlife.com | www.mynwl.com | |

Page 2 of 2 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | This form is used to request a partial surrender of funds from your annuity account. |

| Policy Number Requirement | The policy number must be provided to identify the account involved in the surrender request. |

| Withdrawal Types | Two types of withdrawals are available: net withdrawal and gross withdrawal. Choose carefully based on your tax preferences. |

| Tax Implications | Withdrawals are taxable events, and federal income tax withholding may apply. |

| IRS Form Requirement | Submit IRS Form W-9 along with the surrender request for processing to confirm your taxpayer identification. |

| Delivery Methods | You can select from multiple delivery methods for your check, though USPS 1st Class Mail is free. |

| Signature Requirement | All signatures must match the names on the policy and must be written in ink. |

| Applicable State Laws | Please refer to governing laws based on your state of residence for any specific regulations related to partial withdrawals. |

| Penalty Notices | Be aware that penalties may apply if inadequate tax is withheld from your distribution. |

| Home Office Location | The cash value is payable at National Western Life Insurance Company's home office in Austin, Texas. |

Guidelines on Utilizing Western National Annuity

Completing the Western National Annuity form requires careful attention to detail. Follow each step to ensure the form is filled out accurately and completely. This will help in processing your request smoothly.

- Locate your policy number and write it on the form.

- Identify the insured owner or write down your name if you are the insured.

- Select the amount requested by entering the desired dollar amount or choosing the penalty-free withdrawal option.

- Choose between net withdrawal and gross withdrawal by checking the appropriate box.

- Mark if you want to transfer from the National Western Annuity Policy to any life insurance policy, acknowledging this as a taxable event.

- Elect your federal income tax withholding option by checking one of the boxes. If applicable, specify the withholding rate if it exceeds 10%.

- Complete your date and owner's date of birth on the designated lines.

- Provide your daytime phone number.

- Gather necessary signatures: sign the form as the owner, and collect the signature of a joint owner or assignee if needed.

- Choose your preferred delivery method for receiving your surrender check, if applicable.

Once completed, check the form for accuracy. Ensure that any required documents, like the IRS Form W-9, are included. Then submit the form and await further instructions regarding your request.

What You Should Know About This Form

What is the purpose of the Western National Annuity form?

The Western National Annuity form primarily facilitates the process of making a partial surrender request from your annuity. This could involve withdrawing a specific amount or choosing a penalty-free withdrawal option. It also addresses federal income tax withholding elections and provides instructions for submitting the necessary documentation. Completing this form correctly is crucial to ensure that your request is processed efficiently and in accordance with your financial goals.

What are the differences between a Net Withdrawal and a Gross Withdrawal?

A Net Withdrawal is the amount you choose to receive in your check after any applicable withdrawal charges and taxes are deducted. Conversely, a Gross Withdrawal is the total amount deducted from your annuity without considering these fees. Therefore, if you are looking to understand the exact amount you will receive, it’s important to consider additional costs associated with each type of withdrawal to make informed financial decisions.

What should I know about federal income tax withholding on my distribution?

When completing the form, you must elect whether to have federal income tax withheld from the taxable portion of your distribution. You may opt for no withholding, but if you choose to withhold, be mindful that the IRS mandates a 10% minimum unless a higher rate is specified. Failing to withhold adequate taxes may result in penalties under the estimated tax rules, so it's essential to weigh your options carefully. If your state also requires withholding, both federal and state taxes may be deducted simultaneously from your distribution.

Who needs to sign the Annuity Partial Surrender Request?

The form must be signed by the individuals who hold ownership rights to the annuity, which typically includes the policyholder and any joint owners. If the policy has been assigned, the assignee must also sign. It’s vital that all signatures match those on record and are provided in ink. Additionally, if the policy is held by a corporation, an authorized officer must sign on behalf of the corporation, ensuring compliance with the ownership rules outlined in the policy.

What delivery methods are available for my surrender check?

You have several options for receiving your surrender check. The default method is USPS 1st Class Mail at no charge. Alternatively, you can choose Federal Express or USPS Express Mail, but note that shipping costs will be deducted from your withdrawal amount. If you select Federal Express, be aware that deliveries cannot be made to P.O. Boxes. If you don’t specify a method, you will automatically receive the check via regular mail, which is both cost-effective and standard practice.

Common mistakes

Completing the Western National Annuity form can be a straightforward task, but several common mistakes can lead to delays or complications. One significant error involves not filling out all the required areas. Skipping sections marked as necessary can result in the form being rejected or returned for corrections. It’s crucial to ensure that each box that requires information is properly filled in to expedite processing.

Another frequent misstep is failing to check only one option when multiple choices are presented. For instance, when indicating the amount requested or the type of withdrawal, marking more than one box can confuse the processing team. Clarity is key; stick to selecting one option to clearly communicate your intentions.

When indicating whether the withdrawal will be net or gross, misunderstanding these terms can lead to unexpected tax implications. A net withdrawal is the amount you want after deductions, while a gross withdrawal reflects the total amount before taxes and charges. Choosing the incorrect option can affect your financial outcome, so take the time to understand the difference.

Not considering the tax withholding election can also pose a significant issue. Some people overlook this section entirely or fail to select a choice regarding federal income tax withholding. Inadequate withholding may trigger penalties, creating unexpected tax burdens later on. Careful attention here can save you from headaches down the line.

Another mistake often made involves not completing IRS Form W-9 when required. This form must accompany your submission to validate your taxpayer identification number and ensure proper tax reporting. Neglecting to attach it can stall the processing of your annuity request, so remember to include it to keep everything moving smoothly.

Signature issues often arise as well, with people sometimes forgetting to sign or incorrectly signing with initials instead of their full name. Signatures on the form must match precisely how they appear on the policy. Failing to follow this guideline can lead to rejected requests or further inquiries, which could delay your access to the funds.

Don’t forget to check the delivery method! Some individuals inadvertently leave the section blank, which defaults to the standard postal mail option. If you prefer a faster shipping method, such as FedEx or USPS Express Mail, make sure you mark your choice clearly. A small oversight can significantly delay when you receive your funds.

Another common pitfall is not providing accurate contact information, particularly the daytime phone number. If there are questions or issues with your request, not having a way to reach you can cause unnecessary delays. Ensure that the number provided is correct and that you’re available to respond promptly.

Lastly, many people fail to review their form before submitting it. Double-checking your work can catch errors that might have been overlooked in the initial filling out. This simple step could save you a lot of time and frustration by preventing requests to correct or resubmit the form.

In summary, filling out the Western National Annuity form requires attention to detail and an understanding of what each section entails. By avoiding these common pitfalls, you can ensure a smoother process for your annuity request and move forward with your financial plans without unnecessary delays.

Documents used along the form

When engaging with the Western National Annuity form for partial surrender requests, several other documents and forms often accompany it. These forms help clarify details, ensure compliance with tax obligations, and facilitate smooth transactions. Here is a brief overview of such documents typically associated with this process.

- IRS Form W-9: This form is crucial for tax purposes. It provides the taxpayer's identification number to the insurance company, ensuring that they can accurately report any taxable distributions to the IRS. Completing this form is essential for the processing of any distribution, including partial surrenders.

- Distribution Request Form: Often required by financial institutions, this form captures the specifics of the withdrawal request. It details the amount being requested, the type of withdrawal (net or gross), and any relevant instructions regarding tax withholdings.

- Tax Withholding Election Form: This document allows the owner to specify whether they would like federal income tax withheld from their distribution. It is vital for ensuring that appropriate taxes are deducted from the amount received, thus avoiding potential penalties in the future.

- Transfer Request Form: If the annuity proceeds are being transferred to a different financial product, this form outlines the specifics of the transfer. It serves to confirm the details of the transaction and may include instructions regarding tax implications associated with the transfer.

Understanding these additional documents can streamline the process of managing your annuity. By ensuring all forms are correctly completed and submitted together, individuals can facilitate a smooth navigation of any financial decisions related to their annuity contracts.

Similar forms

- Annuity Withdrawal Request Form: Similar to the Western National Annuity form, this document allows a policyholder to request a withdrawal from their annuity. It includes a choice between net and gross withdrawals and outlines any potential penalties or fees.

- IRA Distribution Request Form: Like the annuity form, this document facilitates withdrawing funds from an Individual Retirement Account (IRA). It details tax implications and options for tax withholding.

- Life Insurance Cash Value Withdrawal Request: This form serves a similar purpose, permitting policyholders to withdraw cash value from a life insurance policy. It highlights tax implications and potential charges.

- 401(k) Loan Request Form: This document allows participants to request a loan against their 401(k) plan. Like the annuity form, it includes information about tax withholding and repayment terms.

- Retirement Account Roll Over Request Form: Much like the annuity partial surrender, this form facilitates the transfer of funds from one retirement account to another, addressing tax implications for the account holder.

- Tax Withholding Election Form: Similar to the withholding section within the Western National Annuity form, this document allows individuals to elect how much federal tax to withhold from their distributions.

- Withdrawal Penalty Acknowledgment Form: This document explains potential penalties for early withdrawals, similar to the warnings provided in the annuity form regarding withdrawal charges.

- Transfer of Benefits Form: This form describes how to transfer benefits from one account to another, echoing the transfer capabilities outlined in the annuity form.

- Loan Repayment Agreement: If a policyholder takes a loan, this agreement resembles the annuity form's withdrawal process by detailing repayment obligations and tax consequences.

- Estate Claim Form: This form is similar in that it allows beneficiaries to claim benefits from a policy upon the policyholder's death, addressing the financial implications involved.

Dos and Don'ts

- Do fill out all required fields, especially the policy number and amount requested.

- Don't skip signing the form; each required signature must be in ink and match the names on the policy.

- Do indicate whether you want a net or gross withdrawal to avoid confusion regarding amounts.

- Don't forget to check your federal tax withholding preference; you have options to select from.

- Do include your date of birth to ensure accuracy and speed in processing your request.

- Don't neglect to provide a contact phone number in case the company needs to reach you.

- Do read the instructions carefully to understand any potential charges related to your withdrawal.

- Don't choose a delivery method without considering its cost and your needs for urgency.

Misconceptions

Understanding the Western National Annuity form can help you make informed financial decisions. However, several misconceptions can lead to confusion. Here are six common misunderstandings:

- Partial Surrender Means No Penalties: Many people think that withdrawing money through a partial surrender will not incur any penalties. In reality, there may be charges associated with the withdrawal based on your policy specifics. Always check your contract for details.

- Gross and Net Withdrawals Are the Same: Some believe that gross and net withdrawals refer to the same amounts. Gross withdrawal is the total deducted from your account, while net withdrawal is what you actually receive, accounting for any charges and taxes.

- Tax Withholding is Optional for All Distributions: It’s a common belief that you can choose to withhold taxes on any distribution. However, certain distributions like those from 403b contracts are subject to mandatory federal tax withholding. Understanding these requirements is crucial.

- You Don't Need to Worry About State Taxes: Another misconception is that if federal tax withholding does not apply, state taxes won't either. In fact, if you choose not to have federal taxes withheld, your state tax withholding may still be applicable, depending on state regulations.

- The Form is Only for the Owner to Sign: Some individuals think only the policy owner needs to sign the form. In truth, signatures may also be required from other parties, like assignees or joint owners, depending on the ownership structure of the policy.

- Delivery Method Doesn't Matter: Many assume that the delivery method is irrelevant. However, opting for certain delivery methods, like FedEx or Express Mail, can lead to deducted shipping costs from your surrender check, impacting the amount you receive.

It's essential to clarify these misconceptions to ensure you fully understand how your annuity works and what fees or taxes may apply to any withdrawals you consider.

Key takeaways

Understanding the Western National Annuity form is essential for anyone looking to manage their annuity effectively. Below are key takeaways that can help guide you through the process of filling out and utilizing this form.

- Complete All Required Areas: It is imperative that all noted areas on the form are filled out. Incomplete forms can lead to delays or rejection of your request.

- Choose the Right Withdrawal Type: You will need to decide whether to make a net or gross withdrawal. A net withdrawal gives you the amount you want after taxes and charges, while a gross withdrawal is the total amount taken from your account.

- Understand Tax Implications: When making a withdrawal, you may face federal and possibly state income tax withholding. Make an informed choice about withholding, as failing to do so could result in tax penalties.

- Proper Signatures Required: Ensure that all required signatures are provided in full and exactly as they appear on the policy. This includes signatures from stakeholders like owners, assignees, and possibly other interested parties.

- Select Your Delivery Method: Indicate how you would like to receive any checks. Be aware that different delivery methods may incur charges or affect the timing of your receipt.

By keeping these takeaways in mind, you can navigate the Western National Annuity form with more confidence and clarity.

Browse Other Templates

Lvn Application Form - The DCA 55M 11 form streamlines the approvals necessary for nursing school operations in California.

Kaplan University Online Transcripts - Ensure all personal information on the form is accurate before submission.

What Is an Apportioned Tag - The vehicle's established place of business must be in Oklahoma to qualify for IRP registration.